Dental Orthobiologics Market Size, Share & Industry Analysis, By Product Type (Allograft, Bone Growth Factors, Synthetic Bone Graft Substitute, Demineralized Bone Matrix, Cellular Allografts, and Others), By Form (Paste, Granules, Putty, and Others), By End-user (Solo Practices, DSO/ Group Practices, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

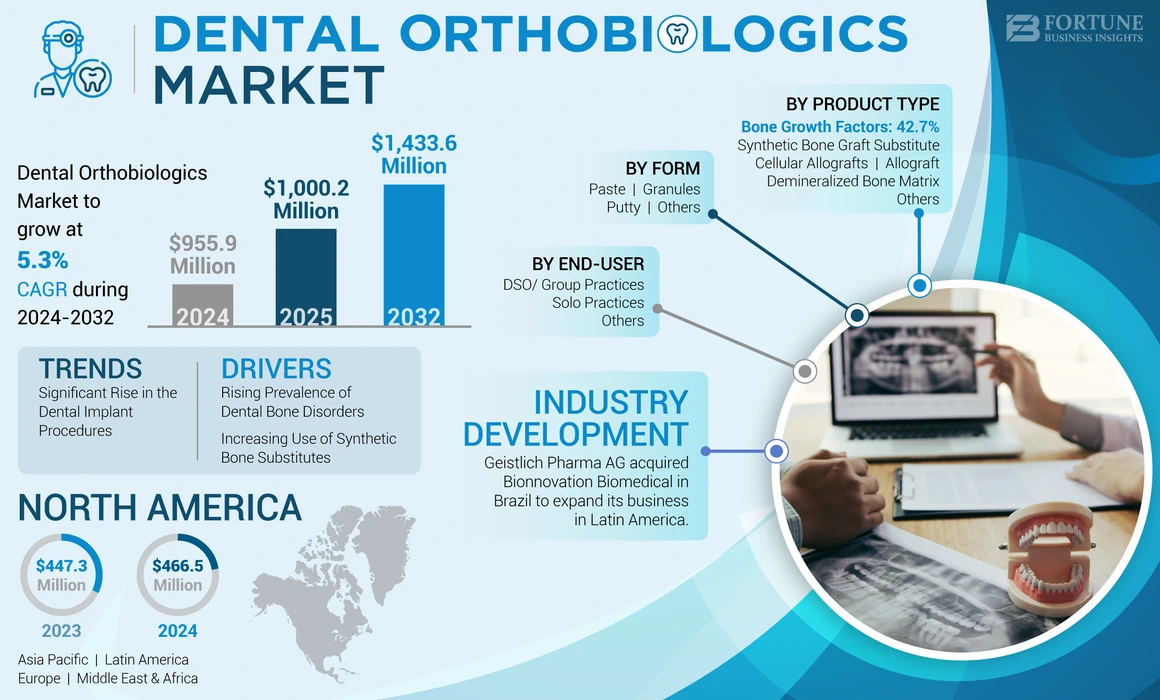

The global dental orthobiologics market size was valued at USD 955.9 million in 2024. The market is projected to grow from USD 1,000.2 million in 2025 to USD 1,433.6 million by 2032, exhibiting a CAGR of 5.3% during the forecast period. North America dominated the dental orthobiologics market with a market share of 48.8% in 2024.

Dental orthobiologics refer to organic and synthetic materials that are used for the regeneration or healing of bone, cartilage, and soft tissues. There has been an increasing interest in the utilization of orthobiologics products and the incorporation of the principles of biology and biochemistry in the management of dental bone and soft tissue injuries. These products include allografts, bone growth factors, synthetic bone substitutes, demineralized bone matrix, cellular allografts, and other biologics intended for dental applications.

The global market is expected to grow significantly in the coming years, driven by factors such as the increasing prevalence of dental diseases such as edentulism and dental bone loss. This increases the implants and bone grafting procedures that surge the adoption of bone graft substitutes and growth factors for dental bone healing and regeneration. In addition, advancements such as the introduction of synthetic and 3D-printed bone grafts are shifting the trend in the market.

Other factors driving market growth include clinicians' rising awareness of advanced products. In addition, new product launches and the rising number of distribution collaborations and acquisitions in the market are expected to fuel the market growth.

- For instance, in January 2021, Dentsply Sirona acquired Datum Dental, Ltd. with its strong OSSIX biomaterial portfolio. The product portfolio includes various regenerative products, including bone ossifying mineralized collagen sponges. This advanced product portfolio enables the company to grow in the market.

The market saw a decrease in terms of revenue in 2020 as a result of the COVID-19 pandemic, with many dental offices either closing or restricting operations to only urgent cases. This led to a decrease in the demand for these products. The global lockdown and travel restrictions further added to the market's challenges. However, in 2021, the market began to recover as the dental practices reopened and there was an increase in the use of tele-dentistry and other digital tools. The increased adoption of implant surgery and bone grafting procedures in 2021 led to substantial market growth, which is expected to continue throughout the coming years.

Global Dental Orthobiologics Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 955.9 million

- 2025 Market Size: USD 1,000.2 million

- 2032 Forecast Market Size: USD 1,433.6 million

- CAGR: 5.3% from 2025–2032

Market Share:

- Region: North America dominated the market with a 48.8% share in 2024. This is driven by the high prevalence of dental bone deformities, a large volume of dental implantation procedures, and the continuous launch of advanced products by key players in the region.

- By Product Type: The bone growth factors segment held the largest market share. Its dominance is attributed to the rising demand for dental implants, which require bone growth factors to enhance bone regeneration and ensure jaw bone stability, particularly with the high prevalence of alveolar bone loss.

Key Country Highlights:

- Japan: Market growth is propelled by the increasing penetration and adoption of advanced orthobiologic products. Rising strategic collaborations among regional players are also working to increase the availability of these products in the Japanese market.

- United States: The market is driven by a high volume of dental procedures and frequent new product launches from major U.S.-based companies. For instance, the recent launch of new allograft products by ZimVie Inc. is increasing product availability and adoption.

- China: Growth is supported by increasing investments and collaborations aimed at bringing new technologies into the market. A key trend is the rising export and distribution partnerships, such as collaborations to bring synthetic bone graft materials into the country.

- Europe: The market is characterized by the strong presence of major global players like Institut Straumann AG and Geistlich Pharma AG. Growth is fueled by rising R&D initiatives for advanced product development and an increasing number of dental clinics across the region.

Dental Orthobiologics Market Trends

Significant Rise in the Dental Implant Procedures to Boost Market Growth

The use of bone graft substitutes is rapidly increasing due to the various advantages associated with them, such as the reduction of complications related to traditional bone grafting procedures. The rise in the number of dental implant procedures is expected to be one of the key drivers for the market growth during the forecast period. These bone graft substitutes are used in implant procedures when there is no adequate bone volume to support the implant.

In addition, the advancements in dental implantology further increase the complexity of these procedures, and bone graft substitutes are increasingly utilized in dental implant procedures to support implant stability. Furthermore, these substitutes are also beneficial in enhancing the height and thickness of the jawbone, enabling the dental implant to get primary stability and bone growth around the implant area.

- For instance, according to a June 2021 Dental Tribune International article, there has been a significant increase in the number of patients opting for implant procedures, which is expected to increase the number of bone graft substitutes adopted.

Download Free sample to learn more about this report.

Dental Orthobiologics Market Growth Factors

Rising Prevalence of Dental Bone Disorders to Grow the Market

The increasing prevalence of oral diseases such as periodontal diseases, jawbone atrophy, and edentulism drives the demand for a wide range of dental procedures. These procedures, such as dental implantation, tooth extraction, and bone density restoration due to periodontal gum diseases, require bone graft substitutes to aid bone regeneration.

- According to the WHO Oral Health Report in March 2023, oral diseases affect nearly 3.5 million people across the globe, and the same report stated that edentulism has a higher global prevalence of around 23%. This increases the demand for dental orthobiologics around the world.

In addition, several studies have demonstrated that bone graft substitutes can effectively reverse dental bone loss by aiding in bone regeneration. These factors are expected to drive the market growth during the forecast period.

Furthermore, companies are increasingly focusing on the development of innovative products that offer better osteoinduction and biocompatibility. Such factors are expected to fuel the market growth. Overall, the combination of high prevalence rates of dental diseases, coupled with the introduction of new products, is expected to fuel the global dental orthobiologics market growth.

Increasing Use of Synthetic Bone Substitutes to Fuel Market Growth

The use of synthetic bone substitutes in dental applications is becoming increasingly common due to their various benefits over the other types of dental orthobiologics. One of the primary advantages of synthetic bone graft substitutes is their biocompatibility, which reduces the risk of adverse reactions or rejection by the body. This can lead to improved healing outcomes and reduced post-operative complications for the patients. In addition, the composition and structure can lead to more predictable results in terms of bone regeneration and reconstruction. This can be particularly beneficial in complex dental procedures such as implant placements.

Furthermore, synthetic bone graft substitutes are generally more cost-effective compared to traditional allografts. Moreover, the inclusion of 3D technologies to create precise and highly customizable synthetic grafts that mimic the natural bone composition and microarchitecture is expected to drive the market in the coming years.

RESTRAINING FACTORS

Clinical Limitations of These Products May Limit Market Growth

Despite the several advancements made by the key players in the industry, the clinical limitations of dental orthobiologics limit the market growth to a certain extent. The use of orthobiologics is associated with various side effects, including adverse tissue reactions, and the incomplete or lack of bone formation is expected to hinder market growth during the forecast period.

Furthermore, the issues associated with bone morphogenetic proteins and clinical limitations of several dental orthobiologics are poised to hamper the market growth. In addition, the risk of disease transmission and immunogenicity, poor resorption, poor mechanical strength, and lack of osteoinductive properties could potentially impede the market growth during the forecast period.

- For instance, according to the article published in the Journal of the Indian Society of Periodontology in September 2019, bovine bone xenografts have been associated with complications such as sinus and maxillary bone pathologies, displacement of graft materials, and chronic inflammation. The report stated that demineralized bone matrix may also lead to longer surgical and anesthesia times for patients and incomplete bone formation. These risks could result in poor product adoption and impede market growth.

Dental Orthobiologics Market Segmentation Analysis

By Product Type Analysis

Bone Growth Factors Segment Dominated Due to Increasing Demand for Dental Implants

Based on product type, the market is segmented into allograft, synthetic bone graft substitutes, demineralized bone matrix, cellular allograftx`s, bone growth factors, and others.

The bone growth factors segment dominated the market in 2023. The growth of the segment can be attributed to the rising demand for dental implants that require bone growth factors for the enhancement of bone regeneration to increase jaw bone stability and growth in the prevalence of dental disorders such as alveolar bone loss. Moreover, advanced product launches are further expected to drive the segment growth in the coming years.

The synthetic bone graft substitutes segment is expected to grow at a higher CAGR during the forecast period. The segment growth is attributed to advantages such as biocompatibility and osteoconductivity that support direct bone growth. In addition, the ease of availability and low production cost are resulting in the shift toward synthetic bone graft substitutes for dental applications. Moreover, the increasing collaboration between market players to strengthen the distribution network is expected to propel the segment growth. For instance, in March 2022, CGbio, a company specializing in regenerative medicine, collaborated with Kerunxi Medical to export Bongros Dental, a bone graft material including synthetic bone grafts. This can increase the adoption of synthetic bone grafts, which is expected to drive the segmental growth.

The others segment includes xenograft. The segment growth is attributed to the advancements in processing technology, improved sterility, improved risk of infection, and others.

To know how our report can help streamline your business, Speak to Analyst

By Form Analysis

Paste Segment Held a Leading Position Driven by Rising Focus of Major Companies on Research and Development

By form, the market is divided into paste, granules, putty, and others.

The paste segment dominated the global dental orthobiologics market share in 2024. The growing focus of key players on the research and development of the paste forms of dental orthobiologics is expected to boost the segmental growth. In addition, the high use of bone growth factors in the paste form is boosting market growth.

The granules segment is expected to grow at a higher CAGR during the forecast period. Granule bone graft substitutes are highly preferred due to their advantages in the grafting procedures. The surface texture of the granule significantly increases the surface area for osteoblast attachment and stimulates osteogenesis. In addition, they do not require specific storage conditions. These are the key factors that increase the adoption of granules. Moreover, new product launches are further supporting the growth of the segment. For instance, in January 2023, Envista launched creos syntogain, a biomimetic bone graft substitute in two granule sizes (0.2-1.0 and 1.0-2.0 mm). Such product launches are expected to drive the segment growth.

By End-user Analysis

Solo Practices Segment Dominated Due to Large Number of Patients Undergoing Dental Procedures

Based on end-user, the market is classified into solo practices, DSO/ group practices, and others.

The solo practices segment dominates the market due to high patient preference. The expansion of this segment can further be attributed to the presence of a significant number of dental clinics with solo practitioners and an increasing patient pool for dental procedures such as bone grafting and implantation across the globe.

On the other hand, the DSO/group practices segment is expected to grow at a higher CAGR during the forecast period, fueled by a shift toward DSO affiliation in developed countries. Strategic acquisitions by DSO companies are expected to expand the segment growth and increase procedure volume, driving market growth. For instance, in December 2020, Smile Brands Inc. acquired Midwest Dental, which is expected to develop the procedure volume in the DSOs and boost market growth in the near future.

The others segment comprises hospitals and research institutes, which are expected to witness considerable growth during the study period. The rising number of oral surgeries in these settings is expected to drive product adoption.

REGIONAL INSIGHTS

In terms of region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Dental Orthobiologics Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

In 2024, North America held the largest market share, with a revenue of USD 466.5 million. The growing prevalence and incidences of dental bone deformities and the high dental implantation and alveolar bone graft volumes are the major factors that drive the adoption of orthobiologics products for dental bone regeneration and healing. Moreover, the rising number of advanced product launches in the region is expected to drive market growth during the forecast period.

- For instance, in April 2023, ZimVie Inc. launched RegenerOss CC Allograft and RegenerOss Bone Graft Plug in North America, which are to be used in various dental applications. This can increase product availability, and the adoption is expected to grow in the near future.

Europe is estimated to be the second-largest regional market. The presence of some of the major players, such as Institut Straumann AG and Geistlich Pharma AG, is contributing to the region’s growth. In addition, the growing number of dental clinics and rising R&D initiatives in the region for advanced product development are expected to drive market growth.

Asia Pacific market is anticipated to grow at a higher CAGR during the forecast period due to the rising prevalence of dental bone disorders in the region. In addition, the rising public awareness about oral health and increasing expenditure on dental procedures are expected to drive the region's growth significantly. Furthermore, the increasing penetration of advanced products in Japan and South Korea is expected to propel the market growth in the region. Moreover, the presence of major players and rising collaboration among regional players is expected to increase the penetration of dental orthobiologics in the region.

Latin America and the Middle East & Africa are projected to experience significant growth during the study period as a result of the high prevalence of dental diseases, increasing awareness among dental professionals, and rising healthcare investments. Furthermore, market expansion in these regions is expected to be driven by investments by key companies in the acquisition of subsidiaries.

KEY INDUSTRY PLAYERS

ZimVie Inc., Medtronic, and Geistlich Pharma AG Accounted for a Substantial Share Owing to Strong Product Portfolio

The global dental orthobiologics market is partially consolidated due to the large shares accounted for by the key players. ZimVie Inc., Medtronic, and Geistlich Pharma AG held substantial revenue shares in the market in 2024 due to their strong product portfolio of bone graft substitutes. Furthermore, there is a growing focus on strategies such as acquisitions and mergers with other market players to increase presence in the market. Moreover, the consistent focus of key companies on the introduction of dental orthobiologics is expected to strengthen their market share during the forecast period.

Other companies, including Envista, BioHorizons, NovaBone, and other small and medium-sized market players, are constantly focusing on geographical expansions and new product launches with advanced features. Moreover, the rising number of product approvals secured by these companies is expected to fuel market growth in the coming years.

LIST OF TOP DENTAL ORTHOBIOLOGICS COMPANIES:

- ZimVie Inc. (U.S.)

- Institut Straumann AG (Switzerland)

- Envista (U.S.)

- Dentsply Sirona. (U.S.)

- Henry Schein, Inc. (U.S.)

- Medtronic (Ireland)

- BioHorizons (U.S.)

- NovaBone (Halma) (U.K.)

- Geistlich Pharma AG (Switzerland)

KEY INDUSTRY DEVELOPMENTS

- April 2024: Geistlich Pharma AG acquired Bionnovation Biomedical in Brazil to expand its business in Latin America.

- June 2023: Geistlich Pharma AG launched a non-surgical periodontitis treatment gel. It is a combination of hyaluronic acid and a thermosensitive filler to promote healing.

- October 2022: Geistlich Pharma AG acquired Lynch Biologics, LLC. Lynch Biologics, LLC. is a U.S. based company operating in the bone regeneration segment, including dental bone graft substitutes and dental growth factors.

- October 2021: CoreBone received a USD 3.7 million fund from the Guangzhou Sino-Israel Biotech Investment Fund ("GIBF"). The company specializes in bringing Israeli medical technologies into the Chinese market and offers bioactive bone graft material used in orthopedic and dental treatments.

- April 2019: Zimmer Biomet & RTI Surgical collaborated with the American Academy of Implant Dentistry Foundation (AAIDF) to donate allograft implants for increased access to dental care for veterans.

REPORT COVERAGE

The report provides an in-depth global dental orthobiologics market analysis. It focuses on market segmentation, such as by , product type, form, , end-user, and region. Besides, it offers the dental orthobiologics market forecast in relation to the current market dynamics, the impact of the COVID-19 pandemic, and the latest market statistics. In addition, the report highlights the market share by various segments and the factors driving the market growth. The report also mentions the key players operating in the market, their swot analysis, and the competitive landscape of the market at a global level. Moreover, the report provides key insights on technological advancements, the prevalence of dental disorders, and key industry developments.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 5.3% from 2025-2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Form

|

|

|

By End-user

|

|

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 955.9 million in 2024 and is projected to reach USD 1,433.6 million by 2032.

The market is slated to exhibit a steady CAGR of 5.3% during the forecast period of 2025-2032.

By product type, the bone growth factors segment led in 2024.

The rising prevalence of dental bone disorders and the growing adoption of synthetic bone substitutes are the key factors anticipated to drive the market growth.

ZimVie Inc., Medtronic, and Geistlich Pharma AG are some of the key players in the market.

North America dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us