Dental X-ray Systems Market Size, Share & Industry Analysis, By Type (Wall-mounted, Floor-Mounted, and Portable), By Product Type (Analog and Digital), By End-user (Solo Practices, DSO/Group Practices, and Others), and Regional Forecast, 2026-2034

Dental X-ray Systems Market Overview

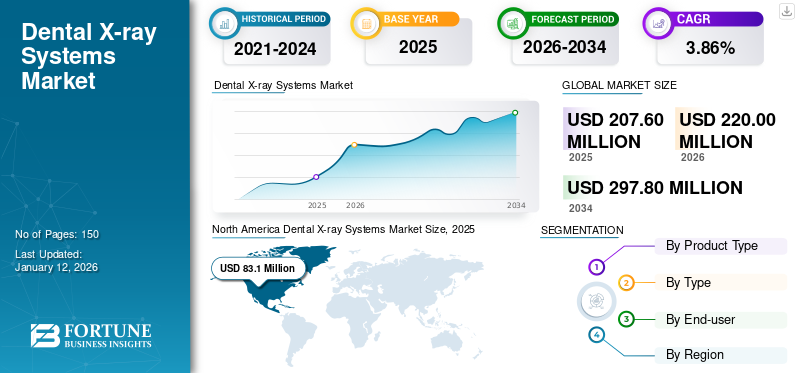

The global dental x-ray systems market size was valued at USD 207.6 million in 2025. The market is projected to grow from USD 220 million in 2026 to USD 297.8 million by 2034, exhibiting a CAGR of 3.86% during the forecast period. North America dominated the dental X-ray systems market with a market share of 39.71% in 2025.

Dental x-ray systems are specialized devices used in dental radiography to produce X-rays directly within the mouth. These compact units enhance image quality and reduce radiation exposure by targeting specific areas with precision. Their design allows for closer proximity to the area of interest, resulting in clearer images and improved diagnostic accuracy. By minimizing the distance between the X-ray source and the target, these systems also contribute to patient safety and comfort during dental procedures.

Several factors, including advancements in dental technology, the increasing prevalence of dental disorders, and a growing demand for precise diagnostic tools, drive the global market growth. In addition, rising awareness about oral health and the benefits of early detection of dental issues contribute to market growth. Enhanced image quality, reduced radiation exposure, and the push for minimally invasive procedures further fuel the adoption of the product in modern dental practices.

In 2020, the COVID-19 pandemic temporarily hindered the market due to reduced dental visits and postponed elective procedures. Supply chain disruptions also affected manufacturing and distribution and hampered the growth of the market during the pandemic. However, post-pandemic, the market is rebounding as dental practices resume normal operations. Increased emphasis on infection control and the growing need for advanced diagnostic tools are driving demand.

Global Dental X-ray Systems Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 207.6 million

- 2026 Market Size: USD 220 million

- 2034 Forecast Market Size: USD 297.8 million

- CAGR: 3.86% from 2026–2034

Market Share:

- Region: North America dominated the market with a 39.71% share in 2025. This is driven by a large population suffering from oral disorders, increasing patient visits to dental clinics, the presence of numerous leading dental manufacturers, and a strong focus on innovation in digital technology.

- By Product Type: The digital segment held the largest market share in 2026. Its growth is fueled by the rising demand for advanced technologies in dental care, as digital systems offer enhanced precision, efficiency, and improved patient outcomes, making them the preferred choice over analog equipment.

Key Country Highlights:

- Japan: The market is driven by rising disposable incomes, improving access to healthcare services, growing awareness of dental health, and the increasing adoption of high-tech solutions in dental practices throughout the Asia Pacific region.

- United States: Growth is supported by a large patient population with oral disorders and a strong focus on innovation and continuous advancements in digital dental technology, which supports widespread product adoption.

- China: The market is expanding due to rising disposable incomes, improved access to healthcare services, and a growing awareness of dental health, leading to the increased adoption of high-tech solutions in dental practices.

- Europe: The market is propelled by the growing adoption of advanced technologies by dental practices to improve diagnostic accuracy and patient outcomes. The region also has a large number of dentists, with countries like Belgium and the Netherlands having 8,926 and 10,023 dentists respectively, which increases the demand for advanced imaging equipment.

Dental X-ray Systems Market Trends

Growing Adoption of Mobile Dental X-ray Systems Among Dental Facilities

The portable devices offer flexibility and convenience, allowing dental professionals to provide high-quality diagnostic services in various settings, including clinics, nursing homes, and remote areas. This trend is driven by the increasing need for accessible dental care and the demand for efficient, on-the-go diagnostic solutions. Mobile products are designed to be compact and lightweight, facilitating easy transportation and setup.

- For instance, Carestream Dental LLC has CS 2300P, an intraoral generator in its portfolio for dental imaging systems. It offers precise, high-quality images with reduced radiation exposure. Its lightweight and compact design makes it ideal for use in various clinical settings, enhancing diagnostic accuracy and patient care.

Their integration with digital technologies enhances image quality and enables immediate sharing and analysis of radiographs, improving patient outcomes and streamlining workflows. In addition, the ability to perform X-rays in non-traditional settings reduces the need for patient travel, particularly benefiting those with mobility issues or in underserved regions. The COVID-19 pandemic has further accelerated these key market trends, as the need to minimize patient movement and maintain social distancing has highlighted the advantages of mobile solutions.

Download Free sample to learn more about this report.

Dental X-ray Systems Market Growth Factors

Technological Advancements in Dental X-ray Systems to Boost Market Growth

Some of the major market opportunities are due to the technological advancements in these systems that are poised to enhance the growth of the global market significantly. These innovations focus on improving efficiency, precision, and patient comfort, which are key drivers of market expansion. Modern products have advanced x-ray imaging technologies and more compact designs, making them easier to use and integrate into dental practices. Enhanced software algorithms provide more accurate diagnostic data, leading to better patient outcomes and streamlined workflows.

The shift toward wireless and portable systems adds convenience and flexibility, allowing dental professionals to perform high-quality imaging in various settings, including remote locations. Enhanced connectivity features also facilitate seamless data sharing and integration with other digital dental tools, streamlining workflows and improving overall efficiency in dental practices.

Furthermore, as dental technology continues to evolve, these advancements contribute to more effective and efficient diagnostics, fueling the growth of the market. The continuous innovation in these devices and the increasing need for accurate, reliable, and patient-friendly diagnostic solutions are expanding the adoption of advanced intraoral X-ray systems in modern dentistry.

Growing Oral Health Issues to Impel Market Growth

The rising prevalence of dental diseases globally is a major factor propelling the market growth. Various oral health issues such as cavities, gum disease, and oral cancer are becoming increasingly common, and there is a high demand for advanced diagnostic and treatment tools. Dental x-ray systems, which provide detailed imaging and accurate diagnostics, are crucial for early detection and effective management of these conditions.

- For instance, according to a study published by NCBI in December 2023, Mexico has one of the highest rates of dental caries in the world. Moreover, approx. 50.0% of students aged 5-16 have or reported suffering from dental caries.

In recent years, with more people experiencing dental problems, dental practices have been seeking innovative solutions to enhance their diagnostic capabilities and improve patient care. Dental x-ray systems, with their high-resolution imaging and real-time data processing, offer precise insights that help in timely intervention and treatment planning. Moreover, growing awareness about oral health and the increasing emphasis on preventive care are driving the demand for sophisticated dental technologies. In addition, healthcare systems around the world prioritize better dental health outcomes, and the adoption of the product is expected to rise. This surge in demand for effective diagnostic tools supports the expansion of the market. Hence, this is identified as a major market driver.

RESTRAINING FACTORS

Concerns over Radiation Exposure of Intraoral Sensors May Hamper Market Growth

Advanced diagnostic tools, which are essential for detailed imaging and precise diagnostics, such as dental x-ray systems, often come with substantial costs due to their technology and manufacturing requirements. This high cost can be a barrier for many dental practices, particularly smaller or independent clinics, limiting their ability to invest in these crucial devices.

- For instance, the average retail price of these devices ranges from USD 4,000.0 to USD 5,000.0. Such high costs of these devices are expected to hinder their adoption, thereby limiting market growth.

The expense associated with the product impacts the overall adoption rate within the dental industry. The initial investment required for these advanced devices can be prohibitive, limiting their accessibility to a broader range of dental professionals. This reluctance to invest in high-cost equipment can slow the market's expansion and inhibit the widespread integration of cutting-edge technology in dental care.

Moreover, the financial strain placed on healthcare systems and dental practices can hinder the implementation of these products in regions with limited resources, thereby limiting the growth of the market.

Dental X-ray Systems Market Segmentation Analysis

By Product Type Analysis

Digital Segment Held Largest Share Owing to Diverse Benefits

By type, the product type, the market is bifurcated into analog and digital.

In 2026, the digital segment held the largest global dental x-ray systems market with a share of 95.73%. The segmental growth is growing demand for advanced technologies in dental care. These generators offer enhanced precision, efficiency, and improved patient outcomes, making them a preferred choice. Furthermore, the growing shift toward digital equipment from analog also plays a significant role in the growth of the segment.

The analog segment holds a significant share of the market. Analog dental x-ray systems, despite being older technology, continue to be favored for their proven performance and lower initial costs compared to digital counterparts. Many dental clinics, especially those with established equipment and limited budgets, prefer analog systems for their simplicity and ease of use. Furthermore, the introduction of new clinics across the world is expected to boost the demand for analog equipment during the forecast period.

By Type Analysis

Wall-mounted Segment Witnessed Largest Share Owing to Robust Demand from Dental Practices

Based on type, the market is categorized into wall-mounted, floor-mounted, and portable.

In 2026, the wall-mounted segment held the largest market share of 44.36%. The segmental growth is due to the high precision, durability, and integration with other stationary dental equipment. Furthermore, the widespread adoption of wall-mounted dental x-ray systems in both large and medium-sized dental practices underscores their critical role in providing reliable, high-quality dental care. This contributes significantly to their substantial share of the market.

The portable segment of the market holds a significant share due to its growing appeal in flexible and on-the-go dental care solutions. These systems offer the advantage of portability, allowing dental professionals to perform procedures in various settings, including remote or underserved areas. The increasing demand for mobile dental units in emergency care, home visits, and temporary clinics has driven the adoption of these portable devices.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Solo Practices Segment Led Driven by Large Number of Installed Base in These Settings

On the basis of the end-user, the market is classified into DSO/group practices, solo practices, and others.

The solo practices segment held the largest share of 52.86% in 2026 and is expected to expand at a substantial CAGR during the forecast timeframe, 2026-2034. The growth is attributed to the improved access to advanced and digital diagnostic options in developing countries and the increase in the demand for the same among patients. In addition, the growing prevalence of dental disorders that require x-ray systems is expected to considerably drive the segment’s growth.

The DSO/group practices segment is anticipated to witness the highest CAGR during the study period. The growth is attributed to the increased adoption of x-ray systems in these settings and the growing penetration of manufacturers and providers across the world.

The others segment includes dental hospitals and academic research institutes. The segment is expected to register a significant share and grow at a moderate CAGR during the forecast period. The presence of advanced healthcare facilities, awareness about oral care products, and increasing per capita income drive the market growth in developed countries. In addition, the increasing adoption of these devices in several hospital settings, coupled with the growing incidence of dental malocclusion among the population is anticipated to considerably augment the segment’s growth during the forecast period.

- For instance, Germany ranked second in the 2020 Healthiest Teeth Index due to regular dental checkups done by 80% of Germans who consider oral health essential.

REGIONAL INSIGHTS

Regionally, the market is divided into Europe, the Middle East & Africa, North America, Asia Pacific, and Latin America.

North America

North America Dental X-ray Systems Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America was the dominant region in the market, with a revenue of USD 83.1 million in 2025, and is anticipated to continue its dominance during the forecast period. The share is due to the large population suffering from oral disorders coupled with increasing patient visits to dental clinics. Moreover, the presence of numerous leading dental manufacturers and suppliers in the region contributes to this medical device market's growth. In addition, the strong focus on innovation and continuous advancements in digital technology in the region supports the widespread adoption of the product. The U.S. market is projected to reach USD 81.6 million by 2026.

Europe

Europe held the second-highest share in 2024. The regional growth is attributed to the growing adoption of advanced technologies by dental practices to improve diagnostic accuracy and patient outcomes, which drives the demand for high-quality products. Furthermore, the growing number of dentists is expected to increase the adoption of advanced imaging equipment, including x-ray systems, driving regional growth. The UK market is projected to reach USD 9.9 million by 2026, while the Germany market is projected to reach USD 15.8 million by 2026.

- For instance, according to the stats published by Eurostat, in 2021, the number of dentists in Belgium and the Netherlands was 8,926 and 10,023, respectively. Such a large number of dentists is expected to surge the demand for x-ray systems.

Asia Pacific

Asia Pacific is expected to grow at the highest CAGR over the forecast period. The growth is attributed to rising disposable incomes and improving access to healthcare services in China, India, and Japan. In addition, the growing awareness of dental health and the adoption of high-tech solutions in dental practices further fuel the dental x-ray systems market growth. The Japan market is projected to reach USD 12.1 million by 2026, the China market is projected to reach USD 14.1 million by 2026, and the India market is projected to reach USD 5 million by 2026.

Middle East & Africa and Latin America

The Middle East & Africa and Latin America are expected to grow at a significant CAGR during the forecast period. The efforts to modernize medical facilities and enhance the quality of healthcare services drive the demand for advanced dental technologies, such as dental x-ray systems, in these regions, boosting market expansion. Furthermore, growing cases of various dental disorders, such as dental caries and tooth decay, are expected to increase the demand for these devices for better diagnosis.

KEY INDUSTRY PLAYERS

Carestream Dental LLC Secures a Prominent Position Owing to its Comprehensive Product Range

The market is consolidated with the presence of a few players with significant shares. PLANMECA OY, VATECH, Dentsply Sirona, and Carestream Dental LLC held a significant market share in 2023. Carestream Dental LLC is in a prominent position due to its comprehensive range of dental products and solutions, including cutting-edge X-ray systems. The company’s strong global presence and commitment to quality drive its prominence in the dental imaging sector.

Other companies operating in this market include XpectVision Technology Co., Ltd, Trident, Acteon, Freedom Technologies Group, LLC., and other small & medium-sized players. These companies' focus on integrating new technologies and introducing high-performance systems contributes to their substantial presence in the market. Furthermore, strategic initiatives taken by these companies, such as collaboration with distributors to expand their footprint in untapped regions, are also considered contributing factors.

LIST OF TOP DENTAL X-RAY SYSTEMS COMPANIES:

- Dentsply Sirona (U.S.)

- Carestream Dental LLC (Germany)

- VATECH (South Korea)

- PLANMECA OY (Finland)

- Acteon (U.K.)

- Trident (Italy)

- DÜRR DENTAL SE (Germany)

- Midmark Corporation (U.S.)

- Dental Imaging Technologies Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: DÜRR DENTAL SE showcased its intelligent and sustainable solutions at the IDS 2023 event.

- April 2022: ClearChoice Dental Implant Centers announced a collaboration with PLANMECA OY and Henry Schein, Inc. in order to enhance its digital imaging technology services, including x-ray systems. The centers have more than 75 ClearChoice centers.

- February 2022: Midmark Corporation announced a new strategic partnership with Bien-Air Dental SA that combines the two companies’ renowned dental technology into a simple, easy-to-use delivery care solution.

- June 2021: Carestream Dental LLC partnered with SLOWDENTISTRY to promote the use of digital dental technology, including x-ray systems.

REPORT COVERAGE

The research report offers a comprehensive overview of the competitive landscape, highlighting key industry developments such as mergers, partnerships, and acquisitions. It also provides valuable insights into the market, such as trend analysis, the number of dentists across major countries, and an analysis of technological advancements within the market. In addition, the report analyzes various market segments across different regions, includes profiles of leading companies in the market and assesses the impact of COVID-19 and its post-pandemic scenario. Moreover, the report provides a market trend analysis and encompasses qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.86% from 2026-2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Product Type

|

|

By Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global dental X-ray systems market is projected to grow from USD 220 million in 2026 to USD 297.8 million by 2034.

North America dominated the dental X-ray systems market with a market share of 39.71% in 2025.

The market is expected to exhibit a CAGR of 3.86% during the forecast period.

AI plays a crucial role in enhancing diagnostic capabilities by assisting in the detection of dental conditions, improving image analysis, and streamlining workflow efficiency in dental practices.

Key drivers include technological advancements, increasing prevalence of dental disorders, rising awareness about oral health, and the growing demand for precise diagnostic tools.

Leading companies include Dentsply Sirona, Planmeca Oy, Carestream Health, Vatech Co. Ltd., and Danaher Corporation, among others.

Challenges include high equipment costs, regulatory hurdles, and concerns regarding radiation exposure, which can impact the adoption of advanced systems, especially in developing regions.

The market is segmented into solo practices, DSO/group practices, and others, with solo practices holding a significant share due to the increasing number of individual dental practitioners.

Digital X-ray technology offers benefits such as faster image acquisition, lower radiation exposure, and easier storage and sharing of images, leading to improved diagnostic efficiency and patient care.

Recent advancements include the integration of artificial intelligence (AI) for improved diagnostic accuracy, the development of 3D imaging systems, and the introduction of portable and handheld devices for enhanced accessibility.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us