Diamond Market Size, Share & Industry Analysis, By Type (Synthetic and Natural), By Product (Rough and Polished), By Application (Jewelry and Industrial), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

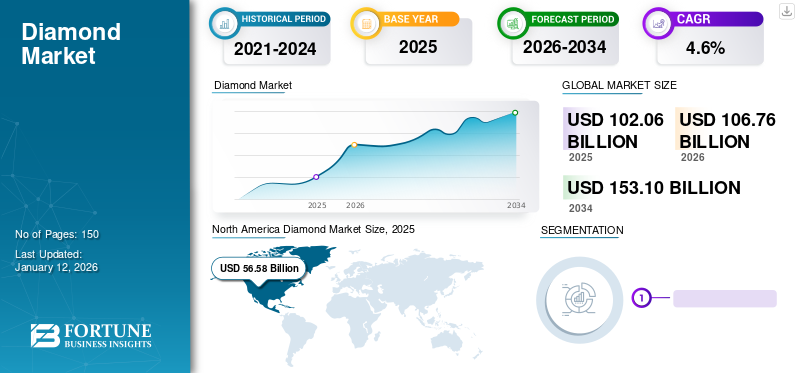

The global diamond market size was USD 102.06 billion in 2025 and is projected to grow from USD 106.76 billion in 2026 to USD 153.1 billion in 2034 at a CAGR of 4.6% during the forecast period. North America dominated the diamond market with a market share of 55% in 2025. Moreover, the diamond market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 68.64 billion by 2032, driven by the growing consumption of the jewellery worldwide.

Diamonds are one of the hardest materials on earth and are well-known as a gemstone. The growth of the market is associated with the rise in the demand for jewelry and its use in industrial applications. The product is utilized according to its extreme hardness and distributed to industry experts for jewelry manufacturing and industrial purposes. Additionally, the product is adopted for research purposes where the unique qualities are required. Thus, all the factors are expected to boost the global market in the forecast period.

Global Diamond Market Overview

Market Size and Forecast

- 2025 Market Size: USD 102.06 billion

- 2026 Market Size: USD 106.76 billion

- 2034 Forecast Value: USD 153.1 billion

- CAGR (2026–2034): 4.6%

Market Share Highlights

- Regional Leader: North America held a 55% share in 2025.

- The U.S. alone is projected to reach USD 68.64 billion by 2032, driven by strong jewelry demand and high disposable income.

Regional Insights

- North America: 2026 market size: USD 59.29 billion

- Asia Pacific: Fast-growing economies (China, India)

- Europe: Strong per capita income and presence of major producers (e.g., De Beers, Alrosa).

- Latin America: Industrialization fueling demand for diamond-based cutting tools.

- Middle East & Africa: Growth from industrial applications and increased regional investments.

The COVID-19 outbreak impacted nearly every country in the world. The mines were closed, and production was limited due to the restrictions imposed on polishing and cutting centers. Jewelry manufacturers had to face supply chain disruptions as the impacted countries such as the U.S., India, China, Russia, and others had imposed lockdowns. However, the demand was not massive during the pandemic, but the global market returned to the pre-pandemic level. China led to the recovery of the market as it is one of the fastest-recovering economies in the world.

Diamond Market Trends

Rising Demand for Innovative Jewelry Designs Owing to Changing Consumer Preferences to Aid Market Proliferation

The demand for colorful jewelry has risen as the preference of the consumer has changed. The changed behavior of the consumers created a massive opportunity for the existing and new producers of these synthetic diamonds along with the many resellers to establish their presence in the global market. Additionally, online platforms have grown dramatically in just a few years, therefore propelling the consumption of jewelry products as a consumer prefers to buy online in order to save time and maintain social distancing.

Download Free sample to learn more about this report.

Diamond Market Growth Factors

Growing Demand from Jewelry Industry Due to its Properties to Propel Market Growth

Diamond is the hardest allotrope of carbon, as it has been used in jewelry and industrial applications for centuries. The growth of the market is associated with the favorable properties of the product as it has the highest thermal conductivity than any natural material. These properties enable its application in industries including polishing and cutting. The usage of the product in construction industry has increased over the past years as its demand for hand sawing, wire sawing, and core drilling due its remarkable properties such as the highest sound velocity, optical dispersion, and low thermal expansion coefficient has increased. Additionally, the use of this gemstone for ornamentation will surge product demand. Moreover, the rising use for lab-grown diamond is boosting the jewelry market as these stones are physically, chemically, and optically identical to the mined diamonds. Thus, consumers are moving towards artificial jewelry.

Product Utilization in the Cutting Tools for industrial Applications is Propelling the Market Growth

Diamond-cutting tools play a crucial role in the cutting of multiple metals and materials. The diamond can easily remove much amount of stock when it comes into the abrasive contract to the other metal. Thus, it is used in the industrial grinding cutting wheels to grind metals such as tungsten carbide, hard metals, and granite. Moreover, the product is also utilized in the cutting tool edge for the machining of abrasive metals such as high silicone, hard ceramics, and high silicone aluminium. On the other side, rapid industrialization across the globe has emerged in demand for tools, types of machinery, and equipment. This has resulted in a strong product demand from cutting tools. Thus, all these factors have boosted the product demand in the market.

RESTRAINING FACTORS

High Price of the Natural Product May Restrain Product Adoption in Various Applications

Although, diamond is widely used in industrial and jewelry applications rising uncertainties in the prices of natural stones may hamper diamond market growth. The value of the product from production to retail has increased drastically. Additionally, the price of polished stone remains costly as compared to rough stone. This higher price is caused by multiple factors including currency fluctuations, low production, and changes in international import-export policies. Such factors had made this stone unaffordable to many people thereby affecting the consumption of product by middle to lower-class people. Hence, the aforementioned factors are acting as a major restraint towards market augmentation.

Diamond Market Segmentation Analysis

By Type Analysis

Synthetic Type to Hold Dominant Share Owing to Rising Usage in Construction Tools

The market is segmented into natural and synthetic, on the basis of type. The demand for synthetic stone is high in the market due to their wide availability and lower cost. The growth of synthetic stone is associated with a boost in the construction industry as it is used in cutting tools for different industrial applications such as cutting bit and drilling tools. Additionally, the product is widely used in manufacturing glass-cutting tools. Also, it helps to cut production costs as it reduces maintenance costs and can be easily replaced. The Synthetic segment is contributing 96.97% globally in 2026

Moreover, the use of synthetic stone in jewelry became far more popular over the past years. Western wedding trends have influenced Asian and European countries, and it has the potential to control the consumption of synthetic stone for wedding purposes.

By Product Analysis

Rough Segment Accounts for Largest Share Due to Lowered Prices

The market is segmented into rough and polished stone, on the basis of product. The rough segment accounting for 76.63% market share in 2026. The demand for the rough segment is associated with their low cost as compared to polished ones. Additionally, rough stones are widely utilized in cutting tools, and drilling equipment. For instance, rough stone grains are installed into the metal tip of the drill bits and ream shells. Moreover, rough diamonds are utilized in the production of optical lenses as the product can be installed into the grinding wheels to cut the lenses. Thus, the demand for rough stone is expected to increase during the forecast period. Moreover, rapidly growing jewelry industry will propel the demand for polished stone during the forecast period.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Jewelry Segment to Exhibit a Significant Growth Rate Due to Rising Disposable Income

On the basis of the application, the market can be segmented into jewelry and industrial application. The growth of the jewelry segment with a share of 94.79% in 2026 is associated with the increase in disposable income. Multiple brands in the market are offering different gem-grade diamonds for various occasions including weddings and Valentine’s day. These grades come with different price ranges from lower to higher, therefore attracting consumers to buy them. Additionally, the number of fashion influencers has increased in the past few years. This has resulted in the young generation investing in branded jewelry. Thus, all these mentioned factors are expected to drive the market.

On the other hand, the demand for the industrial segment can be attributed to increasing in industrialization. Developing countries such as India, China, Brazil, and Argentina have the highest growth rate of industrialization. The demand for the rough stone has increased in these countries as mining and drilling activity has increased recently. Additionally, growing investments by companies in R&D and technological advancements worldwide will further influence market growth. Thus, all these factors are expected to grow the market.

REGIONAL INSIGHTS

North America

North America Diamond Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America stood at USD 59.29 billion in 2026. The growth of the market in the region is associated with the high disposable income and extensive use of the product in wedding jewelry. Countries in the region such as the U.S. individually record more than half the global demand for the product. Additionally, the number of influencers is high in the region which influences young consumers to buy jewelry. Thus, the demand is drastically increasing in the region and is expected to grow with a moderate CAGR during the forecast period. The U.S. market is projected to reach USD 51.69 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific market is projected to showcase moderate growth in the upcoming years. Countries in the region including China, and India are the fastest-growing economies, additionally, both of the countries have the highest global population. Therefore, China is the leading consumer of the product as the popularity of Western weddings continues even though there is a downward trend in the wedding rate. Moreover, the influence of western wedding culture and fashion is rapidly increasing in Japan, Indonesia, and other countries. The Japan market is projected to reach USD 5.46 billion by 2026, the China market is projected to reach USD 12.23 billion by 2026, and the India market is projected to reach USD 7.82 billion by 2026.

Europe

The market in Europe may exhibit substantial gains during the forecast period. High per capita income and consumer preference for expensive jewelry are expected to boost the market in the region. Additionally, the region has a few giant players. For instance, Alros, and De Beers account more than 60 percent of mine production in Russia, and Luxembourg respectively. Moreover, change in lifestyle, and consumer behavior is expected to drive market growth in this region in the forecast period. Germany market is projected to reach USD 2.22 billion by 2026.

The growth of the market in Latin America is owing to an increase in industrialization as the product primarily works as a cutting tool for various end-use industries due to its extreme hardness. For instance, the demand for engraved products is rapidly increasing, therefore, propelling product demand in the region. Meanwhile, the Middle East & Africa region is expected to have significant market growth driven by increased investments in industrialization.

List of Key Companies in The Diamond Market

Key Players to Strengthen Their Position by Expanding their Regional Presence

The foremost producers, including KGK Group, De Beers, and Rio Tinto are operating in the market. De Beers has a strong presence in Europe and manufactures natural stones. The company has a presence in Hong Kong, New York, Beijing, and other countries in Europe. The company is one of the rare and unique diamond manufacturers in Russia. Similarly, the other key market players have established a strong regional presence, robust distribution channels, and varied product offerings.

LIST OF TOP DIAMOND COMPANIES PROFILED:

- KGK Group (China)

- De Beers (Canada)

- Rio Tinto (U.K.)

- Arctic Canadian Diamond Company Ltd (Canada)

- Petra Diamonds (South Africa)

- Alrosa (Canada)

- Argyle (Switzerland)

- WD Lab Grown Diamonds (U.S.)

- Gem Diamonds (U.K.)

- Sagar Diamonds (India)

KEY INDUSTRY DEVELOPMENTS:

- September 2022- Arctic Canadian Diamond Company Ltd. announced that the company has recovered a fancy vivid yellow diamond which is the largest of its kind in Canada. The recovery of these types of the diamonds will ensure the highest revenue for the company.

- May 2022- WD Lab Grown Diamonds announced its first authorized distributor to expand its market in Chicago. The purpose of the partnership is to maximize the company’s revenue.

- March 2022- Rio Tinto has offered a proposal to the Turquoise Hill Board. The purpose of the proposal is to acquire 49% shares of Turquoise Hill in order to expand the business activity as the company has a large amount of the unmined diamonds which may boost the company’s revenue.

- November 2021- Signet Jewelers Limited acquired Diamonds Direct USA Inc to achieve growth strategy while meeting the customer needs and to access accessible luxury and bridal segment. The company did the transection in US$ 490 million.

- August 2021- The KGK Group launched its whole new diamond manufacturing facility in Saurimo. The purpose of the diamond business expansion in Angola is to establish a key presence in the country.

REPORT COVERAGE

An Infographic Representation of Diamond Market

To get information on various segments, share your queries with us

The research report provides a detailed analysis of the market and focuses on crucial aspects such as types, product, application, and leading companies. It provides quantitative data regarding value, research methodology for market size estimation, and insights into market trends. It highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By Application

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global diamond market was valued at USD 102.06 billion in 2025 and is expected to reach USD 153.1 billion by 2034.

Growing at a CAGR of 4.6%, the market will exhibit rapid growth in the forecast period (2026-2034).

Demand for jewelry, industrial uses, and rising popularity of synthetic diamonds drive market growth.

Synthetic diamonds offer a cheaper alternative with similar properties, boosting demand in jewelry and industry.

North America leads with over 55% market share, driven mainly by the U.S.

Diamonds are used in cutting, drilling, grinding tools, and optical lenses due to their hardness.

High prices and import/export issues limit affordability and growth.

Top companies include De Beers, KGK Group, Rio Tinto, and Petra Diamonds.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic