Digital PCR Market Size, Share & Industry Analysis, By Type (Droplet Digital PCR, Chip-based Digital PCR, and Others), By Product (Instruments and Reagents & Consumables), By Indication (Infectious Diseases, Oncology, Genetic Disorders, and Others), By End-user (Hospital & Clinics, Pharmaceutical & Biotechnology Industries, Clinical Laboratories, and Academic & Research Organizations), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

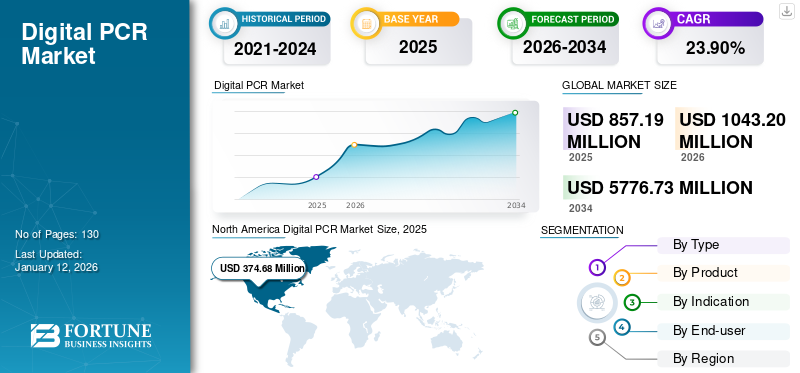

The global digital PCR market size was valued at USD 857.2 million in 2025. The market is projected to grow from USD 1,043.20 million in 2026 to USD 5,776.73 million by 2034, exhibiting a CAGR of 23.90% during the forecast period. North America dominated the digital pcr market with a market share of 43.70% in 2025.

A digital polymerase chain reaction is a biotechnological advancement of conventional technology. It is a high-throughput absolute quantitative method that provides a sensitive and reproducible way of measuring the amount of DNA or RNA in a sample. Some of the benefits of this method include precise, fast, straight forward, and cost-effective detection, higher sensitivity, absolute quantification, and others.

The rise in prevalence of infectious diseases, cancer, and genetic disorders, the introduction of products, increasing acquisitions, and the growing adoption of the technology by laboratories are some of the key factors expected to drive the market growth during the forecast period. Moreover, rising technological advancements in digital devices are projected to contribute to the market growth during the forecast period.

The impact of COVID-19 resulted in considerably high growth of the market in 2020. This is attributed to the vast spread of the virus, thereby increasing the demand for effective diagnostics to control its spread. The global market witnessed a humongous growth rate of 38.6% in 2020 as compared to 18.1% in 2019.

The reallocation of healthcare resources for COVID-19 treatment increased the number of people going for the COVID-19 diagnosis and the adoption of these devices in the clinical laboratories, and research institutes, thereby fueling the demand for the devices. Furthermore, the positive impact was due to the strong increase in COVID-19 testing in high-burden countries globally. Decline in the number of COVID-19 cases among the population post pandemic limited the use of COVID-19 test kits and use of digital PCR devices across healthcare settings.

However, the resumption of routine medical diagnosis at hospitals and diagnostic centers in 2021 augmented patient visits to healthcare settings. Moreover, rising emphasis of key players on production and launch of new dPCR assays & equipment for extensive biopharma applications further propelled the adoption of these devices. Thus, these factors further augmented the demand for these tests in 2021 at a considerable pace as compared to 2020. Strong and sustained demand for these products will contribute to the market growth over the forecast period of 2025-2032.

Digital PCR Market Snapshot & Highlights

Digital PCR Market Size & Forecast

- 2025 Market Size: USD 857.2 million

- 2026 Market Size: USD 1,043.20 million

- 2034 Forecast Market Size: USD 5,776.73 million

- CAGR: 23.90% from 2026–2034

Market Share

- North America dominated the global digital PCR market in 2025, accounting for 43.70% of the total market share. This dominance is attributed to the region’s early adoption of advanced molecular diagnostic technologies, a high prevalence of chronic and infectious diseases, and strong investments in clinical research and development. The U.S. market, in particular, demonstrated strong demand for digital PCR systems due to an increase in diagnostic procedures and high-end biopharmaceutical applications.

- By type, droplet digital PCR (ddPCR) is expected to hold the largest market share in 2026, driven by increasing product launches and high sensitivity in detecting infectious diseases. Companies such as Bio-Rad Laboratories, Inc. and Thermo Fisher Scientific Inc. are investing significantly in ddPCR platforms to support diagnostics and research applications.

Key Country Highlights

- Japan: Digital PCR demand in Japan is supported by growing investments in personalized medicine and the increasing adoption of advanced technologies for cancer and infectious disease diagnostics. Companies like Sysmex Corporation are leading innovation in this space.

- United States: Growth is largely driven by high adoption among clinical and academic laboratories, robust funding for molecular diagnostics research, and the presence of market leaders like Bio-Rad and Thermo Fisher. The country has also seen strong post-pandemic adoption of dPCR for broader diagnostic applications.

- China: The market in China is expanding rapidly due to rising healthcare investments, large patient pools for infectious and genetic diseases, and growing awareness around precision diagnostics. Government initiatives to upgrade molecular diagnostic capacity across hospitals are further boosting the market.

- Europe: Growth is supported by increasing R&D funding, favorable government initiatives, and strong infrastructure for molecular biology research. Initiatives like the European Investment Bank’s USD 31.3 million investment in next-gen dPCR development via Stilla Technologies highlight Europe’s focus on digital diagnostics.

Digital PCR Market Trends

Shift of Healthcare Providers from Droplet to Chip-based Tests to Boost Market

The shift from droplet to chip-based tests for the diagnosis of various diseases has been pivotal in the advancement of the devices. In commercially available droplet digital test kits, the droplets have to be transferred manually, leading to underestimation of the targets. Moreover, ddPCR kits also pose a risk of cross-contamination during the transfer of the sample. Furthermore, there are several limitations associated with ddPCR such as the variability in shape and size of droplet which affects the reproducibility and robustness of the method. Several other limitations include a time-consuming workflow, requirement of trained professionals, and others.

On the other hand, in a chip-based technology, droplets always run in channels, reducing the risk of cross-contamination. In addition, these test kits have several advantages compared to others. Some of these advantages include rapid, technically simple, and cost-effective screening.

This innovation is expected to increase its adoption for the diagnosis of various diseases in the near future. Moreover, the increasing incidence of infectious diseases and the growing prevalence of cancer are expected to shift healthcare providers to chip-based devices. This is further projected to propel the digital PCR market growth during the forecast period.

Download Free sample to learn more about this report.

Digital PCR Market Growth Factors

Technological Advancements in dPCR to Enhance Market Growth

Digital polymerase chain reaction is the refinement of conventional technology that can be used to quantify and clonally amplify nucleic acids directly. Increasing research and development activities and growing demand for innovative devices have led to the introduction of various PCR technologies offering great benefits. The introduction of innovative devices based on techniques such as droplet, chip-based, beam, and crystal reaction, by key market players is anticipated to drive market growth.

- In November, 2022, Shenzhen New Industries Biomedical Engineering Co., Ltd. launched a new product in the Snibe Molecular portfolio, the Molecision S6 digital PCR system, at MEDICA 2022. The Molecision S6 is an automated, integrated digital PCR system that provides a full-platform solution for research/in vitro diagnostics.

Such technological advancements are expected to fuel the market during the forecast timeframe (2025-2032).

Additionally, owing to the growing demand for dPCR products, various public entities, private organizations, and research institutions are actively involved in the development of digital PCR systems devices. Majority are being developed by private organizations. Some of the actively involved market players are Bio-Rad Laboratories, Stilla Technologies, and others.

Several Benefits of dPCR over Real-time Polymerase Chain Reaction to Boost Market Globally

dPCR is a third generation of PCR which allows for the complete quantification through the partitioning of the reaction. These tests are aimed to deliver a complete measure of target nucleic acid molecules compared to others. This absolute DNA quantification allows for reproducibility, sensitivity, and precision, further enabling researchers to quantify smaller differences and precisely measure minor variants.

Additionally, despite the wide application of real-time devices chain reaction, it is not a preferred technique for detecting various parasitic infectious diseases such as malaria and COVID-19 due to multiple types of genomes present in the virus and extremely low template concentration available in the sample. Digital droplet devices overcome those issues and deliver accurate results with better comparability of results from different groups.

- For instance, in March 2022, according to an article by Clinical Microbiology Review for the detection and diagnosis of SARS-CoV-2, tests based on digital technology have been extensively used over real-time polymerase chain reaction due to various benefits associated with it.

Various advantages associated with these digital devices over real-time devices are expected to increase the adoption of tests and instruments based on digital technology during the forecast period.

RESTRAINING FACTORS

High Cost of Instruments, and Presence of Other Alternatives such as NGS May Limit Market Growth

Despite various advantageous applications of digital polymerase chain reaction, a few limitations are associated with its use, which can hamper its adoption in the market.

Certain limitations, such as higher cost of these digital devices as compared to other options, may limit its adoption. This factor gives rise to multiple alternative options in the market. For instance, counting PCR is an alternative to the digital technique for absolute quantification. It quantifies viral load, copy number variation, and gene expressions. Such an alternative is expected to limit the growth of these digital devices in the market.

- For instance, in August 2022, according to the Frontiers Media S.A. article, limitations of digital PCR, such as the high cost of instrument, and its limited versatility of reagents as compared to NGS, led to its limited adoption across general biochemistry laboratories.

Additionally, there is a requirement of trained personnel to handle the dPCR devices to perform and quantify the results. This leads to the slower adoption of these products in the low-and-middle income countries due to the lack of skilled professionals. Also, many equipment and reagents are not easily available for microfluidic technologies, limiting their adoption in many underdeveloped countries that are more vulnerable to viral infections.

Such limitations associated with the use of these digital devices coupled with the presence of other effective alternatives can restrain the overall market growth in the coming years.

Digital PCR Market Segmentation Analysis

By Type Analysis

Droplet dPCR Segment to Hold a Major Share due to Increasing Product Launches for Infectious Disease Diagnosis

By type, the market is divided into droplet digital PCR, chip-based digital PCR, and others.

In 2026, the droplet dPCR segment held the highest market with a share of 82.04%. It is anticipated to expand at a substantial CAGR during the forecast period, 2026-2034. The growth is attributed to the increasing emphasis of market players on the development and commercialization of dPCR for infectious disease diagnostics.

- In April 2023, Bio-Rad Laboratories, Inc., launched its new QX600 Droplet Digital PCR System. This device utilizes the same droplet generation and processing protocols as the QX200 system, and enables easy adoption of its advanced multiplexing capabilities.

Furthermore, the increasing prevalence of infectious diseases and the advantages of these devices in the diagnosis of diseases are expected to boost the segmental growth during the forecast period.

- For instance, in June 2022, as per an article by NCBI, digital droplet PCR is more sensitive than reverse transcription quantitative real-time polymerase chain reaction and is usually considered the superior choice in detection of viral pathogens in clinical specimens.

The chip-based segment is projected to expand at a moderate CAGR during the forecast timeframe. The segmental growth is attributed to the sensitivity of chip-based tests in detecting strain’s specificity with less variability compared to the current standard of plate count enumeration techniques and quantitative polymerase chain reaction.

To know how our report can help streamline your business, Speak to Analyst

By Product Analysis

Instruments to Hold a Major Share due to Increasing Adoption of Digital Technologies

Based on product, the market is segmented into instruments, and reagents & consumables.

The instruments segment accounted for the largest global digital PCR market with a share of 59.01% in 2026 and is expected to expand at a substantial CAGR during the forecast period. The largest share of the segment is attributed to the increasing initiatives of the market players for the launch of new products and rising applications of this device in the market.

- For instance, in August 2023, F. Hoffmann-La Roche AG launched a digital PCR system, to fight against cancer and other diseases. The Digital LightCycler System is a next-generation system that helps clinical researchers better predict cancer, genetic disease or infection.

The reagents & consumables segment is projected to expand at the highest CAGR during the forecast timeframe. The growth of the segment is due to increasing commercialization of these digital device kits for diagnosis purposes. Furthermore, due to the COVID-19 pandemic, governments provided emergency use authorization to certain kits based on digital techniques for the diagnosis of COVID-19, which is anticipated to further boost the market growth in the long run.

- For instance, in November 2023, QIAGEN introduced new QIAcuity digital PCR kits for food safety and biopharmaceutical customers.

- Similarly, in May 2020, the FDA granted emergency use authorization (EUA) for Bio-Rad's SARS-CoV-2 ddPCR Kit in the U.S. The kit is a COVID-19 diagnostic tool with high sensitivity and precision beyond that of qPCR assays.

By Indication Analysis

Clinically Proven Effectiveness of Digital Polymerase Chain Reaction in Infectious Diseases to Increase Demand

Based on indication, the market is segmented into infectious diseases, oncology, genetic disorders, and others.

The genetic disorders segment dominated the market with a share of 51.56% in 2026 and is expected to expand at a moderate CAGR during the forecast timeframe, 2025-2032. The growth of the segment is attributed to the increasing adoption of these devices to identify gene alterations due to its high sensitivity and specificity in detection.

- According to an article published by National Library of Medicine in 2023, the sensitivity of the RT-qPCR rapid test was 37.9%, the specificity was 65.5% as compared to RT-PCR rapid tests.

The oncology segment is projected to expand at a substantial CAGR during the forecast timeframe. The growth of the segment is attributed to the increasing prevalence of cancer diseases and the growing adoption of these digital devices over other devices in cancer research.

- According to an article published by America Cancer Society in 2022, around 1,918,030 new cancer cases were diagnosed in the U.S.

The infectious diseases segment is anticipated to expand at the highest CAGR during the forecast period. The clinically proven potential advantages of these droplet digital devices in the diagnosis of infectious diseases, including viral, bacterial, and parasitic infections are expected to boost the adoption of these devices, thereby propelling segmental growth.

By End-user Analysis

Academic & Research Organizations to Continue Dominance due to Higher Adoption of Digital Technologies for Research Activities

Based on end-user, the market is segmented into hospitals & clinics, pharmaceutical & biotechnology industries, clinical laboratories, and academic & research organizations.

The academic & research organizations segment held the largest market with a share of 67.90% in 2026 and is expected to expand at a moderate CAGR during the forecast period. The segment's growth is attributed to the increasing use of these devices in research studies in various fields, including oncology, genetic diseases, and others.

- In February 2023, Thermo Fisher Scientific Inc., announced the launch of its new digital PCR research solution, the Applied Biosystems QuantStudio Absolute Q AutoRun dPCR suite.

The clinical laboratories segment is projected to expand at the highest CAGR during the forecast timeframe. The segment's growth is attributable to the increasing prevalence of infectious diseases and the rising use of these digital devices for the diagnosis of various types of these diseases. Furthermore, with the outbreak of COVID-19, many market players increased their focus on developing and commercializing COVID-19 diagnostics kits.

- In March 2020, Bio-Rad Laboratories, Inc. and Biodesix, Inc., a diagnostics company in lung disease, announced their partnership to bring the COVID-19 droplet digital polymerase chain reaction test to the FDA for an Emergency Use Authorization (EUA) approval to support the escalating need for testing in the U.S. Such partnerships for new product approvals related to COVID-19 contributed to the segmental growth in 2020.

REGIONAL INSIGHTS

North America

North America Digital PCR Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The North America market was valued at USD 374.68 Million in 2025 and is projected to expand at a substantial CAGR during the forecast period. The growth is due to the highly alert and economically stable population. Moreover, the increasing adoption of technologically advanced and high-cost diagnostics in the region is also expected to propel the regional market growth during the forecast period. The U.S. market is projected to reach USD 426.29 Million by 2026.

- According to research statistics published by SDi report in December 2022, the adoption of dPCR among the 248 scientists surveyed in the U.S. labs was over 40%.

Europe

Europe is anticipated to expand at a moderate CAGR during the forecast timeframe. The growth is attributable to strong infectious diagnostics volume in key European countries and the rising expenditure on research & development in Europe. The UK market is projected to reach USD 33.09 Million by 2026, while the Germany market is projected to reach USD 82.64 Million by 2026.

- In March 2022, Stilla Technologies, announced a new project with investment of USD 31.3 million by the European Investment Bank. The project focuses on accelerating the development of next-generation genetic tests by providing a ground-breaking and flexible solution.

Asia Pacific

The market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The market growth across the region is attributed to the improvement in healthcare infrastructure in Asian countries, the high burden of chronic and infectious diseases in the region, and increasing consciousness of individuals in terms of better treatment outcomes. The Japan market is projected to reach USD 50.98 Million by 2026, the China market is projected to reach USD 83.81 Million by 2026, and the India market is projected to reach USD 30.93 Million by 2026.

- For instance, according to the data provided by the National AIDS Control Organization in April 2022, in response to an RTI query, over 17 lakh people contracted HIV in India in the last 10 years. Such increasing prevalence of infectious diseases has been increasing the demand for effective diagnosis in the region, thereby spurring the market growth in Asia Pacific.

Latin America and the Middle East & Africa

The market in Latin America and the Middle East & Africa is expected to expand at a significant CAGR during the forecast period. The growth is attributable to the growing number of clinical studies to evaluate the efficacy of these devices and the increasing commercialization of such products in the region. Furthermore, increasing efforts to enhance the healthcare infrastructure of these countries are expected to further support market growth across the region.

List of Key Companies in Digital PCR Market

Diverse Portfolio of Leading Players and Strong Focus on Partnerships and Acquisitions to Strengthen their Market Position

The market is consolidated due to large market shares of key companies operating in the market.

The key companies operating in the market are Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., and Qiagen. In 2024, these three companies together accounted for a major share of the market.

Bio-Rad Laboratories, Inc. dominated the market with the highest market share. The company’s market dominance is due to its strong droplet digital test product portfolio covering instruments and consumables. Moreover, the company’s strong market share is due to the acquisitions of other digital devices manufacturers in the historical years. Moreover, other major players, such as Qiagen N.V., are now focusing on inorganic strategies such as collaborations with new dPCR manufacturers for production and expansion of existing product portfolio globally. These factors are further propelling the company growth in the market.

- In August 2022, Bio-Rad Laboratories, Inc. announced the acquisition of Curiosity Diagnostics, Sp. Z. O. o., a Poland-based developer of innovative technology solutions for the medical diagnostic and healthcare markets.

- In July 2022, Qiagen announced a series of enhancements through collaborations for its QIAcuity series of digital PCR instruments designed to drive greater use among customers, particularly those involved in the biopharma industry.

Other prominent players in the global market include Stilla, Sysmex Corporation, JN Medsys, and Standard BioTools Inc. (Fluidigm Corporation). These companies are focusing on strategic initiatives to gain more market shares during the forecast period.

- In March 2023, Stilla and AtilaBiosystems entered into an agreement to market co-labelled digital PCR kits.

LIST OF KEY COMPANIES PROFILED:

- QIAGEN (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- JN Medsys (Singapore)

- Stilla (France)

- Sysmex Corporation (Japan)

- Standard BioTools Inc. (U.S.)

- Precigenome LLC. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2023: QIAGEN expanded its digital PCR offerings with the launch of new dPCR kits.

- March 2023: Thermo Fisher Scientific Inc. introduced new digital PCR research solution.

- October 2022, Standard BioTools Inc. announced the launch of the X9 Real-Time PCR System, an innovative high-capacity genomics instrument offering superior efficiency.

- April 2022, Stilla and Promega Corporation announced their co-marketing agreement that combined sample preparation with the latest Maxwell systems and digital polymerase chain reaction on the six-color Naica system. This collaboration strengthened both companies’ digital workflow solutions.

- March 2022, Stilla announced its partnership with 12 distributors across the EMEA region. With this partnership, the company expanded its presence in the EMEA region.

- September 2021, Thermo Fisher Scientific Inc., announced the launch of Applied Biosystems QuantStudio Absolute Q DPCR System.

- August 2021, QIAGEN and GT Molecular announced the collaboration to offer a complete SARS-CoV-2 wastewater detection solution based on QIAcuity Digital PCR technology.

REPORT COVERAGE

The research report provides a detailed competitive landscape and market dynamics. It focuses on key aspects such as the prevalence of chronic disease, regulatory scenarios by key countries/regions, and an overview of microfluidic consumables in the market. Furthermore, the report provides information on key industry developments, pricing analysis of consumables by key companies, and detailed product mapping of consumables supplied by key companies. In addition, the report includes insights related to technological advancements in the devices used in digital PCR method.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.90% from 2026-2034 |

|

Unit |

Value (USD million) |

|

Segmentation

|

By Type

|

|

By Product

|

|

|

By Indication

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 857.19 million in 2025 and is projected to reach USD 5,776.73 million by the end of 2034.

The market is expected to expand at a CAGR of 23.90% during the forecast timeframe (2026-2034).

The droplet digital polymerase chain reaction segment is the leading segment in the market by type.

The growing adoption of digital techniques over other conventional methods and the rising incidence of chronic and infectious diseases are some of the factors driving the market.

Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., and Qiagen are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us