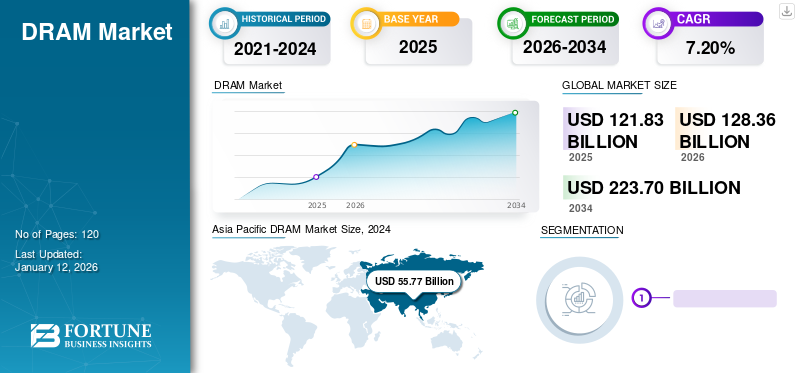

DRAM Market Size, Share & Industry Analysis, By Type (Double Data Rate SDRAM, Rambus DRAM, Fast Page Mode DRAM, Extended Data Out DRAM, and Others), By Technology (DDR4, DDR5, and Others), By Application (Gaming Console, PCs/Laptops, Automotive, Mobile Phones, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global DRAM market size was valued at USD 121.83 billion in 2025 and is projected to grow from USD 128.36 billion in 2026 to USD 223.7 billion by 2034, exhibiting a CAGR of 7.20% during the forecast period. Asia Pacific dominated the global market with a share of 45.80% in 2025.

Dynamic random access memory is an integrated circuit that is used for digital electronics requiring high-capacity memory and low-cost such as graphics cards, game consoles, portable devices, and modern computers.

The industry is perceiving the adoption of 3D dynamic random access memory modules to overcome the challenges of this technology, marking it as a crucial direction for future memory. Currently, 3D dynamic random access memory is in its early stage of development. Key players are investing in research and development and introducing new products related to 3D DRAM.

- Samsung started research and development in 2019 and launched 3D-TSV technology in the same year. In May 2023, the company established a development team within its semiconductor research division for mass production of 4F2 structured dynamic random access memory.

- In May 2023, NEO Semiconductor launched 3D X- dynamic random access memory to overcome the capacity limitations of dynamic random access memory.

- In June 2023, the Tokyo Institute of Technology research team launched a 3D DRAM stacking design technology called as BBCube that allows integration between processing units and dynamic random access memory.

Based on current research progress, the industry is actively engaged in the development of 3D products, which is in the initial stage and estimated to emerge by 2025.

During the pandemic demand have surged for memory due to remote working, increase in online gaming, increase in online media streaming and others. In first quarter of 2020, Netflix had nearly 16 million new users, 60% more than previous years. Also, around 23 million users visited online gaming platform per day during the lockdown period. However, due to increasing online gaming, media streaming, remote working policy the demand for DRAM increased during the pandemic.

DRAM Market Trends

Surge in Dynamic Random Access Memory Demand for Artificial Intelligence PCs to Drive the Market Growth

In 2024, the term AI PCs gained popularity. AI PCs are computers with generative AI capabilities without the necessity of a cloud platform. These PCs have the same central processing unit (CPU) and graphics processor unit (GPU) as a traditional PC and an additional neural processing unit (NPU) that traditional PCs do not have. The NPU can rapidly process huge amounts of data with low power utilization and is combined with a local large language model (LLM) to proliferate the usage of generative AI in various industries. Memory is an essential part of AI PC that has a direct impact on overall system performance and AI task implementation.

AI processes need a huge amount of data for training and deep learning, and this data is temporarily stored in memory. The trained AI model comprises an enormous number of factors including algorithms, training data and others and as the complexity of the model increases, the number of factors including algorithm and training data also increases, and an adequate amount of memory capacity is essential to store these parameters. Hence, by using high-capacity and high-speed memory, data can be accessed quickly and it can speed up the training process of the model. When moving the trained model into actual applications, reducing model size, optimizing memory, and enhancing memory usage efficiency is vital. However, to fulfil the memory requirements, the demand for dynamic random access memory is increasing in AI PCs.

Therefore, the above factors are boosting the DRAM market share.

Download Free sample to learn more about this report.

DRAM Market Growth Factors

Increasing Number of Data Centers to Augment the Market Growth

The demand for data centers has soared owing to remote work and the growth of high speed streaming. There are around 7 Bn internet-connected devices and the number continues to grow and many of these generate huge volumes of data that need to be stored, captured, routed, evaluated, and retrieved. With the surge of Internet of Things (IoT) devices and Industry 4.0, manufacturers are dependent on big data and data analytics to improve the productivity, efficiency, security, and cost-effectiveness of their operations. Moreover, organizations are also dependent on data center services, from colocation to hyperscale, as they face new issues due to economic challenges, COVID-19 pandemic, and market growth trends.

The pandemic compelled organizations to adopt digitalization to support remote work, new services, and other things. This shift required scalability and flexibility to allow businesses to introduce services across enterprise. In 2021, the number of hyperscale data centers was more than twice the number of hyperscale data centers in past years. In addition, investments in data centers are witnessing a surge to meet an expected increase in demand for cloud computing. For instance, Microsoft is heavily investing in building 100 new data centers per year.

Therefore, surging data volume across the world is increasing demand for data centers and the growing number of data centers is driving the DRAM market growth.

RESTRAINING FACTORS

Decline in the Sales of Smartphones May Hamper the Market Growth

Shipments of smartphones and other consumer electronics have witnessed a decline in 2024 compared to 2022 due to economic downturn, increase in inflation, and decrease in consumer spending. The leading smartphone players, including Apple, Oppo, One Plus, Samsung, and others, witnessed a decline in smartphone sales in 2023 due to higher interest rates and increasing uncertainty due to geopolitical tension. Moreover, the long life cycle of dynamic random access memory allows for one-time investments in memory solutions, excluding critical damages. Therefore, the drop in the demand for DRAM manufacturing restricts the market growth.

DRAM Market Segmentation Analysis

By Type Analysis

Increasing Adoption of Double Data Rate SDRAM for Faster Data Transfer to Boost the Segment Growth

By type, the market is segmented into double data rate SDRAM, rambus DRAM, fast page mode DRAM, extended data out DRAM, and others.

The double data rate SDRAM segment dominated the market with a share of 43.66% in 2026. and is estimated to expand with the highest growth rate during the forecast period. Double data rate SDRAM has a high-speed data transfer rate and it enables faster data access for a wide range of applications. In addition, DDR SDRAM helps improve efficiency and consumes less power compared to other memory types. It operates in coordination with the system clock rate to comprehend more efficient data transfer and lower power consumption.

By Technology Analysis

Faster Data Transfer Through DDR4 to Propel the Segment Expansion

By technology, the market is segmented into DDR4, DDR5, and others.

The DDR4 segment dominated the market with a share of 53.07% in 2026., as DDR4 runs at speeds between 2133MHz and 3200MHz, compared to DDR3, which runs at speeds between 800MHz and 2133MHz. DDR4 RAM can transfer data at much faster rates, resulting in smoother multitasking, improved performance, and quicker load times. Its RAM modules can range from 4GB to 32GB per module, allowing it to install more RAM in the computer and run more applications simultaneously without slowing down. This is especially important for users who want to run multiple applications simultaneously, including virtual machines or video editing software.

The DDR5 segment is expected to register the highest CAGR during the forecast period as DDR5 has a memory capacity range of 8 to 64 GB and produces less heat with a predictable impact on server performance. With DDR5, power management is moved from the motherboard to the DIMM. These new DIMMs comprise a 12V power management integrated circuit (PMIC), which decreases noise problems and signal integrity and also the margin of loss prompted by a lower operating voltage.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Smartphone Penetration to Surge the Mobile Phones Segment Growth

By application, the market is divided into gaming console, PCs/laptops, automotive, mobile phones, and others.

The mobile phones segment dominated the market with a share of 33.59% in 2026., owing to growing smartphone usage and a surge in smartphone penetration, which has increased the demand for low power consumption and high processing capabilities with high storage capacity. Mobile manufacturers are utilizing dynamic random access memory for supporting various AI and 5G powered applications.

The automotive segment is estimated to grow with the highest CAGR during the forecast period as dynamic random access memory can be used in safety-critical areas of the automobile to deliver high bandwidth and large capacity to assist the computing required for ADAS, driver information systems, and self-driving vehicles. High-definition displays generally need dynamic random access memory so that the instrumentation consoles and heads-up displays can transmit safety-critical information to the driver. Furthermore, a large amount of data is generated through the cameras and other sensors in ADAS. These data require further processing to remove noise, identify objects and obstacles and adjust according to different lighting conditions. For this process, capacity and bandwidth of dynamic random access memory are required. In addition, self-driving vehicles need processing of a number of high bandwidth input sources and intense computation, which require dynamic random access memory.

REGIONAL INSIGHTS

The market is studied across the regions, including North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. These regions are further classified into leading countries.

Asia Pacific DRAM Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific generated maximum revenue of USD 55.77 billion in 2025 and is estimated to showcase the highest CAGR during the forecast period, as Taiwan, China, South Korea, and Japan account for around 72% of global semiconductor production. In addition, countries including Taiwan and South Korea are major producers of dynamic random access memory and related products and players in these countries account for around 90% of the total market share. Furthermore, the outbreak of the COVID-19 pandemic escalated the trend of remote operations and online working. Increased usage of the internet in private and public organizations and by individuals is creating demand for smart storage. Moreover, government initiatives to promote digitalization are driving the demand for storage. In 2021, the Japanese government provided financial support to enterprises for establishing data centers in around five regional cities. With the increasing dependence on artificial intelligence, Internet of Things (IoT) devices, cloud services, and big data analytics, the requirement for scalable and strong data centers has increased greatly. The Asia Pacific has become the center of this data revolution, with a remarkable increase in data center developments, which is driving the region toward a digital future. Thus, the above factors are driving the demand for dynamic random access memory in the region. The Japan market is projected to reach USD 12.25 billion by 2026, the China market is projected to reach USD 8.18 billion by 2026, and the India market is projected to reach USD 1.37 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America is expected to witness substantial growth during the forecast period as the Creating Helpful Incentives to Produce Semiconductor (CHIPS) Act introduced in 2022 has provided billions of dollars to bring the manufacturing of semiconductors to the U.S. However, semiconductor fabrication plant requires skilled technicians and engineers at all levels and the U.S. does not have the talent pool to support this ambition. Currently, the country manufactures around 12% of the world’s chips and has outsourced the manufacturing of semiconductors for 3 decades. Furthermore, companies such as Micron, Intel, and TSMC are building new Fab center across the U.S. through CHIPS Act funding and are working with universities and consortiums to update and build curricula within existing engineering schools and introducing new degrees or certifications regarding semiconductors. The U.S. market is projected to reach USD 20.61 billion by 2026.

Europe is estimated to witness significant growth in coming years as the region has a dynamic semiconductor manufacturing industry and around 60 operating fabrication plants. In 2023, the EU CHIPS fund has been introduced to help European semiconductor manufacturers increase their manufacturing capability and capacity. Moreover, the EU Commission has allocated around USD 50 Bn of funding and companies have started setting up their semiconductor facilities through the EU CHIPS Act. Some European countries already have active semiconductor fabricator projects. Ireland has an Intel F34 newbuild, which is now on the way for production capability. Germany will witness an increase in construction due to numerous new build and expansion projects. Other countries such as Spain, France, and Italy will also see projects in the 2023-2024 timeframe. The UK market is projected to reach USD 2.87 billion by 2026, while the Germany market is projected to reach USD 7.57 billion by 2026.

South America and the Middle East & Africa are experiencing steady growth as venturing into semiconductor manufacturing poses challenges and establishing the requisite technical expertise and infrastructure is a difficult task that demands huge investments and skill development in the regions.

List of Key Companies in DRAM Market

Major Players Focus on Developing Advanced Products to Strengthen Their Market Positions

The dynamic random access memory market is highly concentrated and is dominated by key players, including Samsung Electronics, SK Hynix, and Micron Technology, together holding over 90% of the entire market share. With the advanced technologies including AI & ML companies are upgrading their product portfolio. With this, companies aim to transform their services and better serve their customers. They also focus on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations proactively adopt collaboration, mergers and acquisitions, and partnerships to bolster their product offerings.

List of Key Companies Profiled:

- Samsung Electronics (South Korea)

- Micron Technology (U.S.)

- SK Hynix (South Korea)

- Elpida (Japan)

- Transcend Information (Taiwan)

- Nanya Technology (Taiwan)

- Powerchip (Taiwan)

- Winbond (Taiwan)

- Infineon Technologies (Germany)

- Kingston Technology (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- In February 2024, Samsung launched the industry’s first 36GB HBM3E 12H DRAM to provide companies with an ideal solution for future systems that require more memory.

- In February 2024, Hynix announced that it is planning to start a packaging facility in Indiana, U.S., that will specialize in stacking DRAM chips to create high-bandwidth memory chips.

- In November 2023, Micron launched 128GB DDR5 RDIMM memory that is 32GB monolithic die-based, including the best-in-class performance of up to 8000 MT for supporting the data center workloads.

- In September 2023, Samsung introduced 32-gigabit DDR5, the highest capacity DRAM using 12-nanometer class process technology to serve the growing demand for AI and big data.

- In June 2023, Micron Technology planned to build a new test facility and assembly in Gujarat, India. This new facility enables assembly and test manufacturing for both DRAM and NAND products.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights the competitive landscape. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Technology

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 223.7 Billion by 2034.

In 2025, the market was valued at USD 121.83 Billion.

The market is projected to grow at a CAGR of 7.20% during the forecast period.

By type, the double data rate SDRAM segment led in 2026.

The increasing number of data centers is poised to augment the market growth.

Samsung Electronics, Micron Technology, and SK Hynix are the top players in the market.

The Asia Pacific generated the maximum revenue in 2025.

By application, the automotive segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us