Employee Engagement Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Enterprise Type (Large Enterprises and Small & Medium Enterprises), By Function (Onboarding, Training, Collaboration & Interaction, Customer Service, Rewards & Recognitions, and Others), By Industry (Retail, BFSI, Government, Healthcare, IT & Telecom, Hospitality, Manufacturing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

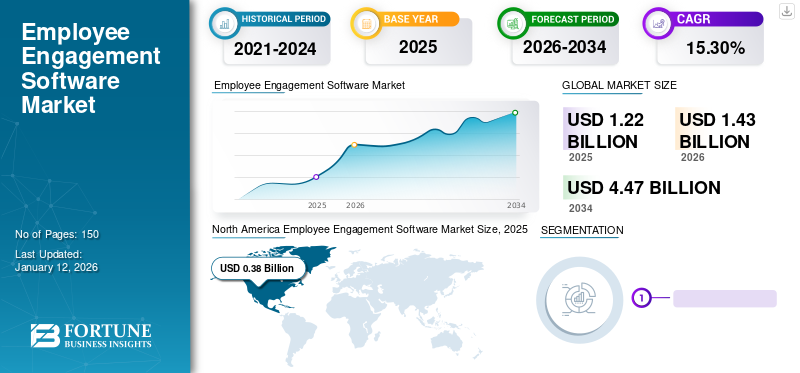

The global employee engagement software market size was valued at USD 1.22 billion in 2025. The market is projected to grow from USD 1.43 billion in 2026 to USD 4.47 billion by 2034, exhibiting a CAGR of 15.30% during the forecast period. North America dominated the global market with a share of 31.40% in 2025.

Employee engagement software helps enterprises in retaining employees, offering easy communication, boosting productivity, and improving customer services boosting business growth and its revenue. Some of the employee engagement software considered in the report for the study includes Lattice all-in-one employee engagement, Emplus employee survey platform, Synergita employee engagement tracking and survey software, and more. The increasing employee resignations and lack in management communication are driving the software demand across industries. Thus, with software implementation, businesses are witnessing rapid growth in its sales, employee productivity, and customer satisfaction. For instance,

- In January 2022, Boston-based HelloTeam witnessed the annual recurring revenue increase three times, its customer base grew two times in combination with an increase in employee headcount by 200% with the implementation of performance management and employee engagement experience solutions.

Furthermore, the growing need for advanced communication and team management solutions amid the COVID-19 pandemic fueled the demand for employee engagement software. Similarly, significant focus of employees on work-life-balance during the pandemic surged the adoption of the software. During the period, companies also invested in employee engagement solutions to boost remote working productivity, well-being and health, and other onboarding operations.

Employee Engagement Software Market Trends

Advancements in Gamification-based Software to Boost Market Growth

Globally, gamification is gaining significant demand as it enhances user capabilities and their involvement across business operations. According to Zippia, Inc., 90% of employees stated that gamification improved performance significantly. It is expected to expand various human resource capabilities through its integration such as boost in employee productivity, higher job satisfaction, an effective reward system, and more, thus boosting company revenue. According to the MarTech Alliance data, 85% of employees agreed that gamification enhances engagement across the workplace.

Similarly, businesses can improve social interactions and collaborations between employees that pace-up the business workflow. For instance,

- In 2022, Deloitte revamped its onboarding process using gamification for more innovative employee engagement strategies. This uplifted various approaches including learning functional, virtual office tour, introduction of company culture, and more. Thus, the integration of advanced features of gamification is likely to boost the market share.

Download Free sample to learn more about this report.

Employee Engagement Software Market Growth Factors

Growing Adoption of Digital Workplaces to Drive the Market Growth

Digital workplaces leverage technologies such as cloud computing, collaboration tools, and automation to facilitate remote work, enhance productivity, and streamline communication and collaboration among employees. The growing awareness of work-life balance is propelling the companies’ management to focus on employee well-being. Similarly, the integration of employee engagement enhances the employee’s ability to manage the work efficiently. For instance,

- In June 2023, WorkBuzz, an employee engagement software provider, unveiled its survey platform in the U.S., enabling all employees to voice their opinions, regardless of their location or role. It is the first platform to offer customizable engagement surveys tailored to companies with both desk-based and remote workers. By collecting feedback from all employees, WorkBuzz empowers organizations to enhance retention, recruitment, inclusion, and productivity organization-wide.

In the digitalized workplace, employees have access to tools that simplify work tasks. Also, the emphasis is given to efficient collaboration and improved interaction that helps the employee in improving productivity. Similarly, AI-powered digital tools also help in enhancing employee engagement through automation, providing employees with behavioral analysis that helps in retaining employees. Additionally, examples of employee engagement software include platforms such as Slack, Microsoft Teams, and Asana, which offer features such as instant messaging, project management, and virtual team collaboration. Thus, the increased adoption of digitalized workplaces drives the market growth.

RESTRAINING FACTORS

Time Consuming Activities of the Software to Hamper Market Growth

Engagement software continuously needs feedback and data to analyze the employee engagement rate in an organization. However, sometimes the time required for filling surveys, sharing feedback, and real-time interactions consumes employee-dedicated working hours. With additional work, the employee may feel burnout and dissatisfaction with the organization. The constant need for feedback from the employee is expected to hinder market expansion. Thus, it is essential to plan engagement forms and surveys with proper definitions, goals, and frequency.

Employee Engagement Software Market Segmentation Analysis

By Deployment Analysis

Real-time Communication to Fuel Cloud-based Deployment Demand

Based on deployment, the market is bifurcated into cloud and on-premises.

On-premises segment to gain maximum share accounting for 50.37% market share in 2026. The internally established software provides full control to the organizations over the cloud-based software. This helps the managers to use the employee data as per the organizational or the operational needs. Similarly, easy access to data, tools, and other resources enhances the employee engagement further.

Cloud to showcase rapid growth during the forecast period owing to quick customization, collaboration, and process integration. Through this deployment, the companies can effectively boost employee engagement operations that offer real-time analysis and services.

By Enterprise Type Analysis

Seamless Employee Management through Software to Surge Large Enterprises Segment

Based on enterprise type, the market is segmented into large enterprises and small & medium enterprises.

Large enterprises segment dominates the market with a share of 55.10% in 2026, owing to the presence of vast numbers of employees with cultural and geographic differences. The enterprises with multi-location businesses struggle in understanding and engaging the employees seamlessly. This is likely to surge the demand for the software across large enterprises.

Small & medium enterprises segment to gain rapid growth rate during the forecast period as post pandemic many small businesses shifted to permanent remote working. The integration of software is expected to enhance the communication and employee recognition of the enterprises. Also, owing to the limited funds, SMEs lack the focus on employee feedback and coordination. Thus, growing focus on employee management transparency is expected to boost the market growth.

By Function Analysis

Faster Decision Making Capabilities of Collaboration & Interaction to Boost the Segment Share

Based on function, the market is categorized into onboarding, training, collaboration & interaction, customer service, rewards & recognitions, and others.

Collaboration & interaction segment to gain maximum segment contributing 23.09% globally in 2026. Through real-time communication, the employees can enhance decision-making capabilities and improve productivity.

The training segment is expected to witness a rapid growth rate during the forecast period as companies are focused on employee development through engaging tools. Training through engagement helps senior management levels to address and understand employee challenges and other difficulties. Similarly, onboarding is gaining significant growth as properly communicated onboarding process enhances long-term employee commitment and conveys company culture.

Customer service segment to gain significant demand as businesses are encouraging the employees to offer satisfying services to the customers. As per the survey of Quantum Workplace, 72% of executives agreed that engaged employees can offer satisfaction and have happy customers. Similarly, rewards and recognition to showcase steady growth as it helps organizations in identifying and rewarding potential employees along with increasing retention.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Focus on Employee Retention to Fuel the IT and Telecom Segment Share

Based on industry, the market is categorized into retail, BFSI, government, healthcare, IT & telecom, hospitality, manufacturing, and others.

The IT & telecom segment is expected to dominate the segment. As an early adopter of advanced tools, the industry is significantly investing in employee engagement software to boost productivity. The growing employee retention challenges is driving the software adoption in the IT and telecom industry.

Retail segment is expected to dominate the segment with a share of 19.59% in 2026. Also, to increase employee satisfaction it is necessary that the retail employees are engaged and communicate effectively. Similarly, the BFSI industry is also witnessing a rapid growth rate during the forecast period. Effective reward and recognition in banking sales boost employee morale and increase productivity.

Also, in the healthcare industry, the growing focus on patients’ safety and satisfaction is expected to fuel employee engagement software demand. The manufacturing industry is also showcasing steady growth by implementing the software for employee retention and enhanced productivity.

REGIONAL INSIGHTS

In terms of region, the market is divided into five key regions, North America, South America, Europe, the Middle East & Africa, and Asia Pacific. They are further segmented into countries.

North America Employee Engagement Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 0.38 billion in 2025 and USD 0.44 billion in 2026. The growing investment in digital solutions and HR tech tools is expected to fuel the software demand in the region. As per the Gallup's State of the Global Workplace 2022, 33% of employees in the U.S. are engaged with customer service and communication, which is twice the global share. Similarly, Mexico is now investing in employee-focused tools post-pandemic to ensure business continuation in the country and to boost employee productivity. The U.S. market is projected to reach USD 0.39 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe is expected to showcase significant growth during the forecast period. European organizations are facing challenges with an increasing number of unsatisfied employees across industries. This is expected to fuel the growth opportunities for employee engagement software providers. The job providers are investing in employee management tools to boost productivity and reduce employee absenteeism. The UK market is projected to reach USD 0.07 billion by 2026, while the Germany market is projected to reach USD 0.06 billion by 2026.

Asia Pacific is likely to showcase a rapid growth rate during the forecast period. The increasing number of small and medium enterprises focused on employee retention in the region is expected to drive market growth. Also, governments across the countries are supporting employees with respect to work-life balance and transparent company work culture. This is expected to boost the employee engagement software market share. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.12 billion by 2026, and the India market is projected to reach USD 0.08 billion by 2026.

The Middle East & Africa to showcase significant growth rates during the forecast period owing to increasing investments in digital solutions. The growing awareness of employee engagement across industries is driving market growth in the region.

Similarly, the focus on employee management is likely to boost the software demand in South America.

List of Key Companies in Employee Engagement Software Market

Market Expansion Driven Strategies to Boost Key Players’ Market Share

The key employee engagement software players are keen in expanding their market share through innovative employee engagement solutions that support business growth. Through collaboration, players can expand their customer base and create strong market presence. Thus, players are strategically collaborating and entering into partnerships to offer advanced engagement tools. These advanced engagement tools are helping businesses in building customer relationships. Also, to gain specific capabilities and expertise, these players are investing in mergers and acquisitions that help in understanding customer needs.

List of Key Companies Profiled:

- Teamflect

- 15Five (U.S.)

- Lattice (U.S.)

- Smartly, Inc. (Bonusly) (U.S.)

- Vantage Circle (U.S.)

- Xoxoday Emplus (U.S.)

- Workvivo Limited (Ireland)

- Synergita Software Private Limited (U.S.)

- Leapsome GmbH (Germany)

- Kudos, Inc. (Canada)

- Culture Amp Pty Ltd. (Australia)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: Xoxoday, a fintech SaaS company, integrated Empuls, an employee engagement platform, with Amazon Business, revolutionizing employee recognition and rewards. This partnership would offer a dynamic fusion, allowing employees to choose meaningful rewards and enjoy a seamless redemption experience with Amazon's excellent service.

- August 2023: Vantage Circle, an HR Tech firm, announced its recognition as a global leader in employee engagement and recognition software platforms, according to G2's Annual Summer 2023 Global Grid Reports.

- May 2023: Vantage Circle, an employee engagement platform, unveiled its inaugural AIR Benchmarking Report at the SHRM Tech Conference & Expo 2023. The report, derived from a survey of over 150 Indian organizations, offers insights into HR technology adoption and implementation in India, highlighting challenges in recognition program implementation and suggesting best practices for measuring program success.

- April 2023: Zoom Video Communications Inc. acquired Workvivo Ltd., a startup offering an employee engagement platform. Workvivo, based in Cork, Ireland, provides a platform for executives to share business updates with employees, allowing users to post content, including videos, podcasts, and news articles. An embedded comment system enables interaction between workers and company leadership.

- September 2022: Lattice launched Lattice Connect is a network that empowers its clients to enhance employee success strategies that can boost their growth in the business. It enhances the capabilities to keep employees engaged and boost its performances by offering its ability to collaborate, onboard or to find the right partner.

- November 2022: Vantage Circle announced a collaboration with a team collaboration software provider to enhance its employee engagement capabilities. Together, the companies aim to offer an all-in-one platform for employee collaboration and communication.

- November 2022: Leapsome GmbH announced its expansion strategy in the U.S. market owing to the growing HR technology opportunity. The company offers an all-in-one solution that provides learning, development and engagement measurement.

- September 2021: DXC Technology announced collaboration with Qualtrics to integrate Qualtrics’ EmployeeXM to DXC’s Modern Workplace service solution. The integration of the solution supports the company with insights such as employees’ feedback, real-time sentiments, productivity and more.

REPORT COVERAGE

The study on the market includes prominent areas worldwide to get a better knowledge of the industry. Furthermore, the research provides insights into the most recent industry and market trends, trend analysis as well as an analysis of technologies that are being adopted quickly worldwide. It also emphasizes some of the growth-stimulating elements, allowing the reader to obtain a thorough understanding of the industry.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.30% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Deployment

By Enterprise Type

By Function

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 4.47 billion by 2034.

In 2025, the market stood at USD 1.22 billion.

The market is projected to grow at a CAGR of 16.3% over the forecast period (2026-2034).

By function, the collaboration & interaction segment is likely to lead the market.

Increasing connected medical machines is likely to drive the market growth

Lattice, Smartly, Inc. (Bonusly), Vantage Circle, Xoxoday Emplus, Workvivo Limited, Synergita Software Private Limited, Leapsome GmbH, Kudos, Inc. and more are the top players in the market.

North America is expected to hold the highest market share.

By industry, BFSI is expected to grow with the highest CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us