Epinephrine for Anaphylaxis Treatment Market Size, Share & Industry Analysis, By Product Type (Autoinjectors, Prefilled Syringes, and Others), By Type (Branded and Generics), By Distribution Channel (Hospital Pharmacies and Online & Retail Pharmacies), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

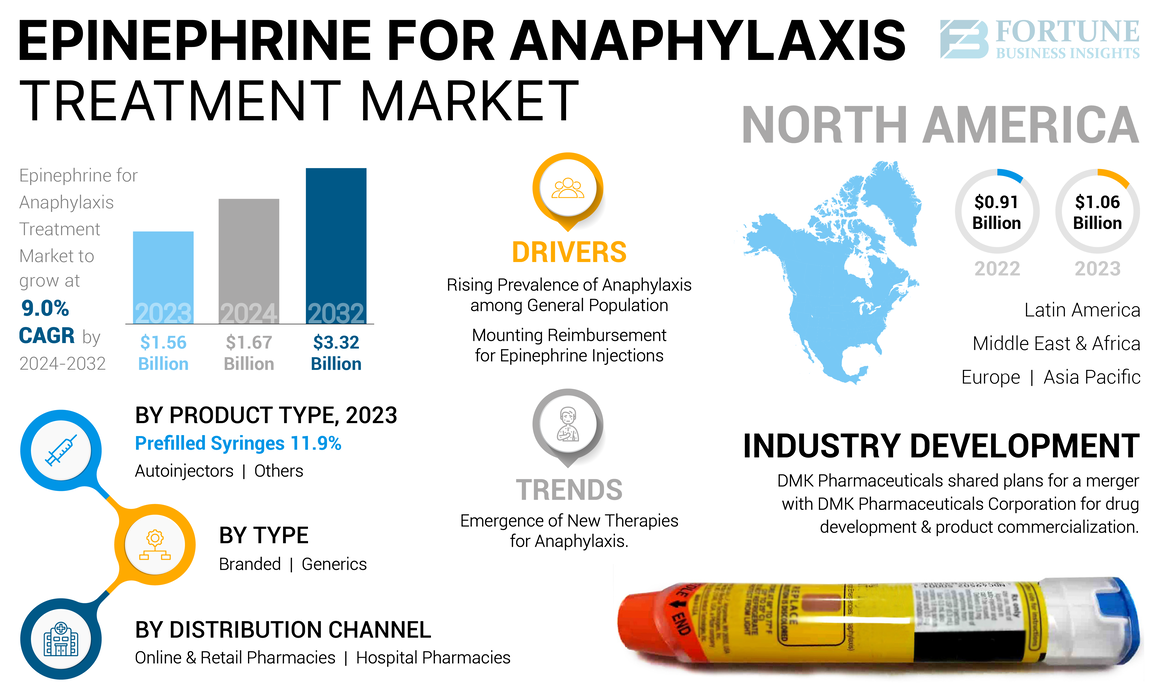

The global epinephrine for anaphylaxis treatment market size was valued at USD 1.56 billion in 2023. It is projected to grow from USD 1.67 billion in 2024 to USD 3.32 billion by 2032, exhibiting a CAGR of 9.0% during the forecast period. North America dominated the epinephrine for anaphylaxis treatment market with a market share of 67.95% in 2023.

Anaphylaxis is a most severe, acute, life-threatening allergic disease that remains mostly underdiagnosed and improperly managed. Food allergy, bee sting allergy, and pollen are some of the agents that cause anaphylactic shock. Anaphylaxis occurs within seconds or minutes of exposure to allergic agents such as peanuts, bee stings, or sometimes drug-induced reactions. In these conditions, the immune system releases a flood of chemicals that immediately leads to skin rash, nausea, vomiting, shock, drop of blood pressure, sudden narrowing of airways, and respiratory failure. Thus, due to these severe conditions, anaphylaxis needs to be treated immediately with an injection of epinephrine, or it can be deadly.

Global Epinephrine for Anaphylaxis Treatment Market Overview

Market Size:

- 2023 Value: USD 1.56 billion

- 2024 Value: USD 1.67 billion

- 2032 Forecast Value: USD 3.32 billion, with a CAGR of 9.0% from 2024–2032

Market Share:

- North America led the epinephrine for anaphylaxis treatment market with a 67.95% share in 2023, driven by high allergy prevalence and advanced healthcare infrastructure.

- By distribution channel, hospital pharmacy is projected to hold a 22.4% share in 2025.

Key Country Highlights:

- The epinephrine for anaphylaxis treatment market in Japan is expected to reach USD 115.0 million by 2025.

- China is forecast to witness a strong CAGR of 12.70%, while Europe is anticipated to grow at a CAGR of 9.9% during the forecast period.

- By application, anaphylaxis is projected to generate USD 1.69 billion in revenue by 2025.

The rising burden of allergy and anaphylaxis worldwide is increasing the demand for accurate, portable, and easy-to-use epinephrine injectors that quickly initiate action to reduce the serious conditions associated with it. Such scenarios are propelling the market's growth.

Moreover, the presence of key market players with branded and generic product offerings of epinephrine autoinjectors is expected to spur the global epinephrine for anaphylaxis treatment market. Increasing investments in research and development activities to develop novel and advanced drug delivery systems for epinephrine for the effective treatment of anaphylaxis reactions further support industry expansion.

- For instance, in December 2023, Aquestive Therapeutics, Inc. announced that the first patient had received a dose in the initial Phase 3 pivotal Pharmacokinetic (PK) clinical trial of Anaphylm (epinephrine) sublingual film. This product is used for the treatment of severe, life-threatening allergic reactions, including anaphylaxis. Such clinical studies are set to propel the market's growth.

In 2020, the global epinephrine for anaphylaxis treatment market witnessed negative growth during the initial phase of the COVID-19 pandemic due to a decline in patient visits and hospital admissions. This led to a reduction in prescriptions for anaphylaxis treatment. However, with the ease of COVID-19 restrictions, the market started growing in late 2021 with an increase in patient visits for anaphylaxis treatment.

Furthermore, the market is expected to grow during the forecast period due to rising demand for adequate treatment options. In addition, the increasing number of prescriptions and rising research and development initiatives to launch advanced delivery systems for anaphylaxis treatment are expected to boost the market's growth over 2024-2032.

Epinephrine for Anaphylaxis Treatment Market Trends

Emergence of New Therapies for Anaphylaxis is a Prominent Trend

Globally, the prevalence of anaphylaxis is increasing rapidly. To cater to the growing demand for epinephrine, market players are focusing on the introduction of innovative products offering novel routes of administration.

Furthermore, increasing research and development activities by key epinephrine for anaphylaxis treatment companies are being undertaken to launch novel and faster drug delivery systems for epinephrine delivery in anaphylactic conditions. This scenario aims to boost the growth of the market during the forecast period.

- For instance, in June 2024, Aquestive Therapeutics, Inc. announced positive topline pharmacokinetic data from the temperature/pH study after the self-administration study of Anaphylm (epinephrine) Sublingual Film. If approved by the U.S. Food and Drug Administration (FDA), Anaphylm would be the first and only orally delivered non-invasive epinephrine for treating severe life-threatening allergic reactions, including anaphylaxis.

Such advancements in drug delivery systems are expected to improve patient outcomes and shift companies' focus toward product launches during the forecast period.

Download Free sample to learn more about this report.

Epinephrine for Anaphylaxis Treatment Market Growth Factors

Growing Prevalence of Anaphylaxis among the General Population to Drive Demand for Epinephrine

Anaphylaxis is an acute, life-threatening hypersensitivity disorder, a rapidly evolving, multi-systemic allergic reaction. Anaphylaxis is often fatal if not treated on time due to its rapid progression to respiratory collapse. The common allergens that lead to anaphylaxis are certain medications, foods, or insect stings. This presents a large patient pool suffering from the condition and subsequently drives the demand for epinephrine to treat the emergency condition.

- According to an article published by the National Institutes of Health (NIH) in 2023, the global incidence of anaphylaxis was found to be approximately 46 cases per 100,000 population per year. Such a rising number of cases increases the demand for quick and accurate treatment methods, which is expected to propel the market's growth.

Additionally, increasing awareness programs for the management and treatment of allergies by using epinephrine injectors is expected to raise the adoption of epinephrine for anaphylaxis treatment and drive the growth of the market.

Increasing Reimbursement for Epinephrine Injections is Driving Market Growth

The rising demand for prominent treatment for anaphylaxis to reduce the hospitalization rates due to the associated chronic symptoms is propelling the adoption of epinephrine autoinjectors. However, the cost of an epinephrine pen is higher and inaccessible for many patients. Therefore, government bodies are offering reimbursement on epinephrine pens to make them accessible to the people.

- According to an article published by Oak Street Health in 2022, about 98.0% of Medicare prescription drug plans cover the generic version of EpiPen epinephrine. Further, some other insurance policies cover the branded version of EpiPen in the U.S.

Such policies are driving the adoption of epinephrine pens and boosting the growth of the market.

RESTRAINING FACTORS

Product Recalls and Law Infringements for Epinephrine Injectors May Hamper Market Growth

Despite rising product launches for epinephrine injectors due to increasing demand for anaphylaxis treatment. The recalls associated with epinephrine injectors are rising due to the potential manufacturing defects leading to inaccurate dosage delivery. Such scenarios led to a decrease in consumer trust and are expected to hamper the growth of the market.

- In April 2023, Bausch Health, Canada Inc. recalled its Emerade 0.3 mg (DIN 02458446) and 0.5 mg (DIN 02458454) epinephrine autoinjectors due to possible device failure.

Additionally, certain law infringements related to the EpiPen Autoinjector influence the investment strategies and brand image of key companies, which may limit the growth of the epinephrine for anaphylaxis treatment market.

Epinephrine for Anaphylaxis Treatment Market Segmentation Analysis

By Product Type Analysis

High Demand for Portable and Easy-Use Treatment Drives Autoinjectors Segment Growth

Based on product type, the market is segmented into autoinjectors, prefilled syringes, and others.

The autoinjectors segment held a dominant market share in 2023. The dominant share of the segment is attributed to the rising prevalence of anaphylaxis and the sudden onset of serious life-threatening anaphylaxis reactions due to allergens. Thus, to suppress the symptoms associated with the anaphylaxis shock, there is an increased demand for efficient treatment to reduce the chronic symptoms of allergic reactions. The autoinjectors are easy to use, portable, and provide the quick onset of action over the anaphylactic shock. Moreover, the presence of key players in the market with the branded and generic versions of the epinephrine autoinjectors for anaphylaxis treatment is expected to propel the segment growth.

Furthermore, increases in guidance by the regulatory bodies to avoid serious consequences of allergies by using autoinjectors are expected to propel the segment growth.

- For instance, The Medicines and Healthcare Products Regulatory Agency (MHRA) has strengthened its safety guidelines regarding the appropriate actions to take in cases of anaphylaxis. These guidelines were released due to the new statistics indicating 25,721 hospital admissions in England due to allergies and anaphylaxis during 2022-23. Additionally, MHRA issued guidelines for recognizing and responding to the signs of anaphylaxis, including the use of adrenaline autoinjectors (Epi-Pen and Jext products), which are prescribed to people at risk of anaphylaxis. Such guidelines promote the growth of the segment.

The prefilled syringes segment held a substantial share of the market. The segment's growth is augmented by the rising number of hospitalizations associated with allergies and anaphylaxis, leading to the increased demand for accurate and measured doses of epinephrine, which offer convenience to healthcare professionals.

- For instance, in November 2021, according to the Australian Commission on Safety and Quality in Healthcare (ACSQHC) report, emergency department admissions in public hospitals for anaphylaxis treatment increased by 51.0% from 2015 to 2020.

The other segment is expected to grow with a steady CAGR during the forecast period. However, the segment is expected to hold a notable portion of the market due to rising research and development activities of the key companies of the market to launch advanced and convenient drug delivery options of epinephrine for treating anaphylaxis reactions. Such scenarios are expected to boost the segment growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Increasing Demand for Cost-effective Epinephrine to Drive Generics Segment Growth

Based on type, the market is segmented into branded and generics.

The generics segment held the highest global epinephrine for anaphylaxis treatment market share. The dominant share of the segment is due to the rising demand for cost-effective treatment options for anaphylaxis. Further, the patent expiration of the branded drugs led to an increase in the manufacturing of generic versions of epinephrine in the market. Thus, to reduce the shortage of epinephrine and offer cost-effective options, the key players in the market are focusing on the launch of generic epinephrine.

Additionally, the rising focus of government agencies to reduce healthcare costs and offer convenient treatment to patients is expected to boost the growth of the segment.

- For instance, in September 2022, according to an article published by the Dubai International Pharmaceutical & Technologies Conference & Exhibition (DUPHAT), the Saudi government aggressively attempted to encourage generic consumption by limiting imported branded pharmaceuticals and encouraging local generic manufacturing in an effort to reduce healthcare costs and diversify their economy. Such promotions boost the growth of the segment in the market.

The branded segment held a substantial share of the market, boosted by the presence of key players offering branded products of epinephrine for anaphylaxis treatment. Furthermore, increasing research and development activities to launch novel patented formulations of epinephrine for the easy and convenient treatment of sudden onset allergic reactions are expected to propel the segment's growth.

In the By Application segment, anaphylaxis is projected to generate USD 1.69 billion in revenue by 2025.

By Distribution Channel Analysis

Online & Retail Pharmacies Segment Registered Highest Share Owing to Increased Adoption of Epinephrine Injections

Based on distribution channel, the market is segmented into online & retail pharmacies and hospital pharmacies.

The online & retail pharmacies segment held a dominant share of the market. The segment growth is due to its accessibility, convenience, and broad distribution network. These pharmacies offer ease of access for patients needing epinephrine autoinjectors, ensuring timely procurement of this critical medication. The convenience of online pharmacies allows patients to purchase epinephrine from home, with the leverage of doorstep delivery. Moreover, both channels offer competitive pricing, discounts, and insurance billing options, making them attractive to customers. By distribution channel, hospital pharmacy is expected to account for a 22.4% share in 2025.

Additionally, the increasing number of e-pharmacies globally to boost the sales of drugs, propelling segment growth.

- For instance, according to the report published in July 2023 by the India Brand Equity Foundation, there are around 50 e-pharmacies in India.

The hospital pharmacies segment held a substantial portion of the market for epinephrine for anaphylaxis treatment. Owing to patients' higher preference for hospitals, the increasing number of emergency department hospitalizations leads to increased demand for quick treatment with epinephrine injections. In addition, the presence of a large number of hospital pharmacies in the region propels the growth of the segment.

- For instance, according to the Drug Usage Statistics, the U.S., 2013 – 2022, estimated that the number of patients in the U.S. on epinephrine treatment was 992,912 in 2022. Such a large number of patients is expected to propel the growth of the segment.

REGIONAL INSIGHTS

By geography, the market for epinephrine for anaphylaxis treatment has been studied across Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa.

North America Epinephrine for Anaphylaxis Treatment Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the highest share of the market and generated a revenue of USD 1.06 billion in 2023. The rising prevalence of anaphylaxis and allergy drives the dominant share of the region. Furthermore, the region has advanced healthcare facilities and strong healthcare expenditure for the treatment of chronic conditions of anaphylaxis. Additionally, increasing research and development initiatives by key players to launch new epinephrine formulations for anaphylaxis treatment is expected to boost the growth of the market.

- For instance, in March 2024, Aquestive Therapeutics, Inc. announced topline clinical results from its Phase 3 pivotal pharmacokinetic (PK) clinical trial of Anaphylm (epinephrine) Sublingual Film. The sublingual film successfully met the primary and secondary endpoints of the trial. Such clinical trials are expected to boost the growth of the region in the market.

Asia Pacific holds the second-largest market share. The growth of the region is owing to the increasing prevalence of allergy with a larger patient pool, leading to the increased demand for epinephrine for anaphylaxis treatment. Further, growing strategic initiatives by companies in the market to expand their geographical footprint with commercial launch of epinephrine injections in the region are expected to propel the regional growth. The epinephrine for anaphylaxis treatment market in Japan is expected to reach USD 115.0 million by 2025. China is projected to witness a strong CAGR of 12.70% during the forecast period.

- For instance, in October 2019, DMK Pharmaceuticals entered into an exclusive distribution and commercialization agreement with Emerge Health Pty to commercialize SYMJEPI (epinephrine) Injection products in Australia and New Zealand.

Europe accounted for a substantial share of this market. Rising demand for quick and accurate emergency treatment options for anaphylaxis and the presence of key players with increasing focus on research and development to launch branded and generic versions of the drugs are subsequently driving the growth of this region over the forecast period. Europe is anticipated to grow at a CAGR of 9.9% during the forecast period.

Latin America and the Middle East & Africa accounted for a comparatively lower market share due to the lack of regulatory approval for epinephrine injectors in the region and the higher cost associated with the autoinjectors. However, rising initiatives and awareness programs regarding the management of anaphylaxis are expected to boost the growth of the market during the forecast period.

- For instance, in June 2024, the Argentine Association of Allergy and Clinical Immunology – Argentina participated in the Conference on Environment, Allergy, and Respiratory Diseases to discuss the causes and treatments associated with allergies. Such conferences promote the adoption of epinephrine and boost regional growth.

KEY INDUSTRY PLAYERS

Introduction of Branded and Generics Autoinjectors by Viatris Inc., Teva Pharmaceutical Industries Ltd to Strengthen their Market Positions

The global epinephrine for anaphylaxis treatment market is consolidated. Viatris Inc. and Teva Pharmaceutical Industries Ltd. are among the top players in the market due to their strong brand presence and recent product approvals. The companies' increasing focus on receiving regulatory approvals and generic product launches leads to the highest share of companies in the market.

Furthermore, other players involved in the market include Amneal Pharmaceuticals LLC., ALK-Abelló A/S, kaleo, DMK Pharmaceuticals, and Bausch Health Companies Inc. The strong focus of companies on mergers and acquisitions and new technologically advanced product launches is fueling the market growth.

LIST OF TOP EPINEPHRINE FOR ANAPHYLAXIS TREATMENT COMPANIES:

- Viatris Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Adamis Pharmaceuticals LLC. (Canada)

- Bausch Health Companies Inc. (U.S.)

- Amneal Pharmaceuticals LLC (U.S.)

- DMK Pharmaceuticals (U.S.)

- ALK-Abelló A/S (Denmark)

- BIOPROJET (France)

KEY INDUSTRY DEVELOPMENTS

- May 2023: DMK Pharmaceuticals announced its merger with DMK Pharmaceuticals Corporation. The merger aimed to commercialize products and the development of new drug candidates.

- July 2021: ALK-Abelló A/S partnered with Grand Pharmaceutical Group Limited to launch the first adrenaline autoinjector, Jext, in China to expand its geographical presence in the country.

- October 2020: Bausch Health Companies Inc. launched Emerade, an epinephrine injection with a dosage of 0.3mg and 0.5mg in Canada for the emergency treatment of anaphylactic reactions in patients. This product launch created a new treatment option for anaphylaxis in Canada.

- October 2018: Amneal Pharmaceuticals LLC collaborated with the U.S. Food and Drug Administration (FDA) to extend the expiration dates for certain lots of its epinephrine injection, USP autoinjector, 0.15 mg, and 0.3 mg Adrenaclick.

REPORT COVERAGE

The global market report provides detailed information about the competitive landscape of the market. It includes statistics, such as the prevalence of anaphylaxis. Further, the report comprises the market overview with value, volume, size, and share of the market segments. Additionally, the global market analysis report focuses on key points, such as technological advancements, new product launches, and key industry developments, such as partnerships, mergers, and acquisitions. Furthermore, it offers a regional analysis of different segments, profiles of key market players, trends, and the impact of COVID-19 on the market. The report also comprises quantitative and qualitative insights contributing to the market growth.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 9.0% from 2024-2032 |

|

Unit |

Value (USD billion) and Volume (Units) |

|

Segmentation |

By Product Type

|

|

By Type

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 1.56 billion in 2023 and is projected to reach USD 3.32 billion by 2032.

The market will exhibit steady growth at a CAGR of 9.0% during the forecast period of 2024-2032.

Currently, autoinjectors are the leading product type segment.

The growing prevalence of anaphylaxis and increasing reimbursement for epinephrine injections are driving the demand for epinephrine for anaphylaxis treatment.

Viatris Inc. and Teva Pharmaceutical Industries Ltd. are the major players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us