Europe Caps & Closures Market Size, Share & Industry Analysis, By Material (Plastic, Metal, and Others), By Product Type (Tethered Caps, Push/Pull Caps, Screw Caps, and Others), By Capacity (18-400, 22-400, 28-400, 38-400, 45-400, 58-400, 70-400, 89-400, 120-400, and Others), By End-use Industry (Food & Beverages, Pharmaceutical, Consumer Goods, Personal Care & Cosmetics, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

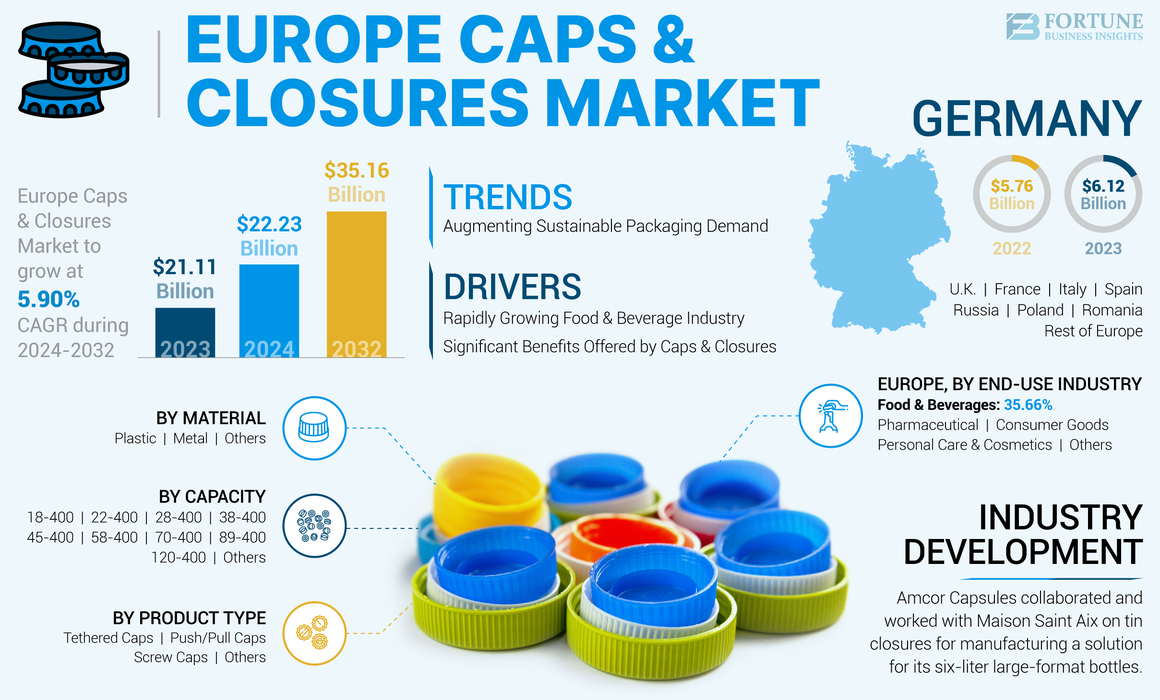

The Europe caps & closures market size was valued at USD 21.11 billion in 2023. The market is projected to grow from USD 22.23 billion in 2024 to USD 35.16 billion by 2032, exhibiting a CAGR of 5.90% during the forecast period.

Caps & closures are devices used for opening and closing containers. The term closure includes caps, lids, plugs, and covers. Each type of closure refers to the component found at the opening of a container used for sealing the product inside.

Closures are used in every industry to seal products ranging from food to chemicals. Closures are designed to pair with a variety of containers, such as bottles, jars, tubes, pails, and more. Different types of closures are selected based on the end user’s product application, such as resealing for reuse or dispensing a specific amount of product.

The growing demand for pharmaceutical products, rising research & development activities, increasing demand for personal care products through online platforms, and the online food delivery trends during the pandemic led to the high demand for caps & closures, further enhancing the market growth.

There was a rapid consumption of bottled water, energy drinks, and nutraceutical products during the COVID-19 pandemic due to increased health-conscious consumers. Such increased consumption of beverage & food products boosted market growth during the COVID-19 pandemic.

Europe Caps & Closures Market Trends

Augmenting Sustainable Packaging Demand Will Generate Lucrative Opportunities for Market Growth

There is a growing demand for recycled plastic packaging among manufacturers and consumers. Recycled plastic packaging is essential as it is more environmentally friendly than regular plastic packaging. It leaves a considerably reduced carbon footprint compared to manufacturing new plastic, as it can be used again for other packaging products. The growing demand for sustainable packaging in Europe will create profitable opportunities for the growth of the caps & closures market.

Sustainable packaging, also referred to as green packaging, offers several benefits, such as less dependence on fossil fuels, low consumption of natural resources, and less energy consumption. These advantages have prompted the food & beverage sector to adopt environment-friendly food packaging solutions to reduce its greenhouse gas emissions.

The rising utilization of lightweight recycled plastic packaging, such as R-PET, which reduces transportation costs, is boosting market growth. Moreover, as it is highly resistant to abrasion and breakage, it is utilized by several end-use industries for product packaging, further contributing to the market growth. The ban on single-use plastic, the growing demand from consumers for more environmentally friendly products, and the rising focus of manufacturers on offering recyclable packaging solutions enhance market growth.

Download Free sample to learn more about this report.

Europe Caps & Closures Market Growth Factors

Rapidly Growing Food & Beverage Industry Drives Market Growth

The Europe caps & closures market is witnessing substantial growth driven by diverse industries as well as evolving consumer preferences. These closures, including screw caps, flip-tops, dispensing caps, and tamper-evident closures, play a crucial role in preserving product integrity, ensuring safety, and enhancing convenience, further driving the market growth.

Rising demand for caps & closures is closely linked with growing urbanization. Urban consumers are majorly inclined toward convenient and on-the-go packaging solutions for food or beverage products. Caps and closures play a significant role in providing convenience, ensuring the products are easy to open and close and can be consumed without spillage. Such benefits aid its usage in the food and beverage industry.

The food and beverage sector in Europe is growing at pace. The growing trend of on-the-go beverages and sustainability is cushioning the demand for caps and closures as they offer an airtight seal, preventing the entry of bacteria and keeping the product fresh for a longer time. Moreover, they address the growing concern about safety and hygiene associated with food & beverage products by preventing spoilage. With a focus on food safety and hygiene and an increasing demand for packaged food, the caps & closures market is expected to experience robust growth.

Manufacturers also offer various customization alternatives more suitable for the product, which helps retain their customers, thus boosting their market globally. The extensive use of closures in the beverage industry is driven by the need for secure and efficient packaging solutions to preserve the freshness and quality of liquid products. Caps & closures are used for diverse beverage types, including carbonated drinks, water, and juices. The growing food and beverage sector in Europe is thus boosting the caps and closures market in the region.

Significant Benefits Offered by Caps & Closures Drive Market Growth

The caps & closures serve the primary purpose of keeping the container closed and the contents contained for the designated shelf life. It also acts as a barrier against dirt, oxygen, and moisture, as well as preventing the goods from being opened prematurely. In the packaging industry, caps and closures are primarily used to protect items and extend their shelf life.

Plastic and metals are majorly used to produce caps to provide appropriate product packaging. Caps offer several advantages, including being simple to open and providing an airtight seal, protecting contents inside from oxygen, and increasing product shelf life. These closures also prevent leaks, which is essential for packaging potentially harmful pharmaceutical products. Lightweight caps and closures offer a range of benefits to consumers and manufacturers, which has led to increased demand and adoption in the market. Plastic closures offer manufacturers a versatile solution suitable for various industries. Such potential benefits of the closures boost its demand in varied end-use industries.

Their ease of use, lightweight nature, customizability, and compatibility with diverse product types contribute to their widespread adoption. They use fewer resources and generate less waste making them eco-friendlier than conventional caps and closures. It is particularly important for companies looking to reduce their carbon footprint and minimize their environmental impact.

In addition to the environmental concerns, lightweight caps and closures are more cost-effective than traditional options. They use fewer materials and are less expensive to produce and transport, which can significantly reduce manufacturers' costs and is thus anticipated to drive this market in the upcoming years. The user-friendly design, ease of customization, durability, and accurate closing and binding properties of the caps and closures will continue to drive its demand in major industries, thus driving the market growth.

RESTRAINING FACTORS

Availability of Substitutes Majorly Restrain Market Growth

Despite the potential benefits offered by the caps and closures, some factors hamper the market growth. Flexible packaging solutions are highly in demand among various end-use industries. The flexibility and lightweight properties of flexible packaging solutions are driving their demand in major end-use industries, such as food & beverages, pharmaceuticals, personal care, and others. The rising growth of flexible packaging products is restraining the market growth of caps and closures in the European market.

Rigid packaging solutions cost more to produce and transport than flexible packaging solutions. The time-and-effort-consuming process of designing customized products compared to alternative packaging solutions is the key factor that hampers the growth of the global market. Moreover, the growing environmental concerns in the European region due to the hazardous effects of plastic material is also a major factor hampering the market growth.

The ban on single-use plastics in Europe is also hindering the manufacturing of plastic caps and closures, due to which the market growth is stunted. Manufacturers and consumers are seeking sustainable packaging solutions due to which the Europe caps & closures market growth is hampered.

Europe Caps & Closures Market Segmentation Analysis

By Material Analysis

Plastic Material is Set for Strong Growth with Augment Demand for Beverages

Based on material, the market is segmented as plastic, metal, and others.

Plastic holds the largest Europe caps & closures market share and the material is analyzed to attain vital growth over the forthcoming years. Plastic is the most versatile substance owing to its light, flexible, and cost-effective features, due to which it can be used to produce caps and closures of various shapes & sizes. The rising demand for plastic caps and closures from the beverage sector drives the segment’s growth.

The material is hard to break, which boosts its usage in the manufacturing of closures. Plastic closures are also inexpensive and have fewer potential contaminants. The rising demand for bottled water, sports drinks and several other beverages in the European region drives the segmental growth.

Metal is the second-dominating material in the market. The rising demand for metal closures for luxurious packaging as well as for the packaging of alcoholic beverages drives the segment's growth.

By Product Type Analysis

Screw Caps Dominate Market Share with Versatile Application Across Industries

Based on product type, the market is segmented as tethered caps, push/pull caps, screw caps, and others. Screw caps and closures hold the largest market share. They can be easily screwed on and off containers, allowing for repeated opening and closing without compromising the integrity of the product. It makes them suitable for a wide range of applications, from food and beverages to pharmaceuticals and personal care products.

Tethered caps are the second-dominating product type owing to the high demand for the utilization of bottled water and sports bottles.

By Capacity Analysis

28-400 Segment Expected to Experience Substantial Growth Due to Versatility and Safety Features

Based on capacity, the market is segmented as 18-400, 22-400, 28-400, 38-400, 45-400, 58-400, 70-400, 89-400, 120-400, and others. The 28-400 is the dominating capacity segment and is analyzed to foresee noteworthy growth in the upcoming years. The closure with 28-400 capacities is theft-proof and leak-proof and is senior-friendly, child-resistant, and tamper-resistant.

The 28-400 caps and closures are high-quality, standard-weight closures that can be used with a wide array of products across a variety of industries such as agriculture, automotive, dressings & sauces, food, household chemicals, industrial products and chemicals, nutraceutical products, personal care & cosmetics, and several others.

The 38-400 is the second-dominating capacity segment and is expected to grow rapidly due to the increasing demand from the food and beverages sector.

By End-use Industry Analysis

Food & Beverages Lead, Driving Growth Through Customization and Secure Packaging Solutions

Based on the end-use industry, the market is segmented as food & beverages, pharmaceutical, consumer goods, personal care & cosmetics, and others. Food & beverages are the dominating end-use industry segment of the Europe caps & closures market. The segment holds the largest market share and is forecast to grow significantly in the upcoming years. Manufacturers also offer various customization alternatives more suitable for the product, which helps retain their customers, thus boosting their market globally. The extensive use of closures in the beverage industry is driven by the need for secure and efficient packaging solutions to preserve the freshness and quality of liquid products.

Consumer goods is the second-dominating end-use industry segment and is projected to grow rapidly over the forecast years. Caps and closures often include ridges or a textured surface to provide a better grip on consumer goods, further boosting its demand in Europe.

To know how our report can help streamline your business, Speak to Analyst

By Country Analysis

Based on country, the market is segmented into Germany, the U.K., France, Italy, Spain, Russia, Poland, Romania, and the rest of Europe.

Germany is the dominating country in the Europe caps & closures market. The country's well-established food and beverages, personal care, and pharmaceutical sectors in the country are major contributors to the market’s growth. In addition, the prominence of reliable and efficient packaging solutions, specifically in automotive and pharmaceuticals, drives the demand for cap and closure technology for protecting the goods during transportation and storage in the country.

France is the second-dominating country and is analyzed to grow massively over the forecast period. The rising export and import of caps and closures from the country majorly contribute to the market growth. Moreover, the increasing focus of manufacturers and consumers on food safety and hygiene and a rise in demand for packaged goods also enhance the market growth in France. The U.K. is the third-leading country and will experience significant growth in the forecast period due to the growing food & beverage sector in the country.

KEY INDUSTRY PLAYERS

Fragmented Market Showcases Competition with Major Players Driving Innovation and Expansion

The Europe caps & closures market is highly fragmented and competitive. In terms of market share, the few players dominate the market by offering innovative packaging in the packaging industry. These major players in the market are constantly focusing on expanding their customer base across the regions and innovation.

Major players in the market include Berry Global, Amcor plc, ALPLA, Tecnocap Group, BERICAP, United Caps and others. Numerous other players operating in the industry are focused on delivering advanced packaging solutions.

List of Top Europe Caps & Closures Companies:

- Berry Global (U.S.)

- Amcor plc (Switzerland)

- ALPLA (Austria)

- Tecnocap Group (Italy)

- BERICAP (Germany)

- United Caps (Luxembourg)

- Richmond Containers (Scotland)

- Silgan Closures GmbH (Germany)

- Closure Systems International (U.S.)

- AptarGroup, Inc. (U.S.)

- Albea Group (France)

- Retal Industries LTD (Cyprus)

- Calaso (Netherlands)

- LOG Pharma Packaging (Israel)

- Finn-Korkki Oy (Finland)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 – Origin Materials, a carbon-negative materials company, announced the launch of an innovative and new sustainable product offering, a carbonated soft drink Polyethylene Terephthalate (PET) cap. The cap is said to be lightweight and compatible with the PCO 1881 neck finish. This new offering claims to be the first commercially produced product using 100% PET and can be manufactured with either virgin or recycled PET (rPET).

- April 2024 – Berry Global introduced new, lightweight closures for protein powder and wellness supplements to help reduce the carbon footprint of nutraceuticals. These new closures are part of Berry’s B Circular Range of packaging and product solutions that leverage the company’s engineering expertise and proprietary processes in the design for circularity to reduce products’ impact on the environment, focusing on helping brand owners meet and exceed their sustainability goals.

- June 2023 – Amcor Capsules collaborated and worked with Maison Saint Aix on tin closures for manufacturing a solution for its six-liter large-format bottles. The launch is an ideal closure that perfectly fits the necks of these bottles. It also has a luxurious finish and a flawless print result that matches the design of the company’s entire product range. The move witnessed Amcor work with the winemaker following previous collaboration from 2015 when the firms first teamed up on development and began supplying the winery with Stelvin Lux screw caps for their 75cl bottles.

- March 2023 – United Caps, an international manufacturer of caps and closures, announced the launch of a unique, highly effective, and sustainable tethered closure for carton packaging, 23 H-PAK. This closure, which has patents pending, includes an innovative tamper-evident (TE) band that keeps all parts intact for easier recycling. The 23 H-PAK tethered closure is designed to make an instant connection with established filling lines, ensuring seamless integration with existing processes and fast production-line implementation.

- July 2022 – Guala, a leading global producer of closures for wines, spirits, beverages, and oil bottles, announced the acquisition of Labrenta. This company specializes in high-end, tailor-made closures. The acquisition will contribute to the achievement of the goals set in Guala's strategic plan and further strengthen its significant presence in the luxury segment. The plant in Breganze will become an important center for research, development, and production of luxury closures.

REPORT COVERAGE

The Europe caps & closures market research report provides a detailed analysis. It focuses on key aspects such as leading companies, competitive landscape, product types, Porter’s five forces analysis, and leading end-use industries of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the above factors, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.90% from 2024 to 2032 |

|

Unit |

Value (USD Billion) and Volume (Billion Units) |

|

Segmentation |

By Material

|

|

By Product Type

|

|

|

By Capacity

|

|

|

By End-use Industry

|

|

|

By Country

|

Frequently Asked Questions

The Fortune Business Insights study shows that the market was USD 21.11 billion in 2023.

The market is projected to grow at a CAGR of 5.90% over the forecast period.

The market size of Germany stood at USD 6.12 billion in 2023.

Based on material, the plastic segment leads and dominates the market share.

The market size is expected to reach USD 35.16 billion by 2032.

The rapidly growing food & beverage industry drives market growth.

The top players in the market are Berry Global, Amcor plc, ALPLA, Tecnocap Group, BERICAP, and United Caps.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us