Europe Modular Construction Market Size, Share & Industry Analysis, By Type (Permanent (PMC) and Relocatable), By Material (Concrete, Steel, and Wood), By Application (Commercial, Healthcare, Education & Institutional, Hospitality, and Others (Residential and Religious buildings)), Country Forecast 2025-2032

Europe Modular Construction Market Size

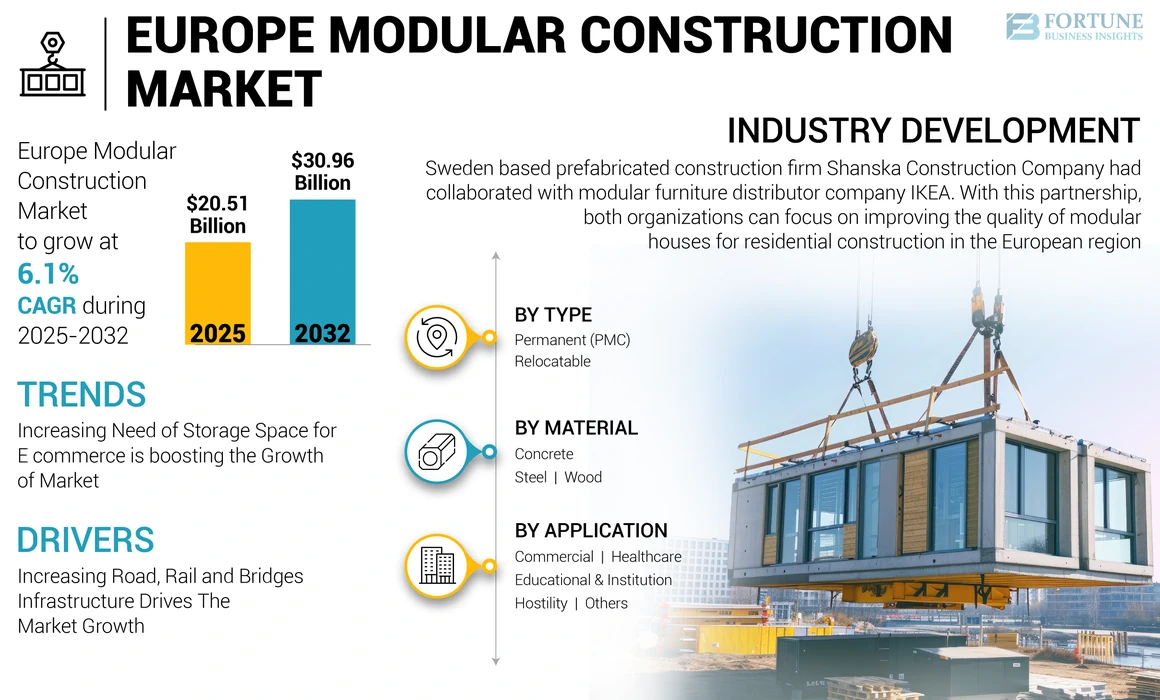

The Europe modular construction market size is projected to grow at a CAGR of 6.1% during the forecast period. The European market is projected to grow from USD 20.51 billion in 2025 to USD 30.96 billion by 2032.

Modular construction is a method of building where pre-engineered building units, or modules, are constructed off-site in a factory and then transported to the construction site for assembly. This construction method has gained popularity in Europe due to its ability to significantly reduce project timelines, increase construction quality, and provide cost savings. In recent years, this industry has experienced significant growth in Europe. This growth is primarily due to increased demand for affordable housing, commercial buildings, and infrastructure projects. This industry has also gained recognition as a sustainable construction method due to its reduction in construction cost, reduced waste, energy efficiency, and use of recycled materials. In the United Kingdom, the government has set a target of building 300,000 new homes per year by 2025, and modular construction is seen as a key method to achieving this goal. Germany has also seen a rise in this type of construction, particularly in the hotel and student accommodation sectors.

LATEST TRENDS

Increasing Need of Storage Space for E commerce is boosting the Growth of Market

Modular construction is used to fulfill storage space needs in a variety of ways. The pre-engineered building units, or modules, used in this type of construction can be customized to meet specific storage requirements, such as size, height, and loading capacity. These modules can be designed to accommodate a wide range of storage needs, from small storage sheds to large-scale warehouses. Modular construction can also be used to quickly and efficiently construct storage facilities. Since modules are constructed off-site in a factory, the construction process is not affected by weather conditions or other delays that can occur with traditional construction methods. This means that modular storage facilities can be built faster and with less disruption to the surrounding environment, which is driving in the Europe modular construction market share.

DRIVING FACTORS

Increasing Road, Rail and Bridges Infrastructure Drives The Market Growth

Modular construction is frequently used in construction of road, rail, and bridge infrastructure in a number of ways. Pre-engineered bridge modules are built off-site and transported to the construction site for assembly. These bridge modules can be designed to meet a variety of specifications, including load capacity, span length, and aesthetic requirements. Modular construction can also be used to quickly construct temporary road and rail infrastructure. This is particularly useful in situations where existing infrastructure has been damaged or destroyed, such as in the aftermath of a natural disaster or during large-scale construction projects. Temporary modular road and rail infrastructure can be quickly assembled and disassembled as needed, minimizing disruption to traffic and reducing construction time. In addition, modular construction can be used to construct permanent road and rail infrastructure. This includes the construction of modular railway stations, tunnels, and other infrastructure components. Modular construction can reduce construction time and cost, while also ensuring high quality and precision in the finished product. These factors are driving the market growth during the forecast period.

RESTRAINING FACTORS

Recession in Civil Engineering and War in Ukraine Restrain Market Growth

The recession and Russia-Ukraine war are collectively impacting the prefabricated construction industry. Due to the recession and slowdown in the overall construction industry, a significant decrease in demand for modular construction products was recorded in the European market during the past year. Furthermore, the ongoing Russia-Ukraine war has created uncertainty in the market, which can make businesses hesitant to invest in modular construction projects. The Russia-Ukraine war disrupted supply chains, particularly for materials that are imported from these countries. This can lead to delays and increased costs for modular construction projects. Moreover, during a recession, government authorities prioritize spending on other areas such as healthcare and social welfare, which reduced the spending on infrastructure projects including modular construction. This abovementioned factors may restrain the growth of the market.

KEY INDUSTRY PLAYERS

Skanska is one of the largest construction companies in Europe and is well-known for its innovative and sustainable building solutions. The company has a dedicated modular construction arm called BoKlok, which offers affordable and sustainable housing solutions across Europe. Furthermore, Katerra Inc., Laing O'Rourke, Modulaire Group, KLEUSBERG, Berkeley Group, Bouygues Batiment International, Daiwa House Modular Europe Ltd., Modubuild, Elements Europe, Moelven Industries ASA, and other construction companies are also focusing on the adoption of business strategies in the European construction industry.

LIST OF TOP EUROPE MODULAR CONSTRUCTION COMPANIES:

- Laing O'Rourke,

- Skanska

- Modulaire Group

- KLEUSBERG

- Berkeley Group

- Bouygues Batiment International

- Daiwa House Modular Europe Ltd.

- Modubuild

- Elements Europe

- Moelven Industrier ASA

KEY INDUSTRY DEVELOPMENTS:

- February 2023 – Sweden based prefabricated construction firm Shanska Construction Company had collaborated with modular furniture distributor company IKEA. With this partnership, both organizations can focus on improving the quality of modular houses for residential construction in the European region.

- June 2022 – Berkeley Modular, the Berkeley Group's construction division, has partnered with coBuilder, a software and service provider for the construction industry. Through this collaboration, coBuilder provides Berkeley Group with all software-related assistance in managing their documents, orders, and prefabrication-related equipment.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market report provides an in-depth analysis of the market dynamics and competitive landscape. It provides key insights, including recent industry developments in the market, such as mergers & acquisitions, macro and microeconomic factors, SWOT analysis, and company profiles.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.1% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Material

|

|

|

By Application

|

|

|

By Country

|

Frequently Asked Questions

Growing at a CAGR of 5.8%, the market will exhibit steady growth in the forecast period (2023-2030).

Increasing Road, Rail and Bridges Infrastructure Drives the Market Growth

Katerra Inc., Laing O'Rourke, Modulaire Group, KLEUSBERG, Berkeley Group, Bouygues Batiment International, Daiwa House Modular Europe Ltd., Modubuild, Elements Europe, Moelven Industries ASA, and other are the major market players in the Asia Pacific market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us