Europe Railway Passenger Coaches Market Size, Share & Industry Analysis, By Train Type (InterCity Express (ICE), Regional, and Local), By Propulsion (Internal Combustion Engine and Electric), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

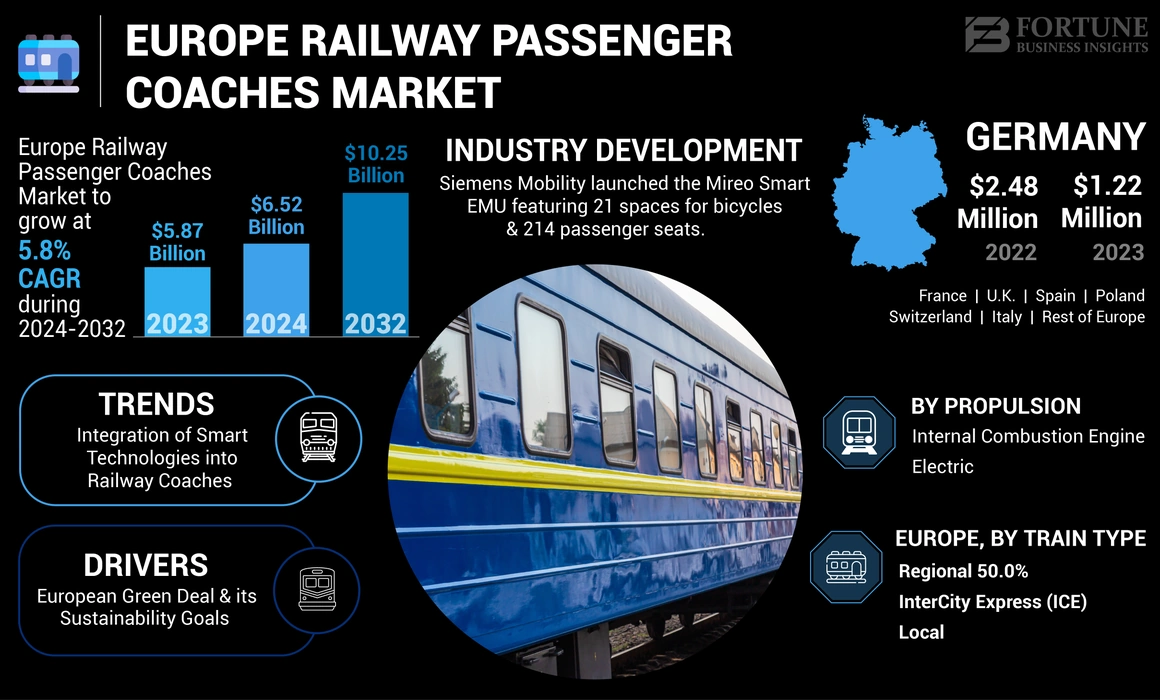

The Europe railway passenger coaches market size was valued at USD 5.87 billion in 2023. The market is projected to grow from USD 6.52 billion in 2024 to USD 10.25 billion by 2032, exhibiting a CAGR of 5.8% during the forecast period.

Railway passenger coaches are specialized vehicles designed to transport passengers on trains. They are equipped with seating, amenities, and safety features to ensure comfort and security during travel. These coaches can vary in design and capacity, serving different classes of service, such as economy, first class, and sleeper accommodations. They can serve various train types, such as long-distance, regional, and local trains.

The market is set to grow, driven by sustainability initiatives, technological advancements, high-speed rail investments, and increasing demand for energy-efficient, low-emission, and smart transportation solutions. Key players in the market include Alstom, Stadler, and Siemens, among others, which compete in the development of propulsion systems, passenger comfort, technological advancements, and pricing.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

“European Green Deal” and its Sustainability Goals Propel the Market Demand

The European Green Deal and its sustainability goals are major catalysts driving the Europe railway passenger coaches market growth. As per the Community of European Railway and Infrastructure Companies, European railways urged the European Commission, Parliament, and Member States to endorse a robust European Green Deal that would help achieve net-zero greenhouse gas (GHG) emissions from both transport and the broader economy by 2050 at the latest. They support the European Parliament's March 2019 proposal to raise the EU's 2030 GHG reduction target from the current 40% (based on 1990 levels, as agreed in 2014) to 55%, aligning it with the EU's commitments under the 2015 Paris Agreement along with the aim to limit global warming to 1.5°C.

In July 2023, as part of the European Green Deal, the EU set ambitious goals to double high-speed rail (HSR) traffic by 2030 and triple it by 2050. A modeling study conducted by PTV Group for Deutsche Bahn (DB) simulated the feasibility of these targets and examined how the HSR network needs to expand to meet the EU's objectives. Currently, high-speed rail transport in Europe is a patchwork of disconnected networks, primarily focused on national traffic, with varying technical standards and operational models. In collaboration with DB and numerous European railway operators, PTV developed a travel demand model in just five months. This is the first model to cover cross-border high-speed and conventional rail traffic across the EU, along with private car, coach, and air traffic. It allows for an exploration of the potential for a unified European HSR network and an analysis of multimodal effects.

Download Free sample to learn more about this report.

Market Restraint

Alternate Transportation Models May Hamper the Preference for Railways

Alternative modes of transport often provide greater flexibility, convenience, and shorter travel times, leading to a decline in railway usage. In many cases, low-cost airlines offer competitive pricing that can be lower than train fares, especially for long-distance travel. When travelers perceive flights as more cost-effective, they are less likely to choose trains. Flights can often cover long distances faster than trains, especially when considering travel time to and from train stations versus airports. Thus, alternate transportation models may hamper the passenger adoption of railways.

Market Opportunities

High-speed Rail Projects Offer Market Opportunity

High-speed rail projects are designed to offer fast, reliable, and efficient travel across long distances, particularly between major cities. As a result, there is a growing demand for high-capacity, high-speed passenger coaches that can operate at speeds of 250-350 km/h or more. These coaches need to be equipped with advanced technology and aerodynamic designs to ensure optimal performance at high speeds. High-speed rail routes such as those between Paris and London, Madrid and Barcelona, and Milan and Rome have set the benchmark for further expansion across Europe, leading to increased orders for new high speed trains.

In October 2023, China's high-speed EMUs (electric multiple units) were exported to Europe following a commercial contract signing. The agreement was passed during the third Belt and Road Forum for International Cooperation, where CRRC Changchun Railway Vehicles Co., Ltd., a subsidiary of CRRC Corporation Limited (CRRC), China's leading train manufacturer, secured a contract with Serbia's Minister of Construction, Transport, and Infrastructure, Goran Vesic. The contract includes the delivery of 20 high-speed EMUs, each with a top speed of 200 kilometers per hour, which are expected to enter service by 2025. The EMUs will be designed in compliance with the European Technical Specifications for Interoperability (TSI) and other regional technical standards, as stated by CRRC Changchun.

Market Challenge

Regulatory Requirements and Upfront Cost Challenges the Market Development

Different countries within Europe have varying regulatory requirements, complicating the cross-border operation of passenger coaches. Harmonizing standards across the EU remains a slow process. The procurement and maintenance of modern railway coaches involve significant upfront costs. Budget constraints and funding issues in some regions hinder large-scale upgrades. Additionally, with the push toward greener and more sustainable rail transportation, companies must balance meeting environmental standards with cost-effective solutions, such as investing in eco-friendly propulsion systems (e.g., hydrogen or battery-electric coaches). All these factors challenge the market to uphold its adoption and interest among the government and railway operators.

Europe Railway Passenger Coaches Market Trends

Integration of Smart Technologies into Railway Coaches Advances the Market

Many European countries have aging railway networks and rolling stock, some of which are decades old and no longer meet modern standards. This aging infrastructure is inefficient, expensive to maintain, and often fails to meet the expectations of today's passengers. To address these issues, governments and rail operators across Europe are investing in large-scale modernization projects. This includes replacing outdated passenger coaches with modern ones that are furnished with the latest technologies. New rolling stock is more energy-efficient, safer, and provides improved comfort and amenities, which enhances the overall appeal of rail travel. Modernization projects, such as those in Germany, France, and the U.K., are providing significant opportunities for manufacturers of passenger coaches to supply new, high-performance coaches to replace older fleets.

In January 2022, Siemens Mobility secured a contract from NMBS/SNCB, the Belgian National Railways, to upgrade 390 trains and steering cars with European Train Control System (ETCS) Level 2 technology. This technological enhancement improves the fleet's operational efficiency and ensures compliance with the latest European rail safety and interoperability standards.

Impact of COVID-19

The COVID-19 pandemic significantly impacted the European railway passenger coaches market by drastically reducing the passenger footfall due to lockdowns and social distancing measures. This decline led to reduced revenue for rail operators, causing budget constraints and delaying planned upgrades and new coach acquisitions. Additionally, supply chain disruptions affected the production and delivery of railway coaches, further complicating fleet modernization efforts. However, the pandemic also accelerated a shift toward enhanced hygiene measures and digitalization in rail services, prompting investments in contactless ticketing and improved passenger amenities.

Segmentation Analysis

By Train Type

Increased Focus on Reducing Carbon Emissions Propels the Regional Segment Demand

On the basis of train type, the market has been divided into intercity express (ICE), regional, and local.

The regional segment is expected to lead the market during the forecast period. In October 2022, Switzerland's Rhaetian Railway (RhB), with support from its long-time technology partner ABB, set a world record for operating the longest passenger train. This achievement highlights the advancements in electric rail transport. The record-breaking train, comprising 100 cars, 4,550 seats, and weighing 2,990 tons, covered 24 km through the Swiss Alps, overcoming a 790-meter altitude change in 45 minutes. ABB’s latest traction converter supplied 1.6 MW of power to each of the twenty-five train units. An 80-meter model railway was also showcased at the final station. Thus, increased focus on reducing carbon emissions and promotion of environmentally friendly transport encourages governments to invest in electrified regional rail networks, fueling the segment growth.

The local segment is recorded to develop with the fastest-growing CAGR during the upcoming years. The rise in urban populations increases the demand for efficient public transport systems, making local trains essential for daily commuting within cities. As per the European Commission, the urbanization level in Europe is likely to rise to around 83.7% by 2050.

To know how our report can help streamline your business, Speak to Analyst

By Propulsion Type Analysis

Increasing Investment in Modern Electric Trains Fuels the Electric Segment Growth

Based on the propulsion type, the market has included internal combustion engines and electric.

The electric segment dominated the market in 2023 and is anticipated to grow at the fastest CAGR during the forecast period. In July 2024, the European Investment Bank (EIB) provided EUR 1 billion (USD 1.10 billion) in loans to purchase up to 90 modern S-Bahn trains for Rhineland routes. The trains, procured by go.Rheinland and VRR feature wheelchair accessibility, improved passenger information, mobile reception, WiFi, toilets, and space for 1,343 passengers. This investment supports future passenger growth and promotes the shift to CO2-reducing rail transport. Thus, increasing investment in modern electric trains fuels the segment growth during the forecast period.

The internal combustion segment held a decent share in the market in 2023. Many regions still rely on diesel-powered trains due to the extensive existing infrastructure that supports ICE trains, especially in non-electrified areas. Diesel trains often have lower initial investment costs compared to electrification projects, making them a practical choice for many operators. ICE trains can operate on a wider range of routes, including those without electrification, providing greater operational flexibility in rural and remote areas. All these factors drive the growth of the segment.

Europe Railway Passenger Coaches Market Regional Outlook

Germany

In 2023, Germany secured a major share of 20.8% in the Europe railway passenger coaches market. The government and railway operators in the country have made substantial investments in rail infrastructure as part of a broader strategy to promote sustainable transportation. Initiatives to upgrade existing rail networks and build new lines contribute to the demand for modern passenger coaches. In 2023, the German government funded Deutsche Bahn with EUR 12.5 billion (USD 13.6 billion) for investment in rail infrastructure.

Spain

Spain market is projected to depict the highest growth rate in the coming years. Spain has one of the leading high-speed railway networks (AVE) in the world, which continues to expand. Investments in expanding and modernizing the AVE system drive the demand for high-speed rail passenger transport coaches capable of accommodating higher speeds and offering enhanced comfort and safety features. In September 2024, the budget train operator Iyro introduced a direct route connecting Malaga and Barcelona.

Competitive Landscape

Key Market Players

The Europe railway passenger coaches market is competitive, driven by major players including Alstom, Siemens AG, Stadler Rail, CAF, and SKODA, among others. These companies focus on innovation, energy-efficient designs, and passenger comfort to meet evolving demand for sustainable and modern transit solutions. Key strategies of the key players include investments in digitalization, such as smart systems for operational efficiency and enhanced passenger experience, and the development of lightweight materials for better fuel efficiency. Strategic collaborations with governments and operators are prevalent, alongside customized offerings for regional, intercity, and high-speed rail segments, driving the competitive edge in the market.

Major Players in the Europe Railway Passenger Coaches Market

To know how our report can help streamline your business, Speak to Analyst

Alstom, Siemens AG, Stadler Rail, CAF, and SKODA are some of the major players in the market. The market is consolidated, with the top 5 players accounting for around 81% of the Europe railway passenger coaches market share.

List of Key Companies Profiled In The Report

- Siemens AG (Germany)

- Alstom (France)

- Stadler Rail (Switzerland)

- CAF (Construcciones y Auxiliar de Ferrocarriles) (Spain)

- Hitachi Rail (U.K.)

- Titagarh Firema SPA (Italy)

- SKODA TRANSPORTATION a.s. (Czech Republic)

- CRRC Corporation Limited (China)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Pesa Group (Poland)

Key Industry Developments

- October 2024 - Siemens Mobility unveiled the Mireo Smart EMU to the public. This train features 214 passenger seats and 21 spaces for bicycles, boasting a top speed of 160 km/h. The Mireo Smart is equipped with passenger information and security monitoring systems, including displays located in entry areas. It will be available in three traction configurations: overhead catenary, a combination of catenary and batteries, and hydrogen fuel cells.

- October 2024 - Stadler secured a contract to deliver up to 24 battery-powered FLIRT trains to Lokaltog A/S as part of the company's efforts to decarbonize its fleet in the Zealand region of Denmark. Lokaltog chose Stadler, a global leader in battery-electric multiple units, to supply 14 FLIRT Akku trains, with an option for ten additional vehicles. Scheduled for delivery in 2028, the trains would operate on the Tølløsebanen and Østbanen lines, with potential expansion to Lollandsbanen and Odsherredsbanen. The contract, signed in Taastrup, Denmark, follows a public tender issued in November 2023.

- September 2024 - Škoda Group signed contracts with Tampereen Raitiotie Oy to produce 10-meter extension modules for the existing 37-meter trams operating on the Tampere tram network. These agreements, worth around EUR 25 million (USD 27.6 million), are part of an option from the original order and will be executed in two phases to expand tram capacity in response to increasing passenger demand. Additionally, the contracts include a comprehensive 10-year full-service package.

- September 2024 - Polish manufacturer PESA secured a USD 113.4 million contract with the regional operator Lower Silesian Railways for the delivery of 10 Elf trains, with an option for an additional 10. The regional operator, Lower Silesian Railways (KD), finalized a deal worth PLN 438.4 million (EUR 113.4 million) (USD 126.6 million) with Pesa for ten new five-car Elf EMUs.

- July 2024 - Alstom, a leader in smart and sustainable mobility, entered into a framework agreement with Hamburger Hochbahn AG valued at up to EUR 2.8 billion (USD 3.03 billion). This contract entails the delivery of as many as 374 metro trains for both fully and semi-automated operations.

- July 2024 - Hitachi Rail announced a new metro train project designed to operate on Rome's Lines A, B, and B1, with service expected to begin in 2025. The trains would be manufactured at Hitachi's facility in Reggio di Calabria, Italy. All transport infrastructure development projects in Ukraine have been approved under the CEF Program. These new trains would replace the outdated MB300 and MB400 models from CAF, which were manufactured in the early 2010s. The six-car trains would be 106 meters long and have a passenger capacity of up to 1,204, with a maximum speed of 80 km/h. A significant improvement includes a 10% reduction in the consumption of energy compared to current models, achieved through more efficient traction systems.

- March 2024 -CRRC China delivered composite double-decker trains to five European countries. CRRC Zhuzhou, a subsidiary of China Railway Rolling Stock Corp (CRRC)—the largest rolling stock manufacturer in China— commenced the export of its double-deck Electric Multiple Units (EMU) train sets from its facility in Hunan province.

Investment Analysis and Opportunities

Investments in Modernizing Aging Infrastructure and Expanding Electrification Efforts Provide Market Opportunity

The European railway passenger coaches market presents significant investment opportunities driven by the upward demand for sustainable and efficient transport solutions. Investments in modernizing aging infrastructure and expanding electrification efforts can enhance operational efficiency and reduce carbon emissions. Key areas for investment include advanced technologies such as passenger communication systems, comfort & safety, and eco-friendly propulsion systems such as hydrogen and battery-electric trains. Additionally, public-private partnerships can facilitate funding for large-scale projects, ensuring compliance with stringent environmental regulations.

Report Coverage

The Europe railway passenger coaches report analyzes the market in-depth and highlights crucial aspects such as prominent companies, market segmentation, competitive landscape, train type, propulsion type, electrification type, and technology adoption. Besides this, the market research report provides insights into the market trends and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market growth over recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.8% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Train Type

By Propulsion Type

By Country

|

Frequently Asked Questions

Fortune Business Insights says that the market size was USD 5.87 billion in 2023 and is anticipated to reach USD 10.25 billion by 2032.

The market will exhibit a CAGR of 5.8% over the forecast period.

By train type, the regional segment is predicted to dominate the market during the forecast period (2024-2032).

“European Green Deal” and its sustainability goals are vital factors propelling the market expansion.

Alstom, Siemens AG, Stadler Rail, CAF, SKODA, and others are some of the leading players in the market.

Germany dominated the Europe market in 2023.

Related Reports

- Locomotive Maintenance Market

- Air Brake System Market

- Railway Passenger Coaches Market

- Europe Rail Infrastructure Market

- North America Rail Infrastructure Market

- Metro Rail Infrastructure Market

- Railway Lubricants Market

- Railway Signalling System Market

- Railway Axle Market

- Railway Cyber Security Services Market

- Locomotive Market

- Rolling Stock Market

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us