Fermenters Market Size, Share & Industry Analysis, By Mode of Operation (Automatic and Semi-automatic), By Process (Batch, Fed-Batch, and Continuous), By Material (Stainless-steel, Glass, and Others), By Application (Food, Beverages, Healthcare & Cosmetics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

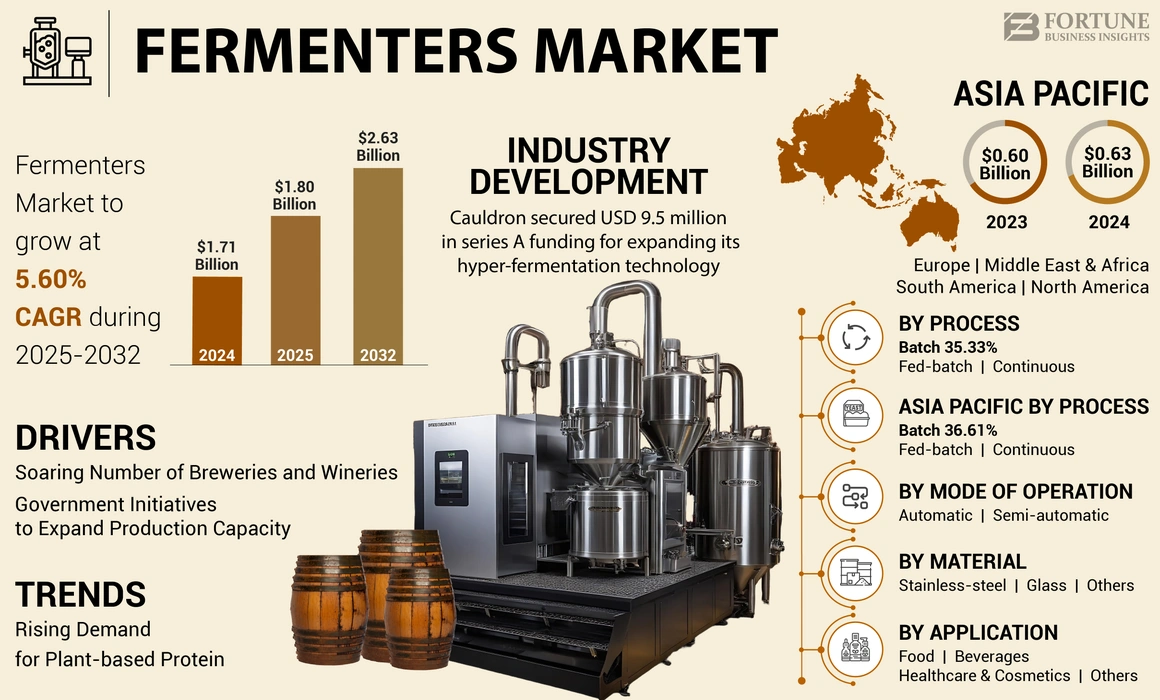

The global fermenters market size was valued at USD 1.80 billion in 2025 and is projected to grow from USD 1.89 billion in 2026 to USD 2.98 billion by 2034, registering a CAGR of 5.87% over the forecast period. Asia Pacific dominated the fermenters market with a market share of 36.78% in 2025. Moreover, the U.S. fermenters market is projected to reach USD 524.79 million by 2032, due to the growing use in biotechnology and food processing.

Fermenters are sterilized, enclosed vessels that create optimal conditions to promote the growth of microorganisms. These vessels are traditionally used to carry out the microbial fermentation process using microorganisms in industries, such as beverage, food, ethanol, pharmaceuticals, and cosmetics. Fermentation is an essential process in producing alcoholic beverages such as beer, wine, and distilled spirits. Increasing number of craft breweries and microbreweries globally significantly drive the market growth. Furthermore, the product is used in the food industry to improve the sensory attributes and to enhance the product's shelf life. Additionally, increasing plant-based food products such as meat and dairy alternatives will propel the product’s sales in the near future.

Global Fermenters Market Overview

Market Size:

- 2025 Value: USD 1.80 billion

- 2026 Value: USD 1.89 billion

- 2034 Forecast Value: USD 2.98 billion, with a CAGR of 5.87% from 2026–2034

Market Share:

- Asia Pacific led the market with a 36.78% share in 2025, driven by high beer production in China and growing demand for plant-based foods across the region.

- Semi-automatic segment is expected to hold an 85% share in 2025, while the fed-batch process segment is projected to generate USD 898.63 million by 2025.

Key Country Highlights:

- The U.S. fermenters market is projected to reach USD 524.79 million by 2032, fueled by rising biotechnology and food processing usage.

- Japan is expected to reach USD 49.94 million by 2025.

- India is projected to witness a strong CAGR of 6.42% during the forecast period.

- Europe is expected to grow at a CAGR of 5.24%, with support from microbrewer expansion and government initiatives in alternative proteins.

During the COVID-19 pandemic, product sales were negatively influenced due to the lower product demand from breweries and other beverage industries. New craft and microbreweries became conscious of investing considerable funds to expand their production scale amid lower beer demand due to restricted on-trade distribution of alcohol products. However, increasing plant-based meat and dairy products during the pandemic slightly balanced the hampered product demand during the period.

Fermenters Market Trends

Increasing Plant-Based Protein Demand to Propel the Market in the Near Future

The usage of the product within the alternative protein industry helps the cultivation of microbial organisms for the purpose of producing food ingredients and obtaining more organisms as a source of protein. They also help in the production of specialized ingredients such as enzymes, flavorings, fats, and proteins, mainly to incorporate plant-based products or cultivated meat. Leading companies are utilizing traditional fermentation to improve the sensory, functional, and nutritional attributes of several ingredients.

According to the Good Food Institute, a non-profit organization promoting plant-based foods, the number of venture capital investments in fermentation globally increased by 22% to 693 investors. Emerging plant-based foods demand, such as meat and dairy products, is significantly set to influence the global market growth in the upcoming years.

Download Free sample to learn more about this report.

Fermenters Market Growth Factors

Growing Breweries and Wineries across the Globe to Propel Industry Growth

The alcoholic beverages industry, especially breweries and wineries, is rapidly expanding over the past decade with the growing demand for beer and wine. With the changing landscape of the industry, there is an expansion in the number of craft brewers and wine producers globally. Fermenter is a vital and inseparable instrument in the beverage industry to produce beer, wine, and distilled spirits. The increasing number of craft breweries and wineries is anticipated to significantly drive the global fermenters market growth in the near future. According to the Brewers Association, in 2023, nearly 9,683 brewers were operating in the U.S. and nearly 495 new breweries opened throughout the year.

Government Initiatives to Expand the Production Capacity to Drive Market Growth

Fermentation is one of the effective and ancient methods of food preparation, which enhances the nutritional quality and sensory attributes of the food. This process is one of the essential stages in the production of alternative proteins. As plant-based and cultivated meat product demand increases globally, government bodies are involved in promoting companies who are operating in the sector to achieve more food safety. Several government authorities are investing in various phases of producing meat and dairy analogs, which is driving the global market growth. For instance, in March 2024, the Illinois government invested USD 680 million funding in the biotechnology sector to scale up bio manufacturing and precision fermentation capacities.

RESTRAINING FACTORS

High Prices and Installation Costs May Impede Market Growth

Industrial fermenter tanks are relatively expensive, which will increase the company's capital investment. Most brewers and vinegar producers will invest an average of USD 7,000 to USD 10,000 for a single fermenter having a capacity of 500 to 1000 gallons. Traditionally, wineries prefer to purchase more-capacity fermenter tanks with higher quality. Commercial wineries are opting for the product having 200 hl or more capacity. These fermenters are relatively high in the price range. Therefore, it will require more capital investments for the new entrants. Furthermore, a single fermenter has a higher lifetime of around 15 to 20 years. As a result, existing players will not spend more on upgrading or replacing fermenting equipment in a shorter period. As a result, the product demand is anticipated to grow at a slower rate during the forecast period.

Fermenters Market Segmentation Analysis

By Mode of Operation Analysis

Higher Quality Control Exposure to Drive Automatic Fermenters Demand in the Near Future

Based on the mode of operation, the market is divided into automatic and semi-automatic.

The automatic segment is anticipated to grow at the highest CAGR during the forecast period. Advancements in technology primarily brought a paradigm shift in driving the demand for automated fermenters in the industry. These types of fermenters have been changing the way of fermentation process in food, beverages, and ethanol sectors by offering higher quality and improved efficiency. With enhanced abilities such as accurate monitoring & controlling temperature and oxygen levels, this mode of operation allows manufacturers to minimize the variations in the production process and maintain consistent quality. the semi-automatic segment is expected to hold a 85.21% share in 2026.

The semi-automatic segment holds the highest share of the global market with the broader availability of the product. The semi-automatic fermentation tank offers both automatic and manual operation functions. It will allow more control during the production of beer, wine, vinegar, protein, and other chemicals. Furthermore, a more significant number of manufacturers traditionally utilize semi-automatic fermenters for a more flexible fermentation process.

By Process Analysis

Fed-Batch Process Segment to Lead Due to Benefit of Shorter Fermentation Time with Higher Accuracy

Based on process, the market is classified into batch, fed-batch, and continuous.

The fed-batch segment led by process type, holding 50.07% of the market share in 2026. Fed batch is an advanced version of the batch process, developed to minimize its challenges. This process allows for continuous addition of essential nutrients for cell growth or product formation during the process. This helps to enhance the product concentration or product yield in a shorter time. Therefore, several beneficial factors, including a shortened fermentation process, increased productivity, high cell concentration, and reduced water loss, make the process more ideal for key players. the fed batch segment is projected to generate USD 898.63 million in revenue by 2025.

The continuous segment is anticipated to grow at the highest rate during the forecast period. Advancements in technological aspects in improving the fermentation process are primarily driving the demand for this process. Compared to others, the continuous fermentation process offers more product yield. It allows to minimize operational costs while maintaining consistency in product quality.

To know how our report can help streamline your business, Speak to Analyst

By Material Analysis

Durability and Re-usability Advantages to Drive the Demand for Stainless Steel Materials

Based on material, the market is classified into stainless-steel, glass, and others.

The stainless steel segment dominated by material type, capturing 82.11% of the global market share in 2026. Stainless steel offers an exceptional hygienic condition in the fermentation process. It also helps the growth of fermenting bacteria by resisting the growth of other contaminants. Another benefit of fermenters made of stainless steel is higher durability. These tanks are built to last and their lifespan is longer than other materials such as glass and plastic. Furthermore, the segment is anticipated to grow at the highest CAGR during the forecast period, as stainless steel is hygienic, clean, reusable, cost-effective, and efficient.

Glass is another important material traditionally used in fermenters across different industries, including pharmaceutical, cosmetics, and food. A glass fermenter tank allows the manufacturer to effectively monitor the product in every stage of the production process. Furthermore, it is easy to handle, clean, and sanitize the tank. Therefore, the segment is anticipated to depict promising growth rate in the upcoming years.

By Application Analysis

Rising Demand for Beer and Wine Strongly Impact on Driving the Product Demand from the Beverages Sector

Based on application, the market is classified into food, beverages, healthcare & cosmetics, and others. The beverages segment accounted for 71.59% of the market share in 2026 driven by the rising demand for fermented beverages such as beer, wine, and distilled spirits. In addition, emerging demand for kombucha, kefir, and other fermented beverages across the U.S. and Europe is likely to drive the market in the near future. Furthermore, increasing micro and craft breweries across the world significantly drives the industry growth. According to the statistics of the Brewers of Europe, 2023 edition, beer production in Europe increased from 380,550,000 hl in 2020 to 401,945,000 hl in 2022, a 5.62% growth. Thus increasing beer production in the global space is strongly driving the sales of the product.

The food segment is set to exhibit the highest CAGR during the forecast period as the increasing plant-based food products popularity is primarily contributing to the product demand. Several companies are entering the industry to meet the growing demand for vegan food products such as dairy alternatives and meat alternatives. According to the Good Food Institute, the number of fermentation companies increased by 16% in 2023 across the world. The industry in the food sector continues to expand with innovation and technological advancement to produce plant-based protein products. Further, new product development, expanding manufacturing facilities, and partnership activities are set to drive the product demand in the food industry during the forecast period.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Fermenters Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific accounted for USD 0.66 billion in 2025. Asia Pacific is dominating the market with the highest share as China and India are contributing significantly to the global beer production, with a high number of brewers. China is the leading beer producer in the world. According to the U.S. Department of Agriculture, nearly 34.1 billion liters of beer were brewed in China in 2020. According to the National Bureau of Statistics China, beer production in the country in 2021 increased to 3.56 billion liters, nearly 4.4% growth over the previous year. Therefore, the increasing beer production in China is primarily contributing to the market. Furthermore, increasing vegan protein products and plant-based meat and dairy products popularity across Asia Pacific, including India, China, Japan, and Australia, has a significant impact on the market growth. As a result, the region is anticipated to grow at the highest CAGR during the forecast period.

- The fermenters market in Japan is expected to reach USD 0.05 billion by 2026.

- India market reaching USD 0.09 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

is another prominent market that holds approximately one-fourth of the global fermenters market share. Microbrewers' growth across France and Italy is driving the industry to newer heights. According to the Brewers of Europe, the number of microbreweries in France and Italy has reached 2,300 and 870 in 2022, increasing from 2,100 and 756 in 2020, respectively. Furthermore, government involvement in promoting the fermentation industry, especially for the food & alternative protein sector, is anticipated to drive the industry growth during the forecast period. Europe is anticipated to grow at a CAGR of 5.24% during the forecast period. The UK market reaching USD 0.07 billion by 2026 and the Germany market reaching USD 0.11 billion by 2026.

North America

North America is another promising market anticipated to grow with a lucrative CAGR during the forecast period. This is due to the growing production of alcoholic beverages, ethanol, and ingredients for personal care products. Furthermore, companies in the industry are raising financial assistance to expand their production capacity. According to the Good Food Institute, nearly USD 411 million of capital investment in the fermentation business has been recorded in 2022 across the U.S. Furthermore, the government is also involved in investing in the sector for future expansion, which is significantly supporting the market growth across the region. The U.S. market reaching USD 0.37 billion by 2026.

Increasing ethanol production in Brazil and other South American countries is primarily driving the growth of the market. According to the U.S. Department of Agriculture, total ethanol production in Brazil was estimated to be 31.66 billion liters in 2022, approximately 6% growth from 2021. Additionally, the emerging demand for meat alternative products derived from plant sources is likely to shape the industry during the forecast period.

Middle East & Africa

The Middle East & Africa is a relatively small market with a lower production capacity of alcoholic beverages across several countries including UAE and Saudi Arabia. However, the increasing beer and winery industries in African countries drive the market growth in the region. Furthermore, increasing investment in R&D and development activities to produce plant-based protein products across Israel and Middle Eastern countries are anticipated to drive the product demand.

KEY INDUSTRY PLAYERS

Key Players are Emphasizing Merger and Acquisition Activities to Expand their Market Share

The market is moderately consolidated with the presence of established mid and large-scale companies such as Bioengineering AG, Pierre Guerin, and Solaris Biotech. These companies are highly involved in the development of tech-edge products that enhance product quality and yield. Furthermore, global companies are emphasizing partnership, merger, and acquisition strategies to expand their production capacity, geographical presence, and clientele base. These strategies provide exposure to business expansion and assist companies in establishing strong supplier networks and adopting novel technologies. For instance, in October 2022, Zeta Group, a global biopharma company, acquired the majority stake in Biotree, an Indian bioreactor & fermenters manufacturer. The acquisition assists the company in intensifying its presence in the Asian market and offering quality services to its consumers from India and Southeast Asian countries.

List of Top Fermenters Companies:

- Bioengineering AG (Switzerland)

- DIOSNA Dierks & Söhne GmbH (Germany)

- Pierre Guerin (France)

- SYSBIOTECH GmbH (Germany)

- CETOTEC GmbH (Germany)

- Sartorius AG (Germany)

- GEA Group (Germany)

- Solaris Biotech (U.S.)

- Biotree (India)

- Electrolab Biotech (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: An Australian start-up, Cauldron, closed nearly USD 9.5 million in series A funding to expand its hyper-fermentation technology.

- March 2024: Locus Fermentation Solutions, an Ohio-based company, raised USD 30 million from debt financing to extend its biological production capacities to bio-surfactants for the mining and bioenergy industries.

- October 2023: MycoTechnology Inc., an American fermentation service provider, launched its Fermentation as a Service (FaaS) platform in the U.S. The company offers several services including essential tools and expertise to scale up their production capacity from as low as 300 liters to 90,000 liters. The FaaS platform accommodates a diverse range of bio-products, including proteins, enzymes, and probiotics.

- March 2023: Cauldron, an Australian start-up, raised approximately USD 7 million in its seed round led by Main Sequence and Horizons Ventures. The company raised funds to scale up its precision fermentation more effectively, efficiently, and smartly.

- February 2021: Stepan Company, a global specialty and intermediate chemicals manufacturer, acquired a fermentation plant located in Lake Providence, Louisiana.

REPORT COVERAGE

The report includes quantitative and qualitative insights into the market and also offers a detailed regional and global industry analysis of the market size, statistics, regional and global market share, and growth rate for all possible market segments. Additionally, the report provides various key insights on the market, an overview of related markets, competitive landscape, recent industry developments such as mergers and acquisitions, the regulatory scenario in critical countries, and key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.87% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Mode of Operation

By Process

By Material

By Application

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global fermenters market size was valued at USD 1.80 billion in 2025 and is projected to grow from USD 1.89 billion in 2026 to USD 2.98 billion by 2034.

Increasing at a CAGR of 5.87%, the market will exhibit promising growth over the forecast period (2026-2034).

The fermenters market is primarily driven by increasing demand for plant-based proteins, expansion of craft breweries and wineries, and rising applications in food, beverages, and biotechnology. Government support for alternative protein production also contributes significantly to market expansion.

Asia Pacific dominates the global fermenters market, accounting for 36.84% of the market share in 2024. This dominance is attributed to high beer production in countries like China and India, and the rising popularity of plant-based food products across the region.

Fermenters are widely used in the beverages sector for brewing beer, wine, and kombucha, and in the food industry for producing dairy and meat alternatives. They are also essential in healthcare & cosmetics for cultivating microorganisms to produce enzymes, proteins, and probiotics.

Automatic fermenters are gaining popularity due to their ability to offer higher quality control and operational efficiency. However, semi-automatic fermenters still hold the largest market share due to their flexibility and broader usage across traditional setups.

High equipment costs and installation expenses pose significant challenges. New entrants often face barriers due to capital-intensive investments, and existing players typically do not replace fermenters frequently due to their long operational lifespan of 15–20 years.

The fed-batch process leads the market due to its ability to provide higher yield in shorter fermentation time. It allows for the continuous addition of nutrients, enhancing productivity and minimizing water loss compared to batch and continuous processes.

Key players in the global fermenters market include Bioengineering AG (Switzerland), Pierre Guerin (France), Solaris Biotech (U.S.), Sartorius AG (Germany), and Biotree (India). These companies focus on technological innovation, strategic partnerships, and capacity expansion to maintain competitive advantage.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us