Field Force Automation Market Size, Share & Industry Analysis, By Solution (Mobile-based and Desktop/Web-based), By Deployment (On-premise and Cloud), By Enterprise Type (SMEs and Large Enterprises), By Industry (Logistics & Transportation, Healthcare, Manufacturing, Construction & Real Estate, IT & Telecom, Energy & Utilities, and Others), and Regional Forecast, 2026 - 2034

Field Force Automation Market Size

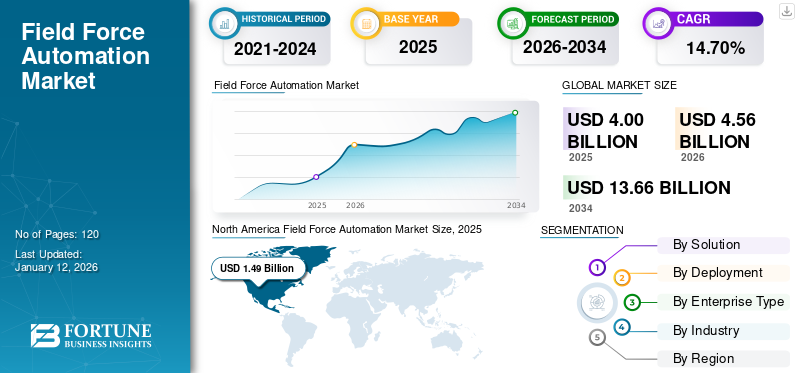

The global field force automation market size was valued at USD 4.00 billion in 2025 and is projected to grow from USD 4.56 billion in 2026 to USD 13.66 billion by 2034, exhibiting a CAGR of 14.70% during the forecast period. North America dominated the global field force automation market with a share of 37.30% in 2025.

Field Force Automation (FFA) solutions gained popularity in recent years, as this software has optimized the workflow by changing the way teams engage with other businesses. This solution reduces administrative time, which helps to reduce costs and improve productivity. As per industry experts, field force automation can increase sales by 30% and reduce the time required for sales management work by 14%. Industries, including utilities with large field sales teams, are adopting this solution for higher productivity. According to Harvard Business Review, automation in field sales leads to a 20% increase in service-level agreement compliance and 23% higher productivity.

The COVID-19 pandemic generated a tremendous impact on field service, and companies adopted automation to ease their operations. Saving time and improving the productivity of field employees was critical during the pandemic, and for this, companies adopted automation solutions to enhance the efficiency of field service operations. However, the surge in demand for digital mediums and the fast pace of production in the post-lockdown period will encourage industries to implement field force automation in the coming years.

IMPACT OF GENERATIVE AI

Significant disruptions in industries across the globe have forced service providers to restructure their operations in recent years. Many companies are facing challenges in the form of worker attrition, preventing their growth. As customers are investing more in digital products service providers are facing challenges in getting skilled technicians, and due to this, around 50% of service providers are unable to meet service level agreements. To operate in a highly competitive market, companies in the market need to adapt to the ongoing talent pool disruption, and companies are exploring the potential of generative AI in the field services. Generative AI offers the ability for a personalized service experience for all technicians, and based on the knowledge and familiarity of the asset, product, or customer, AI insights can be personalized to help that technician achieve faster resolution times. The field service company is at a critical crossroad when it comes to impacting the customer experience. Field employees work with customers, solving vital issues, building relationships, and delivering differentiated value that improves the perception of the company’s brand. By using generative AI, employees can do their work more efficiently, as it helps automate tasks.

Field Force Automation Market Trends

Growing Popularity of AR-enabled Field Force Automation to Drive Market Growth

The popularity of AR-enabled field force automation is increasing as this can overlay schematics and other vital information onto actual software to help field employees to carry out their roles. The field employees can be guided on-site by experienced professionals through augmented reality tools. The use of AR tools helps employees to simplify the complex process of assembly and disassembly of parts. Using AR field service, technicians can access real-time data related to the servicing of the equipment and can collaborate and get support from an expert. AR helps speed up the process of troubleshooting by identifying problems early.

AR devices help technicians to easily identify errors and issues related to maintenance by viewing customers’ equipment through AR headset. The technician can also check the instruction steps with a diagram overlaid on the equipment’s image. This helps to simplify the job of field service technicians with enhanced performance, proper diagnoses, and a higher rate of first-time fix rates. Through every service call, the AR device gathers useful information. This way, it captures the skills and knowledge of the most experienced technicians and engineers and provides a great source of training for future technicians. The execution of an augmented reality solution allows real-time association between a technician and an expert in providing instructions in complex situations. Augmented reality in field force automation helps to reduce the training cost by upto 50%, and the remote resolution rate is increased by 50% and first-time fixes by 30%.

Therefore, the above-mentioned factors are boosting the field force automation market share.

Download Free sample to learn more about this report.

Field Force Automation Market Growth Factors

Digital Transformation among Enterprises to Augment Market Growth

Enterprises are undergoing digital transformation by leveraging advanced technologies, including IoT, AI, and cloud computing, among others, in field force automation solutions and surging requirements for automating repetitive activities. The integration of advanced technologies with field force automation solutions helps to improve the capabilities of the solution. As per industry estimates, around 40% of sales tasks are automated. As the penetration of connected devices is increasing, the adoption of this solution is witnessing a surge among various industries, including manufacturing, construction & real estate, energy & utilities, and others. In addition, this solution offers enhanced workforce productivity and saves time for field employees.

Analyzing field team performance in real time with Business Intelligence can provide insights that can be used to improve consumer focus brands in the market. Additionally, automation in data analysis can guarantee immediate solutions when similar data is collected in real time. This may aid in making important decisions for the organization, such as employee incentives, leave management, promotion, and others. Data-driven decisions could affect the development and growth of the organization and help to achieve business goals in the field efficiently.

Therefore, digital transformation among enterprises is driving the field force automation market growth.

RESTRAINING FACTORS

Data Privacy and Security to Hamper Market Growth

Data privacy and security concerns are among the key challenges hindering market growth. One of the key issues associated with the implementation of the FFA solution is its data and privacy concerns, as it involves collecting and storing sensitive customer data, such as personal information, financial details, and contact information. Thus, FFA is vulnerable to unauthorized access to this data, leading to data breaches and potential misuse of customer information if proper security measures are not in place. Hence, in order to protect the data while in transit and prevent unauthorized interception and access, encryption protocols should be implemented. Thus, organizations have to ensure that their FFA practices comply with applicable data protection and privacy regulations, such as the General Data Protection Regulation (GDPR) in the European Union or the California Consumer Privacy Act (CCPA) in the U.S. Therefore, data privacy concerns are expected to pose a significant threat to market growth during the forecast period.

Field Force Automation Market Segmentation Analysis

By Solution Analysis

Mobile-Based Solutions Projected to Achieve Highest CAGR Due to Offline Access and Enhanced Security Features

By solution, the market is segmented into mobile-based and desktop/web-based.

Mobile-based solutions are estimated to register market share of 52.31% in 2026, as mobile applications are easy to access without browsing the web applications through a browser. Mobile applications can be accessed even offline and have more sophisticated security than web-based applications.

The desktop/web-based segment dominated the market in 2024, as desktop/web-based are flexible and can be accessed via any browser. Web applications need not be updated manually as they update on their own. Applications are cross-platform and can run on any operating system.

By Deployment Analysis

Cloud-Based Solutions Lead Due to Scalability, Adaptability, and Real-Time Access

By deployment, the market is segmented into on-premise and cloud.

Cloud-based solutions dominated the market share of 63.37% in 2026 and are estimated to register the highest CAGR during the forecast period, owing to their scalability and adaptability. Cloud-based solutions allow businesses to effectively oversee their mobile workforce and respond to evolving needs. Cloud-based solutions offer instant access to vital information and analytics from any location.

On-premise is expected to showcase steady growth as on-premise solution involve implementing solutions within the company’s internal infrastructure, instead of using cloud-based hosting services.

By Enterprise Type Analysis

SMEs to Experience Highest CAGR with Solutions Enhancing Field Activity Optimization, Efficiency, and Task Automation

By enterprise type, the market is divided into large enterprises and SMEs.

The SMEs are estimated to grow with the highest CAGR during the forecast period as the solution offers affordable resources that help SMEs optimize their field activities, improve efficiency, and automate mundane tasks. This solution gives SMEs insight related to field operations, allowing them to allocate tasks more efficiently, monitor their field staff's performance, and improve route planning for better productivity.

Large enterprises dominated the market share of 67.41% in 2026, as the solutions offered immediate insight into field operations, helping businesses improve customer service quality. Large enterprises invest in field force automation solutions to enhance loyalty and customer satisfaction.

By Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Manufacturing Sector Leads with Advanced Technology Adoption and Growing Demand for Field Force Automation Solutions

By industry, the market is divided into logistics & transportation, healthcare, manufacturing, construction & real estate, IT & telecom, energy & utilities, and others.

Manufacturing dominated the market in 2024, owing to the increased adoption of advanced technologies among enterprises in the manufacturing sector. According to an Aptean survey, around 44% of manufacturers are in the advanced stages of digital transformation. The demand for field force automation solutions is increasing across the sector, as the solution helps manufacturing companies to manage the customers of the enterprise and provide full visibility of the customer data to the company across all departments. Also, the solution helps in ensuring that work is done on time and with the highest quality.

The energy & utilities are estimated to grow with the highest CAGR during the forecast period. Automation improves field services in the energy & utility sector as it helps streamline repetitive tasks, improves workforce productivity, and improves first-time fix rates across the sector. According to Capgemini, utility companies save between USD 237 billion and USD 813 billion over three years with automation. However, the demand for automation solutions will witness growth in the coming years in the energy & utility sector.

REGIONAL INSIGHTS

The market is studied across the regions, including North America, South America, Europe, the Middle East & Africa, and the Asia Pacific. These regions are further classified into leading countries.

North America Field Force Automation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 1.49 billion in 2025 and USD 1.66 billion in 2026. North America generated maximum revenue in 2023, owing to robust connectivity technologies across sectors, including manufacturing, construction & real estate, and others. Enterprises across industries, including manufacturing, are undergoing digital transformation. As per Aptean, in North America, around 10% of discrete and process manufacturers have completed digital transformation projects and realized the benefits. Also, enterprises in the region are increasingly investing in mobile-based workforce automation solutions to improve the productivity and efficiency of field employees. As per statistics, the mobile workforce in the U.S. will be around 60% by 2025. Therefore, due to the above-mentioned factors, the demand for FFA solutions is increasing across the region. The U.S. market is projected to reach USD 1.35 billion by 2026.

Asia Pacific

Asia Pacific is estimated to grow with the highest CAGR during the forecast period, owing to the rapid economic development, widespread adoption of advanced technologies, and cloud-based solutions among businesses that boost the market growth. China dominated the market in 2023 as China is a global manufacturing hub with a significant footprint in sectors including logistics, utilities, and services. Furthermore, government initiatives are promoting digitalization across industries. India is estimated to grow with the highest CAGR over the forecast period. The Japan market is projected to reach USD 0.19 billion by 2026, the China market is projected to reach USD 0.27 billion by 2026, and the India market is projected to reach USD 0.29 billion by 2026.

Europe

Europe is estimated to witness significant growth in coming years as the European government regulates technology and enterprises in the region invest in digitalization. According to European Bank Investment, around 46% of enterprises claimed that they are taking steps towards digitalization. This factor is expected to surge the demand for FFA solutions in the region. The UK market is projected to reach USD 0.17 billion by 2026, and the Germany market is projected to reach USD 0.15 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa are experiencing steady growth as countries in these regions recognize the importance of advanced technology and continuously focus on developing new technologies.

KEY INDUSTRY PLAYERS

Major Players Focus on Developing Advanced Products to Strengthen Their Market Positions

Key players in the field force automation market are adopting advanced technologies, including AI & ML for upgrading their product portfolio. With this, companies aim to transform their services and better serve their customers. They also focus on enhancing their existing product portfolio to deliver flexible solutions with unique attributes. Furthermore, these organizations proactively adopt collaboration, mergers & acquisitions, and partnerships to bolster their product offerings.

List of Top Field Force Automation Companies:

- IFS (Sweden)

- Microsoft Corporation (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Trimble (U.S.)

- ClickSoftware (U.S.)

- FieldEZ (India)

- Folio3 (U.S.)

- Astea (U.S.)

- Kloudq (India)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Microsoft introduced new capabilities in Dynamics 365 Field Service that help technicians and managers efficiently find information, resolve issues, and improve productivity.

- August 2023: Tech Mahindra entered into partnership with global cloud enterprise software company, IFS, to foster workforce productivity and operational excellence. As part of this partnership, Tech Mahindra became the exclusive distributor of the IFS cloud platform, which delivers automation across field service management.

- August 2022: Global SaaS provider of connected fleet management solutions, Mix Telematics acquired Trimble’s Field Service Management Business.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as prominent companies, product types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights the competitive landscape. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 14.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

By Deployment

By Enterprise Type

By Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to record a valuation of USD 13.66 billion by 2034.

In 2025, the market was valued at USD 4.00 billion.

The market is projected to record a CAGR of 14.70% during the forecast period.

By solution, the desktop/web-based segment led the market in 2025.

Digital transformation among enterprises to augment market growth.

Samsung Electronics, Micron Technology, and SK Hynix are the top players in the market.

North America dominated the global field force automation market with a share of 37.30% in 2025.

By industry, the energy & utilities segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us