Fill Finish Manufacturing Market Size, Share & Industry Analysis, By Service (Injection Filling, Vials & Ampoules Filling, Cartridge Filling, and Others), By Sterilization (Terminal Sterilization and Aseptic Processing), By End-user (Pharmaceutical Companies and Biotechnology Companies), and Regional Forecast, 2025-2032

Fill Finish Manufacturing Market Insights

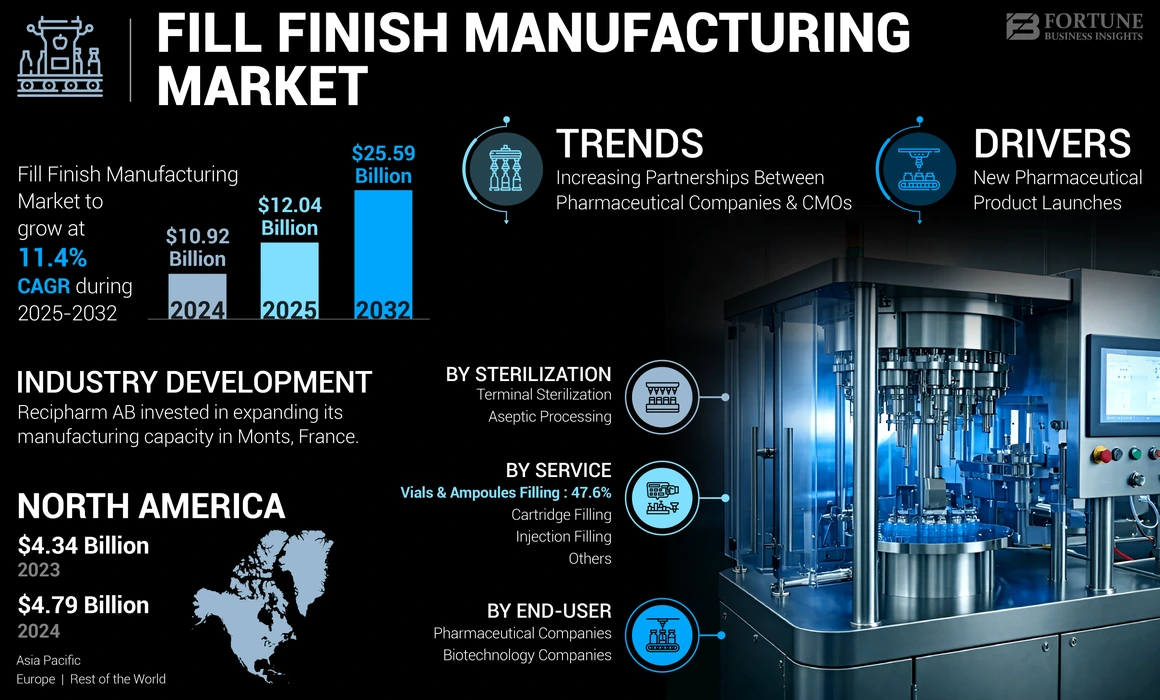

The global fill finish manufacturing market size was valued at USD 10.92 billion in 2024. It is projected to grow from USD 12.04 billion in 2025 to USD 25.59 billion by 2032, exhibiting a CAGR of 11.4% during the forecast period. North America dominated the global market with a share of 43.58% in 2024.

Fill and finish are the final steps in pharmaceutical product manufacturing. The biotechnology and pharmaceutical industries outsource fill-finish manufacturing to enhance their final manufacturing steps. The increasing development and approval of pharmaceuticals are fueling the demand for outsourcing manufacturing, as these Contract Manufacturing Organizations (CMOs) provide specialized equipment and expertise to ensure product safety and accelerate the manufacturing process.

- For instance, according to data published by the Food and Drug Administration (FDA) in October 2023, from 2013 to 2022, the Center for Drug Evaluation and Research (CDER) approved 43 novel drug products annually.

Moreover, the increasing focus of market players on adopting advanced technology and the increasing demand for novel therapeutics have been fueling the market’s growth.

Global Fill Finish Manufacturing Market Overview

Fill Finish Manufacturing Market Size:

- 2024 Value: USD 10.92 Billion

- 2025 Value: USD 12.04 Billion

- 2032 Forecast Value: USD 25.59 Billion, with a CAGR of 11.4% from 2025–2032

Fill Finish Manufacturing Market Share:

- North America led the fill finish manufacturing market with a 43.58% share in 2024, driven by high healthcare expenditures and strong presence of key CMOs.

- By service, the vials & ampoules filling segment is expected to hold a 48.6% share in 2025.

Key Country Highlights:

- The fill finish manufacturing market in Japan is expected to reach USD 533.7 million by 2025.

- China is forecast to witness a strong CAGR of 12.70%, while Europe is anticipated to grow at a CAGR of 11.0% during the forecast period.

- By sterilization type, the aseptic manufacturing segment is projected to generate USD 6,999.4 million in revenue by 2025.

Fill Finish Manufacturing Market Trends

Increasing Partnerships and Collaborations between Pharmaceutical Companies and Contract Manufacturing Organizations for Fill Finish Manufacturing

The pharmaceuticals market has been growing at a significant rate, and this factor has been increasing the demand for fill finish manufacturing. Pharmaceutical and biotechnology companies have increased their focus on collaborations with contract manufacturing organizations to enhance the manufacturing of their products.

- For instance, in November 2021, BioConnection announced that Nykode, a clinical-stage biopharmaceutical company, had selected BioConnection for the aseptic manufacturing of its lead vaccine.

- Similarly, in March 2021, Moderna, Inc., a biotechnology company, partnered with Baxter for the fill/finish manufacturing of its COVID-19 vaccines.

The trend of outsourcing fill finish manufacturing by pharmaceutical companies increased after the COVID-19 outbreak and is fueling significantly.

Download Free sample to learn more about this report.

COVID-19 IMPACT:

Increased Demand for Vaccines Fueled Market Growth During Pandemic

The global market experienced growth during the COVID-19 outbreak in 2020. The sudden outbreak of COVID-19 fueled the need for therapeutics and vaccines, which increased demand for an efficient and rapid manufacturing process. Moreover, the increased sales of vaccines indicated to prevent respiratory diseases during 2020 also fueled the global fill finish manufacturing market growth.

- For instance, in 2020, Pfizer Inc.’s vaccine Prevnar, indicated to prevent pneumonia, experienced a growth of 11.0% in its sales in the U.S. as compared to the prior.

Moreover, market players experienced a growth in the revenue generated through their manufacturing and packaging services during the pandemic. For instance, Eurofins Scientific generated a revenue of USD 5,719.2 million in 2020 from its services portfolio, experiencing a growth of 19.2 % from the prior year.

This market experienced significant growth in 2021 and 2022. The market's growth is attributed to the increased commercialization of the COVID-19 vaccines, which increased the demand for these services for rapid commercialization of vaccines.

Fill Finish Manufacturing Market Growth Factors

New Pharmaceutical Product Launches Fuel Demand for Fill Finish Manufacturing Services

The pharmaceutical and biotechnology companies have been strategizing to develop and manufacture novel therapeutics to control the increasing burden of chronic diseases, such as diabetes and neurological disorders.

- For instance, as per the article published by the Food and Drug Administration (FDA) in January 2023, the Center for Drug Evaluation and Research (CDER) approves around 43 drugs annually.

Moreover, the demand for effective therapeutics and vaccines to manage chronic diseases is also increasing significantly. For instance, as per the data published by UNICEF in July 2023, around 20.5 million children need lifesaving vaccines globally. In addition, government bodies have been focusing on mass vaccination to prevent life-threatening diseases.

Such increased demand for therapeutics and vaccines has been fueling the need for bulk manufacturing of these pharmaceutical products. To fulfill this demand, pharmaceutical and biotechnology companies have been focusing on outsourcing their manufacturing and packaging to CMOs. This factor is expected to fuel the demand for fill finish manufacturing services over the forecast period.

RESTRAINING FACTORS

Lack of Skilled Workforce Hinders Market Growth

The pharmaceutical market has been growing at a significant rate, and this factor has been increasing the demand for manufacturing services. Market players have increased their focus on adopting advanced technologies, such as robotics and single-use systems, to improve the service's safety, accuracy, and efficiency. A skilled workforce is required to operate such advanced equipment.

Moreover, the life science industry requires a highly skilled workforce to work efficiently with the growing technological advancements in fill finish manufacturing processes.

- For instance, as per the study published by the Coalition of State Bioscience Institutes in July 2021, the life science industry requires around 47% of highly skilled employees and 34% of the employees to be moderately skilled.

However, the healthcare industry has been experiencing difficulty in hiring and maintaining employees with such experience in the pharmaceutical and biotechnological industries. This factor is anticipated to limit the market growth during the forecast period.

Fill Finish Manufacturing Market Segmentation Analysis

By Service Analysis

Increased Demand for COVID-19 Vaccines to Prevent the Spread of the Virus Boosted Vials & Ampoules Filling Segment Growth

The market is segmented by service into injection filling, vials and ampoules filling, cartridge filling, and others.

The vials and ampoules filling segment dominated the market in 2024. The segment’s growth is attributed to the increased production of COVID-19 vaccines to prevent the spread of the virus.

The injection filling segment is expected to grow at a significant CAGR during the forecast period. This growth is attributed to the increasing demand for pre-filled injections for anaphylaxis drugs, biological drugs, and other such diseases.

- By service type, the vials & ampoules filling segment is expected to hold a 48.6% share in 2025.

- For instance, as per the study published by the National Center for Biotechnology Information (NCBI) in 2023, around 50.0 million individuals suffer from some allergy annually.

To know how our report can help streamline your business, Speak to Analyst

By Sterilization Analysis

Increased Demand for Injectable Drugs and Vaccines Fueled Aseptic Processing Segment Growth

Based on sterilization, the market is bifurcated into terminal sterilization and aseptic processing.

The aseptic processing segment dominated the market in 2024. The segment's dominance is attributed to the increased demand for injectable drugs and vaccines, as these drugs are heat-sensitive and are sterilized before being filled. The increasing prevalence of diseases, such as diabetes, in which insulin is required to be injected into the body, has been fueling the demand for aseptic processing and fill finish manufacturing of these drugs to fuel the growing demand.

- By sterilization type, the aseptic manufacturing segment is projected to generate USD 6,999.4 million in revenue by 2025.

- For instance, as per the data published by the International Diabetes Federation, in 2021, around 537 million in the age group of 20-79 years are living with diabetes globally. Moreover, this number is expected to rise to 783 million by 2045.

Moreover, the terminal sterilization segment is expected to grow at a substantial CAGR during the forecast period. This growth is attributed to the increased demand for small-molecule drugs that are not heat-susceptible and IV solution bags.

By End-user Analysis

Increased Approval of Biologics Fueled Biotechnology Companies Segment Growth

Based on end-user, the market is bifurcated into pharmaceutical companies and biotechnology companies.

The biotechnology companies segment dominated the market in 2022. The segment's growth is attributed to biopharmaceutical companies' increasing focus on new product launches.

- For instance, according to a research study published by the National Center for Biotechnology Information (NCBI), in 2021, the U.S. Food and Drug Administration (FDA) approved around 50 drugs. Moreover, the number of approved biological drugs increased by 4.2% from 2019.

REGIONAL INSIGHTS

The global market scope is classified across regions, such as North America, Europe, Asia Pacific, and the rest of the world.

North America Fill Finish Manufacturing Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market in 2024, accounting for a significant market share of USD 4.79 billion. Market growth in North America is attributed to increasing healthcare expenditures and the strong presence of market players such as AbbVie Inc., Lubrizol Life Science, and West Pharmaceutical Services, Inc., among others.

Europe accounted for a substantial market share in 2022. The region’s growth is attributed to the strong presence of biopharmaceutical and biotechnology companies in European countries, which have increased their R&D investments for the commercialization of new therapeutics. Europe is anticipated to grow at a CAGR of 11.0% during the forecast period.

Asia Pacific is anticipated to grow at a significant CAGR during the forecast period. The growth of the market in the region is attributed to the increasing demand for vaccines and therapeutics. Moreover, research institutes and small biopharmaceutical companies with few resources for manufacturing their drugs have increased their focus on outsourcing the manufacturing of their products to CMOs. This factor has also been fueling the growth of the market in the region.

- The fill finish manufacturing market in Japan is expected to reach USD 533.7 million by 2025.

- China is projected to witness a strong CAGR of 12.70% during the forecast period.

The market in the rest of the world is expected to grow at a substantial CAGR during the forecast period. The growth of the market in the region is attributed to the increasing demand for vaccines and other therapeutics to control the increasing burden of chronic diseases.

List of Key Fill Finish Manufacturing Market Companies

Increasing Focus of Market Players on Receiving Regulatory Approvals for Service Offerings is Responsible for their Growth

Key companies, such as BioConnection, Catalent, Inc., Boehringer Ingelheim International GmbH, and Recipharm AB, accounted for a significant proportion of the global fill finish manufacturing market share in 2022. The strong growth of these companies in the market is attributed to their strong focus on getting government approvals to strengthen their position in the market.

- For instance, in June 2021, BioConnection received GMP certification from the Dutch Healthcare and Youth Inspectorate (IGJ) for the production of sterile drugs. This regulatory approval fueled the company’s growth in the market.

Moreover, other players, such as Baxter, Lubrizol Life Science, and Eurofins Scientific, are focusing on expanding their manufacturing capacity to enhance their service offerings in the market.

- For instance, in November 2020, Baxter invested around USD 50.0 million to expand their sterile fill/finish manufacturing site in Indiana, U.S.

LIST OF KEY COMPANIES PROFILED:

- AbbVie Inc. (U.S.)

- Lubrizol Life Science (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- Recipharm AB (Sweden)

- Alcami Corporation (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Catalent, Inc. (U.S.)

- Baxter (U.S.)

- BioConnection (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- May 2023: West Pharmaceutical Services, Inc. inaugurated its manufacturing facility in Singapore to expand its capacity and fulfill customers’ demands.

- February 2023: Recipharm AB invested in expanding its manufacturing capacity in Monts, France, to strengthen its fill/finish manufacturing service offerings in the country.

- March 2022: Gimv, an equity firm, invested in BioConnection. This investment would help the company strengthen its position in the market by enhancing its service offerings.

- November 2021: Baxter invested USD 100.0 million for the expansion of its fill/finish manufacturing facility in Germany to enhance its offerings in the country.

- May 2021: Eurofins Scientific collaborated with Plus Therapeutics, Inc., a pharmaceutical company, for the development and cGMP manufacturing of Rhenium NanoLiposome (RNL).

REPORT COVERAGE

The global market research report provides a detailed competitive landscape. It also includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions. Additionally, it focuses on key points, such as new solution launches in the market. Furthermore, the report covers regional analysis of different segments, profiles of key market players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 11.4% from 2025-2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Service

|

|

By Sterilization

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 12.04 billion in 2025 to USD 25.59 billion by 2032.

In 2024, the market value stood at USD 4.79 billion.

The market is predicted to exhibit a CAGR of 11.4% during the forecast period of 2025-2032.

The vials & ampoules filling segment led the market by service.

New pharmaceutical product launches and the adoption of advanced technology have been fueling the markets growth.

BioConnection, Catalent, Inc., Boehringer Ingelheim International GmbH, and Recipharm AB are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us