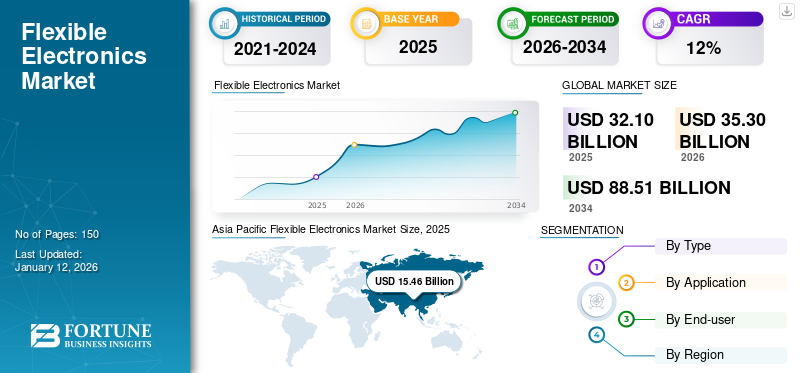

Flexible Electronics Market Size, Share & Industry Analysis, By Type (Flexible Printed Circuits and Rigid-Flexible), By Application (Monitoring, Sensing, Lighting, Display, Storage, and Others (Sensors)), By End-user (Consumer Goods, Healthcare, Automotive, Robotics, Agriculture, Aerospace and Defense, and Others (Energy and Power), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

The global flexible electronics market size was valued at USD 32.1 billion in 2025. The market is projected to grow from USD 35.3 billion in 2026 to USD 88.51 billion by 2034, exhibiting a CAGR of 12.20% during the forecast period. Additionally, the U.S. flexible electronics market is projected to grow significantly, reaching an estimated value of USD 10,037.3 million by 2032.

Flexible electronics refers to the electronics circuits and devices that are manufactured using flexible substrates, enabling them to bend, twist or conform into irregular shapes. These circuits are typically manufactured using organic or inorganic materials on flexible plastic substrates, enabling innovative applications in several industries. The increasing demand for lightweight, durable and portable electronic devices with enhanced form factors has been driving market growth, leading to a rise in product applications such as flexible displays, wearable electronics, among others. Moreover, the integration of these flexible electronic components into products such as bendable smartphones, smart textiles, and flexible medical devices has showcased the rapid transformations and potential of this technology.

In January 2024, BOE showcased their display solutions at CES 2024, featuring a 14.6 inch oxide LCD display powered by their ADS Pro. The oxide technology delivered enhanced image quality with high transmittance and contrast. They also introduced a dual-slidable flexible display using f-OLED technology, offering adjustable size and aspect ratio for several applications.

The supply chain disruptions caused by the COVID-19 pandemic had a profound impact on the market. It led to the cancellation of major industrial events such as LOPEC 2020 and Drupa 2020, severing the traditional avenues for showcasing and acquiring new technologies, impeding innovation and market visibility.

For instance, in May 2020, Apple Inc. delayed the launch of its iPhone 12 series by two months, setting it back to November. This was reported in a Cowen Bank statement, which justified the setback as a concern caused by fewer production units and supply chain disruptions.

The pandemic stifled the market growth of flexible electronics, further highlighting the market’s vulnerabilities to external business threats. However, as the restrictions were alleviated, the market showed a significant recovery.

Download Free sample to learn more about this report.

Flexible Electronics Market Trends

Deployment of Flexible Printed Batteries to Enhance the Development of Compact and Lightweight Electronic Devices

Flexible printed batteries represent a breakthrough in energy storage technology. These batteries leverage advanced materials, such as flexible lithium-ion and thin-film technologies, to achieve superior flexibility and conformability. The incorporation of these flexible power sources has augmented the creation of compact and lightweight electronic devices with enhanced energy density, making them particularly suitable for wearables, Internet of Things (IoT) devices, and other applications where size and weight constraints are critical. This innovation in flexible energy storage not only addressed the need for miniaturization but also fostered the development of next-generation electronics with improved form factors and energy efficiency.

In January 2024, LiBEST unveiled its latest flexible batteries in Seoul, Korea, showcasing advancements in lithium-ion technology. The company presented innovative multi-structured batteries for AR glasses and expandable head-mounted displays (HMDs). The AR glasses featured a unique design with a capacity of up to 1,500mAh, while the HMD batteries offered parallel or series expansion configurations within the headband's strap, catering to devices with higher output and capacity requirements.

Flexible Electronics Market Growth Factors

Surging Integration of Flexible OLED Displays into Foldable Devices to Propel Market Growth

Several players have launched their organic light-emitting diodes (OLED) installed foldable smartphone devices, such as Samsung, OnePlus, Huawei, and Google, among others. The integration of polyimide for increased resilience in foldable devices and the incorporation of OLEDs on flexible substrates are shaping the industry's trajectory. This exploration of durable materials has been pivotal in addressing the structural challenges associated with foldable smartphones and tablets, ensuring enhanced durability without compromising performance. Furthermore, the increasing adoption of OLEDs on flexible substrates signifies a paradigm shift in display technologies, offering improved flexibility and visual output in the realm of wearable devices such as VR headsets, smart watches, and smart glasses, among others. These technological innovations have significantly enhanced the market, with polyimide emerging as a robust solution for achieving bendable and durable electronic components.

RESTRAINING FACTORS

Limited Availability of Suitable Substrates and Costly Manufacturing Processes May Hinder Market Growth

The limited range of materials suitable for flexible substrates in the market restricts the design possibilities for manufacturers and innovators. The use of specialized materials is associated with higher costs, and the selection of appropriate materials becomes crucial in balancing flexibility, durability, and performance. In addition, the costly manufacturing processes required for flexible electronics exacerbate the economic challenges faced by the industry. Moreover, the need for specialized equipment and techniques increases production expenses, making it difficult for manufacturers to achieve cost-effectiveness and broad market affordability. The combination of material constraints and expensive manufacturing processes hinders the flexible electronics market growth.

Flexible Electronics Market Segmentation Analysis

By Type Analysis

Rigid Flexible Electronics Segment to Lead Due to its Increasing Consumer Adoption and Cost-effectiveness

According to the study, by type, the market is bifurcated into flexible printed circuits and rigid-flexible.

Rigid flexible electronics refer to devices that combine both flexible and rigid elements, allowing for bending or folding in specific areas while maintaining overall structural stability. They are projected to hold the highest market share of 55.63% in 2026, as this technology is more accessible to consumers at competitive prices, thereby increasing demand for flexible electronics in multiple sectors. Moreover, the cost-effectiveness of rigid flexible electronics is facilitating the integration of advanced features and designs into a wide range of applications, from consumer electronics to healthcare devices, driving the widespread adoption of these technologies.

Flexible printed circuits involve the use of flexible substrates, typically made of polymers, enabling electronic components to be printed or deposited on the flexible surface. This segment is projected to demonstrate the highest growth rate during the forecast period, facilitating applications in diverse industries such as wearables and IoT devices.

By Application Analysis

Rising Deployments of Foldable and Curved Screen Devices to Boost the Adoption of Flexible Displays

As per the market study, with respect to application, the market is divided into monitoring, sensing, lighting, display, storage, and others.

The display segment is projected to hold the largest market share of 40.05% during the forecast period due to its ability to deploy innovative and dynamic screens that can be curved, folded, and rolled, offering design flexibility for electronic devices. This adaptability in display technology has enabled the development of sleek, portable gadgets with enhanced user experiences.

In sensing applications, these products are utilized due to their adaptability, enabling integration into several environments for enhanced data collection.

Moreover, the flexibility of these electronics is instrumental in lighting applications, facilitating the development of flexible and bendable lighting sources for unconventional and space-efficient installations.

In addition, these products are pivotal in storage applications, where their malleability allows for the creation of compact and flexible storage solutions for electronic devices.

To know how our report can help streamline your business, Speak to Analyst

By End-user Analysis

Consumer Goods Segment to Dominate Owing to Capability of the Product to Offer Sleek Displays

According to the study, based on end user, the market is segregated into consumer goods, healthcare, automotive, robotics, agriculture, aerospace and defense, and others.

The consumer goods segment is expected to dominate the market share of 36.22% in 2026, due to the technology's transformative impact on the design and functionality of consumer devices such as smartphones, wearables, and tablets. The ability of these electronics to provide sleek, bendable displays and improved user interfaces aligns with consumer preferences for the latest, innovative, and versatile electronic products, increasing the adoption of such devices.

In the healthcare sector, these products enable the creation of wearable health trackers and biosensor-equipped smart clothing, facilitating real-time health monitoring and personalized patient care.

Moreover, the automotive industry benefits from flexible displays and sensors, enhancing vehicle interiors with curved touchscreens and contributing to the development of smart and connected vehicles.

In robotics, these electronics provide adaptable components, enabling robots to achieve improved flexibility, dexterity, and ease of movement in applications ranging from manufacturing to healthcare.

Aerospace and defense sector utilizes these technologies in lightweight and conformable components. These include flexible displays, sensors, and communication devices that contribute to advancements in cockpit design, wearable technologies for military personnel, and the development of innovative aerospace systems.

REGIONAL INSIGHTS

The geographies covered in this study include North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into several dominating countries.

Asia Pacific Flexible Electronics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 15.46 billion in 2025 and USD 16.73 billion in 2026. Due to the soaring demand for smart electric vehicles and the extensive incorporation of consumer electronics within the automotive sector. The surge in consumer interest in inventive and portable devices is also expected to play a pivotal role in driving the demand for the product. In this region, consumers are increasingly drawn to lightweight and adaptable gadgets that offer advanced functionality while maintaining an appealing aesthetic. The Japan market is expected to reach USD 2.72 billion by 2026, the China market is expected to reach USD 7.01 billion by 2026, and the India market is expected to reach USD 1.66 billion by 2026. This evolving consumer demand has compelled manufacturers to take the lead in developing cutting-edge technologies, including flexible displays, foldable smartphones, and wearable devices. In addition, the major electronics market in China is another key driver behind the overall demand for flexible electronics across the region. The sheer size of the market and the availability of cost-effective labor contribute significantly to the intensive generation of electronics in the country.

To know how our report can help streamline your business, Speak to Analyst

Europe has emerged as the fastest-growing region among others due to several factors. In the region, the presence of a growing automotive sector, particularly in Germany and Italy, is a notable driving force behind the market’s growth. Both nations, known for their automotive prowess, are incorporating flexible electronic technologies into vehicles, contributing to advancements in smart displays, electronic controls, and innovative features that enhance the driving experience. Moreover, the U.K. is known for its technological innovations, as major players in the mobile industry are exploring flexible electronics for applications in smartphones and wearable devices. The UK market is expected to reach USD 0.58 billion by 2026, while the Germany market is expected to reach USD 1.57 billion by 2026.

The market growth in North America is significantly propelled by the surging demand for wearables and smart devices, reflecting consumers' heightened interest in products that enhance their overall user experience. As a result, manufacturers are compelled to develop products capable of seamlessly integrating into the human body, providing a blend of comfort and unobtrusive functionality. This consumer-driven shift has sparked collaborative initiatives among electronic manufacturers, material suppliers, and design firms, fostering an environment of innovation. The U.S. market is expected to reach USD 5.33 billion by 2026.

In the Middle East & Africa, the adoption of such electronics is influenced by the region's focus on smart cities and various governmental initiatives. UAE and Saudi Arabia are investing heavily in smart city projects, integrating advanced technologies to enhance urban living. In addition, government-backed initiatives are fostering the use of the product in diverse applications, including healthcare, where wearable devices with flexible sensors can support remote patient monitoring.

Key Industry Players

Key Players are Expanding Support and Resources toward Printed Circuits to Enhance their Applications

Key players in the industry are ramping up their support and resources for PCBs, with a focus on enhancing their applications, such as integrating artificial intelligence and advanced sensors into PCBs, enabling them to act as miniaturized computers with data sensing and processing capabilities. The increased investment is also being driven by a number of factors, including the growing demand for miniaturization, the need for improved performance, and the rise of new applications such as wearable electronics and the Internet of Things (IoT), enhancing their flexible electronics market share.

In November 2023, Würth Elektronik launched HyPerStripes, a research project developing limitless flexible printed circuit boards (PCBs) for miniaturized electronics applications in the healthcare sector and LED lighting. This EU-funded initiative aimed to overcome the limitations of conventional cable wiring, which can be costly, material-intensive, and hinder innovation.

List of Top Flexible Electronics Companies:

- Samsung Group (South Korea)

- LG Electronics Inc. (South Korea)

- E INK Holdings Inc. (Taiwan)

- MFLEX (U.S.)

- OLEDWorks LLC (U.S.)

- General Electric (U.S.)

- Pragmatic (U.K.)

- The 3M Company (U.S.)

- Imprint Energy Inc. (U.S.)

- FlexEnable Limited (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Samsung Display unveiled a range of latest technologies at CES 2024, including foldable, rollable, and slidable display innovations. The showcase featured micro-displays for immersive extended reality experiences, revolutionary OLED products for vehicle interiors, monitors catering to entertainment and professional applications in video production and healthcare, and a 360-degree display experience.

- January 2024: Dracula Technologies unveiled a novel application for its organic photovoltaic (OPV) cells, presenting a device at CES 2024 that integrated mini-OPV modules for solar energy production and a flexible film-based storage device. LayerVault aimed to replace traditional batteries, utilizing Dracula's OPV inkjet technology to capture both natural and artificial light to offer enhanced autonomy by converting ambient light energy.

- November 2023: FLEXcon Global, a provider of adhesive coating and laminating, partnered with Dawako Medtech to launch the WBS Patch and WBS-US patch. These innovative patches utilized FLEXcon OMNI-WAVE and FLEXcon dermaFLEX flexible materials, serving as disposable electrode arrays for the simultaneous acquisition of ultrasonic imaging and bio-signals during musculoskeletal movement.

- October 2023: Corning partnered with AUO Corporation to enhance the production of AUO's large curved automotive display modules using Corning ColdForm Technology, enabling cost-effective and energy-efficient shaping of cover glass at room temperature. This collaboration enabled AUO to provide automakers with seamlessly integrated large displays, catering to the evolving demands of global automakers and offering immersive driving experiences with innovative curved displays.

- October 2023: Terran Orbital opened two advanced Printed Circuit Board Assembly (PCBA) lines in California, U.S. These new facilities featured their Surface Mount Technology (SMT) lines and additional capabilities for post-SMT processes, 3-dimensional X-ray testing, automated inspection, flying probe technologies, and Automated Optical Inspection (AOI), enhancing the company’s ability to manufacture, inspect, and test a wide range of PCBAs in-house.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, product/service types, and leading applications of the product. Besides this, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Application

By End User

By Region

|

Frequently Asked Questions

Fortune Business Insights Inc. says that the market is projected to reach USD 88.51 billion by 2034.

In 2025, the global market was valued at USD 32.1 billion.

The market is projected to grow at a CAGR of 12.20% during the forecast period.

By application, the display segment is expected to lead the market during the forecast period.

The surging integration of flexible OLED displays into foldable devices is poised to drive market growth.

Samsung Group, LG Electronics Inc., E INK Holdings Inc., MFLEX, OLEDWorks LLC, General Electric, Pragmatic, The 3M Company, Imprint Energy Inc., and FlexEnable Limited are the top players operating in the market.

Asia Pacific is expected to hold the largest market share during the forecast period.

By type, the flexible printed circuits segment is expected to grow at the highest rate during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us