Flip Chip Market Size, Share & Industry Analysis, By Wafer Bumping Process (Copper Pillar, Lead Free, Tin Lead, and Gold Stud), By Packaging Type (FC BGA, FC QFN, FC CSP, and FC SiN), By End-Use Industry (Consumer Electronics, Telecommunication, Automotive, Industrial, Medical and Healthcare, and Military & Aerospace) and Regional Forecast, 2026-2034

Flip Chip Market Size

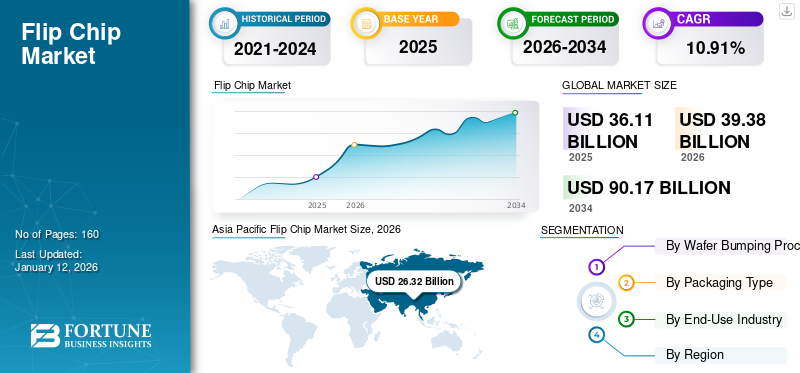

The global flip chip market size was valued at USD 36.11 billion in 2025 and is projected to grow from USD 39.38 billion in 2026 to USD 90.17 billion by 2032, exhibiting a CAGR of 10.91% during the forecast period. Asia Pacific dominated the global market with a share of 66.29% in 2025.

Flip chips are also known as controlled collapse chip connections that are used to develop semiconductor packages to interconnect semiconductor dies to external circuits. These packages allow enhanced power handling capacity, high-performance computing, and increased chip density, thereby boosting their adoption across diverse sectors. The varied packaging types, such as Ball Grid Array (BGA) and Chip Scale Package (CSP), are finding their extensive application in diverse consumer electronic products, such as game consoles, graphics, servers, network products, cellular base stations, handheld electronic products, high-speed memory, and cameras. Government investments, supportive policies, and updated regulations are further expected to diversify the flip chip market growth across different countries.

For instance, The European Policy announced capital expenditure of approx. USD 47.0 billion in July 2023 to increase semiconductor chip production in Europe. The introduction of the Chips Act in August 2022 is anticipated to attract more funding for the semiconductor industry in Europe.

Although the COVID-19 pandemic had a significant impact on semiconductor packaging due to temporary lockdowns and supply chain disruptions, the market rebounded post-pandemic period, experiencing steady growth across regions. Several manufacturing companies are focusing on expanding flip chip packages across a wide range of sectors, including telecommunication, automotive, industrial, healthcare, and aerospace. Growing advanced semiconductor packaging in circuit boards and microchips to enhance electronic devices' performances and functionality are all subject to boosting the flip chip market share over the forecast period. Several manufacturing companies are diverting their capital investment in research and development activities owing to an increasing trend toward miniaturized and high-functional electronic products. End users are developing flip-chip-based LED and other electronic devices catering to customer requirements.

Flip Chip Market Trends

Increasing Application of Flip Chips in Gaming Products to Upsurge Market Growth

Continuous advancements across the semiconductor industry and innovative chip-stacking methods, such as wafer thinning and micro-bumping, have all resulted in the demand. The gaming sector requires high-performance chips with reduced sizes and enhanced functionalities, contributing to a positive growth of the market. The ascending trajectory and surge in gaming equipment to further generate strong prospects for the market in the coming years.

Download Free sample to learn more about this report.

Flip Chip Market Growth Factors

High Demand for IoT and Miniature Electronic Devices to Boost Market Expansion

Automation across small, medium, and large-scale industries is propelling the demand for IoT-based devices. Enterprises across regions are focusing on investing in interconnected devices and systems to expand production and optimize energy consumption. For instance, 48% of large enterprises in Europe employed IoT-based devices in 2021.

The emergence and penetration of Internet of Things (IoT), miniaturization of electronic devices, and other smart technologies, such as 5G, across geographies, are driving the demand for innovative packaging techniques. Increasing demand for high-performing advanced electronic devices and miniaturization are all anticipated to generate strong market growth in the coming years. Furthermore, heavy expenditure by governments and private organizations on production facilities will generate considerable growth during the forecast period. For instance, in February 2024, the Government of India has announced a USD 15.2 billion investment in semiconductor manufacturing to incentivize investors and diversify the manufacturing and packaging of electronic devices across regions.

RESTRAINING FACTORS

Manufacturing Challenges and Complex Replacement of Flip Chips to Hinder Market Growth

Manufacturing companies lack larger-scale packaging production capabilities, substrates, and wafer bumping services. Semiconductor production and supply chain remain concentrated due to the availability of raw materials in specific countries, such as Taiwan. For instance, chips are manufactured at one location, and packaging is processed at another location in several different facilities, such as in Asia, Europe, and North America, increasing the overall cost of manufacturing and logistics. Moreover, the replacement of flip chip technology further poses a challenge, which hinders market growth across regions.

Flip Chip Market Segmentation Analysis

By Wafer Bumping Process Analysis

Tin Lead Segment Led the Market Owing to High Demand for High-Frequency Applications

Based on the wafer bumping process, the market is categorized into copper pillar, lead free, tin lead, and gold stud.

The tin lead segment is projected to account for 44.64% of the market share in 2026. The tin lead wafer bumping process offers different material-based flip chip packaging technology due to rising demand for high-frequency applications and miniaturized electronic devices, which leads to a strong market revenue share.

The copper pillar technology is gaining popularity over other wafer bumping processes owing to its compact design, low-cost and superior electromigration performance, and wide range of applications, such as transceivers, processors, power management baseband, embedded processors, and SOCs.

Lead free initiatives, fewer processes, and strong conductivity are some of the prominent factors forcing manufacturers to seek solder-free packaging solutions across industries.

By Packaging Type Analysis

Flip Chip BGA Led the Market Owing to Its Greater Input-output Flexibility

Based on the packaging type, the market is categorized into FC BGA, FC QFN, FC CSP, and FC SiN.

The FC BGA segment is expected to hold a 41.80% share of the market in 2026. Flip Chip Ball Grid Array (BGA) eliminates the traditional method of wire bonded technology in packages by offering a wide range of advantages, such as reduced size, weight, greater input-output flexibility, and enhanced performance in comparison to traditional packaging techniques. FC BGA packaging finds its extensive application in several consumer electronics, such as game consoles, graphics and chipsets, servers, microprocessors, and memory. Moreover, its wide application in telecommunication, such as network products, switching, cellular base stations, and transmission, is subject to boosting FC BGA revenue demand across sectors.

The Quad Flat No-Lead (QFN) segment is projected to show strong growth in the market owing to several benefits, such as low cost, lightweight, easy handling, superior electrical and thermal performance, and reduced complexity of circuits. FC QFN finds its electronics application across devices, such as mobile phones, industrial control systems, and automotive electronics. FC Chip Scale Package (CSP) and FC System in Packaging (SiN) are expected to experience considerable market revenue growth owing to their increasing demand for handheld electronics, GPS, cameras, amplifiers, and filters.

By End-Use Industry Analysis

To know how our report can help streamline your business, Speak to Analyst

Consumer Preference for Compact Electronics with Integrated Technology to Fuel Segment Growth

Based on end-use industry, the market is classified as consumer electronics, telecommunication, automotive, industrial, medical and healthcare, and military & aerospace.

The consumer electronics segment is forecast to represent 45.05% of the total market share in 2026. Investments in integrated digital technologies for consumer electronics manufacturing are on the rise, aimed at delivering superior experiences to consumers. The global push toward the miniaturization of electronic products is gaining substantial momentum, fueling the popularity of portable and lightweight devices. This inclination has raised the uptake of compact electric components, contributing to the continuous expansion of the global consumer electronics market. Opportunistic markets, such as 5G, IoT devices, telecommunication products, and wearable electronics, are further generating high demand for compact devices.

The automotive industry is predicted to showcase a robust growth rate in the market over the forecast period as a result of the increasing trend toward battery-powered vehicles, ADAS systems, self-propelled vehicles, and efficient mobility systems. The market revenue is to experience considerable demand from the telecommunication sector, industrial automation equipment, medical and healthcare devices, and military & aerospace sectors.

REGIONAL INSIGHTS

Based on region, the market is further segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Flip Chip Market Size, 2026 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific has been a primary contributor to the market revenue, surpassing other regions and accounting for about two-thirds of the total market revenue share. Prominent factors driving the market that include large packaging and assembling capacity, supply chain security, capital expenditure, and supportive government policies, have all resulted in adoption of flip chips across the region. Asia Pacific shows the highest growth prospects for the end-use industry owing to rising investments and expanding semiconductor production.

According to industry analysis, about 75% of semiconductor manufacturing is highly concentrated in East Asian markets, driving the growth of assembly and packaging facilities. Large electronics manufacturing facilities are concentrated across the Asian market, directing the demand across the region. Several Asian countries, such as China and South Korea, have robust semiconductor manufacturing infrastructure, assembly and packaging facilities supported by skilled workforces and government subsidies, thereby catering to a strong demand for flip chips and generating significant revenue.

China (including Taiwan) has catered to nearly 3/4th of the market revenue owing to increasing private and government investment in semiconductor manufacturing, assembly, and packaging. For instance, in December 2022, the Chinese government planned financial assistance of about USD 143 billion to semiconductor industry stakeholders through incentives and subsidies. China’s supportive policies are further strengthening the market for flip chips across the country. The industrial policies by the country associations aim to create a closed-loop semiconductor manufacturing ecosystem, from IC designing to packaging, testing, and production of related materials. The Japan market is projected to reach USD 2.55 billion by 2026, the China market is projected to reach USD 18.9 billion by 2026, and the India market is projected to reach USD 1.34 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America to remain the second largest revenue shareholder in the market. The North American market is largely focusing on diversifying semiconductor packaging across varied geographies and heavily investing in advanced manufacturing facilities across countries, such as Mexico and Canada. Along with strong capital expenditure, supportive regulations are expected to boost market growth. The U.S. market is projected to reach USD 5.92 billion by 2026.

Europe

Semiconductor manufacturing, packaging, and assembly in Europe are projected to show a considerable growth rate during the forecast period. Supportive government investments and incentive strategies to boost the demand for the market across the region. For instance, the French Government has announced investment of USD 5.3 billion to enhance the electronics sector by 2030. Similar investment and strategic policies will generate strong market revenue in the coming years. The UK market is projected to reach USD 0.6 billion by 2026, while the Germany market is projected to reach USD 1.47 billion by 2026.

High demand for flip chips is projected in South American and Middle East & African countries as a result of high demand for consumer electronics, AI, IoT, and telecommunication devices. Several electronic product manufacturers are diversifying their manufacturing units, generating strong demand for flip chips across these regions.

KEY INDUSTRY PLAYERS

Collaboration Strategy and New Product Launches to Generate Robust Opportunities for Market Participants

Key players in the market are making huge investments in research and development activities to provide miniaturized and high-functional flip chips for end users. Several market players are catering to increasing product demand through partnerships and collaborations.

Taiwan Semiconductor Manufacturing Company (TSMC), Advanced Semiconductor Engineering, Inc. (ASE Inc.), Intel, Amkor Technology, and United Microelectronics Corporation (UMC) are focusing on expanding through merger and acquisition strategies. They are also striving to widen their product portfolios for a varied range of applications.

Henkel announced the introduction of technology supporting flip chips with advanced packaging applications.

- In 2022, Henkel introduced the commercialization of Capillary Underfill (CUF) formulation for advanced packaging applications, such as flip chips.

List of Top Flip Chip Companies:

- Taiwan Semiconductor Manufacturing Company (TSMC) (Taiwan)

- Advanced Semiconductor Engineering, Inc. (ASE Inc.) (Taiwan)

- Intel (U.S.)

- Amkor Technology (U.S.)

- United Microelectronics Corporation (UMC) (Taiwan)

- JCET/JCAP (China)

- Samsung (South Korea)

- NEPES (South Korea)

- Global Foundries (U.S.)

- Powertech Technology (Taiwan)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: YES TECH launched the Mnano Ⅱ series of small-pitch products in Spain that offers high reliability and low power dissipation in the display industry.

- December 2023: Innoscience launched low-voltage discrete HEMTs with FC QFN packaging that offers benefits such as easy assembly, mounting, and greater design flexibility.

- September 2022: Bridgelux announced a new series of Chip Scale Package LEDs with advanced flip chip packaging that enables flexible assembly and offers high efficiency.

- September 2021: United Microelectronics Corporation and Chipbond Technology Corporation approved the share exchange resolution, which is expected to result in a long-term strategic partnership over the forecast years. The partnership is expected to widen and generate new opportunities for the flip chip market.

- September 2021: SUSS MicroTec SE and SET Corporation SA announced a partnership to provide customizable and automated equipment solutions to end users.

REPORT COVERAGE

The report provides detailed information regarding various insights into the market. Some of them are growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the market, current trends, and estimations to illustrate the forthcoming investment pockets. The market is quantitatively analyzed from 2024 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Forecast Period |

2025 – 2032 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 10.91% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Wafer Bumping Process

By Packaging Type

By End-Use Industry

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market stood at USD 36.11 billion in 2025.

Fortune Business Insights says that the market will reach USD 90.17 billion in 2034.

Growing at a CAGR of 10.91%, the market will exhibit strong growth during the forecast period.

High demand for IoT and miniature electronic devices to boost market growth.

The top companies in the market are Taiwan Semiconductor Manufacturing Company (TSMC), Advanced Semiconductor Engineering, Inc. (ASE Inc.), Intel, and Amkor Technology.

Asia Pacific leads the market with the largest share.

Flip Chip Quad Flat No-Lead is projected to hold a strong CAGR in the market over the forecast period.

The consumer electronics industry leads the market.

The increasing application of flip chips in gaming products is the key trend in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us