Gas Turbine MRO Market Size, Share & Analysis, By Technology (Heavy Duty, Light Industrial, Aero-derivative), By End-user (Power Utilities, Oil & Gas, Manufacturing, Aviation, Others), and Regional Forecasts, 2026-2034

KEY MARKET INSIGHTS

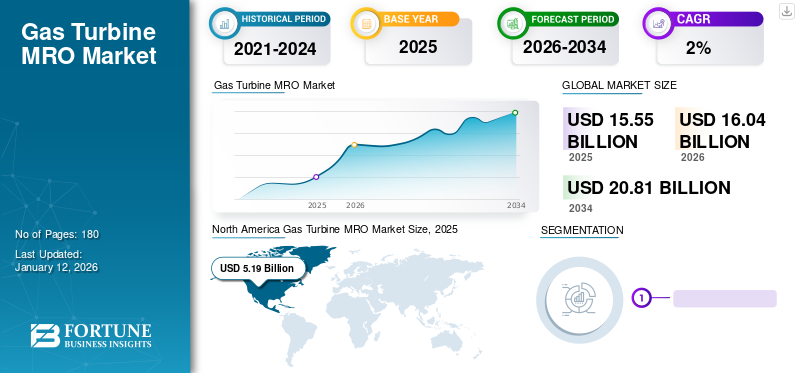

The global gas turbine MRO market size was valued at USD 15.55 billion in 2025. The market is projected to grow from USD 16.04 billion in 2026 to USD 20.81 billion by 2034, exhibiting a CAGR of 3.31% during the forecast period. North America dominated the global market with a share of 33.38% in 2025.

A gas turbine is an engine that uses combustion to spin a turbine and generate electricity. The process involves heating a mixture of air and fuel to high temperatures, causing the turbine blades to rotate. These engines are commonly used in the energy and oil & gas industries for power generation and oil extraction. Regular Maintenance, Repair, and Overhaul (MRO) services are necessary to keep the gas turbine operating efficiently and effectively.

Global Gas Turbine MRO Market Overview

Market Size:

- 2025 Value: USD 15.55 billion

- 2026 Value: USD 16.04 billion

- 2034 Forecast Value: USD 20.81 billion

- CAGR: 3.31% from 2026 to 2034

Market Share:

- Regional Leader: North America held 33.38% market share in 2025

- Fastest‑Growing Region: Asia Pacific is expected to witness strong growth due to industrialization and infrastructure development

- End‑User Leader: Power utilities segment dominated the market demand in 2026

Industry Trends:

- Digitalization & Predictive Maintenance: Growing adoption of IoT, sensors, and analytics to optimize maintenance operations

- COVID‑19 Resilience: MRO activities remained essential to maintain uninterrupted power supply during pandemic disruptions

- Impact of Renewable Energy Integration: Increasing renewable energy usage impacts gas turbine runtime but boosts demand for efficiency-improving MRO solutions

Driving Factors:

- Increasing demand for long-term service agreements and routine maintenance schedules

- Rising global electricity consumption supporting continuous gas turbine operations

- Aging turbine fleets requiring overhaul and modernization services

- Market consolidation with major OEMs expanding service networks and capabilities

- Need for operational reliability in critical infrastructure during unforeseen disruptions

The COVID-19 pandemic caused significant disruptions across all major global economies. The energy sector was slightly affected during the initial phase of this outbreak due to sudden announcement of lockdowns. Commercial and industrial sectors witnessed a major decline in electricity demand; however, the demand for electricity from residential end-users was high. Furthermore, since the need for constant power supply is growing each year, the market growth was less affected.

Gas Turbine MRO Market Trends

Digitalization and Data-Driven MRO to Drive the Market Growth

By analyzing sensor data and historical trends, MRO providers predict potential issues and schedule maintenance before they occur, preventing breakdowns and reducing downtime. This leads to increased operational efficiency, reduced repair costs, and extended equipment lifespan. Furthermore, data analysis helps tailor maintenance schedules to individual turbine needs, avoiding unnecessary interventions and optimizing resource allocation.

Real-time data allows for remote monitoring of turbine performance, enabling faster problem identification and troubleshooting, reducing travel costs, and improving response times. MRO providers can leverage data to gain deeper insights into equipment health, identify trends, and make informed decisions about maintenance strategies and investments. Digital platforms provide transparent data access to stakeholders, fostering trust and collaboration between operators and service providers. AI algorithms can analyze vast amounts of data to identify subtle patterns and predict failures with even greater accuracy, leading to more proactive maintenance. These technologies can be used for remote inspections, training technicians, visualizing repair procedures, and improving efficiency and safety.

Gas Turbines Upgrades to Drive Market Growth

Gas turbines are gaining traction in the energy and oil & gas industry verticals as they are used to power oil extraction operations. To maintain peak performance and efficient operations, these engines require regular maintenance, repair, and overhaul services. In the energy sector, preventive and predictive maintenance techniques are often utilized to ensure the smooth functioning of gas turbines. Upgrading older gas turbines is an important aspect of maintaining the overall system.

Companies and power plant operators perform regular maintenance services, such as periodic inspections, component replacement, diagnosis, and renovation, to enhance the facility’s performance and ensure its long-term and stable operation.

Download Free sample to learn more about this report.

Gas Turbine MRO Market Growth Factors

Increasing Replacement of Nuclear and Coal Driven Turbines with Gas Turbines to Propel Market Expansion

Coal-fired power plants are known to release significant amounts of harmful pollutants into the atmosphere. These emissions contribute to environmental dangers such as global warming and climate change. Similarly, nuclear energy-powered turbines produce toxic waste that can harm the environment for a long time. To tackle these issues, many governments are working on various plans to reduce greenhouse gas (GHG) emissions and move away from coal-fired and nuclear power plants in favor of gas-fired turbines. While these turbines still produce emissions, they tend to be less harmful as compared to those used in coal-fired power plants.

The trend of decommissioning coal-fired power plants and transitioning to cleaner ways of generating electricity is expected to fuel the market growth of gas turbine MRO. For example, in November 2021, Southern Co. announced plans to close a significant portion of its coal-fired power plants by 2030 as it planned to move toward a zero-emission electricity mix. This plan included the shutdown of the company's two largest coal plants and the previously announced closure of the Daniel plant, which was one of the last coal generators in Mississippi.

Growing environmental concerns have encouraged key players to increase the number of natural-gas-based power generation plants, thereby favoring the market. Natural gas is a low-carbon power source, which means it emits less CO2 emissions as compared to other fossil fuels. For instance, according to an order issued by the Central Environment Ministry panel on air pollution, India has temporarily shut down a few coal-fired power plants near New Delhi to combat air pollution.

Aging Energy Generation Infrastructure to Augment Market Progress

The aging energy generation infrastructure is a major factor surging the demand for gas turbine MRO services. Gas turbines have experienced significant growth in demand in recent years, leading to an increased need for gas turbine MRO services. The rising demand for electricity across the world, driven by urbanization and infrastructure development, is contributing to the market progress of gas turbine MRO.

The growing number of smart building and city projects is increasing the need for electricity, and the global demand for energy has led to increased investments in gas turbine power plants. To meet the high demand, both public and private sectors are expanding their power plant capacity through new installations and upgrades, often opting for gas turbines due to their efficiency and low environmental impact. Strict emission regulations are also boosting the adoption of gas-based turbines. These factors are expected to increase the gas turbine MRO market share.

RESTRAINING FACTORS

Increasing Emphasis of Renewable Energy Generation to Restrain the Global Gas Turbine MRO Market Growth

Growing focus on renewable energy generation is expected to inhibit the global market growth. Natural gas power plants mainly utilize gas turbines for energy production. However, renewable energy sources, such as wind and solar have become increasingly important due to rising global warming and climate change concerns. Renewable energy systems do not need gas turbines, plummeting the demand for gas turbine MRO services. High adoption of green sources of energy is also accelerating the renewable energy sector growth. Moreover, heavy investment in renewable energy projects, such as solar PV panels and wind turbines, will fuel the market expansion of gas turbine MRO.

The world is increasing its inclination toward clean energy sources. With the aim of reducing dependence on conventional and unsustainable energy sources, such as oil and coal, many countries are expanding their renewable energy capacities. A report from the International Energy Agency predicted that the global renewable power generation capacity would witness a growth of over 8% in 2022. China currently holds the top position in solar power generation, with an installed capacity of more than 300 GW. Many nations have set ambitious solar power production goals and are constructing large-scale power plants to meet their energy demands.

Gas Turbine MRO Market Segmentation Analysis

By Technology Analysis

Growing Use of Mobile Technologies to Boost Demand for Aero-derivative Technology

Based on technology, the has been segmented into heavy duty, light industrial, and aero-derivative. with a share of 41.03% in 2026 The aero-derivative segment is anticipated to record considerable CAGR during the forecast period. The growing accessibility of mobile and flexible technologies might boost the adoption of aero-derivative technology. This technology has numerous applications such as district heating, marine propulsion, and power generation.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Coal Turbine Replacements to Make Power Utility Sector a Major End-user

Based on end-user, the market is divided into power utilities contributing 53.34% globally in 2026, oil & gas, manufacturing, aviation, and others. There is a strong focus on replacing traditional coal-fired and steam turbines with gas ones in different power generating stations. These turbines offer higher efficiency in electricity generation as compared to the conventional power generation plants, which will bolster their installation.

REGIONAL INSIGHTS

North America Gas Turbine MRO Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The global market is studied across five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America is expected to capture a large industry share during the forecast timeframe, supported by a substantial number of power generation plants utilizing gas turbines. The U.S. market is estimated to reach USD 4.68 billion by 2026, driven by extensive gas-driven turbine plants operating mainly on natural gas amid rising shale gas exploration activities. For instance, the U.S. Energy Information Administration (EIA) states that more than 40% of the nation’s power comes from coal and around 25% from natural gas, with natural gas anticipated to become the primary electricity generation fuel by 2035. As the majority of electricity in North America is generated from gas turbine-powered plants, this trend is expected to continue, thereby increasing the regional gas turbine MRO market share.

Asia Pacific

The Asia Pacific market is expected to witness substantial growth due to robust investments in gas turbine power plants. The Japan market is estimated to reach USD 0.72 billion by 2026, reflecting its mature natural gas-based power generation industry and rising concerns over equipment service life, which have led to a notable increase in gas turbine MRO projects. The China market is estimated to reach USD 1.08 billion by 2026, supported by expanding power infrastructure and sustained energy demand, while the India market is estimated to reach USD 0.4 billion by 2026, driven by growing investments in gas-based power generation capacity. For example, in February 2021, Kanamoto was awarded a contract to supply seven C65 microturbine systems to a Japanese chemical company, highlighting continued project activity and efficiency-focused investments that are expected to support regional market recovery following the COVID-19 pandemic.

Europe

The Europe market might experience substantial progress over the coming years as countries across the region focus on reducing carbon emissions and transitioning away from coal-powered energy generation toward gas-driven turbine plants. The UK market is estimated to reach USD 0.53 billion by 2026, while the Germany market is estimated to reach USD 0.41 billion by 2026, reflecting policy-driven shifts toward cleaner energy sources and increased adoption of gas turbine-based power generation systems.

List of Key Companies in Gas Turbine MRO Market

GE Service Solutions to Increase Reliability and Flexibility of Gas Turbines while Reducing their Environmental Footprint and Production Costs

Some of the prominent gas turbine MRO companies are focusing on executing a wide range of inorganic growth strategies, such as product launches, partnerships, and mergers & acquisitions, to increase their presence in the industry.

General Electric is one of those key market players as it offers a wide range of high-performance and aero-derivative gas turbines for utilities, independent power producers, and numerous industrial applications. These applications range from small, mobile power plants to utility-scale power generation facilities. In addition, it provides maintenance & service solutions throughout the operational life cycle of its products. Its gas turbine upgrade solutions can boost the system performance, reliability, efficiency, flexibility, and extend the equipment’s lifespan.

List of Key Companies Profiled:

- GE (U.S.)

- Siemens (Germany)

- Mitsubishi Hitachi Power Systems, Ltd. (Japan)

- Ansaldo Energia (Italy)

- Solar Turbines (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Baker Hughes (U.S.)

- Bharat Heavy Electrical Limited (India)

- PJSC UEC-Saturn (Russia)

- OPRA Turbines (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- December 2022 - General Electric and MYTILINEOS teamed up to supply around 200 megawatts of Reserve Power to the Electricity Supply Board of Ireland. GE Gas Power and MYTILINEOS announced that they had been awarded a contract by the Electricity Supply Board of Ireland (ESB) to construct a new gas-fired power station in Dublin within ESB's existing North Wall power station. 6 GE LM2500XPRESS gas turbines will power the new temporary reserve power plant with a total capacity of up to 200 megawatts (MW) to meet their customers’ electricity needs and ensure a stable electricity supply in Ireland. Under the terms of the agreement, GE and MYTILINEOS will collaborate on the facility's construction, operations, and maintenance (O&M).

- November 2021 – General Electric (GE) stepped up the maintenance of its industry-leading HA gas turbines with the first shipment of HA component repairs at Global Repair Solutions Singapore Center’s (GRAS) newly opened ART Center in Singapore.

- June 2021 - Mitsubishi Power signed three 16-year service agreements for six M701F gas turbines. Two of these turbines would be delivered to the Sidi Krir Power Plant, the El Atf Power GTCC Plant, and North Cairo, Egypt. These natural gas-fired power plants have a capacity of 750 MW and use the combined cycle technology for gas turbines. Mitsubishi Power would ensure the smooth and reliable operation of the plants through maintenance, management, remote monitoring, parts supply, and repair services, thereby contributing to the stability of Egypt's electricity supply.

- September 2019 - Evonik Industries, a specialty chemical company, selected Siemens to construct a turnkey combined cycle power plant at the Marl Chemical Park in North Rhine-Westphalia, Germany.

- July 2019 - Caspian Pipeline Consortium (CPC) and Siemens inked an agreement for gas turbine maintenance and spare parts supply at CPC’s Moscow office.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the latest market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the market growth in recent years.

An Infographic Representation of Gas Turbine MRO Market

To get information on various segments, share your queries with us

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.31% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights shows that the global market size was valued at USD 15.55 billion in 2025.

The global market is projected to grow at a CAGR of 3.31% over the forecast period.

The North America market size stood at USD 5.19 billion in 2025.

Based on the end-user, the power utilities segment holds a dominating share in the global market.

The global market size is expected to reach USD 20.81 billion by 2034.

An increase in multiyear gas turbine services contracts as well as regular checkups and maintenance to avoid operational failures are some of the key market drivers.

The top players in the market are General Electric, Siemens Energy, Mitsui power, Ansaldo Energia, and others.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic