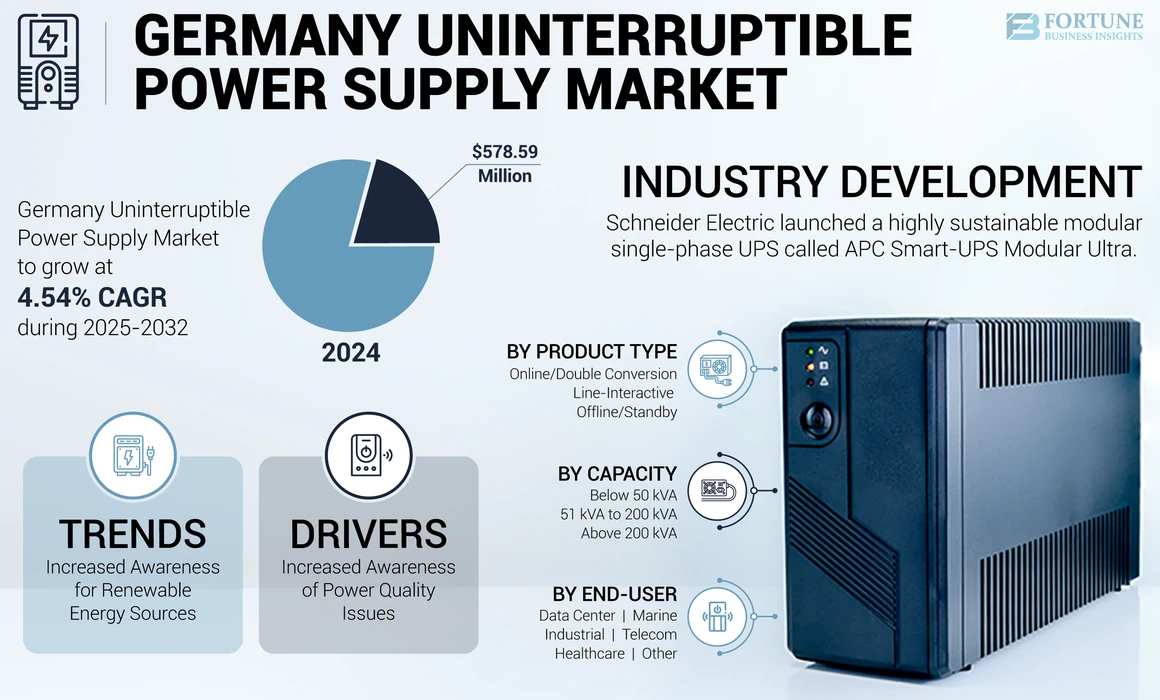

Germany Uninterruptible Power Supply Market Size, Share & Industry Analysis, By Product Type (Online/Double Conversion, Line-Interactive, and Offline/Standby), By Capacity (Below 50 kVA, 51 kVA to 200 kVA, and Above 200 kVA) and By End-user (Industrial, Telecom, Data Center, Marine, Healthcare, and Other), and Country Forecast, 2025-2032

Germany Uninterruptible Power Supply Market Size

The Germany uninterruptible power supply market size was worth USD 578.59 million in 2024 and is projected to grow at a CAGR of 4.54% during the forecast period.

Germany has observed a substantial rise in the demand for Uninterruptible Power Supply (UPS) from the data center as it provides a secure way to shut down systems, saves on data losses, and is easily adopted for cloud computing and repairing costs. UPS is a battery backup system used to deliver continuous power to electric devices in the case of a deficiency in regular power or a voltage drop. UPS is broadly used with desktops to avoid data loss in case of electricity faults, such as power cuts and voltage fluctuations, which may decrease the life of the hardware and circuits inside.

The COVID-19 pandemic headed to supply chain disruptions, leading to supply shortages or lesser demand in the uninterrupted power supply market. The travel restrictions and social-distancing actions have resulted in a sharp descent in consumer and business spending. The end-user trends and preferences have reformed due to the pandemic and have led to developers, manufacturers, and service providers adopting several strategies to stabilize the company.

Germany Uninterruptible Power Supply Market Trends

Increased Awareness for Renewable Energy Sources in Germany Boosting Power Backup Solutions

Germany has been actively promoting renewable energy sources, such as wind and solar power. As the country transitions toward a more sustainable energy mix, there is a need for UPS systems that can seamlessly integrate with these renewable sources and provide reliable backup power. Businesses in Germany are becoming more aware of the importance of power quality in maintaining the reliability of their operations. Uninterruptible power supply systems contribute to uninterrupted power supply during outages and also help regulate voltage and minimize disruptions due to fluctuations as the growing demand for power supply plays a crucial role in economic development.

Germany Uninterruptible Power Supply Market Growth Factors

Increased Awareness of Power Quality Issues to Drive the Germany Uninterruptible Power Supply Market Growth

As businesses become more aware of the potential risks associated with power quality issues, such as voltage fluctuations, surges, and interruptions, there is an increased focus on risk mitigation. Uninterruptible power supply systems provide a crucial line of defense against these issues by offering a reliable and continuous power supply to critical equipment. Companies are recognizing the importance of business continuity planning, and a reliable power infrastructure is a key component of such plans. UPS systems play a critical role in ensuring that essential operations can continue without disruption, minimizing downtime and associated financial losses.

RESTRAINING FACTORS

High Initial Costs of Uninterruptable Power Supply Systems to Restrain Market Growth

Many businesses, especially Small and Medium-Sized Enterprises (SMEs), may have limited capital expenditure budgets. The high upfront cost of purchasing and installing uninterruptible power supply systems can be a barrier, leading businesses to prioritize other essential investments. Some businesses may perceive UPS systems as a non-revenue-generating investment. The delay in realizing the return on investment, especially when considering other pressing operational needs, can lead to hesitancy in adopting UPS solutions.

Germany Uninterruptible Power Supply Market Segmentation Analysis

By Product Type Analysis

Based on product type, the market is divided into online/double conversion, line-interactive, and offline/standby.

The offline/standby segment held a larger Germany uninterruptible power supply market share in 2024. The offline/standby segment led the market as it is a highly preferred and distributed grade of uninterruptible power supply. As per product type, offline/standby is the utmost grade uninterruptible power supply available to consumers in Germany, and this is what companies are offering to their consumers.

The double conversion/online UPS is widely used due to its high energy efficiency. Double conversion filters frequency variations and preserves battery life.

By Capacity Analysis

Based on capacity, the market is divided into 51 kVA to 200 kVA, below 50 kVA, and above 200 kVA.

The above 200 kVA segment held a larger Germany uninterruptible power supply market share in 2024. Rapid adoption of above 200 kVA UPS solutions in large data centers and IT & Telecom infrastructure is driving the segment growth. The surging need for constant power backup from consumers is also supporting segment growth.

The 51 kVA to 200 kVA is the fastest-growing capacity segment. Different telecommunication operators, BFSI service suppliers, small and medium-sized data centers, and cloud service suppliers highly adopt it.

By End-User Analysis

Based on end-user, the market is divided into industrial, telecom, data center, marine, healthcare, and others.

The data center segment held a larger market share in 2024. A rise in data centers due to surging investments from the government and large enterprises is augmenting segment expansion. The rapid shift of businesses toward a cloud environment is also favoring segment growth. Data centers could provide a total of 16.9 GW of flexibility in the UPS market through on-site UPS, backup power, backup batteries and load shifting.

Further, telecom businesses store large amounts of data, and the ability to maintain and access this data is critical to day-to-day operations. Systems are backed up with UPS to prevent data loss due to power failure.

Key Industry Players

The uninterruptible power supply market is split in nature, owing to the existence of several uninterruptible power supply providers with a tough-to-crack competitive landscape of companies. These players are dominating the market in terms of uninterruptible power supply production, owing to their increased production offerings at many facilities globally with increasing growth rates of revenue.

Schneider Electric, Eaton, and ABB are some of the leading companies in the market. Supply chain disruption, changes in policies and regulations, as well as price and availability of uninterruptible power supply are the factors that impacted these companies. The Germany uninterruptible power supply market growth is driven by the increased investments in data centers by the government and its awareness of a battery backup system.

LIST OF TOP GERMANY UNINTERRUPTIBLE POWER SUPPLY COMPANIES:

- Schneider Electric (France)

- Eaton (Ireland)

- ABB (Switzerland)

- Delta Electronics (Taiwan)

- Toshiba Corporation (Japan)

- Aerospace Baykee (Guangdong) Technology Co. Ltd. (China)

- Riello UPS (Italy)

- Vertiv Group Corp (U.S.)

- AEG Power Solutions (Netherlands)

- Kehua Data Co., Ltd (China)

KEY INDUSTRY DEVELOPMENTS:

- September 2023: Toshiba launched its regenerative innovation center in Düsseldorf, Germany. As a strategic move for the company, Toshiba reinforces its commitment to carbon neutrality and the circular economy (CN-CE) with this new venture. The center acts as a European hub for the development of new technology and real-world applications of CN-CE and supports companies through digital transformation.

- June 2022: Schneider Electric launched a highly sustainable modular single-phase UPS called APC Smart-UPS Modular Ultra. At 50% smaller, 60% lighter and 2.5x more power density than comparable offerings, Smart-UPS Modular Ultra is the smallest, lightest and most powerful modular 5-20kW UPS within the industry.

- March 2022: Riello UPS enriches the Sentryum S3U series with the new power ratings of 40.50 and 60 kVA, which are transformer-free UPS with double conversion ON LINE technology that provides high levels of power availability and energy efficiency up to 94.5%. Hence, ideal for the protection of small or medium-sized Data Centers and "mission-critical" applications, Sentryum S3U has been designed by choosing a "Green Technology" approach, with components that allow to reduce dissipation and energy losses and improve the overall energy efficiency performance.

REPORT COVERAGE

The Germany uninterruptible power supply market report provides a detailed analysis of the market. It focuses on key aspects such as an overview of the technological advancements, the prevalence of its usage in Germany, and pricing analysis. Additionally, it includes an overview of the day-to-day use in the telecom sector in Germany, the increasing demand for the industrial sector in Germany, new product launches, key industry developments such as mergers, partnerships, and acquisitions, Porters Five Forces Analysis and the impact of COVID-19 on the market. Besides this, the report also offers insights into the market trends, effects of power outage and highlights key industry dynamics with market research expertise. In addition to the aforementioned factors, it encompasses several factors, such as market drivers and restraints that have contributed to the market growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 4.54% from 2025 to 2032 |

|

Unit |

Value (USD Million), Volume (Units) |

|

Segmentation |

By Product Type

|

|

By Capacity

|

|

|

By End-user

|

Frequently Asked Questions

Fortune Business Insights says that the Germany market was worth USD 578.59 million in 2024.

The market is expected to exhibit a CAGR of 4.54% during the forecast period (2025-2032).

By product type, the offline/standby segment held a larger share of the market.

Schneider Electric, Eaton, and ABB are the top players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us