Graphene Market Size, Share & Industry Analysis, By Product (Graphene Oxide, Graphene Nanoplatelets (GNP), and Others), By End-use Industry (Electronics, Aerospace & Defense, Energy, Automotive, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

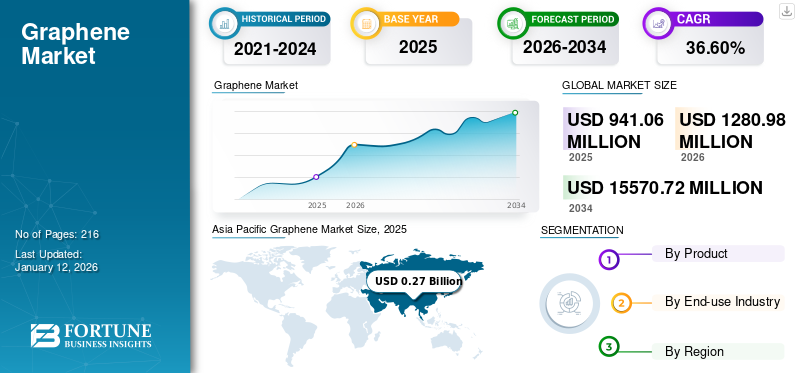

The global graphene market size was valued at USD 0.94 billion in 2025. The market is projected to grow from USD 1.28 billion in 2026 to USD 15.57 billion by 2034, exhibiting a CAGR of 36.60% during the forecast period. Asia Pacific dominated the graphene market with a market share of 29% in 2025.

Graphene is a form of carbon that consists of a single layer of atoms arranged in a two-dimensional honeycomb lattice. It is transforming aerospace industry by enhancing the performance of coatings and composites used in the manufacture of drones, helicopters, airplanes, and spacecraft. Improved mechanical properties allows for thinner materials to be used and reduces weight.

The development of graphene technology and its applications saw significant acceleration during the COVID-19 pandemic, due to its remarkable properties, such as flexibility, conductivity, and effectiveness against bacteria and viruses. During this time, graphene-based biosensors, protective equipment, drug delivery systems, and treatment solutions were developed and employed to combat COVID-19. However, in contrast to the advancements in the healthcare and biomedical sectors, the electronics and energy sectors faced negative impacts during the pandemic. This was majorly due to disruptions in logistics, decreased demand, and limited access to raw materials needed for graphene production.

Global Graphene Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 0.94 billion

- 2026 Market Size: USD 1.28 billion

- 2034 Forecast Market Size: USD 15.57 billion

- CAGR: 36.40% from 2026–2034

Market Share:

- Asia Pacific dominated the graphene market with a 29% share in 2025, driven by government support for R&D, strong presence of manufacturers, and rapid integration of graphene in electronics, automotive, and aerospace applications, particularly in China, Japan, and South Korea.

- By product, Graphene Nanoplatelets (GNP) are expected to retain the largest market share in 2025, supported by rising demand from the aerospace, automotive, and electronics sectors due to properties such as high strength, lightweight, and conductivity.

Key Country Highlights:

- China: Leading global investments in graphene R&D and commercialization. The government's focus on becoming a technological leader in nanomaterials is supporting domestic production and export capabilities.

- United States: Growing use of graphene in electronics, energy storage, and aerospace applications. Significant presence of R&D institutions and key market players is enhancing innovation and commercialization.

- European Union: Backed by the USD 1.16 billion Graphene Flagship initiative, the EU is spearheading graphene innovation, aiming to bring academic and industrial breakthroughs to market through public-private partnerships.

- Japan: Graphene is increasingly being used in high-tech applications including sensors, electronics, and medical devices. The country’s focus on innovation and material science supports the rapid deployment of graphene technologies.

GRAPHENE MARKET TRENDS

Increasing R&D Activities of Graphene-based Sensors is an Emerging Trend in the Market

Graphene is an active chemical sensor in electrolyte-gated arrangements. Graphene-based top-gate insulators can be manufactured with 1 to 5 nm thickness in an electrolyte, with a concentration of a few millimolar, which could not be matched by the best top-gate Field-Effect Transistors (FETs) that have Atomic Layer Deposition (ALD).

A graphene-based photodetector computes photon flux, is measured by converting the energy of the absorbed photons into electrical current. These photodetectors have more extensive operating wavelength range than traditional detectors based on III-V and IV group semiconductors.

The photoelectric sensors are essentially similar to indium-tin-oxide (ITO) alternatives used in transparent conductors. Its high electrical conductivity and transparency makes it an appealing choice for creating transparent electrodes in photovoltaic cells and photoconductive sensors.

MARKET DYNAMICS

MARKET DRIVERS

Growing Product Demand From Electronics Industry to Aid the Market Growth

Due to its exceptionally electrical and thermal conductivity and lightweight nature, this allotrope of carbon is particularly well-suited for electronics applications. The electrons in this form of carbon have greater mobility, allowing them to accelerate more rapidly in response to an electric field compared to traditional semiconductors such as silicon, which are commonly used in electronic devices. As a result, devices made with this material operate more efficiently, functioning faster than conventional alternatives while consuming less power.

Due to this material's high mechanical resilience, it can tolerate higher voltages. This is likely to influence the growth as industries adopt greater electrification. Recently, there has been a progress in developing a foam-based design for batteries that will possibly bridge the gap between capacitors and batteries. The design is based on lithium technology and, in a new form, has an analogous capacity-to-weight ratio to current lithium-ion batteries. Moreover, it can discharge and recharge as quickly as a capacitor and can discharge in 20 seconds.

Graphene film is one of the strong alternatives for indium tin oxide. Indium tin oxide is a commercial product that is extensively used in touch screens of smartphones, and tablet computers as a transparent conductor, and electrodes in OLEDs and solar cells. The growing demand for touchscreen technologies and products is likely to foster the graphene market growth.

Download Free sample to learn more about this report.

MARKET RESTRAINTS

Negative Environmental Impact Tends to Restrain the Market Growth

Graphene nanomaterials (GFN) have gained acceptance in nanotechnology research due to their versatile carbon-based structure, which allows for a wide range of applications across different fields. However, there are concerns regarding the material's impact on sustainability.

Researchers at the Riverside Bourns of Engineering at the University of California discovered that graphene oxide (GO) nanoparticles are highly mobile in streams and lakes, posing a potential threat to the environment if released. The increasing use of GO is considered toxic to human health. As the production of this material rises, it is crucial for regulatory bodies, such as the Environmental Protection Agency (EPA), to understand its potential environmental impacts. These concerns could hinder the market growth.

MARKET OPPORTUNITIES

Novel Opportunities in the Medical Industry to the Boost the Market Growth

GO-based nanomaterials have obtained extensive interest in research owing to their inimitable physiochemical properties. Their 2D allotropic structure makes them versatile in different biological application fields. The biomedical applications of the product, its derivatives, and its composites involve the product’s use in small molecular drug delivery and gene therapy. They are also used in the bio-functionalization of proteins, as an antimicrobial agent for bone and tooth implantation, and in anticancer therapy. The biocompatibility of these synthesized nanomaterials allows their considerable use in medicine and biological research.

The development of a distinctive product-based biosensor with strong operationalization under multiple physiological conditions, but with the loss of certain properties, is an emerging application area. Research on GNP scaffolds for stem cell culture implementation shall also act as an opportunity for the market. To form therapeutics on the basis of graphene, researchers are expected to regulate its derivatives and check its functionalization in the biological area to analyze the response of cells to graphene and its derivatives.

MARKET CHALLENGES

Succeeding Ecological Factors Pose Risks to Market Growth

GFN, a 2D carbon nanomaterial, may act as an ecological hazard if released into the air, water, and soil. Furthermore, succeeding environmental components can impact GFN, including chemical, physical, and biological transformations, thus resulting in changes in their structural, chemical, and physical properties. These changes can be a concern to the environment as they can further lead to changes in the toxicity levels of GFNs. Exploring any possibility of subsequent toxicity caused by these changes and their effect on the environment plays a crucial role in a sustainable future. These factors are expected to limit the market growth. However, various steps are initiated to analyze the effect of changes that occur on the environment. For instance, a semi-quantitative tool called Life Cycle Assessment (LCA) can be used to examine the force of causal effects. This might begin with economic activities and result in an undesirable side effect on public health, which can further damage the ecosystems and resources.

TRADE PROTECTIONISM

Export Controls: Several nations are adopting protective measures regarding advanced materials such as graphene. They are concerned with the unrestricted exports that could enable competitors to create technologies that weaken their domestic advantages. This concern is particularly prominent in countries including China, which has enforced strict export controls on high-performance materials to maintain technological dominance in industries such as electronics and energy.

Tariffs and Duties: Several countries have implemented tariffs on the import of product and its derivatives to protect their local industries. This protectionist approach may affect its global price and availability. As a result, companies that depend on imported materials could face higher costs, potentially slowing the market's growth.

Intellectual Property: Graphene-related innovations are protected by intellectual property laws, with numerous companies and research institutions holding patents for unique methods of producing and its usage in various applications. These intellectual property protections are essential for maintaining competitive advantages; however, they can also pose barriers for new market participants seeking to enter the field.

SEGMENTATION ANALYSIS

By Product

Graphene Nanoplatelets (GNP) Segment Dominated Due to Demand from Aerospace and Automotive Industries

Based on product, the market is segmented into Graphene Nanoplatelets (GNP), Graphene Oxide (GO), and others.

The GNP segment accounted for the largest graphene market share in 2024 and is expected to continue its dominance until 2032. These advanced nanoparticles are widely used in applications such as medical devices, conductive inks, energy, composites, and coatings. Increasing demand for lightweight composites in the automotive and aerospace industries due to their surface hardness, strength, and stiffness properties will drive segment growth. Several R&D activities are performed to commercialize GNP production. Various non-government and government research institutes are entering strategic partnerships with various commercial manufacturers for product development and innovation. In addition, GNP is used in automotive & transportation, building & construction, energy & power, electrical & electronics, rubber, medical, packaging, and chemicals. The growing use in electrical & electronic devices due to its superior properties, including excellent electrical & thermal conductivity, permeability, transparency, and strength, will also drive the segment’s growth.

Graphene Oxide (GO) is likely to experience considerable growth during the forecast period. It is dispersible in water and other solvents and comes in solution or powder form, for coating substrates. The product has a high surface area and can be used as an electrode material for solar cells, capacitors, and batteries. It is easier to manufacture and has comparatively lower in price. As the product easily mixes with materials and polymers, it enhances the properties of the composite materials. GO is likely to show significant gains during the forecast period owing to the growing demand for nanotechnology in the electronics and semiconductor industry. Moreover, the growing application of GO in a wide range of end-use sectors, including textile, automotive, construction, aerospace & defense, healthcare, and electronics is one of the key factors anticipated to drive the growth of the market during the study period. The segment captured 45.15% of the market share in 2026.

By End-use Industry

Global Graphene Market Share, By End-use Industry, 2026

To get more information on the regional analysis of this market, Download Free sample

Electronics Segment Holds the Largest Share owing to Extensive Adoption of the Material

In terms of end-use industry, the market is classified into electronics, aerospace & defense, automotive, energy, and others.

The electronics segment holds the largest share of the graphene market. The ongoing demand for smaller, more powerful electronic devices pushes research and development toward novel materials like graphene that can outperform traditional silicon-based technologies in certain applications. Moreover, graphene’s exceptional conductivity and electron mobility make it a prime candidate for use in high-frequency transistors, interconnects in integrated circuits, and heat dissipation layers in electronic devices. The segment is foreseen to attain 37.39% of the market share in 2026.

The aerospace segment accounts for a significant market share. Graphene is revolutionizing the aerospace industry by enhancing the functionality of composites and coatings used in the manufacturing of drones, planes, helicopters, and spacecraft. It improves mechanical properties, allows for thinner designs, and reduces weight, leading to better fuel efficiency and lower emissions over an aircraft’s lifespan. This material is also utilized to create lighter, damage-tolerant structures for helicopters and aircraft, due to its high electrical conductivity, which enables the integration of de-icing systems into the wings. This segment is set to grow with a considerable CAGR of 35.60% during the forecast period (2025-2032).

The automotive segment is expected to grow moderately during the forecast period. The global automotive industry is currently grappling with challenges such as energy efficiency, safety, and the need to reduce carbon emissions. Addressing these issues can lead to improvements in the dimensional stability of vehicles, creating significant opportunities for innovation. The product is utilized in coatings and composites, enhancing the strength, safety, and lightweight characteristics of vehicles. It has the potential to replace traditional materials such as steel, aluminum, and carbon fiber while improving the overall dimensional stability of vehicles.

GRAPHENE MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Graphene Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the global market, which stood at USD 0.27 billion in 2025 and USD 0.37 billion in 2026, owing to favorable policies by the governments, academic research, and funding, which is likely to boost the market in the region. China is set to reach USD 0.17 billion in 2026. Also, the presence of large-scale manufacturers and consumers and the rise in production in various industries, such as automobile, defense, marine, and aerospace, are expected to drive the market growth in the region. Countries such as China are investing heavily in research, facilitating the rapid integration of the product into commercial applications. India is predicted to grow with a valuation of USD 0.08 billion in 2026, while Japan is poised to hit USD 0.04 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

North America

North America is set to grow with a valuation of USD 0.34 billion in 2026, exhibiting a CAGR of 36.98% during the forecast period (2025-2032). The market in this region is expected to experience significant growth, driven by increasing demand from the aerospace and energy industries. There is a strong demand for efficient, eco-friendly, strong, and lightweight products, which will further propel market growth in the region. Additionally, the rising installation of GO in batteries and solar cells for improved performance will likely boost market revenue. The U.S. graphene market is anticipated to grow significantly. It is one of the major exporters of graphene-based products to several countries that do not have graphene production capacity. Furthermore, the increasing popularity of graphene due to its excellent properties is expected to drive market growth during the forecast period. The U.S. market is estimated to be worth USD 0.31 billion in 2026.

Europe

Europe is the third largest market expected to hit USD 0.3 billion in 2026. In Europe, the market is projected to grow at a substantial rate and may maintain its dominance throughout the forecast period, owing to increasing investments in R&D activities. In June 2019, the European Union (EU) invested USD 1.16 billion in the Graphene Flagship, which would leverage the product into commercial markets. The U.K. market is set to reach a market value of USD 0.03 billion in 2026.This project will bring together industrial and academic research institutes to ensure the commercialization of the product, making Europe an economic powerhouse for such technologies. The rising focus on environmental sustainability has augmented the demand for hybrid and electric vehicles in the region, thereby propelling the market growth. Germany is anticipated to be valued at USD 0.09 billion in 2026, while France is foreseen to gain USD 42.21 million in 2025.

Latin America

Latin America is the fourth largest market anticipated to gain USD 0.10 billion in 2026. The region is anticipated to see exponential growth during the forecast period, primarily due to the use of GO in a wide range of applications, including transistors, capacitors, semiconductors, and sensors.

Middle East & Africa

The Middle East & Africa market is expected to experience moderate growth during the forecast period. The demand from the automotive sector for products such as graphene-based batteries in anti-crash systems, vehicles, tires, and more is growing, owing to the excellent material properties, including electrical conductivity, tensile strength, and thermal conductivity. Saudi Arabia is expected to hold USD 15.06 million in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Are Adopting Strategies to Maintain their Positions in the Market

The global market is fragmented with key players operating in the industry such as NanoXplore Inc., Universal Matter GBR Ltd, Graphenea, The Global Graphene Group, and ACS Material. Other key players include XG Sciences, Xiamen Knano Graphene Technology Co., and Grolltex Inc. Manufacturers are also expanding their business to gain competency in the industry and alleviate new entrants’ threats.

Market participants are fiercely competing with international and regional players with extensive distribution networks, regulatory know-how, and suppliers. In addition, companies sign contracts, acquisitions, and strategic partnerships with other market leaders to expand their existing market presence.

LIST OF KEY GRAPHENE COMPANIES PROFILED

- Xiamen Knano Graphene Technology Co. (China)

- Graphenea (Spain)

- ACS Material (U.S.)

- Global Graphene Group (U.S.)

- Universal Matter GBR Ltd (Canada)

- Grolltex Inc (U.S.)

- Directa Plus S.p.A (Italy)

- NanoXplore Inc. (Canada)

- Thomas Swan & Co. Ltd. (U.K.)

- First Graphene (Australia)

KEY INDUSTRY DEVELOPMENTS

- December 2023 - NanoXplore Inc. announced the successful commissioning of two anode material pilot lines, which will help the company achieve sustainable energy storage solutions.

- June 2022- Graphenea and Grapheal joined forces to quicken the study on biosensors with GraphLAB, a graphene-based product. GraphLAB is a next-gen assessment method for protein disease and screening detection.

- July 2021- AGM launched an innovative new series of eco-friendly GNP dispersions. These dispersions will enable coatings, paints, and composite material consumers to develop the sustainability of their various product formulations.

- February 2020- The production of XG graphene-enhanced polyurethane engine covers was initiated. These covers are now available on all Ford and Lincoln light truck boards and passenger cars. The product has increased compression strength by 20%, heat deflection temperature by 30%, NVH sound absorption by 17%, and reduced weight by 10%.

- January 2020- ACS material introduced Graphene/Silver Nanowire Composite Transparent Conductive Film (TCF), which has enhanced performance than its TCF precursors.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, products, and end-use industries. Also, the report offers insights into market trends and highlights vital industry developments. In addition to the factors mentioned above, the report encompasses various factors contributing to the market's growth in recent years. This report includes historical data & forecasts revenue growth at global, regional, and country levels and analyzes the latest market dynamics and opportunities.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 36.60% during 2026 to 2034 |

|

Segmentation |

By Product

|

|

By End-use Industry

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 0.94 billion in 2025 and is projected to reach USD 15.57 billion by 2034.

In 2025, the Asia Pacific market size was valued at USD 0.27 billion.

Registering a CAGR of 36.60%, the market will exhibit steady growth during the forecast period.

In 2025, the electronics segment is the leading segment in this market.

The growing product penetration in the electronics industry will aid the market growth.

NanoXplore Inc., Universal Matter GBR Ltd, Graphenea, The Global Graphene Group, and ACS Material are the major players in the global market.

Asia Pacific dominated the market share in 2025.

Superior product properties and their rising demand from the energy industry are expected to foster the growth of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us