Green Coatings Market Size, Share & Industry Analysis, By Technology (Water-Borne, Powder, High-Solids, Radiation-Cure, and Others), By Application (Architectural, Automotive, Industrial, Wood, Packaging, Marine & Protective, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

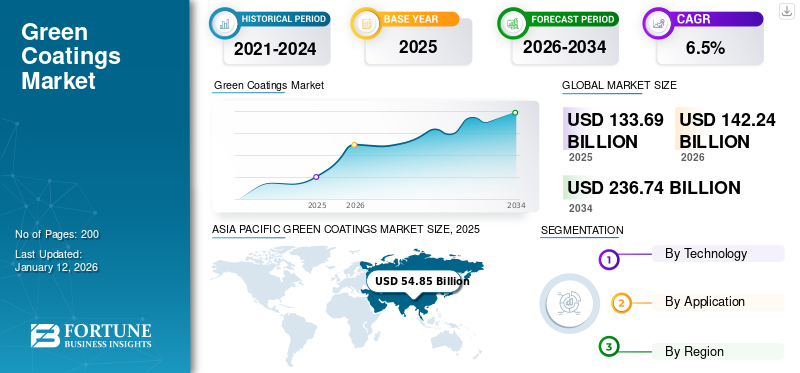

The global green coatings market size was valued at USD 133.69 billion in 2025. The market is projected to grow from USD 142.24 billion in 2026 to USD 236.74 billion by 2034, exhibiting a CAGR of 6.5% during the forecast period. Asia Pacific dominated the green coatings market with a market share of 41% in 2025.

Green coatings are engineered to reduce environmental impact by minimizing volatile organic compounds (VOCs), hazardous air pollutants (HAPs), and carbon footprints, while preserving or enhancing the protective and aesthetic qualities characteristic of conventional coatings. Unlike traditional solvent-based coatings that emit harmful emissions, green coatings are produced using natural raw materials, water-based technology, bio-based resins, and advanced curing methods that adhere to strict environmental regulations. Their adoption signifies an increasing commitment by industries and consumers toward sustainability, energy efficiency, and healthier living and working environments.

The market's growth is propelled by increasing awareness of environmental issues, the escalation of governmental regulations on VOC emissions, and the worldwide shift toward renewable and bio-based resources. Moreover, end-use sectors such as construction, automotive, packaging, aerospace, industrial manufacturing, and consumer goods are implementing environmentally friendly coatings to comply with green building standards, energy conservation initiatives, and corporate sustainability objectives.

The market encompasses several major players, including AkzoNobel, PPG INDUSTRIES, Sherwin-Williams, BASF, and Axalta. Broad portfolio with innovative product launches and strong geographic presence expansion has supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS:

Strict Environmental Regulations and Policies to Propel Market Growth

The increasing stringency of environmental regulations and international policies designed to curb air pollution, chemical hazards, and carbon emissions drives the green coatings market growth.

- For example, in the U.S., the Environmental Protection Agency (EPA), under the Clean Air Act, mandates restrictions on VOC emissions in industrial coatings. Concurrently, the South Coast Air Quality Management District (SCAQMD) in California enforces some of the most stringent standards globally such as Toxic Air Contaminants (TACs), Greenhouse Gas (GHG) Emissions, Volatile Organic Compounds (VOCs). Similarly, the European Union’s REACH regulations rigorously regulate hazardous chemicals used in paints and coatings, requiring manufacturers to reformulate their products with waterborne, powder, or bio-based alternatives.

China’s 14th Five-Year Plan emphasizes green development and mandates VOC reductions across industrial sectors. As a result, demand for waterborne coatings has surged in China’s construction and automotive markets, pushing both domestic players and multinational firms to scale up green production. India has also increasingly aligned with global sustainability norms through the Bureau of Indian Standards (BIS) and state pollution boards, which are gradually restricting the use of harmful solvent-based coatings.

- Companies such as AkzoNobel, BASF, and Sherwin-Williams are investing heavily in R&D to ensure compliance, while marketing their green coatings ranges as premium solutions for both regulatory and brand-conscious buyers.

MARKET RESTRAINTS:

High Production and Raw Material Costs to Restrict Market Expansion

Traditional solvent-based coatings that utilize petroleum-derived resins and less costly solvents are increasingly giving way to environmentally friendly coatings, which predominantly employ bio-based resins, advanced polymers, and renewable raw materials. These sustainable options tend to involve higher costs in sourcing and processing. Furthermore, waterborne and powder coatings necessitate specialized manufacturing procedures and additional research and development investments to ensure durability and performance comparable with conventional solvent-based alternatives.

MARKET OPPORTUNITIES:

Technological Advancements and Innovation in Coatings to Create Lucrative Growth Opportunities

Traditionally, environmentally friendly coatings encountered challenges such as reduced durability, increased costs, and limited performance in adverse conditions. However, advancements in waterborne technology, powder coatings, UV/EB curing, and bio-based resins have bridged the performance gap between sustainable coatings and conventional solvent-based coatings.

- For example, powder coatings eliminate the need for solvents and enable nearly 100% utilization with minimal waste, rendering them both cost-effective and sustainable. Organizations such as Axalta Coating Systems and AkzoNobel have broadened their powder coating product lines for automotive, furniture, and industrial purposes.

GREEN COATINGS MARKET TRENDS:

Rising Consumer Awareness and Preference for Eco-Friendly Products is One of the Significant Market Trends

Growing awareness regarding the detrimental impacts of VOC emissions on indoor air quality, allergies, and long-term health has prompted consumers to proactively seek paints and coatings labeled as low-VOC, zero-VOC, or bio-based.

- For instance, Nippon Paint’s Odour-less series has achieved extensive popularity across Asia due to its safety for families and children. Conversely, Asian Paints’ Royale Health Shield in India markets itself as an antibacterial, low-VOC interior paint. Likewise, in North America, Benjamin Moore’s Natura range is positioned as a zero-VOC product line that attracts environmentally conscious homeowners.

The demand for such products is further reinforced by the increasing availability of eco-label certifications such as GreenGuard, EcoLogo, and Green Seal, which validate the environmentally friendly and health-conscious qualities of these coatings, thereby driving the growth of the market during the forecast period.

MARKET CHALLENGES:

Supply Chain and Scale Limitations to Hamper Growth

Conventional coatings traditionally depend on widely accessible petrochemical-based solvents and resins. In contrast, green coatings often rely on specialized raw materials such as bio-based resins, renewable feedstock, and advanced polymers. These inputs are not yet produced at a large scale, resulting in supply shortages, elevated procurement costs, and a concentration of resources in specific geographic regions.

Download Free sample to learn more about this report.

Segmentation Analysis

By Technology

Water-Borne Segment Held the Dominant Share Due to Green-Building Mandates

By technology, the market is segmented into into water-borne, powder, high-solids, radiation-cure, and others.

The water-borne segment held the largest green coatings market share 48.00% in 2026 and is expected to experience substantial growth, driven by stringent regulations on VOC emissions and environmental policies, making waterborne systems a preferred “green” alternative. The growth of the segment is further boosted by demand from the architecture, automotive, and industrial sectors, as emerging markers shift from solvent-based systems in line with infrastructure expansion and green-building mandates.

The growth of the powder segment is driven by the use in appliances, furniture, metal panels, automotive rims, and architectural components. Moreover, improvements in resin and curing technology allow lower-temperature and more substrate-friendly powders, expanding their applicability to heat-sensitive parts.

The growth of the high-solids coatings segment is associated with their formulations, which reduce solvent volumes (thus VOCs) by increasing the proportion of solids. This makes them a transitional “greener” alternative to conventional solvent coatings.

The growth of the radiation-cure segment is driven by the growing demand across various sectors such as electronics, packaging, automotive trim, and coatings due to ultra-fast curing (seconds), enabling high throughput in manufacturing and minimal energy consumption.

By Application

Architectural Segment Leads Owing to Increasing Demand from the Architectural and Automotive Industries

Based on application, the market is segmented into architectural, automotive, industrial, wood, packaging, marine & protective, and others.

To know how our report can help streamline your business, Speak to Analyst

The architectural segment dominates the market, driven by urbanization, infrastructure expansion, and increasing residential and commercial construction. This drives demand for sustainable coatings in walls, ceilings, and façades. Green building certifications (LEED, BREEAM, WELL) enforce the use of low-VOC and low-emission materials, further pushing the adoption of eco-friendly paints. Consumer preference for healthier indoor air quality and low-odor formulations further accelerates migration from conventional coatings to green alternatives. Furthermore, the segment is set to hold a 36.78% share in 2026.

The automotive segment is witnessing favorable growth throughout the forecast period. This expansion is attributed to the increasing demand for compliance with stringent emission standards and environmental regulations, which compel Original Equipment Manufacturers (OEMs) to adopt environmentally friendly coatings for exterior, interior, and underbody components. In addition, automotive applications are projected to grow at a CAGR of 6.3% during the study period.

In the heavy industry sectors, including machinery, metal fabrication, and infrastructure, there is a pronounced focus on durability, corrosion resistance, and extended service life, which fosters interest in environmentally friendly protective coatings. The necessity to decrease operational emissions, adhere to environmental regulations, and reduce maintenance expenditures underpins a transition toward sustainable formulations. Research and development advancements in performance attributes such as chemical and abrasion resistance further enhance the acceptability of green alternatives within industrial environments. These factors collectively propel the growth of the industrial segment in the market.

The wood segment is driven by the growing demand for eco-friendly furniture, interior design, and construction wood products, which encourages the use of green coatings (waterborne, UV-cure) with low odor and low VOCs. Interior safety and regulatory norms for formaldehyde and solvent emissions incentivize the use of greener finishes.

In the packaging segment, rigorous regulation of materials in contact with food, prohibitions on PFAS and volatile substances, alongside increasing consumer demand for sustainable packaging, are driving the implementation of environmentally friendly coatings (such as edible, bio-based, and UV-curable) on cans, cartons, labels, and flexible films.

In the marine & protective segment, regulatory pressures to eliminate harmful biocides, reduce VOCs, and enhance environmental safety are driving the development of environmentally friendly alternatives.

Green Coatings Market Regional Outlook

ASIA PACIFIC GREEN COATINGS MARKET SIZE, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The Asia Pacific held the dominant share in 2025, valued at USD 54.85 billion, and maintained its lead in 2026, with USD 58.75 billion. The factors fostering the dominance of the region include rapid urbanization, infrastructure expansion, and industrialization in China, India, Southeast Asia, and Korea. The rising middle class demands better quality, healthier indoor environments, and accelerated adoption of low-VOC architectural paints. Automotive manufacturing hubs in China, India, and ASEAN also drive OEM demand for greener coatings. Governments increasingly impose regulations and environmental standards, and are promoting sustainability initiatives. In 2026, the China market is estimated to reach USD 19.64 billion.

- China is the fastest-growing market due to rapid urbanization, large-scale infrastructure projects, and booming construction activity. Expanding automotive hubs in China, India, Japan, and South Korea are also major contributors, as OEMs adopt eco-friendly coatings to meet both domestic and international environmental standards.

To know how our report can help streamline your business, Speak to Analyst

Europe is anticipated to witness notable growth in the coming years. During the forecast period, the region is projected to record a growth rate of 6.5%, which is the second-highest amongst all the regions, and reach the valuation of USD 30.89 billion in 2025. The growth of the market is driven by the strictest regulations globally (e.g. EU’s Industrial Emissions Directive, REACH, Green Deal), which compel coatings producers and users to reduce emissions and environmental impact. Government incentives and public procurement policies increasingly favor sustainable materials. Backed by these factors, countries including the U.K. are expected to record the valuation of USD 6.16 billion, Germany to record USD 7.21 billion, and France to record USD 4.21 billion in 2026.

After Europe, the market in North America is estimated to reach USD 26.01 billion in 2025 and secure the position of the third-largest region in the market. The growth of the market is driven by strong industrialization in sectors such as automotive, aerospace, and heavy manufacturing fuels demand for sustainable protective and performance coatings. In 2026, the U.S. market is estimated to reach USD 22.52 billion.

- In the U.S., agencies such as the Environmental Protection Agency (EPA) and state-level bodies such as the California Air Resources Board (CARB) enforce stringent VOC and hazardous substance restrictions, pushing coating manufacturers toward waterborne, powder, and UV-cured solutions.

Over the forecast period, the Latin America and Middle East & Africa regions will witness moderate growth in this market. The Latin America market in 2025 is set to record USD 9.60 billion in valuation. The market's growth is driven by increasing urbanization, infrastructure development, and rising awareness of environmental health issues. As governments introduce stricter regulations on solvent emissions and support sustainable building practices, the demand for green coatings is rising.

In the Middle East & Africa, Saudi Arabia is set to attain the value of USD 3.80 billion in 2025. The market’s growth is attributed to large-scale infrastructure, urban development, and industrial projects (e.g., oil & gas, petrochemical, transportation) that demand durable protective coatings.

COMPETITIVE LANDSCAPE

Key Industry Players:

Key Market Players Focus on R&D Efforts to Strengthen their Market Position

This market is competitive and fragmented, with key manufacturers operating in the industry such as AkzoNobel, PPG INDUSTRIES, Sherwin-Williams, BASF, and Axalta. Most global corporations have integrated raw material production and sales activities to maintain product quality and expand their regional presence. This gives businesses a competitive edge in the form of a cost advantage, which improves profit margins. To remain competitive and meet the changing needs of end-users, corporations are also placing more emphasis on their R&D efforts.

LIST OF KEY GREEN COATINGS COMPANIES PROFILED:

- AkzoNobel (Netherlands)

- PPG INDUSTRIES (U.S.)

- Sherwin-Williams (U.S.)

- BASF (Germany)

- Axalta (U.S.)

- Nippon Paint (Japan)

- Hempel (Demank)

- Jotun (Norway)

- Asian Paints (India)

- Kansai Paint (Japan)

- Berger Paints (India)

- Benjamin Moore (U.S.)

- Rust-Oleum (U.S.)

- Tikkurila (Finland)

- Clariant (Switzerland)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: PPG INDUSTRIES Comex introduced its “Productos ECO” line in Mexico, featuring eco-friendly paints with reduced VOC emissions and the incorporation of recycled materials. This advances its sustainability offerings in the architectural segment.

- November 2023: AkzoNobel developed its inaugural bio-based interior coating for KIA Motors using rapeseed and pine rosin. Two variants of bio-rosin were utilized, one extracted from rapeseed and the other from pine resin. This coating is applied to the KIA EV9's interior door switch panels, with AkzoNobel also provides coatings for the rest of the interior.

- December 2022: BASF introduced its novel biomass-balanced automotive coatings in China. The novel ColorBrite Airspace Blue ReSource basecoat has the potential to reduce the carbon footprint by nearly 20% during production. BASF additionally achieved biomass certification for its resin facilities in Caojing, China.

- August 2022: Nippon Paint China and BASF collaborated on the launch of Joncryl HPB, BASF's first water-based barrier coating tailored for industrial packaging in China.

- August 2021: AkzoNobel's Dulux brand unveiled a USDA-certified top-tier interior emulsion in India, marking the debut of the country's initial bio-based paint designed to purify indoor air.

REPORT COVERAGE

The global market analysis provides an in-depth study of market size & forecast by all the market segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the technological advancements, new product launches, key industry developments, and details on partnerships, mergers & acquisitions. The market research report also encompasses a detailed competitive landscape with information on the market share and profiles of key operating players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.5% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Technology, Application, and Region |

|

By Technology |

· Water-Borne · Powder · High-Solids · Radiation-Cure · Others |

|

By Application |

· Architectural · Automotive · Industrial · Wood · Packaging · Marine & Protective · Others |

|

By Geography |

o Rest of Middle East & Africa (By Application) |

Frequently Asked Questions

The global green coatings market size is projected to grow from $142.24 billion in 2026 to $236.74 billion by 2034.

In 2025, the market value stood at USD 54.85 billion.

The market is expected to exhibit a CAGR of 6.5% during the forecast period (2026-2034).

The water-borne segment led the market by technology.

The key factors driving the market are the rising demand for stringent global regulations to curb VOC emissions, growing environmental and health awareness, and the rising demand for sustainable coatings in the construction and automotive sectors.

AkzoNobel, PPG INDUSTRIES, Sherwin-Williams, BASF, and Axalta are some of the top players in the market.

Asia Pacific dominated the market in 2025.

Increasing availability of eco-label certifications to favor product adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us