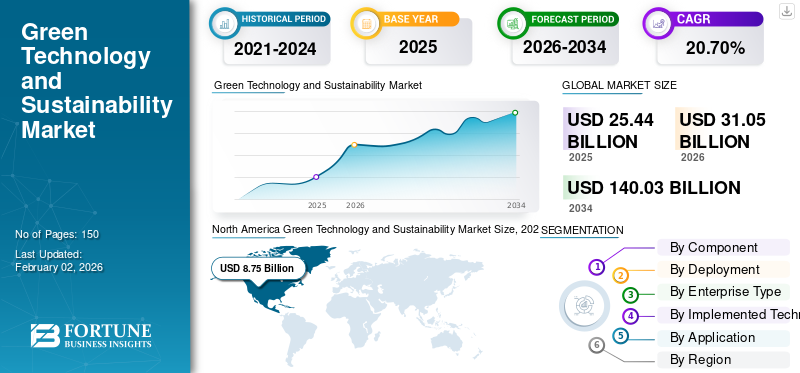

Green Technology and Sustainability Market Size, Share & Industry Analysis, By Component (Solutions & Services), By Deployment (Cloud & On Premise), By Enterprise Type (Large Enterprise and SMEs), By Implemented Technology (Internet of Things, AI & Analytics, Digital Twin, Cloud Computing, Blockchain), By Application (Air & Water Pollution Monitoring, Carbon Footprint Management, Crop Monitoring, Fire Detection, Forest Monitoring, Green Building, Soil Condition Monitoring, Sustainable Mining, Water Management, Weather Monitoring), Regional Forecast, 2026 – 2034

Green Technology and Sustainability Market Size

The global green technology and sustainability market size was valued at USD 25.44 billion in 2025. The market is projected to grow from USD 31.05 billion in 2026 to USD 140.03 billion by 2034, exhibiting a CAGR of 20.70% during the forecast period. North America dominated the global market with a share of 34.40% in 2025.

Green technologies and sustainability include advanced environmental solutions that are deployed to secure natural resources and atmosphere, mitigate or minimize undesirable impacts from human-made actions on the surroundings, and increase sustainable development. In addition, the main aim of the solution is to secure and maintain the environment and repair past damages.

The market is growing with a positive trajectory due to the increasing investment by key players in developing customized solutions and services. Key players are integrating their green technology solutions with emerging technologies, such as generative artificial intelligence (AI), advanced analytics, the Internet of Things (IoT), blockchain, cloud, cybersecurity, big data, and others. These technologies assist end-users in gathering, integrating, and analyzing data from numerous real-time data sources, such as sensors, a global positioning system (GPS), and cameras. For instance,

- In April 2023, YvesBlue, an ESG as a Service Platform provider, successfully integrated generative AI expertise with ESG/Sustainability.

Moreover, governments, public organizations, and private enterprises across the globe are investing in technology to secure nature and lessen the adverse impact on the environment, which is enhancing the growth of the market.

The COVID-19 pandemic moderately impacted the market with supply chain concerns and halted projects. However, the rise in environmental concerns, the need for a sustainable future, and the governmental push toward implementing sustainable solutions positively pushed the trajectory of the market. According to an article published by ETTelecom, three things in the adoption of green technologies will define the new way businesses and would operate in the post-COVID world. The three things include collaboration with green technology firms, prioritizing sustainability in the company’s genetic code, and adopting digital equality and environmental responsibility.

IMPACT OF GENERATIVE AI

Integration of Gen AI into Existing Green Technology Solutions to Propel Market Growth

The wave of generative AI had a positive impact on the overall market. In 2024, the market is expected to witness several innovations and sustainability initiatives globally. Gen AI assets such as models, codes, designs, and other synthetic data majorly contribute to sustainability measures, business, and innovation KPIs.

As the market progressed through COVID-19, major efforts by companies were witnessed to track, measure, analyze, and optimize their ESG indices. In 2024, these efforts will be further transformed to check the status of socially responsible investments. As the technology evolves, it is expected that more accurate models and codes will reshape the market in the coming years.

The recent development mentioned below highlights the integration of gen AI into green technology and sustainability solutions.

- In November 2023, Schneider Electric integrated the expertise of Gen AI, intending to help its end users revolutionize their internal operations. The company aims to transform its gen AI productivity and sustainability tools by integrating Microsoft Azure OpenAI.

Green Technology and Sustainability Market Trends

Organizations Confronting Climate-stable Future to Indicate a Growing Trajectory for the Market

Governments and private organizations have announced several programs for a climate-stable future. These initiatives are likely to drive the rapid adoption of green technology and sustainability practices. For instance,

- India announced a National Action Plan on Climate Change covering eight key goals, including improved energy efficiency, solar, water, energy, sustaining Himalayan ecosystems, sustainable agriculture and habitat, Green India, and smart information for climate change. Around 33 states and Union territories have already taken steps to work toward these goals.

Moreover, several economies are working successfully toward their net zero 2050 targets. For instance,

- In September 2023, it was announced that India is successfully working toward achieving its long and short-term goals under the Panchamrit action plan. This plan includes minimizing carbon emissions by 1 billion tons, achieving a non-fossil fuel energy volume of 500 GW, minimizing carbon intensity below 45%, and completing at least half of its energy necessities via renewable energy by 2030. These targets will help the country pave the way toward attaining its net-zero target by 2070.

All these developments indicate that organizations are working toward attaining a sustainable future, which is expected to positively influence the market in the coming years.

Download Free sample to learn more about this report.

Green Technology and Sustainability Market Growth Factors

Growing Implementation of Internet of Things (IoT) Technology to Make Way for Advanced Green Technology

Green technology refers to eco-friendly technologies and tools that enhance business operations. This technology also facilitates consumer applications such as charging systems, electric vehicles, smart homes, and other applications powered by IoT sensors.

The Internet of Things (IoT) is an important aspect of the green technology and sustainability industry. IoT in green tech enables sensor-based solutions, minimizes the need for human intervention, and provides rich data insights to enable service providers to constantly improve their services. The combination of IoT and green technology has been facilitating the use of renewable energy in recent years.

Green networks in IoT are likely to deliver a reduction in emissions and pollution, exploiting surveillance and conversation and minimizing operational costs and consumption. The Green Internet of Things (G-IoT) is projected to initiate significant changes that will support to realize the idea of green ambient intelligence. For instance,

- According to GSMA Intelligence, the IoT connections are expected to reach approx. 24 billion globally by 2025, up from 13.1 billion in 2020. This shows that within some years, there would be massive clusters of sensors, devices, and things that would communicate through high-speed technology such as 5G.

Such growing proliferation of Internet of Things technology is likely to drive the market toward a higher growth trajectory.

RESTRAINING FACTORS

High Costs Associated with Green Technology and Sustainability Solutions May Limit Market Growth

In general, traditional technologies are less expensive than green technology solutions. The high costs of green technology solutions are constituted by the environmental expenses that are externalized in many conventional production procedures. In addition, as the technology is still new, the associated training and development costs are expected to be higher in comparison with existing technologies. High initial deployment costs are likely to restrict the adoption of green technologies among enterprises. For example, when using air quality monitoring tools to analyze and test air quality metrics, the detection of biological and chemical parameters from the air necessitates the employment of new-age technologies such as gas sensors, RFID, and PCR-based biosensors, all of which are costly.

Moreover, the estimated advantages of green technology are dependent on factors such as technology readiness, human resources capabilities, geographic elements, and availability of supporting infrastructure. Hence, to deploy green technology, businesses should satisfy all the requirements mentioned above. However, inadequate infrastructure is likely to impede market growth.

Green Technology and Sustainability Market Segmentation Analysis

By Component Analysis

Solutions Segment Held the Leading Position with Increasing Demand for Green Technology Solutions

By component, the market is bifurcated into solutions and services.

In 2026, the solutions segment dominated the market owing to an increase in the demand for green technology and sustainability solutions. This surge in demand is owing to consumers' inclination to become more environmentally conscious. The segmental growth is also majorly driven by the governmental push toward promoting green technologies. The segment held 72.20% of the market share in 2026.

On the other hand, in the coming years, the services segment is expected to grow at an accelerated pace owing to the increasing inclination of companies to invest in market-related service providers. For instance,

March 2023: A global sustainability consultancy firm, ERM, completed the acquisition of NINT, a Latin American-based consultancy. With this, the company aims to offer ESG advisory and sustainable finance services focusing on corporations, financial institutions, and other major companies in the financial sector landscape.

By Deployment Analysis

Cloud Segment Dominated Owing to its Increased Adoption Due to Several Benefits

By deployment, the market is divided into cloud and on premise.

In 2026, the market was led by the cloud segment. Cloud offers a myriad of sustainability benefits by promoting energy-efficient systems, reducing hardware needs, and minimizing environmental impact. It enables organizations to optimize resource usage, leading to lower energy consumption and carbon footprints. Along with this, general awareness among the population is increasing the adoption of cloud-based green tech and sustainability solutions. The segment is expected to hold 59.50% of the market share in 2026. For instance,

February 2024: The U.S. Department of Energy announced over USD 366 million for 17 ventures across 30 Tribal States and societies across 20 states. These investments align with President Biden’s agenda to propel clean energy deployment in rural and remote areas across the country.

In addition, cloud services often use renewable energy sources, contributing to a cleaner and greener ecosystem. Owing to these reasons, the cloud segment is expected to continue its dominance in the coming years.

The on premise segment is expected to grow at a steady pace, yet slower than the cloud segment. The need for on premise green technology solutions is rising as they generate lesser environmental impacts and CO2 emissions. Also, IoT technology plays a critical role in on-premises green technology adoption. Sensors and smart devices are used to monitor energy consumption, water usage, and emission in real-time. This data enables companies to make informed decisions to optimize resources and reduce their environmental footprint. The segment is likely to grow with a considerable CAGR of 19.70% during the forecast period (2024-2032).

March 2024: The European Parliament made significant enhancements to the building energy operation rules with the aim of achieving a climate-neutral building sector by the end of 2050. Following this, the REPowerEU project intends to introduce 10 million heat pumps by the end of the same year.

In addition, there is a rise in demand for air-to-water (A2W) systems across the European region. These systems produce fewer CO2 emissions and environmental impacts, and thus, these reasons validate the surging demand.

By Enterprise Type Analysis

Large Enterprise Segment Witnessed Major Share with Heavy Investments in Green Technology

By enterprise type, the market is categorized into large enterprise and SMEs.

In 2026, the large enterprise segment held the majority of the overall green technology and sustainability market share. For large enterprises, investing in the green technology market brings several benefits. The segment is estimated to capture 54.89% of the market share in 2026.

According to a study by Veolia North America, over half of the U.S. companies surveyed are expected to have ambitious goals for addressing the net zero carbon, zero liquid discharge, and zero waste to landfill, among others. The survey was conducted by studying responses from 245 large U.S. companies and found that most have already set specific targets in the sector. These findings represent a higher adoption rate of green tech and sustainability solutions by large enterprises.

However, the SMEs segment is expected to grow with the highest CAGR of 23.87% during the forecast period. Several SMEs globally have been incorporating sustainability goals, indicating a positive future outlook for the market.

According to a recent study, “Sustainability in the Latin American Leadership Agenda,” over 69% of large and medium-scale firms already have a sustainability strategy in progress.

By Implemented Technology Analysis

Rise in Adoption of Smart Devices for Energy Optimization Fuels the Demand for IoT Devices among Consumers

By implemented technology, the market is classified into internet of things (IoT), AI and analytics, digital twin, cloud computing, blockchain, and others (edge computing, cybersecurity, and others).

In 2026, the Internet of Things (IoT) segment captured the largest share of the market. IoT devices, such as smart meters and sensors, are used to monitor energy consumption in real time. This data allows businesses and households to optimize energy use, reducing waste and lowering costs. For example, smart thermostats can adjust heating and cooling systems based on occupancy, weather conditions, and energy prices. By enabling real-time monitoring, data-driven decision-making, and automation, IoT is playing a crucial role in the global transition to promote sustainable practices. The segment is expected to dominate the market with a share of 36.02% in 2026.

The AI and analytics segment is expected to grow at the highest CAGR during the forecast period. AI-driven analytics are used to process vast amounts of environmental data, such as air and water quality readings. This helps in identifying pollution sources, predicting environmental hazards, and enforcing regulations to protect public health and ecosystems. In addition, AI systems can analyze the carbon footprint of different activities and products throughout their lifecycle, helping organizations reduce emissions and move towards carbon neutrality. As AI continues to evolve, its role in promoting sustainability is anticipated to grow during the forecast period. This segment is likely to grow with a significant CAGR of 24.70% during the forecast period (2024-2032).

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Green Building Segment Dominated Owing to a Significant Trend of Green Building Technology

By application, the market is divided into carbon footprint management, air and water pollution monitoring, fire detection, crop monitoring, green building, forest monitoring, sustainable mining and exploration, soil condition/moisture monitoring, water management, weather monitoring and forecasting, and others.

In 2023, the green building segment dominated the market as green building technology has become one of the significant trends in the construction industry. This technology leverages RFID scanners and sensors, access card readers, motion detectors, and other sensors to monitor the residential status of the building sector. According to a study by JLL, there has been a rising demand for sustainable buildings, and occupants and tenants are willing to pay more for environmental performance pointers such as electrification and energy intensity. The segment is poised to attain 18.89% of the market share in 2025.

The crop monitoring segment is expected to grow with the highest CAGR of 25.80% during the study period. Crop production is mainly dependent on dynamic weather changes; as a result, crop monitoring is becoming extremely crucial in the agriculture sector. In the agriculture industry, the convergence of advanced technology tailored with government initiatives is projected to drive the demand for crop monitoring in the near future.

REGIONAL INSIGHTS

The market for green technology and sustainability has been studied by categorizing it into five key regions: North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Green Technology and Sustainability Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest market share with a valuation of USD 8.75 billion in 2025 and USD 10.45 billion in 2026, owing to advancements in technology, consumer awareness, effective sustainability goals by companies based across the region, and regulatory measures. Moreover, the government is taking several initiatives to achieve regional sustainability goals in the coming years. For instance,

In August 2022, the U.S. implemented the Inflation Reduction Act, establishing the country’s largest-ever climate investment to decarbonize the country’s economy and boost jobs in green industries. The U.S. market is foreseen to grow with a value of USD 8.33 billion in 2026.

Europe

Europe is the second largest market expected to gain USD 7.16 billion in 2025, recording a significant CAGR of 23.45% during the forecast period (2024-2032). Europe lags behind the American market due to the lack of investments related to the market. For instance, in February 2024, The Parliament and Council of the region approved the Net-Zero Industry Act. This Act intends to accelerate domestic green tech; however, it lags behind the U.S., which invests over USD 369 billion in the market’s landscape. The U.K. market continues to expand, projected to reach a market value of USD 1.91 billion in 2026. Europe will make the same efforts; however, no money will be attached to the EU Act. Moreover, strong government backing and the need to achieve sustainability goals are expected to propel Europe’s market growth in the coming years. Germany is foreseen to reach USD 1.90 billion in 2026, while France is expected to be valued at USD 1.06 billion in 2025.

Asia Pacific

Asia Pacific is the third largest market estimated to be valued at USD 7.12 billion in 2025. In the near future, the Asia Pacific is expected to display the largest regional green technology and sustainability market growth. China is foreseen to hit USD 3.81 billion in 2026. This growth is attributed to the growing smart city initiatives, sustainable agriculture projects, and increasing demand for electric vehicles, which prove to present lucrative opportunities for the regional market. India is predicted to be worth USD 1.51 billion in 2026, while Japan is estimated to stand at USD 0.86 billion in the same year.

Middle East & Africa and South America

South America is the fourth largest market set to gain USD 1.12 billion in 2025. The Middle East & Africa and South America showcase a slower pace of growth than other regions. However, several initiatives are being observed across the regions that indicate positive growth for them. These initiatives and the adoption of green technologies are responses to environmental concerns and a strategic necessity. The GCC market is set to hold USD 0.60 billion in 2025.

The chart below represents the export of green technologies in the years 2021 and 2018. It shows that USD 75.00 billion of green technologies was exported to developing countries and USD 156.00 billion was exported to developed countries in 2021. Thus, these results highlight an increase in demand for green technologies across the globe compared to 2018.

List of Key Companies in Green Technology and Sustainability Market

Key Players are Prioritizing Effective Business Strategies to Expand Their Position in the Market

Companies operating in the market have been prioritizing business strategies such as strategic collaborations and partnerships with the aim of expanding their business operations and client base. These key players are also investing in emerging technologies to integrate and introduce green technology and sustainability solutions. Besides this, several small-scale players are securing funding to launch better solutions and expand their global reach.

LIST OF KEY COMPANIES PROFILED:

- IBM Corporation (U.S.)

- Sensus (Xylem Inc.) (U.S.)

- Microsoft Corporation (U.S.)

- ENGIE Impact (France)

- General Electric Company (U.S.)

- Schneider Electric (France)

- Oracle Corporation (U.S.)

- CropX Inc. (Israel)

- Taranis Visual Ltd. (U.S.)

- Cority (Canada)

KEY INDUSTRY DEVELOPMENTS:

- March 2024: Schneider Electric announced the addition of advanced sustainability reporting to its EcoStruxure IT data center infrastructure management tool. This feature will be available starting next month and will help data center operators meet the European Energy Efficiency Directive (EED) requirements.

- February 2024: IBM Envizi updated its Scope 3 emissions accounting solution with extra functionality. The part of the IBM Envizi ESG Suite, Supply Chain Intelligence module, collects Product Carbon Footprint Data (PCF) and high-volume supplier and product-level transactional data for Scope 3 reporting and calculation.

- February 2024: Microsoft introduced AI and data tools to enable companies to advance their sustainability goals. The company also added Microsoft Sustainability Manager with Copilot and intelligent insights to help companies efficiently report, record, and reduce waste and emissions or water impact. Microsoft Sustainability Manager is a solution for sustainability within Microsoft Cloud.

- December 2023: CropX Technologies completed the acquisition of Green Brain, which specializes in providing digital irrigation management tools and is based in Adelaide, Australia. The company expects to expand its customer base and market expertise with this acquisition.

- May 2023: ENGIE introduced the largest agrovoltaic park developed in Italy. This new plant combines solar panels with agricultural farming. The renewable energy created will be transported to Italy’s national grid, further powering Amazon’s set-ups in the country.

- March 2024: Aligned with United Nations SDG 11, IBM Corporation requested proposals from non-profit organizations and the government for the IBM Sustainability Accelerator. This request is dedicated to technology-based projects to enhance city resilience. The company aims to advance its investments in the pro-bono social impact initiative by 50%. In the coming years, it is estimated that the company will raise upto USD 45 million in cash and in-kind donations of services and technology.

- July 2023: NTT Data Corporation introduced NTT Green & Food Corporation, a new business using emerging technologies such as AI, IoT, and others to provide its end users with more sustainable food production solutions.

REPORT COVERAGE

The report offers its end-users a detailed analysis of the market, majorly focusing on factors that influence the market growth. Factors such as key market players, flagship solutions, and related services, and the major use cases of these solutions are considered while studying the market. The report also provides insights into market opportunities, trends, and recent industry developments. Besides this, the report provides an overview of government initiatives and information on R&D investments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 20.70% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Enterprise Type

By Implemented Technology

By Application

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 140.03 billion by 2034.

In 2025, the market was valued at USD 25.44 billion.

The market is projected to grow at a CAGR of 20.70% during the forecast period.

By component, the solutions segment dominated the market in 2025.

The benefits associated with green cloud computing are one of the major driving factors.

IBM Corporation, Sensus (Xylem Inc.), Microsoft Corporation, ENGIE Impact, General Electric Company, Schneider Electric, Oracle Corporation, CropX Inc., Taranis Visual Ltd., and Cority are the top players in the market.

North America dominated the global market with a share of 34.40% in 2025.

By application, the crop monitoring segment is expected to grow with the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us