HBsAg Testing Market Size, Share & Industry Analysis, By Type (Qualitative and Quantitative), By Technique (Enzyme-linked immunosorbent Assay, Chemiluminescence Immunoassay, and Chromatographic Immunoassay), By Setting (Point of Care and Laboratory-based), By Sample Type (Blood, Plasma, and Others), By End-User (Hospitals & Clinics, Clinical Laboratories, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

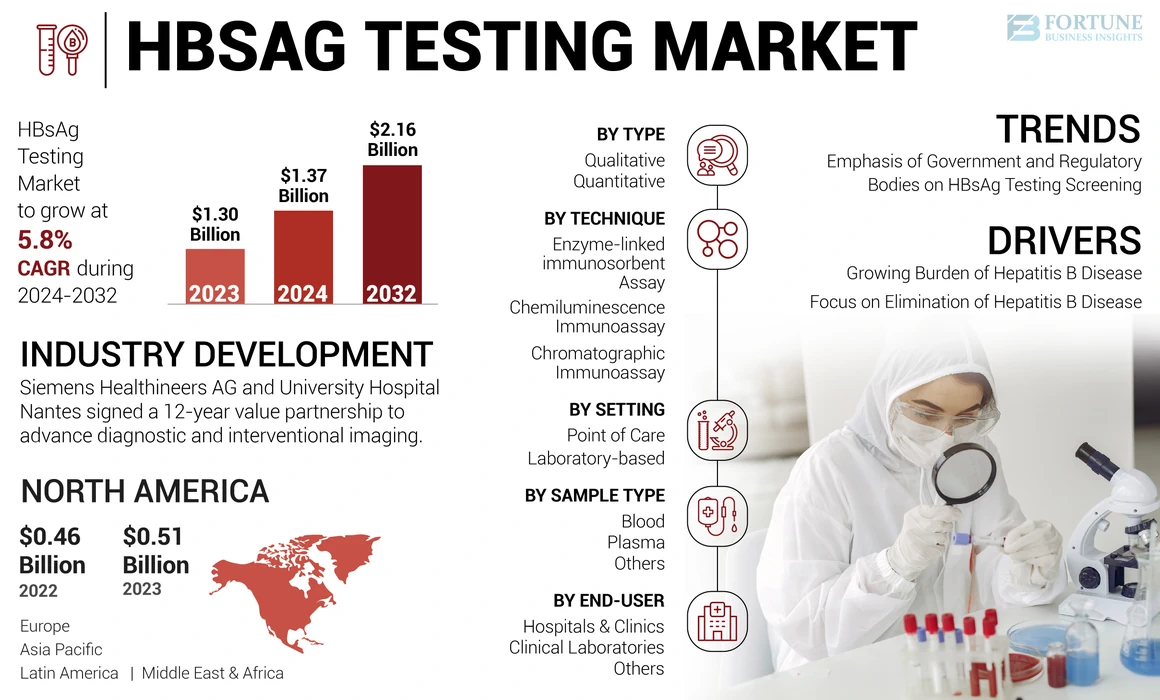

The global HBsAg testing market size was valued at USD 1.30 billion in 2023. The market is projected to grow from USD 1.37 billion in 2024 to USD 2.16 billion by 2032, exhibiting a CAGR of 5.8% during the forecast period. North America dominated the hbsag testing market with a market share of 39.23% in 2023.

HBsAg tests help in diagnosing the hepatitis B virus by assessing the presence of hepatitis B surface antigen. The growing burden of hepatitis B has been fueling the demand for efficient diagnosis.

- For instance, as per the data published by the World Health Organization (WHO), in 2022, around 254.0 million people were living with hepatitis B globally, accounting for 3.3% of the total population.

Moreover, the increasing focus of the government and regulatory bodies in many countries on creating awareness and implementing guidelines for hepatitis B diagnosis in order to reduce the burden of the disease has also been fueling the global HBsAg testing market.

- For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in March 2024, the CDC recommends HBsAg diagnosis of all pregnant women in the first trimester, all infants born to HBsAg-positive people, and adults aged 18 years and above at least once in their life.

Furthermore, Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., and Abbott are among the major market players focusing on strategic initiatives enhance its offerings with an aim to improve healthcare facilities.

Global HBsAg Testing Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 1.30 billion

- 2024 Market Size: USD 1.37 billion

- 2032 Forecast Market Size: USD 2.16 billion

- CAGR: 5.8% from 2024–2032

Market Share:

- North America dominated the HBsAg testing market with a 39.23% share in 2023, driven by strong diagnostic infrastructure, high testing rates, and robust government initiatives focusing on hepatitis B prevention and control.

- By technique, the chemiluminescence immunoassay segment is expected to retain its largest market share owing to the increasing initiatives by market players to expand product applications for hepatitis B antigen testing and the high sensitivity and efficiency of this technique.

Key Country Highlights:

- United States: The growing emphasis on nationwide screening initiatives and funding for hepatitis B prevention is driving demand for HBsAg testing.

- Europe: Regulatory bodies are intensifying screening programs and awareness campaigns to curb hepatitis B prevalence across the region.

- China: Rising prevalence of hepatitis B and active awareness drives by healthcare companies are boosting the adoption of HBsAg testing.

- Japan: Implementation of updated national guidelines and global health strategies is accelerating early diagnosis and treatment efforts for hepatitis B.

MARKET DYNAMICS

MARKET DRIVERS

Growing Burden of Hepatitis B Disease Fuels Demand for Effective Diagnosis

The burden of hepatitis B has been growing significantly across the globe, creating a lucrative opportunity for effective hepatitis B testing.

- Similarly, as per the data published by the Centers for Disease Control and Prevention (CDC), in 2021, around 2,045 new cases of acute hepatitis B and 14,229 new cases of chronic hepatitis B were reported in the U.S.

Hepatitis B virus can easily be spread in hospitals through infected blood, semen, or other body fluids. Additionally, poor healthcare infrastructure in emerging countries fuels the prevalence of hepatitis B.

- For instance, as per the data published by BioMed Central Ltd in January 2022, the prevalence of hepatitis B in South Africa increased from 56.14 per 100,000 population in 2015 to 67.76 per 100,000 population in 2019.

Therefore, the increasing prevalence of hepatitis B has been fueling the demand for effective diagnosis, thereby positively impacting the HBsAg testing market growth.

Focus on Elimination of Hepatitis B Disease Projects Positive Market Growth

The growing prevalence of hepatitis B has also been fueling the mortality rate due to the disease globally. In order to prevent this, many organizations and regulatory bodies are implementing strategies to completely eliminate the disease.

- For instance, the World Health Organization (WHO) has laid a plan to eliminate hepatitis B by 2030. In this plan, the WHO strategizes to reduce new hepatitis infections by 90% and deaths by 65% by 2030. This strategy is endorsed by all the WHO Member States, such as the U.S., Canada, Germany, the U.K., and India, among others.

This strategy of the WHO includes vaccinations, diagnosis, medication, and educational campaigns for hepatitis.

The WHO member countries, including the U.S., U.K., India, and others are focused on adhering to this strategy and laying guidelines for prevention, diagnosis, and treatment of the disease. This in turn has been fueling the number of tests being conducted annually.

Moreover, government and regulatory bodies in regions with high prevalence, such as Asia Pacific and the Middle East & Africa, are expanding healthcare infrastructure for better hepatitis B testing. Also, prominent companies in the sector are focused on development and approval of rapid testing methods and point-of-care solutions to improve the accessibility of HBsAg tests among the population globally.

MARKET RESTRAINTS

Limitations Associated with the Use of HBsAg Tests and the Presence of Alternatives Restrict Market Growth

The growing prevalence of hepatitis B, rising awareness regarding early diagnosis, and the high efficiency associated with the use of HBsAg tests in giving faster results contribute to market growth. However, there are certain risk factors associated with the administration of these tests which has been limiting their use among the population.

- For instance, HBsAg is not always 100% accurate and generates false negatives if the assay is not sensitive enough or is not able to detect certain variants of HBV.

Moreover, these tests can sometimes give false positives post hepatitis B vaccinations. This inaccuracy can also be influenced by various environmental factors such as humidity, temperature, and storage conditions.

- For instance, as per the data published by the National Centers for Biotechnological Information (NCBI) in 2020, HBsAg test false positive results were observed in 2.56% of the total studied records of 117 individuals.

Therefore, the limitations mentioned above, along with the presence of alternatives such as anti-HBs, IgM anti-HBc, and others, have been restricting the market growth.

MARKET CHALLENGES

Limited Accessibility to Advanced Diagnostics in Emerging Countries with Low-resource Settings

The growing burden of hepatitis B fuels the demand for effective diagnostics globally. However, Afghanistan, South Africa, Nigeria, and other countries, face challenges in acquiring advanced diagnostics due to underdeveloped healthcare infrastructure, limited availability of trained professionals, and economic constraints.

Moreover, another factor that has been limiting the number of HBsAg tests being conducted in low-income and emerging countries is the social stigma due to Hepatitis B. A huge number of people suffering from hepatitis B avoid getting treatment and diagnosis as they fear that society may discriminate which will further limit their personal and professional opportunities and will also impact their human rights.

Stringent Regulatory Scenario has been Limiting the Approval of Potential Products

Variations in the regulatory guidelines between regions can delay the introduction of innovative diagnostic technologies in certain countries. Moreover, the stringent regulatory scenarios requiring compliance with diverse healthcare standards across regions have also been limiting the approval of potential advanced diagnostics.

MARKET OPPORTUNITIES

Increasing Focus of Market Players and Research Institutes on R&D for New Product Launches to Fuel Market Growth

Market players and research institutes have increased their focus on the development of advanced diagnostics for effective HBsAg diagnosis.

- For instance, in November 2023, researchers at Chulalongkorn University in Bangkok, Thailand, developed a point-of-care self-testing kit that can be self-administered, and data can be collected through an online database.

Moreover, market players are working on getting regulatory approval for their products to launch them at their earliest.

- In October 2020, DiaSorin S.p.A. received Food and Drug Administration (FDA) approval for six assays for hepatitis B testing. The approval of these six assays completes the Liaison XL Hepatitis menu offering in the U.S.

The market is anticipated to depict positive growth with market players conducting research studies for new product development, along with the rising number of product approvals.

Download Free sample to learn more about this report.

HBsAg TESTNG MARKET LATEST TRENDS

Increasing Emphasis of Government and Regulatory Bodies on HBsAg Testing Screening Guidelines and Programs to Reduce the Disease Burden

Globally, the prevalence of hepatitis B has increased significantly. To reduce and control the disease burden, government and regulatory organizations are implementing guidelines to increase the diagnosis rate of hepatitis B.

- For instance, in 2024, the World Health Organization (WHO) released new guidelines on the prevention, diagnosis, and treatment of chronic hepatitis B at the Asian Pacific Conference for the Study of Liver Disease (APASL) in Kyoto, Japan. These guidelines explain the awareness about the diagnosis and eligibility for the effective treatment of hepatitis B.

- Similarly, in April 2023, the World Health Organization (WHO) updated the 2015 WHO Guidelines for hepatitis B testing and treatment.

Moreover, the regulatory bodies of many countries have been conducting screening programs for the early diagnosis of hepatitis B to provide effective treatments for hepatitis B-positive patients.

- For instance, in the U.K, testing for hepatitis B is free of cost by the National Health Service (NHS). One can visit a sexual health clinic general practitioner or can also conduct self-sampling at home.

The increasing emphasis of the regulatory and government bodies on implementing guidelines and conducting screening programs has been fueling the number of HBsAg tests being conducted globally, thereby positively impacting the market growth.

Other Trends:

- Increasing demand for advanced technologies in Rapid Diagnostic Tests (RDTs) and Nucleic Acid Amplification Tests (NAAT) to improve the efficiency of the diagnosis.

Growing emphasis on digital health integration for remote HBsAg diagnosis, data sharing, and result interpretation. Individuals can get these tests conducted at the convenience of their home.

Impact of COVID-19

During the COVID-19 pandemic in 2020, the market experienced a decline in its market value due to reduced number of HBsAg diagnoses being conducted globally owing to lockdown restrictions and supply chain disruptions.

The market experienced significant growth in 2021 and 2022 due to the increased emphasis of government and regulatory bodies on creating awareness regarding the early diagnosis of hepatitis B and the rise in the number of patients undergoing HBsAg diagnosis.

SEGMENTATION ANALYSIS

By Type

Increasing Focus of Market Players on New Product Launches is Responsible for Qualitative Segment’s Dominance

On the basis of type, the global market is segmented into qualitative and quantitative.

The qualitative segment accounted for the major HBsAg testing market share in 2023. The segment’s dominance is attributed to the growing burden of hepatitis B. This factor has increased the focus of the market players on the development and launch of technologically advanced products.

- For instance, in June 2022, DiaSorin S.p.A. announced that its products, LIAISON XL MUREX HBsAg Qual and LIAISON XL MUREX Control HBsAg Qual, received premarket approval from the U.S. Food and Drug Administration (FDA).

The quantitative segment is expected to grow at a substantial CAGR during the forecast period. The segment’s growth is attributed to the growing burden of chronic hepatitis B virus disease and the increasing number of diagnostic laboratories conducting HBsAg testing globally.

To know how our report can help streamline your business, Speak to Analyst

By Technique

Increasing Focus of Market Players on Expansion of Product Application for HBsAg Testing Fuels Chemiluminescence Immunoassay Segment’s Dominance

Based on technique, the market is segmented into enzyme-linked immunosorbent assay (ELISA), chemiluminescence immunoassay, and chromatographic immunoassay.

The chemiluminescence immunoassay segment dominated the market in 2023 fueled by the increasing initiatives by market players on the expansion of its products’ application for hepatitis B antigen testing.

- For example, in April 2024, Beckman Coulter, Inc. announced that it had extended the menu of DxI 9000 Immunoassay analyzer assays at the European Society of Clinical Microbiology and Infectious Diseases (ESCMID Global) congress. The company stated that the tests for Hepatitis B virus, namely Access HBsAg and Access HBsAg Confirmatory assays, can be performed on a DxI 9000 Immunoassay analyzer.

The enzyme-linked immunosorbent assay (ELISA) segment accounted for the second-largest market share in 2023. Furthermore, the growing burden of hepatitis B globally has been fueling the demand for cost-effective and highly sensitive HBsAg testing.

By Setting

Increasing Number of Clinical Laboratories Conducting HBsAg tests Drive Laboratory-Based Segment’s Leadership

On the basis of setting, the market is bifurcated into point of care and laboratory-based.

The laboratory-based segment dominated the market in 2023. The segment’s dominance is attributed to the opening of new clinical laboratories for the diagnosis of various diseases, including hepatitis B.

- For example, in May 2021, Neuberg Diagnostics announced the launch of the Neuberg Centre for Genomic Medicine, its first Laboratory in the U.S. This facility performs genomic and molecular tests.

The point of care segment is expected to grow at the fastest CAGR during the forecast period. Many healthcare facilities are adopting point of care testing for rapid detection of hepatitis B surface antigens in serum, plasma, or whole blood.

By Sample Type

Blood Sample Type Leads with Government’s Prioritization on Initiating HBsAg Screening Programs through Blood Samples

On the basis of sample type, the market is segmented into blood, plasma, and others.

The blood segment dominated the market in 2023 and is expected to account for the maximum share during the forecast period. The growth of the segment is attributed to the increasing emphasis of government organizations on early diagnosis and prevention of hepatitis B through blood screening programs.

- For example, as per the data provided by the Centers for Disease Control and Prevention (CDC) in January 2024, the CDC recommended that all adults should get screened for hepatitis B at least once in their lifetime through a blood test. It also recommends blood testing for hepatitis B in high-risk groups such as pregnant women and newborns.

The plasma segment is expected to grow at the second-largest share during the forecast period. The growing initiatives by market players to receive regulatory approvals for the launch of HBsAg testing products have been fueling the segment’s growth.

By End-user

Clinical Laboratories Gain Dominance with Increasing Number of HBsAg Tests being Conducted at Clinical Laboratories

Based on end-user, the market is segmented into hospitals & clinics, clinical laboratories, and others.

In 2023, the clinical laboratories segment dominated the market fueled by the increasing number of clinical laboratories conducting HBsAg tests.

- For example, in August 2024, Metropolis Healthcare Limited announced the launch of two advanced diagnostic laboratories in Telangana, India.

The hospitals & clinics segment is anticipated to grow at a significant CAGR during the forecast period. The growing burden of hepatitis B virus disease is responsible for increasing the number of HBsAg tests being conducted in these settings.

HBsAg TESTNG MARKET REGIONAL OUTLOOK

Based on geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America HBsAg Testing Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market in 2023, accounting for USD 0.51 billion of the global market. The region’s HBsAg testing market is expected to grow throughout the forecast period with strong diagnostic infrastructure and high testing rates in the U.S. and Canada.

Moreover, the strong emphasis of the U.S. government on funding for the prevention and control of hepatitis B adds fuel to the region’s dominance.

- For example, as per the data provided by the Global Hepatitis Elimination in September 2023, there has been a "Viral Hepatitis National Strategic Plan for the United States" to increase screening and better management of the hepatitis B disease.

Europe

Europe accounted for a significant market share in 2023 on the back of increasing emphasis of the government and regulatory bodies on conducting screening programs. Moreover, the region witnesses rising cases of hepatitis B, along with the increasing healthcare expenditure among the aging population.

Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The growing prevalence of hepatitis B in China and India, along with the increasing emphasis of healthcare companies on conducting awareness programs and campaigns to promote hepatitis B testing, supports the region’s market growth.

- For example, in April 2023, Aster DM Healthcare, a healthcare brand in Kerala, launched 'B Aware. B Negative', a 100-day campaign, which was held statewide for screening of Hepatitis B. The campaign was spearheaded by Aster DM Healthcare's diagnostic wing, Aster Labs, which has over 100 centers in Kerala.

Latin America and the Middle East & Africa

The market in Latin America and the Middle East & Africa is expected to grow at a substantial growth rate during the forecast period. The market’s growth in the region is attributed to the increasing prevalence of hepatitis B in the regions and the increasing focus of the government and regulatory bodies on implementing guidelines for hepatitis B diagnosis and treatment.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Companies Emphasize on Partnerships and Collaborations to Strengthen their Product Offerings

Market players such as Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., and Abbott are among the major players, accounting for the majority of the global HBsAg testing market value. The significant presence of these companies is attributed to their focus on improving the diagnosis facilities for efficient patient care.

- For instance, in February 2023, Siemens Healthineers AG signed an agreement with Unilabs for a value of around USD 216.5 million. This strategic initiative was made for the latest diagnostic testing infrastructure to improve patients’ care.

Moreover, other players, such as CTK Biotech, Inc., Avecon Healthcare Pvt. Ltd., and Elabscience Bionovation Inc., among others, have been focusing on the acquisition of other companies to expand their presence and enhance product portfolio.

- For instance, in September 2020, CTK Biotech, Inc. was acquired by SSI Diagnostica A/S Group. With this acquisition, both companies grew together and provided rapid diagnostic tests throughout the world.

LIST OF KEY MARKET PLAYERS PROFILED IN THIS REPORT:

- CTK Biotech, Inc. (U.S.)

- Biopanda Reagents Ltd (U.K.)

- Avecon Healthcare Pvt. Ltd. (India)

- Elabscience Bionovation Inc. (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Siemens Healthineers AG (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024 – Siemens Healthineers AG and University Hospital Nantes signed a 12-year value partnership to advance diagnostic and interventional imaging.

- February 2024 – F. Hoffmann-La Roche Ltd. announced that it had received the U.S. Food and Drug Administration (FDA) approval for Elecsys HBsAg II and Elecsys HBsAg II Auto Confirm.

- August 2022 – Abbott announced that its HBsAg test products received the U.S. Food and Drug Administration (FDA) approval. The approved products included ARCHITECT HBsAg NEXT Qualitative Reagent Kit, etc.

- July 2022 – Siemens Healthineers AG received the U.S. Food and Drug Administration (FDA) Notice of Approval for its HBsAg diagnosis products.

- March 2021 – Elabscience Bionovation Inc. announced that it had received an award from CiteAb as an "Antibody Supplier to Watch in 2021". Recognition of such awards enhanced the company’s brand image in the market.

REPORT COVERAGE

The global HBsAg testing market research report provides a detailed competitive landscape and market insights. The report includes key insights, such as top industry developments covering partnerships, mergers, and acquisitions as well. Additionally, it focuses on key points, such as new product launches. Furthermore, the report covers regional analysis of different market segments, profiles of key players, market trends, and the impact of COVID-19 on the market. The report consists of quantitative and qualitative insights that have contributed to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.8% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Technique

|

|

|

By Setting

|

|

|

By Sample Type

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 1.30 billion in 2023 and is projected to reach USD 2.16 billion by 2032.

In 2023, the market value stood at USD 0.51 billion.

The market is predicted to exhibit a CAGR of 5.8% during the forecast period.

By type, the qualitative segment leads the market.

The growing burden of hepatitis B among the population and the increasing focus of the market players on new product launches has been fueling the market growth.

Siemens Healthineers AG, F. Hoffmann-La Roche Ltd., and Abbott are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us