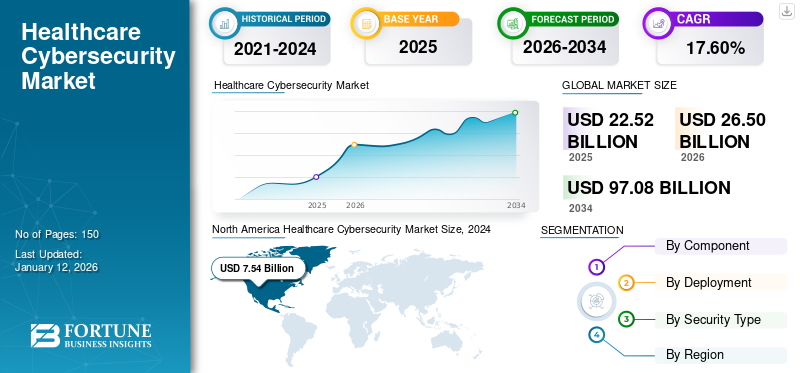

Healthcare Cybersecurity Market Size, Share & Industry Analysis, By Component (Solution and Managed Services), By Deployment (Cloud and On-premise), By Security Type (Cloud security, Ransomware and Incident Response, Digital identity, Patient Privacy and Medical Data Safety), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global healthcare cybersecurity market size was valued at USD 22.52 billion in 2025. The market is projected to be worth USD 26.50 billion in 2026 and reach USD 97.08 billion by 2034, exhibiting a CAGR of 17.60% during the forecast period. North America dominated the global market with a share of 38.50% in 2025.

Cybersecurity in healthcare is a strategic imperative for every organization in the sector, including insurance companies, healthcare providers, pharmaceutical companies, biotechnology, and medical equipment manufacturers. It includes various measures to protect organizations from external and internal cyber-attacks, ensuring the availability of medical services and the normal operation of systems and equipment. Additionally, it protects the security and integrity of patient data and ensures compliance with industry regulations.

Due to the increase in cyberattacks as a result of COVID-19, market demand for cybersecurity increased. As more patients relied on remote care, hacking of medical devices became a frequent cyberattack. Additionally, provisional medical facilities set up to treat people infected with coronavirus introduced vulnerabilities that hackers exploited. For instance, in August 2021, COVID-19 vaccination appointments in Italy's Lazio province were temporarily disrupted due to a cyberattack. New vaccination appointments were no longer available for several days after the attack.

IMPACT OF GENERATIVE AI

Artificial intelligence Continues to Demonstrate Increasing Benefits in Healthcare Cybersecurity.

Using generative AI provides insight into trends and patterns in data that can be used to develop new medical discoveries. Generative AI models can analyze large amounts of data to identify unusual patterns and potential threats more effectively than traditional methods. By continuously learning from new data, these models can detect sophisticated cyberattacks and zero-day vulnerabilities. There are ethical considerations involved in using patient data to train genomic AI models. Ensuring these models comply with regulations such as HIPAA is important but challenging.

Healthcare Cybersecurity Market Trends

Growing Adoption of Cloud-Based and IoT Technologies in Healthcare is Considered as a Market Trend

Cloud solutions provide scalable resources that can adapt to the dynamic needs of healthcare companies, allowing enhanced security measures as threats evolve. AI algorithms analyze user behavior and network traffic in real-time, identifying unusual patterns that may indicate cyber threats such as unauthorized access or malware. By leveraging cloud technologies with AI, healthcare organizations can bolster their cyber security strategies, safeguarding patient data and maintaining trust in their services.

Download Free sample to learn more about this report.

Healthcare Cybersecurity Market Growth Factors

Increased Data Breach and Cyber Attacks in the Healthcare Sector to Propel Market Growth

The increasing number of cyberattacks due to inadequate security protocols is a top concern for the healthcare industry and is expected to drive the adoption of enhanced security solutions. This enables the implementation of government policies and measures to protect patient information from data breaches, motivating healthcare organizations to use highly developed cybersecurity solutions to protect medical and health data. For instance,

- According to the IBM Cost of Data Breach Report, the cost of a data breach in the healthcare industry reached USD 9.23 million in 2021. Additionally, the report of Unsecured Protected Health Breaches by the U.S. Department of Health and Human Services has reported approximately 592 breaches of unsecured patient data affecting more than 500 individuals in the past two years, with ongoing investigation by the Civil Rights Office.

RESTRAINING FACTORS

Insufficient Training and Scarcity of Knowledgeable IT Staff

With the advancement of technology, network architecture for healthcare cybersecurity is becoming more complex. In the virtual environment, there are numerous entry points that can exploit, yet there is a shortage of trained cybersecurity experts capable to understand and prevent such complex zero-day vulnerabilities. This lack of qualified security professionals places the healthcare sector at serious threat. Cyber threats exploit network vulnerabilities to gain unauthorized access and as these attacks become more sophisticated, number of zero-day attacks has increased. The tactics and strategies used by attackers to penetrate networks often remain undetectable. Additionally, companies do not invest enough in security infrastructure due to a lack of awareness of cyber threats, leading to significant losses.

Healthcare Cybersecurity Market Segmentation Analysis

By Component Analysis

Intrusion Detection and Prevention Segment Dominated owing to Growing Number of Cyber Threats

Based on component, the healthcare cybersecurity market is segmented into solutions and managed services.

The solutions segment is projected to dominate the market with a share of 65.29% in 2026. Solutions are further categorized into Firewall/Antimalware/Antivirus, Intrusion detection and prevention system (IDPS), Identity and Access Management (IAM), Data Loss Prevention (DLP) & Disaster Recovery, Security information and event management (SIEM), and others (encryption & tokenization, and risk & compliance).

Among the above solutions, the Intrusion Detection System (IDS)/Intrusion Prevention System (IPS) segment is anticipated to grow at the highest CAGR of 22.8% over the forecast period. Healthcare facilities are prime targets for cyberattacks due to the sensitive nature of the patient data they handle. The growing number of cyber threats, including ransomware, phishing attacks and data breaches, necessitates the implementation of strong intrusion detection and prevention measures.

Managed services are expected to grow at the highest CAGR during the forecast period (2024-32) due to their role in protecting sensitive data and enhancing overall security. One of the key benefits of these services in healthcare is 24-hour monitoring, allowing for rapid incident response and corrective action in the event of a breach. The focus of managed services is aimed at strengthening defenses against the growing wave of cyberattacks.

By Deployment Analysis

On-premise Led the Market owing to Increasing Cloud-based Security Solutions in Healthcare

Based on deployment, the healthcare cybersecurity market is bifurcated into cloud and on-premise.

On-premise segment will account for 33.21% market share in 2026, owing to strict regulations such as HIPAA requiring healthcare companies to protect patient data, driving investments in robust on-premises security solutions. Additionally, the growing use of Internet of Things (IoT) devices in healthcare increases the attack surface, making on-premises solutions critical for managing and securing these devices.

Cloud segment will witness fastest growth during the forecast period (2025-32). Many healthcare companies are adopting cloud-based security technologies in their business operations. These companies are also adopting cloud-based strategies including partnering and launching cloud-based products, thereby contributing to the growth of the segment. For instance,

- In July 2022, Google Cloud became with Health-ISAC (Health Information Sharing and Analysis Center), leveraging its rich resources and expertise to collaborate with industry leaders to support and secure the healthcare industry. Google also established the Google Cybersecurity Action Team (GCAT) to align security measures and resources to help the healthcare industry improve its cybersecurity efforts.

By Security Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Need for Data Privacy Across Healthcare Companies Dominated the Cloud Security Segment

Based on security type, the market is categorized into cloud security, ransomware and incident response, digital identity, patient privacy, and medical data safety.

Cloud security accounted for the largest healthcare cybersecurity market share by 2024. In healthcare, cloud security is crucial for protecting data privacy across online infrastructure, applications, and platforms. It ensures the clinical applications, confidentiality and integrity of patient records, and valuable medical research data. Cloud security is essential to foster trusted communication between doctors and patients, impacting the reputation and market positioning of healthcare organizations.

Patient privacy and medical data security will witness the highest growth during the forecast period (2025-2032). Healthcare privacy encompasses a set of rules and regulations designed to ensure that only authorized people and organizations can access patient data and medical information. It also includes organizational processes to protect patient health information from unauthorized access, which will contribute to market growth in the coming years.

REGIONAL INSIGHTS

Geographically, the market is divided into five key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America. They are further categorized into countries.

North America Healthcare Cybersecurity Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 8.68 billion in 2025 and USD 10.12 billion in 2026. The growth for the regional market is influenced by presence of leading market players, boosting applications of cybersecurity in the healthcare organizations and facilities. Rising investments in cybersecurity and technological advancements are continuing to drive market expansion. The launch of innovative products to secure health data also plays an important role. Palo Alto Networks launched a Zero Trust security solution named Medical IoT Security which is customized for digital healthcare. The U.S. market is projected to reach USD 7.77 billion by 2026.

South America will witness the highest CAGR growth over the forecast period due to the growing importance of cybersecurity amid the increasing number of cyber threats targeting the healthcare sector in the region.

Asia Pacific healthcare cybersecurity market growth is driven by increasing digitization and the adoption of electronic health records (EHR), wireless medical devices, and telemedicine. Furthermore, growing cyber-attacks in the region will drive market growth from 2025 to 2032. For instance, in February 2021, Trend Micro, a multinational cybersecurity software company in Japan, launched the Trend Micro Vision One expanded detection and response platform. The Japan market is projected to reach USD 1.12 billion by 2026, the China market is projected to reach USD 1.40 billion by 2026, and the India market is projected to reach USD 0.85 billion by 2026

European healthcare firms are strengthening their defenses against cyber attacks by injecting funds in cutting-edge security solutions such as endpoint security, encryption technologies, and threat detection systems. They are also improving employee training programs. The European Commission's December 2023 publication highlights a significant boost to Europe's digital transformation and cybersecurity efforts, with new investments worth more than USD 821.2 million under the Digital Agenda for Europe. The U.K. market is projected to reach USD 1.28 billion by 2026, while the Germany market is projected to reach USD 1.40 billion by 2026.

The Middle East & Africa will witness significant growth during the forecast period, as healthcare organizations work to protect sensitive patient data and ensure the security and integrity of their digital infrastructure.

KEY INDUSTRY PLAYERS

Key Players to Emphasize on Advanced Healthcare Cybersecurity to Strengthen Their Positions

The prominent players in the market, such as IBM Corp., Cisco Systems, Inc., and CyberArk Software Ltd, are expected to dominate the market. These players are focused on offering software to cater to the advanced security requirements. Similarly, these companies are adopting various strategies, such as partnerships and investments, to continue their dominance in the upcoming years.

List of Top Healthcare Cybersecurity Companies :

- IBM Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- AO Kaspersky Labs, Inc. (Russia)

- Palo Alto Networks (U.S.)

- Check Point Software Technologies Ltd (U.S.)

- Broadcom, Inc. (U.S.)

- McAfee, Inc. (U.S.)

- CyberArk Software Ltd (U.S.)

- Trend Micro (Japan)

- CrowdStrike (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Microsoft Corporation announced a new cybersecurity program to assist hospitals that help more than 60 million people in rural America. The Microsoft Cybersecurity for Rural Hospitals program was designed to meet the unique cybersecurity needs of healthcare organizations and will provide free and low-cost technology services to hospitals.

- May 2024: IBM and Palo Alto Networks announced a wide-ranging partnership to provide AI-powered security solutions to customers. This announcement demonstrates Palo Alto Networks and IBM's commitment to advancing their innovation platforms and capabilities.

- December 2023: Cisco Systems, Inc. launched Cisco AI Assistant for Security, a key advancement in integrating AI into the Security Cloud. This tool shows Cisco's commitment to empowering customer support with informed decision support, enhancing the functionality of their tools, and streamlining complex tasks through automation.

- December 2022: Palo Alto Networks (U.S.) launched Medical IoT Security, a solution designed for medical devices by removing implicit trust and constantly verifying every device. This solution enabled healthcare organizations to deploy and manage new connectivity technologies quickly and securely.

- May 2022: Clearwater acquired CynergisTek for USD 17.7 million. CynergisTek offers IT, compliance, and cybersecurity services, focusing on addressing security and privacy issues. This partnership supported CynergisTek's people-centered approach to cybersecurity and auditing, reinforcing its role in serving the healthcare industry and its customers.

REPORT COVERAGE

The study on the market includes prominent areas across the world to help the user get a better knowledge of the industry. Furthermore, the research provides insights into the most recent market trends and an analysis of technologies that are being adopted quickly across the world. It also emphasizes some of the growth-stimulating factors and restrictions, allowing the reader to obtain a thorough understanding of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 17.60% from 2026 to 2034 |

|

Segmentation |

By Component

By Deployment

By Security Type

By Region

|

Frequently Asked Questions

The market is projected to reach USD 97.08 billion by 2034.

In 2025, the market stood at USD 22.52 billion.

The market is projected to record a CAGR of 17.60% during the forecast period.

By security type, cloud security led the market in 2025.

Increased data breach and cyber attacks in healthcare sector are the key factors propelling market growth

IBM Corp., Cisco Systems, Inc., and CyberArk Software Ltd, are the top players in the market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us