Heat Pump Water Heater Market Size, Share & COVID-19 Impact Analysis, By Type (Air Source and Geothermal), By Capacity (Less than 10 kW, 10 kW to 30 kW, and Greater than 30 kW), By End-User (Residential, Commercial, and Industrial), and Regional Forecast, 2025-2032

Heat Pump Water Heater Market Size

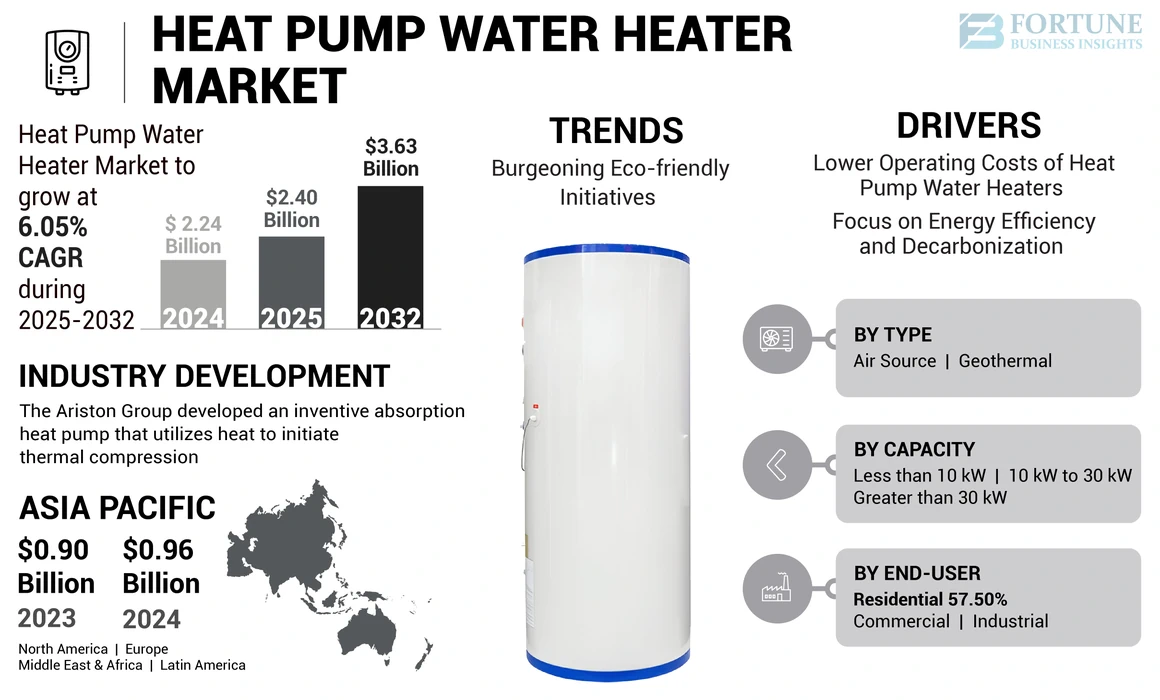

The global heat pump water heater market size was valued at USD 2.24 billion in 2024 and is projected to grow from USD 2.40 billion in 2025 to USD 3.63 billion by 2032, exhibiting a CAGR of 6.05% during the forecast period. Asia Pacific dominated the global market with a share of 42.86% in 2024.

Heat Pump Water Heater (HPWHs) operate by utilizing electricity to extract heat from the surrounding air and apply it to heat water instead of directly generating heat using electricity or gas. This approach enhances energy efficiency, with such water heaters being potentially two to three times more efficient than standard ones. Considering that water heaters typically account for approximately 19% of residential energy consumption, widespread adoption of HPWHs could lead to a substantial reduction in energy usage and a decrease in greenhouse gas emissions. They can be installed in various settings, such as residential homes, hotels, hospitals, and commercial buildings. They are most effective in moderate to warm climates, where the surrounding air or ground temperature is relatively higher, as this enables the heat pump to extract more heat and operate more efficiently.

Global Heat Pump Water Heater Market Overview

Market Size:

- 2024 Value: USD 2.24 billion

- 2025 Forecast: USD 2.40 billion

- 2032 Forecast Value: USD 3.63 billion, with a CAGR of 6.05% during 2025–2032

Market Share:

- Regional Leader: Asia Pacific, commanding 42.86% of the global market in 2024

- Fastest‑Growing Region: Asia Pacific is expected to retain the highest growth momentum through 2032

- End‑User Leader: The air‑source segment led the market in 2024, ahead of geothermal heat pump types

Industry Trends:

- Eco‑friendly adoption rising: Heightened focus on decarbonization and energy-efficient heat pump water heaters due to regulatory pressure and environmental goals

- Air-source dominance: Favored for wide applicability, easier installation, and better performance in moderate climates

- Smart and connected tech adoption: Increasing integration of IoT and digital controls (though specific to HPWH this is suggestive based on overall energy trends)

- Growing deployment across multiple end‑users: Residential, hotel, hospital, and commercial sectors expanding use of HPWHs for energy savings

Driving Factors:

- High energy efficiency and reduced operating costs: HPWHs are often more efficient than conventional water heaters, reducing lifecycle spending

- Government focus on energy transition and CO₂ reduction: Policy mandates and green building codes heavily support HPWH deployment

- Air‑source systems suitability: Effective in various climates and simpler to install versus geothermal or water‑source systems

- Strong infrastructure investment in Asia Pacific: Especially in China and India, driving regional expansion of HPWH systems

- Rising awareness of environmental impact and total cost of ownership: Consumers and businesses prioritize low-emission, cost-saving modern water heating technologies

COVID-19 IMPACT

Reduced Industrial Activities Amid COVID-19 Pandemic Hampered Market Growth

The COVID-19 pandemic had a significant impact on the global heat pump water heater market growth. The pandemic caused disruptions in global supply chains, reduced industrial activities, and created economic uncertainties. The pandemic led to delays and postponements in project installations and investments, including (HPWH) projects. Restrictions on the construction and non-essential services in many countries impacted the installation and sales of new (HPWH). Restrictions on movement, lockdown measures, and international trade disruptions affected the supply chain for components and materials. Delays in the delivery of critical components and constraints in raw material availability impacted the manufacturing and production of the heaters.

However, as countries started to recover from the pandemic, the demand for technological equipment is expected to increase, which could stabilize the global market size.

Heat Pump Water Heater Market Trends

Burgeoning Eco-friendly Initiatives to Stimulate Demand for Heat Pump Water Heaters

Hot water is an everyday requirement for modern living. Traditionally, water is heated through burning fossil fuels or using electric heaters. These methods of water heating work at an energy efficiency of less than 1, which means that the heating delivered is less than electrical energy or fuel used. Increasing energy prices of gas or oil heating systems, along with the need to meet CO2 emission targets, have caused interest in the dedicated growth of heat pumps. In preference to burning fossil fuels to produce heat and continuous CO2 emissions, dedicated heat pumps utilize renewable energy from the environment, such as air, ground, and water. The consumption of primary energy is up to 70% less, hence a drastic reduction of pollution resulting from the use of fossil fuels.

Heat pumps available in the market showcase a 3-5 times higher energy efficiency compared to natural gas boilers. This technology not only minimizes households' exposure to fluctuations in fossil fuel prices but has become increasingly crucial amidst the ongoing global energy crisis. Heating in buildings accounts for about one‐sixth of the world's natural gas demand, rising to one‐third in the European Union. Many heat pumps are multifunctional, offering both heating and cooling capabilities. This decreases the need for a separate air conditioner for a significant portion of the population residing in areas requiring both by 2050. Opting for heat pumps over fossil‐fuel‐based boilers substantially slashes greenhouse gas emissions across major heating markets, even with the current electricity generation mix. This advantage will only grow as electricity systems transition toward decarbonization.

Download Free sample to learn more about this report.

Heat Pump Water Heater Market Growth Factors

Lower Operating Costs and Efficient Operation of Heat Pump Water Heaters to Drive Market Growth

The accelerated deployment of heat pumps brings a range of benefits. Increasing demand for heat pumps to save consumers’ money and shield them from price shocks is driving market growth. The average household or business that uses a heat pump expends less on energy than those utilizing a gas boiler. These energy savings counterbalance the higher upfront costs for heat pumps in many markets today, in some even without subsidies. The economic proposition of heat pumps improves in the context of today’s energy price spikes, with household savings ranging from USD 300 per year in the U.S. to USD 900 in Europe. With appropriate support for poorer households to manage the upfront costs, heat pumps can meaningfully address energy poverty, with energy bill savings in low‐income households ranging between 2% and 6% of their household revenue after moving away from a natural gas boiler.

Water heaters stand as the second most significant energy consumer in homes, following heating and cooling systems. The adoption of new energy-efficient heat pump technology in water heaters proves to be an exceptionally effective method for heating water, resulting in reduced energy consumption and cost savings on utility bills compared to conventional electric resistance water heaters. In contrast to standard electric models, (HPWH’s) exhibit three times the efficiency. They also outperform gas water heaters, which experience energy loss during the venting process, boasting efficiencies three to four times greater than traditional gas water heaters. Stringent governmental regulations aimed at reducing emissions from HVAC equipment in both residential and commercial sectors contribute to advancing the perception of this technology. Furthermore, advancements in technology enable users to personalize settings based on daily, weekly, or monthly needs and even control temperature settings via a mobile app.

Growing Focus on Energy Efficiency and Decarbonization to Boost Market Expansion

Electricity use and power will increase when heat pumps, both air-to-water and ground-source heat pumps, are used for heat sources in new residential buildings compared to heating solutions that do not use electricity. There is a spiralling demand for (HPWH’s) in residential buildings as the application of high-performance insulation reduces hourly peak power in different buildings relative to the minimum insulation. In apartment buildings, high-performance insulation compensated for about half of the additional electric power when buildings with heat pumps were compared to district heating. In this scenario, the application of high-performance insulation will fully compensate for the installation of heat pumps in all apartment buildings. Preference for ground source heat pumps over the air to water heat pumps would further reduce the electricity power needed.

Commercial hot water system requirements can be larger and more demanding than residential systems, and some manufacturers are bringing these higher-output heat pump systems to the market. North America and Asia Pacific are retrofitting heating and cooling equipment across buildings to meet their emission targets. Depending on the type of business, there are specific resources to assess the options, such as commercial resources from the Department of Energy and the Environmental Protection Agency. Some residential integrated HPWHs are equipped with the ability to link with the electricity provider through a device that supports the EcoPort communication standard but has not yet been prevalently adopted for larger commercial integrated HPWHs, nor has a corresponding alternative been established. These could be controlled through a building automation system and could be programmed to respond to demand response signals from a utility. Even the government has a long-term vision to decarbonize the electric grid, which will require market transformations for both the residential and commercial sectors.

RESTRAINING FACTORS

Higher Upfront Costs of Installation of Heat Pump Water Heaters Hampers their Adoption

High upfront costs can discourage consumers despite long‐term savings. The expense of purchasing and installing an air‐to‐air heat pump is usually between USD 3,000 and USD 6,000. However, even the cheapest air‐to‐water models, including modifications to the existing radiator systems, remain two to four times more expensive than natural gas boilers in major heating markets. Financial incentives are currently available in over thirty countries around the globe, covering more than 70% of today’s heating demand. The subsidies in these countries provide the cheapest heat pump options comparable to the cost of a new gas boiler for consumers. Additional incentives can target low‐income households (as in Poland) or high-efficiency models (as in Canada). In some countries, the design of electricity tariffs and energy taxation put heat pumps at a disadvantage relative to fossil fuel boilers. Tariffs and taxes should instead be tilted in favour of cleaner and more efficient consumer choices.

Regardless of the type of property, the upfront capital cost for installing a heat pump today is particularly higher than for hydrogen-ready boilers, and this discrepancy increases once home upgrades such as energy efficiency measures and new heat distribution systems are required. There are several costs facing consumers looking to upgrade their home heating systems from existing gas boilers to low-carbon alternatives. These include costs associated with the capital cost of the new heating system depending on the choice of Ground source heat pump (GSHP), Air source heat pump (ASHP), or Hydrogen hybrid heat pump (HHHP). Secondly, potential energy efficiency measures, such as solid wall insulation, cavity wall insulation, loft insulation and more, are also new heat distribution measures. The upfront capital cost, therefore, increases for heat pumps when we consider the need for these additional measures, and these will naturally vary across property types depending on their existing level of energy efficiency.

Heat Pump Water Heater Market Segmentation Analysis

By Type Analysis

Air Source Segment Dominates the Market Due to its Effective Advantages

Based on type, the global market is segmented into air source and geothermal, where air-source heat pump is dominating the market.

An air-source heat pump offers efficient heating and cooling for the home or any other place. Air-sourced heat pumps are relatively easier to install compared to other heat pumps. The installation process is easier than that of geothermal heat pumps; they don’t require extensive excavation or ground loop installation, such as geothermal. Air sources provide the versatility of installation for them.

Geothermal heat pumps are technologies that influence the nearly constant temperature below the earth (regardless of the season) to heat and cool buildings. Just a few feet under the ground, the earth has a constant temperature of between 50 to 60 degrees Fahrenheit.

By Capacity Analysis

10 kW to 30 kW Capacity Segment Dominates the Market due to Its Growing Usage in Commercial Applications

Based on capacity, the global market is segmented into Less than 10 kW, 10 kW to 30 kW, and greater than 30 kW.

The 10 kW to 30 kW segment dominates the market as it is used largely for commercial applications, including small businesses, such as cafes, restaurants, and small-scale retail establishments. As the handling capacity is greater than the previous one, they can handle the higher demand for hot water, making it suitable for larger households, businesses, and commercial use, including hotels, restaurants, and small-scale industrial facilities.

The capacity less than 10kW are commonly used for residential applications. These systems are designed to meet the hot water needs for small household apartments or individual units or buildings. They are suitable for small amount of usage of hot water for kitchens or bathrooms.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Residential Segment to Take the Lead Due to Growing Demand for Cost-Sensitive Products

Based on end-user, the global market is divided into residential, commercial, and industrial, where residential segment is dominating the market.

The demand for heat pump water heaters is high in residential use due to their high efficiency, converting electricity into heat at a much higher rate. The efficiency leads to reduced energy consumption and lower operating costs. Residential households typically have a significant demand for hot water, and (HPWH’s) fulfil the required demand. The residential segment is particularly sensitive to utility costs. Using a (HPWH) reduces the energy consumption for water heating, resulting in a reduction in electricity bills.

The commercial uses heat from the air to heat water and saves energy as much as 60-80%, when associated to oil fired boilers or electric water heaters. It is ideal for commercial applications like in hotels, hospitals, spas, hostels etc. where hot water is needed in large volumes.

REGIONAL INSIGHTS

The heat pump water heater market share is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific Heat Pump Water Heater Market Size, 2024

To get more information on the regional analysis of this market, Download Free sample

Among all regions, Asia Pacific holds the largest market share and is expected to maintain a steady growth rate over the forecast period. Asia Pacific has been investing heavily in technology and infrastructure, leading to the establishment of high installations across the region. China is dominating the Asia Pacific region as it is working towards a 13th five-year plan. The project aims to develop compressed high-efficiency heat pumps for industrial waste heat, high-efficiency absorption heat pumps and chemical heat pumps for upgrading the grade of low-temperature heat energy.

The market for heat pump water heater is growing in North America as the increasing demand for heat pump water heater sales in the U.S. is fueled by the advantages of energy efficiency and a concenrted effort by manufacturers, utilities, and governments to encourage wider adoption. Similar to the general water heater market, the U.S. market for these products seems to be dominated by a relatively limited number of companies. Several factors have propelled the market growth in the past five years, including the rise in new home construction, the implementation of new energy-efficiency standards, increased incentives from manufacturers and utilities, as well as customer preferences leaning toward more efficient products and those with reduced operational costs. The Heat Pump Water Heater Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 765.89 million by 2032.

Leading manufacturers have recently announced an investment of more than USD 4 billion in the expansion of heat pump production capacity and related efforts, mostly in Europe. Europe has been at the forefront of implementing various policies and schemes for energy efficiency regulations to reduce greenhouse gas emissions and combat climate change. The Energy Efficiency Directive has set minimum energy performance standards for water heaters, encouraging the adoption of energy-efficient technologies, such as heat pumps.

Key Industry Players

Dominance of Large Suppliers to Fortify Market Position for Heat Pump Water Heaters

The competitive landscape for the market for heat pump water heater has been continuously consolidating, giving rise to the current market dominance of a small number of large players. However, each of these large suppliers owns multiple brands/subsidiaries, the majority of which run as independent businesses. The market is in the growing stage, and its primary factors for expansion are the growing demand for reliable & efficient water heaters, as well as the rising energy security concerns as a result of macroeconomic conditions. Meanwhile, the market is restricted by fierce price competition among manufacturers and the absence of distinct product features.

List of Top Heat Pump Water Heater Companies:

- STIEBEL ELTRON GmbH & Co. (Germany)

- Daikin Industries Ltd. (Japan)

- Glen Dimplex Group (Ireland)

- Panasonic Corporation (Japan)

- Samsung Electronics Co. Ltd. (South Korea)

- LG Electronics (South Korea)

- Rheem Manufacturing Company (U.S.)

- Ariston Holding N.V (Italy)

- Bradford White Corporation (U.S.)

- Rinnai Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS:

- March 2023 - Rheem launched its innovative Endeavo Line of heat pumps, which has been completely redesigned from the ground up. This new lineup represents Rheem's most energy-efficient, reliable, and sustainable offering to date. It fully complies with the new Department of Energy regulations that came into effect in 2023.

- April 2023 - The Rheem announced an air-source heat pump that offers uninterrupted heating capabilities even under ambient conditions as low as 22.9°F. This heat pump successfully met the requirements of the U.S. Department of Energy's Cold Climate Heat Pump Challenge.

- January 2023 - Bradford White Water Heaters, a prominent manufacturer of water heaters, boilers, and storage tanks, introduced Bradford White Connect, an external adapter featuring app-driven monitoring technology for their Aerotherm heat pump water heater series. This innovative adapter offers homeowners various convenient options to remotely manage their Aerotherm unit from any location.

- December 2022 - The Ariston Group developed an inventive absorption heat pump that utilizes heat to initiate thermal compression. Known as the Thermally Driven Heat Pump, this system employs a unique thermodynamic cycle, enabling it to deliver high flow temperatures for radiators, consistent heating power, and exceptional energy efficiency, consistently achieving primary energy levels above 100%.

- August 2022 - Stiebel Eltron announced its strategic investment plan to invest more than EUR 600 million toward expanding its heat pump production in the upcoming years. This decision comes as the company anticipates achieving record sales in 2022, driven by the surging demand for eco-friendly heating solutions. The capital will be utilized for capacity expansion and research & development, enabling Stiebel Eltron to meet the rapidly growing demand for heat pumps effectively.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies' types of heat pump water heaters across the region. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.05% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Capacity, By End-User, and By Region |

|

Segmentation |

By Type

|

|

By Capacity

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the size of the market was USD 2.24 billion in 2024.

The market is likely to grow at a CAGR of 6.05% over the forecast period (2025-2032).

The air source segment leads the market.

The market size of Asia Pacific stood at USD 0.96 billion in 2024.

Lower operating costs, efficient operation of pumps, and a focus on energy efficiency and decarbonization are the key factors to drive market growth.

Some of the top players in the market are STIEBEL ELTRON GmbH & Co., Daikin Industries Ltd., Panasonic Corporation, and LG Electronics.

The global market size is expected to reach USD 3.63 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us