Helicopter Leasing Market Size, Share & Industry Analysis, By Helicopter (Light helicopter, Medium Helicopter, and Heavy Helicopter), By Light Helicopter (H125/AS350, Bell 407, R66, AW109/A109, H130T2, H135P2, BK 117, MD 500, and Others), By Medium Helicopter (AW139, Bell 412, UH-1, S-76, AS365, H155, and Others) By Heavy Helicopter (Mil Mi-8, Mil Mi-172, and Others), By Lease Type (Dry Lease and Wet Lease), By Application (Offshore Commercial Operations, Emergency Medical Services (EMS), Firefighting, Search and Rescue (SAR), and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

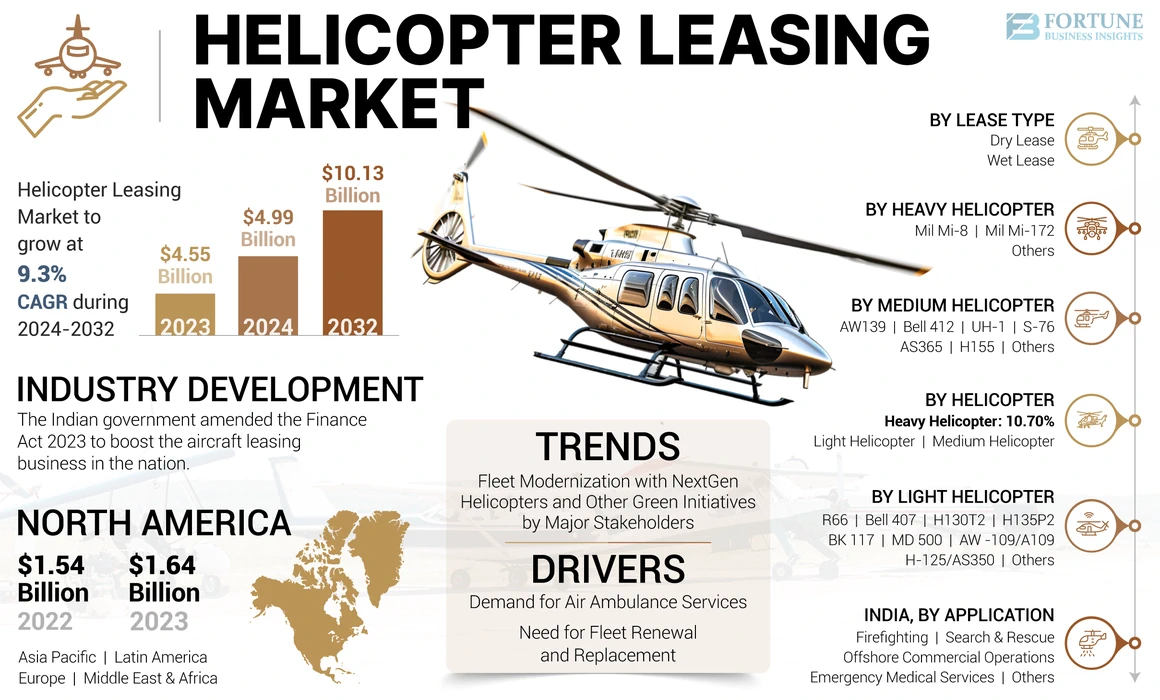

The global helicopter leasing market size was valued at USD 4.55 billion in 2023. The market is projected to grow from USD 4.99 billion in 2024 to USD 10.13 billion by 2032, exhibiting a CAGR of 9.3% during the forecast period. North America dominated the helicopter leasing market with a market share of 36.04% in 2023.

Helicopter charter or leasing is a contract between a helicopter owner and a lessee, in which the owner authorizes the lessor to use the helicopter according to the contract and agreement. There are two main types of leases, namely, dry lease and wet lease. A dry lease is the rental of a helicopter without crew, maintenance, or insurance, leaving operational responsibility on the lessee. In contrast, a wet lease includes the provision of an aircraft along with crew, maintenance, and insurance, while the lessee retains operational control.

The market’s growth is driven by diverse applications ranging from oil and gas exploration to emergency medical services (EMS) and tourism. To cater to these diverse needs, the market offers flexible leasing options, including dry and wet leases.

Furthermore, technological advances in helicopter design and performance have also contributed to market expansion. Modern helicopters offer enhanced performance, safety features, and multi-role configurations, making them attractive for a wide range of applications including search and rescue, firefighting, and public works. The adaptability of helicopters to perform multiple functions increases their appeal to potential lessees.

Moreover, as operators realize the benefits of leasing (reduced financial risk, operational flexibility, and access to the latest technologies) the market is expected to continue its upward trajectory, thereby reshaping helicopter operations globally. The market landscape is continuously evolving, influenced by technological advancements, regulatory developments, and shifting economic conditions.

GLOBAL HELICOPTER LEASING MARKET OVERVIEW

Market Size & Forecast:

- 2023 Market Size: USD 8.19 billion

- 2024 Market Size: USD 8.53 billion

- 2032 Forecast Market Size: USD 12.65 billion

- CAGR: 5.0% from 2024–2032

Market Share:

- Europe dominated the helicopter leasing market with a 34.28% share in 2023, driven by strong demand from offshore oil and gas operations, emergency medical services (EMS), and government contracts across countries such as the U.K., Norway, and Germany.

- By lease type, wet lease is expected to retain the largest market share in 2025, owing to its operational flexibility, reduced upfront costs, and higher demand in time-sensitive mission profiles like HEMS and SAR operations.

Key Country Highlights:

- United States: Increasing offshore energy activity and rising EMS operations are propelling helicopter leasing demand, especially in the Gulf of Mexico and Alaska.

- United Kingdom: North Sea oil and gas sector continues to be a key driver, alongside growing demand for short-term leasing for VIP and corporate transport.

- Germany: Law enforcement and utility sectors are increasingly adopting leased helicopters for surveillance and grid monitoring missions.

- France: Expansion of HEMS coverage and modernization of rotorcraft fleets are supported by long-term leasing agreements with private and public operators.

- Brazil: Growth in offshore transport and VIP tourism segments is fueling demand for leased helicopters in major cities and coastal hubs.

- India: Leasing is gaining momentum in both civil and defense segments due to budget constraints and the need for rapid fleet scalability.

RUSSIA-UKRAINE WAR IMPACT

Regional Disruptions, Economic Sanctions, and Trade Barriers Negatively Impacted the Market

The European Union (EU) and the U.S. implemented extensive sanctions against Russia following its invasion of Ukraine on February 24, 2022. These sanctions, primarily economic, imposed significant costs on its economy, targeting critical sectors, including the airline and aviation industries. Sanctions prohibit the supply of aircraft and aircraft components to Russian entities, effectively disrupting the operations of Russian airlines.

As of March 2022, the Irish Aviation Authority and the Bermuda Civil Aviation Authority mandated that Western aircraft lessors terminate leasing contracts with Russian airlines. This move was part of a broader strategy to limit Russia's access to essential aviation resources and capabilities.

The Russia-Ukraine conflict has had significant financial implications on the helicopter charter market. In April 2022, Air Lease Corporation reported a write-off of leased aircraft stranded in Russia, valued at USD 802 million.

According to Allianz, the aviation insurance industry is expected to suffer significant losses as a result of the conflict. Total insured losses for the industry due to the war are estimated to exceed USD 20 billion, with some forecasts reaching USD 35 billion. The greatest risk is likely to come from aviation lines of business, particularly aircraft leasing companies.

Regulatory and compliance challenges facing the helicopter renting market due to the Russia-Ukraine war include dealing with sanctions, jurisdictional conflicts, complex litigation, insurance complexities, and difficulties in asset recovery.

According to a report from the business post, in 2022, Russia’s unilateral actions, such as suspending bilateral agreements and re-registered leased aircraft domestically, further complicate recovery efforts for lessors.

Helicopter Leasing Market Trends

Fleet Modernization with NextGen Helicopters and Other Green Initiatives by Major Stakeholders are Prominent Market Trends

The modernization of NextGen helicopters and the many green initiatives from major players involved in the helicopter charter industry have significantly contributed to the reduction of carbon emissions in the industry. A number of key actors are pursuing environmentally friendly approaches, including the use of Sustainable Aviation Fuel (SAF) by increasing supply and reducing costs.

For example, as per the International Air Transport Association (IATA) SAF production reached 300 million liters in 2022, a significant increase from 100 million liters in 2021. In October 2021, during the 77th IATA Annual General Meeting in Boston, USA, member airlines committed to achieving zero carbon emissions by 2050.

Pratt is working to develop the PurePower Geared Turbofan engine family, designed to provide environmentally friendly solutions for the aviation industry. In addition, governments around the world have launched programs to facilitate commercial aircraft leasing to increase economic growth and support the aviation industry’s recovery post-COVID-19 pandemic.

Download Free sample to learn more about this report.

Helicopter Leasing Market Growth Factors

Surge in Demand for Air Ambulance Services Will Catalyze the Helicopter Leasing Market Growth

Air ambulances, typically helicopters, are critical for transporting sick or injured people to hospitals during emergencies. Air ambulance services are becoming more prevalent globally due to medical technology advancements, and they have gained popularity as they provide quick and efficient transportation for critically ill patients.

Their ability to reach inaccessible and remote areas makes them an ideal option for transporting patients to medical facilities with speed and efficiency. The growing need for rapid transportation of critical patients to hospitals has driven the growth of the air ambulance services. Helicopters provide unmatched speed, making them an indispensable mode of emergency medical transport.

For instance, in October 2022, at the annual Air Medical Transport Conference, Airbus Helicopters revealed robust sales momentum in the U.S. medical market. Over, the last 12 months, the original equipment manufacturer (OEM) reported the sale of over 35 new single- and twin-engine Airbus rotorcrafts tailored for air medical sector.

Additionally, governments, healthcare organizations, and private entities are investing significantly in expanding and modernizing air ambulance fleets to meet the rising demand. This surge extends beyond traditional emergency responses to include interfacility transfers, ensuring patients access specialized care at the earliest possible stage of their medical journey.

Rising Need for Fleet Renewal and Replacement to Boost Helicopter Leasing Growth

As the global helicopter fleet ages, a significant portion of it is approaching the end of its operational life. This trend is particularly evident in the offshore sector, where older helicopters are increasingly unable to meet modern operational and safety standards. The demand for newer, more efficient aircraft is driving operators to consider leasing as a viable option to renew their fleet without the financial burden of purchasing an entire fleet.

The introduction of advanced helicopter models equipped with the latest technology is improving operational efficiency and safety. Modern helicopters typically feature enhanced fuel efficiency, advanced avionics, and robust safety systems, making them attractive for leasing.

In July 2023, the Ministry of Defence (MoD), Government of India (Lessor), intended to lease 20 helicopters (Reconnaissance and Surveillance helicopters) along with ground support equipment for a period of 5 years. The lease will also include all maintenance support including performance-based logistics (PBL) and training of crew and maintenance team for the duration of the lease.

The helicopter renting market is also shaped by fluctuating demand across different sectors. For instance, the offshore oil and gas industry is experiencing renewed interest as oil prices stabilize, driving increased demand for heavy helicopters.

RESTRAINING FACTORS

Economic Downturns or Instability to Reduce Demand for Helicopter Charter

During economic downturns, businesses often implement stricter budgets controls and reduce unrestricted spending, including travel. Therefore, demand for corporate transportation services, including helicopter rental, tends to decrease. Many businesses shift to more cost-effective travel solutions, such as commercial flights or ground transportation, to manage expenses.

Historical data shows that the aviation sector, including helicopter charter, is particularly sensitive to economic downturns. For example, spikes in carrier bankruptcies coincided with economic downturns, leading to increased equipment downtime and reduced leasing activity.

These conditions create a challenging environment for helicopter lessor and helicopter operators, necessitating strategic adjustments to navigate the complexities of the market during such periods.

Economic instability also affect the costs associated with helicopter operations and maintenance. For instance, changes in fuel prices, which influence economic conditions, can impact operating expenses.

Helicopter Leasing Market Segmentation Analysis

By Helicopter Analysis

Light Helicopter Segment Held the Leading Share due to Its Growing Demand for a Wide Range of Applications

Based on helicopter, the market is segmented into light helicopter, medium helicopter, and heavy helicopter.

The light helicopter segment held the highest share in 2023. Light helicopters are suitable for a wide range of applications, including Search and Rescue (SAR), Emergency Medical Services (EMS), law enforcement, public safety, and firefighting. Their versatility allows them to be used in various industries, contributing to their high market share. For instance, in April 2023, Chinese aircraft manufacturer Avic announced the successful first flight of its two-seat light helicopter AC332 in Tianjin. With a design influenced by the Bell 429 and the Airbus H145 models, the AC332 features a four-blade main rotor system and shrouded tail rotors and is designed to operate at high-temperature operations.

The medium helicopter segment is estimated to be the fastest-growing segment during the forecast period. The growth is attributed to the development of a new generation of medium helicopters equipped with advanced technology to improve operational efficiency and safety. Innovations in avionics, fuel efficiency, and safety systems are making medium helicopters more attractive to operators. This has facilitated their adoption in civil and military applications, positioning the segment to showcase the highest CAGR in the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Light Helicopter Analysis

Proven Performance of H125/AS350 Series Aircraft Led to the Dominance of the Segment

By light helicopter, the market is divided into H125/AS350, Bell 407, R66, AW109/A109, H130T2,

H135P2, BK 117, MD 500, and others.

The H125/AS350 segment accounted for the largest helicopter leasing market share and is estimated to be the fastest-growing during the forecast period of 2024-2032. The H125/AS350 series has been in production since the 1970s and has accumulated nearly 36 million flight hours worldwide, with some aircraft in service for over 41 years. This extensive experience and proven reliability make the H125/AS350 an attractive choice among operators. Moreover, it is a highly versatile light lift helicopter suitable for a wide range of activities such as logistics operations, search and rescue and among others.

The Bell 407 segment is likely to witness significant growth during the forecast period. The Bell 407 has a larger cabin volume and a larger payload capacity than many competitors, including the Airbus H125. This feature is especially appealing to operators who needs leasing for applications such as EMS or cargo transport. In April 2024, ITC-AeroLeasing announced the lease of five Bell 407 aircraft from Med-Trans, bringing the total number of helicopters Med-Trans leases from ITC to seven. The five Bell 407s are configured for emergency medical services and will be deployed to Med-Trans facilities in Texas, Iowa, Oklahoma, and Kansas, supporting local hospital systems.

By Medium Helicopter Analysis

AW139 Segment Holds the Highest Market Share Owing to its Usage in Various Operations

By medium helicopter, the market is divided into AW139, Bell 412, UH-1, S-76, AS365, H155, and others.

The AW139 segment holds the highest market share in the medium helicopter segment due to several compelling factors including safety, performance, cost effectiveness, and so on. AW139 is designed for various roles such as VIP and corporate transport, offshore transport, and search and rescue operations. The AW139 has established a strong presence globally, with over 1,100 units sold to date. It is used by large fleets operators such as CHC Helicopter and Gulf Helicopters, particularly in the offshore oil and gas sector, where its performance, reliability, and adaptability are key factors.

Bell 412 is anticipated to show significant growth during the forecast period. The increased demand for helicopters in oil and gas industry and offshore personnel transport is anticipated to increase the growth of the segment. The, Bell 412’s is recognized for its versatility, operational efficiency, and safety features, making them the contributing factors for the growth of the segment.

By Heavy Helicopter Analysis

Mil Mi-8 to Hold the Highest Market Share Owing to the Continuous Technological Upgrades

By heavy helicopter, the market is divided into Mil Mi-8, Mil Mi-172, and others.

Mil Mi-8 is anticipated to hold highest market share along with highest CAGR during the forecast period. The growth in the segment is owing to the continuous technical upgrades that enhance the helicopter model suitable for a wide range of operations. In April 2024, a new version of the Mil Mi-8 was spotted on Russia's southern borders. The latest version, designated Mi-8AMTSH-VN, represents a modernized version of the classic Mi-8(17) designed for specialized combat operations, including support of special forces.

Others segment is anticipated to show significant CAGR during the forecast period. The category includes model such as S-92, Mil 172, and others. Global dominance, versatility, and large existing fleet indicate these models will continue to have significant market share in the heavy lift helicopter segment.

By Lease Type Analysis

Dry Lease Segment Dominated the Market in 2023 Due to High Cost Efficiency Associated with it

Based on lease type, the market is categorized into dry lease and wet lease.

The dry lease segment held the highest market share in 2023 and is estimated to be the fastest-growing during the forecast period. Dry lease is often more cost-effective, making it an attractive option for operators aiming to optimize operational cost. Operators who already have infrastructure and resources to manage other factors such as crew, maintenance, and insurance prefer dry lease.

The wet lease segment is anticipated to witness significant growth during the forecast period. Wet lease provide a comprehensive solution by including the aircraft, crew, maintenance, and insurance. The growth is attributed to the comprehensive benefits for operators who lack resources and necessary infrastructure. This flexibility, combined with reduced operational burden and risk contributes to their growing adoption.

By Application Analysis

Others Segment Dominated the Market Owing to Wide Range of Applications

Based on application, the market is categorized into offshore commercial operations, Emergency Medical Services (EMS), firefighting, Search and Rescue (SAR), and others.

The others segment is anticipated to hold the largest market share during the forecast period. The segment includes a wide range of applications such as homeland security, corporate transport, utility operation, recreational activities, media, entertainment & tourism, and VIP transport. The rise in demand for such applications globally and increased interest by operators in expanding their application areas, is expected to boost to the growth of the segment during the forecast period.

Emergency medical service (EMS) is anticipated to experience the highest growth rate during the forecast period. As the market continues to expand, helicopter charter for EMS operations is expected to play a key role in meeting the growing needs of healthcare providers. In May 2024, Milestone Aviation leased two AW169 helicopters from Northern Rescue Helicopters. The lease agreements signed would enable Northern Rescue Helicopters to standardize its fleet for EMS and SAR missions.

REGIONAL INSIGHTS

Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

North America Helicopter Leasing Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the largest helicopter renting market share in 2023 and was valued at USD 1.64 billion in 2023. This region's growth is due to increasing demand for helicopter lease, advancement in infrastructure activities, and technological innovations. Moreover, leasing companies from the region often cater international clients, leveraging their expertise and fleet to serve global clients and solidify their position in market. For instance, In July 2024, Victoria Helicopters Inc., a custom helicopter charter solutions company, announced that it has signed a bare aircraft lease agreement with the Texas Department of Public Safety, through Berry Aviation, Inc. for an Airbus H125 helicopter.

The market in Europe held the second-largest share in the base year. The region’s growth is due to the geographic location and its role as a hub for international business and travel. Furthermore, the regions strategic position facilitates global operations and supports a diverse range of leasing needs. In April 2024, Airbus Helicopters and GDAT signed a contract for 20 H175 helicopters (ten firm orders and ten options). GD Helicopter Finance (GDHF), a helicopter leasing and financing startup headquartered in Dublin, Ireland will be promoting these H175 helicopters to clients in the energy, SAR, and EMS, market sectors globally.

Asia Pacific is the fastest-growing region in the market. Rapid economic growth in countries such as China, India, and Australia is driving the demand for offshore helicopter charter in the region. Furthermore, the region is investing heavily in sectors such as oil and gas, Emergency Medical Services (EMS), and others. Other factors such as supportive regulatory environment and technological advancements collectively drive the regions market growth.

The Middle East & Africa will witness significant helicopter leasing growth during the forecast period. In the region particularly in countries such as Saudi Arabia, UAE helicopters are essential for offshore oil and gas operations. For instance, Saudi Arabia’s national oil company, Aramco heavily relies on helicopter for its offshore platforms. Apart from this, there is a significant increase in helicopter renting for travel and tourism sector in the region. According to Dubai Tourism Board, there has been a rise in high-end tourism experiences, including helicopter tours.

Latin America is anticipated to show moderate growth in helicopter leasing during the forecast period. The growth in the region is driven by the region’s expanding mining sectors, rising demand for VIP travel, and others. Furthermore, the growth of the businesses in the region is leading to a rising demand for leased fleet. Countries such as Peru, Chile, and Brazil are major players in global mining and oil and gas industry. In February 2024, Milestone Aviation Group Limited signed a lease agreement for a Sikorsky S-92 helicopter with Líder Aviação, a Brazilian offshore operator.

KEY INDUSTRY PLAYERS

Key Players Are Focusing on Introducing New Models and Expanding Helicopter Leasing Service to Strengthen their Market Position

The helicopter leasing industry is highly fragmented, with several players involved in developing leasing solutions. Latest trends in the market include the introduction of new helicopter models that incorporate cutting edge technology, offering the benefits of modern equipment without the high costs associated outright ownership. The approach helps companies strengthening their market position. Many key players are focused on expanding leasing services to boost strategic partnership.

In March 2024, China's Skyco International Leasing Company signed a contract to purchase six Airbus Helicopters H175s. The Guangdong provincial government would use these super-medium-sized helicopters for search and rescue, emergency medical assistance, disaster relief, and public service missions.

List of Top Helicopter Leasing Companies:

- Waypoint Leasing (Ireland)

- Lobo Leasing (Ireland)

- Lease Corporation International (LCI) (Ireland)

- Macquarie Rotorcraft Leasing (Australia)

- Milestone Aviation (Ireland)

- Nova Capital (U.K.)

- AerCap Holdings N.V. (Ireland)

- Air Lease Corporation (U.S.)

- BBAM US LP (U.S)

- Savback Helicopters (Sweden)

KEY INDUSTRY DEVELOPMENTS:

- November 2024 – Helicopter leasing firm GDHF has entered into a framework deal for 10 Leonardo AW189 super medium helicopters to assist the offshore oil-and-gas industry, with deliveries scheduled from 2027 to 2029. The deal, revealed on the first day of the European Rotors trade exhibition in Amsterdam, the Netherlands, will increase GDHF’s AW189 fleet to 13 aircraft.

- July 2024 – Aviation leasing specialist AerCap revealed that it signed 21 helicopter leases agreements with milestone aviation in the second quarter (Q2) of 2024. The owner of Milestone Aviation signed a total of 162 leases, including, in addition to helicopters, 6 wide-body aircraft, 88 narrow-body aircraft, fuselages and 47 engines with Aercap.

- February 2024 – The Milestone Aviation Group Limited (Milestone) unveiled that it had signed lease agreements for two Leonardo AW139 helicopters with Lufttransport, scheduled for delivery in 2025.

- November 2023 - Helicopter charter provider Milestone Aviation Group Limited announced the signing of lease agreements with UNI-FLY (Danish and British helicopter operator) for three Leonardo AW169 helicopters.

- July 2023 - The Indian government amended the Finance Act 2023, under which The Central Board of Direct Taxes (CBDT) exempted the dividend paid by an International Financial Services Centre (IFSC) leasing aircraft to another such unit from tax deduction at source (TDS). The amendment, effective from September 1, 2023, aimed to boost the aircraft leasing business in the nation. The payee would be required to provide a statement-cum-declaration to the tax department to claim the exemption.

REPORT COVERAGE

The report provides a detailed analysis of the market insights, focusing on key aspects such as leading companies, different types of helicopters, materials used, and their applications in helicopter charter services. Besides this, the report offers insights into the market trends, supply chain trends, and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

CAGR |

9.3% CAGR during the 2024-2032 |

|

Unit |

Value (USD Billion) |

|

|

By Helicopter

|

|

By Light Helicopter

|

|

|

By Medium Helicopter

|

|

|

By Heavy Helicopter

|

|

|

By Lease Type

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 4.55 billion in 2023 and is projected to reach USD 10.13 billion by 2032.

Registering a CAGR of 9.3%, the market will exhibit steady growth during the forecast period.

By helicopter, the light helicopter segment led this market.

Waypoint Leasing (Ireland), Lobo Leasing (Ireland), Lease Corporation International (LCI) (Ireland), and Macquarie Rotorcraft Leasing (Australia) are few top players in the global market.

North America dominated the market in terms of share in 2023.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us