Helideck Monitoring System Market Size, Share & Industry Analysis, By Helideck Type (Fixed, Portable, and Rooftop), By Components (Sensors, Display & Communication Systems, Helideck Lighting Systems, and Software), By Point of Sale (OEM and Aftermarket), By End User (Oil & Gas Exploration, Marine Operations, Government & Civil Agencies, Defense & Homeland Security, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

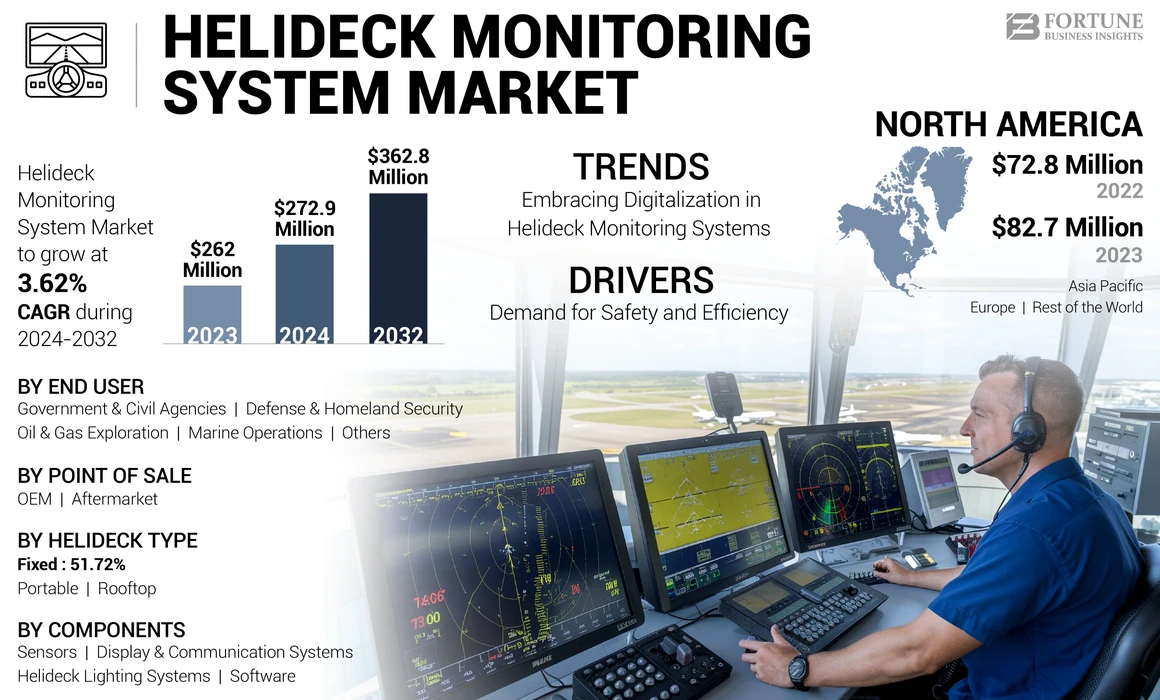

The global helideck monitoring system market size was valued at USD 262 million in 2023. The market is projected to grow from USD 272.9 million in 2024 to USD 362.8 million by 2032, exhibiting a CAGR of 3.62% during the forecast period. North America dominated the helideck monitoring system market with a market share of 31.56% in 2023.

A Helideck Monitoring System (HMS) is defined as an integrated set of sensors, cameras, and communication tools designed to monitor the operational environment of helidecks. Its primary functions include:

- Ensuring safety during helicopter takeoff and landing

- Providing real-time data on atmospheric conditions

- Detecting potential hazards that could affect helicopter operations

- Offering alerts and warnings to personnel regarding unsafe conditions

The HMS is essential for industries, such as oil and gas, marine operations, and defense, where helicopter transport is critical. The market is a specialized sector that focuses on the design, production, and maintenance of monitoring systems for helidecks, primarily located on offshore installations, such as oil rigs and marine vessels. These systems are crucial for ensuring the safety and efficiency of helicopter operations in challenging maritime environments by monitoring various parameters, including weather conditions, helideck status, and aircraft positioning.

The global market is expected to witness significant growth in the coming years, driven by advancements in technology, regulatory changes, and increasing offshore activities. The integration of advanced sensor technologies and digital solutions is anticipated to enhance the capabilities of HMS. Innovations, such as real-time monitoring systems and embedded sensors, will improve operational efficiency and safety during helicopter operations on helidecks.

For instance, projects, such as the EU-funded MORPHO initiative aim to develop smart aeronautical parts that facilitate real-time monitoring and maintenance, which will be crucial for the HMS market. Regulatory frameworks, such as the European Union Aviation Safety Agency (EASA) standards for electric and hybrid helicopters, are expected to shape the market landscape. Compliance with these regulations will drive demand for sophisticated monitoring systems that ensure safety and operational efficiency. Increased military spending on modernization programs, such as Poland's acquisition of Boeing AH-64E Apache helicopters, will likely contribute to the demand for HMS. These programs necessitate robust monitoring systems to ensure safe operations in military contexts. The expansion of offshore oil and gas industries, along with the development of offshore wind farms, is a significant driver for the HMS market. As more operations take place in challenging maritime environments, the need for reliable monitoring systems becomes critical to ensuring safe helicopter landings and takeoffs.

Several key players dominate the global market, contributing significantly to its revenue generation, such as Fugro, Vaisala, Kongsberg Gruppen, ABB, and Miros Group. These companies are involved in various activities ranging from product development to strategic partnerships aimed at enhancing their market presence. They focus on integrating advanced technologies, such as AI and IoT, into their HMS solutions to improve operational efficiency and safety standards.

GLOBAL HELIDECK MONITORING SYSTEM MARKET Overview & Key Metrics

Market Size & Forecast:

- 2023 Market Size: USD 262 million

- 2024 Market Size: USD 272.9 million

- 2032 Forecast Market Size: USD 362.8 million

- CAGR: 3.62% from 2024–2032

Market Share:

- North America dominated the helideck monitoring system market with a 31.56% share in 2023, supported by a robust offshore oil & gas sector and advanced aviation infrastructure.

- By helideck type, fixed helidecks are expected to retain the largest market share in 2025, driven by their widespread use on offshore platforms, military bases, and hospitals requiring permanent, high-frequency helicopter operations.

Key Country Highlights:

- United States: Demand is driven by large-scale offshore oil & gas operations in the Gulf of Mexico and defense modernization initiatives requiring advanced monitoring technologies.

- United Kingdom: CAP437 safety regulations and the expansion of offshore wind farms are fueling demand for compliant and sophisticated HMS on North Sea platforms.

- India: Rising offshore exploration and medical evacuation needs are boosting investments in both fixed and portable helideck monitoring systems.

- United Arab Emirates: Ongoing offshore infrastructure expansion and high investment in oil platforms are contributing to growing demand for real-time monitoring technologies.

Market Dynamics

Market Drivers

Increasing Demand for Safety and Efficiency is leading to Robust Helideck Monitoring System Market Growth

The global market is experiencing robust growth driven by the increasing demand for safety and operational efficiency in helicopter operations, particularly in offshore environments. As offshore oil and gas exploration intensifies, the need for advanced monitoring systems to ensure safe helicopter landings and takeoffs becomes paramount. This growth is largely attributed to the rising investments in offshore exploration and production activities, especially in emerging economies where new drilling projects are being initiated.

Recent developments also play a crucial role in driving market growth. Companies are increasingly adopting digital solutions and IoT technologies to enhance the capabilities of HMS. For example, in April 2022, Observator Instruments received CAP437 certification from the Civil Aviation Authority (CAA) for its helideck monitoring system, which conforms to stringent safety standards required for offshore operations. This certification was part of their development of the OIC-2021 HMS Server, installed on Van Oord’s offshore installation vessel Aeolus. It showcased how compliance with regulatory standards can stimulate demand for updated monitoring systems.

Moreover, military modernization programs are contributing significantly to market growth. For instance, Poland's acquisition of 96 Boeing AH-64E Apache helicopters in 2023 underscores the increasing focus on enhancing military capabilities, which necessitates reliable helideck monitoring solutions for safe helicopter operations. These developments indicate a broader trend where both civilian and military sectors are prioritizing safety through advanced monitoring systems.

The growing emphasis on environmental sustainability and safety regulations further propels the demand for HMS. As offshore wind farms increase, there is a corresponding need for effective monitoring systems to support helicopter operations related to construction and maintenance activities. The integration of smart monitoring solutions allows operators to optimize helicopter movements based on real-time data, thereby improving operational efficiency and safety standards.

Market Restraints

High Costs and Regulatory Challenges to Hinder Investments and Market Growth

Despite the promising growth trajectory of the market, several restraining factors could impede its expansion. One significant challenge is the high cost associated with implementing advanced monitoring systems. The initial investment required for sophisticated HMS can be substantial, making it a barrier for smaller operators or companies with limited budgets. Recent reports indicate that while larger firms may easily absorb these costs, smaller entities struggle to justify such expenditures amidst tight profit margins prevalent in the oil and gas sector.

Furthermore, regulatory challenges present another hurdle for helideck monitoring system market growth. Compliance with evolving safety standards can be complex and costly. For instance, as of April 2021, new CAP437 standards mandated rigorous testing and certification processes for operating in European waters. Companies such as Observator Instruments have had to invest significantly in R&D to meet these requirements while ensuring their products remain competitive. This regulatory burden can deter smaller players from entering the market or prompt existing companies to delay upgrades or replacements of their systems.

Moreover, geopolitical uncertainties can impact investment decisions in offshore projects, leading to fluctuations in demand. The ongoing Russia-Ukraine conflict has already caused disruptions in energy supply chains and increased operational risks in certain regions. This instability may lead companies to postpone or scale back their investments in new technologies, such as HMS, until the geopolitical situation stabilizes.

Lastly, the rapid pace of technological advancements poses a challenge as well. Companies must continuously innovate to keep up with competitors who are developing cutting-edge solutions that enhance safety and efficiency. The pressure to adopt new technologies can strain resources and divert attention from core business operations, creating an environment where some firms may struggle to maintain their market position.

Market Opportunities

Expansion into Emerging Markets Presents Significant Growth Opportunities

The market presents numerous opportunities for growth, particularly through expansion into emerging markets where offshore activities are on the rise. Countries in Asia Pacific, such as India and China, are ramping up their offshore oil and gas exploration efforts due to increasing energy demands. As reported in February 2024, North America is expected to dominate the HMS market; however, significant growth is anticipated in Asia Pacific due to these emerging opportunities. Companies that strategically position themselves within these markets could capitalize on the increasing demand for reliable helideck monitoring solutions.

Furthermore, technological advancements offer avenues for innovation within the HMS sector. The integration of IoT technologies and artificial intelligence in HMS can enhance predictive maintenance capabilities and operational efficiency. For instance, advancements such as real-time data analytics can provide operators with critical insights into weather patterns and helideck conditions, allowing them to make informed decisions quickly. Companies investing in R&D for smart HMS solutions are likely to gain a competitive edge.

Moreover, partnerships between technology providers and end-users present significant opportunities for collaboration and product development. For example, recent collaborations between companies, such as Fugro and various offshore operators, have focused on developing customized monitoring solutions tailored to specific operational needs. Such partnerships can facilitate knowledge sharing and resource pooling, accelerating innovation while reducing costs.

As environmental regulations become stricter globally, there is an increasing need for advanced monitoring systems that comply with sustainability standards. Companies that develop eco-friendly helideck monitoring solutions will not only meet regulatory requirements but also appeal to environmentally conscious clients looking to minimize their ecological footprint during offshore operations.

Helideck Monitoring System Market Trends

Embracing Digitalization in HMS to Drive Market Trends

The market is witnessing significant technological trends that are shaping its future landscape. One prominent trend is the digitalization of MRO (Maintenance, Repair, Overhaul) processes within the industry. As companies increasingly adopt digital tools and platforms for managing their assets more efficiently, there is a growing demand for HMS that integrates seamlessly with these digital ecosystems. In February 2024, it was highlighted that advancements, such as sensor technology integration with weather forecasting systems, are becoming essential features of modern HMS solutions.

Another key trend is the incorporation of artificial intelligence (AI) into helideck monitoring systems. AI-driven analytics can enhance decision-making processes by providing predictive insights based on historical data patterns related to weather conditions or helideck usage trends. This capability allows operators to anticipate potential issues before they arise, thereby improving safety outcomes during helicopter operations. Companies investing in AI capabilities within their HMS offerings stand poised to capture significant market share.

Moreover, there is an increasing emphasis on user-friendly interfaces that facilitate ease of use during critical operations. Recent developments have seen companies, such as Observator Instruments, introducing software packages such as Blue2Cast that offer intuitive dashboards displaying meteorological data alongside helideck status information. Such innovations not only improve operational efficiency but also enhance user experience during high-pressure situations.

Sustainability trends are influencing technological advancements within the HMS sector as well. With the growing awareness around environmental issues associated with offshore operations, there is a push toward developing eco-friendly monitoring solutions that minimize energy consumption while maximizing performance efficacy. Companies focusing on sustainability will likely gain favor among clients seeking responsible operational practices.

Download Free sample to learn more about this report.

Impact of Russia-Ukraine War

Geopolitical Tensions Affecting Operations are Influencing the Market Amid the Russia-Ukraine War

The ongoing Russia-Ukraine conflict has had profound implications on various global markets, including the sector. One immediate impact has been disruptions in energy supply chains across Europe, which directly affects investment decisions related to offshore oil and gas projects—key drivers of demand for HMS. As companies reassess their operational strategies amidst geopolitical tensions, many may choose to delay or scale back investments in new technologies until stability returns.

Furthermore, increased operational risks associated with conducting business near conflict zones have led some firms operating in affected regions to reconsider their presence altogether. This shift could result in reduced demand as companies either exit or limit their activities within these high-risk areas.

Moreover, heightened security concerns may lead organizations involved in maritime operations to prioritize investments solely focused on immediate safety measures rather than long-term technological upgrades, such as advanced HMS solutions. This short-term focus could stifle innovation within the sector as firms become more risk-averse.

On a more positive note, though, some analysts suggest that conflicts often lead nations involved—particularly those reliant on energy exports—to invest heavily in enhancing their military capabilities, which could indirectly boost demand for sophisticated HMS designed specifically for military applications. However, this potential opportunity must be balanced against the broader economic uncertainties created by ongoing geopolitical strife.

While the Russia-Ukraine war presents challenges that could restrain market growth through reduced investments and heightened risks, it also creates nuanced opportunities related specifically toward enhancing military readiness amidst evolving global dynamics.

SEGMENTATION ANALYSIS

By Helideck Type

Fixed Helideck Dominated the Market Owing to Ongoing Expansion of Offshore Oil and Gas Exploration Activities

The market is classified by helideck type into fixed, portable, and rooftop.

Fixed helideck is the dominant segment with the largest in the market share in 2023. Fixed helidecks, commonly found on offshore oil rigs and large vessels, are experiencing robust demand due to the ongoing expansion of offshore oil and gas exploration activities. The need for reliable monitoring systems to ensure safe helicopter operations on these permanent structures is paramount. Their widespread use in offshore oil and gas platforms, hospitals, and military installations. These structures provide a stable and permanent landing area for helicopters, making them essential for operations that require frequent air transport. The increasing demand for efficient logistics in remote locations, particularly in the oil and gas sector, drives the need for fixed helidecks equipped with advanced monitoring systems to ensure safety and compliance with aviation regulations.

For instance, in February 2024, Kongsberg Gruppen announced a contract with an offshore oil platform operator to supply advanced HMS solutions for their fixed helidecks, enhancing safety protocols and operational efficiency. For instance, in January 2024, Babcock International Group announced a contract with a major oil company to install advanced HMSs on multiple fixed platforms in the North Sea. This contract aims to enhance operational safety and efficiency by providing real-time data on weather conditions, helideck status, and helicopter movements.

The portable helideck segment is experiencing the fastest growth due to increasing demand for flexible and mobile solutions that can be deployed in various environments. Portable helidecks are particularly advantageous for emergency response operations, military missions, and disaster relief efforts where rapid deployment is essential. The ability to set up temporary landing zones quickly allows organizations to respond effectively to emergencies, driving demand for portable systems.

The portable helideck segment is also emerging as one of the fastest-growing categories within the market. Portable helidecks are gaining traction due to their versatility and ability to be deployed in remote locations where fixed installations may not be feasible.

For instance, in March 2023, Fugro successfully deployed a portable system for a marine construction project in the North Sea, allowing for flexible operations while ensuring compliance with safety regulations. For instance, In March 2023, Helidex Technologies introduced a new line of portable helidecks designed for rapid deployment in emergencies. This innovative product features lightweight materials and modular designs that allow for quick assembly and disassembly. The launch received positive feedback from emergency services and military organizations looking for adaptable solutions in critical situations. This adaptability appeals to various industries, including construction and emergency response, further driving growth in this segment.

To know how our report can help streamline your business, Speak to Analyst

By Components Analysis

Sensors Dominate the Market Due to Their Critical Role in Ensuring Safety and Operational Efficiency During Helicopter Landings and Takeoffs

The market is segmented by components into sensors, display & communication systems, helideck lighting systems, and software.

Among the components, the sensors segment is the dominant, with the largest market share in 2023. The sensors segment dominates the market due to its critical role in ensuring safety and operational efficiency during helicopter landings and takeoffs. Advanced sensor technologies, including weather sensors, motion detectors, and obstacle detection systems, are essential for providing real-time data on environmental conditions and helideck status. The increasing focus on safety regulations in the aviation industry drives investments in sophisticated sensor systems that enhance situational awareness and minimize risks associated with helicopter operations.

For instance, in November 2023, Honeywell announced a contract with a leading offshore oil and gas company to supply advanced sensor systems for their helidecks. This contract aims to enhance safety protocols by integrating state-of-the-art weather monitoring and obstacle detection sensors, reflecting the industry's commitment to improving operational safety standards. For instance, in January 2024, Vaisala launched a new line of weather sensors specifically designed for helideck applications, which integrate seamlessly with existing monitoring systems to provide accurate environmental data.

The software segment is experiencing the fastest growth due to the increasing integration of digital technologies in HMSs. Advanced software solutions enable better data analysis, real-time monitoring, and enhanced communication between ground control and aircraft. The rise of smart helidecks equipped with automated systems for managing operations is driving demand for software that can seamlessly integrate various components, including sensors and communication systems. As digitalization becomes more prevalent in maritime operations, there is a growing need for sophisticated software that can analyze data from various sensors and present it in an actionable format.

For instance, in December 2023, Observator Group announced a partnership with several offshore operators to develop a comprehensive software platform that integrates sensor data with predictive analytics capabilities. This collaboration aims to enhance decision-making processes during helicopter operations, thereby driving demand for advanced software solutions.

For instance, in January 2024, Helideck Solutions launched a new software platform designed for helideck management that incorporates artificial intelligence (AI) for predictive analytics and operational efficiency. This platform allows operators to monitor helidecks remotely and make informed decisions based on real-time data analysis. The introduction of this innovative software solution highlights the growing trend toward automation and digitalization in the helideck monitoring sector.

By Point of Sale

OEM Segment Dominates the Market Owing to Increased Demand for Integrated and High-quality Monitoring Systems

The market is segmented by point of sale into Original Equipment Manufacturer (OEM) and aftermarket.

The OEM segment dominates the market due to the increasing demand for integrated and high-quality monitoring systems that ensure safety and compliance in helicopter operations. OEMs provide complete solutions that include advanced sensors, display systems, and software tailored for specific helideck applications. As the aviation industry emphasizes safety and efficiency, operators prefer OEM products that guarantee compatibility and reliability. The focus on new installations in offshore oil and gas platforms, hospitals, and military bases drives the growth of the OEM segment.

For instance, in February 2024, Kongsberg Gruppen announced a contract with a major offshore operator to supply a comprehensive HMS as part of a new platform development project. This system will include advanced sensors and communication technologies designed to enhance operational safety and efficiency on fixed helidecks in challenging environments. For instance, in February 2024, Dynamax Inc. reported a significant increase in aftermarket sales following their introduction of upgraded sensor packages compatible with existing Helideck Monitoring System installations on offshore platforms.

The aftermarket segment is experiencing the fastest growth due to the increasing need for upgrades, replacements, and maintenance of existing systems. As many operators seek to extend the life of their current systems without incurring the costs of new installations, aftermarket solutions provide a cost-effective alternative. Additionally, advancements in technology make it feasible for aftermarket suppliers to offer competitive products that enhance the functionality of older systems, appealing to budget-conscious operators.

For instance, in January 2024, Helideck Solutions launched a new line of aftermarket components designed to upgrade existing systems. This initiative focuses on improving sensor capabilities and software functionalities for older installations, allowing operators to enhance their current setups without undergoing full system replacements. The response from the market has been positive, indicating strong demand for these cost-effective upgrade solutions. For instance, in November 2023, ABB secured a contract with a major oil company to supply new HMS units for multiple offshore platforms, emphasizing the continued importance of OEM sales in meeting industry demands.

By End User

Oil & Gas Exploration Segment Dominated the Market Owing to Rising Need for Safe and Efficient Helicopter Operations

The market is segmented by end user into oil & gas exploration, marine operations, government & civil agencies, defense & homeland security, and others.

The oil & gas exploration sector accounted for the largest market share and remained the dominant end user due to the critical need for safe and efficient helicopter operations in offshore drilling and production activities. As exploration moves into deeper waters and more remote locations, the demand for advanced monitoring systems that ensure compliance with safety regulations and enhance operational efficiency is increasing. The rising focus on safety standards in this sector further drives investments in sophisticated helideck monitoring solutions that can provide real-time data on environmental conditions and helideck status.

For instance, in February 2024, Babcock International Group secured a contract with a major oil company to install advanced Helideck Monitoring System on multiple offshore platforms in the North Sea. This contract aims to enhance operational safety by integrating state-of-the-art sensors and communication technologies, reflecting the industry's commitment to improving safety protocols in oil and gas operations. For instance, in January 2024, Fugro announced its collaboration with an oil major to enhance safety protocols through advanced HMS solutions on their offshore platforms.

The defense and homeland security segment is experiencing the fastest growth in the market due to increasing investments in military capabilities and the need for enhanced surveillance and operational readiness. As military operations expand globally, there is a growing emphasis on using helicopters for troop transport, reconnaissance, and emergency response. The integration of advanced monitoring systems into military helidecks enhances situational awareness, safety, and operational efficiency, making them essential for modern defense strategies.

For instance, In January 2024, Northrop Grumman announced a partnership with the U.S. Department of Defense to develop advanced systems for military bases. This initiative focuses on integrating cutting-edge sensor technologies and software solutions to improve helicopter operations' safety and efficiency. The contract aims to enhance situational awareness during military operations, showcasing the growing importance of Helideck Monitoring System systems in defense applications. For instance, in March 2023, Miros Group launched a new HMS tailored specifically for marine applications, focusing on providing real-time data that enhances operational safety during vessel operations. This trend reflects a broader shift toward integrating advanced monitoring technologies across various maritime applications.

Supply Chain Analysis

Raw Materials and Components Suppliers: - The supply chain for the market begins with raw materials and components suppliers. These suppliers provide essential parts such as sensors, communication devices, and lighting systems that are critical for HMS functionality. The demand for high-quality sensors has surged due to increasing safety regulations and technological advancements in monitoring systems.

Manufacturers and Assembly: Following raw materials, manufacturers play a pivotal role in assembling the Helideck Monitoring System components into complete systems. These manufacturers are responsible for integrating various technologies to create efficient and reliable monitoring solutions. Companies, such as Kongsberg Gruppen and Fugro are significant players in this space.

Distributors and Resellers: - Distributors and resellers act as intermediaries between manufacturers and end-users, ensuring that HMS products reach the market effectively. They play a critical role in marketing these systems to various sectors, including oil & gas, marine, and defense. The effectiveness of distribution channels can significantly impact market penetration and sales volume.

End Users: - The final component of the supply chain consists of end users, which include industries such as oil & gas, marine operations, government agencies, and defense organizations. These sectors rely heavily on HMS for safe helicopter operations on helidecks. The growing emphasis on safety protocols and operational efficiency drives demand for advanced monitoring solutions.

Helideck Monitoring System Market Regional Outlook

The market is segmented by region into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Helideck Monitoring System Market Size, 2023 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America remains the dominant region in the helideck monitoring system market share due to its advanced aviation infrastructure and significant investments in offshore oil and gas operations. The presence of major oil companies and military installations drives demand for sophisticated systems that ensure safety and compliance with stringent regulations. Additionally, the increasing focus on improving operational efficiency in helicopter operations further propels market growth.

For instance, in January 2024, Honeywell announced a contract with a leading oil company to supply advanced systems for offshore platforms in the Gulf of Mexico. This contract aims to enhance safety protocols by integrating state-of-the-art sensors and communication technologies, reflecting North America's commitment to operational excellence in its energy sector.

Europe

Europe is the second-dominant region in this market, driven by increasing investments in offshore wind farms and stringent safety regulations for helicopter operations. The European Union's focus on renewable energy sources has led to a surge in offshore activities, necessitating advanced systems to ensure safe helicopter landings and takeoffs in challenging environments. For instance, in March 2023, Babcock International Group secured a contract with a European offshore wind farm operator to install systems on newly constructed platforms. This initiative aims to enhance safety during helicopter operations associated with maintenance and logistics for wind turbine installations.

Asia Pacific

The Asia Pacific region is witnessing significant growth in the market due to increasing investments in maritime infrastructure and rising helicopter usage for medical emergencies and logistics. Countries, such as Australia and India are expanding their offshore capabilities, which drives demand for reliable monitoring systems that ensure safe helicopter operations. For instance, in February 2024, Thales Group announced a partnership with an Australian energy company to provide integrated helideck monitoring solutions for offshore facilities. This collaboration aims to enhance operational safety and efficiency as Australia expands its offshore energy sector.

Rest of the World

The Rest of the World is experiencing the fastest growth due to emerging markets investing in their aviation infrastructure amid expanding oil and gas exploration activities. The increasing need for efficient transportation solutions in remote areas drives demand for systems that ensure safe helicopter operations. For instance, in April 2023, an African oil consortium awarded a contract to a local supplier for the installation of systems on multiple offshore platforms. This initiative aims to enhance safety measures as exploration activities ramp up in the region, showcasing the growing importance of helideck monitoring technology in emerging markets.

Competitive Landscape

Key Industry Players

Leading Players Are Focusing on Integrating Advanced Technologies to Gain Strong Foothold

The market is characterized by a competitive landscape featuring key players, such as Kongsberg Gruppen, Thales Group, and Honeywell. These companies are integrating advanced technologies, such as IoT, AI, and real-time data analytics, into their systems to enhance safety and operational efficiency while complying with strict aviation regulations. The continuous technological evolution addresses the rising demand for automated solutions across sectors such as oil and gas, defense, and emergency services.

For instance, in 2023, Kongsberg Gruppen launched an upgraded HMS that includes advanced sensors and AI-driven analytics for real-time monitoring and predictive maintenance aimed at improving safety in offshore operations. For instance, in February 2024, Honeywell secured a contract with a major offshore oil company to supply its advanced monitoring systems, highlighting the importance of reliable communication and data integration.

Regional factors influence the competitive dynamics, with North America leading due to its established oil and gas infrastructure, followed by Europe and the rapidly growing Asia Pacific region. Overall, the market is set for significant growth as key players focus on technological integration and expanding their geographical reach to capitalize on emerging opportunities.

List of Key Helideck Monitoring System Companies Profiled:

- Kongsberg Gruppen ASA (Norway)

- Fugro N.V. (Netherlands)

- Vaisala Oyj (Finland)

- ABB Ltd. (Switzerland)

- ASB Systems Private Ltd. (India)

- AWA Marine Ltd. (U.K.)

- Monitor Systems Scotland Ltd. (U.K.)

- Dynamax Inc. (U.S.)

- Miros Group AS (Norway)

- Observator Group B.V. (Netherlands)

- RH Marine B.V. (Netherlands)

- RIGSTAT LLC (U.S.)

- ShoreConnection International AS (Norway)

- Automasjon og Data AS (Norway)

- Fendercare Marine Ltd. (U.K.)

KEY INDUSTRY DEVELOPMENTS:

- October 2024 – Vaisala acquired Nevis Technology to expand its offering in the offshore wind market. Nevis Technology specializes in facilitating helideck and environmental monitoring systems and data portals for the offshore energy industry. The acquisition strengthens Vaisala’s position as a weather and intelligence partner for the offshore wind market.

- March 2023 – Vaisala announced that its GLD360 Enhanced helideck monitoring system has been equipped with the most accurate, real-time, and precise lightning data for situational awareness of lighting risks for efficient helicopter route planning and elevated safety worldwide.

- March 2022— Vaisala announced that its helideck monitoring system now complies with renewed CAP437 standards issued by the UK Civil Aviation Authority (CAA) to improve pilot safety and offshore flight planning operations for offshore helicopter landing areas.

- October 2021 – Fugro announced that it has become among the first companies to acquire accreditations from the U.K. Civil Aviation Authority (CAA) and Helideck Certification Agency (HCA) as an approved supplier of helideck monitoring systems conforming to the new 2021 UK CAA standards.

- April 2019 - RH Marine was supplying its Rhodium Alarm Monitoring System (AMS) and Dynamic Positioning and Tracking control system (DPT) to the Ecodelta, the first Dutch dredger on LNG.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on important aspects, such as key players, helideck type, component, point of sale, and end user depending on various countries. Moreover, it offers deep insights into the market trends, competitive landscape, market competition, pricing of helideck monitoring system, and market status, and highlights key industry developments. Also, it encompasses several direct and indirect factors that have contributed to the expansion of global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 3.62% from 2024 to 2032 |

|

Unit |

Value (USD Million) |

|

Segmentation |

Helideck Type, Components, Point of Sale, End User, and Region |

|

By Helideck Type

|

|

|

By Components

|

|

|

By Point of Sale

|

|

|

By End User · Oil & Gas Exploration · Marine Operations · Government & Civil Agencies · Defense & Homeland Security · Others |

|

|

By Region |

· North America o U.S. (By Helideck Type) o Canada (By Helideck Type) · Europe (By Service Type, By Helicopter Type, By Application, and By Country) o U.K. (By Helideck Type) o Germany (By Helideck Type) o France (By Helideck Type) o Russia (By Helideck Type) o Italy (By Helideck Type) o Rest of Europe (By Helideck Type) · Asia Pacific o China (By Helideck Type) o India (By Helideck Type) o Japan (By Helideck Type) o South Korea (By Helideck Type) o Rest of Asia Pacific (By Helideck Type) · Rest of the World o Middle East & Africa (By Helideck Type) o Latin America (By Helideck Type) |

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 262 million in 2023 and is anticipated to be USD 362.8 million by 2032.

The market is likely to grow at a CAGR of 3.62% over the forecast period.

The top ten players in the industry are Kongsberg Gruppen ASA, Fugro N.V., Vaisala Oyj, ABB Ltd., AWA Marine Ltd., Monitor Systems Scotland Ltd., Dynamax Inc., Miros Group AS, Observator Group B.V., and RH Marine B.V.

North America dominated the global market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us