Home Decor Market Size, Share & Industry Analysis, By Product (Home Textile, Floor Covering, Furniture & Home Furnishings, and Others), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online Channels, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

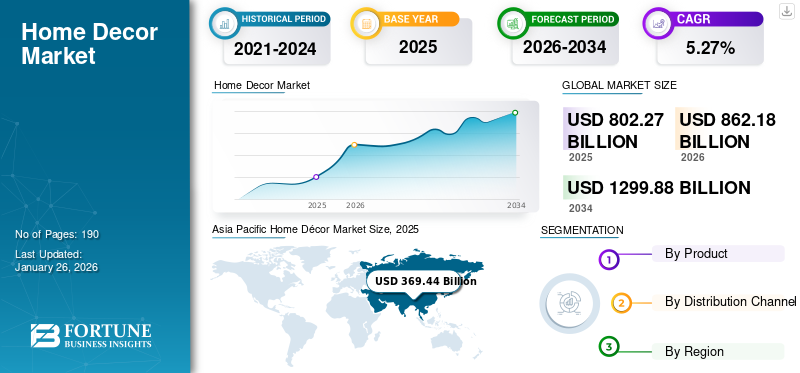

The global home decor market size was valued at USD 802.26 billion in 2025. It is anticipated to grow from USD 862.18 billion in 2026 to USD 1,299.88 billion by 2034, exhibiting a CAGR of 5.27% during the forecast period of 2025-2032. Asia Pacific dominated the home decor market with a market share of 45.75% in 2025. Moreover, the home decor market in the U.S. is expected to grow significantly, reaching USD 305.51 billion by 2032. The growing influence of interior design trends and online retail is driving market expansion.

Decorative accents, including artworks, scented candles, and throw pillows, enhance the aesthetics of the living spaces. Consumers use luxury decor products to enhance their living room’s design styles. Evolving household needs for interior decoration and renovation drive the global demand for home decor products. Furthermore, the growing trend of home gardening and decorating outdoor living spaces is poised to drive market growth.

- According to the American Institute of Architects (AIA) Home Design Trend Survey published in 2023, around 65% of Americans prefer covering their outdoor living spaces with decorative decks and patios, 53% prefer covering with blended indoor/outdoor products, and 45% prefer covering with outdoor fireplaces.

- Furthermore, in America, 24% and 18% of the home decor projects were conducted for custom and luxury homes and addition/remodel projects respectively in the first quarter of 2023.

The occurrence of COVID-19 pandemic encouraged interior designers to take virtual consultations and meetings and deliver personalized interior products. Increasing interior designers’ utilization of software & applications to create virtual living room interior designs positively contributed toward the market development during the COVID-19 pandemic.

GLOBAL HOME DECOR MARKET SNAPSHOT

Market Size & Forecast:

- 2025 Market Size: USD 802.26 billion

- 2026 Market Size: USD 862.18 billion

- 2034 Forecast Market Size: USD 1,299.88 billion

- CAGR: 5.27% from 2026–2034

Market Share:

- Asia Pacific led with 45.75% share in 2025, driven by urbanization, rising residential projects, and growing demand for modern, space-saving furnishings in China, India, and Southeast Asia.

- Floor covering holds the largest share due to renovation trends, while furniture & furnishings segment is growing fastest, fueled by demand for multifunctional, luxury pieces.

- Hypermarkets & supermarkets dominate distribution; online channels rapidly expanding with digital shopping growth. Sustainability, smart home integration, and DIY décor continue to shape product trends.

Key Country Highlights:

- U.S.: Set to reach USD 305.51 billion by 2032; demand driven by smart décor, virtual interior services, and renovation projects.

- China: Strong market led by demand for modern furniture; commercial housing growth boosts spending.

- India: High demand for affordable custom furniture and DIY décor solutions.

- U.K.: Eco-friendly furnishing gains traction; recycled materials fueling growth.

- Brazil & Middle East: Surge in luxury décor and kitchen upgrades among affluent buyers.

- Africa: Rising incomes and urban housing fuel demand for stylish, functional home decor.

Home Decor Market Trends

Sustainability is a Prominent Market Trend

Evolving consumer preferences toward home products made of eco-friendly and recycled/upcycled material is poised to favor the home decor market growth. In addition, increasing manufacturers’ provision of sustainably produced products to minimize the impact of waste generation from their manufactured products positively contribute toward the sustainable development of the market. For instance, in May 2023, Laurence Carr Inc., a U.S.-based restorative interiors and circular product designer, launched a sustainable capsule collection of 12 sculptural vessels crafted from sustainable biomaterials, including Stonecast, Naturescast, and Nucast. These formulated materials are patented, lightweight, and durable materials that outperform traditional metal and stone materials.

- Asia Pacific witnessed home decor market growth from USD 317.20 Billion in 2023 to USD 342.09 Billion in 2024.

Download Free sample to learn more about this report.

Home Decor Market Growth Factors

Continual Smart Home Offerings to Drive Market Growth

Continual growth in smart home offerings with smart decorative lighting, speakers, and aesthetic home appliances drive product consumption growth rates in many countries worldwide. In addition, the growing trend of buying connected technology-based decor products featuring personalized health management, home security, and next-generation entertainment accelerates market growth. The evolving real estate industry and growing commercial and residential infrastructural facilities also add impetus for the industry’s growth. According to the Government of the U.K. Land Registry Office Survey, 25% of the U.K.-based potential home movers consider smart technology as a ‘must have’ option in their homes.

Rising Demand for Personalized Interior Products to Propel Market Growth

Rising consumer demand for custom-made interior products with personalized decor options, including monogrammed items and DIY (do-it-yourself) craft supplies, drive the product revenues globally. In addition, increasing households’ preference toward custom-made functional furniture items featuring easy entryway options, storage solutions, and home-office product upgradation capabilities accelerate product demand.

RESTRAINING FACTORS

Higher Cost of Premium-priced Products May Limit Market Growth

The higher cost of premium-priced furniture and floor covering products limits their demand among the households of middle and lower income groups. Incidences of limited operations of home decor products’ shops and supermarket retailers due to the COVID-19 pandemic-induced lockdown restrictions influenced them to hike product prices, restraining the product consumption rate. Besides this, households' accessibility to counterfeit products of affordable prices negatively impacts market growth.

Home Decor Market Segmentation Analysis

By Product Analysis

Floor Covering Segment Leads Due to Higher Spending on Flooring During Renovation

Based on product analysis, the market is segregated into home textile, floor covering, furniture & home furnishings, and others. The floor covering segment held a major home decor market with a share of 57.79% in 2026 due to the higher household spending on soft flooring during home renovation and remodeling activities. Furthermore, technological innovations in the design and material composition of floor covering products influence households to install floorings, accelerating the floor covering segmental growth. For instance, in January 2022, Unilin Technologies launched two new PVC-free floor-covering technologies, XPC & P-SPC, that provide a robust, sustainable floor-covering performance to the users.

The furniture & home furnishings segment is slated to grow at a fastest-growing rate during the projected period due to the rising global consumer demand for luxury sofas of curved lines, vintage aesthetics, and colorful chairs. In addition, increasing consumer preference for multi-functional furniture items that align with their home improvement resolutions is slated to lead to a skyrocketing growth of the segment in the future.

- The furniture & home furnishings segment is expected to hold a 16.14% share in 2024.

Growing fashion consciousness and increasing households' preference for luxury bedding and window covering products drive home textile segmental growth.

The others segment mainly covers the market analysis of various other products, including wall decor products, lighting products, and home decor accessories. Rising demand for artistic paints, drawings, sculptures, and wall art prints to enhance the aesthetics of the living and hall room spaces drives others segmental revenues. Furthermore, shifting household preference from traditional lighting products to premium decorative lighting products is expected to favor others segmental growth during 2024-2032.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Accessibility to Premium Products Under One Roof Result Hypermarkets & Supermarkets to Dominate Market

By distribution channel, the market is segregated into different market segments, including hypermarkets & supermarkets, specialty stores, online channels, and others. The hypermarkets & supermarkets segment exhibits a dominant market with a share of 38.95% in 2026 owing to easy consumers' accessibility to the wide assortment of affordable and premium-priced products under one roof at supermarkets. Continual provision of decor products-related discount coupons by these stores supports the product demand.

The specialty stores segment is poised to grow at a considerable rate due to the rising number of specialty and brand stores offering luxury interior products. Furthermore, increasing higher-income households’ preference for luxury products drive specialty stores segmental revenues.

Online channels segment is slated to grow at a faster rate during 2024-2032. The rising adoption of online shopping for furniture and home textile goods favor online channels segmental growth.

The others segment covers the market analysis of various distribution channels, including wholesale stores, upholstery shops, and direct selling channels. Others segment is poised to grow at a slower rate during 2024-2032. A rise in the number of upholsters offering affordable bedroom and living room products drives others segmental revenues. According to the U.S. Bureau of Labor Statistics (BLS), as of May 2023, the number of professional upholsterers in the U.S. reached 25,740, 2% up over the previous year.

REGIONAL INSIGHTS

Based on region, the global market for home decor is segregated into North America, Europe, the Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Home Décor Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific dominated the market with a valuation of USD 369.44 billion in 2025 and USD 399.62 billion in 2026 by exhibiting a major market share and is poised to grow at a faster rate during 2025-2032. The growing number of residential and commercial infrastructural facilities drive the modern kitchen and living room furniture demand in China and Southeast Asia. Increasing Chinese and Japanese homeowners’ preference for contemporary-style, free-standing wooden furniture and furnishing products with decorative shelves and drawers also increases the product replacement rate, accelerating the market growth in Asia Pacific. According to the government of the Republic of China, in 2021, sales of commercial housing facilities were 1,794.33 million sq. m., 1.9% up over the previous year. In addition, according to the Monetary Authority of Singapore, single-family offices increased from 400 in 2000 to 700 by the end of 2021. The Japan market is valued at USD 56.47 billion by 2026, and the China market is valued at USD 226.63 billion by 2026.

- In China, the furniture & home furnishings segment is estimated to hold a 16.4% market share in 2024.

To know how our report can help streamline your business, Speak to Analyst

The increasing demand for renovation projects and evolving personal preferences related to home utilities significantly influence the demand for decor products in North America. Furthermore, retailers' continual effective marketing campaigns and advertising efforts influence consumers toward making purchase decisions, driving the global home decor market growth. The U.S. market is valued at USD 228.44 billion by 2026.

- In 2020, as per the National Association of Realtors, Americans invested a total of USD 420 billion in renovating their homes.

- Within the National Association of the Remodeling Industry (NARI), 90% of members observed a heightened demand for remodeling contracts in 2020.

- In addition, 60% of these members noted an increase in project scale, whether through larger individual projects or the remodeling of multiple rooms.

Rising demand for sustainable products and manufacturers' efforts to produce products made of eco-friendly materials accelerate market growth in Europe. For instance, in May 2022, Omega PLC, a U.K.-based producer of furniture, unveiled new doors and colorways throughout its Sheraton, Mackintosh, English Rose, and Chippendale brands. The latest collection of slab doors is wholly made using 100% recycled wood, which provides modern and tactile materials in terms of kitchen furnishing. The UK market is valued at USD 16.34 billion by 2026, and the Germany market is valued at USD 27.11 billion by 2026.

Rising homeowners’ spending on luxury home decor and kitchen furniture products and emerging interior decoration trends will likely favor product revenues across Brazil and Argentina. In August 2023, Fimma Brasil and Movelsul Brasil jointly held Parque de Eventos, a luxury furniture industry event at Bento Gonçalves, Brazil. At the event, the companies welcomed 30,835 visitors preferring luxury furniture products.

Higher-income Middle Eastern homeowners prefer replacing kitchen cabinet doors, incorporating newer storage solutions, and changing countertop materials to enhance the aesthetics of kitchen spaces. Increasing adoption of innovative storage solutions by residential kitchens skyrockets product demand in the Middle East. Growing disposable income of the households and their spending on home products in South Africa and Nigeria drive the growth of the African market for home decor.

KEY INDUSTRY PLAYERS

Companies Focus on Retail Footprint Expansion to Gain a Competitive Edge

Leading market players, such as Williams Sonoma Inc., Ashley Furniture Industries, Inc., and Inter IKEA Systems B.V., focus on expanding their product portfolio to increase their customer base in emerging markets, including Asia Pacific and the Middle East & Africa. In addition, they open newer stores to increase their retail footprint worldwide. For instance, in October 2023, Williams Sonoma Inc. opened a new San Diego store to expand its retail presence in the U.S. These companies’ retail expansion projects favor market growth.

List of Top Home Decor Companies:

- 1888 Mills, LLC. (U.S.)

- Inter IKEA Systems B.V. (Netherlands)

- Williams-Sonoma Inc. (U.S.)

- Ashley Furniture Industries, LLC. (U.S.)

- Idea Nuova (U.S.)

- Ethan Allen Global, Inc. (U.S.)

- American Textile Company (U.S.)

- Ralph Lauren Corporation (U.S.)

- Welspun Flooring (India)

- Kimball International, Inc. (U.S.)

- Herman Miller, Inc. (U.S.)

- Steelcase, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- May 2024: Remax Furnitures, an Indian luxury furniture brand, launched a new store in New Delhi, India, to expand its retail presence in the country.

- March 2024: FabCuro, a stylish furniture boutique, opened a new store to increase its retail presence in Indiranagar, Bengaluru, India.

- February 2024: Havenly, a U.S.-based interior designer group, acquired The Citizenry, a direct-to-consumer home decor brand, to build its product portfolio with ethically crafted rugs, decorative textiles, and accents.

- November 2023: Vaaree, a home furnishing startup invested USD 4 million to enhance the user experience for its online platform. This investment will help the company to address critical business areas, including curation, merchandising, supply chain, and omnichannel experiences.

- June 2021: Capital One Financial established a partnership with Williams-Sonoma, Inc. to enable its partnered company to allow customers to shop and earn rewards across all decor brand verticals. This partnership creates newer business revenue growth opportunities for Williams-Sonoma, Inc. in the furniture decor industry.

REPORT COVERAGE

The report analyzes the market in-depth and highlights crucial aspects, such as prominent companies, product types, and sales channel areas. Besides this, the market outlooks key trends and competitive landscape and highlights significant industry developments. In addition to the aspects mentioned earlier, the report encompasses several factors contributing to the market's growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.27% during 2025-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

By Distribution Channel

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global home decor market was valued at USD 802.26 billion in 2025 and is projected to grow from USD 862.18 billion in 2026 to USD 1,299.88 billion by 2034.

The global market is expected to grow at a CAGR of 5.27% during 2026-2034.

Asia Pacific leads the global home decor market with a 45.75% market share, driven by rapid urbanization, increased spending on interior design, and rising demand for modern furniture and flooring in countries like China, India, and Japan.

Major growth drivers include increased home renovation trends, rising disposable income, smart home integration, and growing online retail channels. Additionally, consumer interest in sustainable and customized interior products is fueling demand.

Williams Sonoma Inc., Ashely Furniture Industries, Inc., and Inter IKEA Systems B.V. are the leading companies in this market.

Sustainability is a major trend, with consumers increasingly preferring eco-friendly and upcycled decor items. Companies are launching collections made from recycled wood, biomaterials, and low-impact substances to meet green living expectations.

Hypermarkets & supermarkets dominate due to their wide range of affordable and premium products under one roof, alongside frequent discounts. However, online channels are growing the fastest, driven by e-commerce convenience and digital marketing.

Key players include Inter IKEA Systems B.V., Williams-Sonoma Inc., Ashley Furniture Industries, Ethan Allen Global, and Herman Miller Inc. These companies focus on expanding their global footprint and offering sustainable, innovative products.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us