Homecare Clinical Nutrition Market Size, Share & Industry Analysis, By Type (Services [Nutrition Assessment, Meal Preparation & Delivery, Feeding Assistance, and Others) and Products [Oral, Parenteral, and Enteral Tube Feeding]), By Age Group (Pediatric and Adult), By Form (Powder and Liquid), By Therapeutic Area (Oncology, Neurological Disorders, Gastrointestinal Disorders, Diabetes, Kidney Disorders, Cardiovascular Disorders, and Others), and Regional Forecast, 2024-2032

KEY MARKET INSIGHTS

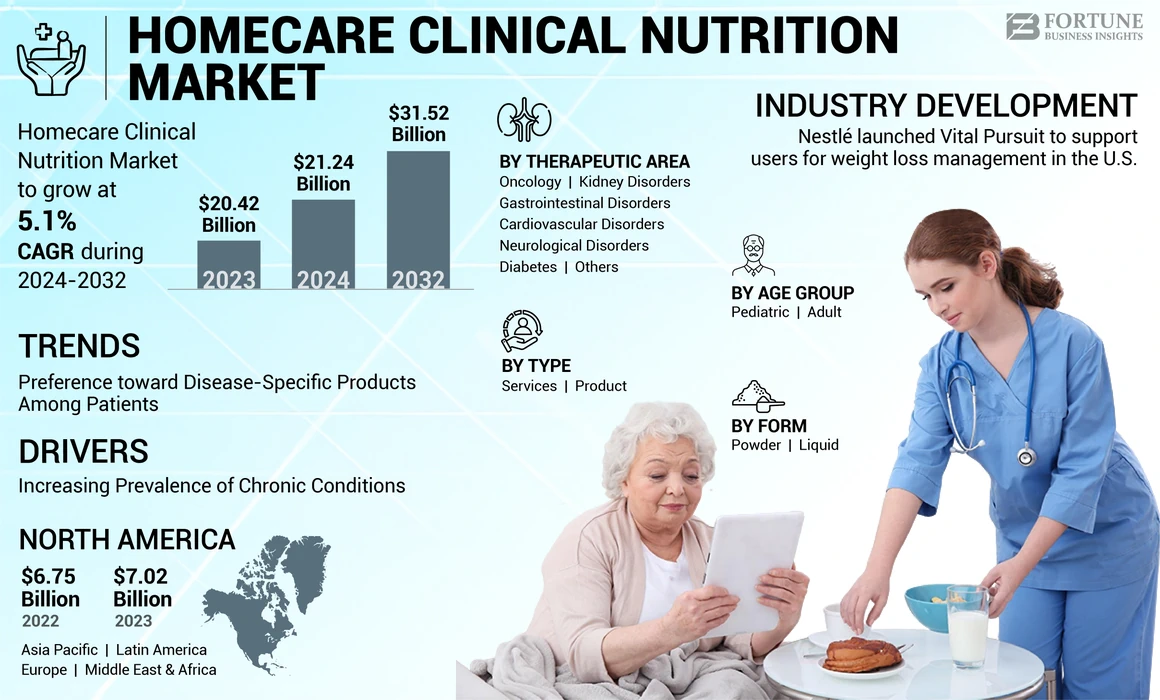

The global homecare clinical nutrition market size was valued at USD 20.42 billion in 2023. The market is projected to grow from USD 21.24 billion in 2024 to USD 31.52 billion by 2032, exhibiting a CAGR of 5.1% during the forecast period. North America dominated the homecare clinical nutrition market with a market share of 34.38% in 2023.

Homecare clinical nutrition refers to the provision of clinical nutrition services and products for the maintenance of adequate nutrition in patients with acute and chronic disorders, such as oncology, cardiovascular disorders, and metabolic disorders, within homecare settings. The growing prevalence of various chronic disorders such as cancer and neurological disorders, along with the rising number of malnutrition cases, is leading to growing demand for these clinical nutrition services and products. This trend is boosting the growth of the global market.

- According to a 2022 Parkinson’s Foundation Project, there will be around 1.2 million people living with Parkinson’s by 2030 in North America. Additionally, nearly 90,000 people in the U.S. are diagnosed with Parkinson’s disease each year.

Moreover, growing awareness about these products and services, coupled with rising R&D activities to develop and introduce novel clinical nutrition products, is likely to support the growing demand for these products and services in the global market. The key players such as Abbott, Baxter, and others are focusing on the development and introduction of novel products for homecare clinical nutrition, which is expected to support the growth of the market.

Global Homecare Clinical Nutrition Market Snapshot & Highlights

Market Size & Forecast:

- 2023 Market Size: USD 20.42 billion

- 2024 Market Size: USD 21.24 billion

- 2032 Forecast Market Size: USD 31.52 billion

- CAGR: 5.1% from 2024–2032

Market Share:

- North America dominated the homecare clinical nutrition market with a 34.38% share in 2023, driven by the presence of well-established homecare settings, strong adoption of customized enteral and parenteral nutrition products, and a high number of active home healthcare agencies in the region.

- By Type, the Services segment is expected to retain its largest market share owing to the growing preference for clinical nutrition services at home, increasing initiatives to promote home-based healthcare services, and the rising benefits of clinical nutrition assessments, meal preparation, and nutritional counseling services.

Key Country Highlights:

- United States: Increasing prevalence of chronic diseases among the aging population is driving demand for long-term homecare nutrition solutions.

- Europe: Rising healthcare expenditure and expanding adoption of home-based clinical nutrition services are supporting market growth across key European countries.

- China: Rapid advancements in homecare infrastructure and growing awareness about the benefits of clinical nutrition are fueling product demand.

- Japan: The rising elderly population and focus on personalized clinical nutrition products to manage chronic diseases are boosting market expansion.

Market Dynamics

MARKET DRIVERS

Increasing Prevalence of Chronic Conditions Among the Population to Fuel Product Demand

The increasing prevalence of chronic disorders such as cancer, diabetes, and other conditions is driving the demand for homecare clinical nutrition. Patients with difficulties maintaining adequate nutritional intake due to swallowing mechanism dysfunction, physiological symptoms related to diseases or their treatments, such as poor appetite, nausea, or taste changes.

- According to 2024 statistics published by the Centers for Disease Control and Prevention (CDC), it was reported that about 38.4 million people have diabetes in the U.S.

The rising geriatric population is also supporting the increasing prevalence of chronic disorders among the population globally. The aging population is more prone to various chronic illnesses due to underlying health conditions, weaker immune systems, and other age-related factors, which underscore the need for long-term nutritional care.

- According to the data published by the Administration for Community Living (ACL), about 17.3% of the total population represents people aged 65 years and above in the U.S. in 2022, with this proportion projected to grow to 22% by 2040.

Moreover, rising awareness about the benefits of clinical nutrition products and services among the patient population is expected to support their adoption, driving growth in the global homecare clinical nutrition market growth.

Other Drivers:

- Increasing awareness about clinical nutrition products along with their benefits to drive the adoption.

- Technological advancements for clinical nutrition products to fuel the demand.

MARKET RESTRAINTS

Limited Reimbursement for Clinical Nutrition Technologies to Hamper Market Growth

Reimbursement policies for clinical foods or Foods for Special Medical Purposes (FSMPs) differ significantly across countries and healthcare settings. According to 2019 data published by ScienceDirect, it was reported that the reimbursement rate for medical food in European countries such as Germany, France, Netherlands, and Spain is higher across all healthcare settings, including outpatient settings, hospitals, homecare settings, and community care centers. However, the reimbursement for these products is limited in other developed and emerging countries.

- According to 2023 statistics published by the Centers for Medicare & Medicaid Services (CMS), the Prosthetic Device benefit covers enteral nutrition products. However, coverage excludes, related supplies, equipment for temporary impairments in enteral nutrition, and orally administered enteral nutrition products, deeming them as non-covered and without benefit.

Few countries have formal health technology assessment (HTA) for clinical nutrition products including enteral and parenteral nutrition products. However, due to a lack of health technology assessment in the U.S., the prices of the products are fixed according to the macronutrients included in the formulation of FSMP/MF and by the quantity of specific ingredients rather than on the demonstrated health outcomes. This, along with stringent laws and regulations imposed by regulatory bodies such as the Food and Drug Administration (FDA) and European Medicines Agency (EMA), is further impacting the demand for clinical nutrition products globally.

Additionally, the limited financial incentives among manufacturers to invest in clinical research for parenteral and enteral nutrition technologies may hamper innovation and the ability of the healthcare ecosystem to promote the role of clinical nutrition. Thus, the above-mentioned factors are likely to hamper the adoption of clinical nutrition products, thereby limiting the growth of the market.

Other Restraints:

- High costs associated with specialized nutritional products to hamper market growth.

MARKET OPPORTUNITIES

Increasing R&D Activities in Emerging Markets

There is significant growth in the oral nutritional supplements, parenteral, and enteral nutrition products industry owing to the benefits these products offer, such as their effectiveness, low time consumption, and ability to address specific patient needs. Hence, the growing advantages of clinical nutrition products are likely to boost the demand for these products in the market.

The growing advantages of clinical nutrition products are further resulting in the increasing focus of prominent players toward R&D activities to develop and introduce novel products, especially in emerging markets such as Asia Pacific and Latin America. Along with this, the growing demand for personalized clinical nutrition products specific to individual patient needs, advanced delivery systems, and disease-specific products are some of the other factors augmenting the demand for these products and services in the market.

- For instance, according to the 2023 annual report published by Abbott, the company invested USD 2,741 million in research and development activities in the market.

The rising focus on clinical studies to identify potential candidates for advanced nutritional products is expected to support the growing number of product launches in the market.

MARKET CHALLENGES

Intense Competition and the Need for Constant Innovation in Products to Limit Growth

There is an increasing number of prominent players operating in the market focusing on the development and introduction of enteral and parenteral nutrition products. Furthermore, the increasing demand for advanced clinical nutrition products is resulting in increasing advancements in the development of these products.

Increasing advancements, such as the integration of artificial intelligence development of novel delivery mechanisms for enteral and parenteral nutrition products, among others, are presenting a potential threat to the existing key players in the market.

Additionally, rising strategic initiatives, including acquisitions and partnerships among industry players, are likely to intensify competition among major market shareholders.

- In July 2023, Pentec Health, Inc., acquired ZOIA Pharma, a medical provider in the U.S., to strengthen its product portfolio for advanced medical products such as PKU GOLIKE, designed for patients with phenylketonuria.

Other Challenges:

- Limited availability of raw materials and products to hamper market growth.

HOMECARE CLINICAL NUTRITION MARKET TRENDS

Shifting Preference toward Disease-Specific Products Among Patients

There is an emerging focus on fulfilling adequate nutrition to meet the specific needs of patients. Factors driving the demand include advancements in oral, parenteral, and enteral nutrition products, and the growing prevalence of chronic disorders.

Clinical nutrition provides critical micro and macronutrients to individuals who are unable to consume sufficient nutrients orally due to medical complications. Clinical nutrition is required for various conditions among patients, such as neurological disorders, diabetes, and cardiovascular disorders.

Every individual has specific requirements for the nutrition formula according to their condition. For example, the development of diabetes in an individual often leads to complications such as stroke, which may require enteral and parenteral feeding to meet their daily requirement of nutrition. Enteral nutrition for diabetic patients provides necessary nutrients, including protein, vitamins, energy, and minerals, reducing the risk of malnutrition in these patients.

Disease-specific nutrition offers benefits such as faster recovery and improved nutritional status by delivering targeted macro and micronutrients tailored to patient conditions. Moreover, there has been a growing focus among researchers on conducting a high number of clinical studies, especially concerning disease-specific products, to improve the nutritional requirements among patients.

Key players in the market are also focusing on R&D activities to develop disease-specific clinical nutrition products globally.

- In October 2023, Nutricia (Danone) launched its first medical nutrition drink with a balanced mix of real fruit and vegetable ingredients. This product is specifically formulated for the dietary management of disease-related malnutrition and faltering growth in pediatric patients.

Other Trends:

- Increasing Demand for Plant-Based and Functional Foods

- Integration of Telehealth and Digital Health to Monitor Patients

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The global market witnessed slower growth during the COVID-19 pandemic in 2020 owing to disruptions in the supply chain, delays in diagnosis and treatment, and major product shortages. Moreover, the limited availability of healthcare workers in homecare settings and limited screening for malnourished patients, are some of the additional factors that resulted in slower growth of the market.

- For instance, according to the 2021 article published by ScienceDirect, it was reported that more than half of physicians and one-third of nurses from home parenteral nutrition units were working simultaneously in hospital wards during the pandemic.

SEGMENTATION ANALYSIS

By Type

Increasing Demand for Clinical Nutrition Services Led to the Dominance of the Services Segment

Based on type, the market is segmented into services and products. The services segment is further classified into nutrition assessment, meal preparation & delivery, feeding assistance, and others. The products segment is divided into oral, parenteral, and enteral tube feeding.

The services segment dominated the market in 2023. Clinical nutrition services provide the prevention, diagnosis, and management of nutritional changes which further helps in the maintenance of a healthy energy balance in patients. Increasing benefits of these services are further enabling the service providers to offer innovative clinical nutrition services such as nutrition education and counseling, and nutritional assessment, driving their global adoption among patients.

This, along with a growing preference toward clinical nutrition services at home, is prompting key service providers to develop novel home healthcare services globally.

- For instance, the U.S. Food and Drug Administration (USFDA) launched the Healthcare At Home initiative with an aim to address the increasing demand for home-based healthcare services, including clinical nutrition.

Thus, the rising number of initiatives to promote home care services for clinical nutrition is likely to support the growing adoption rate for these services in the market.

On the other hand, the products segment is expected to grow at a considerable growth rate during the forecast period. The growth is due to increasing demand for novel clinical nutrition products resulting in the growing focus of key players to launch innovative products in the market. Moreover, the availability of customized enteral and parenteral products tailored to patient needs is likely to support the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Age Group

Growing Prevalence of Chronic Disorders Among Adults Led to the Dominance of the Adult Segment

Based on age group, the market is divided into adult and pediatric.

The adults segment dominated the market in 2023. The dominance of the segment is due to the increasing prevalence of chronic disorders such as diabetes, cardiovascular disorders, and gastrointestinal disorders is driving the adoption of these services and products among adults. This, along with the increasing benefits of clinical nutrition services and the rising number of key players offering novel enteral and parenteral nutrition products are some of the major factors supporting the growth of the segment globally.

- For instance, according to statistics published by the Centers for Disease Control and Prevention, it was reported that about 3.1 million adults are suffering from inflammatory bowel disease in the U.S. The rising prevalence of chronic conditions such as diabetes and Crohn’s disease is likely to support the growth of the segment.

On the other hand, the pediatric segment is also expected to grow with the considerable growth rate during the forecast period. The growth is due to the rising prevalence of malnutrition among pediatric patients resulting in growing demand for clinical nutrition products. Along with this, key players are focusing on the development and introduction of specific products for pediatric patients, which is likely to augment the growth of the segment.

By Form Analysis

Increasing Product Launches of Liquid Products Led to the Dominance of Liquid Segment

Based on form, the market is divided into liquid and powder.

The liquid segment dominated the market in 2023. The dominance of the segment can be attributed to certain benefits of liquid clinical nutrition products, including easier digestion, provision of hydration and nourishment, and improved bioavailability. These advantages have led to a rising demand for liquid clinical nutrition products.

Additionally, key players are focusing on research and development activities to launch potential liquid ingredients to manufacture liquid nutritional products. These advancements are likely to support the growth of the segment.

- For instance, in November 2023, FrieslandCampina Ingredients launched a heat-stable whey protein ingredient – Nutri Whey ProHeat, by using a microparticulation technology. This ingredient is designed for use in clinical nutrition products to provide a nutrient-dense liquid formulation with low viscosity, neutral pH, good drinkability, and a clean taste.

Such innovations in liquid clinical nutrition products are supporting the growth of the segment.

The powder segment is also expected to grow with the considerable growth rate during the forecast period. Innovations in the development of powder clinical nutrition products and their less expensive prices are some of the major factors supporting the growth of the segment.

By Therapeutic Area

Growing Prevalence of Cancer Among the Population Led to the Dominance of Oncology Segment

Based on therapeutic area, the market is divided into oncology, neurological disorders, gastrointestinal disorders, diabetes, kidney disorders, cardiovascular disorders, and others.

The oncology segment dominated the market in 2023. The dominance of the segment is due to the increasing prevalence of various types of cancer, such as lung cancer and breast cancer, which has led to a large patient population suffering from malnutrition.

The increasing patient population is resulting in a growing demand for clinical nutrition services and products in the market. Additionally, key players are focusing on developing customized enteral and parenteral solutions tailored to specific patient needs, thus boosting the growth of the segment.

- For instance, according to the National Cancer Institute (NCI), in 2023, 2.0 million new cases of cancer were diagnosed in the U.S. This rising number of patients suffering from malnutrition is likely to augment the demand for clinical nutrition products and services in the market.

The gastrointestinal disorders segment is also expected to grow with a significant growth rate during the forecast period. The increasing prevalence of gastrointestinal disorders such as inflammatory bowel disease (IBD), bowel obstruction, and ulcerative colitis, are becoming increasingly prevalent, contributing to a patient pool globally. This, along with the increasing advantages of clinical nutrition services in homecare settings, is likely to support the growth of the segment in the market.

Additionally, the neurology and diabetes segments are also expected to grow with the considerable growth rate during the forecast period. The growth is due to the increasing prevalence of neurological disorders, type-1 diabetes, and type-2 diabetes among patients, resulting in growing demand for clinical nutrition products. This, along with the growing number of R&D activities to launch novel products among key players to strengthen their presence in the market, is further likely to support the increasing adoption of these products.

- For instance, according to the 2023 data published by the National Health Service (NHS), it was reported that there are about 438,213 patients suffering from dementia in the U.K.

The kidney disorders and cardiovascular disorders segments are also expected to grow with the considerable growth rate during the forecast period. The increasing prevalence of these disorders is driving demand for enteral and parenteral nutrition products. Moreover, strategic acquisitions and mergers among key players are enabling them to strengthen their market presence, further contributing to the adoption of these products in the market.

Along with this, increasing number of patients suffering from diseases such as cancer, neurological disorders, gastrointestinal disorders, among others, is supporting the growing diagnosis rate and further increasing the adoption of homecare clinical nutrition, thereby supporting the segmental growth.

HOMECARE CLINICAL NUTRITION MARKET REGIONAL OUTLOOK

Based on geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Homecare Clinical Nutrition Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America was valued at USD 7.02 billion in 2023 and dominated the market. The region’s growth is due to certain factors, including well-established homecare settings and the adoption of customized enteral and parenteral clinical nutrition products. Along with this, the presence of key market players in this region and active home-healthcare agencies, among others are some additional factors anticipated to drive the market's growth in North America.

- For instance, according to 2022 data published by Home Health Care News, there were about 11,353 active home healthcare agencies in the U.S. The growing number of home healthcare agencies, along with other factors, are supporting the growing adoption of clinical nutrition products and services in the market.

Asia Pacific is expected to grow with a considerable CAGR during the forecast period. With the increasing prevalence of cardiovascular diseases, gastrointestinal disorders, and cancer, combined with rapid advancements in homecare settings in developing countries such as India and China are anticipated to drive the demand and adoption of clinical nutrition products and services in the market. Additionally, improvements in reimbursement policies and rising per capita healthcare expenditure are projected to drive the growth of the market in the region.

- For instance, according to 2023 data published by the Government of Japan, the per capita cost of medical care for elderly patients is about USD 6,792.1. Thus, rising per-capita healthcare expenditure, along with the awareness about the benefits of clinical nutrition services in the homecare setting, is likely to support the growth of the market in the region.

Europe is projected to witness significant growth in the global market. The high-income countries, including Germany, the U.K., and France, are anticipated to contribute to the growth of the market in the region. Rising healthcare expenditure and increasing adoption of clinical nutrition services are some of the major factors driving the growth of the market in the region.

- According to 2023 data published by the Office for National Statistics (ONS), the healthcare expenditure is around USD 316.0 in the U.K.

Latin America is expected to grow with a considerable CAGR during the forecast period. The growth is due to the increasing demand for enteral tube feeding and parenteral nutrition products among the patient population.

The Middle East & Africa is projected to grow at a considerable growth rate during the forecast period. The increasing number of key players focusing on strategic initiatives such as acquisitions and mergers is likely to drive the growing demand for these products and services globally.

COMPETITIVE LANDSCAPE

Key Industry Players

Prominent Players Focus on Collaborations to Strengthen their Product Portfolio

The global homecare clinical nutrition products market is a consolidated market with three major players, including Nestlé, Abbott, and Nutricia (Danone), operating in the global market with a novel product portfolio.

Nestlé dominated the global clinical nutrition products market in 2023. The dominance of the company is due to the increasing focus of the company on R&D activities for clinical nutrition products. This, along with a growing emphasis on acquisitions and collaborations among the major players to create awareness about clinical nutrition, is also supporting the global homecare clinical nutrition market share.

- In January 2024, Nestlé collaborated with Global Shapers, an initiative by the World Economic Forum, and Accenture to support youth innovation and accelerate breakthrough ideas. This partnership helped enhance the company’s brand presence in the market.

The increasing number of product launches by Nutricia (Danone), Abbott, and Baxter to widen their product portfolio for parenteral and enteral nutrition products is contributing to the growing market share of the companies.

Other key players such as Reckitt Benckiser Group PLC, and Ajinomoto Co., Inc., are focusing on research innovations to launch disease-specific products for conditions such as cancer and gastrointestinal disorders. These innovations are likely to support the growth of the homecare clinical nutrition products market and increase competitive landscape.

LIST OF KEY COMPANIES PROFILED:

- Ajinomoto Co., Inc. (Japan)

- Nutricia (Danone) (Netherlands)

- Abbott (U.S.)

- Nestlé (Switzerland)

- B. Braun SE (Germany)

- Medtrition Inc. (U.S.)

- Reckitt Benckiser Group PLC (U.K.)

- Baxter (U.S.)

- Fresenius Kabi AG (Germany)

KEY INDUSTRY DEVELOPMENTS:

- September 2024 - Nutricia launched its reformulated Nutrison core range tube feeds at the 46th European Society for Parenteral and Enteral Nutrition (ESPEN) Congress on Clinical Nutrition and Metabolism in Milan.

- August 2024 - Ajinomoto Co., Inc. Health & Nutrition partnered with Shiru, Inc. to develop sweet proteins using AI to address global health issues such as diabetes, obesity, and cardiovascular disease to strengthen its product portfolio.

- May 2024 - Nestlé introduced Vital Pursuit aimed at supporting weight loss management in the U.S. This launch helped the company to increase its brand presence.

- February 2024 - Fresenius Kabi AG continued its collaboration with the European Society of Intensive Care Medicine (ESICM) to promote clinical nutrition through initiatives such as the ESICM-Fresenius Kabi Clinical Nutrition Award and fellowships for a specialized eCourse on nutrition in critical illness. This partnership enhances research and education in critical care nutrition, directly supporting advancements in home care nutrition.

- February 2022 - Medtrition Inc. presented its first case series demonstrating the effectiveness of an oral nutrition supplement containing collagen dipeptides and L-Citrulline on healing chronic wounds at the American Professional Wound Care Association’s Wound Week 2022. This initiative helped the company to increase its brand presence globally.

STRATEGIC RECOMMENDATIONS

- The key players may focus on acquisitions and collaborations among the other players which is expected to increase the adoption rate for clinical nutrition products and services globally.

- The key players may focus on strategic initiatives, such as an expansion of their R&D facilities, which is likely to fuel the adoption rate for clinical nutrition products in the market.

REPORT COVERAGE

The global homecare clinical nutrition market report provides a detailed market analysis. It focuses on key aspects, such as market size & market forecast, market segmentation based on type, age group, form, and therapeutic area. It also gives a detailed analysis of the key players and competitive landscape. It also gives an overview of the prevalence of chronic disorders, product launches, and the impact of COVID-19.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 5.1% from 2024-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Age Group

|

|

|

By Form

|

|

|

By Therapeutic Area

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market was valued at USD 20.42 billion in 2023 and is projected to reach USD 31.52 billion by 2032.

In 2023, the North America market value stood at USD 7.02 billion.

The market will exhibit a steady 5.1% CAGR during the forecast period.

By type, the services segment leads this market.

The key driving factors of the market include the increasing prevalence of chronic diseases, increasing demand for clinical nutrition products and services, favorable health reimbursement policies, and the launch of novel clinical nutrition products.

Abbott, Nestle, and Baxter are the leading players in the global market.

North America dominated the market in 2023.

Launch of novel products addressing the critical unmet needs of the market, growing prevalence of chronic disorders, are driving the product’s adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us