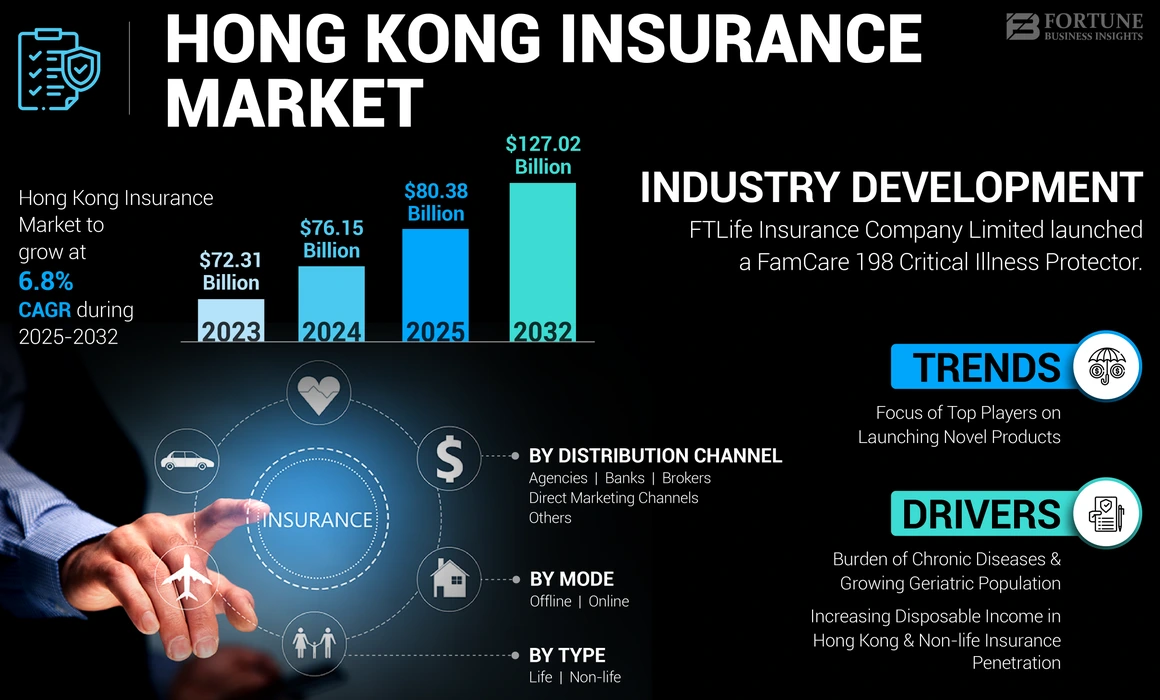

Hong Kong Insurance Market Size, Share & Industry Analysis, By Type (Life and Non-life {Property, Health, Motor, and Others}), By Mode (Offline and Online) By Distribution Channel (Agencies, Banks, Brokers, Direct Marketing Channels, and Others), and Country Forecast, 2025-2032

Hong Kong Insurance Market Size

The Hong Kong insurance market size was valued at USD 76.15 billion in 2024. The market is projected to grow from USD 80.38 billion in 2025 to USD 127.02 billion by 2032, exhibiting a CAGR of 6.8% during the forecast period.

Insurance is a contract (policy) in which an insurer compensates the insured person for losses in exchange for a premium. It provides financial protection during emergencies, inevitable loss, damage, or injury and offers tax benefits, such as tax deductions and exemptions. These type of policies include life and non-life policies.

The penetration of insurance in Hong Kong is quite higher as compared to other developed countries, this is due to the regional integration of the country, changing consumer preference, and increasing awareness about various benefits associated with such policies among the population.

Moreover, the resumption of cross-border travel from Mainland China is also expected to surge the demand for life insurance among the country’s population, driving the market growth.

- For instance, as per the recent survey conducted by the Swiss Re group, nearly 30.0% of Hong Kong citizens intended to purchase life insurance in 2022 and 2023.

During the COVID-19 pandemic in 2020, the market experienced positive growth. This was due to increased awareness of the importance of financial security and risk management among consumers during the pandemic. Moreover, the increasing digitalization of distribution channels and growing accessibility to customers have significantly contributed to the growth in insurance penetration in Hong Kong. Furthermore, owing to these factors, prominent market players reported an increase in their revenues and gross written premiums, mainly from health insurance businesses in 2020.

- For instance, in December 2020, AXA reported a growth of 5.1% in revenue of the health insurance segment as compared to 2019.

Hong Kong Insurance Market Trends

Increasing Focus of Prominent Players on Launching Novel Products

Over recent years, there has been an increase in demand for life and non-life insurance in Hong Kong, which has led to strong penetration in the country. To fulfil this growing demand for life and non-life policies, major players in the market are highly focusing on introducing new products with additional benefits. This will enhance their product offerings, providing the customers with multiple options.

- For instance, as of April 2023, AIA Group Limited announced the launch of AIA CarePass, the first comprehensive curation of premium medical support services in the Hong Kong market. This allowed Hong Kong residents to effortlessly obtain precise medical services and medical provisions from global specialists.

Furthermore, prominent market players have increased their focus on strategic initiatives, such as partnerships and collaborations with other players, to fulfil the high demand and expand the customer reach. This strategic initiative is mainly the impact of the resumption of cross-border travel between Mainland China and Hong Kong in 2023.

- For instance, in November 2023, AXA Group partnered with UMP Healthcare Holdings Limited to provide one-stop premium cross-border medical and healthcare services and experiences to their customers on the mainland with greater accessibility.

Download Free sample to learn more about this report.

Hong Kong Insurance Market Growth Factors

Rising Burden of Chronic Diseases and Growing Geriatric Population to Boost the Demand for Life Insurance

The burden of chronic diseases, including cancer, cardiovascular diseases, and diabetes, has been increasing significantly in Hong Kong. This rising burden further increases healthcare expenses, resulting in a financial burden on the country’s population. To avoid such expenditures, the residents are highly adopting life insurance policies, which are expected to fuel the demand, driving the Hong Kong Insurance market growth.

- For instance, as of August 2022, according to the data published by Roche Diagnostics Asia Pacific Pte Ltd., approximately 1-2% of the Hong Kong population suffers from heart failure, out of which around 20,000 cases require hospitalization annually.

Furthermore, the growing aging population, which is more prone to chronic disorders, has been fueling the burden of cancer and heart stroke in the country. The aged individuals are more dependent on care, constant medical treatment, and permanent nursing. This care can be expensive for the older population. Therefore, to overcome these expenses, old individuals prefer purchasing life insurance with retirement plans, which provides financial stability.

- For instance, according to the Census and Statistics Department, in Hong Kong, the geriatric population was around 1.45 million in 2021 and is projected to reach 2.74 million by 2046.

Increasing Disposable Income in Hong Kong to Fuel the Life and Non-life Insurance Penetration in the Country

In recent years, there has been a significant growth in disposable income among the Hong Kong population. This high disposable income is expected to fuel the financial flexibility of the people in the country. Moreover, this high disposable income allows people to spend more on enhancing their standard of living and also propelling the demand for life and health risk coverage in the country.

- For instance, as of 2023, according to the data published by the Census and Statistics Department, the gross national disposable income (GNDI) of Hong Kong was USD 411,027.2, a growth of 8.8% from the previous year. Furthermore, the gross national disposable income between 2010 to 2023 increased by 80.5%.

Moreover, the increase in disposable income has resulted in higher spending among the general population on assets, such as properties and vehicles. Subsequently, there has been a rise in the number of registered vehicles and properties in the country.

- For instance, according to data from the Transport Department of Hong Kong, there were approximately 108,674 registered motorcycles in Hong Kong in 2023, highlighting a 28.7% increase from 2019. According to the government regulations in Hong Kong, having vehicle plans, particularly third-party insurance, is crucial in the country.

These regulations regarding motor and property insurance are leading to increasing penetration of non-life insurance in the country.

RESTRAINING FACTORS

Complex Industry Regulations to Limit the Entry of Emerging Players

The International Accounting Standards Board (IASB) developed a set of accounting rules known as International Financial Reporting Standard 17 (IFRS 17), which came into force in 2023 after being developed in 2017. These standards aim to improve the accuracy and transparency of information in the financial statements of insurers. However, after the amendment of IFRS17, insurers have faced certain challenges.

- For instance, the balance sheets should reflect changes in accordance with market conditions, IFRS 17 requires increased transparency in financial statements. Additionally, the timeframe for insurers to comply with the standards following the implementation of IFRS 17 was very short.

Furthermore, to implement and understand these complex standards, companies require skilled resources. This may pose a challenge for emerging and small-sized companies to adapt to these standards, limiting their market entry, which is expected to restrict the Hong Kong insurance market growth.

Hong Kong Insurance Market Segmentation Analysis

By Type Analysis

Increasing Penetration of Life Insurance in the Country Boosted Segment Growth

Based on type, the market is classified into life and non-life. The non-life segment is further segmented into property, health, motor, and others.

The life segment dominated the market in 2024 and is expected to grow at the highest CAGR during the forecast period. This dominance was mainly due to the high penetration of life insurance products in Hong Kong. Moreover, the increasing awareness of the country’s residents regarding the importance of financial planning and protecting their families monetarily in case of unexpected circumstances is also anticipated to drive the high penetration of life plans in the country, driving the segment growth.

- For instance, as of March 2023, as per Actuary Magazine, Hong Kong reported sales of 1,075,080 new individual life insurance policies in 2021.

The non-life segment accounted for a substantial market share in 2023 and is expected to expand at a significant CAGR during the forecast period. The increased premium volumes of general liability business, property business, and accident & health business in Hong Kong have surged the gross written premium generated by several insurers in Hong Kong. This is expected to propel the segment growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Mode Analysis

Benefits and Convenience of Offline Insurance Plans Fueled Segment Growth

By mode, the Hong Kong market is segmented into online and offline.

The offline segment dominated the market in 2024. The segment’s dominance was mainly due to the benefits associated with offline plans, such as more precise explanations of terms, personalized assistance from experienced agents, and the ability to deal directly with trusted agents, reducing the risk of cyber fraud. In addition, it allows customers who are uncomfortable with online processes to call agents directly or visit local branches for assistance, safeguarding a more supportive and personalized experience in navigating health insurance options. This is expected to fuel the segment's growth in the coming years.

The online segment is projected to grow at the highest CAGR in the forthcoming years. This growth can be attributed to the increasing digital penetration in the country, including the insurance sector. This enabled the customers to compare and purchase suitable policies considering their needs with greater convenience and accessibility. This is anticipated to increase the popularity of online plans in Hong Kong. Therefore, insurers in Hong Kong are significantly focused on providing online plans. This will expand the product availability and lead to higher purchase rates, propelling the segment growth in the coming years.

- For instance, as of May 2024, HSBC Group offers a broad range of online plans, such as the Swift Guard Critical Illness, VHIS Flexi plan, and Family Protector Term Life, in Hong Kong.

By Distribution Channel Analysis

Strategic Launches of Various Plans by Banks to Fuel the Segmental Growth

By distribution channel, the Hong Kong market is segmented into agencies, banks, brokers, direct marketing channels, and others.

The banks segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is attributed to the strategic launches of various plans, including study insurance and wealth selection insurance plans, by banks in the country. These plans provide the students pursuing education abroad with extensive care and offer different investment options to suit the evolving needs of consumers, which boosts their demand, spurring segmental growth.

- For instance, as of August 2022, HSBC Group announced the launch of the Wealth Select Protection Linked Plan in Hong Kong to offer diverse investment options suitable for customer's evolving needs.

The agencies segment is projected to grow at a substantial CAGR in the forthcoming years. This growth can be attributed to the greater strategic focus on agent recruitment and performance by several firms in the country. This can support the company’s sales of products more precisely and efficiently, which is expected to spur segment growth during the projection period.

On the other hand, the others segment is also anticipated to expand at the highest CAGR during the forecast period. This growth is attributed to a significant rise in direct marketing channels in response to increasing digitalization and an increase in the number of brokers to communicate and transact with customers efficiently.

KEY INDUSTRY PLAYERS

Focus on Launching New Products by the Key Market Players Drives the Competition in the Market

Key players in the market, such as AIA Group Limited, AXA, China Taiping Insurance Holdings Company Limited, and Prudential, accounted for the significant Hong Kong Insurance market share in 2024. The significant growth of these players in the market is attributed to their strong focus on new product launches.

- In January 2024, AIA Group Limited launched Global Power Multi-Currency Plan 3 to aid consumers in achieving their individual goals sooner, offering extra flexibility and higher returns.

Moreover, the other prominent players in the Hong Kong insurance market have shifted their focus to strategic initiatives such as collaborations and partnerships to enhance their brand presence in the market.

- In January 2023, HSBC Group entered into a partnership with MediTrust Health Technology Co. Ltd., an online healthcare solutions provider in Mainland China, to provide a wide range of healthcare services, accelerating the growth of its wealth and insurance business in Mainland China.

LIST OF TOP INSURANCE COMPANIES:

- AXA (France)

- China Taiping Insurance Holdings Company Limited (Hong Kong)

- AIA Group Limited (Hong Kong)

- Zurich Insurance Group Ltd. (Switzerland)

- Bupa (U.K.)

- Prudential (U.K.)

- American International Group, Inc. (U.S.)

- FTLife Insurance Company Limited (Hong Kong)

- BANK OF CHINA (BOC) (China)

- HSBC Group (U.K.)

- China Life Insurance Company Ltd. (China)

KEY INDUSTRY DEVELOPMENTS:

- March 2024 – AXA upgraded its SmartTraveller Plus, a travel insurance plan with newly added benefits, including virtual medical consultation, medicine delivery, and optional cruise benefits.

- February 2024 – FTLife Insurance Company Limited launched a FamCare 198 Critical Illness Protector – Pregnancy Baby Protection to provide early critical illness protection for persons and their family members, ensuring a secure future.

- February 2024 – Prudential entered into a collaboration with Shenzhen New Frontier United Family Hospital ("UFH") to improve healthcare offerings and meet the evolving need for convenient and trusted cross-border medical services.

- July 2023 – AXA entered into a partnership with GoGoX, Asia's leading logistics technology platform, to co-create a new model, joining forces with insurance that delivers tailored and complete insurance coverage to GoGoX users.

- November 2022 – Zurich Insurance Company Ltd announced a collaboration with Citi to promote a fully customizable Zurich Lifestyle insurance plan.

REPORT COVERAGE

An Infographic Representation of Hong Kong Insurance Market

To get information on various segments, share your queries with us

The market report provides a detailed analysis of the competitive landscape. It also includes key insights, such as insights of penetration in Hong Kong, new product launches by key players, key industry developments, and an overview of the regulatory scenario. Moreover, the report covers the impact of COVID-19 on the market, Hong Kong market forecast, company profiles of key market players, market trends, and company market share analysis. In addition, the report comprises quantitative and qualitative insights that have contributed to the market's expansion.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 6.8% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Mode

|

|

|

By Distribution Channel

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 127.02 billion by 2032.

In 2024, the market value stood at USD 76.15 billion.

The market is predicted to exhibit a CAGR of 6.8% during the forecast period.

The life segment was leading the market by type.

The rising geriatric population and growing burden of chronic diseases, strong demand for health and risk protection among the general population, increasing vehicle ownership, and resumption of cross-border travel from Mainland China are the key factors driving the Insurance market growth.

AIA Group Limited, Prudential, HSBC Group, and AXA are the top players operating in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic