Human Hair Extension Market Size, Share & Industry Analysis, By Type (Clip-in Hair Extension, Fusion & Pre-Bonded Hair Extension, Tape-in Hair Extension, and Others), By Application (Female and Male), By Sales Channel (Offline Channel and Offline Channel), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

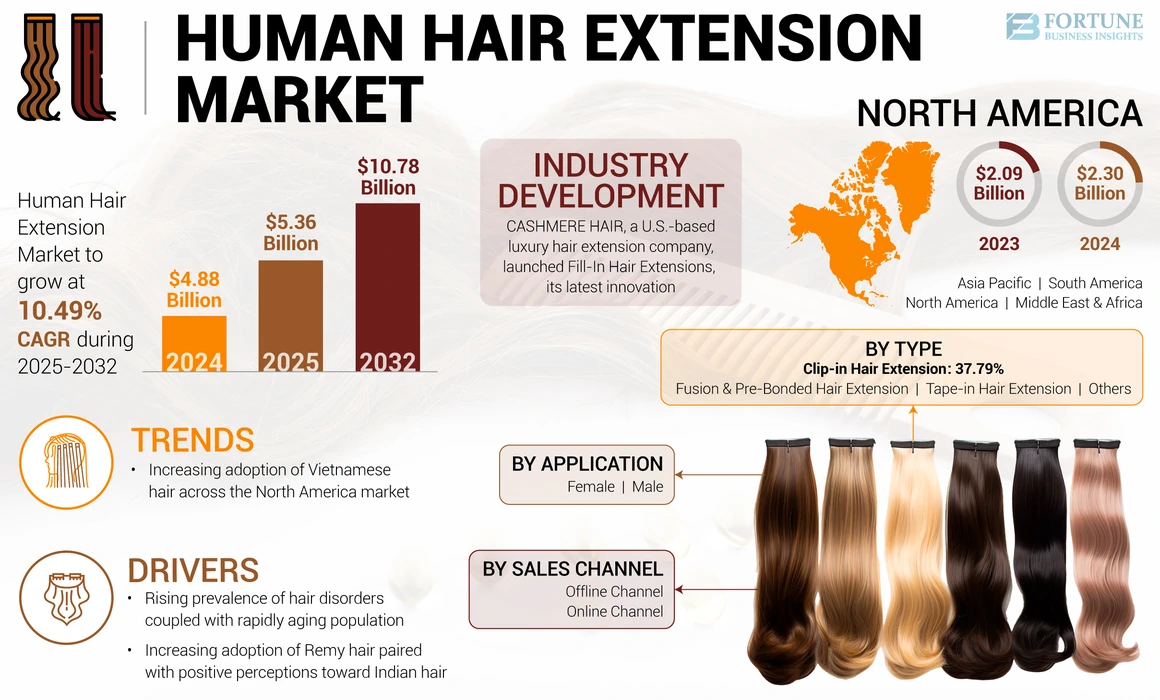

The global human hair extension market was valued at USD 4.88 billion in 2024. The market is projected to be worth USD 5.36 billion in 2025 and reach USD 10.78 billion by 2032, exhibiting a CAGR of 10.49% during the forecast period. North America dominated the human hair extension market with a market share of 47.13% in 2024.

Human hair extensions can be styled using hot tools (straightened or curled), dyed for a darker color, washed, and can be treated just the way a user would treat their natural hair. On the contrary, synthetic hair extensions are typically sensitive to the sun and difficult to blend or style with the user’s natural hair. Furthermore, synthetic hair wigs/extensions have a shorter lifespan, while their natural hair counterparts can last up to a year or longer if maintained well. Various studies suggest that consumers typically prefer natural hair to synthetic hair extensions owing to installation (heat) - related challenges associated with the latter. Given the rising global demand for natural hair, human hair extensions are finding extensive use in hair wigs and extensions as key market participants focus on new product launches. At a macro level, the rapidly expanding wigs & extensions market will increase the human hair extension market share in the coming years.

The impact of the COVID-19 pandemic on the product demand has been twofold, most notably throughout 2020. International raw material suppliers across many countries were unable to operate owing to shipping restrictions and quarantines in 2020. Moreover, the few vendors who shipped the raw materials to the Western markets, including the U.S., increased their prices, making it challenging for industry participants to sell their products without increasing the final price.

GLOBAL HUMAN HAIR EXTENSION MARKET SNAPSHOT

Market Size & Forecast:

- 2024 Market Size: USD 4.88 billion

- 2025 Market Size: USD 5.36 billion

- 2032 Forecast Market Size: USD 10.78 billion

- CAGR: 10.49% from 2025–2032

Market Share:

- North America led with a 47.13% market share in 2024, driven by high demand for premium Remy hair and salon-based distribution.

- Clip-in extensions remain the most popular type due to ease of use and affordability, while tape-in extensions are gaining traction for their natural appearance and comfort.

- Offline channels dominate, supported by personalized service in salons, though online platforms are growing rapidly through brand-owned apps and e-commerce innovations.

Key Country Highlights:

- U.S.: Strong demand for Remy and Vietnamese hair; key players like Perfect Locks and SL Raw Virgin Hair drive growth through salon partnerships and e-commerce apps.

- Vietnam: Major raw material source; known for high-quality hair from young women using natural haircare, widely exported to North America and Europe.

- India: World's largest human hair exporter; Remy hair sourced from temples fuels exports through brands like Indique Hair, serving markets in the U.S., Canada, and Europe.

- U.K. & France: Strong salon and retail network; brands like Balmain Hair Couture and Racoon International focus on ethically sourced premium products.

- U.A.E. & Brazil: Emerging import hubs; increasing demand for natural and organic hair extensions as alternatives to synthetic and plastic-based products.

Human Hair Extension Market Trends

Increasing Adoption of Vietnamese Hair across North American Markets to Favor Asian Raw Material Suppliers

The increasing popularity of Vietnamese hair across North American markets, most notably in the U.S., is likely to encourage the entry of new raw material suppliers into Asia. Vietnamese hair is typically sourced from villagers residing in high mountains where their hair quality is unaffected by sunlight. Vietnamese hair suppliers usually source hair from women aged 18-25 to supply strong and healthy hair across the world.

Vietnamese women have long, straight hair, and maintain an effective hair care routine. They rarely dye their hair and don’t use chemical-based shampoos. Most women in Vietnam shampoo and maintain their hair using natural products, such as locusts, rice water, herbs, or leaves. Prospective industry players promote Vietnamese hair by highlighting the hair care routine in Vietnam.

- North America witnessed human hair extension market growth from USD 2.09 billion in 2023 to USD 2.3 billion in 2024.

Download Free sample to learn more about this report.

Human Hair Extension Market Growth Factors

Rising Prevalence of Hair Disorders and Rapidly Aging Population to Fuel Product Demand

According to the American Hair Loss Association (AHLA), Male Pattern Baldness (MPB) is a major hair-related issue worldwide, affecting approximately 25% of men with hereditary MPB before the age of 21. The AHLA also states that 66% of men will have experienced some degree of hair loss by the age of 35 and will have also experienced hair thinning before turning 50. According to the U.S. Census Bureau report published in 2017 and revised in 2020, the share of individuals aged 65 and older will increase from 15% in 2016 to roughly 25% by 2060.

A rapidly aging population also highlights the rising prevalence of hair disorders in the U.S., as is the case globally, which, in turn, will boost the product demand in the forthcoming years. According to data published in 2022 by the Population Reference Bureau (PRB), a U.S.-based non-profit organization collecting and providing relevant statistics for academic and research purposes, China, India, and the U.S. emerged as the countries with the largest number of people aged 65 years or above (older adults). Given the large number of older adults in these countries, industry participants will likely contemplate geographic expansion strategies to stay competitive in the coming years.

Increasing Adoption of Remy Hair and Positive Perception Toward Indian Hair to Favor Market Expansion

Unlike most non-Remy hair extensions, Remy hair is considered the best-quality human hair that is commercially available as its cuticles are intact. India is considered a major source of Remy hair for many international markets. In August 2023, Anupriya Patel, the Union Minister of State for Commerce and Industry, said that India is the world’s largest source for human hair exports. The presence of Indian companies in international markets highlights the popularity of Indian hair. Indique Hair is a dominant Indian company operating in the U.S. It sources hair from collectors and Indian temples from Southeast Asia and ships to its offices in Boston. It then ships its products to the U.S. stores and online customers in Canada, Africa, and Western Europe. Internationally reputed brands focusing on the ethical sourcing of human hair, including Great Lengths, Hailes, and Woven Hair, procure high-quality hair from India by highlighting its superior characteristics.

The adaptability and versatility of strong and naturally-thick Indian hair make it ideal for producing high-quality products. Remy hair is usually procured from religious sites and often marketed as ‘organic’ or ‘ethically sourced’ to enhance its appeal internationally. Given the rising concerns regarding the environmental issues of synthetic hair extensions, Remy hair, with its natural/organic image, is likely to witness heightened consumer interest in the forthcoming years.

RESTRAINING FACTORS

Rising Demand for Substitute Products/Procedures will Limit Product Adoption

Wigs are the biggest substitutes for human hair extensions. Recent developments in the wigs category indicate the rising popularity of substitutes for human hair extensions. For instance, in June 2021, WEAVE, a California-based new lifestyle brand, penetrated the wigs category by launching a line of wigs created by Black women to uplift Black consumers. Furthermore, synthetic materials are more readily available than their natural counterparts. At a macro level, the increasing launches of innovative hair products will likely hamper the product demand across countries in the coming years, with hair companies striving to achieve product differentiation. For instance, ReGen Hair Fiber, a U.S.-based sustainable hair products company, launched its new line of compostable and biodegradable braiding hair extensions featuring banana fiber in 2019. Though these innovative products are intended to replace their plastic-based counterparts, their increasing adoption can also negatively influence human hair-based products worldwide.

According to the International Society of Hair Restoration Surgery (ISHRS), approximately 182,025 procedures were performed in the U.S./Canada in 2019. Furthermore, the ISHRS estimated that the global hair restoration market increased from USD 4.1 billion in 2016 to USD 4.6 billion in 2019. The American Academy of Dermatology (AAD) recommends using human hair extensions only on special occasions, as they can pull on the users’ hair and cause permanent hair loss. Such recommendations can affect the degree of optimism among consumers regarding these extensions.

Human Hair Extension Market Segmentation Analysis

By Type Analysis

Rising Consumer Preference for Affordable Products to Trigger Demand for Clip-in Hair Extensions

The market is segmented into clip-in hair extension, fusion & pre-bonded hair extension, tape-in hair extension, and others based on type.

Clip-in hair extension is among the most popular product categories globally. Unlike most other product types, clip-in hair extensions can be easily removed and reused at the user’s convenience without hassles. The simplicity of installation of these extensions will increase their preference among users. Tape-in hair extensions are usually lighter on the users’ scalp than their clip-in counterparts. This product type will likely gain heightened consumer interest in the coming years as they are known to lay more naturally on a user’s scalp.

- The Clip-In Hair extension segment is expected to hold a 37.79% share in 2024.

‘Non-commitment’ will likely emerge as the operative term in the global market in the coming years. From an end-user standpoint, non-commitment translates to the freedom or ability to change the product style or color often. This factor may boost sales across the tape-in and clip-in categories. The concept of non-commitment also helps brands minimize the threat of substitute products as individuals/consumers tend to change their styles or colors by visiting a salon rather than consulting a licensed cosmetologist, an expert in skincare, makeup, and beauty products.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Marketing Efforts Targeted at Female Consumers to Encourage Product Innovation

Based on application, the market is bifurcated into female and male.

The female segment emerged as the largest segment in 2024 and is expected to grow at a considerable rate over the forecast timeframe. Though most individuals who experience hair loss issues are men, hair extensions are yet to witness widespread adoption among men worldwide, principally attributed to the fact that most human hair extension brands have traditionally marketed their products to female consumers. The multi-billion dollar Hollywood industry offers lucrative opportunities for brands to exploit the male category in the coming years.

The majority of brands cater to female consumers. Prominent brands are targeting African-American women to stay competitive. Various studies suggest that black consumers prefer hair extensions or products specifically marketed for them. Well-established and new brands across countries must offer natural products to target both males and females. While Remy hair can be targeted at female consumers, products designed to provide stylish protection to the scalp of those individuals suffering from hair thinning and baldness can be targeted at men while marketing these products as a better and more stylish option than hats.

By Sales Channel Analysis

Growing Preference for Personalized Over Virtual Services Boosted Demand for Offline Channels

The market is segmented into online and offline based on sales channel.

The offline segment dominated the global market in 2024. Rising consumer preference for personalized over virtual services is a key factor contributing significantly to the growth of the offline channel segment. Moreover, professional hairdressers and salons are the most prominent distributors of all types of hair extensions. The offline distribution channel helps consumers learn about the product & consumption trends, and manufacturers can develop new products based on consumer behavioral patterns.

The online segment will grow at the fastest CAGR over the forecast period. Industry participants have recently launched new websites to strengthen their e-commerce presence in recent years. For instance, in July 2021, SL Raw Virgin Hair, a U.S.-based hair extension supplier, launched its first e-commerce app for iOS and Android devices. Through the new app, the company enabled access for consumers across the country to purchase its products.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

North America Human Hair Extension Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America emerged as the largest market in 2024. Hair extension companies in the U.S. typically partner with only well-established salons to achieve a greater brand reputation. For instance, Perfect Locks LLC, a California-based hair extension company, only offers distribution opportunities to reputed businesses/salons. Furthermore, the company requires its distributors to retain the Perfect Locks brand.

In recent years, the U.S. witnessed various developments in the product distribution space. For instance, in March 2021, USA Hair, a prominent U.S.-based online beauty supply company, announced the launch of a broad spectrum of hair products, including hair extensions. The new line of hair extensions is available in various color options to suit the needs of various consumer groups. The online shop also announced sizable discounts (up to 17%) on all its products purchased till March 28, 2021. This strategic move, i.e. product launch, highlights the rising demand for fashionable products in the U.S. and the need for brands to innovate their product offerings to stay competitive. Hair Visions International is one of the major distributors worldwide.

Asia Pacific is likely to witness significant growth in the future. India is a raw material and finished product supplier to Western countries backed by several natural hair suppliers, most notably concentrated in Chennai (Tamil Nadu). Shanmuga Hair Products India Pvt. Ltd., one of the leading natural human hair manufacturers and exporters, typically exports a fifth of its hair products to the U.S. annually. Italy is the company’s biggest consumer/market. The company partners with Hair Luxury, a European retail partner, to sell its products. According to various data sources, Hair Luxury can sell the product for approximately USD 2,000 per kilo, depending on the hair quality. Shanmuga Hair Products India Pvt. Ltd processes approximately 1,000 kgs of hair by hand every month. While the company sells weaves at around USD 500 per kg, and its hair extensions are sold to international markets at approximately USD 900 per kg.

The markets in the Middle East & Africa and South America will likely create lucrative growth opportunities for international players in the forthcoming years. While Asian countries, such as India are the major source of raw materials, the U.A.E. is one of the world’s biggest importers of natural hair.

Key Industry Players

Global Expansion and Partnership With Reputed Hairstylists are Key Strategies Fueling Market Growth

A high focus on collaboration and partnership with hairstylists and industry experts are key factors enabling reputed players to address new market trends and gain a competitive edge to penetrate new markets. Product differentiation will be a key factor driving product sales and impacting market dynamics throughout the forecast period. Recent years have witnessed various developments, notably in the mergers & acquisitions space. For instance, in July 2018, Beauty Industry Group Inc., a Utah-based company, collaborated with GAUGE CAPITAL, a Dallas-based private equity firm, to acquire the assets of HALOCOUTURE, a California-based company.

List of Top Human Hair Extension Companies:

- Great Lengths (Italy)

- Balmain Hair Couture (France)

- Hairdreams Haarhandels GmbH (Austria)

- easihair pro (U.S.)

- Beauty Industry Group Inc. (U.S.)

- Cinderella Hair Extension (U.S.)

- Hairlocs (U.S.)

- Klix Hair, Inc. (U.S.)

- UltraTress (U.S.)

- Racoon International (U.K.)

- Hair Addictionz (U.S.)

- FN Longlocks (U.S.)

- Viva Femina, Inc. (U.S.)

- Femme Extensions (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- December 2023: CASHMERE HAIR, a U.S.-based luxury hair extension company, launched Fill-In Hair Extensions, its latest innovation. The company intended to provide a temporary hair volume boost to individuals experiencing hair-thinning issues.

- May 2022: Beauty Industry Group (BIG), a U.S.-based beauty product supplier, announced the acquisition of Bellami Hair, a U.S.-based company specializing in hair extension and hair care products. This acquisition will likely assist BIG in growing its customer footprint and expanding its market share globally.

- June 2021: Mayvenn Inc. opened its first retail shop on Fry Road in Katy Area, Texas, U.S. to offer its products to new customers, provide several services to its users, and bridge the gap between customers and hairstylists.

- April 2021 – Evergreen Products Group Ltd., a Hong Kong-based manufacturer of hair products, developed and invested in digital wigs by using the technology of Non-Fungible Tokens (NFTs) as a part of its business strategy. The company makes unique digital wigs for online customers for social media posts, live video streaming, or video calls.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product types, leading applications of the product, and market insights on key sales channels. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors listed above, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.49% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Sales Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global human hair extension market was valued at USD 4.88 billion in 2024. It is projected to grow from USD 5.36 billion in 2025 to USD 10.78 billion by 2032.

The market is likely to record a CAGR of 10.49% over the forecast period of 2025-2032.

The market is driven by the rising demand for natural-looking hair solutions, increased hair loss cases, and the growing popularity of beauty enhancements.

Human hair extensions can be styled, dyed, and washed like natural hair, offering a more realistic and long-lasting solution. In contrast, synthetic extensions have a shorter lifespan, are less versatile, and are prone to heat damage.

Clip-in and tape-in hair extensions are the most preferred types due to their easy application, removability, and affordability.

Remy hair is considered the highest quality of human hair because its cuticles remain intact and aligned. It offers natural texture, durability, and minimal tangling, making it a top choice for luxury hair extensions globally.

Yes, but they must be properly installed and maintained. Overuse or improper application can lead to hair breakage or traction alopecia. Experts recommend using extensions occasionally or under professional guidance.

Top companies include Great Lengths (Italy), Balmain Hair Couture (France), Beauty Industry Group (U.S.), Hairdreams (Austria), and Indique Hair (India-U.S.), all focusing on quality, innovation, and global expansion strategies.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us