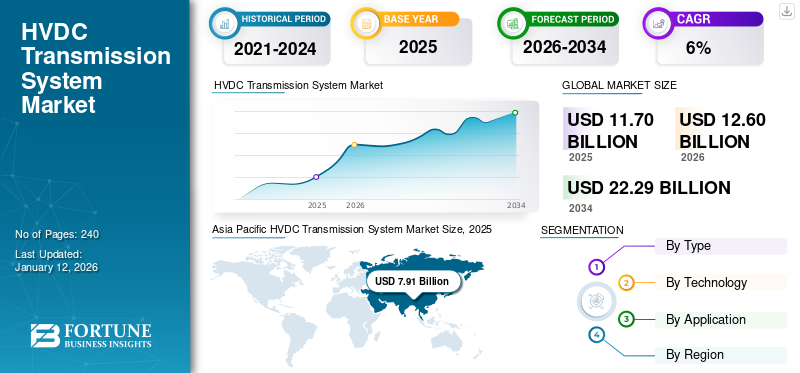

HVDC Transmission System Market Size, Share & Industry Analysis, By Type (High-power Rating Projects and Low-power Rating Projects), By Technology (Line Commutated Converter (LCC) and Voltage Source Converters (VSC)), By Application (Subsea, Underground, Overhead, and Mixed), and Regional Forecast, 2026-2034

HVDC Transmission System Market Size

The global HVDC transmission system market size was valued at USD 11.70 billion in 2025 and increased to USD 12.60 billion in 2026, reaching USD 22.29 billion by 2034, registering a CAGR of 7.39% during 2026–2034. Asia Pacific dominated the HVDC Transmission System industry with a market share of 67.65% in 2025.

HVDC (High Voltage Direct Current) is a vital component of a carbon-neutral energy system. It is highly efficient for transmitting large amounts of power over long distances, integrating renewable energy, connecting grids, and opening up new sustainable power transmission solutions. Another utility of the HVDC system is to avoid the high currents required for the cable capacity of submarine power cables. HVDC also enables power transmission between asynchronous AC grids and can power large urban centers. An HVDC system takes electrical energy from the AC grid via a transformer, converts it to DC at a converter station, and transmits it to a receiving point via overhead or underground cables. At the receiving point, it is converted to AC using another converter.

The COVID-19 pandemic has significantly impacted the global market due to decreased electricity demand on account of the shutdown of commercial and industrial activities and disrupted supply chains. Meanwhile, the increasing usage of renewable energy plants away from fossil fuels and the surging demand for electricity will drive the market after the pandemic. As the pandemic progressed, government authorities all around the world began to recognize the importance of investing in critical infrastructure to ensure energy security and support economic recovery. Further, the growing need for grid stability and a shift toward renewable energy sources, such as wind and solar, could further carve the growth. The post-COVID-19 pandemic will give firms a sort of relaxation to recover and grow, with governments and energy companies focusing on infrastructure investments to support economic growth and ensure energy security.

HVDC Transmission System Market Trends

Growing Number of Grid Interconnections to Propel Market Growth

The expanding network of grid interconnections is significantly boosting the market for HVDC transmission systems, with the increasing need to interconnect power grids across regions and countries. HVDC technologies are emerging as the optimal solution to efficiently transmit large volumes of electricity over long distances with minimal losses. Various factors, including the integration of remote renewable energy resources, such as offshore wind farms and remote solar installations, into the grid will drive the product demand. HVDC systems facilitate this integration by offering better voltage control and lower transmission losses compared to traditional AC systems, thus ensuring the reliable transmission of renewable energy to the population center. Moreover, grid interconnections powered by HVDC enable cross-border electricity trading, thereby promoting efficiency and enhancing energy security. Supported by favorable government policies and investments, HVDC transmission projects are poised to play a crucial role in advancing energy interconnection initiatives worldwide, thereby fostering regional cooperation and accelerating the transition to a sustainable future.

Download Free sample to learn more about this report.

HVDC Transmission System Market Growth Factors

Growing Adoption of VSC Technology to Promote Market Growth

The line commutated current (LCC) sourced converter technology has evolved as one of the most reliable and advanced technologies for HVDC transmission. LCC technology has proven to be reliable and robust, with high availability and minimal downtime. This is due to the maturity of the thyristor technology, which has been optimized for high power applications over many decades. LCC technology is relatively environmentally friendly compared to other power transmission technologies. For instance, it does not require the use of hazardous materials like mercury, which was previously used in arc valves. Innovations in almost every other HVDC field are steadily increasing the reliability of this technology to address the challenges of the new renewable energy economy.

A voltage source converter (VSC) is a self-commutated converter connecting HVAC and HVDC systems to equipment suitable for high-power electronic applications. VSCs are capable of self-commutation with an aim to generate an AC voltage independently without relying on the AC system. This enables fast, independent control of active and reactive power and black start capability. VSC can be easily integrated into multiport DC systems. THE VSC-based HVDC system offers faster active power flow control than the more advanced CSC HVDC system while ensuring flexible and extended reactive power controllability on the two converter ports. VSC technology has several technical advantages, including resilience to commutation errors, auxiliary services, and reactive power control.

Growing Number of HVDC Projects across the Globe to Flourish Market Growth

The installation of HVDC systems is rapidly increasing worldwide as the economic feasibility of using HVDC to enhance grid connectivity has improved. However, the installation of HVDC systems is increasing rapidly worldwide, including in Europe, South America, and China. With the increase in renewable energy capacity, growth in domestic power trading, and increasing demand for more reliable power supplies, have contributed significantly to the development of the market. The fact that HVDC projects and cost-benefit analysis prove it. The rapid technological progress of HVDC using voltage source converters contributed significantly to this result.

The development of VSC HVDC technology offers various advantages to the power grid, making HVDC a practical option for enhancing grid connectivity. In recent years, there has been a significant shift in the use of HVDC transmission links. While these links were used to connect different power grids, there are now occasions where HVDC is being installed within a single synchronous cable network, particularly through the use of submarine cables. This trend has been increasing recently. One of the key drivers of this increase in HVDC deployments is the evolution of VSC HVDC technology. For Instance, From November 2022, Clean hydropower will be transported from Quebec to New York via the CHPE, a planned 339-mile HVDC transmission project. The project provides a capacity of 1,250 megawatts of clean energy, which will power numerous New York homes, and it will be the combination of submarine and terrestrial elements.

RESTRAINING FACTORS

High Cost of HVDC Transmission System at Short Distances Could Hinder Market Growth

The price of a device depends on several variables, including the amount of power transmitted, the type of transmission medium, environmental considerations, and the price of converter stations and associated equipment.

The system requires additional hardware, such as transformers, pole and valve controls, mechanical and electrical auxiliaries. All these devices are very expensive. Since modern equipment requires AC power, converter stations must be built at the endpoints to convert DC to AC, increasing the overall costs. The converter stations and other accompanying equipment also intensify the cost of HVDC projects. HVDC converter stations and associated assets may involve a greater investment than AC transmission lines for shorter distances. Furthermore, the system operator/owner of the transmission line incurs additional expenses for upholding an inventory of customized HVDC assets.

HVDC Transmission System Market Segmentation Analysis

By Type Analysis

Growing Number of Large Capacity Renewable Projects to Stimulate the Growth of the Low-power Rating Projects

Based on type, the global market is segmented into high-power rating projects and low-power rating projects. The Low-power rating projects consist of projects capable of transmitting a capacity of above 1000MW facility. The low-power rating projects type HVDC transmission system market is growing due to increasing demand for efficient power transmission in remote areas, limiting the short circuit, which conventional AC transmission lines cannot serve. Low-power rating projects emerged as the largest project-type segment, accounting for 70.06% of the total market share in 2026.

By Application Analysis

Rising Number of Overhead HVDC Projects to Dominate Global Market

The global market is segmented on subsea, underground, overhead, and mixed. The overhead application in the HVDC transmission system is growing. Overhead application refers to the use of overhead transmission lines for transmitting electricity over long. Overhead HVDC systems represented the largest installation segment, generating USD 6.38 billion in 2026 and holding a 50.65% market share.This method of transmission is gaining popularity due to its lower cost of installation compared to underground cables, making them a more cost-effective option for transmission over long distances. Also overhead lines have a higher power-carrying capacity, allowing for the transmission of larger amounts of electricity over greater distances. Overhead lines have a lower transmission loss compared to underground cables, making them more efficient for long-distance transmission. Moreover, the shift towards renewable energy sources, such as wind and solar, which are typically located in remote areas, is also driving the growth of overhead application in the market.

By Technology Analysis

To know how our report can help streamline your business, Speak to Analyst

Immense Advancement in Voltage Source Converter Technology to Stimulate HVDC Transmission System Demand

On the basis of technology, the global market is segmented into Voltage Source Converter (VSC) and Line Commutated Converter (LCC). Line Commutated Converter (LCC) technology dominated the market, with a market size of USD 9.00 billion in 2026 and a 71.46% market share. It is estimated to hold the largest global HVDC transmission systems market share due to its high efficiency, reliability, and cost-effectiveness. LCCs are preferred for transmitting bulk power over larger distances. The LCC technology is advanced and has been used for many years, making it a reliable option.

REGIONAL INSIGHTS

This market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Asia Pacific HVDC Transmission System Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Among all regions, the Asia Pacific region holds the largest part in the HVDC transmission system market share in the global market and is expected to maintain a steady growth rate. The growth of the market in the Asia Pacific can be attributed to strong economic growth and government-supportive policies to accelerate industrialization across the region. The HVDC transmission system market in the U.S. is projected to grow significantly, reaching an estimated value of USD 2.12 billion by 2032. The China market reaching USD 5.75 billion by 2026, followed by India at USD 1.24 billion and Japan at USD 0.27 billion.

North America

North America is expected to hold a prominent foothold in the market due to increasing demand for renewable energy sources, rising government initiatives to reduce carbon emissions, and increasing investments in the transmission infrastructure. Additionally, the need for transmitting large amounts of power over long distances and the adoption of renewable energy sources are some other factors that propel market growth. North America contributing 15.14% globally in 2025.

Europe

Europe will dominate the market due to expanding industrial infrastructure and increased investment in energy sectors. Europe contributing 9.6% globally in 2025. The Germany market reached USD 0.37 billion in 2026, while the UK market accounted for USD 0.16 billion, supported by investments in offshore wind integration, cross-country grid connectivity, and modernization of transmission networks. Europe accounting for 9.6% market share in 2025.

Key Industry Players

Companies Focus on New Projects on Transmission and Distribution to Strengthen their Market Position

Companies are looking to strengthen their market position by focusing on new projects related to transmission and distribution. For instance, on June, 2022, The Shaoxing Hongxu energy storage power station in China was successfully connected the world's first 35kV high-voltage direct coupled energy storage system developed by NR to the grid.

List of Top HVDC Transmission System Companies:

- Hitachi Energy Ltd. (Switzerland)

- Siemens (Germany)

- NEXANS (France)

- Toshiba Energy Systems Solutions Corporation (Japan)

- CHINA XD GROUP (China)

- Mitsubishi Electric Corporation (Japan)

- General Electric (U.S.)

- Xu Ji Group Co. Ltd (China)

- NR Electric Co. Ltd. (China)

- Prysmian Group. (Italy)

- TBEA Co., Ltd. (China)

- NKT (Denmark)

KEY INDUSTRY DEVELOPMENTS:

- January 2023 - Nexans and SuperGrid Institute successfully transient overvoltage test 525kV DC cable system in compliance with the latest high voltage direct current recommendations.

- January 2023 -The Tingshan Frequency Converter Station, part of the Hangzhou Flexible Low-Frequency Transmission Pilot Project, has officially started. This marks the first-ever achievement of a controllable transformation of power frequency to the low frequency at the 220kV voltage level.

- January 2023 – TenneT, the Dutch-German Transmission System Operator and technology leader Hitachi Energy, and international services company Petrofac have signed agreements supporting TenneT's 2GW Program. As per the agreements, the companies will commence preliminary work and conduct detailed engineering to ensure the timely completion of the first two Dutch converter stations for TenneT's offshore wind grid expansion, which will utilize high voltage direct current (HVDC) technology.

- December 2022 - Toshiba Electronic Devices & Storage Corporation announced the construction of a new back-end production plant for power semiconductors at its Himeji Operations.

- June 2021 – Prysmian Group, a global leader in the energy and telecom cable industry, announced high-voltage DC cable systems for the groundbreaking SOO Green HVDC Link project. The project will be installed underground along existing railroad rights of way.

REPORT COVERAGE

The market research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.39% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type, By Technology, By Application, and By Region |

|

Segmentation |

By Type

|

|

By Technology

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

The global HVDC transmission system market size was valued at USD 11.70 billion in 2025 and increased to USD 12.60 billion in 2026, reaching USD 22.29 billion by 2034.

The market will likely record a CAGR of 7.39% over the forecast period of 2026-2034.

The overhead segment is expected to lead the market due to the development of the HVDC transmission system globally.

The market size of Asia Pacific stood at USD 7.91 billion in 2025.

The growing adoption of VSC technology and the rise of the number of HVDC projects across to boost growth is expected to drive the market growth.

Some of the top players in the market are Siemens, Hitachi Energy Ltd., Toshiba Energy Systems Solutions Corporation, and Mitsubishi Electric Corporation.

The global market size is expected to reach USD 22.29 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us