Hydrogen Fueling Station Market Size, Share & Industry Analysis, By Type (Small Station (Less than 1 t/d of H2) {Low Pressure and High Pressure}, Medium Station (1-4 t/d of H2) {Low Pressure and High Pressure}, and Large Station (More than 4 t/d of H2){Low Pressure and High Pressure}), and Regional Forecast, 2026-2034

Hydrogen Fueling Station Market Size

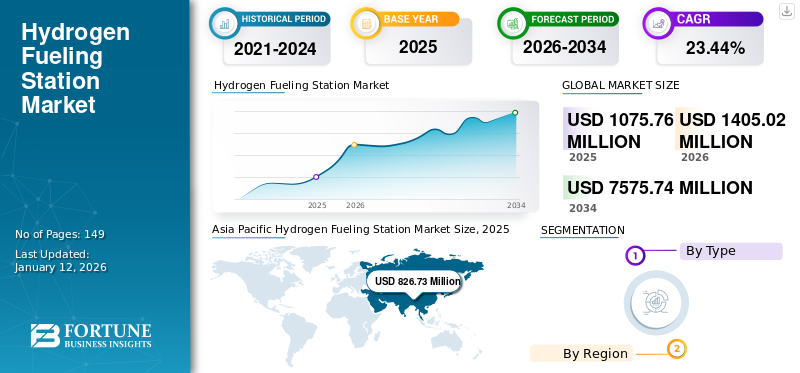

The global hydrogen fueling station market size was valued at USD 1,075.76 million in 2025 and is projected to be worth USD 1,405.02 million in 2026 and reach USD 7,575.74 million by 2034, exhibiting a CAGR of 23.44% during the forecast period. Asia-Pacific dominated the hydrogen fueling stations market with a market share of 76.86% in 2025.

A hydrogen fueling station is a specialized infrastructure designed to supply hydrogen gas to Fuel Cell Vehicles (FCVs) and other hydrogen-powered vehicles. These stations play a crucial role in enabling the adoption of hydrogen fuel cell technology as an eco-friendly and sustainable alternative to conventional fossil fuels.

Global Hydrogen Fueling Station Market Overview

Market Size:

- 2025 Value: USD 1,075.76 million

- 2026 Value: USD 1,405.02 million

- 2034 Forecast Value: USD 7,575.74 million, with a CAGR of 23.44% from 2026–2034

Market Share:

- Regional Leader: Asia Pacific held a 76.86% market share in 2025, driven by large-scale hydrogen infrastructure investments and strong adoption targets in China, Japan, and South Korea.

- Fastest-Growing Market: The U.S. market is projected to reach USD 760.39 million by 2032, supported by zero-emission transportation policies, funding programs, and public-private hydrogen initiatives.

- End-User Leader: The small station segment (<1 t/d of H₂) dominated in 2024 due to cost efficiency, flexibility, and suitability for diverse applications such as vehicles, forklifts, and backup power.

Industry Trends:

- Government-Driven Adoption: Subsidies, incentive programs, and hydrogen roadmaps boost Fuel Cell Electric Vehicle (FCEV) uptake.

- Heavy-Duty Transport Focus: Hydrogen is increasingly adopted in long-haul trucks, buses, and locomotives, where batteries are less practical.

- Technology Advancements: Innovations such as McPhy’s “augmented mcfilling” smart station architecture improve station efficiency and scalability.

Driving Factors:

- Carbon Emission Reduction Goals: Hydrogen adoption supports zero-emission mobility and air quality improvements.

- Rising FCEV Demand: Automakers and governments are investing heavily in fuel cell vehicle infrastructure.

- Diverse Hydrogen Sources: Production from fossil, nuclear, and renewable resources ensures supply flexibility.

- Energy Storage Capability: Hydrogen supports grid balancing, intermittent renewable integration, and multi-sector applications.

They are essential for promoting the widespread use of fuel-cell vehicles and reducing greenhouse gas emissions in the transportation sector. Developing and expanding hydrogen fueling infrastructure are critical steps toward achieving a more sustainable and environmentally friendly transportation system.

Hydrogen fueling stations are growing due to the increasing interest in Hydrogen Fuel Cell Vehicles (FCVs). Governments and organizations globally are promoting hydrogen as part of their efforts to decarbonize the transportation sector, further driving the growth of hydrogen-fueling infrastructure.

The COVID-19 pandemic had a significant impact on the global hydrogen fueling station market growth, leading to delays and postponements in project installations and investments in hydrogen fueling station projects. However, as nations are recovering from the pandemic, the increased demand for renewable fuels, such as green hydrogen and new installation of fuel stations, is expected to stabilize the global market.

Hydrogen Fueling Station Market Trends

Rising Government Initiatives to Adopt FCEVs to Drive Market Growth

The growing preference of customers toward adopting zero-emission vehicles is an emerging outlook for the hydrogen fueling market. Automotive manufacturers are pumping huge investments to develop efficient and high-power vehicles to achieve the global targets for FCEVs to suffice the demand for hydrogen fueling stations and clean fuel vehicles across the globe.

Increasing government initiatives play a vital role in empowering the growth of FCEVs. According to a March 2022 study by DOE’s National Renewable Energy Laboratory, continued improvements with zero-emission vehicle and fuel technologies will make clean trucks cheaper and more readily available over the next decade. Increased use of Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs) within the trucking industry will support the carbon neutrality of the U.S.’s transportation sector and advance to accelerate the adoption of electric vehicles, address the climate crisis, and bolster domestic manufacturing. Many regional governments have announced subsidies and other financial incentive programs promising customers to replace their fleets with energy-efficient fuel cell vehicles. The industry is developing new technologies. For instance, McPhy has created an augmented mcfilling hydrogen fueling station, an innovative, registered, and patented architecture incorporating software intelligence that makes the hydrogen station dynamically reconfigurable.

Automotive manufacturers are also initiating various projects to focus on adopting fuel cell electric vehicles.

Download Free sample to learn more about this report.

Hydrogen Fueling Station Market Growth Factors

Growing Need to Reduce Carbon Emissions Stimulate the Demand for Hydrogen Fueling Station

Air pollution is a significant problem globally, with nearly half of the world's population living in it. The emission of hydrocarbons, nitrogen oxides, and particulate matter from gasoline and diesel vehicles is a major contributor to pollution. Governments have started focusing on low- or zero-emission technologies and resources, including solar, wind, fossil fuels, and nuclear energy, with enhanced emissions controls and carbon sequestration. Moreover, to build a safe, resilient, decarbonized energy system, hydrogen production, and bulk storage are used for intermittent energy supplies from renewable sources. End uses such as grid electricity, domestic and industrial heating, etc., play an important role in balancing the demand for fuel transportation.

Hydrogen fuel is increasingly being used as a reliable fuel source for several applications, including transportation, stationary power generation, and mobile hydrogen applications. It has the potential to reduce greenhouse gas emissions mainly in the transportation sector, especially in heavy-duty transportation sector applications such as long-haul trucks, locomotives, ships, etc. Current battery technology is not completely suitable for the heavy-duty transportation sector. For extended periods, hydrogen can be used to store energy in such transport sectors.

Fuel cell electric vehicles (FCEVs) run on hydrogen, which is more efficient than conventional vehicles with internal combustion engines, producing no harmful exhaust gases such as CO, SOx, CO2, NOx, and other pollutants commonly emitted by fossil fuel units. Hydrogen, as the fuel source, offers a clean, dependable, and highly energy-efficient solution to meet the ever-increasing demand for power. As a result, the market for hydrogen fueling stations is expected to witness substantial growth during the forecasted period due to the pursuit of improved fuel efficiency and the adoption of zero-emission systems. Moreover, hydrogen can be produced from various resources with zero greenhouse gas emissions. Once the production is complete, hydrogen generates electrical power in a fuel cell while emitting water vapor and warm air. It has promising growth in the transportation and energy sectors.

Government Initiatives for the Awareness of Hydrogen to Promote Market Growth

Hydrogen can be produced from fossil, nuclear, and renewable resources, promoting diversity in the country's energy supply. It is being actively promoted and embraced by governments and other government partners globally. The ultimate goal of the entities and the government is to produce cost-effective hydrogen products at different scales, from large-scale central production to small-scale local production, using different raw materials, processing methods, and delivery options, depending on market demand production and delivery. For instance, the U.S. Department of Energy and the U.S. Department of Transportation announced an overview of the Hydrogen Fuels Initiative (HFI), which will accelerate research, development, and demonstration of hydrogen fuel cell technology for use in transportation, power generation, and energy applications.

In order to address the availability and technology adoption challenge, the U.S. Department of Energy (DOE) launched H2USA, a public-private partnership that includes federal agencies, automakers, hydrogen supply companies, fuel cell developers, national laboratories, and other entities. H2USA is focused on advancing hydrogen infrastructure to provide U.S. consumers with more transportation energy options. As of 2024, there are 59 retail hydrogen refueling stations open in the U.S. In addition, at least 50 stations are under various stages of planning or construction.

RESTRAINING FACTORS

Increasing Initial Capital Costs along with Difficulty in Managing Bulk Hydrogen Stations Hinder Market Growth

The implementation of various hydrogen stations may require a substantial investment for the purchase of high-quality equipment and machinery, which could hinder global hydrogen fueling station market growth. Hydrogen fuel is expensive to produce and deliver at gas stations in small quantities and the intricate management of large-scale gas station operations can impede market growth. Furthermore, planning and constructing new stations requires huge investments, which depend on several factors that influence market trends.

Moreover, the development of adequate and cost-effective refueling infrastructure is becoming more challenging for hydrogen than for electricity or renewable liquid fuels. The availability of hydrogen fueling facilities is a crucial factor in determining the value of these vehicles to potential buyers. Due to this, without a sufficient number of hydrogen vehicles and their necessary hydrogen needs, the refueling infrastructure is not funded.

Currently, the sales of fuel cell electric vehicles (FCEVs) are decreasing slightly, so the cost of installing hydrogen filling stations is high. While this could have a positive impact given technological advances, this cost is currently a barrier to the widespread use of hydrogen, even if it would be more powerful once produced. This initiative also affects subsequent costs, such as the price of hydrogen vehicles, making it less likely to be adopted.

Hydrogen Fueling Station Market Segmentation Analysis

By Type Analysis

To know how our report can help streamline your business, Speak to Analyst

Small Stations Dominates the Market Due to Growing Adoption of Hydrogen Vehicles

Based on type, the market is segmented into small stations (less than 1 t/d of H2), medium stations (1-4 t/d of H2), and large stations (more than 4 t/d of H2).

The small-station (less than 1 t/d of H2) segment is leading due to their cost efficiency, flexibility, and ability to provide diverse applications. The Small Station (Less than 1 t/d of H2) segment dominated the market accounting for 91.03% market share in 2026. They are more affordable to build and operate, making them suitable for regions with lower demand or limited space. These stations also support various uses beyond vehicles, such as forklifts and backup power systems. Advancements in technology are making small-scale hydrogen production more efficient, allowing for easier deployment and scalability to meet increasing demand.

These fueling stations for vehicles are comparatively small. The utilization of cryogenic storage at these stations offers the advantage of using less expensive equipment, primarily by eliminating the need for tube trailers and compressors, especially when considering the cost per kilogram of hydrogen.

Larger stations necessitate multiple daily transports of hydrogen, while smaller stations prove to be more convenient and efficient. As a result, the segment is anticipated to stabilize the industry.

REGIONAL INSIGHTS

Based on the geography, the market is segmented into North America, Europe, Asia Pacific, and Rest of the World.

Asia Pacific Hydrogen Fueling Station Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Among all regions, Asia Pacific holds the major global hydrogen fueling station market share of the global hydrogen fueling station market and is expected to maintain a steady growth rate. The Asia Pacific region is investing heavily in the development of hydrogen technology and infrastructure, resulting in the construction of large-scale facilities across the region. This factor has increased the need to operate hydrogen fueling stations. Emerging countries such as China, Japan, and South Korea have set big goals for introducing hydrogen fuel cell cars and heavy vehicles to meet regional demand for cars and buses. The Hydrogen fueling station market in the U.S. is projected to grow significantly, reaching an estimated value of USD 760.39 million by 2032. The Japan market is projected to reach USD 211.41 billion by 2026, and the China market is projected to reach USD 314.85 billion by 2026.

For example, in January 2019, the South Korean government announced its vision to become the world leader in hydrogen vehicles and fuel cells by 2040. It also announced an ambitious roadmap with the goal of producing 6.2 million fuel cell vehicles and installing at least 1,200 hydrogen stations by 2040.

Europe

The growth of hydrogen filling stations in Europe is due to increased investment in hydrogen infrastructure. The goals proposed by the European Commission revised regulation on the deployment of alternative fuel infrastructure for the deployment of hydrogen refueling stations (HRS) in cities and along highways. There were over 265 hydrogen refueling stations in Europe by the end of 2023, which is why the availability of refueling infrastructure is relatively underdeveloped compared to Battery Electric Vehicles (BEVs). To tackle this concern EU has been investing in new hydrogen fueling stations. Policies and regulations such as Alternative Fuels Infrastructure Regulation (AFIR) and FuelEU have created a better supportive environment for the hydrogen technology industry and fostered investment and innovation. The UK market is projected to reach USD 8.47 billion by 2026, while the Germany market is projected to reach USD 76.23 billion by 2026.

North America

Tax benefit policies favor North America, availability of various scale companies, technological advancements, and dedicated research & development initiatives.The hydrogen fueling station market in the U.S. is projected to grow significantly, reaching an estimated value of USD 760.39 million by 2032, driven by zero-emission transportation goals along with government support and funding to develop infrastructure. Furthermore, nations, including the U.S. and Canada, have also observed a considerable increase in HRS count by constructing new facilities due to favorable policies. For instance, in July 2020, the Australian Hydrogen Council (AHC) and the Canadian Hydrogen and Fuel Cell Association (CHFCA) inked a Memorandum of Understanding (MoU) to propel the placement of zero-emission hydrogen and fuel cell technologies in the two countries. The U.S. market is projected to reach USD 53.07 billion by 2026.

Key Industry Players

Key Players’ Focus on New Collaboration Initiatives to Fortify Market Position and New Project Development

Companies such as Air Liquide, FirstElement Fuel, and Cummins Inc. collaborated to pursue the development of new hydrogen fueling station projects globally. The increasing deployment of hydrogen fuel stations drives this shift in focus on improving the convenience of new installations of Hydrogen Fueling Stations. For instance, in March 2023, FirstElement Fuel and Hyundai Motor Company joined a venture to fuel and conduct testing on Hyundai's Xcient fuel cell heavy-duty trucks. In this partnership, FirstElement Fuel is utilizing its True Zero network of hydrogen refueling stations to supply hydrogen at full 700 bar pressure, effectively fueling three XCIENT Fuel Cell prototypes.

List of Top Hydrogen Fueling Station Companies:

- Air Liquide (France)

- Air Products and Chemicals, Inc. (U.S.)

- China Petrochemical Corporation (China)

- FirstElement Fuel Inc. (U.S.)

- FuelCell Energy, Inc. (U.S.)

- Cummins Inc. (U.S.)

- Linde Group (Ireland)

- Nel Hydrogen (Norway)

- Nuvera Fuel Cells (U.S.)

- Praxair (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 – Air Liquide and Trillium Energy Solutions signed a Memorandum of Understanding for the development of the heavy-duty hydrogen fueling the market in the United States to decarbonise the transportation sector. Through this MoU, Air Liquide and Trillium aim to combine their hydrogen production, distribution, and fueling infrastructure deployment. Additionally, it aims to accelerate the heavy-duty hydrogen transportation ecosystem, focusing on both hydrogen supply and its refueling infrastructure.

- February 2023 – Air Liquide and Total Energies collaborated to develop a network of hydrogen stations focused on heavy-duty vehicles on major European roads. This inventiveness will help enable access to hydrogen, allowing the development of its use for transportation and further solidifying the hydrogen sector.

- February 2023 – China Petroleum & Chemical Corporation successfully inaugurated China's first methanol-to-hydrogen and hydrogen refueling service station in Dalian, China. This station represents a significant advancement over the previous facility, which provided fueling options for oil, gas, hydrogen, and electric charging services. The newly upgraded complex can produce 1000 kg of hydrogen daily with an impressive purity level of 99.99%.

- May 2022 – Air Liquide Korea and Lotte Chemical entered a joint venture to scale up the hydrogen supply chain for mobility markets in South Korea. In hydrogen filling centers, Daesan and Ulsan companies will co-invest through the joint venture. They also expect multiple synergies and envision the development of several opportunities to foster the rise of the hydrogen economy in Korea.

- April 2021 – Air Products announced the inauguration of a hydrogen fueling station at one of the industrial gas facilities in South Korea. This station is the first privately owned station in South Korea, established under the South Korean government's subsidy program for hydrogen infrastructure.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, type of hydrogen fuel station, and installation of fuel station across the region. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 23.44% from 2026 to 2034 |

|

Unit |

Value (USD Million) and Volume (Units) |

|

Segmentation |

By Type and Region |

|

Segmentation |

By Type

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 1,405.02 million in 2026.

The market is likely to grow at a CAGR of 23.44% over the forecast period.

The small station (Less than 1 t/d of H2) led the market due to the development of hydrogen fueling stations globally.

Asia-Pacific dominated the hydrogen fueling stations market with a market share of 76.86% in 2025.

The need to reduce carbon emissions and stimulate government initiatives for awareness towards hydrogen to boost growth is expected to drive market growth.

Some of the top players in the market are Air Liquide, Air Products and Chemicals, Inc., China Petrochemical Corporation, and FirstElement Fuel Inc.

The global market size is expected to reach USD 7,575.74 million by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us