India Biogas Market Size, Share & Industry Analysis, By Feedstock (Organic Residue & Wastes {Animal Waste, Municipal & Sewage, Agricultural Waste, and Others} and Energy Crops), By Application (Heating, Electricity Generation, and Transportation), and Country Forecast, 2025-2032

India Biogas Market Size

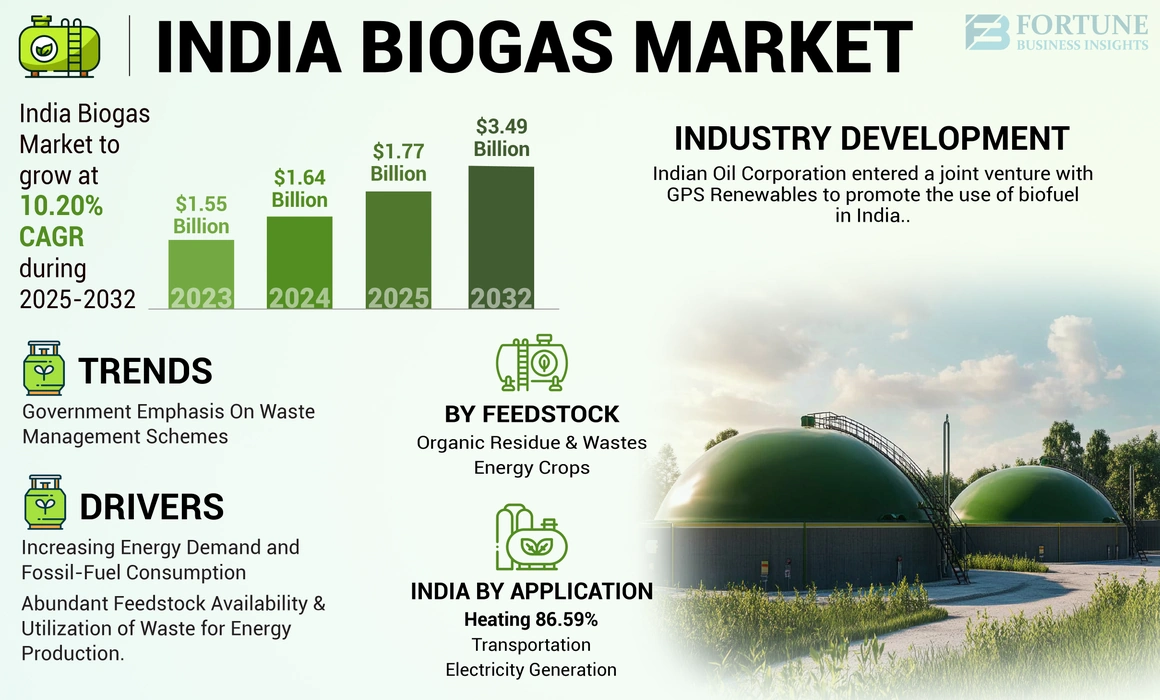

The India biogas market size was valued at USD 1.64 billion in 2024. The market is projected to be worth USD 1.77 billion in 2025 and reach USD 3.49 billion by 2032, exhibiting a CAGR of 10.20% during the forecast period.

India has huge biogas potential, being the world’s most populous country and an agricultural powerhouse. Currently, more than 5 million bio-gas plants are operational in the country. Maharashtra, Gujarat, Karnataka, Uttar Pradesh, and Madhya Pradesh are the major plant operating states in India. Maharashtra had the largest number of plants (935,000) by March 2023. It has readily available feedstock volumes, which indicates that the country is capable of producing over 62MMT bio-CNG (~86BCM/yr). This energy is enough to meet more than 9% of India’s current energy demand. Compared to the current bio CNG output of 3.2 BCM/yr, the bio CNG sector will achieve its full potential by 2047 in support of India’s drive to become energy-independent.

India has made significant progress in renewable energy installation, ranking 4th in the world in 2022. The government has developed a set of policies and initiatives to support the sector’s development. The Ministry of New & Renewable Energy (MNRE) has developed the expansion framework under the wide-ranging National Bioenergy Program and Delivery of separate strands falls on relevant ministries. Sustainable Alternative Towards Affordable Transportation (SATAT) initiative, CNG (Transport) and PNG (Domestic), One Nation, One Gas Grid, Waste to Energy (Central Financial Assistance), and others are some of the major initiatives for the market growth in India.

The COVID-19 pandemic significantly impacted the Indian market, leading to a reduction in production and consumption due to lockdowns and decreased fuel demand. Many plants faced operational challenges, resulting in idled facilities and reduced output. However, the Indian government responded by accelerating policy reforms, such as advancing ethanol blending targets to 20% by 2025, which aims to revitalize the sector. Despite initial setbacks, the long-term outlook remains positive as investments in technology and infrastructure are expected to drive growth in the coming years.

India Biogas Market Trends

Government Emphasis on Waste Management Schemes to Create Growth Opportunities

Many countries are facing significant issues, such as the increasing volume of waste and their inability to manage it effectively. Following this, they are now focusing on implementing programs that will help them manage waste effectively.

The Indian Ministry of New & Renewable Energy is promoting all the available technology options for establishing projects that recover energy in the form of Bio-gas/BioCNG/Electricity from renewable agricultural, industrial, and urban wastes, such as municipal solid wastes, slaughterhouse waste, vegetable, agricultural residues, and other market wastes, and industrial/STP wastes & effluents. According to them, the overall energy-generating capacity of urban and industrial organic waste in India in 2021 was predicted to be 5690 MW.

The Indian Biogas Association has sought financial help from the Ministry of New & Renewable Energy (MNRE) to sustain the waste-to-energy scheme. They emphasized the difficulties encountered by bio-CNG projects. Bio-gas/CBG/bio-CNG projects/plants generate three unique outputs: scientific waste treatment and pollution abatement plants, organic fertilizer manufacturing facilities, and gaseous fuel generating plants. The exceptional output will be caused by the annual production of 62 million cubic meters of Bio-CNG and 658 million tons of organic fertilizers.

Download Free sample to learn more about this report.

India Biogas Market Growth Factors

Increasing Energy Demand and Fossil-Fuel Consumption to Result in Adoption of Clean Fuels

India is the third largest energy consumer globally, and its energy demand is expected to rise significantly over the next 15-20 years. Over 50% of its natural gas requirements are met by imports. In 2021-2022, India spent USD 11.9 billion on the import of over 32 billion cubic meters of LNG, which was USD 7.9 billion for 33 bcm of gas in the previous year and USD 9.5 billion on import of 33.9 bcm in 2019-20. In the past years, the 3x increase in LNG spot price driven by the supply-demand situation and geo-political tensions has mandated the use of CBG as an alternative to CNG for achieving supply and price stability.

According to the Petroleum Planning & Analysis Cell (PPAC), in 2024, India’s crude oil imports rose to its third-highest level on record to meet the domestic demand. It imported over 21.4 million tons (mt) of crude oil in June 2024, with a growth rate of 3% Month-on-Month (M-o-M) and 7% Year-on-Year (Y-o-Y). According to the International Energy Association (IEA), India’s emissions grew faster than its GDP, at more than 7%, rising around 190 Mt to reach 2.8 Gt. However, India’s per capita emissions remain very low, at around 2 tons, less than half the world’s average of 4.6 tons.

India’s attempt to increase the share of renewable energy in its power consumption to reduce imports of natural gas and fossil fuels will drive the demand for alternatives, such as bio-gas and other renewable energy sources. Bio-gas is expected to play an important role in India’s energy transition, thereby ensuring energy affordability and security, enhancing entrepreneurship, providing rural employment, and boosting local economies. New energy targets launched by the government to promote the inclination toward sustainable power have positively affected the market growth. Transitioning can create employment opportunities for semi-skilled and skilled workers in multiple areas, such as waste collection, operations, construction, designing, engineering, and development of plants. Following the same, in India, the installation of renewable energy sources is set to increase tremendously in the coming decade, leading to the expansion of the market.

Abundant Feedstock Availability and Utilization of Waste for Energy Production to Accelerate Market Growth

Biogas plants are capable of producing a wide range of organic matter, such as commercial & domestic food waste, municipal & industrial sewage, agricultural materials, and livestock manures. These are treated in plants to produce. According to the IBA (Indian Biogas Association), India generates an average of 500 Million Tons (MT) of agricultural residue annually. After discounting its usage as fodder and fuel for domestic and industrial applications, ~150 MT is available as surplus. The annual production of horticulture products in India in 2021-2022 was estimated to be ~326 MT, out of which around 65-7214 MT (20-22%) goes to waste. This horticulture waste can additionally produce around 2-2.5 MT of BioCNG annually, which can be used in vehicles as fuel or for other energy applications.

A large amount of solid and liquid waste is generated in the industries and urban regions. The potential creation of Bio-CNG potential India has been estimated to be about 62 MMT a year. According to a recent estimate, about 50 million tons of solid waste (1.40 lakh tons per day) and about 14,000 million cubic meters of liquid waste are generated every year by urban populations, and this has the potential to generate over 2,600 MW of electricity for the country. This figure can go beyond 5,20,016 MW by 2027, and an estimated energy recovery of about 1,300 MW can be made from industrial wastes. The potential of energy from industrial wastes for 2017 was estimated to be over 1,600 MW. Based on the availability of cattle dung of about 304 million tons, about 18,240 million cubic meters of biogas can be generated annually. The increasing number of poultry farms is another factor that contributes to the generation of 2,173 million cubic meters annually. These capabilities, coupled with rising waste generation, are expected to act as catalysts for the growth of the market in India in the coming years.

RESTRAINING FACTORS

High Installation Cost and Limited Technology and Infrastructure to Hamper Growth of Indian Market

One of the key restraints for the market growth is the heavy capital investment required by the industry players to establish a production unit and well-managed waste acquisition and gas transmission & distribution lines. This has led to a less fragmented market, and entering the market is quite a challenge for new players. In certain circumstances, subsidies are set too low to close the growing gap between the cost of generation and the level of government financial aid. In other cases, subsidies that should have been phased out in line with cost reductions have been extended for more than two decades, rendering them ineffective as an incentive to improve performance. Therefore, most of the projects are needed to be carried out with support from government firms. The government also provides only a certain percentage of the total investment, and the rest depends on the company.

Besides the high installation cost, India has a limited number of plants, and the technology used in these plants is often outdated, making it difficult to produce large-scale CBGs. Moreover, the improper segregation of organic and non-organic waste results in low-quality organic feedstock, due to which dust and inert materials also exist in varying degrees. In such cases, waste sorting must be done before digestion at the plant, which further increases the overall generation cost and complexity. Badly segregated waste can lead to construction and demolition waste or other hard particles entering the digester, thereby reducing energy efficiency and damaging it. In addition, unorganized transportation and poor collection of wastes, especially in medium and small cities, increase the supply chain disruption risk. Thus, limited availability of technology and infrastructure gaps can hamper the current India biogas market growth.

India Biogas Market Segmentation Analysis

By Feedstock Analysis

Increase in Municipal Solid Waste Stimulates Organic Residue & Waste Consumption

By feedstock, the market is segmented into organic residue & wastes and energy crops.

The organic residue & wastes segment holds the major share of the Indian market and is expected to remain dominant over the forecast period. Organic residue & wastes include animal waste, municipal & sewage waste, agricultural waste, and other types of wastes.

According to the Ministry of New & Renewable Energy (MNRE), India generates around 0.1 million tons of municipal solid waste every day. In addition, a large amount of solid and liquid waste is generated in the industries and urban regions.

India produces around 38.33 million tons of poultry manure each year, enough to fertilize approximately 3.56 million hectares of cropland. While composting and burning poultry litter have been tried, production may be a viable option.

By Application Analysis

Heating Segment Holds Largest Market Share Due to High Energy Demand

By application, the market is segmented into heating, electricity generation, and transportation.

The heating segment holds the major India biogas market share, followed by electricity generation and then transportation.

In India, the use of biogas has been demonstrated in cooking, heating, and lighting. On the other hand, upgraded bio-gas and biomethane (RNG) have been widely recognized as a pipeline-ready gas that can be used interchangeably with conventional natural gas.

In India, over 4.7 million household plants, which are based on cattle manure, are used for producing cooking fuel and expected to grow exponentially over the forecast period.

Over the forecast period, the electricity and transportation sectors are expected to experience considerable growth owing to certain initiatives being launched by the government. The Ministry of Road Transport and Highways has also updated the Central Motor Vehicles Rules to incorporate provisions for the use of bio-gas in the form of bio-CNG in waste-to-energy vehicles.

The government's SATAT (Sustainable Alternative Towards Affordable Transportation) initiative encourages the use of Compressed Bio-Gas (CBG) by partnering with PSU oil marketing companies to issue Expression of Interest (EOI) to entrepreneurs interested in establishing CBG plants as a viable alternative to conventional fuels.

To know how our report can help streamline your business, Speak to Analyst

KEY INDUSTRY PLAYERS

Major Players are Focusing on Technology Development and Collaboration to Expand in Various Regions

The market is highly fragmented, with medium and large-sized players delivering a wide range of products and services across the value chain. Numerous companies are actively operating in the country to meet the specific demands of the industry for infrastructure development. They are also focusing on product technology advancements, and collaborating with market players for feedstock and application, allows them to access new key markets and enhance their global footprint.

List of Top India Biogas Companies:

- GAIL (India)

- Wärtsilä (Finland)

- Clarke Energy (U.K.)

- GPS Renewable (India)

- Primove Engineering Pvt. Ltd (India)

- Renergon International AG (Switzerland)

- Green Elephant Engineering Pvt. Ltd. (India)

- SFC Umwelttechnik GmbH (Austria)

- Bharat Bio Gas Energy Ltd (India)

- KIS Group (India)

KEY INDUSTRY DEVELOPMENTS:

- June 2024: Indian Oil Corporation entered a joint venture with GPS Renewables to promote the use of biofuel in India. This collaboration aims to leverage advanced bio-gas technologies to reduce greenhouse gas emissions and offer sustainable alternatives to fossil fuels. Additionally, this partnership will support Indian Oil's objective of reaching a net-zero target by 2070.

- April 2024: GPS Renewables, a Bangalore-based cleantech startup, raised USD 50 million in a debt financing round from a cluster of banks and Non-Banking Financial Companies (NBFCs). The newly raised capital will help the company expand its footprint and increase its fuel expansion efforts. Moreover, it will be used for the nationwide establishment of compressed plants.

- January 2024: GAIL and TruAlt Bioenergy Limited, the leading ethanol producer in India, signed a term sheet for GAIL to acquire equity in TruAlt's Joint Venture (JV), Leafinti Bioenergy Limited. In this JV, TruAlt Bioenergy will hold 51% of the shares, while GAIL India will hold 49%, with a combined investment exceeding USD 72 million.

- August 2023: GPS Renewables acquired Proweps Envirotech GmbH, a German design and engineering company specializing in advanced technologies for utilizing municipal and industrial organic waste and agricultural residues for production. As part of the acquisition, Proweps' leadership will continue to collaborate with GPS Renewables and position Proweps as the premier bio-gas design and engineering firm for global project developers. Proweps' international expertise in waste treatment, anaerobic digestion, and bio-gas upgrading plants will provide GPS Renewables with access to advanced technologies, thereby enhancing its market presence and customer reach.

- January 2022: Kohler Co. acquired Heila Technologies to enhance its clean energy management offerings. Heila was integrated into Kohler's Power Group, a global leader in engines, power generation, and clean energy, and now operates as a standalone entity within this group.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as major players and leading applications of the product. Besides, it offers insights into the competition landscape, market trends, and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.20% from 2025 to 2032 |

|

Unit |

Volume (Million Cubic Meter) and Value (USD Billion) |

|

Segmentation |

By Feedstock, and By Application |

|

Segmentation |

By Feedstock

|

|

By Application

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 1.64 billion in 2024.

The market is likely to record a CAGR of 10.20% over the forecast period of 2025-2032.

By application, the heating segment is expected to lead the market.

Increasing energy demand, abundant feedstock availability, and utilization of waste for energy production are key factors driving the market growth.

Some of the top players in the market are GAIL, Wartsila, and GPS Renewables.

The India market size is expected to reach a valuation of USD 3.49 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us