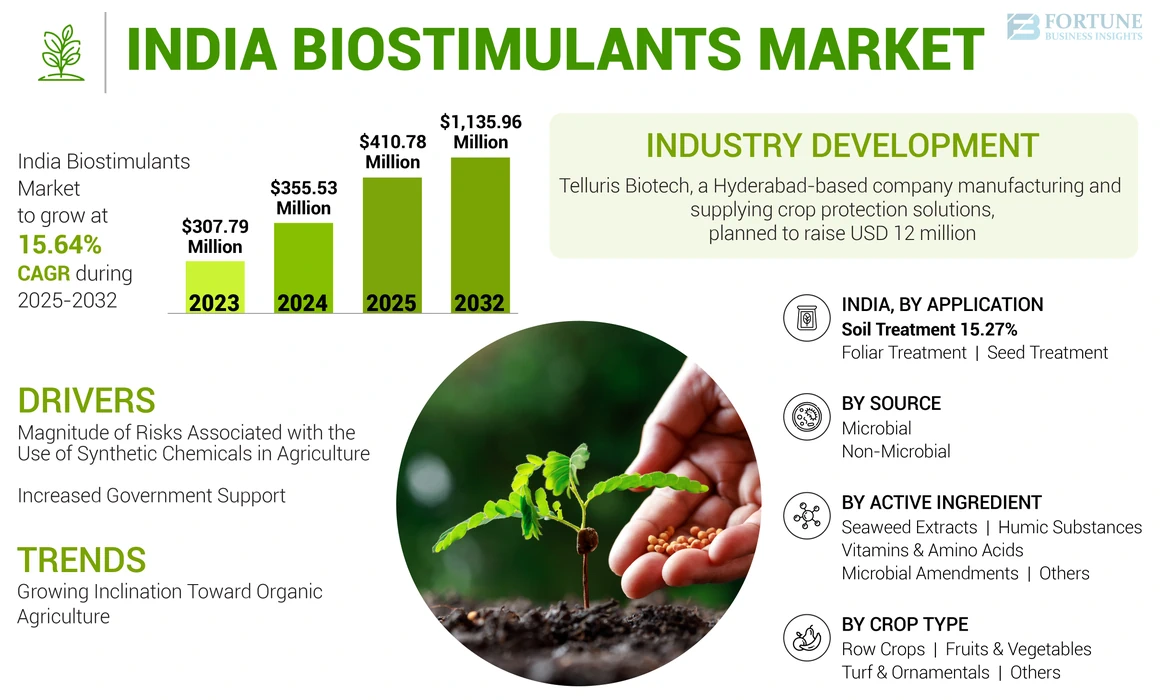

India Biostimulants Market Size, Share & Industry Analysis, By Source (Microbial and Non-microbial), By Active Ingredient (Seaweed Extracts, Humic Substances, Vitamins & Amino Acids, Microbial Amendments, and Others), By Application (Foliar Treatment, Soil Treatment, and Seed Treatment), By Crop Type (Row Crops, Fruits & Vegetables, Turf & Ornamentals, and Others), and Forecast, 2025-2032

KEY MARKET INSIGHTS

The India biostimulants market size was valued at USD 355.53 million in 2024. The market is projected to grow from USD 410.78 million in 2025 to USD 1,135.96 million by 2032, exhibiting a CAGR of 15.64% during the forecast period.

Biostimulants are biologically-derived substances applied to plants or soil to improve nutrient uptake ability, abiotic & biotic stress tolerance, and protection from pests. Unlike traditional crop protection chemical inputs, such as pesticides and herbicides, plant stimulants are unique, single products that possess multiple avenues for promoting crop growth. As there is widespread depletion of soil health due to the overuse of chemicals and fertilizers, an increasing number of farmers in the country are incorporating these biologicals into their farming regimes. Increased investment and the need to improve yields per hectare are expected to drive the India biostimulants market growth. In addition, as the demand for organic foods increases, so does the demand for organic farming, which is further predicted to aid the market’s growth in the country.

COVID-19 IMPACT

Unstable Supply Chain of Raw Materials Amid COVID-19 Pandemic Declined Market Growth

The pandemic initially resulted in the market's slowdown due to various socio-economic changes. Since the outbreak, the Government of India accepted plant stimulants as one of the essential products along with other biologicals that promote and protect crop health. The non-availability of migrant laborers and transportation, and logistical delays initially hampered the market’s supply chain. The market players witnessed a slight decline in their revenue generation during the first quarter of 2020. For instance, Gujarat State Fertilizers & Chemical Ltd.'s revenue declined by 12.14% in the 1st quarter of 2020 due to a nationwide lockdown and halt in economic activities. However, during Q3 and Q4 2020, the revenue started to increase by 28.98% and 1.67%, respectively, as the regulations imposed by the government were relaxed. Even though the COVID-19 outbreak had an unprecedented impact on companies’ cash flows during raw material procurement and product distribution, the demand for Plant Growth Promoters (PGP) is predicted to increase post the pandemic period to ensure food security. The companies are expected to rigorously implement digital solutions and develop novel ingredients to continue revenue generation, which can serve as an opportunity for companies to flourish even after the pandemic.

LATEST TRENDS

Download Free sample to learn more about this report.

Growing Inclination Toward Organic Agriculture to Augment Market Growth

Organic agriculture eliminates the use of chemical fertilizers and other chemical additives, such as synthetic pesticides and genetically modified crops. Plant stimulants increase soil cation exchange capacity (especially reducing nutrient leaching in sandy soils), add nitrogen to crops, and improve nutrient solubility in soil solutions. The awareness about bio inputs is increasing significantly among producers and consumers. According to the Research Institute of Organic Agriculture (FiBL)’s 2021 survey, India comprised 30% of organic producers with 2.30 million ha of total organic cultivation area. The robust emphasis of governments and other stakeholders on the sustainable and organic mode of farming has increased the acceptance of biologicals in the country. In addition, the growing demand for organic food products is positively affecting organic agriculture, which is predicted to further surge the demand for plant stimulants in the coming years.

DRIVING FACTORS

Magnitude of Risks Associated with the Use of Synthetic Chemicals in Agriculture to Favor Market Growth

In recent decades, fertilizers and pesticides have played a vital role in boosting agricultural production. However, there is a growing concern about the negative effects of the widespread use of synthetic chemicals. The overuse of these chemicals reduced soil quality, increased environmental pollution, and human health risks. However, the use of inoculants can improve plant health, thereby reducing the need for chemical fertilizers and improving sustainability. As a result, sustainable and eco-friendly farming methods using innovative solutions, such as inoculants are expected to boost the country’s market progress. In recent years, players in this market have been participating in several agricultural seminars promoting the benefits of plant stimulants. For instance, in September 2021, Tradecorp International, a company manufacturing micronutrients and specialty fertilizers, participated in a seminar specializing in table grape, called the Maharashtra Rajya Draksha Bagaitdar Sangh (MRDBS) in Pune, India. The company showed the benefits of Biimore, a biostimulant that is a bacterial extract derived from a sustainable plant fermentation process. Such developments will positively impact the country’s market forecast.

Increased Government Support to Boost Market Growth

India is an agriculture-based country, with nearly 50% of the population dependent on agricultural activities for their livelihood. The growing awareness among farmers about the benefits of agrochemicals, backed by various government initiatives and funds, is likely to propel the market performance in the coming years. In response to high commercial value and the growing awareness among consumers about the use of synthetic chemicals in agriculture and their detrimental effects on health and the environment, the Indian government has encouraged the development of agriculture biologicals. India is one of the few countries in the world with regulations for biostimulants, which was recently published as a new product category under the Fertilizer Control Amendment (FCA) 2021. It outlines regulations for the registration of plant stimulants. The new regulatory and supervisory frameworks will boost the confidence of market participants and are anticipated to increase investment in R&D. This will lead to the development and commercialization of new products, which will further benefit farmers with access to high-quality products.

RESTRAINING FACTORS

Lack of Commercialization and Marketing of Products in India to Hinder Market Growth

The Indian market is witnessing a comparatively slower growth rate, which is likely to be further hindered by the lackluster marketing and commercialization activities of biostimulants. The marketing of this product is lagging far behind in the country. Additionally, plant stimulants have failed to achieve the desired level of use and awareness among farmers to decrease the dominance of their synthetic chemical counterparts in the country's agriculture market. Also, the demand for plant growth regulators and crop protection chemicals is likely to increase domestically due to their popularity among end-users, ease of use, and cost-effectiveness. Such factors are expected to further hamper the market growth.

SEGMENTATION

By Source Analysis

Non-microbial Segment to Lead Market Growth Owing to its Unique Bioactive Substances

Based on source, the market is segmented into microbial-based and non-microbial biostimulants.

Non-microbial is the leading segment and is expected to grow significantly owing to the improving biochemical and physiological traits of crops. The increase in crop productivity and seedling growth in response to the application of non-microbial plant inoculants is due to the action of bioactive substances on primary or secondary metabolism. This results in an extensive range of biochemical, physiological, and molecular responses. In addition, the use of Protein Hydrolysates (PHs), which contain mainly free amino acids and signaling peptides, have gained prominence. PHs' potential to enhance vegetable quality, seedling & plant growth, germination, and increase crop productivity, especially under environmental stress conditions, will further contribute to this segment's growth.

Using microbial-based inoculants can enhance the uptake of nutrients and their assimilation into the soil. They maximize nutrient use efficiency by acting on the root system and increasing micro and macronutrient solubilization, ensuring better nutrient uptake and performance. The nutrient use efficiency of elements, such as phosphorus and nitrogen is essential for the environment. Thus, microbial-based inoculants display soil conditioning properties and promote plant growth, driving the segment's growth.

By Active Ingredient Analysis

Seaweed Extracts to Hold Major Market Share as They Promote Plant Growth and Defense Reactions

Based on active ingredients, the market is segmented into seaweed extracts, humic substances, vitamins & amino acids, microbial amendments, and others. The seaweed extracts segment is expected to hold the largest market share as it is the most widely used active ingredient. It is expected to maintain its dominance in the coming years as well as it can directly promote plant growth and defense reactions. Additionally, there is a growing production of seaweed extract biostimulants due to the rising cultivation of seaweed. Organizations are also joining hands to develop innovative products to meet the rising demand for seaweed-based biostimulants. For instance, in November 2022, Yara International ASA, a Norwegian chemical company, signed an agreement with Sea6 Energy, a seaweed company based in Bangalore, India, to market and distribute its biostimulant ‘AG Boost’ in India.

Humic Substances (HS) are gaining popularity among manufacturers and customers as they carry out hormonal-like activities that influence sugar metabolism, causing internal hormonal and chemical changes in plants. HS has been recognized as an essential contributor to the physicochemical properties of soil. In addition, most of the effects of HS refer to the stimulation of root growth and improved plant nutrition by increasing the number of nutrients in the soil.

The vitamins & amino acids segment is expected to grow considerably in the coming years. Amino acid-based biostimulants, such as serine, threonine, and proline are responsible for biotic and abiotic stress amelioration. In some fruits, acid-based inoculants increase weight, volume, firmness, and enhance acidity, chlorophyll, and ascorbic acid content. Vitamins and amino acids can improve soil respiration, biomass, and microbial activity as microorganisms can easily use peptides and amino acids as carbon and nitrogen sources. The ability of amino acids to form complex chelate with several macro and micronutrients is currently being used by several industries to develop highly nutrient-efficient inoculants.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Foliar Treatment to be Most Sought-After Application Method as it Maximizes Production Efficiency

Based on application, the market is segmented into foliar treatment, soil treatment, and seed treatment. The foliar treatment segment holds a major market share as it is fast-acting and effective for treating nutrition deficiencies. It serves as a timely measure to prepare the crops for expected biotic or abiotic stress, such as drought, chill, or heat. This treatment is instrumental in intensive mineral nutrition and can address an urgent need in a relatively short period. Therefore, they are especially efficient as preventive and curative treatments.

The seed treatment method segment is expected to witness the fastest growth as it has beneficial effects on the plant's resilience, development of the root system, and productivity of the crop. This treatment improves crop yields while helping plants fight pathogens and lessen biotic stress. The potential to increase the availability of plant nutrients in the root system is further aiding the segment's growth.

By Crop Type Analysis

Row Crops to Dominate Market Due to Their High Tolerance to Diseases

Based on active ingredients, the market is segmented into row crops, fruits & vegetables, turf & ornamentals, and others. The row crops segment is the dominant segment as these plants respond to plant stimulants with improved tolerance to diseases and higher productivity. The segment includes cereals, fiber corn, and other crops widely grown in large areas with good soil quality. In addition, the amino acid content helps increase the cell division rate, yield, and seed size of the crops, which is expected to further contribute to the segment’s growth.

The fruits & vegetables segment is expected to witness substantial growth as biostimulants promote a fruit tree’s crop yield and quality. It improves the commercial quality of the fruits, including nutritional and aesthetical properties. The chitosan ingredient provides post-harvest coating on fruits and vegetables to prevent decay and increase product shelf life. Furthermore, the increasing demand for quality fruits and vegetables among health-conscious customers is expected to boost this segment’s development.

KEY INDUSTRY PLAYERS

Extensive Focus on Raising Funds and Investments to Expand Processing Capacities

Various prominent players are active across this market. The leading players, such as Novozymes, Syngenta, BASF SE, UPL Ltd., and Rallis India Ltd. have a well-developed sales and distribution network and large-scale production facilities. In addition, they are focusing on increasing transparency in the country's supply and value chain, as India offers huge potential for the agrochemicals industry to flourish in the coming years. The players in the market are also capitalizing on the latest seaweed-based sustainable plant protection products to meet the customer demand and increase production capacities. For instance, in July 2021, Sea6 Energy, a seaweed company based in Bangalore, India, raised USD 9 million as a part of its Series B funding round, which was led by Aqua-Spark, a Netherlands-based investment fund. The funding helped the company increase the supply of seaweed-based raw materials and expand processing capacity to produce agricultural biostimulants and animal health products. Such investment strategies contribute to the growing competition within the market, which will positively affect the India biostimulants market share.

LIST OF KEY COMPANIES PROFILED:

- Rallis India Ltd. (India)

- Gujarat State Fertilizers & Chemicals Limited (India)

- PI Industries (India)

- Bayer AG (Germany)

- UPL Limited (India)

- FMC Corporation (U.S.)

- BASF SE (Germany)

- Southern Petrochemical Industries Corporation (India)

- Novozymes (Denmark)

- Syngenta (Switzerland)

INDUSTRY DEVELOPMENTS:

- March 2023: Telluris Biotech, a Hyderabad-based company engaged in the manufacturing and supplying of crop protection solutions, planned to raise USD 12 million. The company has received provisional registration for its biostimulant products and plans to increase crop productivity and quality through new launches and certifications.

- August 2022: BASF Venture Capital, a corporate venture capital company of the BASF Group, and Aqua-Spark, an Indian manufacturing company, invested USD 17 million in Sea6 Energy, an Indian company manufacturing tropical red seaweed.

- March 2022: Valagro, one of the leading companies in the production and marketing of biostimulants, launched its innovative biostimulant Talete in the Indian market. The new product claims to help increase crop water productivity.

- October 2021: Tradecorp launched ‘Biimore’ (marketed as Quikon) in India. Biimore is a biostimulant aimed at enhancing the development and fruit swell in horticulture crops, legume crops, and tree fruits

- April 2021: The Government of India announced that it will set up a regulatory body as well as compliance requirements for the domestic market.

Report Coverage

The India biostimulants market research report provides quantitative and qualitative insights. It also offers a detailed analysis of the active ingredients, crop type, application, market size, and growth rate for all possible segments in the market.

Along with this, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights presented in the report are an overview of related markets, research methodology, recent industry developments, such as mergers & acquisitions, regulatory scenarios in critical countries, and key industry trends.

Report Scope & Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2019-2032 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2032 |

| Historical Period | 2019-2023 |

| Growth Rate | CAGR of 15.64% from 2025 to 2032 |

| Unit | Value (USD million) |

| Segmentation |

By Source

By Active Ingredient

By Application

By Crop Type

|

Frequently Asked Questions

Fortune Business Insights says that the market value was USD 355.53 million in 2024 and is projected to reach USD 1,135.96 million by 2032.

The market will exhibit a CAGR of 15.64% during the forecast period of 2025-2032.

The seaweed extracts segment is the leading segment among active ingredients.

The magnitude of risk associated with synthetic chemicals in agriculture is driving the markets growth.

Novozymes, BASF SE, Syngenta, and UPL Limited are among the key players in the market.

The foliar treatment segment is expected to grow the fastest during the forecast period.

Growing inclination toward organic agriculture is predicted to augment the market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us