India DC and AC Diesel Generator Market Size, Share & Industry Analysis, By Power Rating (Below 75 kVA, 75-375 kVA, 375-750 kVA, and Above 750 kVA), By Application (Continuous Load, Peak Load, and Standby Load), By End-User (Mining, Oil & Gas, Construction, Residential, Marine, Manufacturing, Pharmaceuticals, Commercial, Telecom, Electric, Utility, Data Centers, and Others), and Regional Forecast 2024-2032

KEY MARKET INSIGHTS

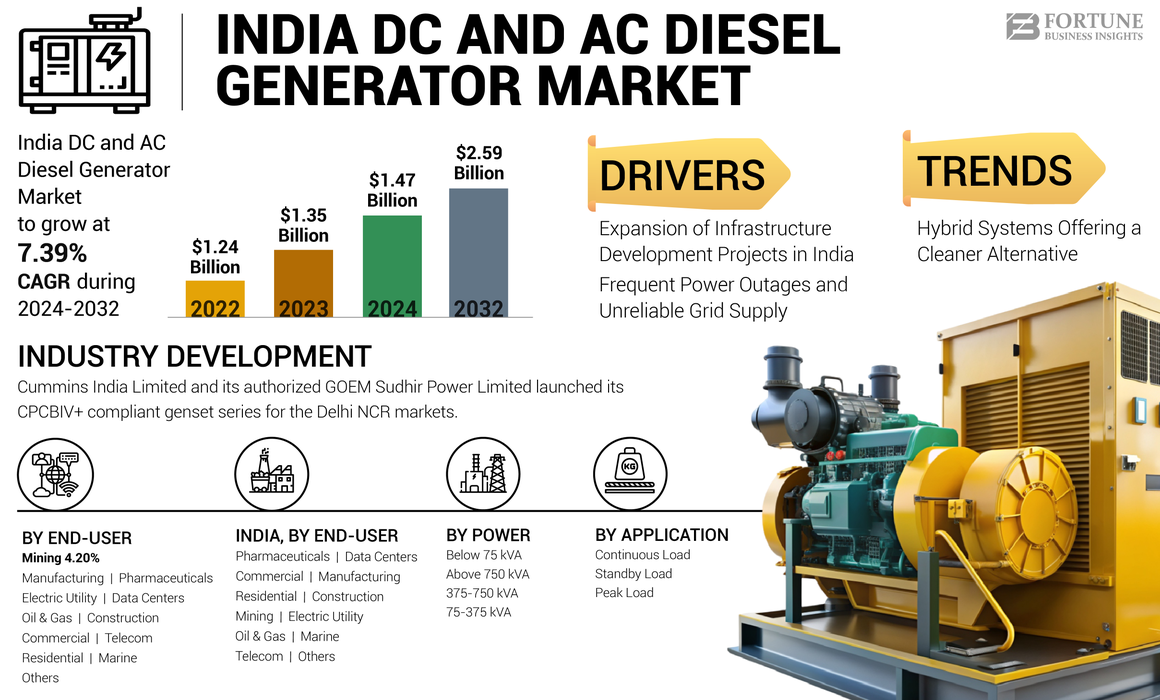

The India DC and AC diesel generator market size was valued at USD 1.35 billion in 2023. The market is projected to be worth USD 1.47 billion in 2024 and reach USD 2.59 billion by 2032, exhibiting a CAGR of 7.39% during the forecast period.

A diesel generator is a robust power generation system that harnesses mechanical energy from a diesel engine to produce electrical energy. It can generate either Alternating Current (AC), which is widely used for general power supply in residential and commercial settings, or Direct Current (DC), which is typically employed for specialized applications, such as battery charging and industrial processes. These generators are valued for their reliability, efficiency, and versatility in fulfilling various power needs.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of Infrastructure Development Projects in India to Boost Demand for Diesel Generators

Rapid urbanization and expansion of infrastructure projects, along with the Indian government's commitment to infrastructure development, are the key drivers of the India DC and AC diesel generator market growth.

- The National Infrastructure Pipeline (NIP), which envisions an investment of approximately USD 1.4 trillion over the next five years, focuses on enhancing transportation, energy, and urban infrastructure.

This infrastructure development not only boosts the construction and real estate sectors, but also significantly impacts the demand for reliable power solutions, including diesel generators.

Moreover, India’s focus on developing smart cities and improving the urban infrastructure is another significant driver. The Smart Cities Mission, launched by the Indian government, aims to transform urban areas into sustainable and citizen-friendly spaces. This mission includes projects that require continuous power supply for both construction and operational phases, leading to a higher demand for diesel generators.

Frequent Power Outages and Unreliable Grid Supply to Augment Demand for Diesel Generators

In India, frequent power outages and an unreliable grid supply are major challenges, especially in rural and semi-urban areas. These power interruptions can severely impact businesses, healthcare facilities, and residential areas, increasing the demand for diesel generators as a reliable backup power solution.

Industries’ reliance on diesel generators for consistent power supply is another important factor for their increased demand in India. This reliance is particularly high in industries with critical operations that cannot afford downtime, such as manufacturing and healthcare.

- A report by the Federation of Indian Chambers of Commerce and Industry (FICCI) highlights that 40-50% of small and medium-sized enterprises (SMEs) in India rely on diesel generators to mitigate power disruptions.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Compliance to Increase Cost of Diesel Generators

The Indian government has implemented rigorous emission standards, such as BS-VI, which have raised the bar for air quality and pollution control. These standards necessitate the use of advanced emission control technologies, such as Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF), leading to increased costs and complexity for manufacturers.

Environmental concerns further exacerbate the challenge, as diesel generators contribute significantly to air pollution, including harmful emissions of carbon dioxide, nitrogen oxide, and particulate matter. Studies by the Center for Science and Environment (CSE) highlight the health risks associated with these emissions, adding pressure on the industry to adopt cleaner technologies. In response, companies, such as Caterpillar are developing new models with improved emission controls to meet these regulations.

- In February 2023, Cummins Group in India completed India’s Bharat Stage-VI (BS-VI) OBD II emissions standard compliance certification tests with the Automotive Research Association of India (ARAI).

MARKET OPPORTUNITIES

Expansion of Data Centers and IT Infrastructure to Drive Market Growth Opportunities

With the rapid growth of the IT & data center sector in India, there is a significant opportunity for both AC and DC diesel generator manufacturers. These facilities require continuous, reliable power to ensure uptime and performance, making high-capacity generators essential.

The Indian government is promoting initiatives like the Digital India campaign, which aims to enhance the country’s digital infrastructure. This includes support for the establishment of new data centers, further boosting the need for dependable power solutions.

- A report from NASSCOM predicted that by the end of 2025, India is expected to have more than 100 data centers, driven by rising digitalization, internet penetration, and demand for cloud services.

MARKET CHALLENGES

Transitioning to Cleaner Technologies to Become a Challenge for Industry Players

The increasing environmental concerns and regulatory compliance requirements pose a significant decline in the India DC and AC diesel generator market share, necessitating a transition to cleaner technologies. Companies must invest in research and development to upgrade to eco-friendly models, which often entails high upfront costs and potential operational disruptions during the transition.

Additionally, stricter emission regulations and growing consumer awareness about sustainability are intensifying competition and shifting market preferences toward cleaner energy solutions. This requires the traditional diesel generator manufacturers to innovate rapidly and adjust their supply chains, ultimately pushing them to adapt their offerings to meet evolving consumer expectations and regulatory standards.

- The Indian government has implemented the Bharat Stage VI (BS-VI) emissions standards, which significantly tighten emissions limits for diesel generators. According to the Central Pollution Control Board (CPCB), compliance with these standards is mandatory, pushing manufacturers to invest in cleaner technologies.

INDIA DC AND AC DIESEL GENERATOR MARKET TRENDS

Hybrid Systems Offering a Cleaner Alternative to Result in Their Increased Adoption

Increasing adoption of hybrid diesel generators in almost all sectors, where it integrates diesel engines with renewable energy sources like solar power and battery storage, is the latest trend. Hybrid systems offer a cleaner and more cost-effective alternative to traditional diesel generators, aligning with both market demands and regulatory requirements. The hybrid diesel generator industry is expanding rapidly as businesses and industries seek more sustainable energy generation solutions.

- For instance, in 2024, Cummins India unveiled its “Crossover Hybrid Generator,” a hybrid diesel generator system that combines diesel power with battery storage systems and solar energy. This hybrid system is expected to enhance fuel efficiency and reduce emissions by utilizing solar power when available, thus minimizing diesel consumption.

Download Free sample to learn more about this report.

IMPACT OF COVID-19 ON THE INDIA DC AND AC DIESEL GENERATOR MARKET

Supply Chain Disruption Caused Production Delays and Increased Costs

The COVID-19 pandemic disrupted the supply chains of diesel generators in India, leading to delays in production and increased costs. Additionally, reduced industrial activity and economic slowdown resulted in lower demand, particularly in sectors, such as construction and manufacturing. However, the growing emphasis on reliable power supply for healthcare and remote work solutions created a niche demand for generators, balancing some of the negative impacts.

INDIA DC DIESEL GENERATOR SEGMENTATION ANALYSIS

By Power Rating

Below 75 kVA Power Category Dominates Market Due to Its Affordability and Compact Size

Based on power rating, the India DC diesel generator market is segmented into below 75 kVA, 75-375 kVA, 375-750 kVA, and above 750 kVA. The below 75 kVA segment accounts for the highest market share. This segment is leading the market as generators of this power rating are primarily used in small-scale applications, such as residential and small commercial setups due to their affordability and compact size. These generators have lower complexity and maintenance needs compared to larger units.

The 75-375 kVA power diesel generator is the second-leading segment. It serves medium-sized commercial and institutional needs driven by business continuity, regulatory compliance, and versatility.

The 375-750 kVA power rating category supports large operations, such as hospitals and data centers due to the high power requirements and critical backup needs of these settings. Expansion of healthcare, IT, and industrial sectors will also drive the need for reliable backup power.

By Application

Standby Load Dominates Market Due to Lower Costs Compared to Continuous Load Generators

Based on application, the market is segmented into continuous load, peak load, and standby load.

The standby load segment accounts for the highest share of the market as these generators are designed to provide backup power during outages or interruptions in the main power supply. They ensure that essential services and operations can continue until the main power is restored. Additionally, lower costs compared to continuous load generators make standby load generators attractive for backup power.

The continuous load segment is the second-leading application segment due to its critical role in ensuring uninterrupted power for essential services, such as hospitals, data centers, and industrial facilities where constant power supply is crucial.

By End-User

Telecom Sector Dominates Market Due to Increasing Digitalization

Based on end-user, the India DC diesel generator market is segmented into mining, oil & gas, construction, residential, marine, manufacturing, pharmaceuticals, commercial, telecom, electric, utility, data centers, and others.

The telecom segment is leading of the India DC diesel generator market share as this sector is the major user of diesel generators, especially for ensuring reliable power supply for cell towers and communication infrastructure. The expansion of 4G and upcoming 5G networks will further drive the demand for backup power solutions in the telecom sector.

Data centers are the second-leading end-user segment as the rapid growth of digital services, cloud computing, and e-commerce will drive high demand for reliable power solutions in data centers.

To know how our report can help streamline your business, Speak to Analyst

INDIA AC DIESEL GENERATOR SEGMENTATION ANALYSIS

By Power Rating

75-375 kVA Category Dominates Due to its High Application in Commercial Sector & Mid-Sized Industries

Based on power rating, the market is segmented into below 75 kVA, 75-375 kVA, 375-750 kVA, and above 750 kVA, where the 75-375 kVA segment accounts for the highest market share. This segment is leading the market as these diesel generators are essential for maintaining operations in commercial establishments, educational institutions, and mid-sized industries.

The below 75 kVA power category is the second-leading segment as these generators are affordable and cater to residential and small-scale commercial needs. Due to their comparatively smaller size, they are ideal for areas with space constraints and minimal power needs. Frequent power outages in some regions will fuel the need for reliable backup power solutions.

By Application

Continuous Load Segment Dominates Market Due to Its Application in Expanding Industrial Sector

Based on application, the market is segmented into continuous load, peak load, and standby load.

The continuous load segment is dominating the market due to India’s rapid industrialization, which has created a robust demand for continuous power supply. As the country continues to advance its industrial capabilities, the demand for continuous load DG sets is expected to grow. The government's push toward 'Make in India' and 'Atmanirbhar Bharat' initiatives will likely bolster this segment’s growth.

Standby load is the second-leading segment in the market. In regions where the power supply is unreliable or prone to frequent outages, businesses and institutions use standby DG sets to ensure backup power.

By End-User

Commercial Sector Dominates Market Due to High-Paced Growth of Commercial Sector

Based on end-user, the India DC diesel generator market is segmented into mining, oil & gas, construction, residential, marine, manufacturing, pharmaceuticals, commercial, telecom, electric utility, data centers, and others.

Commercial is the leading segment in the Indian market. With the growth of commercial establishments, such as office buildings, retail spaces, and entertainment centers, there is a higher demand for DG sets to ensure uninterrupted operations.

Manufacturing accounts for the second-highest market share as India is expanding rapidly due to policies, such as 'Make in India' and 'National Manufacturing Policy,' which boost the demand for reliable power sources. The expansion of industrial corridors and Special Economic Zones (SEZs) under initiatives like the National Industrial Corridor Development Programme (NICDP) has heightened the demand for reliable DG solutions.

To know how our report can help streamline your business, Speak to Analyst

INDIA DC AND AC DIESEL GENERATOR MARKET REGIONAL OUTLOOK

Growing Urbanization in Western India to Fuel Market Growth in the Country

North India exhibits a sharp contrast between the power needs of urban areas like Delhi and rural states, such as Uttar Pradesh and Bihar. During peak summer months, there’s a heightened need for DG sets in commercial and residential buildings to manage air conditioning loads. In urban areas, smart grid integration is being explored to improve the efficiency and reliability of power supply, indirectly influencing the demand for backup DG sets.

Western India, especially Gujarat and Maharashtra, has the presence of numerous economic zones and industrial parks that necessitate backup power solutions. The development of smart cities and industrial hubs presents opportunities for deploying advanced DG technologies that offer remote monitoring, predictive maintenance, and integration with renewable energy sources.

COMPETITIVE LANDSCAPE

Key Industry Players

Competition in the Market is Driven by Diverse Demand & Sustainability Trends

The Indian DC & AC diesel generator market is characterized by the presence of both established multinational players and domestic manufacturers, catering to wide range of power needs. Key players like Caterpillar, Kirloskar Oil Engines, and Cummins dominate the market, leveraging their extensive dealer networks, robust after sale services, and a diverse product portfolio.

Kirloskar has been a major player in the Indian market offering a range of diesel genset products across end user verticals. To align with government initiatives, the company introduced its newest cutting-edge product – Dual Fuel Kits for Diesel Generators. This new launch is aimed at transforming power generation by combining efficiency, environmental consciousness, and economic benefits. It facilitates a seamless transition for generators to operate on a combination of diesel and natural gas, presenting a cleaner and more cost-effective alternative.

Key Companies Profiled:

- Caterpillar Inc. (U.S.)

- Cummins (U.S.)

- Wärtsilä (Finland)

- John Deere (U.S.)

- Kohler Power India (India)

- Kirloskar Oil Engines (India)

- Generac (U.S.)

- FG Wilson (U.K.)

- Atlas Copco (Sweden)

- Briggs & Stratton (U.S.)

- Ingersoll Rand (U.S.)

- Yamaha Motor India (India)

KEY INDUSTRY DEVELOPMENTS:

- June 2024- John Deere Power Systems (JDPS) announced to expand its generator drive power solutions series with the launch of the PowerTech PSL 13.5L prime power generator drive engine. This engine will become the most powerful in a series that meets the U.S. Environmental Protection Agency's (EPA) Final Tier 4 emission regulations without the need for a Diesel Particulate Filter (DPF).

- September 2023- Cummins India Limited and its authorized Genset Original Equipment Manufacturer (GOEM), Sudhir Power Limited, launched its CPCBIV+ compliant genset series for the Delhi NCR markets. These gensets are equipped with integrated control modules for the engine, advanced after-treatment systems, and next-gen monitoring devices for improved load-taking capability, better fuel efficiency, and reduced emissions.

- July 2023- Caterpillar India Private Limited signed an agreement with Pi Green Innovations Private Limited to collaborate on the marketing and distribution of Carbon Cutter through India’s Cat dealers, Gmmco Limited, and Gainwell Commosales Pvt. Ltd.

- May 2023- Kohler India announced the expansion of the Indian data center and IT-enabled services sector through the introduction of a KD4500 (4,500 kVA) generator for mission-critical applications. The company claims that the new expansion is a low-emissions project and meets India’s Central Pollution Control Board norms. Also, it represents the most powerful diesel generator set in the world.

- September 2020- Caterpillar Inc. introduced its Cat DE1100 GC diesel generator set, designed for up to 50 Hz of stationary standby applications. It conforms to the ISO 8528-5 G3 transient response and load acceptance requirements, whereas the Cat control panel ensures reliable generator set operation. Thus, it provides extensive information regarding power output and engine operation.

INVESTMENT ANALYSIS AND OPPORTUNITIES

- In the Union Budget of FY 2023-24, the Indian government has given a massive push to the sector by allocating USD 33.43 billion to the infrastructure sector to enhance the transportation facilities in the country.

- In March 2024, the Minister of Civil Aviation announced plans to inaugurate 15 airport projects worth USD 12.1 billion by 2028.

- Such investments in end-use sectors are likely to create demand for generator sets in the coming years.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such, as major players, product/service types, and leading applications of the product. Besides, it offers insights into the competition landscape for the market, trends, and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

To gain extensive insights into the market, Download for Customization

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 7.39% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Power Rating

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 1.35 billion in 2023.

The market is likely to record a CAGR of 7.39% over the forecast period.

The telecom segment in the DC diesel generator market and the commercial segment in the AC diesel generator market lead the market.

Expansion of infrastructure development projects in India will boost the demand for diesel generators.

Some of the top players in the market are Cummins, Kirloskar Oil Engines, and others.

Indias market size is expected to reach a valuation of USD 2.59 billion by 2032.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us