India Kitchen Cabinets Market Size, Share & Industry Analysis, By Material (Wood, Plastic, Metal, Glass, and Others), By Category (Stock Kitchen Cabinets, Semi-custom Kitchen Cabinets, and Custom Kitchen Cabinets), By Style (Beaded Kitchen Cabinets, Shaker Kitchen Cabinets, Flat Panel Kitchen Cabinets, Wall Kitchen Cabinets, Base Kitchen Cabinets, Tall-Standing Kitchen Cabinets, and Others), By Application (Commercial and Residential), and Country Forecast, 2025-2032

KEY MARKET INSIGHTS

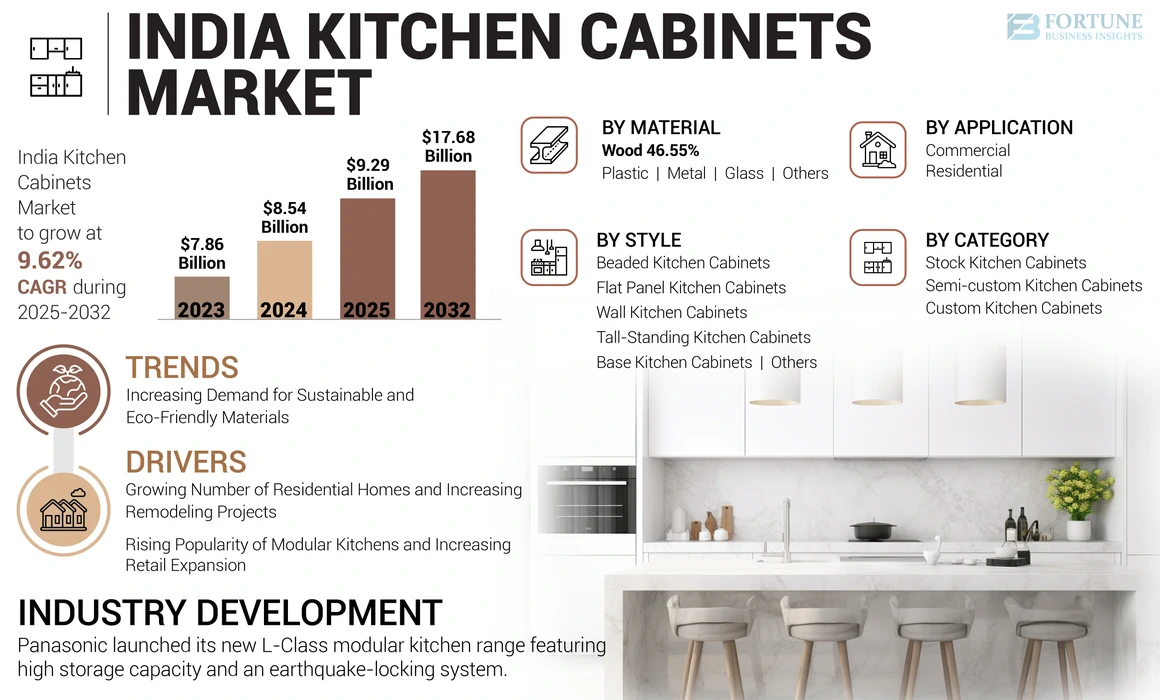

The India kitchen cabinets market size was valued at USD 8.54 billion in 2024. The market is projected to grow from USD 9.29 billion in 2025 to USD 17.68 billion by 2032, exhibiting a CAGR of 9.62% during the forecast period.

Kitchen cabinets are furniture used to store cooking equipment, dishes, silverware, and food items in the kitchen. The Indian kitchen cabinet market is growing at a significant rate favored by the rising construction and sale of residential and commercial buildings across the country. For instance, according to the India Brand Equity Foundation (IBEF), a New Delhi, India-based trust under the Department of Commerce, Government of India, in 2023, the country observed home sales of USD 42 billion, a 48% year-on-year increase. In addition, the volume of sales grew by 36% to 379,095 units. Moreover, luxury home sales across the country rose by nearly 130% in the first half of the year compared to a similar period in the previous year.

The increasing availability of smart kitchen closets with features including integrated wireless charging stations, remote control, and temperature control and consumer inclination toward modern designs are key drivers supporting Indian market expansion.

The COVID-19 pandemic impeded market growth, notably in 2020, due to the imposition of lockdown throughout the country, which resulted in the temporary closure of manufacturing plants and retail stores and affected kitchen cabinet production and sales. In addition, a halt in construction activities and declined demand for non-essential products further hampered Indian market expansion.

India Kitchen Cabinets Market Trends

Increasing Demand for Sustainable and Eco-Friendly Materials to Favor Market Expansion

The rapidly evolving sustainability trend and the increasing number of eco-conscious consumers nationwide fuel the demand for eco-friendly kitchen closets developed from sustainable materials. In addition, the rising consumer consciousness regarding their purchase decision's social and environmental impact boosts the adoption of reclaimed wood cabinets, bamboo cabinets, and Forest Survey of India (FSI) certified cabinets in India. Furthermore, the popularity of Italian design kitchen closets is growing significantly among Indian consumers. Italian kitchen design is renowned for its combination of functionality and aesthetics. Moreover, these Italian cabinets are gaining popularity for their craftsmanship, high-quality materials, and modern design.

- India witnessed india kitchen cabinets market growth from USD 7.86 Billion in 2023 to USD 8.54 Billion in 2024.

Download Free sample to learn more about this report.

India Kitchen Cabinets Market Growth Factors

Growing Number of Residential Homes and Increasing Remodeling Projects to Propel Product Demand

The rapidly growing population and urbanization have led to an increasing number of residential units, including apartments, villas, and individual houses throughout India, resulting in high demand for kitchen cupboards. Furthermore, rising government initiatives to fuel housing development contribute to the Indian market’s growth. For instance, in November 2021, under Pradhan Mantri Awas Yojana (Urban), the Indian Government approved the construction of over 3.61 lakh houses. In addition, increasing consumer interest in modern design and comfort cooking experience are significant factors influencing kitchen cabinet adoption among household consumers.

Real estate developers and builders emphasize offering value-added features in their residential projects, including modular kitchens equipped with high-quality kitchen cupboards, to attract potential buyers, thereby increasing product sales. Moreover, increasing remodeling projects, including kitchen renovations favored by increasing consumer disposable incomes and standard of living bolster the demand for modern cupboards.

Rising Popularity of Modular Kitchens and Increasing Retail Expansion to Fuel Market Growth

The demand for modular kitchens (including I-shaped and U-shaped kitchens) is growing significantly countrywide owing to changing lifestyles, increasing urbanization, and shrinking living spaces across metropolitan cities, including Mumbai, Bangalore, and Delhi. The design versatility and easy installation of modular kitchens also drive the product demand. Moreover, modular kitchens offer diverse customization options, assisting consumers to choose from various cabinet styles, finishes, and colors. Numerous significant players are also launching and designing modular kitchens with diverse kitchen cabinet ranges. For instance, in November 2022, Panasonic Life Solutions India, an India-based technology company, introduced its new exclusive kitchen range, the I-Class Modular Kitchen including cabinets in various patterns and diverse color options.

In addition, the increasing strategic retail expansion by major players provides consumers easy access to kitchen cupboards, significantly driving the India kitchen cabinets market growth. It also boosts product visibility and brand awareness. For instance, in March 2024, Nobilia, a German kitchen manufacturer, unveiled its new experience center in Jaipur, India.

RESTRAINING FACTORS

High Cost of Premium Cupboards and the Large Presence of Unorganized Players May Limit Market Growth

A sizable number of Indian consumers prioritize value and functionality over luxury and exclusivity when purchasing kitchen closets. In this regard, the high prices of premium furniture make affordability a significant concern among budget-conscious consumers, thus affecting product demand. Moreover, the increasing customs duties by the Indian government leads to increased prices of imported furniture, including kitchen cupboards. For instance, in February 2020, the Government of India increased customs duties on furniture, including kitchen furniture, from 20% in 2019 to 25%. The government of India also introduced a 12% goods and services tax on furniture.

The presence of numerous unorganized players offering products at low prices across the country hinders market growth. For instance, according to the Trade Promotion Council of India (TPCI), a government organization, as of May 2023, the furniture market in India has over 80% of its sales from the unorganized sector. The unorganized sector has led to various challenges, including inconsistent pricing, the absence of industry regulations, and a lack of standardization.

India Kitchen Cabinets Market Segmentation Analysis

By Material Analysis

Durability and Strength to Boost Wood Segment’s Growth

Based on material, the market is segmented into wood, plastic, metal, glass, and others. The wood segment dominated the India kitchen cabinets market share in 2023, supported by the durability and strength of wooden kitchen cupboards, which fuels their demand. Moreover, the easy availability of wooden closets in various designs, finishes, and colors boost product sales across the country.

- The wood segment is expected to hold a 46.55% share in 2024.

The metal segment is also growing at a rapid rate, benefitted by the several features of metal closets such as moisture resistance, cost efficiency, easy maintenance, and heat resistance, which contribute to the segmental growth.

To know how our report can help streamline your business, Speak to Analyst

By Category Analysis

Easy Accessibility and Low Cost of Stock Kitchen Cabinets to Support Segmental Expansion

Based on category, the market is divided into stock kitchen cabinets, semi-custom kitchen cabinets, and custom kitchen cabinets. The stock kitchen cabinets segment is estimated to dominate the market in the forthcoming years, attributed to their easy accessibility and low cost. Furthermore, the availability of these products in various trending designs and finishes makes it easy for consumers to find an option that suits their kitchen design without customization.

The semi-custom kitchen cabinets segment is expected to grow considerably in the foreseeable future due to its lower cost and speedy process compared to completely customized kitchen cabinets.

By Style Analysis

Low Maintenance and Simple Design to Accelerate Shaker Kitchen Cabinet Sales

Based on style, the market is divided into beaded kitchen cabinets, shaker kitchen cabinets, flat panel kitchen cabinets, wall kitchen cabinets, base kitchen cabinets, tall-standing kitchen cabinets, and others. The shaker kitchen cabinets segment led the Indian kitchen cabinet market in 2023 due to their low maintenance and simple design, which accelerated their sales. They are also available in various designs and are prevalent in the Indian market.

The wall kitchen cabinets segment is growing at a significant rate as these cabinets optimize the kitchen space effectively. This factor increases their demand notably across metropolitan cities such as Delhi, Mumbai, and Bangalore, where kitchens typically have limited space.

By Application Analysis

Increasing Construction of Housing Facilities and Rapidly Evolving Home Decor Trends to Accelerate Product Sales in Residential Applications

Based on application, the market is categorized into commercial and residential. The residential segment is poised to dominate the market throughout the forecast period backed by growing residential facilities and increasing homeowners' preference for luxury kitchen furniture products. Furthermore, evolving home decor and renovation trends will likely increase homeowners' kitchen furniture replacement rates and favor product revenues across the country.

The increasing construction of new hotels and resorts with well-designed kitchens throughout India is slated to boost commercial segment growth.

List of Key Companies in India Kitchen Cabinets Market

Key Players Offer Products in Various Designs and Innovative Features to Stay Competitive

The India kitchen cabinets market is characterized by intense competitive rivalry due to the presence of numerous renowned and unorganized players. Prominent industry players offer kitchen cupboards in various designs, finishes, and colors to attract more customers and gain a significant share. Furthermore, they emphasize developing products with innovative features such as soft-close mechanisms and integrated lighting and expanding distribution channels. In addition, opening new stores at prime locations assists companies in accelerating sales and enhancing market share. For instance, in August 2023, Panasonic Life Solutions India, an India-based technology company, launched its new 1200 ft. store in New Delhi, India, that offers various home and living products, including kitchen closets.

List of Key Companies Profiled:

- Spacewood (India)

- HomeLane (India)

- Livespace (India)

- Blum (Austria)

- Hettich (Germany)

- Sleek International Pvt Ltd (India)

- Godrej Interio (India)

- Grass (Austria)

- Ebco (India)

- Panasonic (Japan)

- Tusker (India)

- Magppie (India)

- Hacker (Germany)

- KOXYGEN (India)

- nobilia-Werke J. Stickling GmbH & Co. KG (Germany)

- Inter IKEA Systems B.V (Netherlands)

- Oppein Home Group Inc (China)

- Hafele (Germany)

- Nolte (Germany)

KEY INDUSTRY DEVELOPMENTS:

- January 2024: Hafele, a Germany-based architectural hardware and furniture fittings company, unveiled its One Touch Mechanism, the first cabinet mechanism in India, assisting in the easy closing and opening of cabinets. The innovative mechanism combines soft-close and push-to-open technologies in a unit, simplifies daily tasks in the kitchens, and enhances design functionality.

- December 2023: Stanley Group, an India-based furniture company, launched its new flagship store, Stanley Next Level, in Gurugram, India, offering various home and kitchen furnishing products, including kitchen cupboards.

- November 2023: Oppein Home Group Inc, a China-based kitchen and home-furnishing company, celebrated the opening of its new showroom in Hyderabad, India. The new 372 sqm spacious showroom displays the brand’s products, such as kitchen closets.

- November 2022: Panasonic Life Solutions India introduced its I-Class Modular Kitchen collection. The new range combines the latest Japanese technology and quality materials sourced from India. The collection also assists customers in customizing their cabinet doors using various patterns, colors, finishes, and materials. Moreover, its cabinets are developed using plywood and include intelligent features. The range is available across 23 cities nationwide through 25 retail stores.

- August 2019: Panasonic, a Japan-based electronics company, launched its new L-Class modular kitchen shop in Bengaluru, India. The L-Class kitchen range features high storage capacity and an earthquake-locking system, which protects products inside the cabinet from potential damage.

REPORT COVERAGE

The research report provides a detailed market analysis and focuses on key aspects such as leading companies, materials, category, styles, and applications. Besides this, it offers insights into the major trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.62% from 2025 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Category

|

|

|

By Style

|

|

|

By Application

|

Frequently Asked Questions

Fortune Business Insights says that the Indian market was USD 8.54 billion in 2024 and is anticipated to reach USD 17.68 billion by 2032.

The market is slated to exhibit a CAGR of 9.62% over the forecast period (2025-2032).

By material, the wood segment led the market in 2024.

The growing number of residential homes and increasing remodeling projects are set to propel product demand, impelling market growth.

Godrej Interio, Oppine, Hacker, Nobilia, and Sleek International Pvt Ltd are the leading companies in India.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us