3D Printing Market Size, Share & Industry Analysis, By Component (Hardware, Software, and Services), By Technology (FDM, SLS, SLA, DMLS/SLM, Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CLIP/CDLP, SDL, and LOM), By Printing Type (Desktop 3D Printer and Industrial 3D Printer), By Material Type (Metal, Polymer, and Ceramics), By Application (Prototyping, Production, Proof of Concept, and Others), By End User (Automotive, Aerospace and Defense, Healthcare, Architecture and Construction, Consumer Products, Education, and Others), and Regional Forecast, 2026-2034

3D Printing Industry Analysis

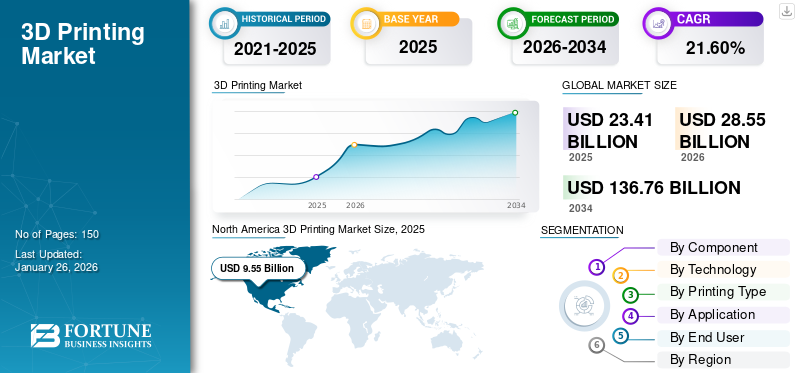

The global 3D printing market size was valued at USD 23.41 billion in 2025 and is expected to grow from USD 28.55 billion in 2026 to USD 136.76 billion by 2034, at a CAGR of 21.60% during the forecast period. North America dominated the 3D printing market with a market share of 40.80% in 2025.

The rapid rise in digitization and increase in the adoption of advanced technologies, including smart factories, Industry 4.0, machine learning, and robotics, will fuel the demand for online 3D printing in simulation applications. The technology has a wide application scope through these technologies across industries, including automotive, aerospace, healthcare, and others.

For instance,

- Aerospace companies are exploring this printing technology to manufacture various hardware parts of their products. For instance, Boeing leverages industrial 3D printing to manufacture the interior parts of its planes, whereas NASA uses it to build rocket engines and parts of the satellite.

- The automotive industry is expected to show a huge adoption of this technology. Rapid tooling incorporated with additive manufacturing has become the priority of many automotive manufacturers. Customization of the automotive interiors is another major application of this technology in the automotive industry.

Post COVID-19 pandemic, industrial hubs and manufacturing sectors witnessed immediate supply chain disruptions and halts on production. As a result of the fast-spreading pandemic, overall industrial production across the globe experienced a sharp decline. It was demobilized, reflecting supply chain disruptions and reviving financial market conditions. The crisis forced market players across the globe to reduce their operational expenditures. Fewer operational expenditures restricted the investments of market players in this technology in 2020, impacting the 3D printing market growth.

MARKET DYNAMICS

3D Printing Market Drivers

Substantial Investments of Governments and Tech Giants to Foster Market Growth

Many countries across the globe are experiencing massive digital disruptions in advanced manufacturing technologies. The U.S. is a potential user of 3D technology. In 2018, the U.S. Department of Defense included this technology as an important capability in its budget. Even tech software giants, such as Autodesk, Microsoft, and HP, have launched products for additive and 3D technology manufacturing.

Similarly, China is making significant efforts to maintain the competitive index of the manufacturing industry in the global market. Chinese manufacturers view this technology as a risk and an opportunity to boost the economy, and hence, they tend to invest in the research and development of this technology.

India is looking forward to this technology as an opportunity to increase its share in global manufacturing competitiveness. Active government initiatives, such as the Make in India initiative, support the market in India. For instance, in May 2022, India Cements partnered with a construction 3D printing startup, Tvasta, to promote sustainability in the construction sector.

Korea has established an independent roadmap for the research and development of this technology and provides national support to execute it. The government of Korea is introducing tax incentives and accelerating industry regulatory agreements to encourage the adoption of this technology.

The U.K. government has developed an independent 3D technology strategy, however, the strategy is witnessing some uncertainties in the country’s manufacturing sector due to Brexit. Germany is expected to define new technology strategies as the country has a well-established Industry 4.0 infrastructure.

- According to the 3D Printing Trend Report 2022 by HUBS, it can make production chains more volatile during global crises, such as climate change and the COVID-19 pandemic. This technology can boost the sustainability of manufacturing and support environmental goals.

As the market is moving to a mature stage, 3D print technology will play a supportive role in various manufacturing processes, will continue to be used as a prototype to accelerate product development, and become more feasible for end-use applications.

3D Printing Market Restraints

High Initial Investments to Restrict Market Growth

High initial investments are observed to be the most significant restraint for the adoption of this technology. This investment encompasses investment in hardware, software, materials, certification, additive & manufacturing education, and training for the employees. The capital and resources required to set up a 3-dimensional system are more expensive than the traditional printing methods.

However, with the introduction of the industrial Desktop 3D printer, manufacturers are helping the end customers cut the high initial costs. Desktop printers are easy to use & handle and less expensive than the 3-dimensional system.

3D Printing Market Opportunities

Rising Demand for 3D Printing in Healthcare to Develop Customized Medical Devices to Drive Market Growth

3D printing is considered essential in the medical field for producing personalized medical tools and generating 3D-printed prosthetic arms and legs for patients. This is a game-changing factor that boosts the market's growth. The application of printing technology in the creation of tissues and organs is quickly progressing, presenting opportunities for significant advancements in medical studies and transplantation.

Furthermore, the ongoing creation of new materials with improved characteristics, such as greater strength and elasticity, expands the uses of 3D scans or printing solutions in different sectors, such as the automotive and healthcare industries. Similarly, increasing usage of printing solutions in the dental industry helps to empower the efficiency of material and time with quality and accuracy. Thus, the integration of 3D technology with healthcare machinery is expected to have a transformative impact on the surgery and dentistry sectors in the near future.

3D PRINTING MARKET TRENDS

Advancements in 3D Hardware and Software to Generate New Revenue Streams for Market Players

Tech-savvy startups and established market players are upgrading and developing new technologies. The advancements in hardware have led to faster and more reliable 3D printers for production applications. Polymer printers are one of the most used 3D printers.

- December 2022 – Redington Limited made an agreement for ETEC, Materialize & Wipro products to establish full-stack services and products for enterprises to facilitate a 3D manufacturing process. Moreover, Redington Limited partnered with Wipro 3D to facilitate the launch of polymer 3D printers across India.

The statistics show that developments in polymer additive manufacturing would create new opportunities for market players.

Fused Filament Fabrication (FFF) and powder bed fusion technologies, such as Multi Jet Fusion offered by HP Inc., are expected to be the most preferred industrial 3D technologies among manufacturers due to their ability to facilitate high-volume manufacturing and increase productivity. Similarly, resin-based technologies, such as Digital Light Processing (DLP) and Stereolithography (SLA), are more likely to witness high demand from the dental and consumer goods industries.

Similarly, software developments are gaining pace in the 3D industry, driven by the demand to streamline operations. The technology has been extensively used in the manufacturing process, which has surged the need for software that can help manufacturers increase production volumes and enhance their additive manufacturing processes efficiently.

Following are the other market trends that play a crucial role:

- Automation across the 3D printing workflow

- High-performance 3D printing materials development

- Demand for large-format systems in metal 3D printing

- Reliability across 3D print technologies

- Adoption of 3D technology across existing markets and a stronger entry into newer markets

- Robust supply chains and on-demand production

IMPACT OF GENERATIVE AI ON 3D PRINTING INDUSTRY

Gen-AI Powered 3D Printing Process Automates the Additive Manufacturing (AM) Operations

Generative AI assists in enhanced design processes and helps in optimizing production ability, thereby transforming the 3D printing process. Integrated gen-AI technology with printing tools boosts the speed of the design process by 25%. It also brings mass customization among products in order to fulfill the specific requirements of the customers.

Similarly, it helps to accelerate prototype generation and improve the prediction accuracy of 3D-printed outcomes. Gen-AI algorithms automate the creation of innovative products by following various product-optimizing criteria, such as strength, material usage, and weight. The predictive potential capability helps to reduce damage caused by failures and issues faced by manufacturers while performing additive manufacturing (AM) processes.

- For instance, in June 2024, Ai Build, a U.K.-based 3D printing software developer, developed Aibuild 2.0, AI-powered cloud-based software for large organizations that automate industrial and large-scale additive manufacturing processes.

These are the factors that drive the growth of the market across various fields, such as healthcare, automotive, and aerospace, to improve the efficiency of manufacturing operations.

SEGMENTATION ANALYSIS

By Component

Software to Witness Strong Growth Owing to Wide Use in Design of Objects and Parts

On the basis of component, the market is divided into hardware, software, and services.

The software is expected to record a highest CAGR during the forecast period. 3D software is widely used in different industry verticals to design the objects and parts to be printed. As manufacturing companies are shifting away from traditional manufacturing methods, the adoption of printing software has grown to print iterations of different manufacturing parts.

The adoption of hardware for manufacturing 3D printed materials is maximum and hence, this segment is likely to maintain its dominance during the forecast period with a share of 46.82% in 2026. The demand for hardware is increasing as major market players are enhancing their product portfolio and launching new technologies to serve high demand from several industry verticals. Companies are investing in research & development activities, which will have a positive impact on the segment’s growth.

By Technology

Fused Deposition Modeling (FDM) Technology Gains Traction Owing to Easy Operation

Based on technology, the market has been divided into FDM, SLS, SLA, DMLS/SLM, Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CLIP/CDLP, SDL, and LOM.

The Fused Deposition Modeling (FDM) technology captured the maximum market share in 2024. The growth of FDM is mainly due to the ease of operation and advantages associated with the technology. This technology is highly used in making durable, strong, and dimensionally stable parts.

- According to research, 71% of businesses use FDM technology to generate highly durable, precisely tolerant, and stable products by following complex geometries.

The Direct Metal Laser Sintering (DMLS/SLM) technology segment is expected to record a high CAGR during the forecast period. The technology promotes the production of high-quality metal components, making them suitable for the manufacturing industry to create complex geometries of metals of extremely small sizes.

The Selective Laser Sintering (SLS) segment is expected to show significant growth in the coming years owing to its growing popularity in the consumer goods sector with a share of 16.49% in 2026. SLS finds a wide variety of applications in industries, including aerospace, defense, automotive, and others.

Polyjet, Multi Jet Fusion, DLP, Binder Jetting, EBM, CLIP/CDLP, SDL, and LOM technologies are expected to witness a significant rise in adoption in the coming years.

By Printing Type

Adoption of Desktop 3D Printer is Increasing Among SMEs Due to its Portable Size and Easy Access for Prototyping the Product

Based on printing type, the market is studied for desktop 3D printer and industrial 3D printer.

The desktop 3D printer has shown tremendous growth and is projected to grow with the highest CAGR over the forecast period. This is due to the extensive usage of 3D printers among small and medium-sized companies for designing and prototyping the parts along with other related services to enhance the operational performance of the businesses. Portable and easy-to-access desktop 3D printers are gaining more popularity than industrial 3D printers among end-users across the globe.

Furthermore, industrial 3D printers accounted for the largest market share 51.66% in the year 2026 and are expected to lead the market with the highest revenue due to the increased adoption of large-sized industrial 3D printers among various industry verticals, such as electronics, healthcare, automotive, and aerospace and defense for designing and prototyping the industrial parts.

- According to industry experts, in 2023, industrial printers dominated the market by holding 76% of the global 3D printing market share due to the demand for high-volume production.

By Material Type

Demand for Polymer Material is Higher Due to its Highly accurate and Fine Material Finishing Properties

On the basis of material type, the market is divided into metal, polymer, and ceramics.

The polymer is estimated to grow at the highest growth rate due to the increasing popularity of lightweight and small-sized desktop 3D printers in the education, healthcare, and consumer products manufacturing industries. Growing adoption of polymer printing materials and technologies to manufacture parts with high accuracy, smooth surface finish, and superior mechanical properties boosts segment growth.

Metal holds the largest market share in the year 2024 due to the growing demand for complex, customized, and detailed design products in the aerospace and healthcare industries. The traditional manufacturing processes often generate large amounts of material waste. In contrast, in the additive manufacturing process when using the metal in the 3D technique, the material is deposited layer to build the final part. Thus, the material waste is reduced on a large scale. These factors are considered to drive the market growth over the forecast period.

By Application

Prototyping Application Segment Captures Maximum Share Due to its Wide Use Across Key Industry Verticals

Based on application, the market is divided into prototyping, production, proof of concept, and others.

The prototyping represented the largest market share in 2024 due to its widespread acceptance of the prototyping process across various industrial verticals. Prototyping helps businesses achieve greater precision and produce consistent end-products. This technology helps in manufacturing 3-dimensional Computer-Aided Design (CAD) models and prototypes.

- According to an analyst survey in 2023, more than 68% of companies are using 3D technology for prototyping and pre-series manufacturing.

The production segment is expected to witness strong growth during the forecast period as manufacturers are shifting from traditional manufacturing processes toward advanced manufacturing processes. Also, the wide usage of this technology to produce complex and low-volume parts is expected to boost the segment’s growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End User

Automotive Industry Leads Owing to Maximum Use of Technology in Producing Prototype Equipment

Automotive, aerospace & defense, healthcare, architecture & construction, consumer products, education, and others are the end users of these printers.

The automotive industry held the maximum market share in 2024. For decades, the automotive industry has been using this technology to produce prototype equipment and small custom products in a short time. The technology is being widely used to manufacture lightweight components for automobiles and OEMs.

The healthcare industry is estimated to grow with the highest CAGR over the forecast period. The integration of additive manufacturing technology in the healthcare sector helps to create artificial tissues and muscles that mimic normal human tissues that can be used in replacement operations. These uses are anticipated to lead to the high acceptance of 3DP in the healthcare sector's development.

Additive manufacturing has tremendous potential in the aerospace industry, where light, solid, and geometrically complex parts are required — and are normally manufactured in limited quantities. Aerospace and defense companies are heavily using this technology to produce lightweight components.

- For instance, in March 2022, South Africa’s Department of Science and Innovation developed a pilot project to build around 25 houses by applying this printing technology to fight the shortage of housing in the country.

On the other hand, architecture & construction, consumer products, and education industries are anticipated to record a significant CAGR during the forecast period.

Regional Insights

North America

North America 3D Printing Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the maximum share in the global market mainly due to rising expenditure on advanced manufacturing technologies by developed countries, such as Canada and the U.S. Also, various government agencies, such as the National Aeronautics and Space Administration (NASA), have identified major R&D investments that can greatly contribute to space applications and create new technologies that drive business expansion.

Download Free sample to learn more about this report.

North America holds the largest market share in the year 2024 as compared to other regions present across the globe. Increasing demand for these solutions across different industrial sectors to fulfil the customized needs of the customers present across the region drives the growth of the market.The U.S. market is projected to reach USD 6.98 billion by 2026.

Download Free sample to learn more about this report.

The U.S. 3D printing market is predicted to grow significantly, reaching an estimated value of USD 33,782.4 million in 2032. The U.S. holds the maximum share in the year 2024 as compared to other countries present across North America. Increasing demand for additive manufacturing (AM) tools and technologies across different industrial sectors to fulfill the growing customized demands of customers and to deliver better user experience drives the growth of the market.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe holds the second-highest share in the global market. The demand for this technology is high among small and medium-sized industries that require high-speed, reliable, and inexpensive prototypes for manufacturing purposes. The regional market is expected to showcase strong growth in adopting this technology in the manufacturing and semiconductors industry.The UK market is projected to reach USD 1.21 billion by 2026, while the Germany market is projected to reach USD 1.4 billion by 2026.

Asia Pacific

Asia Pacific is anticipated to record the highest CAGR during the forecast period. The regional manufacturers and the implementation of several policies and legislative proposals by governments in the region have backed an increasing interest in the development of a sustainable printing environment. Given the massive government funding for the industry, China is possibly the main force behind the adoption of this technology in Asia Pacific.The Japan market is projected to reach USD 1.15 billion by 2026, the China market is projected to reach USD 1.62 billion by 2026, and the India market is projected to reach USD 0.56 billion by 2026.

Middle East & Africa

Middle East & Africa is expected to grow with the second-highest CAGR during the forecast period. Technological advancements and improvements drive the rapid adoption of this type of printing technology in manufacturing industries across the region. Furthermore, growing investments by additive manufacturing companies boost the market's growth.

- For instance, in December 2023, Immensa, a UAE-based additive manufacturing startup secured USD 20 million in funding raised by Global Ventures, a venture capital firm present in the Middle East. Through this funding, Immensa aims to accelerate its global business expansion plan in untapped regions.

South America

South America contributes to developing a standard regulatory framework for bringing development across the 3D printing industry to address various challenges in the market. The growing emergence of new supply chain technologies in manufacturing industries and the setting up of different technology manufacturing units propel the growth of the market across the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Market Players are Constantly Engaging in Strategic Collaborations, Mergers, and Acquisitions to Enhance Business Growth

The market players are increasing their product portfolio due to the increasing demand for more automated technology-driven printing solutions. Market players are implementing various business strategies, such as partnerships, mergers, and acquisitions, to expand their businesses across the world. These players sell their products in various regions worldwide, such as the Americas, Asia Pacific, and Europe, among others. These vendors sell products through their offices in these regions, while some also use a multichannel distribution approach to sell their products to numerous end-user businesses.

List of Companies Studied:

- The ExOne Company (Germany)

- 3D Systems Corporation (U.S.)

- voxeljet AG (Germany)

- Materialise NV (Belgium)

- Redwire Corporation (U.S.)

- Envisiontec, Inc. (Germany)

- Stratasys Ltd. (U.S.)

- HP, Inc. (U.S.)

- General Electric Company (GE Additive) (U.S.)

- Autodesk Inc. (U.S.)

- Canon, Inc. (Japan)

- Desktop metal Inc. (U.S.)

- SLM Solutions (Germany)

- Renishaw plc. (U.K.)

- EOS GmbH (Germany)

- Made in Space, Inc. (U.S.)

- Formlabs (U.S.)

- Imaginarium (India)

- Solo Lattices Company Ltd. (Ireland)

- Protolabs (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2024 – APL, a Switzerland-based medicine manufacturer, formed a partnership with CurifyLabs to enable the production of personalized medicine dosage using innovative 3D printing technology.

- April 2024 - MatterHackers acquired Source Graphics, a U.S.-based 3D printing products provider. They formed a partnership with Formlabs to bring advancements across their newly launched projects using stereolithography (SLA) and selective laser sintering (SLS) technologies and deliver them to the customers of the manufacturing industries.

- March 2023 - Neotech AMT partnered with APES to expand the reach of 3D-printed electronics in North America. This partnership enabled both companies to share resources and technologies to improve the development and manufacturing capabilities of additive manufacturing.

- January 2023 – Lithoz agreed to a partnership with Wendt India Ltd. to expand sales operations in this market in India. By collaborating, companies aim to establish and develop ceramic 3D printing in India.

- January 2023 - Japanese group Nikon acquired industrial 3D printer manufacturer SLM Solutions. This acquisition aided Nikon in strengthening its presence in integrated metal additive manufacturing.

REPORT COVERAGE

The research report highlights leading regions across the globe to offer the user a better understanding of the market. Furthermore, it provides insights into the latest industry trends and analyzes technologies that are being deployed at a rapid pace at the global level. It further offers information on the drivers and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 21.60% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Component

By Technology

By Printing Type

By Material Type

By Application

By End User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global size market is expected to reach USD 136.76 billion by 2034.

In 2025, the market is valued at USD 23.41 billion.

The market is projected to record a CAGR of 21.60% during the forecast period.

By component, the hardware is expected to be the leading segment in the market.

Substantial investment by governments is a key factor driving the market growth.

3D Systems Corporation, the ExOne Company, voxeljet AG, Materialise NV, Hoganas Holding AB, and Optomec, Inc. are the top players in the market.

North America held the highest market share.

Asia Pacific is expected to record the highest CAGR during the forecast period.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us