Aluminium Market Size, Share & Industry Analysis, By Product (Sheet, Plate, Cast Products, Extrusion, and Others), By Alloy Type (Cast Alloy and Wrought Alloy), By End-use (Construction, Transportation {Aerospace, Automotive, and Marine}, Packaging {Food & Beverages, Cosmetics, and Others}, Electrical, Consumer Durables, Machinery & Equipment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

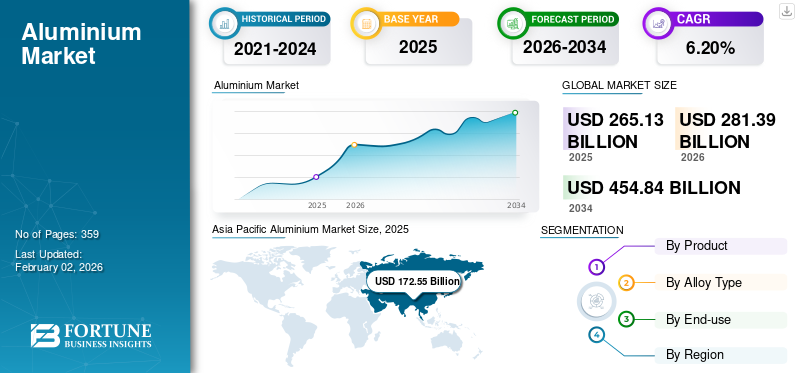

The global aluminium market size was valued at USD 265.13 billion in 2025 and is projected to grow from USD 281.39 billion in 2026 to USD 454.84 billion by 2034, exhibiting a CAGR of 6.20% during the forecast period. Asia Pacific dominated the aluminium market with a market share of 65.10% in 2025.

Moreover, the aluminium market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 43.05 billion by 2032, driven by the rising adoption from electric vehicle manufacturers to reduce the weight of vehicles.

Aluminium is a silvery-white, non-magnetic, and ductile metal that plays a critical role in modern industry and commerce. Its unique combination of lightweight and exceptional strength has drastically transformed sectors ranging from the aerospace to automotive sectors, where weight reduction is equivalent to efficiency. Its corrosion resistance and conductivity make it integral to construction and electrical applications. In addition, its extensive use in everyday consumer products, packaging, and transportation systems, highlights its significance in modern society. Moreover, the rising demand for the product from electric vehicles and OEMs is supporting aluminium market growth.

During the COVID-19 pandemic, the prolonged slowdown of operations in several industries, such as automotive, construction, electronics, consumer appliances, and industrial machinery worldwide, led to short-term production halts. The prices for the product fluctuated significantly during this period. As the pandemic situation worsened, the value of metal decreased, and its price consistently moved lower. As the world recovered from the pandemic and demand rose, a reversal in product prices was observed, with prices reaching historic peak values.

Aluminium Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 265.13 billion

- 2026 Market Size: USD 281.39 billion

- 2034 Forecast Market Size: USD 454.84 billion

- CAGR: 6.20% from 2026–2034

Market Share:

- Asia Pacific led the market in 2025 with a dominant 65.10% share, rising from USD 172.55 billion in 2025, driven by rapid urbanization, construction growth, and automotive production.

- By product, cast products held the largest share in 2026 due to affordability and versatility, while the sheet segment is projected to grow fastest.

- By alloy type, wrought alloys dominated in 2026 owing to their superior strength and ductility, suitable for high-performance applications.

- By end-use, the transportation segment held the largest market share in 2026, fueled by rising demand for lightweight materials in EVs, aerospace, and marine sectors.

- The U.S. aluminium market is projected to reach USD 43.05 billion by 2032, driven by growing EV production and aerospace applications.

Key Country Highlights:

- China: Electrical applications are expected to hold a 13.2% share in 2023, supported by infrastructure and industrial demand.

- United States: Strong growth outlook, especially in EV and aerospace sectors, where lightweighting is critical.

- Germany: Automotive transition to electric mobility and fuel efficiency continues to drive aluminium usage.

- India: Urbanization and rising construction activities propel demand in structural and packaging sectors.

- Middle East & Africa: Steady growth supported by infrastructure expansion and corrosion-resistant building material needs in coastal areas.

Aluminium Market Trends

Rising Product Incorporation in the Automotive & Transportation Industries is the Current Trend

Although aluminium (Al) has been used in automobiles for many years, its proportion in new vehicles is rising. Automotive engineers and designers highly prefer this metal for its ability to reduce emissions and increase fuel economy. Electric vehicle manufacturers are incorporating this metal to reduce the weight of the vehicle and achieve a better driving range. Moreover, automotive manufacturers such as Mercedes and BMW are increasingly substituting stainless steel with the product as it exhibits similar physical properties and lightweight nature. The above-mentioned factors are estimated to drive the aluminum market growth. Asia Pacific witnessed a aluminium market growth from USD 172.55 billion in 2025 to USD 184.32 billion in 2026.

Aluminium Market Growth Factors

Increasing Popularity of Secondary Product to Aid Market Growth

Global consumption of recycled or secondary products accounts for a significant proportion. Waste obtained from the automobile industry, beverage cans, equipment, and machinery is recycled and reused due to its cost-effectiveness. Secondary or scrap metal recycling uses a fraction of the energy required to produce new metals from ore, thereby reducing damage to the environment. In addition, secondary product recycling does not reduce the quality of the metal, so it can be recycled indefinitely. The demand for aluminium cans continues to drive market growth. Moreover, recycling product cans saves natural resources and energy and reduces pressure on landfills. Manufacturing new cans from reused products saves about 95% of the energy used in creating cans from bauxite. The growing focus on the consumption of sustainably sourced products is expected to further boost product recycling and drive the growth of this market during the forecast period.

Increasing Demand from Transportation Sector to Fuel Market Growth

Rising product demand from the transportation sector, including aerospace, automotive, and marine industries is anticipated to fuel market growth. In aerospace, aluminium is essential due to its lightweight nature, which directly improves fuel efficiency and reduced emissions. Aircraft manufacturers such as Boing and Airbus continuously seek to lower aircraft weight to improve fuel efficiency and payload capacity. Aluminium alloys are extensively used in aircraft structures including fuselage, wings, and landing gear, owing to their strength-to-weight ratio and resistance to fatigue and corrosion.

The automotive industry is also significantly driving product demand. With global push toward reducing carbon emissions and enhancing fuel economy automakers are increasingly incorporating aluminium in vehicle design. This trend is anticipated to significantly drive the product demand. For instance, Rio Tinto, predicts that the use of aluminium in lightweight trucks and cars will increase by around 30% from 177Kg/vehicle in 2015 to 227Kg/vehicle by 2025.

The metal lightweight properties significantly contribute to the weight reduction of the vehicles, improving their fuel efficiency and performance. It is used in engine components, body panels, wheels, and increasingly in electric vehicle battery enclosures. The shift toward electric vehicles further amplifies the product demand as it helps offset the weight of heavy batteries, enhancing the range and efficiency of electric vehicles.

In the marine industry, corrosion resistance and lightweight properties make it ideal for shipbuilding. It is extensively used in the construction of hulls and superstructures for ships, boats, and yachts. The reduction in weight leads to improved fuel efficiency and increased payload capacity, crucial for commercial and military vessels.

Overall, exceptional fuel efficiency and other relatively superior functionalities offered by the product are fueling its demand across the transportation sector, encompassing automotive, aerospace, and marine industries.

Download Free sample to learn more about this report.

Key Factors Driving Aluminium Market Growth Include:

- Surging demand for lightweight materials in the automotive and aerospace industries.

- Growing shift toward electric vehicles (EVs) and energy-efficient transportation.

- Expansion in construction and infrastructure projects in the Asia Pacific and the Middle East.

- Increasing adoption of recycled and low-carbon aluminium for sustainability goals.

- Rising demand for aluminium packaging in the food and beverage industries.

RESTRAINING FACTORS

Implementation of Stricter Environmental Regulations May Hamper Market Growth

Several countries across the globe have had to adopt new regulations as a result of expanding environmental issues and increasing public expectations for government action to reduce pollution levels. The implementation of stringent industry standards and regulations by governments and associations is expected to limit market growth. Over the past decade, consumers have become increasingly aware and concerned about environmental health. Governments and international organizations, in collaboration with the private sector, are establishing methodologies to monitor the adverse effects of bauxite ore mining. Companies producing aluminium products will need to spend more to meet with these strict regulations, which is likely to restrict market growth. Strict government regulations on Al products to reduce environmental impact are anticipated to shift the focus of the industry toward sustainability.

Aluminium Market Segmentation Analysis

By Product Analysis

Cast Products Segment accounted for Largest Share due to their Affordability

Based on product, the market is segmented into sheet, plate, cast products, extrusion, and others.

The cast products segment accounted for the largest share in the market of 28.79% in 2026 and is estimated to maintain its leading position throughout the forecast period. The products manufactured using cast aluminium are highly versatile and range from simple hand-held devices to complex automobile parts. The affordability offered by cast alloy makes it an irreplaceable material.

The sheet segment is estimated to grow at the fastest rate during the forecast period. Metal sheets are widely used in manufacturing packaging cans, auto parts, cookware, and building products. The increasing trade activities and expansion of the construction industry amongst developing countries are fueling the segment growth. This segment gained 25% of the market share in 2024.

By Alloy Type Analysis

Wrought Alloy Segment Dominated the Market due to High Strength and Ductility

Based on alloy type, the market is segmented into cast alloys and wrought alloys.

The wrought alloy segment accounted for the largest share of the global market of 71.60% in 2026. In wrought alloy production, the metal is subjected to mechanical processes such as forging, rolling, and extrusion. This makes wrought alloy mechanically stronger and ductile compared to cast alloys. This increasing usage of wrought alloy in various applications requires high material strength, including welding rods, aircraft frames, motorcycle frames, and pressure vessels. Hence, the wrought alloy segment is anticipated to grow substantially with a considerable CAGR of 6.27% during the forecast period (2026-2034).

The high casting flexibility offered by cast alloys increases their use to form a wide range of shapes. This alloy is preferred in applications such as machine tools, window fittings, cast wheels, axle housings, gearbox housings, engine cylinder heads, garden tools, and farm equipment. In addition, cast alloys have a lower price relative to wrought alloys. The specific functionality and cost-effectiveness of cast alloys make them irreplaceable in many applications, thus resulting in high segment growth. The cast alloy segment is foreseen to capture 28% of the market share in 2025.

By End-use Analysis

To know how our report can help streamline your business, Speak to Analyst

Transportation Segment Dominated owing to the Rising Preference for Lightweight Metal

Based on end-use, the market is segmented into construction, transportation, packaging, electrical, consumer durables, machinery & equipment, and others.

The transportation segment held the largest aluminium market share of 35.01% in 2026, driven by the growing adoption of Al in the automotive industry due to its lightweight properties. This segment is anticipated to display a significant CAGR of 6.54% during the forecast period (2024-2032).

The construction segment is expected to grow with the highest CAGR during the forecast period. The rising number of construction and infrastructure development activities and increasing product adoption in interior countertops and cladding are the key factors behind the segment growth. this segment is predicted to gain 20% of the market share in 2025.

The growing demand for sustainable product packaging from the food & beverage industry and strict government regulations to curb the use of plastic packaging are expected to have a positive impact on the packaging segment growth.

The increasing demand for Al metal from machinery manufacturers and the industrial sector is boosting the growth of the machinery & equipment segment.

Sustainability and Recycling Outlook

Recycling plays a central role in the aluminium industry. Producing secondary aluminium requires nearly 95% less energy than making new metal from bauxite ore. The growing focus on net-zero emissions and eco-friendly manufacturing is pushing manufacturers to invest in recycled aluminium. Many global producers, such as Rio Tinto and Norsk Hydro, are expanding their low-carbon product lines to meet sustainability targets by 2030.

Future Outlook and Opportunities

The future of the aluminium industry looks promising with rapid adoption in green construction, renewable energy systems, and electric mobility. Emerging technologies such as carbon-free smelting, AI-driven quality monitoring, and 3D printing using aluminium alloys are opening new opportunities. As countries transition to low-carbon economies, aluminium will remain essential for sustainable infrastructure and next-gen transportation.

REGIONAL INSIGHTS

Based on region, the market is divided into North America, the Asia Pacific, Latin America, the Middle East & Africa, and Europe.

Asia Pacific

Asia Pacific Aluminium Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Asia Pacific stood at USD 172.55 billion in 2025 and USD 184.32 billion in 2026, with the region holding the dominant share of the market. Rapid urbanization and infrastructure development, particularly in countries such as China and India, are driving extensive use of the product in construction for structural components and facades, thereby propelling regional growth. The Chinese market is likely to reach USD 130.15 billion in 2026. The regional automotive industry, driven by the goal to achieve fuel efficiency and reduce emissions, significantly relies on materials such as Al, both in conventional and electric vehicle production. In addition, the growing emphasis on metal recycling and the expansion of the packaging industry in developing countries are contributing factors supporting the market growth in the region. India is predicted to be worth USD 8.18 billion in 2026, while Japan is anrticipated to gain USD 10.84 billion in the same year.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is the second largest market likely to be valued at USD 43.03 billion in 2026, recording a substantial CAGR of 5.02% during the forecast period (2026-2034). In the European market, the demand for the metal is linked to its rapid adoption in the automotive industry. The automotive industry is anticipated to play a critical role as Europe is committed to reducing carbon emissions and promoting the shift to electric vehicles. The U.K. market continues to expand, projected to reach a market value of USD 1.01 billion in 2026. The product’s lightweight properties are essential in achieving fuel efficiency and limiting carbon footprint, making it a preferred choice in automotive manufacturing. In addition to complex structural designs, automakers are using advanced processes and techniques to integrate lightweight metals into other vehicle parts. Moreover, high demand for applications such as packaging and solar panels is driving market growth in Europe. Germany is foreseen to grow with a valuation of USD 9.98 billion in 2026, while France is set to hit USD 3.12 billion in 2025.

North America

North America is the third largest market set to hold USD 39.98 billion in 2026. The market in North America is characterized by high demand from the automotive & transportation industry. The adoption of this metal by EV manufacturers to reduce the weight of vehicles is a prominent factor that is driving the market growth in this region. In addition, the region's rapidly growing aerospace industry relies on Al due to its high strength-to-weight ratio, contributing to increased demand. In addition, the region’s strong emphasis on sustainability is prompting various industries to adopt the metal in manufacturing, packaging, and construction applications. The U.S. market is expected to be valued at USD 31.39 billion in 2026.

Latin America

Latin America is the fourth largest market poised to be worth USD 7.47 billion in 2026. In Latin America, increasing metal consumption for construction and infrastructure development activities in countries such as Brazil and Mexico are the key driving factors. In addition to this, the food and beverage industry in the region extensively uses the product owing to its recyclability and preservative properties, which help maintain the freshness of edible products.

Middle East & Africa

The market in the Middle East & Africa is expected to witness moderate growth during the forecast period due to the rising construction sector in the region. Regional building and construction activities, aimed at achieving economic diversification, are prominent reasons behind metal demand. Al is favored for its corrosion resistance, making it a vital component in building materials and structures, especially in coastal areas where saltwater exposure is a concern. The UAE market is foreseen to stand at USD 2.18 billion in 2025.

Regional Highlights

- Asia Pacific continues to lead the global aluminium market due to strong growth in China and India.

- North America benefits from growing EV production and demand in aerospace and packaging.

- Europe is focusing on green aluminium and vehicle lightweighting.

- Middle East & Africa are seeing growth in aluminium smelting and infrastructure projects.

- Latin America shows increasing aluminium demand in construction and beverage packaging.

KEY INDUSTRY PLAYERS

Key Players Focus on Various Strategies to Increase their Presence in the Market

The global market is fairly fragmented, with RusAL, CHALCO, Alcoa Corporation, China Hongqiao Group, and Rio Tinto as the major players. These players are capitalizing on research and development activities to serve multiple end-use industries. They are employing various growth strategies, including expansion of product portfolios, strengthening of distribution networks, capacity expansions, and acquisitions to maintain their competitive edge in the market.

List of Top Aluminium Companies:

- RusAL (Russia)

- Aluminum Corporation of China Limited (CHALCO) (China)

- Rio Tinto (U.K.)

- Alcoa Corporation (U.S.)

- Emirates Global Aluminium (UAE)

- Norsk Hydro ASA (Norway)

- Hindalco Industries Ltd. (India)

- Vedanta Aluminium & Power (India)

- China Hongqiao Group Limited (China)

KEY INDUSTRY DEVELOPMENTS:

- May 2024 - Emirates Global Aluminium launched the region’s first digital manufacturing platform with a vision to advance its Industry 4.0 strategy. The move is anticipated to unlock additional value for the company.

- January 2024 - Alcoa announced that it would supply low-carbon aluminium to global cable manufacturer Nexans, manufactured using ELYSIS technology. ELYSIS is a technology partnership for the production of aluminium without direct greenhouse gas emissions, generating oxygen as a byproduct.

- January 2024 - Rio Tinto announced the signing of its largest power purchase agreement, acquiring the majority of electricity from the 1.4 GW Bungaban wind energy project by Windlab. Under the agreement, renewable electricity will be supplied to its Gladstone operations in Queensland. The move is anticipated to enable the company to significantly reduce its carbon emissions and make its aluminium production more sustainable.

- September 2023 - Norsk Hydro ASA announced the opening of its new HyForge foundry line in Rackwitz, Germany, responding to the auto industry’s call to decarbonize by incorporating recycled aluminium scrap into vehicle manufacturing.

- July 2023 - Rio-Tinto announced acquired 50% equity shares of a recycled content aluminium producer, Matalco, a part of the Canada-based Giampaolo Group of companies. The move aligns with the company’s vision to supply low-carbon materials.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, competitive landscape, product types, and leading end-use of the product. Besides this, the report offers insights into the market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product

|

|

By Alloy Type

|

|

|

By End-use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 265.13 billion in 2025 and is projected to reach USD 454.84 billion by 2034.

In 2025, the Asia Pacific market value stood at USD 172.55 billion.

Growing at a CAGR of 6.20%, the market is expected to exhibit rapid growth during the forecast period.

By end-use, the transportation segment captured the largest share in 2026.

The increasing demand from the transportation sector is the key factor driving the market growth.

RusAL, Aluminum Corporation of China Limited, Riot Tinto, and Alcoa Corporation are the major players in the global market.

Asia Pacific dominated the aluminium market with a market share of 65.10% in 2025.

Superior physical properties and adoption of Al in automobiles due to its lower weight drive the product demand.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us