Amphibious Vehicle Market Size, Share, Russia-Ukraine War Impact, and Industry Analysis, By Platform (Commercial and Defense), By Mode of Operation (Screw Propellers, Water Jet, Track-based Propulsion, and Others), By Application (Surveillance and Rescue, Transportation, Sports, Excavation, and Others), and Regional Forecast, 2024- 2032

KEY MARKET INSIGHTS

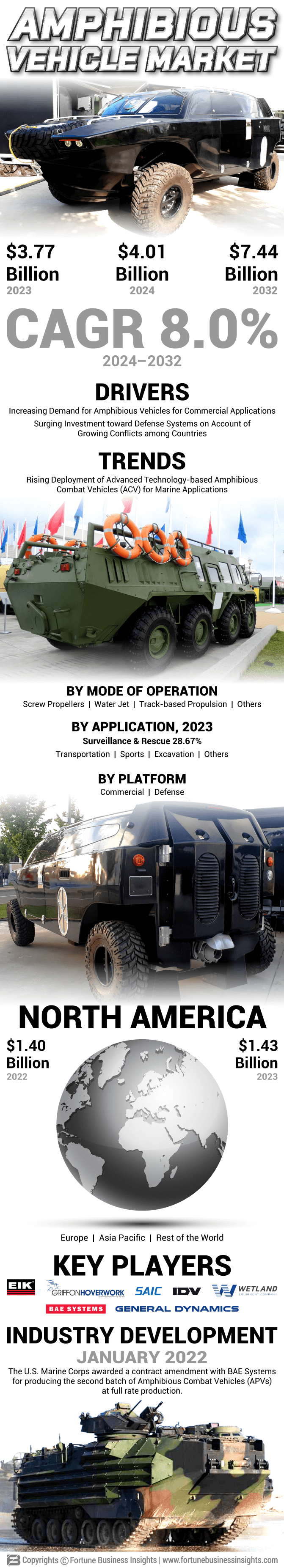

The global amphibious vehicle market size was valued at USD 3.77 billion in 2023 and is projected to grow from USD 4.01 billion in 2024 to USD 7.44 billion by 2032, exhibiting a CAGR of 8.0% during the forecast period. North America dominated the amphibious vehicle market with a market share of 37.93% in 2023.

Amphibious vehicles are used on land, water, and even underwater. Also called amphibians, these vehicles were initially built for defense to carry troops and goods. Later, they were used for commercial purposes. The companies invest in designing and developing vehicles to operate efficiently in adverse environmental conditions. The key market growth opportunities are rise in the use of amphibious landing craft and the development of inland waterways. Technological trends in the market are the high-speed of vehicles, improved water maneuverability, autonomy, ammunition and development of advanced military systems, transportation, and excavation. Moreover, companies focusing on designing and developing high-speed engines with lightweight capabilities and increasing conflicts and adoption in increasing commercial applications will fuel the global amphibious vehicle market growth during the forecast period.

Global Amphibious Vehicle Market Overview

Market Size:

- 2023 Value: USD 3.77 billion

- 2024 Value: USD 4.01 billion

- 2032 Forecast Value: USD 7.44 billion, with a CAGR of 8.0% from 2024–2032

Market Share:

- North America held the largest share in 2023 at 37.93%, driven by defense modernization and presence of major manufacturers

- By platform, Defense segment dominated due to troop transport and marine surveillance applications

- By operation, Track-based propulsion led the market in 2023 due to robust fuel efficiency

- By application, Surveillance and rescue held the largest share in 2023, driven by border security and marine threats

Key Country Highlights:

- U.S.: Contract awarded to BAE Systems in 2023 for delivering 227 amphibious all-terrain vehicles; focus on Arctic-ready fleets

- Japan: Amphibious vehicle market expected to reach USD 0.20 billion by 2025

- China: Projected to grow at a CAGR of 9.1%, fueled by defense investments

- Europe: Expected to grow at a CAGR of 8.3%, with strong adoption of hybrid-based engines and high-tech defense vehicles

RUSSIA-UKRAINE WAR IMPACT

Rise in the Regional Conflicts and Skirmishes to Bolster the Market Growth due to Increased Procurement of Personnel Protection

Due to the Russia-Ukraine war, most countries are focusing on strengthening their defense forces through troop expansion and expanding military camps with new recruits. Growing political conflicts, cross-border issues, increases in crime, and increased terrorist activity have led to the expansion of the military, law enforcement, and internal security forces. For instance, in February 2022, Russia’s preliminary trials of the cutting-edge BT-3F amphibious armored personnel carrier are at the final stage, and the company is ready for its serial production. The BT-3F Amphibious Armored Personnel Carrier is a derivative of the BMP-3 Infantry Fighting Vehicle and has been designated to carry up to 14 Marine infantry battalions and provide fire support.

Furthermore, the conflict has spurred increased investment in research and development within the defense industry. Defense organizations focus on improving the amphibious vehicles' design, technology, and performance. For instance, in March 2022, BAE Systems received a U.S. Marine Corps contract to develop and manufacture an Amphibious Combat Vehicle Recovery ACV variant worth approximately USD 34.9 million. The ACV-R will replace the legacy Assault Amphibious Vehicle recovery variant (AAVR7A1) and provide direct field support, maintenance, and recovery to the ACV family of vehicles.

Amphibious Vehicle Market Trends

Surge in the Use of Advanced Technology-based Amphibious Combat Vehicles (ACV) for Marine Applications

As a result of its characteristics, such as survivability, mobility, command and control, and situational awareness, the use of ACVs has increased. These features will be connected to the CPU of the fighting vehicle. Moreover, new battle vehicles have state-of-the-art remote telescoping turrets, fire control systems, active protection systems, and counter survivability. The equipment plays a crucial role in detecting marine threats and providing guidance on responding accordingly. Conventional boats were less compatible and reliable thanks to integrated systems that protected against threats during use compared to the latest fighting machines. In the coming years, governments of various countries want to strengthen their shipping by adopting advanced technology and a wide range of ACV equipment. For instance, the U.S. Marine Corps, for example, was awarded a contract with BAE Systems in 2020. The contract would result in the development and supply by the company of, amongst others, 116 advanced ACVs equipped with weapons, command and control systems, M16 turret, and recovery versions. BAE Systems designs, develops, and produces highly advanced combat vehicles with next-generation scythe weapons integrated into the vehicle.

- North America witnessed amphibious vehicle market growth from USD 1.40 Billion in 2022 to USD 1.43 Billion in 2023.

Download Free sample to learn more about this report.

Amphibious Vehicle Market Growth Factors

Increase in Investment toward Defense Systems due to Rising Conflicts among Countries

Countries have joined forces over the last few years to modernize their defense systems and equipment. The main reason conventional equipment and systems to fight enemies are being modernized is increased border security and terrorism worldwide. For example, the U.S., China, Saudi Arabia, and India strengthen their defense industries by investing large amounts in procurements and developing sophisticated weapons systems. Further, all terrain armored vehicles carry out a vital part of the fight on land and water. The maritime industry relies heavily on ACVs to transport troops from ships to shore. In addition, Amphibious Assault Vehicles (AAVs) have powerful engines that give them high speed and power in any terrain. Moreover, these vehicles have the advantage of being more reliable, adaptable and equipped with weapons and ammunition to perform well during combat.

Rising Demand for Amphibious Vehicles for Commercial Applications to Propel Industry Growth

The benefits of electric hydroplanes, such as superior endurance, durability, modern electronics, and cost-effective propulsion systems, surge the demand for amphibious vehicles. This type of vehicle or car is used for several commercial uses such as sports activities, mountain climbing, surveillance, and others. The market growth is driven by broad applications of vehicles and growing demand in these areas. For instance, in 2020, Eik Engineering Sdn Bhd, a Malaysia-based all-terrain machine manufacturer, designed and developed EIK Amphibious Excavators AM series. The firm inked contracts for developing and manufacturing amphibious excavators using advanced technology in cooperation with major countries. Such developments will drive the market growth during the forecast period.

RESTRAINING FACTORS

High Initial and Maintenance Cost of Amphibious Vehicles Especially for Defense Applications may Restrain Market Growth

The cost of all terrain armored vehicles will increase with the adoption of advanced technology-based systems and equipment for vehicles. The design of these vehicles can be adapted depending on their use; therefore, the systems must be compatible with both land and water. This ensures the massive cost of the vehicles. These vehicles' engines differ from those used for a land-operated vehicle.

Engines are the most expensive parts of a vehicle. In addition, the living costs of such vehicles are also significant. A major problem is the availability of spare parts for vehicles. In the defense sector, naval forces are escorted from ship to shore using vehicles. Several vehicle accessories, such as load capacities, safety devices, and fire protection system ensure the additional costs of the vehicle.

Amphibious Vehicle Market Segmentation Analysis

By Platform Analysis

Rise in Demand for Marine-based Applications to Boost the Growth of the Defense Segment

Based on platform, the market is bifurcated into defense and commercial. The defense segment held the largest market share in 2023. This is due to the vast usage of these vehicles in marine-based applications for transporting troops and surveillance applications. For instance, in April 2023, BAE Systems awarded a USD 400 million contract for delivering another 227vS10 amphibious all terrain armored vehicle to Germany. The award is based on a joint procurement by Germany, Sweden, and the U.K. in 2022 to bring together an all-terrain vehicle for Arctic operations.

The commercial segment is expected to grow at a substantial CAGR during the forecast period. This is owing to a rise in demand for sports activities, water transportation, and excavation. Further, the increasing adoption of commercial vehicles for land reclamation excavation and water mud removal drives significant growth. Moreover, the demand for eco-friendly and hybrid engine-based amphibious vehicles is expected to boost the market growth during the forecast period. The commercial segment is expected to hold a 42% share in 2025.

By Mode of Operation Analysis

Track-based Propulsion Segment to Dominate due to Better Fuel Efficiency

Based on mode of operation, the market is divided into screw propellers, water jet, track-based propulsion, and others. The track-based propulsion segment holds the largest market share in 2023 and is expected to be the fastest-growing segment during the forecast period. It comprises advanced technology-based systems to perform numerous activities for various commercial and defense applications. It has better fuel efficiency and robust engines as compared to other types of propulsion systems.

The screw propellers segment will hold the largest market share in 2023. It is owing to the effective use of defense applications.

By Application Analysis

To know how our report can help streamline your business, Speak to Analyst

Surveillance and Rescue Segment to Hold Major Share Impelled by Rise in Border Security Concerns

Based on application, the market is classified into surveillance and rescue, transportation, sports excavation, and others.

The surveillance and rescue segment was evaluated to be the largest segment by market share in 2023 and is projected to be the fastest-growing segment during the projection period. The growth is owing to the wide applications for marine-based applications. Moreover, the rise in border security concerns among the nations is expected to propel the growth of the surveillance and rescue segment during the forecast period. The transportation segment is projected to generate USD 1.06 billion in revenue by 2025.

- The surveillance and rescue segment is expected to hold a 28.67% share in 2023.

REGIONAL INSIGHTS

North America Amphibious Vehicle Market Size, 2023 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Based on geography, the market is analyzed across North America, Europe, Asia Pacific, and the Rest of the World.

North America held the largest amphibious vehicle market share in 2023 and is expected to be the fastest-growing region during the forecast period. In recent years, the U.S. has significantly increased spending on modernizing its marine fleets. In addition, key manufacturers such as Kawasaki Robotics and Electroimpact Inc. are driving market growth in the U.S. Moreover, government authorities are focusing on investing in advanced technology propulsion systems in the upcoming years.

Europe is predicted to play a vital role in the market growth due to the hybrid-based engines’ wide adoption. Europe held the second-largest market share in 2023 due to high investment in advanced conventional vehicles with highly advanced technology-based vehicles. The development will boost the market growth in the region during the projection period.

- Europe is anticipated to grow at a CAGR of 8.3% during the forecast period.

Asia Pacific held the second-largest region by market share in 2023 and is also expected to be the second fastest-growing region during the forecast period. The robust growth is due to a significant rise in demand for advanced ACVs from various countries. Besides, China, Saudi Arabia, and India are strengthening their defense budgets, which is likely to impel the market growth. The region is expected to witness long-term growth in this market.

- The amphibious vehicle market in Japan is expected to reach USD 0.20 billion by 2025.

- China is projected to witness a strong CAGR of 9.1% during the forecast period.

Furthermore, the market in the rest of the world, covering Latin America and the Middle East and Africa, is projected to surge at a moderate growth rate over the study period. The expansion is owing to the substantial number of suppliers and distributors of vehicle systems in this region.

List of Key Companies in Amphibious Vehicle Market

Companies Focus on Mergers & Acquisitions and Partnerships to Gain Competitive Edge

Various regional and international players consistently develop advanced strategies for competitive advantage. Key companies in the market focus on business expansion through new contracts, adoption of the latest technology, and mergers & acquisitions to enable market growth. This will facilitate the growth of the global market over the forecast period.

List of Key Companies Profiled

- BAE Systems plc (U.K.)

- EIK Engineering Sdn. Bhd. (Malaysia)

- General Dynamics Corporation (U.S.)

- Griffon Hoverwork Ltd. (GHL) (U.K.)

- Iveco Defense Vehicles (Italy)

- Science Applications International Corporation (SAIC) (U.S.)

- Wetland Equipment Company Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- March 2023 – The U.S. Marine Corps awarded a production contract to BAE Systems. The company would support costs for the Amphibious Combat Vehicle Personnel (ACV-P) and Command variants (ACV-C). The contract would implement existing procurement options, including USD 145.3 million for more than 25 vehicles of the ACVP type and USD 111.5 million for over 15 vehicles of the ACVC type.

- January 2023 - IDV would supply the Italy Navy with 36 Amphibious Armored Vehicles VBA personnel carriers. The fleet of IDVs would be reinforced and the national sea projection capability would be effectively enhanced with the addition of state-of-the-art amphibious vehicles for the San Marco Marina Brigade, BMSM.

- January 2022 - The U.S. Marine Corps awarded a contract amendment with BAE Systems to produce the second batch of Amphibious Combat Vehicles (APVs) at full rate production. A total of 33 vehicles have been awarded contracts for 169 million dollars.

- February 2021 - BAE Systems has a contract option from the U.S. Marine Corps to make more Amphibious Combat Vehicles (ACV) at full rate production amounting to USD 184 million. The contract award comprises production and miscellaneous costs for the ACV personnel carrier (ACV-P) variant. BAE Systems was awarded the first full-rate production contract option in December for 36 vehicles. The total number of vehicles under the Fullrate Production Agreement will be increased to 72 in this option with an overall value of USD 366 million.

- December 2020 - With the U.S. Marine Corps' decision to move toward full production and award a contract valued at USD 184 million for 36 vehicles, the BAE Systems Amphibious Combat Vehicles Family FOV program has reached an important milestone.

REPORT COVERAGE

An Infographic Representation of Amphibious Vehicle Market

To get information on various segments, share your queries with us

The report provides a detailed analysis of the market and focuses on key aspects such as key players, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2023 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024-2032 |

|

Historical Period |

2019-2022 |

|

Growth Rate |

CAGR of 8.0% from 2024 to 2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Platform

|

|

By Mode of Operation

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size was USD 3.77 billion in 2023.

The market is anticipated to grow at a CAGR of 8.0% during the forecast period (2024-2032).

Based on platform, the defense segment is expected to lead the market over the forecast period.

Some of the top players in the market are BAE System Plc., Iveco Defence Vehicles, and Griffon Hoverwork Ltd. (GHL).

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us

View Full Infographic

View Full Infographic