Antiepileptic Drugs (AED) Market Size, Share & Industry Analysis, By Drug Generation (First Generation, Second Generation, and Third Generation), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

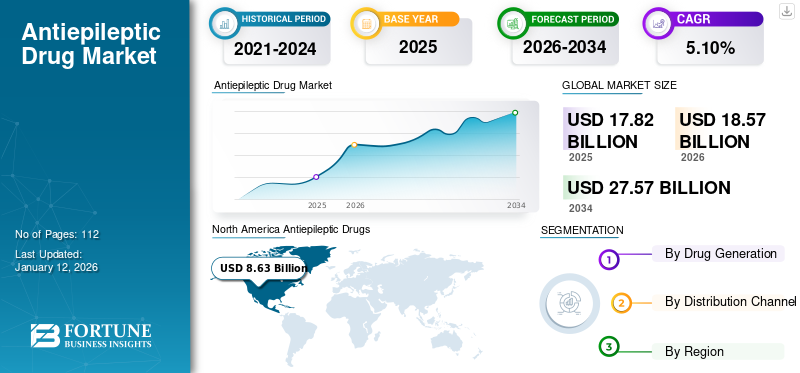

The global antiepileptic drugs (AED) market size was valued at USD 17.82 billion in 2025 and is projected to grow from USD 18.57 billion in 2026 to USD 27.57 billion by 2034, exhibiting a CAGR of 5.10% during the forecast period. North America dominated the global antiepileptic drugs (AED) market with a market share of 48.40% in 2025. Moreover, the U.S. antiepileptic drugs market size is projected to grow significantly, reaching an estimated value of USD 10.03 billion by 2032, driven by increasing prevalence of epilepsy coupled with significant increase in product approvals by FDA.

Epilepsy is one of the most common neurological diseases globally. Patients with this disease suffer from sudden behavioral changes, severe emotional distress, and loss of consciousness. The World Health Organization (WHO) 2023, estimates that around 50 million people have epilepsy worldwide. This disease is a common severe brain disorder occurring due to several causes which leads to epileptic seizures. Approximately 80.0% of people with epilepsy live in low and middle-income countries (LMICs). Due to the rising prevalence of epilepsy, there is a significant economic burden on the healthcare systems globally. The high prevalence rate and growing demand for treatment options for this disorder are anticipated to propel the market growth.

Similarly, top players in the global market are focusing on introducing medications to patients with fewer side effects. Growing clinical trial activities and significant product approvals are boosting the market expansion globally.

The COVID-19 pandemic negatively impacted the global market due to a decline in the demand for neurological drugs and services coupled with issues in terms of access to care. From 2022 onward, there was an increase in the number of patient visits to neurological centers. Owing to this, the market is expected to record the pre-pandemic growth rate over 2026 to 2034.

Global Antiepileptic Drugs (AED) Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 17.82 billion

- 2026 Market Size: USD 18.57 billion

- 2034 Forecast Market Size: USD 27.57 billion

- CAGR: 5.10% from 2026–2034

Market Share:

- Region: North America dominated the market with a 48.40% share in 2025. This leadership is driven by higher diagnosis and treatment rates for neurological conditions, adequate reimbursement policies for epilepsy drugs, heightened patient awareness of new treatments, and significant R&D investments.

- By Drug Generation: Second-generation drugs held the largest market share in 2026. The dominance is attributed to the proven potential and benefits of blockbuster drugs such as Lyrica and Keppra in slowing brain impulses and effectively controlling seizures.

Key Country Highlights:

- Japan: The market is driven by continuous innovation from local pharmaceutical giants. For instance, Eisai Co., Ltd. has actively expanded its portfolio by launching a new fine granule formulation and receiving approval for an injection formulation of its antiepileptic drug, Fycompa.

- United States: Growth is fueled by a high prevalence of epilepsy and strong regulatory support, with the U.S. FDA consistently approving new products. The market is also supported by active government and private sector support, including awareness campaigns such as the Seizure Action Plan (SAP) Awareness Week.

- China: As an emerging country with a higher proportion of its population suffering from epilepsy, China represents a significant market. The government's focus on minimizing the disease burden and making better treatment options available is expected to drive demand.

- Europe: The market is facing significant challenges with medicine supply shortages, particularly in the U.K. due to Brexit uncertainty and in Switzerland, where antiepileptic drugs are being considered for mandatory reserves. However, growth is also supported by an increasing number of drugs receiving regulatory approvals.

Antiepileptic Drugs (AED) Market Trends

Key Players Focus on Introducing Effective Third Generation Drugs to Facilitate Market Growth

There is a crucial need to implement new strategies to revisit the standard AED discovery and development. This will help in achieving the unmet treatment needs. Patent expiration of second-generation drugs is a crucial opportunity for pharmaceutical companies in the development of generic as well as innovative drugs. Some key players are receiving approvals from government bodies and launching third-generation drugs in the market. Such a trend is proving healthy for market growth and ultimately boosting the industry players to invest in complex clinical trials.

For example, in July 2020, Eisai Co., Ltd. launched a new fine granule formulation of its in-house-discovered antiepileptic drug (AED) Fycompa (perampanel hydrate) in Japan. These continuous research and development and product introduction initiatives to meet the unmet needs are projected to further propel the market growth during the forecast period.

For example, in January 2024, Eisai Co., Ltd obtained the marketing authorization approval from the Japanese Ministry of Health, Labour and Welfare for the injection formulation of its in-house discovered antiepileptic drug (AED) Fycompa (perampanel) in Japan as an alternative therapy when oral administration is temporarily not possible. These continuous research and development and product introduction initiatives to meet the unmet needs are projected to further propel the market growth during the forecast period.

Download Free sample to learn more about this report.

Antiepileptic Drugs (AED) Market Growth Factors

Increase in Product Approvals for Epileptic Disorders to Drive Market Growth

Despite the availability of AEDs in the market, one-third of the population faces drug intolerability. The manufacturers are making countless efforts to diminish this problem. R&D personnel have now focused on developing target-specific drugs concerning the neurobiology of the disease condition. The growing prevalence of epilepsy demanding therapeutically effective medications creates pressure among the market players to introduce AEDs. The critical decision of the U.S. FDA is to provide confidence among the players for improving R&D and benefiting the patient population.

- In June 2023, SK Biopharmaceuticals’ partner Paladin Labs received Health Canada’s regulatory approval to market and distribute XCOPRI (cenobamate tablets). The tablets would be used for adjunctive therapy in the management of partial-onset seizures in adults with epilepsy who are not satisfactorily controlled with conventional treatment.

Such decisions taken by the approval committees help the manufacturers in providing potential therapies for epileptic patients.

Active Government Support and Investments to Expedite Market Growth

Epilepsy is the most common neurological condition, significantly more prevalent in emerging countries. Developing countries such as India, China, and Brazil have a higher proportion of the population suffering from the state. In order to minimize the burden of this disease, as well as to expedite the availability of better treatment options, governments from countries across the world are providing active support.

- For example, according to an article published by the Australian Institute of Health and Welfare in 2022, the expenditure for epilepsy accounted for around USD 333.0 million or 0.2% of USD 134.0 billion of recurrent health system expenditure in 2018–19. Also, epilepsy was ranked the 30th cause for disease burden in Australia (2018).

The government's backing is beneficial for patients in controlling their seizures. Such support from the government helps patients manage their seizures. It is understood that the government's support will drive the market for AED drugs. This is estimated to fuel the adoption of AED drugs and boost the growth of the drugs market.

RESTRAINING FACTORS

Lack of Antiepileptic Drugs Supply Restrains the Market Growth

Despite the increasing incidence of epilepsy, seizures, and other chronic conditions in emerging countries, certain factors limit the global antiepileptic drug (AED) market growth. The steep rise in medicine supply shortage is a major factor restraining the market's development. Patients are stockpiling these medicines as there is a shortage of drugs in the pharmacies. This has raised the alarm in investigating the medicine supply chain globally. This devastating situation can worsen in the U.K. and other European countries, such as Britain, due to Brexit uncertainty. This ultimately affects the global market as the U.K. is becoming less desirable for epilepsy medications.

- According to an article published by SWI swissinfo.ch in 2023, Switzerland faced a shortage of certain medicines and plans to boost drug stocks. Christoph Amstutz, head of the Federal Office for National Economic Supply, has said that antiepileptic drugs and medication for Parkinson's disease should be included in the mandatory reserves. Such scenarios of stockpiling have been restricting the Antiepileptic Drugs market growth.

Furthermore, the limited adoption rate for treatment limits the market expansion in many countries. For instance, according to an article published in Epilepsy Action Australia 2023, a recent study commissioned by LivaNova Australia found that despite the widespread awareness of epilepsy, many Australians have a limited understanding of the condition and its treatments. Such factors could restrict the market expansion over the forecast period.

Antiepileptic Drugs (AED) Market Segmentation Analysis

By Drug Generation Analysis

Potential Benefits Aided the Second-Generation Drugs Dominated the Market in 2024

In terms of drug generation, the global market is segmented into first generation, second generation, and third generation.

The second-generation drugs segment held the dominant global antiepileptic drugs market with a share of 39.87% in 2026. The second generation drugs include Lyrica, Keppra, Banzel, and others. Lyrica has been the blockbuster drug for epilepsy treatment and has the maximum share in the market. It has proved its potential to slow the brain's impulses and control seizures. Pfizer’s Lyrica dominated the epilepsy market until 2019, before its patent expiry. However, it is still in demand owing to the benefits of the drug.

The first generation segment held a robust global market share in 2024. The first generation refers to the older‐generation drugs introduced into clinical practice more than four decades ago. It primarily includes phenytoin, primidone, phenobarbital, ethosuximide, valproate, clonazepam, carbamazepine, and clobazam.

The third generation segment growth is attributed to more comprehensive therapeutic ranges and fewer serious adverse effects. Substantial benefits offered by these generation drugs are expected to result in the segment expanding at the maximum CAGR in the global market over the study period.

To know how our report can help streamline your business, Speak to Analyst

By Distribution Channel Analysis

Patient Pool Preferring Hospital Pharmacies Led to Segmental Dominance

In terms of distribution channel, the global market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies.

The hospital pharmacies segment held the dominant share of 50.70% in 2026. The emergence of hospital pharmacies for neurology and patients' preference for hospitals due to equipped advanced infrastructure and adequate facilities contribute to segment dominance. Further, the growing number of hospitals and adequate reimbursement policies provided by these settings are significant factors responsible for more epilepsy patients being treated in these facilities. This is eventually responsible for the adoption of antiepileptic drugs by hospital pharmacies globally.

The retail pharmacies segment held a substantial share owing to the increase in the adoption of epilepsy drugs by these facilities. The availability of these drugs in the pharmacies, which are easily accessible to the patients, will boost the retail pharmacies segmental growth in the forecast period.

Similarly, the online pharmacies segment is expected to grow with a significant CAGR over the study period. This is due to the rising preference for teleconsultation and online pharmacy facilities in developed and emerging nations.

REGIONAL INSIGHTS

By geography, the global market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Antiepileptic Drugs (AED) Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America antiepileptic drugs market size stood at USD 8.63 billion in 2025. The market in the region is characterized by higher diagnosis and treatment rates for neurology conditions, coupled with adequate reimbursement policies for epilepsy drugs. These factors, along with more heightened awareness among the patient population toward new treatment options and the availability of advanced drugs in the region, are responsible for a dominant share of the region in the global market. Moreover, higher R&D investments are mainly promoted for the dominance of the North American region. The U.S. market is projected to reach USD 7.27 billion by 2026.

- In February 2023, The THIRD ANNUAL Seizure Action Plan (SAP) Awareness Week was organized by the Seizure Action Plan Coalition, a collaboration managed by Epilepsy Alliance America. This campaign was underwritten by presenting sponsor Neurelis, Inc., with supportive funding from UCB, Inc. This Awareness Week featured a social media campaign and website planned to emphasize the need for people with epilepsy and their caregivers and healthcare providers to develop detailed plans.

Europe

The Europe markets are projected to exhibit a comparatively higher CAGR during the forecast period. The increasing number of drugs receiving regulatory approvals is anticipated to drive the demand for these anticonvulsant drugs in Europe during 2026-2034. The UK market is projected to reach USD 0.71 billion by 2026, while the Germany market is projected to reach USD 1.13 billion by 2026.

Asia Pacific

Expected regulatory approvals in the Asia Pacific and the penetration of key regional players are projected to drive the epilepsy drugs market revenue in the region during the forecast period. The Japan market is projected to reach USD 0.47 billion by 2026, the China market is projected to reach USD 0.68 billion by 2026, and the India market is projected to reach USD 0.71 billion by 2026.

Latin America and the Middle East & Africa

The Latin America and the Middle East & Africa markets are anticipated to witness growth prospects over the forecast period. Developing healthcare infrastructure in these regions and the growing prevalence of these disorders will fuel the product demand during the forecast period.

List of Key Companies in Antiepileptic Drugs (AED) Market

Global Presence and Product Offerings Enable UCB S.A., Pfizer and GSK plc. to Hold Dominant Market Position

The competitive landscape of the market reflects a consolidated structure. Prominent players such as UCB S.A., Pfizer Inc. and GSK plc., have dominated the global market. Pfizer’s dominance is attributed to a strong product portfolio and global presence. The drug ‘‘Lyrica’’ has provided therapeutically effective benefits in treating epileptic patients, leading to increased demand over the years, and has been responsible for the dominance of Pfizer Inc. However, due to the patent expiration of Lyrica in 2019, its share is expected to decline rapidly as the other key players have come up with generics for Lyrica. Some other factors for these companies’ established market presence include a solid customer base and more launches.

However, other market players, such as UCB S.A., Eisai Co., Ltd., and others, have launched novel medications that have proven therapeutically effective in controlling this disorder. As patent expiration of major drugs can be seen in the coming years, industry players are focused on investing in R&D for the launch of innovative as well as generic products in this market. This is projected to positively impact the global market as these companies are anticipated to gain more global market share during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- Pfizer Inc. (U.S.)

- UCB S.A. (Belgium)

- GSK plc. (U.K.)

- H. Lundbeck A/S (Denmark)

- Eisai Co., Ltd. (Japan)

- Sanofi (France)

- Sunovion Pharmaceuticals Inc. (U.S.)

- Jazz Pharmaceuticals, Inc. (Ireland)

KEY INDUSTRY DEVELOPMENTS:

- January 2025 - Lundbeck announced positive results from a 12-month open-label extension of the PACIFIC trial, evaluating bexicaserin in participants with Developmental and Epileptic Encephalopathies. The treatment demonstrated a 59.3% median reduction in countable motor seizures over the period.

REPORT COVERAGE

The market report provides detailed information regarding various market insights. The report provides global AED market forecast and an account of the growth drivers, restraints, competitive landscape, regional analysis, and challenges. It further offers an analytical depiction of the antiepileptic drugs market trends and estimations to illustrate the forthcoming investment pockets. The market has been quantitatively analyzed from 2019 to 2032 to provide the financial competency of the market. The information gathered in this report has been taken from several primary and secondary sources. Besides this, the report offers insights into the anticonvulsant drug market trends and highlights the vital industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market over the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.10% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Drug Generation

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 17.82 billion in 2025.

In 2025, the global market size in North America was USD 8.63 billion.

The market will exhibit steady growth at a CAGR of 5.10% during the forecast period (2026-2034).

Based on drug generation, the second generation drugs segment was the leading segment in this market.

Rising product approvals and active government initiatives to spread awareness among the patient population is a key factor driving the market growth.

UCB S.A., Pfizer and GSK plc. are the leading players in the global market.

North America dominated the antiepileptic drugs (AED) market with a market share of 48.40% in 2025.

Introduction to therapeutically effective drugs and the increasing prevalence of epileptic seizures in low and middle-income countries are anticipated to boost the adoption of anticonvulsant medications.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us