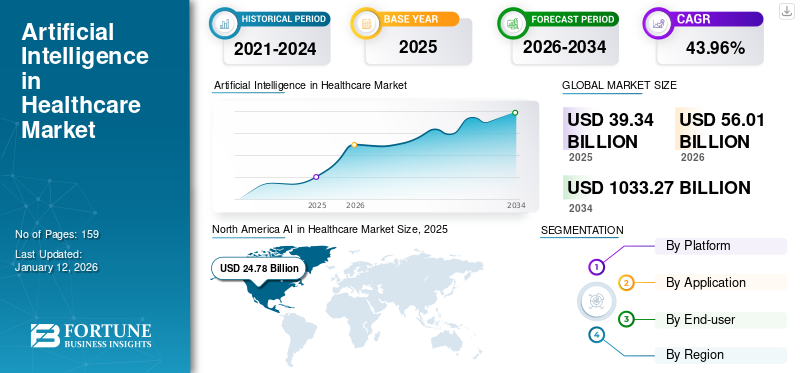

AI in Healthcare Market Size, Share & Industry Analysis, By Platform (Solutions and Services), By Application (Robot-Assisted Surgery, Virtual Nursing Assistant, Administrative Workflow Assistance, Clinical Trials, Diagnostics, and Others), By End-user (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, Contract Research Organization (CRO), and Others), and Regional Forecasts, 2026-2034

AI in Healthcare Market Size & Global Trends

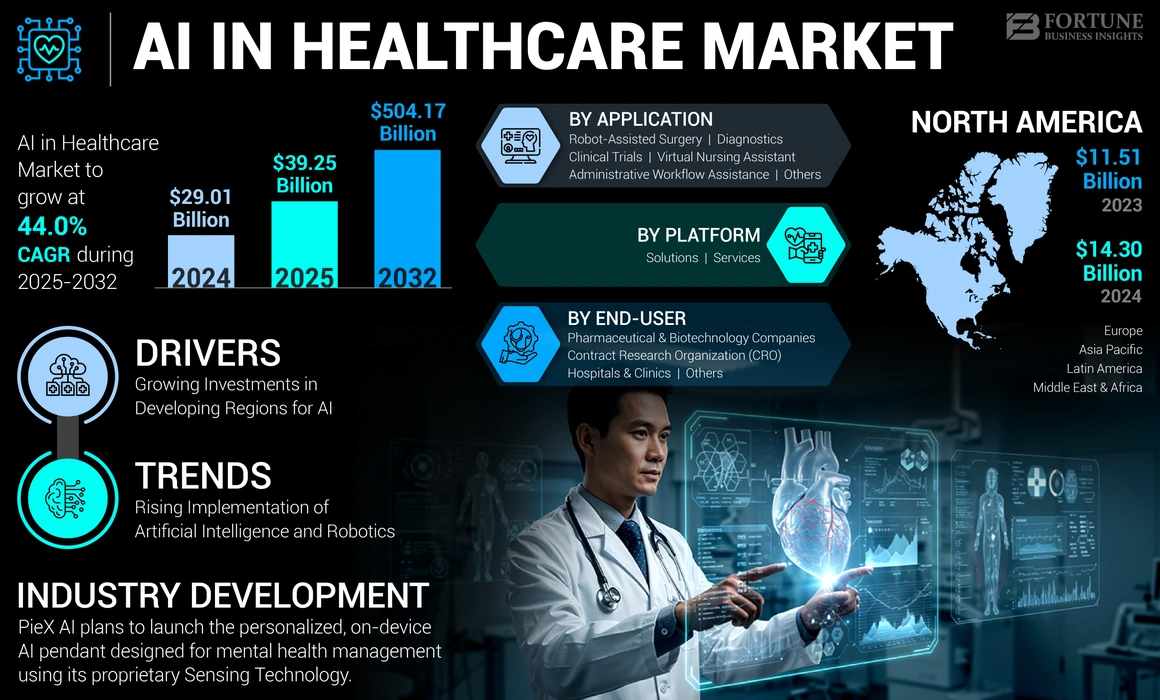

The global AI in healthcare market size was valued at USD 39.34 billion in 2025. The market is projected to grow from USD 56.01 billion in 2026 to USD 1,033.27 billion by 2034, exhibiting a CAGR of 43.96% % during the forecast period. North America dominated the artificial intelligence in healthcare market with a market share of 44.50% in 2025.

The emergence of Artificial Intelligence (AI) in healthcare is groundbreaking, and it is reshaping various healthcare fields such as diagnostics, imaging, hospital administration management, patient monitoring, drug discovery and development, robotic surgery, and others. AI technologies, including machine learning, deep learning, natural language processing, and computer vision are used for various healthcare tasks.

AI helps doctors, nurses, and other healthcare workers to enhance their productivity. This advancement helps patients in treatment and improves their quality of life. Additionally, it is transforming the landscape of patient care, improving outcomes, and enhancing operational efficiency.

By leveraging AI in hospital settings and clinics, healthcare systems can become smarter, faster, and more efficient to offer adequate care and services that millions of people require.

Additionally, the increasing number of new solutions and platforms by the key players to fulfill various healthcare needs is driving the growth of the market.

- For instance, in August 2024, Accenture collaborated with Amazon Web Services, Inc. to create the Accenture Responsible Artificial Intelligence (AI) Platform powered by AWS with an aim to adopt and scale AI rapidly with trust and confidence throughout their enterprise.

Moreover, key players such as Microsoft Corporation, Google (Alphabet Inc.), and Amazon Web Services Inc. are offering robust solutions for integrating AI into the healthcare sector. Also, strategic collaborations and acquisitions with the major healthcare companies to integrate their AI technology with the company's specialties to obtain better outcomes for providers and patients have propelled the market growth.

Global AI in Healthcare Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 39.34 billion

- 2026 Market Size: USD 56.01 billion

- 2034 Forecast Market Size: USD 1,033.27 billion

- CAGR: 43.96% from 2026–2034

Market Share:

- Region: North America dominated the market with a 44.50% share in 2025. This leadership is attributed to increasing technological advancements, a strong emphasis on adopting advanced tools for managing complex workflows, and the presence of an advanced healthcare infrastructure with a high degree of AI integration.

- By Application: Robot-Assisted Surgery captured the largest market share in 2024. The segment's growth is driven by the rising prevalence of chronic diseases and a growing demand for minimally invasive surgical options that offer quicker patient recovery and better outcomes. The integration of AI enhances surgical precision, efficiency, and accessibility.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan is experiencing market growth due to increasing investments in AI-based medical devices for the diagnosis of various diseases and a focus on integrating advanced technology into its healthcare system.

- United States: The market is propelled by the high adoption of AI-based technologies in medical imaging, diagnostics, and patient monitoring. Growth is also fueled by major collaborations, such as GE HealthCare's partnership with Amazon Web Services to build generative AI applications for improving medical diagnostics and patient care.

- China: As part of the Asia Pacific region which is poised for the highest growth, China's market is expanding due to significant investments in AI-based medical technologies and a push to upgrade its healthcare infrastructure to handle the needs of its large population.

- Europe: The market is driven by increasing AI integration into hospitals and clinics for managing patient health records, administrative workflows, diagnostics, and surgery. The presence of major pharma and biotech companies adopting AI for innovative drug discovery, particularly in the U.K. and Germany, is a key growth factor.

MARKET DYNAMICS

MARKET DRIVERS

Growing Investments in Developing Regions for AI in Healthcare to Drive Market Growth

Increasing investments by governments and substantial funds by private enterprises toward R&D in AI technologies tailored for healthcare is one of the prominent drivers of the market. The funding supports the development of innovative solutions. Enhanced research capabilities lead to breakthrough applications that can transform healthcare delivery. Furthermore, increasing funding initiatives in developing regions for adopting AI to improve healthcare access, efficiency, and quality is driving the market's growth.

- For instance, in February 2025, MedMitra AI, India’s health-tech startup, secured funding of USD 358,551 from All In Capital and WEH Ventures. This funding aimed to address critical inefficiencies in patient care through autonomous AI-driven solutions and make healthcare more precise, efficient, and personalized. Such funding initiatives in developing regions boost the global AI in healthcare market growth.

MARKET RESTRAINTS

Increasing Complexities, Data Breaches, and High Costs to Restrict Market Growth

Implementing artificial intelligence-based solutions in healthcare often requires significant financial investment. This encompasses the costs of cutting-edge technology, hiring qualified personnel, and maintaining infrastructure. Consequently, the high expenses associated with implementation pose challenges for organizations seeking to integrate AI into their daily operations.

Another obstacle to the adoption of AI in the healthcare sector is the issue of data privacy. Data breaches involve unauthorized access, disclosure, or theft of sensitive personal and medical information gathered during research. These breaches can occur through various channels, including cyber-attacks, insider threats, and accidental data exposure, ultimately leading to declining patient trust. Additionally, the increasing prevalence of cybercrimes targeting healthcare data fosters mistrust between patients and providers, further impeding market growth.

- For instance, in October 2023, 23andMe confirmed unsettling news of a data breach of genetic information, which resulted in the exposure of personal details of approximately 14,000 individuals, accounting for 0.1% of their clients. Such factors are restraining the use of artificial intelligence technology by healthcare providers and hampering the growth of the market.

MARKET OPPORTUNITIES

Adoption of AI for Mental Health Disorder Diagnosis and Management is a Prominent Market Opportunity

The rising prevalence of mental health disorders, such as depression, anxiety, and stress-related conditions globally caused by fast-paced lifestyles, social isolation, and economic uncertainties, is leading to an increased demand for advanced solutions for improving patient care.

- According to the Mental Health America, Inc. Prevalence of Mental Illness 2024 report, around 60.0 million people in the U.S. experienced mental illness, and 5.8% of the population experienced a form of severe mental illness.

However, the social stigma associated with mental health, discrimination, or personal repercussions from disclosing mental health issues and limited accessibility of mental health professionals brings a significant gap between patients and healthcare providers. Such scenarios increase the demand for AI-based solutions for handling sensitive conditions such as depression and manic disorders. Furthermore, many key providers in the market are offering advanced AI-based solutions for managing mental health, which is expected to cater to the growth of the market.

- In April 2024, NextGen Healthcare introduced the NextGen Ambient Assist, an AI-powered solution designed to tackle the shortage of mental and behavioral health professionals. It transcribes patient-provider conversations in real-time and summarizes encounters within 60 seconds, saving providers up to 2 hours of documentation time daily, thereby improving efficiency and the overall provider experience.

MARKET CHALLENGES

Lack of Skilled Professionals and Reluctance Among Medical Practitioners to Adopt AI in Healthcare Challenges Market Growth

With the rapid advancement in technology-based solutions and AI, many educational institutions often struggle to keep pace, resulting in a shortage of graduate programs specializing in AI for healthcare applications. Additionally, many lower- to middle-income regions with limited healthcare funding are not adopting AI for healthcare practices. Such scenarios challenged the growth of the market.

Furthermore, many healthcare professionals are hesitant to adopt AI technologies due to a lack of understanding, fear of job displacement, or distrust regarding the accuracy and reliability of AI-driven tools. This reluctance can stem from concerns about the potential for AI to make clinical decisions that are traditionally the domain of human practitioners.

AI IN HEALTHCARE MARKET TRENDS

Rising Implementation of Artificial Intelligence and Robotics is Transforming Healthcare Industry

In recent years, the integration of Artificial Intelligence (AI) and robotics in healthcare has been revolutionizing patient care and operational efficiency. Robotics improves surgical precision, allowing for minimally invasive procedures that reduce recovery times. AI-assisted robotic surgeries combine the precision and dexterity of robotic platforms with the analytical power of AI algorithms. The virtual assistance of AI in surgeries guides surgeons in real-time by improving decision-making and providing better precision and safety to the surgeon during remotely guided procedures. Such advancements in AI-based surgeries tend to boost the market growth during the forecast period.

Moreover, key MedTech companies are collaborating with AI solution providers to incorporate AI in their instruments for efficient patient and provider outcomes.

- In March 2024, Johnson & Johnson Services, Inc. partnered with NVIDIA Corporation to accelerate and scale Artificial Intelligence (AI) for surgery and form a digital surgery ecosystem.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic resulted in substantial growth in the AI in healthcare market. This surge was largely due to the intensified need for AI-driven tools and solutions that can assist in diagnosing COVID-19 infection and monitoring the virus's spread. Additionally, there was a rising demand for Electronic Health Record (EHR) systems to support the analysis of pandemic risk profiles within populations by providing real-time data, further contributing to market expansion.

SEGMENTATION ANALYSIS

By Platform

New Launches and Investments Made by Key Players are Contributing to Segment’s Growth

Based on platform, the market is divided into solutions and services.

The solutions segment held the highest share of the market in 2024. The increasing investments by the key market players and the introduction of new products are the major factors boosting the demand for AI in healthcare.

- For example, in November 2024, WellSky introduced SkySense, a group of AI-powered tools designed to extract, transcribe, and summarize to automate forms and reduce documentation time and errors, thus increasing operational and clinician efficiencies. Such launches boost the segment’s growth in the market.

The services segment is projected to grow relatively slower during the forecast period. Services such as virtual nursing assistance help continuously monitor the patient’s symptoms with physician feedback on demand and contribute to the segment's growth. Additionally, many emerging players in the market are engaged in developing and launching new services to assist healthcare providers and patients, which, in turn, propels the segment’s growth.

- For instance, in February 2025, Cedars-Sinai is testing Aiva Nurse Assistant, an Artificial Intelligence (AI) mobile app that aims to lessen the administrative burden on hospital nurses and offer more patient care time. Such launches and utilization of services aim to boost the segment’s growth in the market.

To know how our report can help streamline your business, Speak to Analyst

By Application

Advancements and Introduction of New Technologies Likely to Propel Robot-Assisted Surgery Segment

On the basis of application, the market is segmented into robot-assisted surgery, virtual nursing assistant, administrative workflow assistance, clinical trials, diagnostics, and others.

The robot-assisted surgery segment accounting for 22.94% market share in 2026, driven by the increasing prevalence of chronic diseases and a growing demand for minimally invasive surgical options for quicker patient recovery and better patient outcomes.

Moreover, the integration of AI into robotic-assisted surgery enhanced surgical precision, efficiency, and accessibility. Such advancements and the associated benefits of AI-enabled robotic surgeries are propelling the segment's growth.

Additionally, leading medical device companies are developing various AI-enabled platforms to provide innovative AI-based robotic surgery solutions and improve patient outcomes. Moreover, various AI-enabled platforms offer innovative AI-based robotic surgery and better patient outcomes.

- For instance, in June 2024, Smith+Nephew launched CORIOGRAPH Pre-Operative Planning and Modeling Services for use with the CORI Surgical System. This system offers tools and AI-driven software for personalized solutions across partial and total knee arthroplasty procedures. Such innovations in robotic surgery with AI integration further stimulate market growth.

The diagnostics segment is projected to experience a significant CAGR during the forecast period. This segment's growth is fueled by the rising demand for accurate diagnostics and imaging with reduced turnaround times. The integration of AI in diagnostics and imaging facilitates early disease detection, diagnosis, and personalized treatment planning. Such advancements raise the adoption of AI in healthcare diagnostics, contributing to the segment's expansion.

Furthermore, the virtual nursing assistant and administrative workflow assistance segments are expected to grow with a moderate CAGR. The segment’s growth is supported by the rising demand for remote patient monitoring, patient flow management, human resources management, and insurance claims processing. AI plays a crucial role in improving the daily workload of healthcare professionals. Additionally, increasing collaborations among key players are creating platforms for administrative tasks, fostering segment growth.

- For instance, in September 2022, AGS Health LLC. Launched the AGS AI Platform for automating end-to-end revenue cycle management in hospitals to minimize labor shortages and offer scalable growth. Such launches are expected to boost the growth of the segment during the forecast period.

The clinical trials and other related segments are also expected to experience considerable growth during the forecast period. Rising research and development expenditures for innovative drug launches are driving this growth, with AI aiding in drug discovery, development, and the management of patient records during clinical phases. Numerous key players are collaborating to provide advanced platforms for clinical research and drug discovery, further advancing this segment.

- For example, in March 2024, Microsoft Corporation collaborated with Providence, a not-for-profit health system, to accelerate the scaling of AI innovation, propel in-house solutions development, and advance clinical research. Such collaborations boost the growth of the segment in the market.

By End-user

Need to Manage Hospital & Clinics Administrative Workload in Structured Manner to Drive Market Growth

On the basis of end-user, the market is segmented into hospitals & clinics, pharmaceutical & biotechnology companies, Contract Research Organization (CRO), and others.

The hospitals & clinics segment contributing 42.44% globally in 2026. The increase in the adoption of new technologies in these settings and the increase in collaborations of major players in the market are contributing to the growth of this segment. Additionally, increasing product launches by the key players to improve physician workflows is propelling the segment’s growth in the market.

- For instance, in January 2025, HealthSage AI introduced its open platform, which includes three clinical applications designed to simplify physician workflows. These applications utilize an advanced Large Language Model to enhance administrative tasks, improve billing precision, and facilitate data exchange.

- In partnership with the Amsterdam UMC Heart Center, the company also aims to harness generative AI to advance healthcare practices and implement these solutions in additional hospitals throughout the Netherlands.

The pharmaceutical and biotechnology companies segment accounted for the second-largest share and is expected to experience significant growth at a robust CAGR during the forecast period. AI in healthcare aids in gene sequencing and in predicting the efficacy and safety of pharmaceutical products. The increasing collaborations among various market players are contributing to the expansion of this segment.

- For example, in July 2020, Merck KGaA collaborated with Janssen Pharmaceuticals, N.V., to develop an AI diagnostic tool. This tool can help in the improvisation of the detection of the Neglected Tropical Diseases (NTDs) schistosomiasis and Soil Transmitted Helminthiasis (STH).

The Contract Research Organization (CRO) and others are expected to grow with moderate CAGR during the forecast period. The growth of the segment is augmented by an increasing number of clinical trials and bioequivalence studies, leading to rising demand for AI-based tools for maintaining patient records and trial data. Additionally, increasing the number of launches to maintain clinical trial workflows boosts the segment’s growth in the market.

- For instance, in November 2024, Medable Inc., a prominent provider of clinical development technology, launched Medable AI. This generative AI suite is designed to assist sponsors and Clinical Research Organizations (CROs) in accelerating the development of digital and decentralized trials while maintaining full visibility and control over the technology setup.

AI IN HEALTHCARE REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, Asia Pacific, Latin America, & Middle East & Africa

North America

North America AI in Healthcare Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 14.30 billion in 2024 and is anticipated to continue to dominate the global market during the forecast period. The dominant share of the region is due to increasing technological advancements with an emphasis on adopting advanced tools for maintaining tedious workflows. Additionally, the presence of advanced healthcare infrastructure with the integration of artificial intelligence is also boosting the growth of the region in the market. Also, the increase in the number of Machine Learning (ML) based clinical trials, which gives results with higher accuracy with reduced study period interval, is likely to contribute to the growth of the market in the region. The North America market is projected to reach USD 24.78 billion by 2026.

U.S.

The U.S. held a significant portion of the North American market in 2024 owing to the increasing adoption of AI-based technologies in medical imaging and diagnostics, patient monitoring, hospital management solutions, and others. Moreover, the country comprises key market players with advanced solutions in AI for healthcare, which is boosting its growth. The U.S. market is projected to reach USD 22.7 billion by 2026.

- For instance, in July 2024, GE HealthCare partnered with Amazon Web Services, Inc. to build foundation models and generative Artificial Intelligence (AI) applications with an aim to improve medical diagnostics and patient care.

Europe

Europe is anticipated to be the second-most dominant region in terms of market share. The European market holds a significant share due to the increasing AI integration in hospitals and clinics that maintain patient health records, administrative workflows, diagnostics, and surgery. The Europe market is projected to reach USD 15.73 billion by 2026.

Additionally, the presence of key pharma and biotech companies adopting AI for innovative drug discovery processes is expected to boost the growth of the market in the region.

- For instance, in July 2024, Exscientia plc, a technology-driven drug design and development company in England, launched an AWS Artificial Intelligence (AI) platform for end-to-end drug discovery and automation. Such launches boost the region’s growth in the market.

Asia Pacific

The Asia Pacific market is expected to hold the highest CAGR, especially in developing countries such as China, Japan, and India. The increasing number of investments in AI-based medical devices for the diagnosis of various diseases is likely to drive the growth of the market in the region during the forecast period.

Additionally, increasing collaborations among the key healthcare providers and market players are anticipated to boost the region’s growth.

- For instance, in January 2025, Apollo Hospital partnered with Microsoft Corporation with the aim of integrating AI in research and developing advanced healthcare solutions, including predictive analytics and genomics. Such collaborations are boosting the region’s growth during the forecast period.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa accounted for moderate market revenue during the forecast period. However, increasing collaborations and adoption of AI-based telehealth services in these regions are expected to lead the future growth prospects of the market in the region. The Middle East & Africa market is projected to reach USD 1.24 billion by 2026.

The Latin America market is projected to reach USD 2.25 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Mergers and Acquisitions by Key Players to Propel Market Progress

The global market features prominent players such as Amazon.com, Inc., Microsoft Corporation, NVIDIA Corporation, and Google (Alphabet Inc.), collectively holding a substantial market share in 2024. Key industry leaders are implementing strategies such as mergers and acquisitions, launching new products, and advancing technology to enhance their market positions.

- For example, in March 2022, Microsoft Corporation unveiled technological enhancements in its healthcare cloud, including the introduction of Azure HealthData services. These updates featured improved health bot templates, better integration of clinical workflows, and new patient insight capabilities.

- In June 2021, Amazon Web Services, Inc. partnered with Salesforce, Inc. to integrate AWS services, focusing on machine learning and artificial intelligence to provide a variety of services to customers across multiple industry sectors.

Other notable players in the global market include Hewlett Packard Enterprise Company, Intel Corporation, Siemens AG, and General Electric Company. These companies are anticipated to prioritize new product launches and collaborations to boost their market share during the forecast period.

LIST OF KEY AI IN HEALTHCARE COMPANIES PROFILED

- Amazon.com, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- NVIDIA Corporation (U.S.)

- Google (Alphabet Inc.) (U.S.)

- Hewlett Packard Enterprise Company (U.S.)

- Intel Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- General Electric Company (U.S.)

- Veradigm LLC (U.S.)

- UnitedHealth Group (Optum Inc.) (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2025: PieX AI announced its intentions to launch the personalized, on-device AI pendant designed for mental health management using its proprietary Sensing Technology.

- November 2024: Boston Consulting Group collaborated with Amazon Web Services, Inc. to accelerate the deployment of Generative AI (GenAI) from Proof of Concept (POC) to large-scale, production-ready solutions.

- June 2024: Amazon Web Services, Inc. collaborated with Upstage. This agreement enhanced the partnership between the two companies, aiming to utilize cutting-edge and secure cloud technologies and services to empower customers to harness new generative AI capabilities.

- October 2023: Google (Alphabet Inc.) launched a new generative AI feature for healthcare professionals with the aim of helping them find relevant and accurate clinical information more efficiently.

- March 2022: Microsoft Corporation acquired Nuance Communications Inc. to incorporate the company’s AI and ambient intelligence solutions across industries, including healthcare, financial services, retail, and telecommunications.

REPORT COVERAGE

The global AI in healthcare market research report delivers an in-depth market analysis, highlighting essential elements such as an overview of advanced technologies, the regulatory landscape in key countries, and the challenges encountered in adopting and implementing AI-based solutions. Furthermore, it explores the applications of AI within hospitals and clinics, as well as significant industry developments, including mergers, partnerships, and acquisitions. The global AI in healthcare market report also outlines the factors that have fueled market growth in recent years, along with a regional analysis of various segments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 43.96% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Platform

|

|

By Application

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 39.34 billion in 2025 and is projected to record a valuation of USD 1,033.27 billion by 2034.

In 2025, North America stood at USD 17.51 billion.

Registering a CAGR of 43.96%, the market is projected to exhibit rapid growth over the forecast period of 2026-2034.

The platform segment is expected to lead the market during the forecast period.

Rising investments by private and government sectors in AI are driving the market.

Amazon.com, Inc., Microsoft Corporation, NVIDIA Corporation, and Alphabet Inc. are major players in the global market.

North America dominated the market in terms of share in 2025.

Advancements in medicine, research, innovation, and technology are the factors expected to drive the adoption of the products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us