Blood Group Typing Market Size, Share & Industry Analysis, By Product (Instruments and Reagents & Kits), By Test Type (ABO Tests, Antigen Typing, Antibody Screening, Cross-Matching Tests, and HLA Typing), By Technique (Serology Tests and Molecular Tests), By End-user (Hospital-based Laboratories and Independent Laboratories & Blood Banks), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

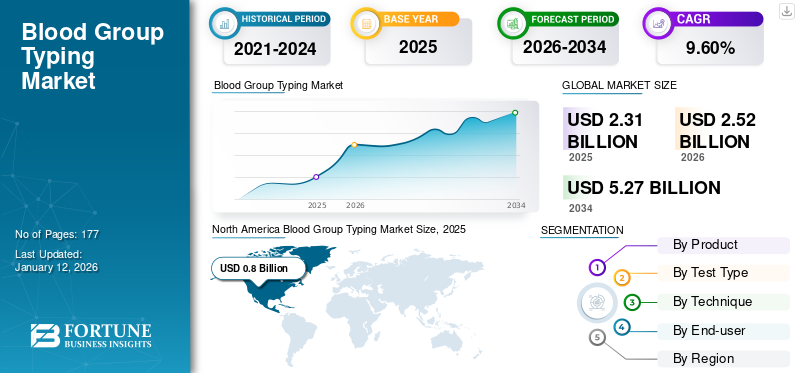

The global blood group typing market size was valued at USD 2.31 billion in 2025. The market is projected to grow from USD 2.52 billion in 2026 to USD 5.27 billion by 2034, exhibiting a CAGR of 9.60% during the forecast period. North America dominated the global market with a share of 34.70% in 2025. Moreover, the U.S. blood group typing market size is projected to grow significantly, reaching an estimated value of USD 1.25 billion by 2032, driven by increase in blood donations coupled with increased blood group typing procedures.

Blood group typing is a test to determine a person’s blood type. The surging demand for blood transfusions and organ transplantations is a leading factor propelling the market growth. The World Health Organization (WHO) stated that there was an increase of 10.7 million blood donations in terms of voluntary blood donations from 2008-2018. The increase in donations over the years signifies that the number of blood group typing procedures has also increased. Furthermore, due to rise in the incidence of accidents, cases of trauma and injuries have risen considerably. Various research articles have stated that in a trauma setting, 6 out of 10 deaths occur due to excessive bleeding in the first 3 hours of sustaining an injury. Therefore, in such cases, massive blood transfusion is performed as a treatment. Thus, the growing number of trauma and accident cases will drive the global blood group typing market growth.

Additionally, strategic initiatives by various key players and public-private partnerships are facilitating innovation and advances in the market. Also, some recent developments in automated blood group typing technologies are expected to be instrumental in propelling the market growth. For instance, in July 2020, a team of scientists from Japan's Tokyo University of Science developed a lab-on-a-chip device that can tell a person’s blood type within five minutes and allows medical staff to read the results through simple visual inspections. Such R&D initiatives will contribute to the expansion of the global market during the forecast period.

The COVID-19 pandemic led to a decline in the number of blood transfusions & donations, manufacturing & supply chain issues, and a decrease in the number of patient visits to healthcare facilities, reducing the usage of these diagnostic products globally. In addition, some prominent market players reported a considerable decline in their annual revenues and sales. For instance, key companies in the global market, such as Bio Rad Laboratories, Inc., witnessed a decrease of 7.6% in revenue from their clinical diagnostics segments, including ID-system and microplates, during FY 2020 compared to the same period in 2019. However, the sales of these diagnostic devices increased in 2021 and 2022 due to the robust adoption of automated blood group typing technologies, improved patient visits, and increased blood donations, normalizing the market growth.

Global Blood Group Typing Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.31 billion

- 2026 Market Size: USD 2.52 billion

- 2034 Forecast Market Size: USD 5.27 billion

- CAGR: 9.60% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a 34.70% share in 2025. This is due to significant demand for blood transfusions, higher adoption rates of automated blood typing instruments, and favorable reimbursement policies for these procedures.

- By Test Type: The Antibody Screening segment held the largest market share. The segment's growth is driven by the increasing number of blood transfusions, rising prevalence of chronic diseases, and a growing volume of prenatal testing where antibody screening is critical.

Key Country Highlights:

- Japan: The market is driven by strong R&D initiatives and technological innovation. For example, scientists from Japan's Tokyo University of Science developed a lab-on-a-chip device capable of determining a person’s blood type within five minutes.

- United States: Market growth is fueled by a high number of organ transplants, with 41,354 performed in 2021, and a constant, high demand for blood, with a need for blood or platelets every two seconds.

- China: As a key part of the fast-growing Asia Pacific market, China is benefiting from increasing R&D activities focused on launching advanced blood group typing technologies to meet the needs of its large population and improving healthcare infrastructure.

- Europe: The market is advanced by strong government initiatives to improve healthcare services. For example, the U.K. Health Ministry has implemented a new strategy with the vision for the country to become a world leader in organ donation and transplantation.

Blood Group Typing Market Trends

Adoption of Automated Blood Group Typing Technologies to Determine Market Growth Trajectory

The global market has recently witnessed an increased focus on developing automated blood typing technologies. Automated blood typing technologies, such as Polymerase Chain Reaction (PCR)-based and microarray techniques have improved the speed, standardization, and safety of transfusion diagnostics.

Automatic blood typing has several advantages over manual typing in terms of cost, efficiency, and errors. An additional benefit of these systems is that they help overcome the shortage of healthcare personnel and the challenge of less-experienced staff at transfusion testing institutions. Therefore, many well-established and emerging market players are engaged in the introduction of these technologies in the market. For instance, in July 2020, a team of scientists from the Tokyo University of Science, Japan developed a lab-on-a-chip device that can tell a person’s blood type within five minutes and allows medical staff to read the results through simple visual inspections. Such rising trends are expected to contribute immensely to the market growth.

Download Free sample to learn more about this report.

Blood Group Typing Market Growth Factors

Increase in Number of Blood Donations to Accelerate Market Growth

Over the years, there has been a notable rise in the number of blood donations globally. Due to an increase in voluntary blood donations, the demand for blood group recognition and cross-matching procedures for transfusion has increased. As per an article by the European Blood Alliance (EBA) (2019-2022), the National Health Service Blood and Transplant (NHSBT) collects around 1.5 million voluntary blood donations, which are processed by the authority before being delivered to hospitals and patients who need them. NHSBT relies on 1.3 million registered donors as it provides a safe and reliable supply of blood components, diagnostic services, and stem cell solutions to hospitals in England. Increase in the number of these procedures due to a surge in blood donations is set to drive the market growth over the forecast period.

Furthermore, there has been a strong rise in the demand for blood and blood components across all regions for various medical and surgical applications. Also, the rising number of government initiatives to raise awareness regarding voluntary blood donations will contribute to the increasing number of donations among people during the forecast period.

- According to an article published by Wausau Pilot & Review in June 2022, every 2 seconds, there is a need for blood or platelets in the U.S. The strong demand for these procedures is leading to market growth.

Rising Transplantation Procedures to Surge Demand for HLA Typing

One of the most critical drivers of the global market is the increasing number of transplant procedures across the globe. This scenario has led to an increase in the number of Human Leukocyte Antigen (HLA) typing tests, thereby contributing to market growth. As per data published by the Organ Procurement and Transplantation Network (OPTN), in 2021, 41,354 organ transplants were done in the U.S., showing an increase of 5.9% over 2020.

Furthermore, HLA typing is essential during renal transplantation, as identification of a foreign HLA by the T lymphocytes triggers an immune response. The activated T lymphocytes initiate a series of mediators, which leads the immune system against the allograft. Therefore, rise in kidney transplants will also boost the number of HLA typing tests.

Similarly, according to data published by the International Registry on Organ Donation and Transplantation (IRODaT), the number of kidney transplants performed by living donors in Spain in 2021 was 2,627. Therefore, according to global statistics, there has been a growth in the number of organ transplants, which will positively contribute to the rise in the number of HLA typing procedures, eventually boosting the market growth.

RESTRAINING FACTORS

Lack of Infrastructure & Trained Personnel for These Procedures in Emerging Nations to Hinder Market Growth

Despite the intense demand for blood donation and transfusion procedures among the patient population, a substantial hindrance to the market growth is the lack of infrastructure for blood group typing, especially in emerging countries.

- For instance, in 2019, an article published by John Wiley & Sons, Inc. stated that in Nigeria, the National Blood Transfusion Service (NBTS) was inaugurated to promote sustainable and safe blood availability to individuals. Still, in Ivory Coast, the NBTS failed to meet its mission due to lack of the required blood collection equipment and poor donor turnout. The same setback was also seen in Mali and Nigeria, where the lack of infrastructure, trained personnel, and inadequate funding decreased the availability of safe blood donation services.

Some other factors restricting the performance of blood donation and transfusion procedures include long distances between centralized service centers and hospitals, infrastructural failures, such as constant disruptions in electricity supply, and lack of political support. Also, emerging nations do not have proper reimbursement policies for these procedures. This increases the cost of the procedure, leading to lowered testing rates. These factors can restrict the market growth during the forecast period.

Blood Group Typing Market Segmentation Analysis

By Product Analysis

Reagents & Kits to Gain Notable Traction Due to Rising Procedural Volume

The market, based on product, is segmented into instruments and reagents & kits. The reagents & kits segment dominated the market as these products are extensively used for blood donation and transfusion procedures with a share of 80.43% in 2026. The increasing number of blood donations and transfusions is one of the primary reasons for the segment’s expansion. The instrument segment is projected to witness positive growth prospects during the forecast period. The rising usage of technologically advanced instruments for these procedures and strategic initiatives are set to augment the segment’s growth. In July 2021, Thermo Fisher Scientific Inc. and Ortho Clinical Diagnostics partnered for providing Thermo’s LabLink xL Quality Assurance Software and MAS Quality Controls via Ortho's VITROS QC Solutions to VITROS System customers across the globe.

To know how our report can help streamline your business, Speak to Analyst

By Test Type Analysis

Antibody Screening to Become Popular Due to Increased Product Usage in Prenatal Testing

On the basis of test type, the market is segmented into ABO tests, antigen typing, antibody screening, cross-matching tests, and HLA typing.

The antibody screening segment dominated the market due to increased blood transfusions, rising prevalence of chronic diseases, and growing volume of prenatal testing with a share of 39.80% in 2026. Pregnant patients require various screening tests during pregnancy including blood group and antibody screening. Thus, an increase in prenatal testing procedures is augmenting the growth of the segment.

The ABO tests segment held the second leading position in the market in 2024. The increasing usage of ABO blood typing to identify and match organs and tissues during transplant procedures is augmenting the segment’s growth. The antigen typing segment is anticipated to account for the third-largest market share due to the rising usage of these tests for patients requiring long-term transfusion therapy, such as sickle cell disease to obtain phenotypically compatible units.

In addition, the cross-matching test and HLA typing segments are projected to record a significant CAGR as they are utilized for the identification and matching of organs and tissues during transplant procedures. Cross-matching tests detect incompatibilities among the donor and recipient that will not be evident on regular blood typing tests, as blood typing is available only for the major ones and not against every blood group. Such features are expected to propel the segmental growth during the forecast timeframe.

By Technique Analysis

Serology Tests to be Widely Demanded due to New Product Launches

Based on technique, the market is segmented into serology tests and molecular tests with a share of 59.42% in 2026. The serology tests segment dominated the global blood group typing market share due to rising initiatives for voluntary blood donations and new product launches. Serology tests are one of the traditional methods that can be used for the laboratory or research processes. Also, they are easy to use and readily available, which will boost their demand among end-users. In July 2021, Ortho Clinical Diagnostics (now QuidelOrtho Corporation) announced that VITROS Immunodiagnostic Products IL-6 Reagent Pack was available in EU countries, the U.K., and several APAC and LATAM nations

The molecular tests segment is projected to grow significantly owing to the rising popularity of molecular testing. The robust efficacy of these tests in detecting chronic diseases is the prominent factor contributing to the expansion of the segment. In addition, molecular testing in blood donors offers a significant advantage of identifying variant alleles resulting in weak antigen expression as they can immunize an antigen-negative transfusion recipient if not recognized. These benefits are expected to increase their adoption, expanding the market during the forecast period.

By End-User Analysis

Independent Laboratories & Blood Banks to Record Appreciable Growth Due to Rising Setup of These Medical Centers

Based on end-user, the market is segmented into hospital-based laboratories and independent laboratories & blood banks. The independent laboratory & blood banks segment dominates the market with a share of 59.42% in 2026 and is expected to grow at a strong pace due to an increase in the network of these medical centers, especially in emerging nations. According to a news article published by the New Indian Express in March 2020, there were nearly 110,000 medical laboratories in India. The presence of laboratories in key countries is anticipated to drive the segment’s growth during the forecast period.

The hospital-based laboratories segment accounts for the second-largest market share. The rising number of hospitals in major countries and favorable reimbursement policies will contribute to the segment’s expansion during the forecast period. Moreover, the increasing number of accidental and trauma cases leading to excessive blood loss requires frequent blood transfusion along with hospital admissions, which boosts the adoption of blood group typing tests in hospital-based laboratories, driving the market growth.

REGIONAL INSIGHTS

Based on region, the global market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Blood Group Typing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in North America was valued at USD 0.8 billion in 2025 and is anticipated to lead the global market growth during the forecast period. The region dominates the market share due to significant demand for blood transfusions, higher adoption of automated blood typing instruments, and favorable reimbursement policies for these procedures. Furthermore, the rising number of regulatory approvals for advanced products is driving the market growth in North America. For instance, in March 2021, Grifols, S.A. installed the DG Reader Net Semi-Automated Analyzer in North America. It is used for compatibility testing of pre-transfusion blood types. The U.S. market is projected to reach USD 0.81 billion by 2026.

Europe

Europe accounted for the second-largest market share in 2025. The regional market growth will be primarily driven by the increasing number of blood transfusion procedures and rising awareness amongst individuals regarding blood donations. The UK market is projected to reach USD 0.12 billion by 2026, while the Germany market is projected to reach USD 0.18 billion by 2026.

- According to an article published by the National Health Service (NHS) in June 2021, the U.K. Health Ministry had prepared a new strategy and set out a vision for the U.K. to be a world leader in terms of organ donation and transplantation.

Asia Pacific

The Asia Pacific market is expected to grow remarkably due to increasing R&D initiatives to launch advanced blood group typing technologies. Such initiatives are anticipated to give rise to novel product launches in countries, such as Japan. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.21 billion by 2026, and the India market is projected to reach USD 0.1 billion by 2026.

Latin America

The market in Latin America has been growing steadily due to increasing awareness regarding blood and organ donations in Mexico and Brazil. The rising blood collection systems in Latin America will effectively contribute to the regional market growth during the forecast period.

- For instance, in November 2019, Grifols, S.A. started production at a new blood collection system plant in Campo Largo, Brazil. The new plant enabled key companies, such as Grifols to expand their presence in Latin America.

Middle East & Africa

The Middle East & Africa is anticipated to witness promising growth over the forecast period due to increasing awareness regarding blood donations and rise in the number of blood transfusions in trauma centers across hospitals.

List of Key Companies in Blood Group Typing Market

QuidelOrtho Corporation Clinched Top Market Position Due to Strong Product Portfolio

The competitive landscape is semi-consolidated with the presence of several regional and international companies operating in the global market. However, QuidelOrtho Corporation accounted for a significant share of the global market in 2023. Consistent product approvals and launches, coupled with robust distribution agreements, have helped QuidelOrtho Corporation become a market pioneer. For instance, in September 2021, QuidelOrtho Corporation launched New Immediate Spin Crossmatch (ISXM) for ORTHO VISION MAX and ORTHO VISION Analyzers. These products will assist in detecting incompatibility between donors and recipients in blood transfusions.

At the same time, Grifols S.A. and Bio-Rad Laboratories, Inc. held major shares in the global market due to strategic initiatives and multiple regulatory approvals from government organizations. In March 2021, Bio-Rad Laboratories, Inc. entered a partnership with F. Hoffmann-La Roche Ltd. Under this partnership, Bio-Rad Laboratories provided the customers of F. Hoffmann-La Roche Ltd. with access to InteliQ products, Unity QC data management solutions, and customer training & support services. Other key players in the market are Quotient Limited, Agena Bioscience, Inc., and CareDx Inc. They are slowly gaining a robust market share due to strategic initiatives, such as collaborations and signing distribution agreements, to improve their market position over the forecast period.

LIST OF KEY COMPANIES PROFILED:

- Quotient Limited (Switzerland)

- CareDx Inc. (U.S.)

- Agena Bioscience, Inc. (Mesa Laboratories, Inc.) (U.S.)

- DIAGAST (U.S.)

- Illumina, Inc. (U.S.)

- Grifols, S.A. (Spain)

- Immucor, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- QIAGEN (Netherlands)

- Beckman Coulter, Inc. (Danaher) (U.S.)

- QuidelOrtho Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- June 2023 - Quotient Limited announced the launch of its ALBA products in Sweden and the Netherlands. The products were also launched in the following countries: France, Germany, Austria, Hungary, Italy, Greece, Poland, Romania, Luxembourg, and Slovakia.

- June 2023 - Quotient Limited entered into a distribution agreement with Transmedic Pte Ltd to distribute ALBA by Quotient and MosaiQ in five Southeast Asian countries including, Indonesia, Singapore, Malaysia, Thailand, and Vietnam.

- May 2023 – Bio-Rad Laboratories, Inc., launched a fully automated system for ID cards, IH-500TM NEXT System, to meet the evolving demands and challenges in the laboratory and health environments.

- April 2023: Metropolis Healthcare launched the 'NextGen HLA' Typing Test integrated with next-generation sequencing technology to aid the identification of donors for bone marrow, cord blood, or organ transplantation.

- March 2023 - Werfen acquired Immucor, Inc. to expand its portfolio of specialized diagnostic solutions for hospitals and clinical laboratories, receiving all necessary regulatory approvals.

- July 2022: Quotient Limited signed an agreement with InfYnity Biomarkers to expand MosaiQ's infectious disease portfolio including blood screening tests.

- April 2022: GenDx received Health Canada approval for NGSgo-MX11-3 HLA genotyping test. The test uses next-generation sequencing (NGS) technology to genotype 11 separate HLA genes.

- March 2022 - Quotient Limited announced that it received the CE Mark for its MosaiQ Extended Immunohematology (IH) Microarray. This IH microarray offers antigen typing, antibody screening, including ABO forward and reverse grouping.

- April 2021: Quotient Limited announced positive results from its MosaiQ Multiplex Molecular Disease Screening (MDS) microarray study and the company's progress regarding MosaiQ expanded Immunohematology (IH) microarray was updated.

REPORT COVERAGE

The global market research report comprises a detailed market analysis. The market is segmented by product, test type, technique, and end-user. The report focuses on crucial aspects, such as market dynamics, key industry developments including mergers, acquisitions, and partnerships, technological advancements in blood group typing, number of blood donations and transfusions, prominent market players, and the COVID-19 pandemic impact on the global market. In addition, the analysis includes insights into the market trends and highlights pricing and profiles of other companies in HLA typing products that have contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.60% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Test Type

|

|

|

By Technique

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 2.52 billion in 2026 to USD 5.27 billion by 2034.

North America stood at USD 0.8 billion in 2025.

The market will exhibit a steady CAGR of 9.60% during the forecast period of 2026-2034.

The reagents & kits segment is expected to be the leading segment in this market during the forecast period.

Increase in the number of blood donations and transplant procedures and rise in trauma and accident cases are driving the market growth.

Grifols S.A., Quotient Limited, Bio-Rad Laboratories, Inc., QuidelOrtho Corporation, and CareDx Inc. are some of the major global market players.

North America dominated the global market with a share of 34.70% in 2025.

Increase in blood transfusion & donation procedures, rising government initiatives to increase blood donation awareness, and technological advancements across the globe are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us