Contraceptive Pills Market Size, Share & Industry Analysis, By Type (Combination Pills and Progestin-only Pills), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Clinics, Online Channel, Public Channel & NGO, and Others) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

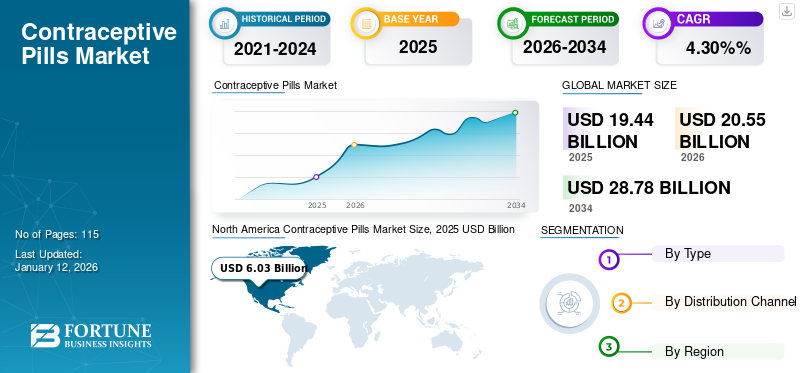

The global contraceptive pills market size was valued at USD 19.44 billion in 2025, The market is projected to grow from USD 20.55 billion in 2026 to USD 28.78 billion by 2034, exhibiting a CAGR of 4.30% during the forecast period. North America dominated the contraceptive pills market with a market share of 31.03% in 2025.

Scientific innovations have guided the positioning of birth-control pills in the global market in recent years. Hormonal contraceptives regulate the hormonal levels during a woman’s cycle. Progesterone and estrogen are the naturally produced hormones in human body. In hormonal birth control, various forms of synthetic hormones that mimic the progesterone and estrogen in women’s body are used. According to the Estimates and Projections of Family Planning Indicators 2019, 922 million women of reproductive age (or their partners) are contraceptive users. Contraceptive pills are suitable for women of all age groups and can be used for long term. It is considered to be one of the highly prescribed medications across the globe. A significant proportion of women in urban regions prefer contraceptive pills.

Download Free sample to learn more about this report.

Increasing need for controlling population growth is boosting investment in the research and development of novel birth-control methods. The market is estimated to witness significant growth in the forecast duration which is attributable to the rising number of local and regional manufacturers and introduction of novel contraceptive pills. Growing number of initiatives by public players of countries such as India and China is further propelling the contraceptive pills market growth.

Global Contraceptive Pills Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 19.44 billion

- 2026 Market Size: USD 20.55 billion

- 2034 Forecast Market Size: USD 28.78 billion

- CAGR: 4.30% from 2026–2034

Market Share:

- North America dominated the contraceptive pills market with a 31.03% share in 2025, driven by high adoption of short-acting reversible contraception, favorable reimbursement policies, and strong presence of leading pharmaceutical companies.

- By type, the combined contraceptive pills segment is expected to retain its largest market share owing to clinical benefits such as menstrual cycle regulation, relief from pre-menstrual syndrome, and acne improvement, along with a well-established global distribution network.

Key Country Highlights:

- United States: Strong demand for oral contraceptives supported by awareness campaigns, availability of OTC products, and favorable reimbursement policies.

- Europe: High contraceptive usage rates, improved reimbursement coverage, and strong policy support for family planning.

- China: Population control initiatives and increasing public awareness about modern birth-control methods are fueling demand.

- Japan: Rising awareness of reproductive health and availability of advanced hormonal contraceptive options are contributing to market growth.

MARKET DRIVERS

“Rising Need for Population Control to Surge the Market”

The efforts taken by governments to control the population in various countries is augmenting the awareness about family planning and contraception amongst women in rural and urban areas. Moreover, rising prevalence of unwanted pregnancy has propelled the uptake of oral contraceptives in the developed markets. The population is growing with a tremendous growth rate, especially in the Asian countries, which is affecting the socio-economic balance at micro-level. To control such rising population, public and private players are collaborating and this is expected to have a favorable impact on sex education and contraceptive usage in coming years. This is anticipated to propel the oral contraceptives market revenue during the forecast period.

“Significant Unmet Needs for Contraceptives to Boost the Market”

The unmet needs for contraception in rural areas of developing nations reflects the potential for market. Between 2005 and 2014, in 52 developing countries, where Demographic and Health Surveys (DHS) were conducted, between 8% and 38% of married women of age 15 to 49 years were found to have an unmet need for contraception. The choices available for contraception depends upon the accessibility and local availability of different contraception methods. Thus, rising demand for cost-effective and short-term contraceptive methods is projected to augment the birth-control pills market growth during the forecast period.

SEGMENTATION

By Type Analysis

“Combined Contraceptive Pills Segment to Witness Remarkable Growth”

The Combined Contraceptives (E+P) segment is projected to dominate the market with a share of 70.60% in 2026. On the basis of type, the market segments are combined contraceptives and progestin-only contraceptives. Combined contraceptive pills contain two hormones – progesterone and estrogen. It is a reliable form of reversible contraception with fewer side effects. The segment accounted for the highest market share in 2024 and is likely to remain leading throughout the forecast duration. Better control of monthly menstrual cycle and relief from pre-menstrual syndrome coupled with the improvement in acne are some of the characteristics the combined contraceptive pills offer. These are anticipated to boost the growth of combined contraceptive pills market revenue during the forecast period. The clinical benefits associated with the combined contraceptive pills along with the improved distribution network of their key manufacturers across the world are the key factors for the estimated growth of this segment during 2025-2032.

To know how our report can help streamline your business, Speak to Analyst

Improved awareness about sexual activity in developed nations, rising prevalence of unwanted pregnancy, and initiatives taken by various organizations to promote sexual health awareness are propelling the uptake of OTC contraceptive pills. According to data published by United Nations, contraceptive pills are used by over 20% of women of reproductive age in around 27 countries across the globe, with the highest prevalence in European countries. Such factors are projected to boost the public expenditure on contraception around the globe by the end of 2032.

By Distribution Channel Analysis

“Improved Distribution Network of Key Manufacturers to Drive the Growth of Retail Pharmacy Segment”

The Retail Pharmacy segment is projected to dominate the market with a share of 37.47% in 2026. On the basis of end user, the market is segmented into hospital pharmacy, retail pharmacy, clinics, online channels, public channel & NGOs, and others. The retail pharmacy segment accounted for the highest market share in 2024, which is attributable to the rising sale of OTC contraceptives, increasing awareness and knowledge of population about various forms of contraception, etc. Moreover, the improved distribution network of key companies across the globe by collaborating with the regional and local distributors is anticipated to boost the market growth of this segment during the forecast period.

The online channel segment is estimated to register highest CAGR during 2025-2032, owing to the increasing investment by key companies to establish their strong presence on the online pharmacy platforms and improved scenario for e-pharmacy in developed regions.

REGIONAL ANALYSIS

North America Contraceptive Pills Market Size, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

North America

North America generated a highest revenue of USD 6.03 billion in 2025, which is attributable to the increasing usage of short-acting reversible contraception in the U.S. and favorable reimbursement policies for oral contraceptives. According to CDC, around 64.9% of the 72.2 million women aged 15–49 in the U.S. were using contraception during 2019-2023, out of which 12.6% of the women preferred oral contraceptive pills. The United States market is expected to reach USD 5.11 billion by 2026. The United Kingdom market is expected to reach USD 0.85 billion by 2026, while the Germany market is expected to reach USD 1.27 billion by 2026.

Europe

Europe is anticipated to be the second most leading region in the global market. According to the Contraception Atlas of Europe, 69% of women in Europe use contraception and 43% of the pregnancies in the region were unintended in 2024-2025. In Europe, France is a country with the highest birth rate and it is also a major country in terms of access to contraception. Improved reimbursement in the region is estimated to drive the contraceptive pills market trends in Europe during 2025-2032.

Asia Pacific

Asia Pacific is anticipated to emerge as the fastest growing region by 2032 owing to the initiatives taken by government for population control and emergence of various non-profit organizations in the region aiming to spread awareness about various birth-control methods. According to a global sex survey conducted by Durex, one of the best-known makers of condoms, unplanned pregnancies in China fell to 14% in 2016 from 30% in 2011.

Increasing penetration of key pharmaceutical giants in the developing areas of Latin America and Middle East & Africa and rising literacy rate in the region are propelling the revenue generation from the two region. Moreover, the increasing awareness about the clinical benefits of oral contraceptives and rising investment by key pharmaceutical distributors to improve the accessibility of oral contraceptives in the niche areas are some of the major factors for the market expansion of Latin America and Middle East & Africa during the forecast period. The Japan market is expected to reach USD 0.63 billion by 2026, the China market is expected to reach USD 1.58 billion by 2026, and the India market is expected to reach USD 1.33 billion by 2026.

INDUSTRY KEY PLAYERS

“Bayer AG and Allergan plc to Account for Maximum Market Share”

The market is a bit fragmented, with numerous local and regional players operating at the global level. Bayer AG and Allergan plc are the key market players accounting for a major share in terms of revenue. In December 2017, Lupin, one of the global pharmaceutical companies, received USFDA approval for Tydemy, a generic version of Bayer’s contraceptive brand Safyral. This is anticipated to affect the market position of Bayer AG during the forecast period. Moreover, the capacity constraints at Bayer’s and Pfizer’s manufacturing sites between June and August 2019 affected the stock of Bayer’s Microgynon 30 and Pfizer’s Ovranette tablets in the market. This is expected to open the gates for local and regional manufacturers in the market in coming years.

LIST OF KEY COMPANIES PROFILED:

- Pfizer, Inc.

- Merck & Co., Inc.

- Teva Pharmaceutical Industries

- Allergan, plc

- Bayer AG

- Janssen Pharmaceutical Company

- HLL Lifecare Limited

- Mylan N.V.

- Piramal Enterprises

INDUSTRY DEVELOPMENT:

- April 2018: Mylan N.V. launched Drospirenone and Ethinyl Estradiol Tablets, a generic version of Bayer's Yaz in the United States. The tablet is indicated by women to prevent pregnancy and for the treatment of acne vulgaris in women.

- December 2017: Lupin Pharmaceuticals, Inc. received USFDA approval for Tydemy tablets, a generic version of Bayer AG’s Safyral tablets indicated to raise folate level in women whoc choose oral contraceptives to prevent pregnancy.

- August 2017: Lupin Pharmaceuticals, Inc. initiated a voluntary recall of its contraceptive brand Mibelas 24 FE from the U.S. market, as they were out-of-sequence. Also, in May 2019, Allergan initiated recall of its leading oral contraceptive brand Taytulla capsules because of some packing errors.

REPORT COVERAGE

Access to contraception is one of the major concerns of government in densely populated countries. The public players are thus engaging themselves in building policies to overcome the poor accessibility to contraception. For instance, Turkey provides certain contraceptive supplies free-of-charge to married women at public health centers.

Also, in 2017, government of India launched centrally-funded 'Antara' scheme, under which women in the age group of 18 to 45 years will be given contraceptive injections free-of-cost once every three months at all state-run primary health centres and hospitals. Such favorable scenarios for contraceptives in countries with unmet needs is augmenting the sale of contraceptive pills. The contraceptive pills market report provides qualitative and quantitative insights on the market trends and detailed analysis of market size & growth rate for all possible segments in the market.

The research report offers an in-depth analysis of the market. It further provides details on the fertility statistics (2018), regulatory and reimbursement scenario for key countries, new product launches, key industry developments such as mergers, acquisitions, and partnerships, and government policies & their impact on the contraceptives industry. Information on drivers, opportunities, threats, and restraints of the market can further help stakeholders to gain valuable insights into the market. The report offers a detailed competitive landscape by presenting information on key players, along with their strategies, in the market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Type

|

|

By Distribution Channel

|

|

|

By Geography

|

Frequently Asked Questions

The value of the global market was USD 19.44 billion in 2024.

Fortune Business Insights says that the market is projected to reach USD 28.78 billion by 2034.

The value of the North America Market was USD 6.03 billion in 2025.

The market is projected to grow at a CAGR of 4.30% during the forecast period (2026-2034).

The combined contraceptive pills among type is the leading segment in this market during the forecast period.

Rising prevalence of unintended pregnancy and government participation to spread awareness about contraception are the key factors driving the market.

Bayer AG and Allergan plc are the top players in the market.

North America is expected to hold the highest market share in the market.

Adoption of contraceptive pills in urban as well as rural areas and initiatives by public & private players to improve the scenario for sex education are the key trends of the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us