Phoropter Market Size, Share & Industry Analysis, By Product Type (Manual and Automated), By End User (Hospitals, Ophthalmic Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

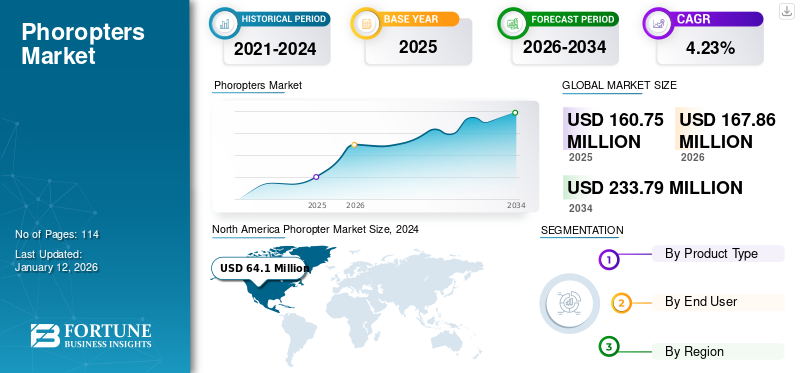

The global phoropter market size was valued at USD 160.75 million in 2025 and is projected to grow from USD 167.86 million in 2026 to USD 233.79 million by 2034, exhibiting a CAGR of 4.23% during the forecast period. North america dominated the phoropter market with a market share of 41.85% in 2025.

Phoropter is an ophthalmic device comprised of cylinders, prisms, and lenses that are used to measure refractive errors in the eye. Refractive errors are common vision problems that keep light from focusing correctly on the retina. There are four types of refractive errors: myopia, hyperopia, astigmatism, and presbyopia. The eye care professionals used this instrument during eye examinations to determine eye prescriptions.

The increasing prevalence and awareness of these refractive errors among the general population drives the demand for routine eye examinations. According to the American Optometric Association (AOA), it is estimated that the number of people with eye conditions will double to 2.01 million people with legal blindness, 6.95 million with visual impairment, and 16.4 million with reduced vision by 2050 from 2015 due to uncorrected refractive errors. In March 2023, the American Optometric Association (AOA) updated its guidelines by recommending annual eye exams for people aged 18 to 64, regardless of their eye health.

Moreover, the growing healthcare expenditure and initiatives made by government entities across the globe to increase the number of eye care professionals and ophthalmic clinical settings are encouraging the general population to undergo eye examinations. These initiatives are increasing awareness about eye health and encouraging people to carry out routine ophthalmic tests, which is anticipated to drive the demand for ophthalmic testing devices.

- According to the General Optical Council 2021 report, 29,480 optometrists, dispensing opticians, student optometrists, and student dispensing opticians registered in the U.K. since 2019, this number has increased by 2.80%.

Phoropter Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 160.75 million

- 2026 Market Size: USD 167.86 million

- 2034 Forecast Market Size: USD 233.79 million

- CAGR: 4.23% from 2026–2034

Market Share:

- North America dominated the global phoropter market with a 41.85% share in 2025, driven by a high prevalence of digital eye strain, increasing demand for routine vision care, and a growing number of ophthalmologists and optometrists across the U.S. and Canada.

- By product type, automated phoropters are expected to retain the largest market share in 2025, supported by their ease of use, integration with electronic health records, higher accuracy, and growing preference among eye care professionals for digital systems over manual alternatives.

Key Country Highlights:

- Japan: Market growth is driven by strong domestic players like NIDEK CO., LTD., increasing R&D activities, and advancements such as the Fully Assisted Refraction System (FARS), enhancing access to automated eye care systems.

- United States: Rising demand for eye exams due to aging population and computer vision syndrome prevalence supports phoropter sales; favorable reimbursement policies and AOA's 2023 recommendation for annual eye exams boost regular testing.

- China: Demand is supported by increasing healthcare investment, rising awareness of myopia management, and the adoption of advanced ophthalmic technologies in both urban and rural areas.

- Europe: The market benefits from increased awareness campaigns around myopia, regulatory encouragement for early eye exams, and the growing number of ophthalmology consultants, particularly within NHS-backed healthcare in the U.K.

COVID-19 IMPACT

Disruption in Supply Chains Amid Pandemic Hindered the Market Expansion

The outbreak of the COVID-19 pandemic led to negative growth in the overall global market in 2020. Supply chain disruptions due to travel bans, import and export difficulties, lockdowns, and lack of skilled workers during the pandemic hampered market growth. These disruptions affected the supply and demand of these devices in various clinical settings.

This disruption affected the operations of ophthalmic care and impacted the delivery of medical care globally. Ophthalmologists have been particularly impacted by the pandemic as most ophthalmic surgical procedures and examinations were elective, and a significant proportion of ophthalmologists’ patients are older, with a greater risk for comorbidities.

- As per an article published by the Community Eye Health Journal in 2020, the government of India announced a countrywide lockdown in response to which Arvind Eye Care System closed its vision centres and stopped offering refraction, routine outpatient services, elective surgery, and community outreach activities during the pandemic.

On the other hand, resumed operations of ophthalmic due to ease in COVID-19 restrictions supporting market expansion. Similarly, the revenues of market players involved in the phoropter market exhibited positive growth in 2021.

- For instance, according to the 2021 annual report of Topcon Corporation, the eye care business segment witnessed a year-on-year growth of 29.6% in 2021 from the -1.1% growth of 2020. The increase in sales of eye screening products drove the market growth.

Phoropter Market Trends

Growing Preference for Automated Phoropters Over Manual Phoropters

One of the prevailing global phoropter market trends observed, especially in developed countries, is the use of electronic and other types of advanced refraction systems by a number of eye care professionals, either in addition to or in replacement of manual ones.

Some industry players offer automated devices with the integration of laser technology, electronic health records, and communication interfaces, reducing the eye care professionals' manual work and minimizing the time spent on performing this procedure. It also saves the doctor from physical exertion and allows them to cater to more patients in a short duration.

- For example, the Phoropter VRx Digital Refraction System (Reichert, Inc.) is an automated system that is quiet and smooth. The system offers fast lens exchanges, split cylinder lenses, motorized prisms, and a quiet operation with a touchscreen display and ergonomic keypad. The system offers numerous pre-program tests and is easy to learn. The device connects to electronic medical records systems and numerous models of pre-test and acuity devices from both Reichert and non-Reichert brands.

The benefits offered by automated phoropters over manual phoropters due to the intensive integration of various technologies are reducing the workload of eye care professionals.

Download Free sample to learn more about this report.

Phoropter Market Growth Factors

Rising Prevalence of Refractive Errors is Likely to Augment Market Growth

One of the major factors for market growth is the growing prevalence of refractive errors across the globe, which is increasing awareness related to timely diagnosis of these diseases to reduce the economic burden of these disorders. The number of patients undergoing eye examinations is anticipated to drive the demand for ophthalmic testing devices.

- According to a study published by the British Journal of Ophthalmology in 2022, the prevalence of spherical equivalent myopia was 1.57% at 5-9 years and for hyperopia was 0.59% in the same age group in a multistate study in India.

Another factor that can lead to refractive error is the growing prevalence of chronic conditions, such as diabetes mellitus. Acute hyperglycemia is associated with myopic refraction. According to studies published by the Investigative Ophthalmology & Visual Science in March 2023, hyperglycemia leads to a myopic shift. Patients with diabetes mellitus had a significantly higher prevalence of myopia than those without diabetes mellitus.

Therefore, the growing prevalence of comorbidities is anticipated to increase the patient pool for refractive disorders, which is projected to increase the need for routine eye checkups. This is anticipated to drive the demand for these devices for measuring these refractive errors, leading to market growth.

Increasing Number of Optometrists is Anticipated to Increase Demand for Phoropters

Growing demand for eye care is anticipated to drive the adoption rate of refraction systems. The growing healthcare expenditure in various countries, coupled with initiatives introduced by government entities, is surging the patient population to undergo diagnosis of eye diseases.

The reimbursement policies for ophthalmic care and the increasing number of optometrists and ophthalmologists are driving the demand for eye care services. An increase in eye care services is anticipated to surge the demand for ophthalmic diagnostic devices, leading to market growth.

- For instance, as per an article published by the American Optometric Association in February 2023, the overall demand for medical eye care is expected to increase in size for the over-65 age group in the United States population. This age group is projected to account for 21% by 2030, with 73.1 million people and 23% by 2060.

The ageing population needs ophthalmic care, and the growing geriatric population is likely to increase the demand for eye care services, including diagnosis and treatment of various eye disorders. Moreover, the growing awareness about routine eye checks is increasing the patient pool of refractive disorders.

- Similarly, per an article published by the Review of Ophthalmology in September 2021, the U.S. population is increasing yearly by 1%, while senior citizens are increasing by 3% yearly. Seniors use nominally about ten times as much ophthalmic care as younger patients, which is increasing the demand for care by 5% per year. The demand for these devices is increasing with a rise in the diagnosis rate of various eye disorders.

RESTRAINING FACTORS

High Costs Associated with Automated Devices are Limiting Phoropter Adoption in Emerging Countries

Despite the growing prevalence of refractive errors and demand for medical eye examinations among the general population, some factors hinder market growth. One of the critical factors is the high costs associated with installing and maintaining automated systems. Even though the automated system generates a prescription for glasses or contact lenses in less than 20 seconds and with much better accuracy than existing methods, these devices are expensive which makes them less popular in countries with low healthcare budgets.

Moreover, it has been observed that there is a reluctance among healthcare professionals to replace manual devices with automated ones. This reluctance is due to the high cost of automated devices. This high cost is associated with the incorporation of advanced technologies, such as artificial intelligence and skilled professionals required for the smooth operation of clinical service. These factors are making the adoption of technology-advanced products more difficult in clinical settings.

- The price of a digital or automated phoropter depends on the model of a device and its manufacturer. For instance, as per Sky Optic, the overall phoropter price varies from USD 550 to USD 18,900. In this, the price of an automated one varies from USD 1,200 to USD 11,000.

High costs associated with the installation and maintenance of automated systems make them less affordable to small clinical settings, limiting the customer base and demand for these products. This may hamper the phoropter market growth potential of the market during the forecast period.

Phoropter Market Segmentation Analysis

By Product Type Analysis

Benefits Offered by Automated Phoropter Led to its Dominance

Based on product type, the global market is divided into manual and automated.

The automated segment dominated the global market in 2026, accounting for 84.86% of the market with a size of USD 142.44 million. The easy use and reduced time taken by automated ones to produce a prescription for glasses and contact lenses are majorly contributing to its increasing demand in the market. Moreover, the accuracy provided by automated ones compared to manual ones is anticipating its growing adoption. Therefore, the reduced time in the process of obtaining refractive corrections among patients aids clinicians in providing more information about other ocular health issues. These factors are major contributors to the growth of the segment in the market.

The manual segment accounted for a minimal share of the market in 2024. The minimal cost of installation associated with manual systems has majorly contributed to the growth of the segment. The limited budget of small hospitals, clinics and optometrists for the installation of a refractor machine is augmenting its growth among practitioners.

To know how our report can help streamline your business, Speak to Analyst

By End User Analysis

Increasing Private Practices Led to Ophthalmic Clinics Segment Dominance in 2024

The market is segmented on the basis of end user into hospitals, ophthalmic clinics, and others.

The ophthalmic clinics segment held a dominant share of the global phoropter market in 2026, accounting for 62.64% of the market with a size of USD 105.15 million. The growing focus of healthcare professionals on the expansion of their profitability is increasing the number of private ophthalmic clinics in developed and developing countries. Moreover, with an aim to expand their footprint, many of them also prefer to start or join a Management Service Organization (MSO) that a physician owns. These strategic footsteps taken by private practitioners for the expansion of their practices as individual clinics are contributing to the growth of these devices among practitioners and augmenting market growth.

The growth of the hospitals segment is attributed to the growing prevalence of refractive errors and other ocular diseases among the general population of developed and developing countries. This encouraged government authorities to increase the number of ophthalmologist consultants in their government facilities. For instance, according to an article published by The Royal College of Ophthalmologists in March 2023, around 87.0% of ophthalmology consultants are working within an NHS setting and around 68.0% of consultants are contracted to work full-time in the U.K.

The others segment includes mobile optometric services, care facilities, and optician stores. The segment is set to have a lower CAGR comparatively due to budget constraints, which makes installation of ophthalmic testing devices difficult in these settings.

REGIONAL INSIGHTS

In terms of geography, the global market is segmented into Europe, North America, Asia Pacific, and the rest of the world.

North America Phoropter Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 67.27 million in 2025 and dominated the market throughout the forecast period. The growing prevalence of refractive errors among the general population is due to the large number of individuals using computer screens for prolonged duration. This factor has contributed to increased demand for routine refractive vision care and has brought opportunities for new optometrists and optical chains to expand their presence in the region. For instance, according to an article published by the American Academy of Ophthalmology in May 2023, at least 60.0% of American men and 65.0% of American women have reported the symptoms of computer vision syndrome, also known as digital eye strain. The US market is projected to reach USD 58.48 million by 2026.

Europe held the second-largest market share. The prevalence of refractive errors among the European population has emphasized regulatory agencies to create awareness about ocular diseases among the general population. It has also released certain advice to avoid its incidence among the younger population. For instance, according to an article published by The International Agency for the Prevention of Blindness (IAPB) in March 2021, the prevalence of myopia in Europe has increased to almost 50% in the age group of 25 to 29. To combat this, the European Society of Ophthalmology has recommended a comprehensive eye examination for evaluating refractive error before a child starts school. The UK market is projected to reach USD 9.39 million by 2026, while the Germany market is projected to reach USD 21.83 million by 2026.

Asia Pacific accounted for a notable market share in 2024. The growing focus of manufacturers on research and development of technologically advanced and innovative products is majorly contributing to market growth in the region. For instance, in December 2022, NIDEK CO., LTD., one of the leading players in designing, manufacturing, and distribution of ophthalmic equipment, launched the Fully Assisted Refraction System (FARS), an optional kit for TS-610 NIDEK Tabletop Refraction System for performing subjective refractions. The Japan market is projected to reach USD 7.44 million by 2026, the China market is projected to reach USD 6.52 million by 2026, and the India market is projected to reach USD 2.86 million by 2026.

The rest of the world is expected to grow with a comparatively lower CAGR over the projected period. Lack of awareness regarding eye health and limited healthcare expenditure in countries of this region are responsible for its slower growth.

Key Industry Players

Reichert, Inc. and NIDEK CO., LTD. are Prominent Market Players Owing to their Strong Product Offerings

In the competitive scenario, the global market is partially fragmented due to the presence of many mid-size domestic players offering products for ophthalmic care. Some of the prominent players have established their presence in this market by increasing their product presence in various countries by making strategic alliances. These companies are Reichert, Inc. (AMETEK, Inc.), NIDEK CO., LTD., Essilor (EssilorLuxottica), ZEISS, and others.

Some other players operating in this industry are Topcon Corporation, Visionix, Rexxam Co., Ltd., Xenon Ophthalmics Inc., US Ophthalmic, S4OPTIKK, Adaptica, Huvitz, Advancing Eyecare, and others. These companies are focused on upscaling their production capacities and are expanding their product presence by making strategic collaborations. For instance, in January 2022, Advancing Eyecare acquired Santinelli International, one of the leading distributors of optical finishing equipment in the U.S. The acquisition was aimed to expand its geographical footprint and strengthen its market position.

List of Top Phoropter Companies:

- Topcon Corporation (Japan)

- NIDEK CO., LTD. (Japan)

- Reichert, Inc. (AMETEK, Inc.) (U.S.)

- ZEISS (Germany)

- Essilor (EssilorLuxottica) (France)

- Visionix (France)

- Rexxam Co., Ltd. (Japan)

- Marco (U.S.)

- Xenon Ophthalmics Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: NIDEK CO., LTD. collaborated with HOYA Vision Care, one of the leading developers of technologically advanced optical products.

- September 2022: AMETEK, Inc., acquired Navitar, Inc., a designer and manufacturer of customized, fully integrated optical imaging systems, components, and software.

- September 2021: Essilor Instruments launched Vision-S 700 Refraction Station, a standalone ultra-compact tabletop subjective refraction unit.

- July 2021: Topcon Corporation acquired VISIA Imaging S.r.l, an ophthalmic device manufacturer in Italy. The collaboration aimed to expand its geographical presence in the European region.

- March 2021: Visionix launched Visionix Eye Refract. The product is comprised of an automated binocular and digital phoropter, which is combined with wavefront-based auto-refractometry and keratometry.

REPORT COVERAGE

The global phoropter market analysis report provides qualitative and quantitative insights on the global market and a detailed analysis of the global market size & growth rate for all possible segments in the market. The report also provides an elaborative analysis of the market dynamics and competitive landscape. The report presents key insights, including the prevalence of refractive errors by key countries/regions, new product launches by key players, key industry developments, technological advancements in the market, and the impact of the COVID-19 on the global market.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.23% from 2026 to 2034 |

|

Unit |

Value (USD million) |

|

Segmentation |

By Product Type

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 160.8 million in 2025 to USD 233.79 million by 2034.

In 2025, the market in North America stood at USD 160.75 million.

The market will grow at a CAGR of 4.23% over the forecast period (2026-2034).

The automated segment led the segment in this market in 2025.

The rising prevalence of refractive errors and the emphasis of market players on introducing educational programs to increase awareness related to timely diagnosis are some of the major factors driving the global market.

Reichert, Inc., NIDEK CO., LTD., Essilor (EssilorLuxottica), ZEISS, and others are some of the prominent players in the global market.

North America dominated the market in 2025.

The growing emphasis of government and non-government organizations to increase awareness related to routine eye examinations is expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us