Healthcare Supply Chain Management Market Size, Share & Industry Analysis, By Component (Software, Hardware, and Services), By Delivery Mode (On-premise and Cloud-based), By End-user (Healthcare Providers, Healthcare Manufacturers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

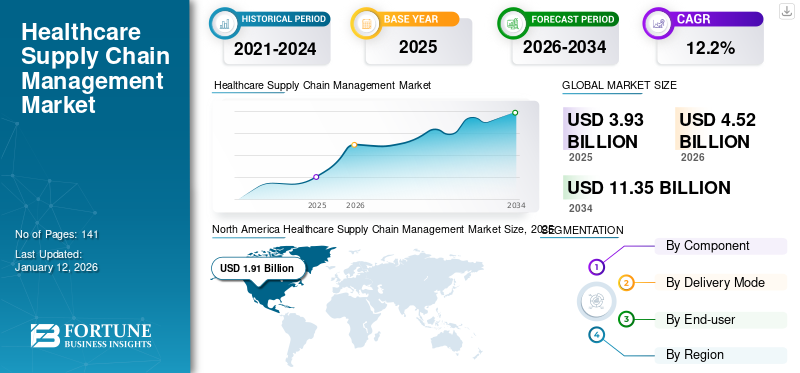

The global healthcare supply chain management market size was valued at USD 3.93 billion in 2025 and is projected to grow from USD 4.52 billion in 2026 to USD 11.35 billion by 2034, exhibiting a CAGR of 12.2% during the forecast period. North America dominated the healthcare supply chain management market with a market share of 48.6% in 2025.

Healthcare supply chain management monitors and manages the flow of healthcare products to eliminate inventory waste, reduce human error, and maximize patient care. It involves managing supplies, obtaining resources, and delivering products to providers and patients. The demand for effective supply chain management in the healthcare sector is increasing due to the rising adoption of cost-cutting strategies by hospitals and physicians. The efforts taken by several organizations to make their supply chain operations more agile and resilient have increased the demand for supply chain management solutions.

In addition, strategic collaborations and acquisitions among key players and hospitals have led to the higher deployment of SCM solutions. For instance, in March 2022, SYMPLR announced the acquisition of GreenLight Medical, Inc., a healthcare supply chain management company. The acquisition aimed to expand SYMPLR’s product portfolio and customer access to make more informed spending decisions.

In response to these positive trends in the market, several companies engaged in providing supply chain management solutions and services and invested considerably in R&D activities. These initiatives have led to the development of software and solutions catering to the specific demands of their clients. The launch of new solutions is set to strongly contribute to the growth of the market over the forecast period considering their adoption in a wide range of applications.

The COVID-19 pandemic brought significant challenges to supply chain operations across the globe. Multiple lockdowns put a temporary halt on the transportation of finished goods and raw materials, disrupting the manufacturing process. The healthcare systems also faced difficulty in their management services due to increased demand for medical services during the disruption in their supply chain operations. The market witnessed slow growth due to the lack of resilience in their supply chain operations. Before the pandemic, organizations focused on cost-effective strategies, which led to a redundant supply chain. Major companies also reported a decline in their revenue for the year 2020.

- For instance, McKesson Corporation reported an increase of 3.1% in their revenue for the year 2020 compared to 7.8% increase witnessed the previous year.

However, after the COVID-19 restrictions were lifted, the supply chain operations slowly gained traction, enabling the market to witness stable growth similar to pre-pandemic level. The growth was due to the companies’ focus toward adopting several strategies to mitigate supply chain disruptions during emergencies.

Healthcare Supply Chain Management Industry Landscape Overview

Market Size & Forecast

- 2025 Market Size: USD 3.93 billion

- 2026 Market Size: USD 4.52 billion

- 2034 Forecast Market Size: USD 11.35 billion

- CAGR: 12.2% from 2026–2034

Market Share

- North America held the largest market share of 48.6% in 2025, driven by strong presence of key solution providers (Oracle, McKesson), widespread technology adoption, and advanced healthcare infrastructure.

- By Component, Software dominated the market in 2026 due to growing adoption of cloud-based and AI-integrated platforms enabling efficient procurement, tracking, and inventory management.

Key Country Highlights

- United States: High adoption of cloud-based platforms and major initiatives like the Duke-Margolis drug supply chain resilience consortium are driving market growth.

- Japan: Investments in RFID tagging and barcode technologies are improving operational visibility and compliance in hospitals.

- India: The Government of Delhi’s USD 18.9 million project for a cloud-based health information system is fostering healthcare IT and SCM integration.

- Germany: AI-based platforms such as those developed by Vamstar (USD 9.5 million raised in 2022) support procurement and digital supply chain visibility.

Healthcare Supply Chain Management Market Trends

Growing Adoption of Radio Frequency Identification (RFID) to Improve Operational Efficiency

Rapid advancement in Radio Frequency Identification (RFID) technology has been improving the supply chain operations in multiple verticals of the healthcare system. RFID markers play key roles in the tracked distribution of pharmaceutical products and medical supplies. RFID enables the user to get notified about the product’s key information, including current stock level, expiration date, and other information about each product. RFID tags also help in asset management by tracking medical supplies, instruments, and equipment. Similarly, by tracking equipment and monitoring theft prevention, distribution management, and patient billing, this technology will reduce costs, improve supply chain management efficiency, and enhance patient safety.

Real-time tracking of healthcare products provides major opportunities and helps them improve customer service such as increasing efficiency of hospital processes and reducing wastes such as expired products, surplus inventory, and unnecessary staff movements. For instance, in August 2022, Bluesight, a medication intelligence company partnered with GENIXUS, an FDA-Registered repackager and 503B outsourcing provider. The partnership aimed to incorporate Bluesight’s RFID technology in KinetiX Propofol syringes, developed by Genixus. Therefore, the increasing use of RFID tagging in pharmaceuticals and medical supplies is positively influencing the stock control and overall supply chain.

Another notable trend in the market is blockchain technology. The transactions through this technology are proving to be a crucial monitoring technology for tapping into the entire process of medicine and medical products movement. Since all transactions are recorded onto the ledger, and each node within the blockchain maintains a record of the transaction, it is easy to verify the origin of the drug, the seller, and the distributor instantly.

Download Free sample to learn more about this report.

Healthcare Supply Chain Management Market Growth Factors

Launch of Advanced Supply Chain Solutions to Propel Market Growth

Organizations across the globe have had the opportunity to modify their services with the help of the latest technology, solutions, and tools. Globally, supply chain management has become popular, as organizations have started integrating their key business operations end-to-end.

Advanced software and solutions, such as e-procurement and advanced supply chain planning systems, are being launched by market players. These software solutions have multiple applications throughout the healthcare supply chain management system and can be used at various stages of supply chain management such as procurement, manufacturing, transportation, and storage.

- In January 2022, Bridge Medical GPO launched the e-Procurement platform at Arab Health 2022. The software platform was developed by JAGGAER, a supply management technology provider. The software allowed healthcare providers in the UAE to adopt best practices in procurement and supply chain management.

Furthermore, various solutions are launched to enhance transparency and make all the processes in an organization more efficient. These solutions help in lowering costs, automating procurement, and help in making supply chain processes effective to help clinicians focus more on patient care outcomes. Thus, by achieving better patient outcomes through streamlining supply chain operations across the healthcare system, these new solutions are contributing positively toward the healthcare supply chain management market growth.

Increasing Adoption of Cloud-based Solutions to Support Market Growth

Cloud-based systems provide certain advantages such as it helps in reducing capital expenses and operating costs. The technology does not require any hardware or IT infrastructure, helping companies streamline supply chain operations by bypassing capital investments. These solutions also help in consolidating multiple systems, such as warehouse management systems and transport spend management, which is critical for supply chain operations. The emergence of cloud-based technology helps healthcare organizations to coordinate and consolidate information with specific solutions to prevent miscommunications and missed savings.

Cloud computing also provides advantages such as cost-effectiveness to Small & Medium-scale Enterprises (SMEs) and on-premise IT systems, which can reduce the total cost of ownership through pay-per-use. Therefore, the advantages associated with this technology have led healthcare systems across the globe to implement cloud based software solutions in their supply chain operations.

The increasing inclination of healthcare organizations toward adopting software solutions to streamline their supply chain operation has led to the growing demand for cloud-based software in the market. Therefore, to cater to the growing demand, major players are working toward strategic alliances for the management of supply chains in health systems.

- For instance, in October 2022, Methodist Hospital in Indiana announced its partnership with Infor, a cloud solution company. The partnership aimed to develop a cloud-based healthcare application to standardize healthcare supply chain management and other operations.

In addition, several healthcare organizations are improving their inventory management with the help of cloud-based supply chain management software.

- For instance, in November 2023, Oracle added new mobile capabilities to Oracle Fusion Cloud Inventory Management as a part of Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). This updated Oracle Fusion SCM helps healthcare organizations optimize stock availability and improve patient care.

Thus, the increasing demand for cloud-based solutions for the healthcare supply chain management, along with the strategic alliances among market players, is expected to support the market growth.

RESTRAINING FACTORS

High Costs Associated with the Supply Chain Management Software to Restrict Market Growth

Supply chain management software can be expensive whether it is being installed or upgraded. The cost generally depends on the number of applications provided by the software. Furthermore, expensive provider preference items and lack of health IT implementation for supply chain functions along with limited hidden cost transparency also results in high costs. The high cost associated with the implementation of these solutions acts as a limitation to the growth of the market as it limits the adoption rate. Therefore, managing these costs is one of the major concerns among healthcare facilities.

Moreover, the installation cost incurred by healthcare organizations is also very high as they have to bear the recurring subscription cost, restricting the adoption of such solutions in healthcare organizations.

- For instance, the software offered by Control Data Inc. (ProcurePort), which is a procurement software that costs around USD 199 per month. In addition, the cost of Flowtrac software required for procurement is around USD 100 per month.

In addition, several factors increase the cost of supply chain management software, including complexity, customization requirements, and integration capabilities.

The high cost of healthcare supply chain management solutions and services has led to slower adoption of supply chain management services in healthcare organizations, impacting market growth.

Healthcare Supply Chain Management Market Segmentation Analysis

By Component Analysis

Growing Adoption of Technologically Advanced Software to Drive Segment Growth

Based on component, the market is segmented into software, services, and hardware. The software segment dominated the market due to the launch of new applications to make the supply chain management operations more efficient. The software segment accounted for the largest share of 56.86% in 2026. Furthermore, the rising adoption of technologically advanced software for managing the workflow in healthcare organizations also leads to segment growth.

The services segment is estimated to grow with a notable CAGR during the forecast period. This is due to the growing focus of major organizations toward outsourcing their supply chain services to facilitate efficiency and business growth.

The hardware segment held a significant market share due to the growing adoption of hardware systems by healthcare organizations. Therefore, to cater the increased demand, organizations are focusing on introducing new solutions.

To know how our report can help streamline your business, Speak to Analyst

By Delivery Mode Analysis

Increasing Launches of Cloud-based Solutions to Boost the Growth of the Segment

On the basis of delivery mode, the market is bifurcated into on-premise and cloud-based. The cloud-based segment accounted for a significant market share in 2024. The higher share of the segment is attributed to the associated advantages such as mitigation, monitoring, and identification of supply chain risks, vulnerabilities, and disruptions. Furthermore, the platform enables collaborative information sharing, which helps the growth of the segment. The advantages lead to an increase in product launches by companies, propelling segment growth.

- For instance, in April 2023, Oracle announced the launch of new capabilities across Oracle Fusion Cloud Applications Suite. The solution was launched with an objective to help customers accelerate supply chain planning, increase operational efficiency, and improve financial accuracy.

In addition, several hospitals and healthcare systems across developed countries are adopting cloud-based tools to enhance efficiency in healthcare operations.

- For instance, as per the data published by Cision US Inc. in September 2023, around 70.0% of the healthcare facilities, including hospitals, have adopted a cloud-based approach to supply chain management, helping them to improve efficiency and agility, enhance decision-making, improve data security, lessen costs, and privacy and streamline processes.

The on-premise segment accounted for a comparatively low market share of 57.08% in 2026. However, the increasing focus of companies on the development of on-premise software is projected to support the market growth. Additionally, the advent of cloud-based technology and the organizations opting for cloud-based deployment are supporting the growth of this segment.

By End-user Analysis

Growing Adoption of Supply Chain Management Solutions by Healthcare Providers to Augment Segment Growth

On the basis of end-user, the market is segmented into healthcare providers, healthcare manufacturers, and others. The healthcare providers segment held the significant market share of 49.78% of 2026, due to the rising adoption of cloud-based software solutions by hospitals and other healthcare facilities. This is one of the key drivers that impacted the growth of this segment.

- In September 2021, Aknamed, a cloud-based healthcare supply chain management platform in India, was purchased by digital pharmacy PharmEasy. It provides a supply chain platform that enables hospitals to simplify, optimize, and monitor procurement and consumption using cloud-based technology.

The healthcare manufacturers segment accounted for a substantial share due to increasing emergence of cloud-based solutions for inventory management, leading to the segment’s growth. Additionally, growing adoption of SaaS software among healthcare manufacturers also fueled the segment growth during the forecast period.

REGIONAL INSIGHTS

North America

North America Healthcare Supply Chain Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the healthcare supply chain management market size and was valued at USD 1.91 billion in 2025. The presence of major companies providing supply chain management solutions is one of the major factors driving regional growth. Additional factor favoring the North America market growth is the increasing adoption of supply chain management solutions by healthcare providers in the region. In addition, several healthcare organizations are collaborating and forming consortiums to reduce the chances of drug shortages. The U.S. market is valued at USD 1.92 billion by 2026.

- In March 2023, the Duke-Margolis Center for Health Policy introduced a new consortium to recognize effective solutions that support a resilient drug supply chain with advanced manufacturing capabilities and, eventually, reduce the frequency and severity of drug shortages.

- For instance, in August 2021, e2open, a connected supply chain software platform, announced that the company entered into a strategic partnership with Vizient, Inc. The partnership was aimed to develop a multi-party collaboration platform to increase visibility among healthcare providers, suppliers, and distributors.

Europe

Europe is projected to grow at a considerable CAGR over the forecast period. This is due to the increasing adoption of tags, RFID, and barcodes for tracking of drugs and other healthcare products. In addition, increasing government funding for the development of AI-based solutions in a few countries in this region is projected to support the market growth. The UK market is valued at USD 0.38 billion by 2026, while the Germany market is valued at USD 0.33 billion by 2026.

- For instance, in June 2022, Vamstar, a start-up that connects healthcare buyers and suppliers using artificial intelligence, secured around USD 9.5 million in Series A funding. The company aimed to utilize the fund to expand AI-based global healthcare supply chain platforms.

Asia Pacific

Asia Pacific is anticipated to register a comparatively higher CAGR over the forecast period due to increasing demand for cloud computing. Furthermore, advancements in healthcare IT infrastructure and increasing number of government investments also contribute to regional growth. The Japan market is valued at USD 0.17 billion by 2026, the China market is valued at USD 0.20 billion by 2026, and the India market is valued at USD 0.12 billion by 2026.

- For instance, in August 2021, the Government of Delhi set up a cloud-based integrated health information management system across its hospitals. The funding of USD 18.9 million was approved by the city government's cabinet. A contract to develop the system was awarded to IT provider NEC Corporation, India.

The rest of the world market is expected to grow rapidly over the study period. This is due to factors such as the launch of new software and the adoption of new scanning technologies among healthcare providers and distributors.

- For instance, in June 2022, the increased adoption of digital health services in Africa led many startups to launch healthcare supply chain services to digitize distribution to their customers.

List of Key Companies in Healthcare Supply Chain Management Market

Strong Product Offerings by Key Players to Propel Market Growth

In terms of the competitive landscape, the market has various players, ranging from large to small players. Regarding the present market scenario, Tecsys Inc., Oracle, and McKesson Corporation hold a comparatively dominant share. The dominance can be attributed to their vast product offering and their focus on new product and service launch.

- For instance, in February 2022, Alithya Group Inc. implemented Oracle Cloud Enterprise Resource Planning (ERP) and Human Capital Management (HCM) for Northbay Healthcare to support their core financials and supply chains.

McKESSON Corporation holds a significant share in the market due to the company’s efforts to invest in analytical programs to mitigate risks. Furthermore, the company has a robust global presence, with operations in more than 14 countries.

Similarly, Tecsys Inc. marked a presence in the global market by expanding its operations in more than 100 countries. The company is focused on adding new applications to its existing solutions to cater to the demands of its clients. Furthermore, the organization partnered with other companies to optimize their supply chain operations through their product offerings.

- For instance, in August 2022, Tecsys Inc. announced that Stanford Health leveraged the Tecsys Elite healthcare supply chain platform to automate and systemize data capture and optimize their operations.

Henry Schein, Inc., Cardinal Health, Global Healthcare Exchange, LLC., and Epicor Software Corporation are a few of the other players operating in this market. These companies have slowly established their market presence due to the launch of new and advanced solutions for supply chain management in a healthcare setting.

Global Healthcare Exchange, LLC. is working toward making a substantial presence in the market through multiple product offerings. The company currently has 15,000 supply divisions, of which 600 are integrated global suppliers.

- For instance, in February 2022, Global Healthcare Exchange, LLC. acquired Syft, a provider of AI-enhanced inventory control and end-to-end supply chain management. The acquisition helped the company to expand its existing portfolio for healthcare supply chain management solutions.

LIST OF KEY COMPANIES PROFILED:

- Oracle (U.S.)

- Tecsys Inc. (Canada)

- Global Healthcare Exchange, LLC. (U.S.)

- Ascension (U.S.)

- Ochsner Health (U.S.)

- Banner Health (U.S.)

- Henry Schein, Inc. (U.S.)

- McKesson CORPORATION (U.S.)

- Cardinal Health (U.S.)

- Epicor Software Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2022- Oracle announced that WellSpan Health opted for Oracle Fusion Cloud Application Suite to unify operations and improve their business visibility. The application would help in integrating its finance, supply chain, and HR processes.

- May 2022- Global Healthcare Exchange, LLC. announced a collaboration with Healthcare Industry Resiliency Collaborative (HIRC) to create a transparent and resilient supply chain in the healthcare industry.

- February 2022: Cardinal Health announced a partnership with Kinaxis RapidResponse platform to increase medical product visibility and supply chain agility.

- January 2022: Tecsys Inc. announced the commercialization of its automated inventory management and management insight solutions to be used in the clinical lab environment.

- May 2021- HealthPartners formed a partnership with Oracle to move their business to the cloud with the help of Oracle Fusion Cloud Applications Suite. The application would help modernize and streamline work, which is essential for the growth of HealthPartners.

REPORT COVERAGE

The market research report provides detailed market analysis and focuses on key aspects such as the overview of pricing analysis, regulatory scenario by key regions/countries, PESTLE analysis, and PORTER’s five forces. Additionally, it includes an overview of key industry developments such as mergers, acquisitions, and partnerships. Besides these, the report offers insights into market trends and highlights key strategies by market players. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.2% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

|

|

By Delivery Mode

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 4.52 billion in 2026 to USD 11.35 billion by 2034.

In 2025, North America stood at USD 1.91 billion.

Growing at a CAGR of 12.2%, the market will exhibit steady growth during the forecast period (2026-2034).

The software segment is expected to be the leading segment in this market during the forecast period.

The growing awareness regarding the need for supply chain management solutions along with increasing adoption of advanced solutions drives the global market.

Tecsys, Inc., McKesson Corporation, and Oracle are some of the major market players.

North America dominated the market in 2026.

The implementation of training programs for providers and manufacturers is expected to drive the adoption of these solutions.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us