Load Bank Market Size, Share & COVID-19 Impact Analysis, By Current (AC and DC), By Site (Portable and Stationary), By Type (Resistant/Reactive Load Bank, Resistive Load Bank, and Reactive Load Bank), By End-User (Power Generation, Data Centers, Oil and Gas, and Others), and Regional Forecast, 2026-2034

Load Bank Market Size

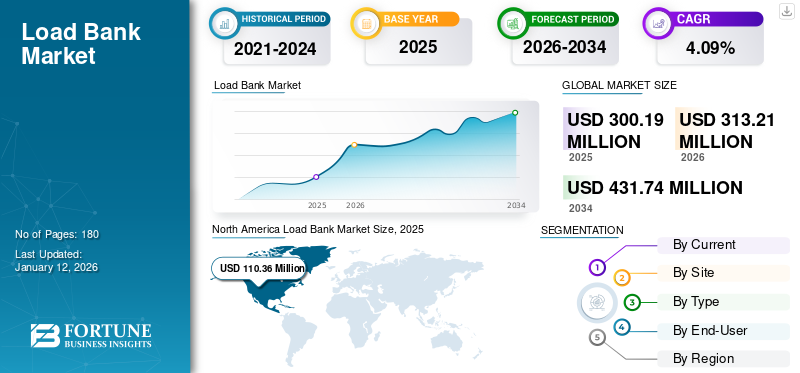

The global load bank market size was valued at USD 300.19 million in 2025. The market is projected to grow from USD 313.21 million in 2026 to USD 431.74 million by 2034, exhibiting a CAGR of 4.09% during the forecast period. North America dominated the global market with a share of 36.76% in 2025. The Load Bank Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 131..27 million by 2032.

A load bank is a device or system designed to provide an artificial electrical load for testing and validating the performance of electrical power sources, such as generators, uninterruptible power supplies (UPS), and electrical systems. It helps ensure that the power source or system can operate at its full capacity and efficiency when needed. These banks come in various sizes and configurations, allowing for different types of testing, including capacity testing, thermal testing, voltage regulation testing, and others.

The market is driving due to these configurations and various capacities of products. They are commonly used in industries, such as telecommunications, data centers, and manufacturing to verify the reliability and functionality of power equipment.

COVID-19 IMPACT

Supply Chain Disruptions Caused by COVID-19 Pandemic Hampered Market Growth

Many non-essential businesses, especially those in the hospitality, entertainment, and retail sectors, were forced to shut down temporarily. This included manufacturing plants, factories, and industrial facilities that were not deemed critical to essential services. Disruptions in global supply chains meant that some industries faced shortages of essential components and materials. This affected their ability to manufacture and maintain equipment, including load banks. Many load banks are manufactured with components sourced from various suppliers, both domestic and international. Lockdowns, travel restrictions, and factory closures in different parts of the world disrupted the production and supply of load bank components, which led to delays in manufacturing these banks.

Load Bank Market Trends

Increasing Demand for Data Center Load Banks is Propelling Market Growth

Data centers use backup power systems, such as uninterruptible power supplies (UPS) and generators, to maintain continuous operations during electrical outages. These banks are employed to test these systems regularly. They simulate various load conditions to ensure that the backup power systems can seamlessly take over in case of a power failure. However, the increasing demand for load banks in data centers is driven by the critical need to ensure uninterrupted power supply and the reliability of backup power systems. For instance, by 2026, India is planning to install 693 MW of Data Centers, which requires an investment of USD 4.4 billion.

Download Free sample to learn more about this report.

Load Bank Market Growth Factors

Integration of Emerging Technologies Will Propel Market Growth

The load bank market growth is being significantly influenced by the integration of emerging technologies, which enhance testing capabilities, data collection, and operational efficiency. Digital twin technology allows load banks to create virtual replicas of physical load banks and power systems. This integration provides real-time simulations and monitoring, enabling operators to visualize and analyze load bank performance remotely. IoT sensors and connectivity are increasingly integrated into load banks. These sensors collect data on load conditions, temperature, voltage, and frequency, among other parameters. Operators can access this data remotely, enabling proactive maintenance, early fault detection, and the optimization of load bank performance.

Renewable Energy Integration Is Boosting Market Growth

Renewable energy sources, such as solar and wind power, can be intermittent, and their output can fluctuate based on weather conditions. Due to involvement of renewable energy integration solution, the market is boosting. Load banks are used to simulate grid conditions and test how renewable energy systems respond to variations in load, helping to ensure grid stability and reliability. Load banks are essential for the performance testing of renewable energy systems. They are used to simulate both partial and full electrical loads on renewable energy installations, allowing operators to assess how well these systems perform under different conditions. Load banks are used to test inverters, which are crucial components in converting the DC power generated by solar panels or wind turbines into AC power suitable for the electrical grid. Inverter testing ensures their reliability and efficiency. For instance, in September 2023, Sterling and Wilson’s Renewable Energy secured a 300 MW EPC project in Gujarat.

RESTRAINING FACTORS

High Initial Cost May Hinder the Market Expansion

Load banks, especially those with high power capacities or specialized features, can represent a significant capital investment for businesses and organizations. The cost of purchasing along with associated accessories and installation expenses, can be substantial. Many organizations operate within budget constraints, and capital expenditures, including the acquisition of load banks, must compete with other essential priorities. During times of economic uncertainty or financial constraints, such as economic downturns or budget cuts, organizations may be hesitant to allocate funds. The high cost is restricting the market growth, affecting the overall industry.

Load Bank Market Segmentation Analysis

By Current Analysis

Integration of Advanced Control Systems Led the AC Load Banks Segment Growth

Based on current, the market is segmented into AC and DC.

AC segment held a larger share of 73.26% in 2026. AC load banks have seen trends such as the integration of advanced control systems for precise load adjustments, remote monitoring and control capabilities, and a focus on energy efficiency to reduce operational costs. These factors influence the more usage of load bank and hence, propelling the market growth.

DC load bank is second dominating and have experienced trends such as the development of load banks with high-resolution data acquisition and monitoring capabilities. These trends help in more adoption leading to drive the market growth.

By Site Analysis

Portable Segment Led the Market Owing to Its Mobility and Easy Transportation

Based on Site, the market is segmented into portable and stationary.

The portable segment dominated the market share of 71.67% in 2026 owing to their design for mobility and can be easily transported to different locations for on-site testing.

Moreover, a stationary load bank is second dominating and it is a piece of equipment designed for testing and validating the performance of power systems and electrical equipment.

By Type Analysis

Resistant/Reactive Load Bank Leads the Market Owing to Its Versatility

Based on type, the market is segmented into resistant/reactive load bank, resistive load bank, and reactive load bank.

The resistant/reactive load bank segment is leading in the market share of 67.10% in 2026 owing to its versatility and capability to stimulate a wide range of real-world loads.

The resistive load bank segment holds a significant share in the industry. The increasing power consumption and the need for efficient power infrastructure contribute to the growth of the resistive load bank segment globally. It provides a controlled electrical load for generators, ensuring their performance and reliability.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Power Generation Segment Holds a Dominating Share Owing to Its Ability to Test and Validate Various Systems

Based on the end user, the industry is divided into power generation, data centers, oil & gas, and others.

A power generation segment holds the dominating market share of 39.31% in 2026 and it is a specialized piece of equipment used for testing and validating the performance of power generation systems, including generators, power plants, and other sources of electrical power.

The data center segment is second dominating segment holding a significant load bank market share for several reasons. Data centers are at the core of modern businesses, serving as the backbone for digital operations and information storage.

The oil & gas segment plays a crucial role in the global market, where the demand for robust power infrastructure is paramount for the exploration, extraction, and refining operations characteristic of this industry. The other segment includes industries, such as healthcare, utilities, and construction, among others.

REGIONAL INSIGHTS

Geographically, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Load Bank Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

North America is a significant market and the dominating region for the market, driven by a robust industrial base, data centers, and the need for reliable backup power systems. Regulatory compliance and the adoption of renewable energy technologies further boosts the demand in this region. The U.S. market is projected to reach USD 106.38 billion by 2026.

Europe

In Europe countries, such as Germany, France, and the U.K. have mature markets due to established industries, data centers, and infrastructure. The emphasis on energy efficiency and sustainability contributes to market growth. The UK market is projected to reach USD 7.08 billion by 2026, while the Germany market is projected to reach USD 8.23 billion by 2026.

Asia Pacific

The Asia Pacific region, particularly countries, such as China and India, has witnessed rapid industrialization over the years. This industrial growth has led to a significant demand for load banks for testing and maintaining backup power systems, generators, and electrical equipment in manufacturing facilities, construction sites, and other various industries. The Japan market is projected to reach USD 5.55 billion by 2026, the China market is projected to reach USD 50.84 billion by 2026, and the India market is projected to reach USD 9.93 billion by 2026.

Latin America

The market in Latin America is characterized by several factors such as usage of electricity in various industries that contribute to its dynamics and growth. The industrial and energy sectors in Latin America are significant drivers of the market. Industries such as mining, oil and gas, manufacturing, and telecommunications rely on load banks for testing and maintaining backup power systems, generators, and electrical equipment.

Key Industry Players

Growing Key Players Focus on Mergers and Acquisitions to Propel Market Expansion

The global market is highly competitive, with multiple players active across different distribution channels. Industry players are emphasizing on the introduction of new hybrid transformers with new technologies to increase customer reach. Additionally, the organizations enter into merger and acquisition deals to expand their technological horizons.

Numerous companies are actively operating across different countries to cater to the specific demands of the customers. Schneider Electric and Cummins Inc. are expected to account for a significant market share owing to their extensive range of product portfolios along with their strong brand value. Furthermore, the companies are also focused on enhancing their sales, distribution, and marketing channels through partnerships with different local associates to fortify its product reach across North America.

Additionally, other key participants operating in the industry include Hubbell Incorporated, Power House Manufacturing, The Vanien Grop, LLC, Eagle Eye Power Solutions LLC, and others, leading in providing various load banks across different verticals. Consequently, numerous other small and medium players are present across the industry with different capacity products to power continuous, peak, and standby load requirements.

LIST OF TOP LOAD BANK COMPANIES:

- Asco Power Technologies (Schneider Electric) (U.S.)

- Avtron Power Solution (U.K.)

- Mosebach Manufacturing Company (U.S.)

- Simplex, Inc. (Israel)

- Crestchic Limited (U.K.)

- Testek Solutions (U.S.)

- Sephco Smartload Banks (U.S.)

- Hebei Kaixiang (China)

- Tatsumi Ryoki (Japan)

- Metal Deploye Resistor (France)

KEY INDUSTRY DEVELOPMENTS:

- May 2023 – Crestchic provided formal load bank training to one of the most elite naval forces globally after the arrival of its 3000 kVA, 3-phase load bank with NOVA control hardware and Orion user interface. The load banks were tested for their resistance of over 550 megaohms at 500V and were later placed in a 10ft ISO container.

- September 2022 – Eagle Eye Power Solution has expanded and moved its headquarters to Mequon, Wisconsin, with an onsite battery learning lab as part of Eagle Eye University headquarters. Eagle Eye also added a services headquarters in 2021, Eagle Eye Services, located in Grain Valley, MO.

- June 2022 – Cummins Inc. has launched a new 1MW twin-pack rental generator, the C1000D6RE, which offers a competitive rental power solution for various applications throughout North America. Manufactured by Cummins, a company that has been synonymous with technology, reliability, and service since 1919, the new C1000D6RE model will be built in Fridley, Minnesota. This product ensures greater reliability for rugged portable power applications and others. The generator’s container is capable of withstanding extreme weather conditions.

- May 2022 – Schneider Electric, a global leader in energy management and automation, has entered into a definitive agreement to acquire AutoGrid, a prominent player in AI-driven optimization for distributed energy resources (DERs). The completion of this acquisition is contingent on regulatory approval and standard closing conditions, with expectations set for Q3 2022. Through this acquisition, AutoGrid anticipates benefiting from Schneider Electric's extensive resources and global presence, enabling an expedited growth trajectory and fostering innovation in product development.

- May 2020 – Crestchic and US-based Hawthorne Cat have recently made a significant investment in their load bank rental fleet. With increased demand for load bank rentals throughout the U.S., the deal will strengthen the market and ensure that customers have access to the latest technology. To meet increased demand, Hawthorne turned to Crestchic to supply three new 30-foot containerised 2500 kVA resistive-reactive medium voltage load banks.

REPORT COVERAGE

The research and business intelligence report offers an in-depth analysis of the market. It further provides details on the adoption of load banks across several regions. Information on trends, drivers, opportunities, threats, and restraints of the market can further help stakeholders gain valuable insights into the market. The report offers a detailed competitive landscape by presenting information on key players in the market, along with their strategies.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.09% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Current

By Site

By Type

By End-User

|

|

By Region

|

Frequently Asked Questions

A study by Fortune Business Insights states that the global market was USD 313.21 million in 2026.

The global market is projected to grow at a CAGR of 4.09% over the forecast period.

North America dominated the global market with a share of 36.76% in 2025.

Based on end-user, the power generation segment holds a dominating share of the global market.

The global market size is expected to reach USD 431.74 million by 2034.

Emerging technologies in the market will propel the market growth.

Asco Power Technologies, Avtron Power Solution, Mosebach Manufacturing Company, etc., are the top players actively operating across the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us