Medical Laser Market Size, Share & Industry Analysis, By Type (Surgical Lasers, Dental Lasers, Aesthetic Lasers, and Others), By Product (Laser Systems and Consumables), By End User (Hospitals and Specialty Clinics), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

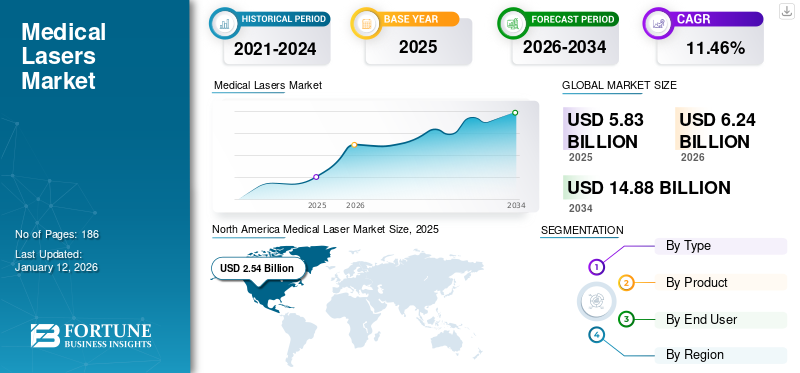

The global medical laser market size was valued at USD 5.83 billion in 2025. The market is projected to grow from USD 6.24 billion in 2026 to USD 14.88 billion by 2034, exhibiting a CAGR of 11.46% during the forecast period. North America dominated the medical lasers market with a market share of 43.57% in 2025.

Laser therapy is a medical treatment that uses an intense beam of light to cut, burn, or destroy tissue. The term LASER stands for Light Amplification by Stimulated Emission of Radiation. Lasers are used in many areas of medical treatment. The earliest medical applications of lasers were in ophthalmology and dermatology. Presently, they are widely used for numerous medical applications such as angioplasty, cancer treatment, liposuction, and others. Medical lasers are a non-invasive and intensive light source to treat tissue and provide quick healing without scarring or discoloration. The escalating need for the treatment of several diseases and intensifying need for non-invasive treatments are some of the factors propelling the market growth.

The rising demand for minimally invasive and cosmetic procedures is poised to boost the market growth rate during the forecast period. For instance, according to 2022 report published by The British Association of Aesthetic Plastic Surgeons (BAAPS), a total of around 31,057 cosmetic surgery procedures were carried out in 2022 in the U.K., witnessing an increase by 102% as compared to the previous year.

The increasing demand for medical treatments related to age-related conditions, such as eye surgeries and vascular procedures, and the growing demand for aesthetic laser procedures in developing countries are anticipated to boost market growth. According to the American Society for Aesthetic Plastic Surgery (ASAPS), the American population spends more than USD 13 billion on several aesthetic treatments, including acne prevention, body contouring, dermal resurfacing, and others. This is expected to foster the demand for these procedures further.

The market witnessed severe impact of the COVID-19 pandemic. Lockdowns imposed globally during the pandemic had reduced the demand for medical lasers. Both in hospitals and other specialty clinics, patients undergoing laser surgeries were reduced drastically. For instance, according to the 2020 report by American Society of Plastic Surgeons, 757,808 laser hair removal procedures were performed in 2020, in comparison to 1,055,456 laser hair removal procedures in 2019, declining by around 28% as compared to the previous year.

Post-pandemic, the market witnessed an increase in demand for medical lasers as there was a decrease in the number of COVID-19 cases and healthcare facilities resumed surgical procedures. In 2021, Iridex Corporation witnessed an increase of 48.3% in its revenue for laser systems. Also, the company reported a revenue of USD 53.9 million. The market is projected to witness strong growth prospects over the forecast period.

Global Medical Laser Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 5.83 billion

- 2026 Market Size: USD 6.24 billion

- 2034 Forecast Market Size: USD 14.88 billion

- CAGR: 11.46% from 2026–2034

Market Share:

- North America dominated the medical laser market with a 43.57% share in 2025, driven by the rising demand for minimally invasive medical procedures, high preference for cosmetic treatments, and early adoption of advanced technologies.

- By type, surgical lasers accounted for the largest market share due to the increasing number of minimally invasive surgeries, technological advancements, and growing prevalence of chronic and ophthalmic disorders.

Key Country Highlights:

- United States: Strong demand for cosmetic and minimally invasive surgeries, along with rapid adoption of technologically advanced laser systems, is propelling the market.

- Europe: Increasing popularity of aesthetic procedures and rising awareness towards minimally invasive treatment options are driving regional demand.

- China: Growing medical tourism, rising disposable incomes, and expansion of cosmetic laser centers are key factors contributing to market growth.

- Japan: High demand for anti-aging treatments and a strong focus on non-invasive procedures are accelerating the adoption of medical lasers.

Medical Laser Market Trends

Growing Technological Advancements to Drive the Market Growth

According to the Refractive Surgery Council, laser vision correction procedures increased in the U.S. Moreover, in the third quarter of 2021, laser vision correction procedure volume increased by 48.0% from 2020, with an upward trend in processes such as LASIK, SMILE, PRK, and others. In the areas of skincare and dermatology, the focus has now shifted from conventional methods of treatment to advance technologies.

The adoption of minimally invasive anti-aging, skin lighting, and pigmentation removal treatment options is anticipated to upsurge the market growth during the forecast period. The rising number of eye disorder cases and the launch of technologically advanced products are subsequently increasing the number of non-invasive surgeries performed using laser systems, which is likely to boost industry growth. For instance, in January 2024, IRIDEX Corporation launched Iridex 532 and Iridex 577 Lasers in the U.S. Both of these lasers are made up of the company’s patented MicroPulse Technology and can be optimized for the treatment of retinal disorders and glaucoma.

Download Free sample to learn more about this report.

Medical Laser Market Growth Factors

Rising Demand for Minimally Invasive Procedures to Foster Market Growth

The increasing popularity of minimally invasive procedures, the growing number of cosmetic surgery, and the rising incidence of eye disorders are some of the major factors promoting the market’s growth. In addition to this, the increasing prevalence of congenital heart diseases, coronary artery diseases, glaucoma, age-related macular edema, and other diseases are also anticipated to fuel the growth of the market.

- According to a 2021 report published by The Aesthetic Society, there were 431,485 skin treatment procedures with combination lasers in 2021, showing a growth of approximately 55% as compared to 2020, wherein the number of procedures was around 278,310.

The safety offered by medical lasers in the treatment of tissue without injuring the surrounding area of the patient has further contributed to its growing popularity and increasing adoption among healthcare providers. Moreover, the introduction of new lasers, with procedure-specific applications and innovative technology integration, are some of the major factors boosting the market during the forecast period. For instance, in August 2020, cosmetic and medical laser manufacturer Erchonia Corporation launched a new low-level green laser designed for body fat reduction, this device emits 10 green lasers onto the skin, aiming to emulsify the adipose tissue and release excess fatty materials.

The growing number of cosmetic procedures, coupled with entry of new market players offering innovative systems are factors propelling the growth of the market in 2023.

Introduction of Technologically Advanced Aesthetic Lasers to Boost the Product Demand

Increasing consciousness of physical appearance is one of the reasons influencing people to adopt the minimally invasive cosmetic procedures globally. In addition, the growing popularity of aesthetic treatments among diverse populations and the increasing concerns of the young population toward skin-related issues such as wrinkles and pigmentation have subsequently surged the demand for less invasive and less time-consuming laser aesthetic procedures. This factor is likely to increase demand for aesthetic laser systems and consumables, hence anticipated to drive the medical laser market growth.

The introduction of technologically advanced procedure-specific aesthetic laser systems is majorly attracting the female population to undergo skin treatments for faster results in less time. The growing demand for procedure specific laser treatments is impelling key market players to introduce novel energy-based aesthetic laser systems.

- For instance, Quanta System and El.En. S.p.A., successfully developed a new technology in laser lithotripsy, NextGen laser development technology named UHPTDL offering widest frequency range. The new solution promises to offer extremely fast and efficient kidney stone dusting treatments.

RESTRAINING FACTORS

High Cost and Side Effects Associated with Laser Surgeries to Limit Product Adoption

The high cost associated with the laser surgery procedures is limiting their adoption in developed as well as emerging markets. The complications associated with the laser surgeries, such as scarring, koebnerization, dyschromia, and others, are also limiting the growth of the market.

- According to a 2021 article published by All About Vision, the average cost of laser refractive surgery in 2019 was around USD 2,300 in 2019, which was around USD 2,100 in 2017.

Additionally, alternative treatments, which are available at lower cost and have fewer side effects as compared to laser procedures, are being preferred by healthcare providers to avoid complications.

This is further augmented by high cost of medical laser systems, especially procedure specific laser systems in the emerging countries. This has limited the adoption and demand for new laser systems in several countries, and has led to the emergence of refurbished market for these systems.

The aforementioned factors together have been instrumental in limiting the demand for new laser systems in the global market.

Medical Laser Market Segmentation Analysis

By Type Analysis

Increasing Minimally Invasive Procedures to Add an Impetus to the Demand for Surgical Lasers

Based on type, market is segmented into surgical lasers, dental lasers, aesthetic lasers, and others.

The surgical lasers segment dominated the market with a share of 57.96% in 2026. and anticipated to grow at a comparatively higher CAGR. The factors include increasing technological advancements, high prevalence of chronic diseases, growing implementation for minimally invasive surgeries, and rising prevalence of ophthalmic disorders. The growing number of surgical procedures owing to the increasing technological advancements in medical laser technology and procedures is expected to fuel the segmental growth.

- According to the 2021 report published by The Aesthetic Society, the surgical procedures increased by 54% in 2021 as compared to the previous year.

On the other side, the aesthetic lasers segment accounted for the second largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth of the segment is attributed to increasing number of minimally invasive cosmetic surgical procedures.

- For instance, according to statistics published by the International Society for Aesthetic Plastic Surgery (ISAPS) in September 2023, the number of procedures performed by plastic surgeons increased by 11.2% in 2022, among which 14.9 million were surgical.

- According to the 2020 report published by the American Society of Plastic Surgeons (ASPS), the number of minimally invasive cosmetic procedures in 2019 was around 15.7 million witnessing a growth of more than 150% as compared to 2000.

Dental laser segment is anticipated to grow at a significant CAGR due to increasing prevalence of dental disorders, coupled with the growing awareness regarding oral hygiene. The rising healthcare expenditure and improving reimbursement scenario in the developed and developing countries is another major factor contributing to the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Product Analysis

Growing Usage of Consumables to Aid to Its Segment Growth

Based on product, the market segments include laser systems and consumables.

Consumables segment accounted for the largest medical laser market with a share of 70.14% in 2026 and is projected to grow at a significant CAGR during the forecast period. Increasing number of consumables used per laser system is propelling the growth of the consumables segment. Around 100-140 consumables are used on the basis of per year per system. Rising demand for various surgeries will subsequently increase the demand for the consumables leading to significant growth of the segment during the forecast period.

Besides, laser systems include solid state lasers system, dye laser, diode lasers, gas lasers, and others. Rising disposable incomes, coupled with the growing demand for laser treatment in developing countries and the collaborative initiatives taken by emerging market players, are expected to offer lucrative growth opportunities for laser systems over the forecast period. For instance, in November 2023, Acclaro Medical, a medical technology company, collaborated with MellingMedical for the expansion of their pathways into federal health facilities.

By End User Analysis

Increasing Number of Specialty Clinics to Assist in its Market Growth

Based on end user, the market is segmented into hospitals and specialty clinics.

Among these, the specialty clinics segment accounted for the highest share 59.50% in 2026. An increase in the number of specialty clinics in developing countries, rising per capita expenditure, and growing demand for aesthetic appeal are poised to augment the segment growth during the forecast period.

Besides this, the hospitals segment will witness significant growth due to rising inclination toward hospital settings, further attributed to cost efficiency and better patient care.

REGIONAL INSIGHTS

Based on the geography, the market is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Medical Laser Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Escalating Preferences and Increasing Number of Cosmetic Surgeries Helped North America in Leading the Market

North America dominated the market with a revenue of USD 2.54 billion in 2025 and is projected to continue the same over the forecast period. The growing demand for minimally invasive medical procedures, high preference for cosmetic procedures, and high adoption rate of novel technologies in the U.S., are the primary factors responsible for the dominance of this region. For instance, according to statistics published by the American Society of Plastic Surgeons in 2023, nearly 23.7 million cosmetic minimally invasive procedures and 1.5 million cosmetic surgical procedures were performed in the year 2022 in the U.S. The U.S. market is projected to reach USD 2.45 billion by 2026.

The UK market is projected to reach USD 0.17 billion by 2026, while the Germany market is projected to reach USD 0.35 billion by 2026.

Asia Pacific accounted for the second largest market share in 2024, followed by North America. Asia Pacific is anticipated to witness the fastest growth in the coming years due to developing healthcare infrastructure, and increasing number of laser centers. Moreover, increasing demand for anti-aging treatment and rise in a number of hair removal procedures are some factors anticipated to increase the demand of the aesthetic lasers, hence propelling the market growth. The Japan market is projected to reach USD 0.62 billion by 2026, the China market is projected to reach USD 0.62 billion by 2026, and the India market is projected to reach USD 0.19 billion by 2026.

Latin America and Middle East & Africa markets are expected to witness a significant CAGR during the forecast period. The rising healthcare expenditure, growing awareness among the population regarding the aesthetic, and cosmetic procedures are some of the major factors anticipated to spur the segmental growth.

Key Industry Players

Strong Product Portfolio of Key Players to Assist in the Market Growth

The competitive landscape of this market is semi-consolidated in nature with the top three players including El.En. S.p.A., Lumenis, and Ellex Medical Lasers Ltd., accounting for a significant share of the market in 2024.

A well-established brand presence in the market, combined with a strong product portfolio of lasers, are factors influencing the dominance of these players in the global market. Lumenis is one of the prominent players in the market, offering a wide range of products in different application segments such as surgical, aesthetics, and ophthalmology.

- For instance, in January 2020, Lumenis, an energy-based medical device company, presented its new platform the LightSheer Quattro at the 22nd International Master Course on Aging Science (IMCAS) conference held in France, LightSheer Quattro system provides laser hair removal treatment for all skin types.

However, other market players are expanding their portfolio especially in the cosmetic lasers segment. Additionally, companies are also focusing on the expansion of geographic presence and strengthening their distribution channel to gain market share during the forecast period.

LIST OF TOP MEDICAL LASER COMPANIES:

- Bausch Health Companies Inc. (Canada)

- Cynosure Lutronic(U.S.)

- Lumenis Be Ltd. (U.S.)

- Candela Corporation (U.S.)

- TOPCON CORPORATION (Japan)

- LUMIBIRD (France)

- IRIDEX Corporation (U.S.)

- Sisram Medical Ltd (Alma Lasers) (Israel)

- BIOLASE, Inc. (U.S.)

- El.En. S.p.A. (Italy)

- LAMEDITECH (Republic of Korea)

KEY INDUSTRY DEVELOPMENTS:

- June 2023 - BIOLASE, Inc., partnered with Pet Dental Services (PDS), with an aim to expand its services among the veterinary segment in the country.

- April 2023 – Lumibird Medical launched its two next-generation lasers, Tango Neo and Ultra Q Reflex Neo, with advanced features, with an aim to expand its product portfolio.

- April 2023 – IRIDEX Corporation launched Iridex PASCAL, a next generation platform imbibed with precise scanning capabilities and expanded its product portfolio.

- April 2023 - Johnson & Johnson Vision, a part of Johnson & Johnson, received FDA clearance for its ELITA Femtosecond Laser, which assists ophthalmologists in improving the visual outcomes of patients and recovery.

- April 2023 – Topcon Corporation announced exclusive partnership with Espansione Group, with an aim to become the sole distributor for the South-east Asian region.

- March 2023 – Sisram Medical Ltd., entered into an agreement to acquire PhotonMed, one of the leading medical aesthetic distributors, with an aim to expand its geographical footprint in China.

- January 2022 – BIOLASE, Inc., key player in dental lasers and EdgeEndo, a company involved in commercializing endodontic products, received FDA 510(k) clearance of the EdgePRO laser-assisted irrigation device, used as effective cleaning and disinfection alternative within root canal procedures.

REPORT COVERAGE

The research report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides this, the report offers insights into the Medical Laser Market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the market growth over the recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.46% from 2026-2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Type

|

|

By Product

|

|

|

By End User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 6.24 billion in 2026 and is projected to reach USD 14.88 billion by 2034.

In 2025, the North America market value stood at USD 2.54 billion.

Growing at a CAGR of 11.46%, the market will exhibit a steady growth over the forecast period.

The aesthetic led the segment based on the type in the market.

Rising demand for minimally invasive aesthetic procedures, and new procedure specific product launches by market players are key factors propelling the growth of the market.

Lumenis, TOPCON Corporation, and El.En. S.p.A., are major players of the global market.

North America dominated the market share in 2025.

Growing awareness among general population toward aesthetic procedures and increasing per capita income in emerging countries, are factors attracting large population undergoing aesthetic and cosmetic surgical procedures.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us