Offshore Support Vessel Market Size, Share & COVID-19 Impact Analysis, By Vessel Type (Anchor Handling Tug Supply Vessel, Platform Supply Vessels, Crew Vessel, and Others), By Water Depth (Shallow Water, Deepwater, and Ultra-Deepwater), By Application (Oil & Gas, Offshore Wind, Patrolling, Research & Surveying, and Others), and Regional Forecast, 2026 - 2034

Offshore Support Vessel Market Size

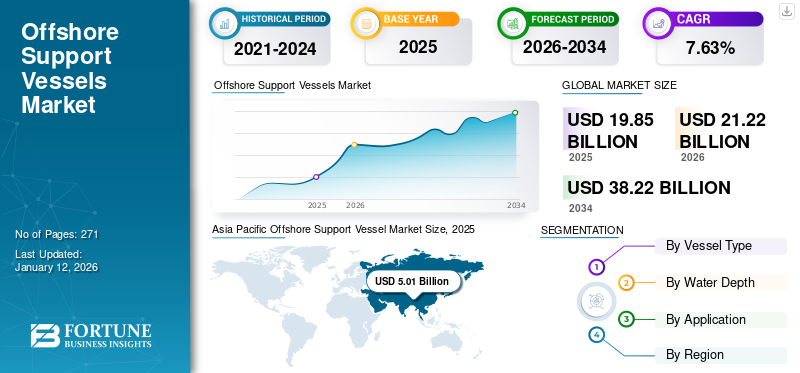

The global offshore support vessel market size was valued at USD 19.85 billion in 2025 and is projected to grow from USD 21.22 billion in 2026 to USD 38.22 billion by 2034, exhibiting a CAGR of 7.63% during the forecast period. Additionally, the U.S. Offshore Support Vessel Market is predicted to grow significantly, reaching an estimated value of USD 4.51 billion by 2032. Asia Pacific is dominating the gloabl market with a share of 25.19% in 2025.

Offshore Support Vessels (OSVs) are specialized ships or vessels designed to provide various services and support to gas exploration and offshore oil production processes. These vessels play a fundamental role in the logistics and operations of offshore oil and gas platforms and their installation.

Offshore support vessels are used for operational purposes in oil & gas exploration and construction work at the high seas. There are a variety of offshore vessels, which not only help in exploration and drilling but also for providing necessary supplies to the excavation and construction units located at the high seas, from transporting equipment and rigs to repairing offshore wind turbines. They are essential in transporting equipment and supplies, as well as assisting in operation and construction activities and materials where they are required, as well as building and reconditioning offshore equipment. Their high adaptability means they can be assembled for almost any type of project. One of the new and common types of OSVs is offshore supply vessels. They transport supplies, materials, and people from land to offshore rigs and ships. The platform supply vessel subsection is commonly used in boring to bring equipment, stores, parts, food, and anything else from an offshore city as an oil rig might need.

Global Offshore Support Vessel (OSV) Market Overview

Market Size & Share:

- 2025 Market Value: USD 19.85 billion

- 2026 Estimate: USD 21.22 billion

- 2034 Forecast: USD 38.22 billion

- CAGR (2026–2034): 7.63%

- Top Country Forecast: U.S. projected to reach USD 4.51 billion by 2032

- Top Vessel Type: Anchor Handling Tug Supply (AHTS) – used for towing and anchor deployment

- Leading Water Depth Segment: Deepwater – due to growing deep-sea exploration activity

Key Trends and Drivers:

- Deepwater expansion: Increased investments in deepwater and ultra-deepwater drilling drive demand for technologically advanced OSVs

- Dynamic positioning systems: Advanced DP systems enable precise station-keeping, especially in harsh offshore conditions

- Hybrid and smart vessels: Innovations like hybrid propulsion and automated systems boost operational efficiency

- Offshore wind surge: Massive expansion of offshore wind projects across China, U.K., and South Korea fuels support vessel demand

- Anchor handling demand: Growth in floating wind and oil rigs increases demand for AHTS vessels with high bollard pull and fire safety features

Market Challenges:

- High capital expenditure: Building, equipping, and maintaining OSVs involve significant upfront and operating costs

- Crude oil volatility: Fluctuating oil prices impact investment in offshore drilling and OSV deployment

- IMO regulations: Mandatory dry-docking and carbon compliance standards raise operational burden

- Pandemic impact: COVID-19 disrupted shipbuilding, delayed deliveries, and halted global offshore operations

Market Opportunities:

- Offshore wind infrastructure: OSVs are critical to installation, logistics, and servicing of offshore wind turbines

- Asia Pacific leadership: Rapid development in China and Southeast Asia expands OSV market footprint

- Tech-enabled fleet modernization: Adoption of AI, automation, and hybrid systems opens new efficiency benchmarks

- Growing subsea activities: Increased use of remotely operated vehicles (ROVs) and diving support drives niche OSV segments

COVID-19 IMPACT

Decline in the Oil Prices during COVID-19 Severely Impacted the Market Growth

The COVID-19 pandemic affected the global economy as operations in various sectors were halted. In the vessel sector, companies faced several challenges due to decreased resources and manpower. The market has been affected by a combination of factors, including disruptions in supply chains, reduced demand for transportation fuels, and declining oil prices. The market was affected by a combination of factors, including disruptions in supply chains, reduced demand for transportation fuels, and declining oil prices. The pandemic decreased the global oil demand as travel restrictions and lockdown measures were implemented worldwide. This decline in oil consumption resulted in a significant drop in oil prices, adversely affecting offshore exploration and production activities. Reduced drilling activities with oil rigs and decline in production projects led to decreased demand for offshore support vessel, as these vessels are largely used to support offshore oil and gas operations. The pandemic caused disruptions in global supply chains, including the manufacturing and delivery of OSVs. Travel restrictions, lockdowns, and social distancing measures impacted the production and transportation of the vessels, leading to delays in vessel construction and delivery. These supply chain disruptions led to a decline in the offshore support vessel market growth.

In addition to these market-specific factors, the pandemic had a broader impact on the vessel industry. Since governments were focusing on containing the virus and supporting the healthcare systems, policies and incentives in the marine industry took a backseat. This slowed the industry's growth and made it more challenging for offshore support vessel service providers to secure financing and investment.

However, as countries recover from the pandemic, the demand for renewable oil and gas sources is expected to increase, which could lead to a rebound in the sales of OSVs. Additionally, the need for these vessels for industrial use is expected to increase in the coming years, providing opportunities for the market’s growth.

Offshore Support Vessel Market Trends

Technical Advancements in Deepwater & Ultra-Deepwater Offshore Support Vessels

Deepwater and ultra-deep-water OSVs now come equipped with advanced subsea intervention systems. These systems enable the deployment of remotely operated vehicles and subsea equipment for maintenance, repair, and inspection of these OSVs at depths. Dynamic positioning system technology allows OSVs to maintain their positions and direction without anchors. These systems use a combination of thrusters, sensors, and computer algorithms to counteract external forces, such as currents and wind, ensuring precise positioning even in harsh conditions. Advanced DPS systems possess improved accuracy, redundancy, and ability to operate in deeper water. Major players operating in the oil & gas sector are exploring deep and ultra-deepwater opportunities to meet the growing oil & gas demand. Owing to this, investments are rising in offshore and subsea activities. Key players are investing in OSVs and developing technologically advanced vessels that can successfully operate in harsh climatic conditions. For instance, SEACOR Marine Holding Inc. started manufacturing its vessels with Dynamic Positioning (DP) technology and a hybrid system for marine vessels. DP systems use thrusters and sensors to counteract the effects of wind, waves, and currents, allowing precise positioning during offshore operations. This technology has improved OSV's safety and efficiency, particularly in deep-water environments. Companies are also upgrading the DP system with the changing requirements as these DP-powered vessels are gaining more importance in the market.

Download Free sample to learn more about this report.

Offshore Support Vessel Market Growth Factors

Growing Measures to Install More Sustainable Energy Infra to Enhance OSV Market Growth

Rapidly growing government commitments and advanced technologies contribute to the positive outlook in established markets as well as countries new to offshore wind. Most companies are tracking offshore wind projects, some of which may include challenges and risks, commercial requirements from authorities, challenging project economics, and the necessity to build or strengthen capabilities. As more countries and industries focus on transitioning to sustainable energy, there is a growing need to develop the necessary infrastructure in offshore renewable energy sectors. The process of creating this infrastructure includes installing and maintaining offshore wind turbines, which require OSVs to transport personnel, equipment, and supplies to and from the new installation sites. OSVs are also vital in providing logistics and support services during oil and gas exploration, drilling, and production these vessels transport equipment, and supplies to and from offshore platforms, ensuring a smooth logistical flow for offshore industry. The demand for these vessels is expected to increase as governments and businesses are investing in renewable energy projects to reduce the carbon footprint and endorse sustainability. Globally, the installed offshore wind capacity reached 57.6GW by the end of 2022, 44% of which (25.6GW) is now installed in China. 42 new offshore wind farms are operated in China, Vietnam, Japan, France, the U.K., South Korea, Germany, Spain, and Italy. These vessels are essential for successfully executing and operating offshore renewable energy projects, thereby enhancing their demand.

Rapidly Growing Demand for Anchor Handling Tug Supply Vessels Will Augment Market Progress

An Anchor Handling Tug Supply (AHTS) vessel is a specialized offshore vessel commonly used in the oil & gas industry. It is designed to perform various tasks related to anchoring and handling offshore drilling rigs. They assist in deploying and retrieving anchors for positioning and stabilizing the offshore structures. AHTS vessels are widely used to support offshore drilling activities by positioning towing and mooring drilling rigs. These vessels also carry and deploy equipment, such remote-operated vehicles which are used underwater in drilling and proper maintenance, installation, and transportation of supplies and equipment from shore bases to offshore drilling rigs. Demand for AHTS vessels is constantly rising due to their excellent physical properties, such as horsepower, bollard pull, brake holding capacity, and wire storage capacity. They are also equipped with firefighting and fuel-efficient capabilities. In the upcoming years, more floating wind turbines will be installed, and eventually, they will require the AHTS vessels and put pressure on those available for offshore oil and gas as AHTS vessels primarily helps offshore drilling activities related to towing and drilling. The uptick in offshore drilling activity will drive the demand for AHTS vessels. Therefore, with the rising number of offshore exploration & production activities across the region, the demand for AHTS vessels is expected to grow significantly during the forecast period.

RESTRAINING FACTORS

Requirement of High Capital Expenditures and Fluctuations in Global Crude Oil Prices May Obstruct Market Growth

The construction of OSVs requires a significant amount of money and technical expertise to match the increasing needs. The ship owners must build special facilities, such as docking units and shipbuilding divisions to construct and store these vessels. For large-scale projects, such as offshore wind farms or oil drilling operations, upfront costs associated with these projects can be substantial, as well as expenses related to vessel acquisition, construction, maintenance, and human resources. These high capital costs pose a challenge as they may delay investment decisions. A dry dock unit area is used to build, uphold, and repair different capacity vessels. The International Maritime Organization (IMO) orders every ship to be dry-docked at fixed intervals to maintain its components, such as structures, hull, machinery, and other equipment in operational conditions. Furthermore, abruptly changing international crude prices predominantly affect offshore exploration & production activities and increasing carbon emission. Lower crude oil prices make it non-feasible to conduct costly operations in various water depths, thereby decreasing the deployment of these vessels for offshore hydrocarbon structures.

The price variations in offshore drilling services or exploration have significant implications for project's financial viability and profitability. Moreover, if the oil prices remain low for a prolonged period, it may affect the productivity of existing operations.

Offshore Support Vessel Market Segmentation Analysis

By Vessel Type Analysis

Anchor Handling Tug Supply Segment Dominated the Market Owing to Its Ability of Towage

Based on vessel type, the market is segmented into anchor handling tug supply vessels, platform supply vessels, crew vessels, and others.

The anchor handling tug supply vessels segment captured the largest offshore support vessels market with a share of 30.54% in 2026. Anchor Handling Tug Supply (AHTS) vessels are designed to handle anchors for drilling rigs, floating production units, and other offshore construction. AHTS vessel units have a robust design and offer additional features to transport colossal oil & gas structures from shore to the desired location. During specific periods, when anchor handling and towing services are not functioning well, AHTS vessels perform as straight supply vessels that provide safety and security to firefighting vessels during oil spill rescue and recovery operations.

These vessels are equipped with advanced Dynamic Positioning Systems (DPS), allowing them to maintain their position or perform complex maneuvers without anchors. DPS utilizes thrusters and sophisticated computer-controlled algorithms to counteract external forces, such as wind, waves, and currents, ensuring precise positioning. This capability enhances operational efficiency and safety, and reduces the environmental impact associated with anchoring.

To know how our report can help streamline your business, Speak to Analyst

By Water Depth Analysis

Deepwater Segment to Dominate the Market Owing to Growing Exploration Activities in Deepwater Sea

Based on water depth, the market is divided into shallow water, deepwater, and ultra-deepwater.

The deepwater segment is projected to lead the market Contributing 40.57% globally, in 2026, as extracting resources from deepwater locations and areas requires the well-equipped and specialized vessels with advanced abilities. Deepwater operations demand vessels equipped that have the ability to sustain in harsh conditions and take up complex tasks. Deepwater reserves often holds the significant oil and gas resources, such as

The deep-water segment in the offshore support vessel market is projected to develop due to its high demand and use in deepwater projects, which contributes to the prominence of this segment. Deepwater areas often have significant hydrocarbon reserves, thereby attracting investments in exploration and production activities. The complexities and challenges associated with deep-water operations often result in the high need for specialized vessels with advanced technology and capabilities where the OSVs are majorly used for various applications. The increased deepwater exploration activity has boosted the demand for OSVs that offer deepwater solutions.

By Application Analysis

Oil & Gas Segment Dominates Owing to the Growing Demand for Technically Sophisticated Vessels Afloat

Based on application, the market is segmented into oil & gas, offshore wind, patrolling, research & surveying, and others.

The oil & gas application segment dominates the global market with a share of 66.16% in 2026. The oil & gas industry heavily relies on offshore exploration and production activities to meet global energy demands. Offshore oil and gas fields require extensive support services, including transportation of tools, equipment, and supplies, and specialized operations, such as anchor handling, towing, and platform maintenance. Oil & gas companies engage in seabed. These activities require a wide range of support vessels for various operations and transportation. The oil & gas sector relies heavily on offshore infrastructure, such as platforms, rigs, and pipelines to extract, process, and transport hydrocarbons. Research and surveying activities are crucial in seabed conditions, mapping resources, and identifying potential sites for offshore infrastructure development. Specialized vessels equipped with advanced surveying and mapping equipment are required to conduct these operations effectively.

REGIONAL ANALYSIS

The market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific Offshore Support Vessel Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The United States market is projected to reach USD 3.22 billion by 2026.

Asia Pacific dominated the market with a valuation of USD 5.01 billion in 2025 and USD 5.31 billion in 2026. The high demand for these vessels in the region is connected with growing offshore energy exploration and production activities, including exploration and manufacturing of oil, gas, and renewable energy. The region is witnessing a rapid growth in offshore wind energy projects.

In Asia Pacific, China is the fastest developing country among other nations. China accounted for 80% of the global offshore wind capacity in 2021, and its cumulative offshore wind installations reached 27.7 GW. The China State Shipbuilding Corp delivered the Hailong the most advanced diving support vessel China has delivered the most advanced diving support vessel. The ship has all the advanced features and the research & development of diving and marine equipment. It can accommodate 120 crew members and diving operation personnel and can sail for 45 days in a single voyage without resupply. The vessel can support and handle 24 divers conducting operations 300 meters deep. These are the most advanced diving support vessel which have created a supportive environment for the offshore support vessel industry, thereby encouraging investment and innovation. The Japan market is projected to reach USD 0.07 billion by 2026, and the India market is projected to reach USD 1.61 billion by 2026.

The China market is projected to reach USD 2.28 billion by 2026. It will improve in terms of market growth as it has a robust offshore wind farm infrastructure and is increasing its investments in energy suppliers.

Europe holds the second largest market share for the global market. As Europe has a significant increase in the market size, serving various sectors such as oil and gas exportation, offshore wind farms, and subsea construction. OSV play a crucial role in supporting offshore operations by providing transportation and essential services required for offshore installations and projects. Offshore wind power production is one of the fastest emerging energy sectors in Europe. With its growing efficiency and low environmental effect, this technology already offers clean and aggregate-priced electricity to millions of Europeans. The Baltic Sea is witnessing significant growth in offshore wind projects.

Countries such as Germany, Sweden, and Denmark are investing in offshore wind farms, creating a demand for OSV for installation, maintenance and crew transfer activities. Although the focus is shifting towards renewable energy, offshore oil and gas exploration still plays a role in Europe’s energy mix. OSVs are vital and support exploration activities, including seismic surveys, drilling operations, and supply logistics. The United Kingdom market is projected to reach USD 0.82 billion by 2026, while the Germany market is projected to reach USD 0.68 billion by 2026.

KEY INDUSTRY PLAYERS

Manufacturers to Focus on Development of Advanced Technologies and Product Innovation to Gain Competitive Edge

The offshore support vessel manufacturing companies are adopting the recent technological trends for manufacturing different vessels. They are incorporating digitalization and connectivity technologies to enable data-driven decision-making and optimize vessel operations. They are integrating advanced sensors, communication systems, and data analytics to monitor the vessel performance, fuel consumption, maintenance requirements, and handling. Along with technological advancements, manufacturers are focusing on environmental monitoring and compliance. Additionally, some vessels employ advanced waste management systems to minimize environmental impact, showcasing the industry’s commitment towards sustainable maritime operations.

List of Top Offshore Support Vessel Companies:

- Wartsila (Finland)

- Damen Shipyards Group (Netherlands)

- Solstad Offshore ASA (Norway)

- Maersk Supply Service (Denmark)

- SEACOR Marine Holdings (U.S.)

- Tidewater Marine (U.S.)

- Siem Offshore (Norway)

- BOURBON (France)

- "K" line (Kawasaki Kisen Kaisha, Ltd) (Japan)

- MMA Offshore Limited (Australia)

- Havila Shipping ASA (Norway)

- Edison Chouest Offshore (U.S.)

- Nam Cheong Offshore Pte. Ltd (Malaysia)

- Hornbeck Offshore (U.S.)

- Vroon (Netherlands)

KEY INDUSTRY DEVELOPMENTS:

- February 2023: Damen Shipyards Group modified its FLOW-SV vessel idea that can fast-track the expansion of vessel concept that can accelerate the development of this maritime segment. The Damen FLOW-SV is mainly designed for installation of ground attacks for offshore-turbine floaters. Moreover, the vessel can load an enormous length of chain required to install and secure nine suction piles or anchors.

- February 2022: Wärtsilä and Solstad Offshore collaborated on their fleet decarbonization goals to reduce carbon dioxide emissions in the upcoming years. This agreement aimed to decrease greenhouse gas emissions produced from Solstad’s offshore vessels. Moreover, according to the agreement, each vessel would be measured for concrete solutions and operational improvements.

- October 2022: SEACOR Marine Holdings Inc. announced the sale of unconsolidated collaborative ventures and refinancing businesses to extend near-term developments significantly. The company developed a Mexican offshore operator, which will create an opportunity for the company to unlock capital.

- September 2022: Tidewater Inc. announced the acquisition of all of the remaining shares of Swire Pacific Offshore for around USD 190 million, making it the world’s top OSV operator.

- September 2022: Bourbon announced the setup of a new division, which is dedicated to offshore wind. This division will help install, transport services, field maintenance, and repair floaters.The Company passes the statement to contribute to the growth of the renewable energy industry, and in particular offshore wind power, in Europe and worldwide, either as a service provider or as a main contractor (EPCI contract). The new division will lead BOURBON's future strategy and execute its aspiring wind expansion plans to serve fields from 250 MW to 1 GW by 2030.

- May 2022: Maersk Trader and Maersk Tender, the two Maersk Supply Service anchor-handling vessels supporting The Ocean Cleanup mission in the Pacific Ocean, signed an agreement for an additional year. The Ocean Cleanup, a Dutch nonprofit organization specializing in green tech, took the initiative to reduce ocean plastic floating by developing new technologies to solve the problem.

- March 2022: Siem Offshore Inc. signed a new agreement with Helix Energy Solutions Group Inc. for developing two types of vessels, Siem Helix 1 and Seim Helix 2. The deals will replace the existing agreement, with three years for Seim Helix 1 and five years for Seim Helix 2 for two different vessels.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the latest offshore support vessel market trends and highlights key industry developments and competitive landscape. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.63% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Vessel Type

|

|

By Water Depth

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was valued at USD 19.85 billion in 2025.

The market is likely to record a CAGR of 7.63% over the forecast period of 2026-2034.

The oil & gas segment leads the market due to its heavy reliance on offshore exploration and production activities to meet global energy demands.

5The market size of Asia Pacific stood at USD 5.01 billion in 2024.

The increasing demand for deep-water oil and gas drilling operations, improved capability of offshore oil and gas projects, and increase in investment and installation of offshore wind energy.

Some of the top players in the market are Maersk Supply Service A/S, Wärtsilä, Kawasaki Kisen Kaisha, Ltd., and Damen Shipyards Group.

The global market size is expected to reach USD 38.22 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us