Radiation Dose Management Market Size, Share & Industry Analysis, By Procedure (Computed Tomography, Nuclear Medicine, Radiography and Mammography, Fluoroscopy and Interventional Imaging, and Others), By Application (Oncology, Orthopedics, Cardiology, Neurology, and Others), By End-user (Hospitals & Specialty Clinics, Diagnostic Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

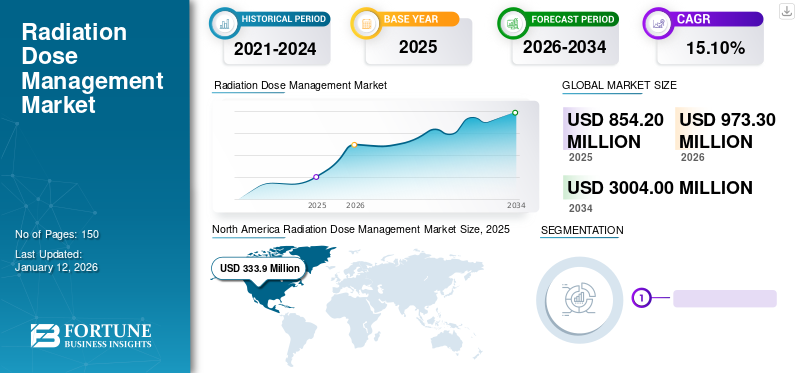

The global radiation dose management market size was valued at USD 854.2 million in 2025. The market is projected to grow from USD 973.3 million in 2026 to USD 3,004.00 million by 2034, exhibiting a CAGR of 15.10% during the forecast period. North America dominated the radiation dose management market with a market share of 39.10% in 2025.

Radiation dose management is the practice of minimizing and optimizing radiation exposure, particularly during interventional radiology and imaging. The channel includes information on radiation dose recording software, regulatory compliance, real-time staff dose monitoring, and technology for dose reduction, including interactive reconstruction software. Such software ensures the safe and effective use of radiation during diagnosis and treatment, minimizing the risk of potential harm. The global radiation dose management market growth is attributed to the increasing number of medical imaging procedures worldwide.

Moreover, the rising awareness of risks associated with radiation and increasing demand for early detection of severe conditions are expected to fuel market growth during the forecast timeframe. Furthermore, strategic initiatives by key players are anticipated to boost market growth during the forecast period.

- For instance, in November 2023, Qaelum NV partnered with Philips to revolutionize radiation dose management in medical imaging, enhancing patient safety and optimizing healthcare workflows.

Global Radiation Dose Management Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 854.2 million

- 2026 Market Size: USD 973.3 million

- 2032 Forecast Market Size: USD 3,004.00 million

- CAGR: 15.10% from 2026–2034

Market Share:

- North America dominated the radiation dose management market with a 39.10% share in 2025, driven by strict patient safety guidelines in radiology, increasing number of nuclear medicine procedures, and a strong presence of SPECT cameras and advanced imaging facilities.

- By procedure, the Radiography and Mammography segment held the largest market share in 2026, supported by rising X-ray and mammography procedures, along with growing adoption of dose management software to reduce cancer risks and optimize radiation exposure.

Key Country Highlights:

- United States: Growing emphasis on radiation safety in diagnostic imaging practices and widespread usage of nuclear medicine procedures is driving demand for dose management software.

- Europe: Increasing focus on radiation protection training and initiatives by companies to expand the deployment of radiation dose management software across healthcare facilities are supporting market growth.

- China: Rising adoption of radiation dose management solutions is driven by growing awareness of radiation safety and increasing healthcare spending to improve imaging infrastructure.

- Japan: Technological advancements in diagnostic imaging and a strong regulatory framework for patient safety are encouraging the integration of radiation dose monitoring solutions in medical facilities.

COVID-19 IMPACT

Surge in CT Scan Cases led to a Positive Impact during the COVID-19 Pandemic on the Market

The COVID-19 outbreak had vastly disrupted healthcare services, with certain areas remaining relatively unscathed, including the imaging tests, especially the CT Scans. Computed tomography (CT) scan was the most frequently used tool for the diagnosis of COVID-19. Moreover, the higher specificity of CT scanners to detect COVID-19 infection and limitations of the reverse transcription-polymerase chain reaction (RT-PCR) resulted in the growing importance of the usability of the CT scan during the pandemic.

Key players operating in the market also generated substantial revenue for their imaging products during the pandemic. Moreover, some of the imaging modalities experienced slow growth during COVID-19, leading to market growth. For instance, Siemens Healthineers AG highlighted a growth of 1.7% for imaging in 2020 compared to 9.6% in 2019.

This increase in CT scans led the hospitals to purchase additional systems, increasing the sales of imaging modalities, which, in turn, increased the adoption of these software. The market was fully recovered in 2022 and it is anticipated to grow significantly during the forecast period.

Radiation Dose Management Market Trends

Integration of Artificial Intelligence (AI) in Radiology Practices is a Major Trend

The market is witnessing a major trend with the integration of artificial intelligence in radiology practices. Artificial Intelligence (AI) technologies are being increasingly used in various healthcare services, including radiology practices. Integration of artificial intelligence in imaging modalities can play a substantial role in this software. In addition, AI algorithms can help optimize imaging protocols by enhancing image reconstruction techniques and predicting individual-specific radiation doses.

- For instance, according to the recent study published in Radiology, a journal of the Radiological Society of North America (RSNA), in July 2023, AI can use information from low-dose CT scans of the lungs to increase risk prediction for death from lung cancer, CVD, and other causes.

Moreover, as diagnostic imaging technology continues to progress, ongoing research and innovation will boost the outcomes of this software. This progress can lead to the development of novel tools, techniques, and methodologies for monitoring, measuring, and minimizing radiation dose exposure.

- North America witnessed a radiation dose management market growth from USD 256.8 Million in 2023 to USD 292.6 Million in 2024.

Download Free sample to learn more about this report.

Radiation Dose Management Market Growth Factors

Suitable Guidelines and Regulations for Patient Safety during Radiology Practices to Boost the Market Growth

One of the most significant drivers is the growing number of imaging procedures due to suitable guidelines for patient safety. The increasing awareness of the potential risks associated with excessive exposure to ionizing radiation, particularly in pregnant women and infants, drives the adoption of these software, which optimizes the dose and maintains the image quality.

Moreover, to maintain the safety standards from ionizing radiation, organizations such as the European Commission (EU) and the International Atomic Energy Agency (IAEA) have set strict guidelines that regulate the use of ionizing radiation. These regulations cover various types of activities, including medical imaging and radiotherapy.

- For instance, according to the article published by NCBI, in January 2023, the International Atomic Energy Agency (IAEA) developed safety standards based on the findings of the United Nations Scientific Committee on the EFFECTS of Atomic Radiation (UNSCEAR).

These continuously evolving guidelines and recommendations for such software significantly propel market growth due to their increasing adoption.

Technological Advancements in Imaging Techniques to Surge Market Growth

Advancements in technology have led radiology manufacturers to develop imaging equipment and software that can minimize radiation exposure and optimize image quality. Radiologists across the globe are using iterative reconstruction algorithms as well as other image improvement techniques, which can reduce the amount of radiation required to generate diagnostic-quality images. For this purpose, software vendors are currently using an advanced version of existing solutions.

- For instance, in August 2021, Affidea announced the launch of a new version, 3.2, of GE Healthcare's DoseWatch software, along with a novel business intelligence tool that allows enhanced monitoring of dosing.

Furthermore, the standardization of imaging protocols ensures consistent and appropriate use of radiation, leading to continuous advancements in imaging technologies and increasing their adoption, thereby spurring market growth.

RESTRAINING FACTORS

High Cost of Imaging Modalities and Lack of Infrastructure in Developing Countries to Hinder the Market Growth

The high costs associated with implementing dose management systems such as radiation management software can act as a significant barrier for several hospitals, especially smaller ones. Moreover, diagnostics imaging can be expensive in some underserved areas, which leads to a limited number of imaging tests and lower adoption of radiation management software.

- For instance, according to the Iranian Journal of Radiology, in January 2023, the monthly cost of various imaging services was USD 10,457.5 in 2019 and USD 26,482.2 in 2021.

Furthermore, the lack of infrastructure and healthcare services in less developed countries poses a major challenge for the implementation of radiation management software, which can hamper the market growth.

- For instance, according to the World Health Organization (WHO), in January 2023, nearly 1.0 billion people in low and middle-income countries were served by healthcare facilities with low or no electricity supply.

Hence, the higher costs of imaging modalities and the lack of healthcare infrastructure in emerging countries pose a major challenge to the growth of the market.

Radiation Dose Management Market Segmentation Analysis

By Procedure Analysis

Radiography and Mammography Segment Dominated the Market owing to Increasing X-ray and Mammography Procedures

Based on procedure, the market for radiation dose management is segmented into computed tomography, nuclear medicine, radiography and mammography, fluoroscopy and interventional imaging, and others.

The radiography and mammography segment accounted for major share of global radiation dose management market share in 2024. This dominance was attributed to the increasing usage of mammography software aimed at reducing the risk of developing cancer. Moreover, the growing number of interventional X-rays systems and the rise in the number of X-rays significantly contribute to the market growth.

- The Radiography and Mammography segment is expected to hold a 40.46% share in 2026.

- For instance, according to the data published by NHS England, in January 2023, plain radiography (x-ray) was most common (1.65 million), followed by diagnostic ultrasonography (0.81 million), computerized axial tomography (0.52 million), and magnetic resonance imaging (0.31 million).

The nuclear medicine segment is anticipated to expand at the highest CAGR during the forecast period. This growth is attributed to increasing number of SPECT and PET scan procedures across the globe. For instance, more than 40.0 million single photon emission computed tomography (SPECT) and positron emission tomography (PET) scan procedures are performed annually, with a yearly demand for radioisotopes increasing by up to 5.0%.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Orthopedics Segment Held the Largest Share due to the Growing Number of Trauma Cases and Sports Injuries

Based on application, the global market for radiation dose management is segmented into oncology, orthopedics, cardiology, neurology, and others.

In 2024, the orthopedics segment accounted for the largest market with a share of 36.64% in 2026. The benefits of these products in protecting patients and orthopedic surgeons during orthopedic surgeries are anticipated to boost the growth of the market. Fluoroscopic procedures offer tremendous advantages in orthopedic surgeries, they expose individuals to radiation, posing risks such as skin injury, infertility, and cataract. Moreover, the rising number of trauma cases and sports injuries boost the growth of orthopedic surgeries, which in turn drives the adoption of these products during orthopedic surgeries.

- For instance, according to the data published by Injury Facts in 2022, about 3.6 million individuals were treated in emergency departments for injuries involving sports and recreational equipment.

The oncology segment is projected to register the highest CAGR during the forecast period. The growth is attributed to the growing demand for non-invasive diagnosis methods such as diagnostic imaging, including CT Scans. Frequent and repetitive tumor detection diagnosis with ionizing radiation can worsen conditions. For instance, a single chest CT scan for detecting lung cancer delivers the amount in 100 to 800 X-rays. Hence, the increasing need for the installation of these software in computed tomography (CT) scan systems is driving market growth.

By End-user Analysis

Increasing Number of Patient Visits Enabled Diagnostic Centers Dominated the Diagnostic Centers Segment

Based on end-user, the market for radiation dose management is segmented into hospitals & specialty clinics, diagnostic centers, and others.

In 2026, the diagnostic centers segment held the largest market share of 49.60% and is expected to expand at the highest CAGR during the forecast timeframe, 2026-2034. The segment’s growth is attributed to the growing number of diagnostic centers across the globe. Patient visits to diagnostic centers are on the rise, as outpatient services of diagnostic centers allow for a personalized approach, which potentially leads to better dose optimization strategies.

- For instance, according to the data published by HealthValue Group in April 2023, there were estimated over 6,000 freestanding outpatient diagnostic imaging centers in the U.S.

The hospitals & specialty clinics segment accounted for the substantial market revenue in 2022. The segment’s growth is due to the increasing number of imaging scans and Single Photon Emission Computed Tomography (SPECT) and Positron Emission Tomography (PET) scan procedures for diagnosis involving the use of radioisotopes. For instance, according to the World Nuclear Association, in July 2023, more than 10,000 hospitals across the globe used radioisotopes in medicine, with nearly 90.0% of the procedures dedicated to diagnosis.

REGIONAL INSIGHTS

North America

North America Radiation Dose Management Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 333.9 million in 2025 and is expected to continue its dominance during the forecast timeframe. The patient safety guidelines during radiology practices, addresses exposure to ionizing radiation, contribute to the growth of these software solutions in the region. Moreover, a large number of nuclear medicine procedures in the U.S. and the presence of SPECT cameras are expected to drive market growth in North America. The U.S. market is projected to reach USD 361 Million by 2026.

- For instance, according to the World Nuclear Association, in July 2023, there were more than 20.0 million nuclear procedures annually in the U.S., followed by approximately 10.0 million in Europe.

Europe

The market in Europe held the second-highest share in 2025, due to the increasing emphasis on education and training in radiation protection, including the use of radiation dose management software. Furthermore, initiatives by key players to expand the reach of their software are anticipated to boost market growth in Europe. The UK market is projected to reach USD 30.9 Million by 2026, while the Germany market is projected to reach USD 64.9 Million by 2026.

Asia Pacific

The Asia Pacific market is expected to grow at the highest CAGR over the projected years. The highest CAGR of the region is attributed to the growing awareness about radiation dose management software, driving increased adoption in the region. Moreover, increasing healthcare spending in the region is expected to drive the market growth. The Japan market is projected to reach USD 108.5 Million by 2026, the China market is projected to reach USD 85.7 Million by 2026, and the India market is projected to reach USD 42.3 Million by 2026.

- For instance, according to the Economic Times, in February 2023, India's public healthcare expenditure was 2.1% of GDP in 2022, compared to 1.8% in 2021 and 1.3% in 2020.

Rest of the world

The markets in the rest of the world are expected to witness comparatively slower revenue growth during the forecast period. The growth is attributed to a lack of healthcare infrastructure and lower healthcare spending, resulting in less implementation of radiation management software.

List of Key Companies in Radiation Dose Management Market

Siemens Healthineers AG, FUJIFILM Corporation, and GE Healthcare with Technologically Advanced Product Portfolio to Held Major Share in the Global Market

Siemens Healthineers AG, FUJIFILM Corporation, and GE Healthcare are the key players in the market. In 2022, these companies were holding the majority of the share in the global market. The strong market position of these companies is attributed to their robust and diverse product portfolio, strong geographic presence, and large global customer base. Strategic initiatives, such as acquiring other companies, are expected to assist key players in sustaining and consolidating their global market position.

Other companies operating in this market include Bayer AG, Koninklijke Philips N.V., Bracco, Medsquare SAS, and other small & medium-sized players. These companies are working on strategic partnerships and collaborations, launching new products, and expanding into new markets to increase their market share in the coming years.

LIST OF KEY COMPANIES PROFILED:

- Bayer AG (Germany)

- Siemens Healthineers AG (Germany)

- FUJIFILM Corporation (Japan)

- GE Healthcare (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Bracco (Italy)

- Medsquare SAS (France)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 - Qaelum NV partnered with I-MED Radiology Network to extend the reach of Qaelum's DOSE and FOQA in the ANZ region.

- May 2023 - Carestream Health announced the introduction of its novel DRX-LC Detector, designed to improve image quality, patient comfort, and diagnostic confidence, as well as productivity for capturing long-length image in orthopedics.

- February 2023: Carestream Health partnered with Robarts Research Institute to increase and demonstrate the clinical value of digital X-ray, digital tomosynthesis, and dual energy technologies. It would improve the outcomes of patients with cardiothoracic and pulmonary diseases.

- December 2022: Fujifilm partnered with Soorya Diagnostics LLP Center in Tirur Kerela to install its latest CT Scan machine at Soorya Diagnostics Center. This development will promote the screening culture and help people in the region get access to quality healthcare services.

- December 2021 - Qaelum NV partnered with ulrich GmbH & Co. KG to combine their innovative contrast management solution with the contrast media injectors of ulrich medical. This collaboration contributed to the requirements of hospitals and imaging networks.

REPORT COVERAGE

The global radiation dose management market report provides a detailed market analysis. It focuses on key segments such as techniques, application and end user. It also encompasses key industry developments, number of imaging procedures in key countries and impact of COVID-19 in the market. Moreover, it provides global radiation dose management market analysis of profiles of key companies, competitive analysis and market dynamics. The report also encompasses qualitative and quantitative insights that contribute towards the growth of the market.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.10% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Procedure

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is projected to grow from USD 973.3 million in 2026 to USD 3,004.00 million by 2034.

The market is expected to exhibit a CAGR of 15.10% during the forecast period.

The North America market size was USD 333.9 million in 2025.

In 2026, the orthopedics segment held the largest share due to the high volume of trauma-related procedures and fluoroscopy use in surgeries. However, the oncology segment is expected to grow fastest, driven by demand for non-invasive diagnostics.

Market growth is driven by the increasing number of imaging procedures, rising awareness about radiation risks, growing adoption of dose optimization software, and regulatory guidelines for patient safety during radiology practices.

Siemens Healthineers AG, FUJIFILM Corporation, and GE Healthcare are the key players in the market.

Integration of artificial intelligence to boost the outcomes in radiation dose management and a surge in strategic initiatives by key players to offer suitable imaging products are key factors contributing to the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us