Regenerative Medicine Market Size, Share & Industry Analysis, By Product (Cell Therapy, Gene Therapy, Tissue Engineering, and Platelet Rich Plasma), By Application (Orthopedics, Wound Care, Oncology, Rare Diseases, and Others), By End User (Hospitals, Clinics, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

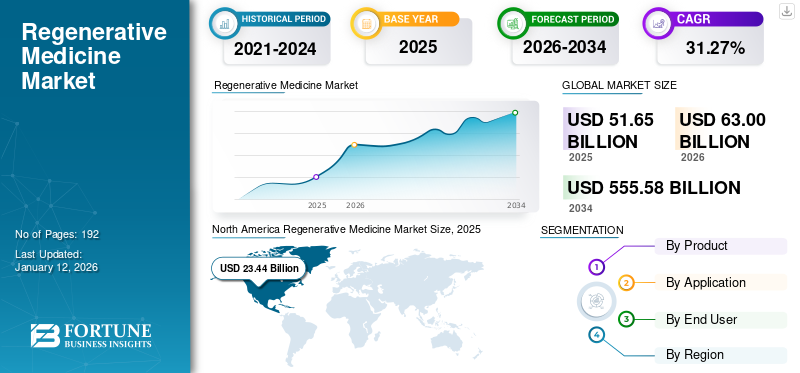

The global regenerative medicine market size was valued at USD 51.65 billion in 2025 and is projected to grow from USD 63 billion in 2026 to USD 555.58 billion by 2034, exhibiting a CAGR of 31.27% during the forecast period. North America dominated the regenerative medicine market with a market share of 45.38% in 2025. Moreover, the U.S. regenerative medicine market size is projected to grow significantly, reaching an estimated value of USD 184.21 billion by 2032, driven by increasing R&D activities leading to innovative product launches.

Regenerative medicine is an emerging field aiming to repair, replace, or regenerate damaged tissue or organ using cells, tissues, or genetic material. It can treat and potentially cure many conditions and diseases that are intractable, chronic, and terminal, such as cancers, Parkinson's disease, Alzheimer's disease, diabetes, renal diseases, cardiovascular diseases, and others. According to the Alliance for Regenerative Medicine (ARM) 2021 report, the global financing in this market was raised to USD 22.7 billion in 2021 from USD 19.9 billion in 2020 to support 2,406 products that are under investigation. This growth is attributed to the technological advancements in the gene therapy field, such as the first in-vivo CRISPR therapy which exhibited positive outcomes in 2021.

Moreover, the rising prevalence of chronic genetic disorders, coupled with increased healthcare expenditure by developed and developing countries is expected to fuel the growth of the regenerative medicine industry. For instance, in July 2022, the Washington University received a grant of USD 557,000 from the National Heart Lung and Blood Institute (NHLBI) to investigate the effectiveness of a novel engineered TRIM72 (ETRIM72) protein to regenerate vasculature and skeletal muscles in murine diabetic Critical Limb Ischemia (CLI). Such growing support from government organizations through research grants will propel the global market growth during the forecast period.

Additionally, strategic activities by key players to integrate artificial intelligence in drug development are expected to propel the market expansion. For instance, in March 2022, Wipro and Pandorum Technologies entered into a long-term partnership to develop technologies that shorten time-to-market and maximize patient outcomes during research and development and regenerative medicine clinical trials. The partnership combines Wipro Holmes’s Artificial Intelligence capabilities with Pandorum’s regenerative medicine expertise.

The COVID-19 pandemic hurt the market. The COVID-19 outbreak impacted the market in different ways as it comprises various segments. The tissue engineering segment witnessed a significant negative decline, while the gene therapy segment witnessed robust growth due to the consistent sales of its rare disease therapeutics. Similarly, the Platelet-Rich Plasma (PRP) segment declined in 2020, whereas the cell therapy segment generated a slightly higher growth rate in 2020. In 2021, the market witnessed a resurgence with the ease of the pandemic restrictions, leading to positive results, such as an increase in approvals by key regulatory agencies. From 2022 onwards, the market is estimated to witness a consistently stronger growth rate during the forecast period. As the prevalence of chronic diseases rises, market players are focusing on R&D initiatives to expand their pipeline of candidates, which will lead to new product launches during the forecast period.

Global Regenerative Medicine Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 51.65 billion

- 2026 Market Size: USD 63 billion

- 2034 Forecast Market Size: USD 555.58 billion

- CAGR: 31.27% from 2026–2034

Market Share:

- Region: North America dominated the market with a 45.38% share in 2025. The region's growth is attributed to significant technological advancements in the field, rapid adoption of cell & gene therapies, and a supportive regulatory environment leading to new product approvals.

- By Product: Cell Therapy held the largest market share in 2024. The segment's growth is driven by its expanding applications in treating a wide range of conditions including cancers, autoimmune diseases, musculoskeletal disorders, and infectious diseases.

Key Country Highlights:

- Japan: The market is driven by the introduction of highly innovative and medically approved products. For instance, Gunze Medical launched the first and only medically approved dehydrated human amnion/chorion membrane (dHACM) allograft for wound care in the country.

- United States: Growth is fueled by strong government support for research and a streamlined regulatory pathway. For example, the U.S. FDA granted Regenerative Medicine Advanced Therapy (RMAT) designation to new CAR-T cell therapies, and institutions like Washington University receive significant federal grants for research in the field.

- China: As a major contributor to the Asia Pacific market, growth is driven by a very large patient population suffering from chronic diseases such as diabetes and cancer, creating a high demand for advanced and potentially curative therapies.

- Europe: The market is advanced by strong research funding and major regulatory approvals. The European Commission has provided funding for developing novel treatments for conditions like osteoporosis and has approved new gene therapies, such as Hemgenix for hemophilia B.

Regenerative Medicine Market Trends

Strategic Acquisitions by Key Players to Offer Market Growth Opportunities

One of the prevailing global regenerative medicine market trends is the implementation of strategic acquisitions by key players to upscale their R&D capabilities. The products of this market comprise various novel approaches derived from living cells, proteins, enzymes, antibodies, Antibody-Drug Conjugates (ADC), and gene and cellular components that have produced life-saving therapies to treat various chronic diseases. However, there is a potential gap between expectations and the realities of translating these technologies into clinical practice. Some prominent regenerative medicine manufacturers are taking strategic initiatives to bridge this gap and expand research in various clinical applications by increasing their focus on acquisitions to strengthen their R&D capabilities.

- In December 2023, the University of Toronto’s Medicine by Design initiative and CCRM launched a new strategic alliance to unlock Toronto’s potential as a world-leading ecosystem for regenerative medicine.

- In April 2022, Metcela Inc. acquired Japan Regenerative Medicine Co., Ltd., a wholly-owned subsidiary of Kidswell Bio Co., Ltd. Through this acquisition, Metcela added JRM-001, an autologous cell product for pediatric congenital heart disease, into its product portfolio to strengthen its clinical development infrastructure for these products.

- In January 2021, Integra LifeSciences acquired ACell, Inc. and its proprietary MatriStem UBM Technologies to provide more comprehensive complex wound management solutions.

The products of this market and cellular therapies are coming together to expand their clinical applications for the treatment of many incurable diseases and improvement of patient health outcomes.

Download Free sample to learn more about this report.

Regenerative Medicine Market Growth Factors

Increasing Investments in R&D Activities Leading to Innovative Product Launches to Drive Market Growth

Increasing investments in this market have initiated full-fledged research and development activities as several investors are funding start-up companies focused on the development of novel therapies and products in the market. This has also paved the way for significant mergers, research collaborations, and partnerships to share the mutual benefits of R&D activities.

- In June 2022, Belgian biotech company Galapagos announced that it would acquire CellPoint and AboundBio to accelerate the development and commercialization of next-generation cell therapies. Through the acquisitions of CellPoint and AboundBio, Galapagos would gain access to an innovative, scalable, decentralized, and automated point-of-care cell therapy supply model and a next-generation fully human antibody-based therapeutics platform. Combined and supported by Galapagos as a fully integrated biopharma, the company has the potential to disrupt the CAR-T treatment paradigm.

Apart from private players, various governments and government-funded research institutes are actively spending on this industry to introduce effective options for the treatment of various chronic diseases, such as cancers, Parkinson's disease, diabetes, renal diseases, cardiovascular diseases, and others.

- In October 2023, Immunoadoptive Cell Therapy (ImmunoACT), an Indian Institute of Technology (IIT) Bombay incubated company, received marketing authorization approval from the Central Drugs Standard Control Organization (CDSCO) for the first humanized CD19-targeted Chimeric Antigen Receptor T cell (CAR-T cell) therapy in India. It is used for relapsed / refractory (r/r) B-cell lymphomas and leukemia.

- In January 2022, the Royal College of Surgeons in Ireland received funding of USD 226,000 from the European Commission to develop antioxidant-ion substituted nanoparticles for osteoporotic bone treatment. Such developments to enhance drug development are expected to expand the market growth.

Innovative Pipeline Candidates to Contribute to Market Growth

Regenerative medicine is broadening its application areas from tissue repair and wound care to various fields, such as cardiology, neurology, oncology, and others. Many pharmaceutical and life science companies are conducting clinical trials to establish their dominance over the traditional treatment methods by launching potential candidates that are under development, leading to the introduction of novel products and therapies in the market.

- In November 2023, Sysmex Corporation announced that AlliedCel Corporation, a joint venture with JCR Pharmaceuticals Co., Ltd., has entered into a license agreement with JUNTEN BIO Co., Ltd. to play roles in the domestic manufacturing and sales of regenerative medicine products for immune tolerance induction with inducible inhibitory T-cells (JB-101).

- In June 2022, CRISPR Therapeutics presented positive results from its ongoing phase 1 COBALT-LYM trial that evaluated the safety and efficacy of CTX130, its wholly-owned allogeneic CAR-T cell therapy targeting CD70 to treat solid tumors and certain hematologic malignancies. Such potential candidates under investigation studies are anticipated to accelerate the demand and adoption of novel treatments for chronic diseases, subsequently driving the global market growth during the forecast period.

RESTRAINING FACTORS

High Treatment Costs and Inadequate Reimbursement Policies to Hinder Market Growth

High costs of treatments using these products and lack of reimbursement policies are key factors restraining the market growth. For instance, most stem cell therapies are experimental or investigational drugs or treatments due to which there is limited Medicare insurance coverageleading to a considerable proportion of out-of-pocket payments. It only covers expenses of treatments that have been approved by the FDA, such as allogeneic transplantation.

- As per an article published by DVC Stem in July 2022, stem cell therapy costs between USD 5,000 – USD 50,000 and the cost varies depending on multiple factors, such as the type of stem cells administered, number of cells administered, the quality of cells, source of stem cells, and many more.

- According to a Pharmacy Times article published in December 2021, Novartis' product Zolgensma is a one-time gene therapy administered using a single intravenous infusion for the treatment of spinal muscular atrophy, leading the list with its one-time price of USD 2.12 million.

Lack of coverage provided by major insurance providers leaves patients with the only option to pay the treatment cost out-of-pocket or through crowd funding, which delays the treatment and can slow the growth of the market. Moreover, there are limited approved therapies for a wide range of patients suffering from various genetic disorders, which are considerably expensive and may have other side-effects, which will restrain its adoption, limiting the market growth.

Regenerative Medicine Market Segmentation Analysis

By Product Analysis

Cell Therapy to Gain Traction Due to Increase in Product Adoption to Treat Chronic Diseases

Based on product, the market segments includes cell therapy, gene therapy, tissue engineering, and platelet rich plasma.

The cell therapy segment is projected to dominate the market with a share of 54.87% in 2026. The segment’s growth is driven by its rising applications in the treatment of autoimmune diseases, cancers, infectious diseases, musculoskeletal disorders, and repairing of joint injuries, which has increased the adoption of products of this segment.

The gene therapy segment is estimated to record the highest CAGR owing to the advantages of this therapy over traditional treatment methods including improved clinical results, targeting desirable sites, and others. Gene therapy has been widely used in the treatment of rare diseases, including Spinal Muscular Atrophy (SMA) and others. Similarly, rising research collaborations among the key players in developing new products are expected to augment the segmental growth.

- In November 2023, AstraZeneca entered a joint research collaboration agreement with Cellectis to develop up to ten cell and gene therapy candidates.

The tissue engineering segment held the second largest share in the global market due to increased demand for its products, such as scaffolds, bio matrixes, and others in wound care. On the other hand, the platelet rich plasma segment held the smallest market share in 2023 due to limited product offerings. However, the demand for cosmetic surgeries is increasing along with the gradual adoption of platelet rich plasma for the treatment of orthopedic diseases, which will propel the segment’s growth during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Rising Prevalence of Orthopedic Diseases to Fuel Product Adoption in Orthopedics

In terms of application, the global market is segmented into orthopedics, wound care, oncology, rare diseases, and others.

The orthopedics segment is expected to account for 40.61% of the market share in 2026 due to a gradual increase in the prevalence of osteoarthritis and bone related injuries. This has led to the adoption of these products to enhance the healing process and reduce pain and discomfort, which is driving the segment’s growth.

The oncology segment is estimated to record a comparatively higher CAGR during the forecast period. Factors, such as the rising prevalence of cancer have increased the unmet needs of cancer patients. To cater to this demand, many novel therapies have been introduced, such as CAR-T cell based therapy, which showcased significant positive results. Furthermore, increasing government support through research grants and awareness programs will contribute to the segment’s growth. Also, rising strategic activities by market players to expand their product portfolio are also expected to propel segmental growth. In November 2023, Kite and Arcellx, Inc. expanded the scope of the collaboration for Arcellx's CART-ddBCMA to include lymphomas.

The wound care segment accounted for a considerable market value in 2024 and is estimated to register a substantial CAGR by the end of 2032. Introduction of advanced products that mimic the skin structure and accelerate wound healing, along with the rising prevalence of chronic wounds, is expected to fuel the segment’s growth.

The rare disease segment is anticipated to display the highest CAGR during the forecast period as the number of individuals living with rare diseases is rising across the world, and the treatment options are limited, providing a huge scope for the segment’s growth in the market.

The others segment comprises cardiovascular diseases, musculoskeletal, ophthalmology, and metabolic diseases where the R&D initiatives are limited and yet to be explored, which can slow the growth of the segment due to limited product launches.

By End User Analysis

Increasing Number of Surgeries to Propel Product Use across Hospitals

On the basis of end user, the global market is classified into hospitals, clinics, and others.

The hospitals segment is anticipated to hold a dominant market share of 62.54% in 2026 and is estimated to record the highest CAGR during the forecast period. The segment’s growth is augmented due to rising number of surgeries in hospitals coupled with increasing government support through policy harmonization, which provides impetus for major companies offering these products.

The clinic segment held the second-largest market share in 2023 owing to the increased privatization of clinics to provide specialized regenerative medicine services which include treatment for musculoskeletal conditions to relieve pain and enhance the healing process. Hence, adoption of these products in these institutions is contributing to the expansion of the segment.

The others segment might showcase a lower CAGRtringent eligibility criteria to conduct R&D activities at academic research institutes.

REGIONAL INSIGHTS

Geographically, the global market for regenerative medicine is studied across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Regenerative Medicine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The North America market size was valued at USD 51.65 billion in 2025 and is likely to remain dominant throughout the forecast period. The growth in this region is attributed to the technological advancements in the field, rapid adoption of cell & gene therapy, and new product approvals. For instance, in May 2022, the U.S. FDA granted the Regenerative Medicine Advanced Therapy (RMAT) designation to obecabatagene autoleucel (obe-cel), a CAR T-cell therapy developed by Autolus Therapeutics and is under clinical trial for the treatment of R/R B-acute lymphocytic leukemia. The U.S. market is projected to reach USD 27.06 billion by 2026.

Europe

Europe is anticipated to be the second leading region in terms of revenue, which is attributed to emerging government guidelines and favorable reimbursement for these therapies. Moreover, the substantial presence of numerous research institutes and increasing government funding are expected to boost the market growth across Europe. The UK market is projected to reach USD 3.58 billion by 2026, while the Germany market is projected to reach USD 4.2 billion by 2026.

Asia Pacific

Asia Pacific is projected to record the maximum CAGR due to the rising prevalence of chronic diseases, active government initiatives for technological advancements, and improving disposable incomes. For instance, as per an article published in November 2021 by BioSpectrum, 8.5 million people suffered from some form of chronic disease, such as diabetes, cancer, and respiratory conditions in Asia. This rising incidence of these diseases offers a lucrative opportunity for the market to grow across the region. The Japan market is projected to reach USD 3.55 billion by 2026, the China market is projected to reach USD 3.21 billion by 2026, and the India market is projected to reach USD 2.01 billion by 2026.

On the other hand, Latin America and the Middle East & Africa regions are estimated to grow at a comparatively lower CAGR due to lower healthcare expenditure per person. Furthermore, lack of awareness regarding the existence of effective treatment options in these regions is leading to a lower adoption rate and slower growth of the regional market.

List of Key Companies in Regenerative Medicine Market

Novartis AG and Zimmer Biomet are Key Market Players due to Strong Sales Owing to New Product Launches and Approvals

In terms of the competitive landscape, the market is highly fragmented, with a few companies holding a higher proportion of the industry. In terms of cell and gene therapies, Gilead Sciences Inc. and Novartis AG are dominant players in these segments on the account of their strong CAR T-cell therapy pipeline, which is anticipated to generate strong sales due to new product launches and approvals during the forecast period. Some other emerging players that are present in cell and gene therapy segment include Orchard Therapeutics plc through its products, such as Libmeldy and Strimvelis which are approved in the European Union and bluebird bio, Inc.

In terms of tissue engineering, Stryker dominates the global market due to its acquisition of Wright Medical Group N.V., which has led to the development of a strong biologics portfolio for the company, while the platelet rich plasma segment reflects a fragmented competitive landscape. However, some key companies including Zimmer Biomet, on account of its product of GPS III Platelet Concentration System, and Terumo Corporation have established their presence in the market due to their strong product offerings.

LIST OF KEY COMPANIES PROFILED:

- Integra LifeSciences Corporation (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- Tissue Regenix (U.K.)

- Smith & Nephew (U.K.)

- MIMEDX (U.S.)

- Novartis AG (Switzerland)

- Allergan Aesthetics (AbbVie Inc.) (U.S.)

- Stryker (U.S.)

- American CryoStem Corporation (U.S.)

- Kite (Gilead Sciences, Inc.) (U.S.)

- AlloSource (U.S.)

- bluebird bio, Inc. (U.S.)

- CRISPR Therapeutics (Switzerland)

- Janssen Global Services, LLC (Johnson & Johnson Services, Inc.) (Belgium)

- Tegoscience (South Korea)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Iovance Biotherapeutics recieved FDA approval for TIL therapy. It is an immunotherapy for adult patients with unresectable or metastatic melanoma previously treated with a PD-1 blocking antibody, and if BRAF V600 is positive, a BRAF inhibitor with or without a MEK inhibitor, called AMTAGVI (lifileucel), an autologous cell therapy.

- September 2023: Dr. Samuel Lynch, DMD and DMSc, a serial biotechnology entrepreneur, launched Lynch Regenerative Medicine, Inc. (LRM), a new advanced biotherapeutics skincare company targeting unmet clinical needs in the aesthetic and advanced wound care markets.

- July 2023: Hong Kong Science and Technology Parks Corporation (HKSTP) partnered with Cordlife Hong Kong Limited (Cordlife) to co-launch a regenerative medical project focused on Mesenchymal Stem Cells (MSCs) biology.

- February 2023: CSL Behring and UniQure’s gene therapy received the Europen Commission’s approval for Hemgenix to treat hemophilia B.

- Decemeber 2022: Atara Biotherapeutics, Inc. received marketing authorization from the European Commission for Ebvallo (tabelecleucel), an allogenic T-cell immunotherapy to treat adult and pediatric patients with relapsed or refractory Epstein‑Barr virus positive post‑transplant lymphoproliferative disease (EBV+ PTLD).

- July 2022: PTC Therapeutics received marketing authorization from the Eurpean Medicine Agency for Upstaza, a gene therapy used for the treatment of patients diagnosed with aromatic L amino acid decarboxylase (AADC) deficiency with a severe phenotype.

- June 2022: Avista Therapeutics partnered with F. Hoffmann La Roche Ltd to develop novel AAV gene therapy vectors for ocular diseases.

- March 2022: Novartis entered a license option agreement with Voyager Therapeutics for next-generation gene therapy vectors for neurological diseases.

REPORT COVERAGE

The report provides qualitative and quantitative insights on the global market and a detailed analysis of market’s size & growth rate for all possible segments. Along with this, it provides elaborative insights on the market’s drivers and competitive landscape. Various key insights presented in the report include prevalence of chronic diseases by key countries/regions - 2021, pipeline analysis, new product launches, key recent industry developments – mergers, acquisitions, & partnerships, technological developments, and impact of COVID-19 on the global market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 31.27% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Product

|

|

By Application

|

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market is projected to grow from USD 63 billion in 2026 to USD 555.58 billion by 2034.

In 2025, the North America market stood at USD 23.44 billion.

Recording a CAGR of 31.27%, the market will exhibit steady growth during the forecast period of 2026-2034.

The cell therapy segment is expected to be the leading segment in this market during the forecast period.

The increasing prevalence of blood cancers and treatment initiatives for rare diseases, coupled with the rising need for personalized treatment, are some of the major factors driving the growth of the market.

Novartis AG, Stryker, and Bristol-Myers Squibb Company are the leading market players in the global market.

North America dominated the market in 2025.

The demand for cosmetic rejuvenation procedures, potential pipeline candidates, and continuous increase in R&D investment for technological advancements are expected to surge the demand for these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us