Revenue Cycle Management Market Size, Share & Industry Analysis, By Structure (In-house and Outsourced), By Type (Software and Services), By Function (Claims & Denial Management, Medical Coding & Billing, Clinical Documentation Improvement (CDI), Insurance, and Others), By End-user (Hospitals, Physician’s Office, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

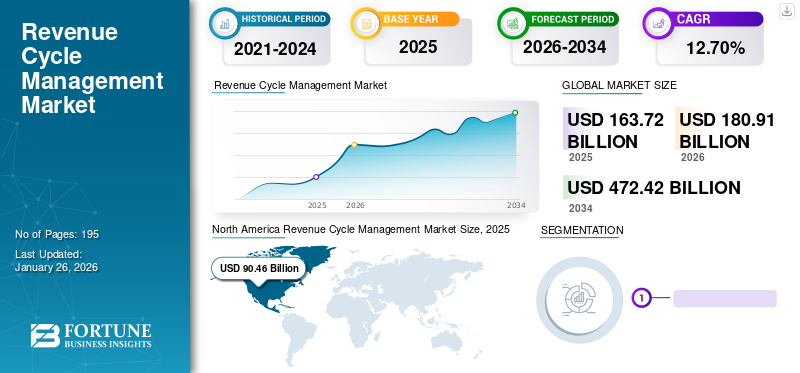

The global revenue cycle management market size was valued at USD 163.72 billion in 2025 and is projected to grow from USD 180.91 billion in 2026 to USD 472.42 billion by 2034, exhibiting a CAGR of 12.70% during the forecast period. North America dominated the revenue cycle management market with a market share of 55.26% in 2025.

Today’s healthcare systems face major challenges, such as increasing complexity, rising treatment costs, and growing patient consumerism, among others. These market dynamics pose enormous stress on large hospitals and clinics, driving them to transform into Revenue Cycle Management (RCM) operations. This factor is defined as a process that hospitals design and implement to maximize patient revenue and its collection speed. Several regulatory mandates for the application of Electronic Health Records (EHR) in healthcare settings and preference toward integrated EHR/RCM software for smooth workflow are surging the demand for this service globally.

Additionally, the increasing number of claim denials and the rising administrative cost for the management of the denied claims are expected to foster the demand for this service in the study period.

- For instance, as per an article published by Etactics, Inc. in February 2023, out of the total in-network claims submitted in 2021, the number of denied claims was 48.3 million. This number accounted for 16.6% of all claims. The insurer denial rates ranged from 1 to 80%.

- Similarly, according to a survey by the Change Healthcare in 2020, the U.S. hospitals experienced a remarkable hike of 23.0% for claim denials in 2020 as compared to 2016. Thus, increasing demand for this service among hospital administrations is bolstering the adoption rate and supporting market growth.

Moreover, medical billing complexity and rising healthcare costs created a drastic rise in demand for outsourcing revenue cycle management solutions across the globe.

The outbreak of COVID-19 had a negative impact on the market growth. Several key market players, including TH Medical and CERNER CORPORATION, witnessed a significant decline in revenue from their RCM services. Additionally, postponement of elective surgeries and a significant decrease in the number of non-COVID-19 patients impacted the revenue of the majority of the hospitals significantly during the pandemic. However, upliftment of lockdown restrictions, increasing non-COVID-19 patients in 2021, and the introduction of advanced software to manage revenue supported market growth in 2021. The market is anticipated to witness significant growth in the coming years.

Global Revenue Cycle Management Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 163.72 billion

- 2026 Market Size: USD 180.91 billion

- 2034 Forecast Market Size: USD 472.42 billion

- CAGR: 12.70% from 2026–2034

Market Share:

- Region: North America dominated the market, accounting for a major share of the revenue in 2025. This is attributed to the presence of leading market players, high usage of RCM solutions in the U.S., and the continuous launch of innovative platforms and technologies.

- By Function: The claims & denial management segment holds the dominant position. Its leadership is due to the launch of advanced solutions, such as AI-powered platforms, designed specifically to reduce the rising number of claim denials and manage the complex claims revenue cycle more effectively.

Key Country Highlights:

- Japan: As part of the fastest-growing Asia Pacific region, Japan's market is expanding due to increasing awareness among hospitals and healthcare providers about the advantages of RCM services for improving financial performance.

- United States: Market growth is driven by the high volume of claim denials, which has pushed a majority of hospitals (over 78%) to adopt RCM solutions. The market is further propelled by major players launching new platforms and forming strategic partnerships to integrate RCM with EHR systems.

- China: The market is poised for rapid growth, benefiting from the increasing adoption of RCM solutions as healthcare providers in the Asia Pacific region become more aware of the need for efficient financial management systems.

- Europe: As the second-largest market, growth is supported by increasing investment in healthcare information technology infrastructure. There is a strong focus on developing financial technology, particularly in major markets like Germany, the U.K., and France, to improve hospital operational efficiency.

Revenue Cycle Management Market Trends

Preferential Shift toward Outsourcing Model to Improve Financial Performance

An increasing number of patient admissions and rising complications during the management of operating revenues in healthcare settings are surging the demand and adoption of revenue cycle management. However, a preferential shift is observed in many healthcare facilities from in-house service to outsourcing service due to certain distinct advantages offered by outsourcing this service. The outsourcing model offers a significant improvement of the operational workflow compared to the in-house model while managing claim denials, medical billing & coding, and others. For instance, according to a 2022 PatientPay study from CWH Advisors, the demand for outsourcing RCM is increasing, and around 61% of providers are planning to use RCM tasks in the future. This study was conducted in November and December 2022.

Also, the implementation of artificial intelligence and machine learning to reduce recurrent errors in a claim denial is cost-effective in the outsourcing model compared to the in-house model. For instance, according to the data published by Change Healthcare LLC in 2022, 65.0% of the U.S. hospitals and other healthcare facilities are using AI in their revenue management. These benefits of this model encourage healthcare facilities to adopt the outsourcing model.

Download Free sample to learn more about this report.

Revenue Cycle Management Market Growth Factors

Regulatory Mandates for Adoption of Electronic Health Records (EHR)/Electronic Medical Records (EMR) to Assist Revenue Cycle Management Market Growth

The introduction of EHRs revolutionized healthcare organizations in collecting, analyzing, and reporting patient data. However, according to an article by QWay Healthcare, Inc., in July 2021, 31.0% of the U.S. healthcare providers were using manual claim denial procedures and experiencing a huge amount of delay and recurrent errors while managing claim denials. Therefore, to reduce operational delay and manual errors, a rising number of healthcare administrations are adopting the EHR/EMR systems.

Eventually, in accordance with the EHR/EMR system, healthcare facilities are focusing on improving workflow of the revenue cycle management procedure. This factor may boost the demand for this service. Further, increasing healthcare spending and technological advancements in the software are expected to fuel the adoption rate and foster the market growth during the study period.

For instance, in July 2021, Access Healthcare introduced Echo, an artificial intelligence and Robotic Process Automation (RPA) platform for introducing automation in the procedure.

RESTRAINING FACTORS

Risks Associated with Healthcare IT Solutions and Budgetary Constraints to Restrain Market

Distinct advantages of the service and advancement of these systems are fueling the demand for this service. However, limited IT infrastructure and budget constraints play a crucial role in hindering market growth.

For instance, according to an article by HIT Consultant Media in 2021, it was reported that 60.0% of a surveyed population consider budget constraints as the root cause of not implementing AI and other advanced technology in the revenue management service.

Furthermore, rising security concerns while protecting the confidential data about patient and healthcare facilities is expected to limit the demand for this service during the study period. For instance, according to a report by IBM Security in June 2023, it was stated that the cost of healthcare data breaches increased from approximately USD 9.23 million in 2021 to USD 10.92 million in 2022 worldwide. These ambiguities are restricting the adoption rate of this service and subsequently restraining market growth.

Revenue Cycle Management Market Segmentation Analysis

By Structure Analysis

In-house Segment to Dominate due to Increase in Patient Admissions

Based on structure, the market is segmented into in-house and outsourced. The in-house segment dominated the market share with 70.94% in 2026, owing to higher adoption of this service by hospitals to stabilize clinical and financial performance. Also, an increase in the number of patient admissions supports the in-house model's adoption rate. According to the American Hospital Association (AHA) survey, more than 33.0 million hospital admissions were recorded in 2021. Also, the developing hospital infrastructure and health insurance policies in emerging nations are also propelling the demand for these solutions. For instance, the America’s Health Insurance Plans (AHIP) implemented RCM solutions with an aim to lower patient out-of-pocket costs and streamline the financial encounter.

The outsourced segment is anticipated to witness fastest growth due to the shifting trend from in-house to outsourcing model in major countries such as the U.S, the U.K., India, and others. Also, the major cost difference between the software and hardware for the in-house and outsourcing model is responsible for strong CAGR over the forecast period. For instance, according to an article published by Advanced-Data Systems in March 2021, it was estimated that the cost of in-house software and hardware is around USD 8,000.0. However, in the case of the outsource segment, the total service cost is around USD 500.0.

To know how our report can help streamline your business, Speak to Analyst

By Type Analysis

Introduction of Technologically Advanced Software Led to its Dominant Market Share

Based on type, the market is segmented into software and services. The software segment dominates the market share with 79.65% in 2026, owing to the launch of advanced solutions to help improve revenue cycle management at hospitals, physician’s facilities, and others. Additionally, in light of the COVID-19 pandemic, several companies have generated lower revenues, which has encouraged them to consult financial advisors to have effective measures. For instance, in May 2020, Objective Capital Partners announced to serve as a financial advisor to RCM Technologies. The company advised them to adopt shareholders' rights plan, which is intended to protect and control the company's service.

The services segment is anticipated to emerge as the fastest-growing during the forecast period. Timely reimbursement, active focus on quality patient care, and reduction in the error while billing and coding are attributable to the growing demand for services such as outsourcing, medical coding and billing services, and others.

By Function Analysis

Claims & Denial Management Segment Dominates due to Launch of Advanced Solutions

On the basis of function, the market is segmented into claims & denial management, medical coding & billing, Clinical Documentation Improvement (CDI), insurance, and others. The claims & denial management segment holds the dominant position with share of 36.64% in 2026, owing to the launch of advanced solutions that reduce claim denials. For instance, in September 2021, Aspirion introduced a secure business intelligence client platform, Aspirion Intelligence, to monitor complex claims revenue cycle performance and reduce claim denials.

The medical coding & billing segment holds the second position, followed by the CDI segment. The high growth rate of this segment is attributable to the increasing demand for medical codes and billing services, owing to the complexities associated with financial management of the end-users.

By End-user Analysis

Hospital Segment to Dominate due to Rising Adoption of RCM Solutions in Hospitals

Based on end-user, the market is categorized into hospitals, physician’s office, and others. The hospitals segment dominated the market share with 61.90% in 2026 in terms of market value and share. The dominance of this segment is attributable to rising patient admissions, thus generating higher revenue for hospitals. Hospitals adopt this solution to effectively manage a revenue collection process, thereby contributing to the segment's growth during the analysis period. For instance, according to a survey done by AKASA in 2021, it was stated that more than 78.0% of hospitals in the U.S. are using this service. Additionally, increasing collaborations between hospitals and technology providers further support the dominance of the segment. For instance, in January 2024, VHC Health signed 15-year RCM partnership agreement with Med-Metrix, LLC. This partnership includes all of VHC Health's revenue cycle functions.

The physician’s office segment is likely to grow at a faster rate during the study period. The primary reason for this is the gradual increase in the number of physicians globally. For instance, according to the American Medical Association, it was reported that approximately 49.1% of the total patient care physicians worked in physician offices in 2020. This prominent increase in the number of physicians in physician offices is fostering this solution's adoption rate and supporting the segment's growth.

REGIONAL INSIGHTS

North America

North America Revenue Cycle Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America was valued at USD 90.46 billion in 2025. This region accounted for the major revenue cycle management market share due to the presence of leading players. Further, the higher usage of the software/service in the U.S. will augment the regional market growth. Moreover, the launch of innovative solutions by the major players in this region also contributes to the growth of the market in North America. For example, in January 2020, a leading player, R1 RCM, launched the R1 Professional platform to expand its geographical reach. Also, the company, in collaboration with Intermountain Healthcare, launched an innovation center to carry these technology innovations. The U.S. market is projected to reach USD 92.43 billion by 2026.

Europe

Europe accounted for the second position in the global market. The provision of growth opportunities for start-ups to develop effective financial technology is propelling the region's adoption and launch of the service mentioned above. In addition, the majority of healthcare companies are constantly focusing on increasing investment in the development of information technology infrastructure. This factor is also expected to support market growth in this region during the study period. For instance, according to the data published by MedTech Europe in 2022, the European medical technology market accounted for around USD 157.7 billion in 2021, an increase of 6.6% from 2020. The top five biggest markets are Germany, France, the U.K., Spain, and Italy. The UK market is projected to reach USD 9.36 billion by 2026, and the Germany market is projected to reach USD 9.77 billion by 2026.

Asia Pacific

Asia Pacific is expected to emerge as the fastest-growing region during the forecast period, owing to increasing awareness about the advantages of RCM service among hospitals. Their rising adoption rate is responsible for the higher growth of the region. The Japan market is projected to reach USD 6.69 billion by 2026, the China market is projected to reach USD 11.1 billion by 2026, and the India market is projected to reach USD 6.88 billion by 2026.

Latin America and the Middle East & Africa

Furthermore, Latin America and the Middle East & Africa markets are likely to witness considerably slower growth, owing to the gradual penetration of advanced solutions into the healthcare financial management systems.

List of Key Companies in Revenue Cycle Management Market

Innovative Solutions & End-to-End Service to Clients Help Players Gain Top Position

The market structure is fragmented, with several players operating in the market of revenue cycle management. Epic Systems Corporation accounts for the major share in the market. The company provides end-to-end service that focuses on efficiency, production, and budget needs. Also, the adoption of this company’s EHR and RCM system is assisting the company to sustain its dominant position.

For instance, in February 2020, Advent Health, a Florida-based health system of 50 hospitals, announced a partnership with Epic Systems to adopt its integrated EHR and RCM system for physician practice, ambulatory, urgent care, home health, and hospital facilities.

Other prominent players operating in the market are Allscripts Healthcare, LLC, Cerner Corporation, Conifer Health Solutions, LLC, GeBBS Healthcare Solutions, Inc., MEDHOST, McKesson Corporation, Medical Information Technology, Inc. (MEDITECH), Optum Inc., and R1 RCM, Inc.

LIST OF KEY COMPANIES PROFILED:

- Allscripts Healthcare, LLC (U.S.)

- Cerner Corporation (U.S.)

- Conifer Health Solutions, LLC (U.S.)

- Epic Systems Corporation (U.S.)

- GeBBS Healthcare Solutions (U.S.)

- MEDHOST (U.S.)

- McKesson Corporation (U.S.)

- Medical Information Technology, Inc. (MEDITECH) (U.S.)

- Optum Inc. (U.S.)

- R1 RCM, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024: Availity and Janus announced a strategic collaboration to improve revenue cycle operations in healthcare.

- November 2023: HFMA co-developed an adoption model for revenue cycle management technology.

- June 2023: OnPoint Healthcare and Office Ally partnered for the expansion of offerings to healthcare providers. Through this, OnPoint now offers the latter company’s advanced Revenue Cycle Management (RCM) solutions to hospitals, health systems, providers & Federally Qualified Health Centers (FQHCs).

- October 2022: Nym Technologies SA launched a radiology coding solution for revenue cycle management. This launch surged automation in emergency departments, urgent care, and radiology facilities, bringing Nym’s medical coding engine to three outpatient specialty areas.

- August 2022: Revecore Technologies acquired Kemberton and Cura Revenue Cycle Management, LLC, two specialized RCM firms. The acquisition has helped Revecore to drive improved outcomes for health systems in the U.S.

- June 2022: Olive launched its Autonomous Revenue Cycle (ARC), the company's flagship RCM suite of solutions. This launch helped Olive to focus more on patient care and easing employee pressure.

- October 2021: R1 RCM, Inc. announced that American Physician Partners extended its R1's revenue cycle management services partnership until 2031 to continue growth in emergency medicine.

- May 2021: Optum, Inc. collaborated with Bassett Healthcare Network to provide RCM services to Bassett's clinics and improve patient care in Central New York.

REPORT COVERAGE

The revenue cycle management market research report covers a detailed analysis and overview. It focuses on key aspects such as competitive landscape, structure, type, function, end-user, and region. Moreover, it offers insights into the market drivers, market trends, market dynamics, and other key insights. In addition to the factors mentioned above, the report encompasses several factors that contributed to the market growth in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 12.70% from 2026 to 2034 |

|

Unit |

Value (USD billion) |

|

Segmentation

|

By Structure

|

|

By Type

|

|

|

By Function

|

|

|

By End-user

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 180.91 billion in 2026 and is projected to reach USD 472.42 billion by 2034.

In 2025, the North America market stood at USD 90.46 billion.

The market is expected to exhibit a CAGR of 12.70% during the forecast period (2026-2034).

The in-house segment is set to lead the market by structure.

Adoption of integrated EHR/RCM system among healthcare facilities will drive market growth.

Epic Systems Corporation, Cerner Corporation, and R1 RCM, Inc. are some of the leading players in the global market.

North America dominated the market in 2025

Increasing patient volume and introduction of technologically advanced software are expected to drive the adoption of these products.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us